PRINCIPAL REAL ESTATE INCOME FUND

STATEMENT OF INVESTMENTS

July 31, 2023 (Unaudited)

| Description | |

Shares | | |

Value (Note

2) | |

| COMMON STOCKS (48.00%) | |

| | | |

| | |

| Investment Management/Advisory Services (0.32%) | |

| | | |

| | |

| RAM Essential Services Property Fund(a) | |

| 482,943 | | |

$ | 241,673 | |

| | |

| | | |

| | |

| Real Estate Management/Services (0.76%) | |

| | | |

| | |

| ESR Kendall Square REIT Co., Ltd. | |

| 56,361 | | |

| 175,320 | |

| Qualitas, Ltd. | |

| 226,910 | | |

| 388,659 | |

| | |

| | | |

| 563,979 | |

| Real Estate Operation/Development (2.04%) | |

| | | |

| | |

| Echo Investment SA | |

| 189,068 | | |

| 206,265 | |

| Mitsui Fudosan Co., Ltd. | |

| 25,300 | | |

| 519,018 | |

| Sumitomo Realty & Development Co., Ltd. | |

| 10,700 | | |

| 286,256 | |

| Sun Hung Kai Properties, Ltd. | |

| 40,000 | | |

| 500,327 | |

| | |

| | | |

| 1,511,866 | |

| REITS-Apartments (6.28%) | |

| | | |

| | |

| Apartment Income REIT Corp. | |

| 17,162 | | |

| 592,775 | |

| AvalonBay Communities, Inc. | |

| 5,449 | | |

| 1,027,954 | |

| Daiwa House REIT Investment Corp. | |

| 166 | | |

| 326,714 | |

| Essex Property Trust, Inc. | |

| 3,565 | | |

| 868,256 | |

| Invincible Investment Corp. | |

| 587 | | |

| 243,027 | |

| Invitation Homes, Inc. | |

| 45,227 | | |

| 1,605,559 | |

| | |

| | | |

| 4,664,285 | |

| REITS-Diversified (12.50%) | |

| | | |

| | |

| Activia Properties, Inc. | |

| 141 | | |

| 410,319 | |

| American Tower Corp. | |

| 780 | | |

| 148,442 | |

| Arena REIT | |

| 41,135 | | |

| 104,995 | |

| Broadstone Net Lease, Inc. | |

| 37,237 | | |

| 606,963 | |

| Cromwell European Real Estate Investment Trust(a) | |

| 214,860 | | |

| 380,346 | |

| Crown Castle, Inc. | |

| 4,252 | | |

| 460,449 | |

| Digital Core REIT Management Pte, Ltd. | |

| 277,391 | | |

| 138,695 | |

| Digital Realty Trust, Inc. | |

| 17,243 | | |

| 2,148,823 | |

| Gaming and Leisure Properties, Inc. | |

| 25,217 | | |

| 1,196,799 | |

| LondonMetric Property PLC | |

| 64,076 | | |

| 151,965 | |

| Mercialys SA | |

| 81,265 | | |

| 703,641 | |

| Merlin Properties Socimi SA | |

| 42,507 | | |

| 395,860 | |

| Sekisui House Reit, Inc. | |

| 840 | | |

| 498,338 | |

| Stockland | |

| 171,773 | | |

| 486,903 | |

| VICI Properties, Inc. | |

| 45,940 | | |

| 1,446,191 | |

| | |

| | | |

| 9,278,729 | |

| REITS-Health Care (6.79%) | |

| | | |

| | |

| Chartwell Retirement Residence | |

| 30,400 | | |

| 230,769 | |

| Healthcare Realty Trust, Inc. | |

| 12,389 | | |

| 241,957 | |

| HealthCo REIT | |

| 39,839 | | |

| 38,133 | |

| Medical Properties Trust, Inc. | |

| 17,484 | | |

| 176,414 | |

| National Health Investors, Inc. | |

| 10,052 | | |

| 551,955 | |

| Sabra Health Care REIT, Inc. | |

| 85,167 | | |

| 1,106,319 | |

| Ventas, Inc. | |

| 34,572 | | |

| 1,677,434 | |

| Welltower, Inc. | |

| 12,380 | | |

| 1,017,017 | |

| | |

| | | |

| 5,039,998 | |

| REITS-Hotels (0.20%) | |

| | | |

| | |

| Far East Hospitality Trust | |

| 312,200 | | |

| 151,434 | |

| | |

| | | |

| | |

| REITS-Manufactured Homes (1.16%) | |

| | | |

| | |

| Sun Communities, Inc. | |

| 6,625 | | |

| 863,237 | |

| Description | |

Shares | | |

Value (Note

2) | |

| REITS-Office Property (1.03%) | |

| | | |

| | |

| Alexandria Real Estate Equities, Inc. | |

| 6,070 | | |

$ | 762,878 | |

| | |

| | | |

| | |

| REITS-Regional Malls (0.79%) | |

| | | |

| | |

| Klepierre SA | |

| 22,163 | | |

| 588,495 | |

| | |

| | | |

| | |

| REITS-Shopping Centers (3.05%) | |

| | | |

| | |

| Lendlease Global Commercial REIT | |

| 352,367 | | |

| 180,192 | |

| Link REIT | |

| 176,620 | | |

| 988,532 | |

| Saul Centers, Inc. | |

| 28,506 | | |

| 1,098,906 | |

| | |

| | | |

| 2,267,630 | |

| REITS-Single Tenant (0.74%) | |

| | | |

| | |

| Spirit Realty Capital, Inc. | |

| 13,623 | | |

| 549,416 | |

| | |

| | | |

| | |

| REITS-Storage (3.13%) | |

| | | |

| | |

| Big Yellow Group PLC | |

| 15,861 | | |

| 218,412 | |

| CubeSmart | |

| 13,098 | | |

| 567,929 | |

| Extra Space Storage, Inc. | |

| 9,209 | | |

| 1,285,300 | |

| National Storage REIT | |

| 160,773 | | |

| 250,540 | |

| | |

| | | |

| 2,322,181 | |

| REITS-Warehouse/Industrials (8.78%) | |

| | | |

| | |

| AIMS AMP Capital Industrial REIT | |

| 274,300 | | |

| 257,849 | |

| Centuria Industrial REIT | |

| 198,728 | | |

| 424,484 | |

| CRE Logistics REIT, Inc. | |

| 228 | | |

| 281,264 | |

| Dream Industrial Real Estate Investment Trust | |

| 43,500 | | |

| 468,104 | |

| ESR-LOGOS REIT | |

| 781,371 | | |

| 202,725 | |

| First Industrial Realty Trust, Inc. | |

| 7,131 | | |

| 368,673 | |

| Goodman Group | |

| 6,562 | | |

| 90,534 | |

| Industrial & Infrastructure Fund Investment Corp. | |

| 272 | | |

| 284,494 | |

| Mitsubishi Estate Logistics REIT Investment Corp. | |

| 96 | | |

| 274,642 | |

| Nexus Industrial REIT | |

| 122,900 | | |

| 767,979 | |

| Plymouth Industrial REIT, Inc. | |

| 34,529 | | |

| 786,225 | |

| PRO Real Estate Investment Trust | |

| 41,803 | | |

| 169,285 | |

| Prologis, Inc. | |

| 10,814 | | |

| 1,349,047 | |

| Segro PLC | |

| 37,952 | | |

| 371,625 | |

| SF Real Estate Investment Trust(a) | |

| 364,000 | | |

| 130,685 | |

| Tritax Big Box REIT PLC | |

| 163,040 | | |

| 288,957 | |

| | |

| | | |

| 6,516,572 | |

| Storage (0.43%) | |

| | | |

| | |

| Safestore Holdings PLC | |

| 27,829 | | |

| 316,429 | |

| | |

| | | |

| | |

| TOTAL COMMON STOCKS | |

| | | |

| | |

| (Cost $36,211,891) | |

| | | |

| 35,638,802 | |

| | |

| | | |

| | |

| PREFERRED STOCKS (0.90%) | |

| | | |

| | |

| REITS-Shopping Centers (0.90%) | |

| | | |

| | |

| RPT Realty, 7.25%(b) | |

| 13,500 | | |

| 666,765 | |

| | |

| | | |

| | |

| TOTAL PREFERRED STOCKS | |

| | | |

| | |

| (Cost $534,888) | |

| | | |

| 666,765 | |

| Description | |

Rate | | |

Maturity Date | |

Principal Amount | | |

Value (Note

2) | |

| COMMERCIAL MORTGAGE BACKED SECURITIES (93.08%) | |

| | | |

| |

| | | |

| | |

| Commercial Mortgage Backed Securities-Other (14.38%) | |

| | | |

| |

| | | |

| | |

| BANK: | |

| | | |

| |

| | | |

| | |

| 2020-BN29(c)(d)(e) | |

| 0.698 | % | |

12/15/30 | |

$ | 11,896,750 | | |

$ | 489,169 | |

| 2021-BN35(c)(d)(e) | |

| 1.500 | % | |

06/15/64 | |

| 3,100,000 | | |

| 264,126 | |

| Benchmark 2022-B36 Mortgage Trust 2022-B36(c)(d)(e) | |

| 2.619 | % | |

05/15/32 | |

| 15,860,000 | | |

| 2,770,295 | |

| Description | |

Rate | | |

Maturity Date | |

Principal Amount | | |

Value (Note

2) | |

| Benchmark Mortgage Trust: | |

| | | |

| |

| | | |

| | |

| 2020-B22(c)(d)(e) | |

| 1.419 | % | |

10/15/30 | |

$ | 7,717,000 | | |

$ | 635,149 | |

| 2020-B20(c)(d)(e) | |

| 1.549 | % | |

10/15/30 | |

| 7,126,000 | | |

| 600,175 | |

| Citigroup Commercial Mortgage Trust: | |

| | | |

| |

| | | |

| | |

| 2019-GC43(c)(d)(e) | |

| 0.620 | % | |

11/10/29 | |

| 2,500,000 | | |

| 75,481 | |

| Citigroup Commercial Mortgage Trust 2022-GC48 2022-GC48(c)(d)(e) | |

| 2.375 | % | |

06/15/32 | |

| 16,920,000 | | |

| 2,760,445 | |

| FHLMC Multifamily Structured Pass Through Certificates 2012-K052(c)(e) | |

| 1.615 | % | |

01/25/26 | |

| 9,690,000 | | |

| 306,587 | |

| Goldman Sachs Mortgage Securities Trust 2020-GSA2(c)(d)(e) | |

| 1.361 | % | |

01/10/31 | |

| 7,000,000 | | |

| 552,195 | |

| JPMorgan Chase Commercial Mortgage Securities Trust: | |

| | | |

| |

| | | |

| | |

| 2015-C28(c)(e) | |

| 0.925 | % | |

03/15/25 | |

| 25,376,302 | | |

| 261,186 | |

| 2013-C15(c)(d)(e) | |

| 1.549 | % | |

10/15/23 | |

| 11,144,808 | | |

| 111 | |

| 2006-CB17(c) | |

| 5.489 | % | |

12/12/43 | |

| 513,733 | | |

| 379,418 | |

| Morgan Stanley Bank of America Merrill Lynch Trust 2015-C20(c)(d)(e) | |

| 1.604 | % | |

02/15/25 | |

| 23,967,000 | | |

| 452,176 | |

| Morgan Stanley Capital I Trust: | |

| | | |

| |

| | | |

| | |

| 2016-UB11(c)(d)(e) | |

| 1.500 | % | |

08/15/26 | |

| 13,495,500 | | |

| 497,520 | |

| 2021-L5(d) | |

| 2.500 | % | |

05/15/31 | |

| 1,400,000 | | |

| 496,192 | |

| Wells Fargo Commercial Mortgage Trust 2022-C62(c)(e) | |

| 0.047 | % | |

04/15/55 | |

| 45,827,000 | | |

| 135,868 | |

| | |

| | | |

| |

| | | |

| 10,676,093 | |

| | |

| | | |

| |

| | | |

| | |

| Commercial Mortgage Backed Securities-Subordinated (78.70%) | |

| | | |

| | |

| BANK: |

| |

| | | |

| |

| | | |

| | |

| 2021-BN35(c)(d) | |

| 1.660 | % | |

08/15/31 | |

| 3,200,000 | | |

| 1,026,714 | |

| 2019-BN22(c)(d) | |

| 1.961 | % | |

11/15/62 | |

| 2,000,000 | | |

| 823,664 | |

| 2021-BN34(d) | |

| 2.250 | % | |

06/15/31 | |

| 1,400,000 | | |

| 478,666 | |

| 2020-BN29(d) | |

| 2.500 | % | |

12/15/30 | |

| 3,300,000 | | |

| 1,690,150 | |

| 2018-BN12(c)(d) | |

| 2.907 | % | |

05/15/28 | |

| 2,500,000 | | |

| 946,706 | |

| 2017-BNK5(c)(d) | |

| 3.078 | % | |

06/15/27 | |

| 2,000,000 | | |

| 1,324,971 | |

| 2020-BN25(c)(d) | |

| 1.915 | % | |

02/15/30 | |

| 3,000,000 | | |

| 1,215,454 | |

| 2020-BN25(d) | |

| 2.500 | % | |

01/15/30 | |

| 1,250,000 | | |

| 606,006 | |

| 2020-BN27(d) | |

| 2.500 | % | |

04/15/30 | |

| 1,949,000 | | |

| 1,091,559 | |

| 2023-BNK45(d) | |

| 4.000 | % | |

02/15/33 | |

| 1,250,000 | | |

| 726,171 | |

| BBCMS Mortgage Trust 2022-C18 2022-C18(c)(d) | |

| 4.000 | % | |

12/15/32 | |

| 3,602,000 | | |

| 2,141,635 | |

| Benchmark Mortgage Trust: | |

| | | |

| |

| | | |

| | |

| 2020-B20(d) | |

| 2.000 | % | |

10/15/30 | |

| 1,800,000 | | |

| 867,770 | |

| 2021-B29(c)(d) | |

| 2.306 | % | |

10/15/31 | |

| 3,000,000 | | |

| 991,506 | |

| BMO 2022-C1 Mortgage Trust 2022-C1(d) | |

| 2.000 | % | |

02/15/32 | |

| 5,048,000 | | |

| 2,356,258 | |

| BMO 2023-C4 Mortgage Trust 2023-C4(c)(d) | |

| 5.863 | % | |

01/15/33 | |

| 2,125,000 | | |

| 1,486,449 | |

| Cantor Commercial Real Estate Lending 2019-CF2 2019-CF2(c) | |

| 3.634 | % | |

10/15/29 | |

| 1,750,000 | | |

| 1,255,582 | |

| Citigroup Commercial Mortgage Trust: | |

| | | |

| |

| | | |

| | |

| 2019-GC43(d) | |

| 3.000 | % | |

11/10/29 | |

| 3,350,000 | | |

| 1,420,777 | |

| 2019-GC41(d) | |

| 3.000 | % | |

08/10/29 | |

| 1,600,000 | | |

| 970,747 | |

| COMM 2012-CCRE3 Mortgage Trust 2012-CR3(d) | |

| 3.922 | % | |

10/15/45 | |

| 3,145,000 | | |

| 2,610,023 | |

| COMM 2015-LC19 Mortgage Trust 2015-LC19(c) | |

| 4.214 | % | |

01/10/25 | |

| 1,490,000 | | |

| 1,286,247 | |

| Commercial Mortgage Trust: | |

| | | |

| |

| | | |

| | |

| 2014-UBS5(d) | |

| 3.495 | % | |

09/10/24 | |

| 4,569,500 | | |

| 3,493,391 | |

| 2013-CR6(c)(d) | |

| 3.859 | % | |

03/10/46 | |

| 7,368,000 | | |

| 5,117,674 | |

| Description | |

Rate | | |

Maturity Date | |

Principal Amount | | |

Value (Note 2) | |

| 2013-LC6(c)(d) | |

| 4.011 | % | |

01/10/46 | |

$ | 1,043,632 | | |

$ | 969,952 | |

| 2012-CR5(c)(d) | |

| 4.339 | % | |

12/10/45 | |

| 3,554,437 | | |

| 2,787,207 | |

| 2014-UBS2(c)(d) | |

| 4.980 | % | |

02/10/24 | |

| 2,932,500 | | |

| 2,506,524 | |

| Goldman Sachs Mortgage Securities Trust: | |

| | | |

| |

| | | |

| | |

| 2020-GC47(c)(d) | |

| 2.454 | % | |

04/12/30 | |

| 2,500,000 | | |

| 1,023,395 | |

| 2013-GC14(c)(d) | |

| 4.546 | % | |

08/10/23 | |

| 2,000,000 | | |

| 1,250,000 | |

| 2013-GC16(c)(d) | |

| 5.326 | % | |

11/10/46 | |

| 2,342,405 | | |

| 2,205,100 | |

| 2010-C1(c)(d) | |

| 5.635 | % | |

08/10/43 | |

| 3,250,000 | | |

| 3,176,191 | |

| JPMorgan Chase Commercial Mortgage Securities Trust: | |

| | | |

| |

| | | |

| | |

| 2013-C15(d) | |

| 3.500 | % | |

10/15/23 | |

| 2,500,000 | | |

| 2,265,653 | |

| 2012-C6(c)(d) | |

| 4.964 | % | |

05/15/45 | |

| 1,500,000 | | |

| 1,206,969 | |

| Morgan Stanley Bank of America Merrill Lynch Trust 2013-C11(c) | |

| 4.326 | % | |

08/15/46 | |

| 3,000,000 | | |

| 2,976,554 | |

| Morgan Stanley Capital I Trust 2020-L4 2020-L4 | |

| 3.082 | % | |

02/15/30 | |

| 541,000 | | |

| 406,181 | |

| UBS Commercial Mortgage Trust 2019-C17(d) | |

| 2.500 | % | |

10/15/29 | |

| 1,400,000 | | |

| 803,390 | |

| Wells Fargo Commercial Mortgage Trust: | |

| | | |

| |

| | | |

| | |

| 2015-NXS3(d) | |

| 3.153 | % | |

09/15/57 | |

| 1,500,000 | | |

| 1,249,087 | |

| 2017-C40(c) | |

| 4.305 | % | |

09/15/27 | |

| 2,000,000 | | |

| 1,681,274 | |

| | |

| | | |

| |

| | | |

| 58,435,597 | |

| | |

| | | |

| |

| | | |

| | |

| TOTAL COMMERCIAL MORTGAGE BACKED SECURITIES | | |

| | |

| (Cost $84,543,128) | |

| | | |

| |

| | | |

| 69,111,690 | |

| Description | |

7-Day Yield | | |

Shares | | |

Value

(Note 2) | |

| SHORT TERM INVESTMENTS (5.41%) | |

| | | |

| | | |

| | |

| State Street Institutional

Treasury Plus Money Market Fund ‐ Premier Class | |

| 5.173 | % | |

| 4,012,252 | | |

| 4,012,252 | |

| | |

| | | |

| | | |

| | |

| TOTAL SHORT TERM INVESTMENTS | |

| | | |

| | | |

| | |

| (Cost $4,012,252) | |

| | | |

| | | |

| 4,012,252 | |

| | |

| | | |

| | | |

| | |

| TOTAL INVESTMENTS (147.39%) | |

| | | |

| | | |

| | |

| (Cost $125,302,159) | |

| | | |

| | | |

$ | 109,429,509 | |

| | |

| | | |

| | | |

| | |

| Liabilities in Excess of Other Assets (-47.39%) | |

| | | |

| | | |

| (35,182,327 | ) |

| NET ASSETS (100.00%) | |

| | | |

| | | |

$ | 74,247,182 | |

| (a) | Securities were purchased pursuant to Regulation S under the Securities Act of 1933, which exempts

securities offered and sold outside of the United States from registration. Such securities cannot be sold in the United States

without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration.

As of July 31, 2023, the aggregate value of those securities was $752,704 representing 1.01% of net assets. |

| (b) | Security has no contractual maturity date, is not redeemable and contractually pays an indefinite stream

of interest. |

| (c) | Variable rate investment. Interest rates reset periodically. Interest rate shown reflects the rate

in effect at July 31, 2023. Certain variable rate securities are not based on a published reference rate and spread but are determined

by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their

description above. |

| (d) | Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may

normally be sold to qualified institutional buyers in transactions exempt from registration. The total value of Rule 144A securities amounts

to $60,422,793, which represents approximately 81.38% of net assets as of July 31, 2023. |

| (e) | Interest only security. |

See Notes to Quarterly Statement of Investments.

PRINCIPAL

REAL ESTATE INCOME FUND

Notes

to Quarterly Statement of Investments

July

31, 2023 (Unaudited)

NOTE

1. ORGANIZATION

Principal

Real Estate Income Fund (the ‘‘Fund’’) is a Delaware statutory trust registered as a non-diversified, closed-end

management investment company under the Investment Company Act of 1940, as amended (the ‘‘1940 Act’’).

The

Fund’s investment objective is to seek to provide high current income, with capital appreciation as a secondary investment objective,

by investing in commercial real estate related securities.

Investing

in the Fund involves risks, including exposure to below-investment grade investments. The Fund’s net asset value will vary and

its distribution rate may vary and both may be affected by numerous factors, including changes in the market spread over a specified

benchmark, market interest rates and performance of the broader equity markets. Fluctuations in net asset value may be magnified as a

result of the Fund’s use of leverage.

NOTE

2. SIGNIFICANT ACCOUNTING POLICIES

Use

of Estimates: The financial statements are prepared in accordance with generally accepted accounting principles in the United States

of America (“GAAP”), which requires management to make estimates and assumptions that affect the reported amounts of assets

and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and reported amount of increase

or decrease in net assets from operations during the period reported. Management believes the estimates and security valuations are appropriate;

however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ

from the value the Fund ultimately realizes upon sale of the securities. The Fund is considered an investment company under GAAP and

follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting

Standards Codification Topic 946 Financial Services – Investment Companies. The financial statements have been prepared as of the

close of the New York Stock Exchange (“NYSE”) on July 31, 2023.

Portfolio

Valuation: The net asset value per common share of the Fund is determined no less frequently than daily, on each day that the

NYSE is open for trading, as of the close of regular trading on the NYSE (normally 4:00 p.m. New York time). The Fund’s net

asset value per common share is calculated in the manner authorized by the Fund’s Board of Trustees (the "Board" or

"Trustees"). Net asset value per share is computed by dividing the value of the Fund’s total assets, less its liabilities by

the number of share outstanding.

The

Board has established the following procedures for valuation of the Fund’s assets under normal market conditions. Marketable securities

listed on foreign or U.S. securities exchanges generally are valued at closing sale prices or, if there were no sales, at the mean between

the closing bid and ask prices on the exchange where such securities are primarily traded.

The

Fund values commercial mortgage-backed securities ("CMBS") and other debt securities not traded in an organized market on the

basis of valuations provided by an independent pricing service, approved by the Board, which uses information with respect to transactions

in such securities, interest rate movements, new issue information, cash flows, yields, spreads, credit quality, and other pertinent

information as determined by the pricing service, in determining value. If the independent primary or secondary pricing service is unable

to provide a price for a security, if the price provided by the independent primary or secondary pricing service is deemed unreliable,

or if events occurring after the close of the market for a security but before the time as of which the Fund values its common shares

would materially affect net asset value, such security will be valued at its fair value as determined in good faith under procedures

approved by the Board.

Pursuant

to Rule 2a-5 under the Investment Company Act of 1940, the Board has appointed ALPS Advisors, Inc. ("AAI" or the

"Adviser") to serve as the valuation designee to perform fair value determinations for investments in the Fund. In fair

valuing the Fund’s investments, consideration is given to several factors, which may include, among others, the following: the

fundamental business data relating to the issuer, borrower, or counterparty; an evaluation of the forces which influence the market

in which the investments are purchased and sold; the type, size and cost of the investment; the information as to any transactions

in or offers for the investment; the price and extent of public trading in similar securities (or equity securities) of the issuer,

or comparable companies; the coupon payments, yield data/cash flow data; the quality, value and salability of collateral, if any,

securing the investment; the business prospects of the issuer, borrower, or counterparty, as applicable, including any ability to

obtain money or resources from a parent or affiliate and an assessment of the issuer’s, borrower’s, or

counterparty’s management; the prospects for the industry of the issuer, borrower, or counterparty, as applicable, and

multiples (of earnings and/or cash flow) being paid for similar businesses in that industry; one or more independent broker quotes

for the sale price of the portfolio security; and other relevant factors when applicable, fair value of an investment is determined

by the Fund’s Fair Valuation Committee as a designee of the Board. In fair valuing the Fund’s investments, consideration

is given to several factors.

Securities

Transactions and Investment Income: Investment security transactions are accounted for on a trade date basis. Dividend income is

recorded on the ex-dividend date. Certain dividend income from foreign securities will be recorded, in the exercise of reasonable diligence,

a soon as the Fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date and may be subject

to withholding taxes in these jurisdictions. Withholding taxes on foreign dividends have been provided for in accordance with the Fund's

understanding of the applicable country's tax rules and rates. Interest income, which includes amortization of premium and accretion

of discount, is recorded on the accrual basis. Discounts and premiums on commercial mortgage backed securities purchased are accreted

or amortized using the effective interest method. Realized gains and losses from securities transactions and unrealized appreciation

and depreciation of securities are determined using the specific identification method for both financial reporting and tax purposes.

Paydown gains and losses on mortgage-related and other asset-back securities, if any, are recorded as components of interest income in

the Statement of Operations. Interest-only stripped mortgage-backed securities (“IO Strips”) are securities that receive

only interest payments from a pool of mortgage loans. Little to no principal will be received by the Fund upon maturity of an IO Strip.

Periodic adjustments are recorded to reduce the cost of the security until maturity, which are included in interest income.

Fair

Value Measurements: Investments in the Fund are recorded at their estimated fair value. The Fund discloses the classification of

its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to

the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be

observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability

that are developed based on market data obtained from sources independent of the reporting entity. Observable inputs reflect assumptions

about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information

available.

Various

inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall

into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined

based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not

necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy

under applicable financial accounting standards:

| Level

1 – |

Unadjusted

quoted prices in active markets for identical investments, unrestricted assets or liabilities that a Fund has the ability to access

at the measurement date; |

| |

|

| Level

2 – |

Quoted prices which

are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable

(either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level

3 – |

Significant unobservable

prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little

or no market activity for the asset or liability at the measurement date. |

The

following is a summary of the inputs used to value the Fund’s investments as of July 31, 2023:

| Investments in Securities at Value* | |

Level 1 – Quoted Prices | | |

Level 2 – Other Significant Observable Inputs | | |

Level 3 – Significant Unobservable Inputs | | |

Total | |

| Common Stocks | |

$ | 35,638,802 | | |

$ | – | | |

$ | – | | |

$ | 35,638,802 | |

| Preferred Stocks | |

| 666,765 | | |

| – | | |

| – | | |

| 666,765 | |

| Commercial Mortgage Backed Securities | |

| – | | |

| 69,111,690 | | |

| – | | |

| 69,111,690 | |

| Short Term Investments | |

| 4,012,252 | | |

| – | | |

| – | | |

| 4,012,252 | |

| Total | |

$ | 40,317,819 | | |

$ | 69,111,690 | | |

$ | – | | |

$ | 109,429,509 | |

| * |

See Statement of Investments

for industry classifications. |

The

Fund did not have any securities that used significant unobservable inputs (Level 3) in determining fair value, and there were no transfers

into or out of Level 3 during the period.

Commercial

Mortgage Backed Securities (“CMBS”): As part of its investments in commercial real estate related securities, the Fund

will invest in CMBS which are subject to certain risks associated with direct investments in CMBS. A CMBS is a type of mortgage-backed

security that is secured by a loan (or loans) on one or more interests in commercial real estate property. Investments in CMBS are subject

to the various risks which relate to the pool of underlying assets in which the CMBS represents an interest. CMBS may be backed by obligations

(including certificates of participation in obligations) that are principally secured by commercial real estate loans or interests therein

having multi-family or commercial use. Securities backed by commercial real estate assets are subject to securities market risks as well

as risks similar to those of direct ownership of commercial real estate loans because those securities derive their cash flows and value

from the performance of the commercial real estate underlying such investments and/or the owners of such real estate.

Real

Estate Investment Trusts (“REITs”): As part of its investments in real estate related securities, the Fund will invest

in REITs and is subject to certain risks associated with direct investment in REITs. REITs possess certain risks which differ from an

investment in common stocks. REITs are financial vehicles that pool investors’ capital to acquire, develop and/or finance real

estate and provide services to their tenants. REITs may concentrate their investments in specific geographic areas or in specific property

types, e.g., regional malls, shopping centers, office buildings, apartment buildings and industrial warehouses. REITs may be affected

by changes in the value of their underlying properties and by defaults by borrowers or tenants. REITs depend generally on their ability

to generate cash flow to make distributions to shareowners, and certain REITs have self-liquidation provisions by which mortgages held

may be paid in full and distributions of capital returns may be made at any time.

As

REITs generally pay a higher rate of dividends than most other operating companies, to the extent application of the Fund’s investment

strategy results in the Fund investing in REIT shares, the percentage of the Fund’s dividend income received from REIT shares will

likely exceed the percentage of the Fund’s portfolio that is comprised of REIT shares. Distributions received by the Fund from

REITs may consist of dividends, capital gains and/or return of capital.

Dividend

income from REITs is recognized on the ex-dividend date. The calendar year-end amounts of ordinary income, capital gains, and return

of capital included in distributions received from the Fund’s investments in REITs are reported to the Fund after the end of the

calendar year; accordingly, the Fund estimates these amounts for accounting purposes until the characterization of REIT distributions

is reported to the Fund after the end of the calendar year. Estimates are based on the most recent REIT distribution information available.

The

performance of a REIT may be affected by its failure to qualify for tax-free pass-through of income under the Internal Revenue Code of

1986, as amended (the “Code”), or its failure to maintain exemption from registration under the 1940 Act. Due to the Fund’s

investments in REITs, the Fund may also make distributions in excess of the Fund’s earnings and capital gains. Distributions, if

any, in excess of the Fund’s earnings and profits will first reduce the adjusted tax basis of a holder’s common shares and,

after that basis has been reduced to zero, will constitute capital gains to the common shareholder.

Concentration

Risk: The Fund invests in companies in the real estate industry, which may include CMBS, REITs, REIT-like structures, and other securities

that are secured by, or otherwise have exposure to, real estate. Any fund that concentrates in a particular segment of the market will

generally be more volatile than a fund that invests more broadly. Any market price movements, regulatory changes, or economic conditions

affecting CMBS, REITs, REIT-like structures, and real estate more generally, will have a significant impact on the Fund’s performance.

Foreign

Currency Risk: The Fund expects to invest in securities denominated or quoted in currencies other than the U.S. dollar. Changes in

foreign currency exchange rates may affect the value of securities owned by the Fund, the unrealized appreciation or depreciation of

investments and gains on and income from investments. Currencies of certain countries may be volatile and therefore may affect the value

of securities denominated in such currencies, which means that the Fund’s net asset value could decline as a result of changes

in the exchange rates between foreign currencies and the U.S. dollar. These risks often are heightened for investments in smaller, emerging

capital markets.

The

accounting records of the Fund are maintained in U.S. dollars. Prices of securities denominated in foreign currencies are translated

into U.S. dollars at the closing rates of the exchanges at period end. Amounts related to the purchase and sale of foreign securities

and investment income are translated at the rates of exchange prevailing on the respective dates of such transactions.

The

Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from

the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized

gain or loss from investments.

Reported

net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade

and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding

taxes recorded on the Fund's books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange

gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period-end,

resulting from changes in exchange rates.

A

foreign currency contract is a commitment to purchase or sell a foreign currency at a future date, at a negotiated rate. The Fund may

enter into foreign currency contracts to settle specific purchases or sales of securities denominated in a foreign currency and for protection

from adverse exchange rate fluctuation. Risks to a Fund include the potential inability of the counterparty to meet the terms of the

contract.

Market

Disruption and Geopolitical Risk: The value of your investment in the Fund is based on the market prices of the securities

the Fund holds. These prices change daily due to economic and other events that affect markets generally, as well as those that

affect particular regions, countries, industries, companies or governments. These price movements, sometimes called volatility, may

be greater or less depending on the types of securities the Fund owns and the markets in which the securities trade. Securities in

the Fund’s portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for

particular products or resources, natural disasters, pandemics, epidemics, terrorism, regulatory events and governmental or

quasigovernmental actions. The occurrence of global events similar to those in recent years, such as the war in Ukraine, terrorist

attacks around the world, natural disasters, social and political discord or debt crises and downgrades, among others, may result in

market volatility and may have long term effects on both the U.S. and global financial markets. The occurrence of such events may be

sudden and unexpected, and it is difficult to predict when similar events affecting the U.S. or global financial markets may occur,

the effects that such events may have and the duration of those effects. Any such event(s) could have a significant adverse impact

on the value and risk profile of the Fund’s portfolio. There is a risk that you may lose money by investing in the Fund.

Social,

political, economic and other conditions and events, such as natural disasters, health emergencies (e.g., epidemics and pandemics), tariffs

and trade disruptions, recession, changes in currency rates, terrorism, conflicts and social unrest, may occur and could significantly

impact issuers, industries, governments and other systems, including the financial markets. As global systems, economies and financial

markets are increasingly interconnected, events that once had only local impact are now more likely to have regional or even global effects.

Events that occur in one country, region or financial market will, more frequently, adversely impact issuers in other countries, regions

or markets. For example, developments in the banking or financial services sectors could adversely impact a wide range of companies and

issuers. These impacts can be exacerbated by failures of governments and societies to adequately respond to an emerging event or threat.

These types of events quickly and significantly impact markets in the U.S. and across the globe leading to extreme market volatility

and disruption. The extent and nature of the impact on supply chains or economies and markets from these events is unknown, particularly

if a health emergency or other similar event, persists for an extended period of time. Such events could impact the Adviser's investment

advisory activities and services of other service providers, which in turn could adversely affect the Fund’s investments and other

operations. The value of the Fund’s investments may decrease as a result of such events, particularly if these events adversely

impact the operations and effectiveness of the Adviser or key service providers or if these events disrupt systems and processes necessary

or beneficial to the investment advisory, other activities on behalf the Fund.

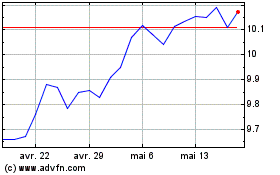

Principal Real Estate In... (NYSE:PGZ)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Principal Real Estate In... (NYSE:PGZ)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024