UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11-K

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2023

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _____________________ to _____________________

Commission file number 001-34728

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

Douglas Dynamics, L.L.C. 401(k) Plan

B. Name of issuer of securities held pursuant to the plan and the address of its principal executive office:

Douglas Dynamics, Inc.

11270 W Park Place Suite 300

Milwaukee, Wisconsin 53224

REQUIRED INFORMATION

The following financial statements and supplemental information of the Douglas Dynamics, L.L.C. 401(k) Plan, prepared in accordance with the financial reporting requirements of the Employee Retirement Income Security Act of 1974, as amended, are filed herewith.

DOUGLAS DYNAMICS, L.L.C.

401(k) PLAN

Milwaukee, Wisconsin

FINANCIAL STATEMENTS AND

SUPPLEMENTAL INFORMATION

December 31, 2023 and 2022

DOUGLAS DYNAMICS, L.L.C.

401(k) PLAN

TABLE OF CONTENTS

PAGE

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMS |

1 |

| |

|

| |

|

| FINANCIAL STATEMENTS |

|

| |

|

| Statements of Net Assets Available for Benefits |

2 |

| Statement of Changes in Net Assets Available for Benefits |

3 |

| Notes to Financial Statements |

4 |

| |

|

| |

|

| SUPPLEMENTAL INFORMATION |

11 |

| |

|

| Schedule H, Line 4a – Schedule of Delinquent Participant Contributions |

12 |

| Schedule H, Line 4i - Schedule of Assets (Held at End of Year) |

13 |

Report of Independent Registered Public Accounting Firm

Plan Administrator and Plan Participants

Douglas Dynamics, L.L.C. 401(k) Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of Douglas Dynamics, L.L.C. 401(k) Plan (the Plan) as of December 31, 2023 and 2022, and the related statement of changes in net assets available for benefits for the year ended December 31, 2023, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2023 and 2022, and the changes in net assets available for benefits for the year ended December 31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplementary Information

The supplemental information in the accompanying Schedule H, Line 4(a) – Schedule of Delinquent Participant Contributions for the year ended December 31, 2023, and Schedule H, Line 4i – Schedule of Assets (Held at End of Year) as of December 31, 2023, has been subjected to audit procedures performed in conjunction with the audit of Douglas Dynamics, L.L.C. 401(k) Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures include determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Wipfli LLP

Wipfli LLP

We have served as the Plan’s auditor since 2022.

June 17, 2024

Milwaukee, WI

DOUGLAS DYNAMICS, L.L.C.

401(k) PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

December 31, 2023 and 2022

| |

|

2023

|

|

|

2022

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Participant-directed investments, at fair value

|

|

$ |

142,797,519 |

|

|

$ |

120,942,513 |

|

|

Contributions receivable

|

|

|

62,706 |

|

|

|

52,303 |

|

|

Notes receivable from participants

|

|

|

2,874,761 |

|

|

|

2,385,778 |

|

| |

|

|

|

|

|

|

|

|

|

NET ASSETS AVAILABLE FOR BENEFITS

|

|

$ |

145,734,986 |

|

|

$ |

123,380,594 |

|

The accompanying notes are an integral part of the financial statements

DOUGLAS DYNAMICS, L.L.C.

401(k) PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

Year Ended December 31, 2023

|

ADDITIONS TO NET ASSETS ATTRIBUTED TO

|

|

|

|

|

|

Investment income:

|

|

|

|

|

|

Interest and dividends

|

|

$ |

698,981 |

|

|

Net appreciation in fair value of investments

|

|

|

19,434,706 |

|

|

Net investment income

|

|

|

20,133,687 |

|

| |

|

|

|

|

|

Interest income from notes receivable from participants

|

|

|

184,007 |

|

| |

|

|

|

|

|

Contributions:

|

|

|

|

|

|

Company

|

|

|

5,161,311 |

|

|

Participants

|

|

|

9,331,782 |

|

|

Rollover

|

|

|

875,762 |

|

|

Total contributions

|

|

|

15,368,855 |

|

| |

|

|

|

|

|

Total additions

|

|

|

35,686,549 |

|

| |

|

|

|

|

|

DEDUCTIONS FROM NET ASSETS ATTRIBUTED TO

|

|

|

|

|

|

Benefits paid to participants

|

|

|

13,068,044 |

|

|

Administrative expenses

|

|

|

264,113 |

|

|

Total deductions

|

|

|

13,332,157 |

|

| |

|

|

|

|

|

NET INCREASE IN NET ASSETS AVAILABLE FOR BENEFITS

|

|

|

22,354,392 |

|

| |

|

|

|

|

|

NET ASSETS AVAILABLE FOR BENEFITS

|

|

|

|

|

|

Beginning of year

|

|

|

123,380,594 |

|

| |

|

|

|

|

|

End of year

|

|

$ |

145,734,986 |

|

The accompanying notes are an integral part of the financial statements

NOTE 1 - DESCRIPTION OF PLAN

The following is a brief description of the Douglas Dynamics, L.L.C. 401(k) Plan (the “Plan”) as in effect during 2023. Participants should refer to the Plan Document and Summary Plan Description for a more complete discussion of the provisions of the Plan.

General

The Plan is a defined contribution plan established on January 1, 1988 and most recently restated effective April 28, 2022. All employees (other than leased employees of Douglas Dynamics, L.L.C. (the “Company”) and its controlled group members who have adopted the plan) are eligible for participation in the Plan. Employees become participants on the first day of each calendar quarter following their employment commencement date. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”), as amended.

On May 31, 2023, the investment options offered in the Plan were updated after a review of the investment options was performed by the Plan’s Fiduciary Committee.

Contributions

Contributions to the Plan are made by the participants in the Plan and by the Company and are subject to the provisions of Section 401(k) of the Internal Revenue Code (IRC).

New employees that meet the requirements to participate in the Plan are automatically enrolled with a default 3% deferral rate, increasing each year until the participant reaches a 6% deferral rate, unless otherwise elected by the Plan participant.

Participants can contribute up to 70% of their eligible compensation, as defined, to the Plan, subject to limits set forth by the IRC. Participants who attained age 50 before the end of the Plan year are eligible to make catch-up contributions. The Company has a Company matching percentage of 100% of contributions up to 3% of compensation, plus 50% of contributions over 3% of compensation up to 6% of compensation. Additional contributions could be made at the option of the Company’s Board of Managers subject to certain limitations set forth in the Plan. All participant and Company contributions are 100% vested.

Participants may also contribute amounts representing distributions from other qualified defined benefit or defined contribution plans (rollover). Participants direct the investment of their contributions into various investment options offered by the Plan. The Plan currently offers mutual funds, Company stock, common collective trusts and prior to May 31, 2023, additionally offered various pooled separate accounts as investment options for participants.

Participant Accounts

Each participant’s account is credited with the participant’s contribution and allocations of (a) the Company’s contribution and (b) Plan earnings or losses. Allocations are based on the participant’s eligible compensation or account balances, as defined. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

NOTE 1 - DESCRIPTION OF PLAN (CONTINUED)

Notes Receivable from Participants

Participants may borrow from their fund accounts a minimum of $1,000 up to a maximum of $50,000 or 50% of their vested account balance, whichever is less. Notes receivable transactions are treated as a transfer between the investment fund and the notes receivable fund. Notes receivable terms range from one to five years, although a longer term is permitted if proceeds are for the purchase of a primary residence. The notes receivable are secured by the balance in the participant’s account and bear a reasonable fixed rate of interest to be determined by the Loan Administrator at the time the loan was made. Principal and interest are paid ratably through payroll deductions in those cases where repayment through payroll deduction is available. Payments of principal and interest are credited to the participant’s account.

Forfeitures

Forfeitures are comprised of non-vested funds from employees who were terminated prior to 2019 or suspense forfeitures which are created by transactions such as the overfunding of employer contributions. In 2019, the Company switched to a safe harbor plan where participants are immediately 100% vested in both employee and employer contributions. Unvested funds from prior to 2019 move to the forfeiture account 5 years after termination if the employee does not withdraw the funds. Forfeited nonvested accounts will be used to pay administrative expenses, reduce Company contributions, or be reallocated to participants. At December 31, 2023 and 2022, there were $936 and $1,092 of forfeited nonvested accounts available to reduce Company contributions and pay administrative expenses, respectively. During 2023, $12,928 of forfeitures were used to reduce Company contributions. During 2023, $484 of forfeitures were used to pay administrative expenses.

Benefit Payments

Plan benefits are payable upon retirement at age 65 or later, disability, death, financial hardship, or termination of employment. Upon death, a participant’s account will be paid to the beneficiary in a lump sum upon the valuation date immediately following death. If a participant is at least age

59-1/2, an election may be made generally once each year, online, to receive a payment consisting of all or part of the account balance.

If the participant’s vested account is $5,000 or greater, upon retirement or termination of employment other than death, the vested account will generally be paid in one single sum (subject to exceptions described in the Plan). For 2023, an account could be maintained up to age 72, at which time payment must be arranged. If the balance is less than $5,000, the entire balance will be distributed upon retirement or termination in one lump sum payment.

Plan Termination

Although it has not expressed an intent to do so, the Company has the right under the Plan to discontinue contributions at any time and to terminate the Plan subject to provisions of ERISA. In the event of Plan termination, the participants would become fully vested in their Company contributions.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting

The financial statements have been prepared on the accrual basis of accounting.

Investment Valuation

Investments are reported at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. See Note 3 for discussion of fair value measurements.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Net investment appreciation (depreciation) includes the Plan’s gains and losses on investments bought and sold as well as held during the year.

Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Delinquent participant loans are reclassified as distributions based upon the terms of the Plan document. Related fees are recorded as administrative expenses and are expensed as incurred. No allowance for credit losses has been recorded as of December 31, 2023 or 2022.

Payment of Benefits

Benefits are recorded when paid.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles in the United States of America (“GAAP”) requires the Plan administrator to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein, and disclosure of certain assets and liabilities. Actual results could differ from those estimates.

Plan Expenses

Pursuant to the terms of the Plan, the Company pays all of the administrative expenses of the Plan except for administrative expenses incurred in conjunction with early withdrawals, participant requested services, and loan distributions (which are paid by participants). Investment related expenses are included in net appreciation (depreciation) in fair value of investments.

Subsequent Events

The Plan has evaluated subsequent events through June 17, 2024, the date the financial statements were issued.

NOTE 3 - FAIR VALUE MEASUREMENTS

The framework for measuring fair value provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are described as follows:

| |

Level 1 -

|

Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access.

|

| |

|

|

| |

Level 2 - |

Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly such as,

• quoted prices for similar assets or liabilities in active markets;

• quoted prices for identical or similar assets or liabilities in inactive markets;

• inputs other than quoted prices that are observable for the asset or liability;

• inputs that are derived principally from or corroborated by observable market data by correlation or other means.

If the asset or liability has a specified (contractual) term, the level 2 input must be observable for substantially the full term of the asset or liability.

|

| |

|

|

| |

Level 3 - |

Inputs to the valuation methodology are unobservable and significant to the fair value measurement. |

The asset or liability's fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

NOTE 3 - FAIR VALUE MEASUREMENTS (CONTINUED)

Following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the methodologies used at December 31, 2023 and 2022.

Douglas Dynamics, Inc. common stock is valued at fair value based on the closing price reported in an active market where such shares are traded.

Mutual funds are valued at the net asset value (“NAV”) of shares held by the plan at year end.

Common collective trusts are valued at the NAV which is based on the market value of its underlying investments. These funds are collective investment trusts that contain synthetic investment contracts comprised of both underlying investment and contractual components which have observable Level 1 or Level 2 pricing inputs, including quoted prices for similar assets in active or non-active markets. NAV is used as an estimate of fair value, as the reporting entity has the ability to redeem its investment at NAV as of the measurement date as collective investment trusts can be redeemed on a daily basis. NAV is a readily determinable fair value and is the basis for current transactions.

Pooled separate accounts, prior to May 31, 2023, consisted of various investment options (i.e. common stock, mutual funds, short-term securities, real estate) and were valued at the NAV which was based on the market value of its underlying investments. While the majority of the underlying asset values were quoted prices, the NAV of the pooled separate accounts was not publicly quoted and was determined by the insurance company. NAV was a readily determinable fair value and was the basis for current transactions.

NOTE 3 - FAIR VALUE MEASUREMENTS (CONTINUED)

The following table sets forth by level, within the fair value hierarchy, the Plan’s assets at fair value as of December 31, 2023:

| |

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Douglas Dynamics, Inc. common stock

|

|

$ |

2,345,353 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

2,345,353 |

|

|

Mutual funds

|

|

|

35,257,518 |

|

|

|

- |

|

|

|

- |

|

|

|

35,257,518 |

|

|

Common collective trusts

|

|

|

- |

|

|

|

105,194,648 |

|

|

|

- |

|

|

|

105,194,648 |

|

|

Total assets at fair value

|

|

$ |

37,602,871 |

|

|

$ |

105,194,648 |

|

|

$ |

- |

|

|

$ |

142,797,519 |

|

The following table sets forth by level, within the fair value hierarchy, the Plan’s assets at fair value as of December 31, 2022:

| |

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Douglas Dynamics, Inc. common stock

|

|

$ |

2,864,603 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

2,864,603 |

|

|

Mutual funds

|

|

|

23,667,567 |

|

|

|

- |

|

|

|

- |

|

|

|

23,667,567 |

|

|

Pooled separate accounts

|

|

|

- |

|

|

|

22,056,997 |

|

|

|

- |

|

|

|

22,056,997 |

|

|

Common collective trusts

|

|

|

- |

|

|

|

72,353,346 |

|

|

|

- |

|

|

|

72,353,346 |

|

|

Total assets at fair value

|

|

$ |

26,532,170 |

|

|

$ |

94,410,343 |

|

|

$ |

- |

|

|

$ |

120,942,513 |

|

NOTE 4 – PARTY-IN-INTEREST TRANSACTIONS

Certain Plan investments are managed by Principal Life Insurance Company. Principal Life Insurance Company is the custodian as defined by the Plan and, therefore, these transactions qualify as party-in-interest transactions. These party-in-interest transactions are exempt from the prohibited transaction rules at ERISA.

Certain Plan investments are shares of Douglas Dynamics, Inc. Common stock. The Plan held 79,021 and 79,220 shares of Douglas Dynamics, Inc. Common stock at December 31, 2023 and 2022 with a fair value of $2,345,353 and $2,864,603, respectively. During the year ended December 31, 2023, purchases of shares by the Plan totaled $552,918 and sales of shares by the Plan totaled $569,785.

NOTE 5 - TAX STATUS

The IRS has determined and informed the Company by a letter dated June 30, 2020 that the volume submitter plan used by the Plan and related trust are designed in accordance with applicable sections of the IRC. The Plan administrator believes that the Plan is designed and is currently being operated in compliance with the applicable requirements of the IRC. Therefore, no provision for income taxes is included in the accompanying financial statements.

GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain tax position that more likely than not would not be sustained upon examination by the IRS. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

NOTE 6 - RISK AND UNCERTAINTIES

The Plan invests in various investment securities. Investment securities, in general, are exposed to various risks, such as interest rate, credit, and overall market volatility. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect the amounts reported in the statements of net assets available for benefits.

NOTE 7 – NON-EXEMPT TRANSACTIONS

In 2022, the Company failed to remit certain employee deferral contributions for certain payroll periods within the timeframe prescribed by the Department of Labor. As of December 31, 2023, $3,452 of the delinquent contributions were corrected related to the 2022 Plan year. For the corrected contributions, the Company has filed the required Form 5330 with the IRS and paid the associated excise tax. There are no additional deferral contributions outstanding as of December 31, 2023.

SUPPLEMENTAL INFORMATION

DOUGLAS DYNAMICS, L.L.C.

401(k) PLAN

SCHEDULE H, LINE 4(a) - SCHEDULE OF DELINQUENT PARTICIPANT CONTRIBUTIONS

Year Ended December 31, 2023

|

Name of Plan Sponsor:

|

DOUGLAS DYNAMICS, L.L.C.

|

|

Employer Identification Number:

|

42-1623692

|

|

Three Digit Plan Number:

|

006

|

|

2022 Participant Contributions Transferred Late to Plan

|

|

|

Total that Constitute Non-Exempt Prohibited Transactions

|

|

|

|

|

|

|

Amount Withheld

|

|

|

Check here if Late Participant

Loan Repayments are

included:

|

|

|

Contributions Not

Corrected

|

|

|

Contributions

Corrected Outside

VFCP

|

|

|

Contributions

Pending Correction

in VFCP

|

|

|

Total fully corrected

under VFCP and PTE

2002-51

|

|

| $ |

3,452 |

|

|

☐ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

3,452 |

|

DOUGLAS DYNAMICS, L.L.C.

401(k) PLAN

SCHEDULE H, LINE 4(i) - SCHEDULE OF ASSETS (HELD AT END OF YEAR)

December 31, 2023

|

Name of Plan Sponsor:

|

DOUGLAS DYNAMICS, L.L.C.

|

|

Employer Identification Number:

|

42-1623692

|

|

Three Digit Plan Number:

|

006

|

| |

|

(b)

|

|

(c)

|

|

|

|

|

|

|

|

|

| |

|

Identity of Issuer,

|

|

Description of Investment

|

|

|

|

|

|

(e)

|

|

| |

|

Borrower, Lessor,

|

|

including maturity date, rate of interest,

|

|

(d)

|

|

|

Current

|

|

|

(a)

|

|

or Similar Party

|

|

collateral, par, or maturity value

|

|

Cost (2)

|

|

|

Value

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Common Stock

|

|

|

|

|

|

|

|

|

|

|

| * |

|

Douglas Dynamics, Inc. Common Stock

|

|

Company Common Stock

|

|

|

|

|

|

$ |

2,345,353 |

|

| |

|

Mutual Funds

|

|

|

|

|

|

|

|

|

|

|

| |

|

Wells Fargo

|

|

Allspring Short-Term High Income Institutional Fund

|

|

|

|

|

|

|

1,168,102 |

|

| |

|

American Funds

|

|

American Funds New World R6 Fund

|

|

|

|

|

|

|

1,078,399 |

|

| |

|

Dodge and Cox Funds

|

|

Dodge & Cox Income X Fund

|

|

|

|

|

|

|

2,190,577 |

|

| |

|

Fidelity Investments

|

|

Fidelity Mid Cap Index Fund

|

|

|

|

|

|

|

1,449,080 |

|

| |

|

Fidelity Investments

|

|

Fidelity Small Cap Index Fund

|

|

|

|

|

|

|

4,210,201 |

|

| |

|

Fidelity Investments

|

|

Fidelity US Bond Index Fund

|

|

|

|

|

|

|

1,597,263 |

|

| |

|

Fidelity Investments

|

|

Fidelity 500 Index Fund

|

|

|

|

|

|

|

11,401,971 |

|

| |

|

Invesco

|

|

Invesco Value Opp

|

|

|

|

|

|

|

1,541,978 |

|

| |

|

T. Rowe Price Funds

|

|

T. Rowe Price Capital Appreciation Fund

|

|

|

|

|

|

|

8,235,065 |

|

| |

|

Vanguard Group

|

|

Vanguard Explorer Admiral Fund

|

|

|

|

|

|

|

2,384,882 |

|

| |

|

Common Collective Trust

|

|

|

|

|

|

|

|

|

|

|

| |

|

Great Gray Trust Company

|

|

Blackrock Equity Index Fund

|

|

|

|

|

|

|

808,746 |

|

| |

|

Great Gray Trust Company

|

|

International Growth II

|

|

|

|

|

|

|

2,294,864 |

|

| |

|

Great Gray Trust Company

|

|

Large Cap Growth Fund

|

|

|

|

|

|

|

6,999,430 |

|

| |

|

Great Gray Trust Company

|

|

Large Cap Value

|

|

|

|

|

|

|

7,006,643 |

|

| |

|

Great Gray Trust Company

|

|

Mid Cap Growth

|

|

|

|

|

|

|

3,958,990 |

|

|

*

|

|

Principal Global Investory Trust Company

|

|

Principal Stable Value Z Fund

|

|

|

|

|

|

|

5,421,182 |

|

| |

|

Great Gray Trust Company

|

|

RetirePilot Aggressive 2025 Fund

|

|

|

|

|

|

|

70,143 |

|

| |

|

Great Gray Trust Company

|

|

RetirePilot Aggressive 2035 Fund

|

|

|

|

|

|

|

17,174 |

|

| |

|

Great Gray Trust Company

|

|

RetirePilot Aggressive 2045 Fund

|

|

|

|

|

|

|

87,405 |

|

| |

|

Great Gray Trust Company

|

|

RetirePilot Aggressive 2055 Fund

|

|

|

|

|

|

|

89,558 |

|

| |

|

Great Gray Trust Company

|

|

RetirePilot Aggressive 2065 Fund

|

|

|

|

|

|

|

16,088 |

|

| |

|

Great Gray Trust Company

|

|

RetirePilot Conservative 2025

|

|

|

|

|

|

|

75,853 |

|

| |

|

Great Gray Trust Company

|

|

RetirePilot Conservative 2035

|

|

|

|

|

|

|

4,147 |

|

| |

|

Great Gray Trust Company

|

|

RetirePilot Conservative 2045

|

|

|

|

|

|

|

1,083 |

|

| |

|

Great Gray Trust Company

|

|

RetirePilot Conservative 2055

|

|

|

|

|

|

|

18,287 |

|

| |

|

Great Gray Trust Company

|

|

RetirePilot Conservative 2065

|

|

|

|

|

|

|

3,063 |

|

| |

|

Great Gray Trust Company

|

|

RetirePilot Moderate Retirement Fund

|

|

|

|

|

|

|

1,234,614 |

|

| |

|

Great Gray Trust Company

|

|

RetirePilot Moderate 2025 Retirement Fund

|

|

|

|

|

|

|

23,091,497 |

|

| |

|

Great Gray Trust Company

|

|

RetirePilot Moderate 2035 Retirement Fund

|

|

|

|

|

|

|

21,110,864 |

|

| |

|

Great Gray Trust Company

|

|

RetirePilot Moderate 2045 Retirement Fund

|

|

|

|

|

|

|

15,281,296 |

|

| |

|

Great Gray Trust Company

|

|

RetirePilot Moderate 2055 Retirement Fund

|

|

|

|

|

|

|

13,168,474 |

|

| |

|

Great Gray Trust Company

|

|

RetirePilot Moderate 2065 Retirement Fund

|

|

|

|

|

|

|

3,346,504 |

|

| |

|

Great Gray Trust Company

|

|

Small Cap Value II

|

|

|

|

|

|

|

1,088,743 |

|

|

*

|

|

Participant Loans

|

|

Notes receivable from participants (1)

|

|

$ |

- |

|

|

|

2,874,761 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

$ |

145,672,280 |

|

*Party-in-interest as defined by ERISA.

|

(1)

|

Bearing interest rates ranging from 5.25 to 10.5 percent and maturing at various dates through August 2032.

|

|

(2)

|

Not applicable - participant directed investments except for notes receivable from participants.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

DOUGLAS DYNAMICS, L.L.C. 401(K) PLAN |

|

| Dated: June 17, 2024 |

By:

|

/s/ Sarah Lauber

|

|

|

|

|

Sarah Lauber |

|

|

|

|

Chief Financial Officer and Secretary of Douglas Dynamics, Inc. |

EXHIBIT INDEX

DOUGLAS DYNAMICS, L.L.C. 401(K) PLAN

FORM 11-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in the Registration Statement (No. 333-184781) on Form S-8 of Douglas Dynamics, Inc. of our report dated June 17, 2024, with respect to the statements of net assets available for benefits of Douglas Dynamics, L.L.C. 401(k) Plan as of December 31, 2023 and 2022, the related statement of changes in net assets available for benefits for the year ended December 31, 2023, and the related supplemental schedules as of December 31, 2023, which report appears in the December 31, 2023 annual report on Form 11-K of Douglas Dynamics, L.L.C. 401(k) Plan.

/s/ Wipfli LLP

Wipfli LLP

Milwaukee, Wisconsin

June 17, 2024

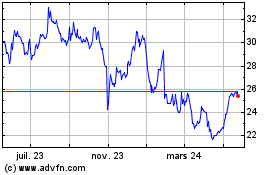

Douglas Dynamics (NYSE:PLOW)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

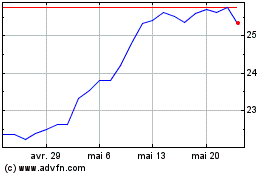

Douglas Dynamics (NYSE:PLOW)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024