0001811414False00018114142023-10-252023-10-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 25, 2023

QuantumScape Corporation

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

001-39345 |

85-0796578 |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

1730 Technology Drive, San Jose, California |

|

95110 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (408) 452-2000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Class A common stock, par value $0.0001 per share |

|

QS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 25, 2023, QuantumScape Corporation (the “Company”) announced its business and financial results for its third quarter of 2023, which ended September 30. A copy of the Company’s Shareholder Letter is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

On October 25, 2023, the Company issued a press release announcing the release of its business and financial results. A copy of the press release is attached as Exhibit 99.2 to this Current Report on Form 8-K.

The information contained in this Item 2.02 and in the accompanying Exhibits 99.1 and 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

QUANTUMSCAPE CORPORATION |

|

|

|

|

Date: October 25, 2023 |

|

By: |

/s/ Kevin Hettrich |

|

|

|

Kevin Hettrich |

|

|

|

Chief Financial Officer (Principal Financial and Accounting Officer) |

Exhibit 99.1

Q3 FISCAL 2023

LETTER TO SHAREHOLDERS

OCTOBER 25, 2023

Dear shareholders,

We’re pleased to share an update on our progress over the third quarter of 2023:

Customer Prototype Testing

In Q4 2022, we shipped our first A0 prototype cells to prospective customers, with the goal of providing a proof-of-concept demonstration of a 24-layer anode-free solid-state lithium-metal battery cell.

While our commercial target remains 800 cycles to 80% energy retention, we can now share that our top-performing A0 prototype cell in one prospective customer’s battery testing labs achieved over 1,000 full cycle equivalents with over 95% discharge energy retention, using customer-specified test conditions of C/3 charge and C/2 discharge with our standard temperature and pressure conditions, and 100% depth of discharge.

Test data sourced from automotive OEM testing lab

Full cycle equivalent is defined by the automotive OEM as the overall discharge capacity throughput divided by the normal discharge capacity.

We emphasize that this is the best-performing cell and we have work to do on aspects such as reliability. Nonetheless, this is an exceptional result. We are not aware of any automotive-format lithium-metal battery that has shown such high discharge energy retention over a comparable cycle count, at room temperature and modest pressure, regardless of C-rate. We believe that no competing electrolyte — solid or liquid — has demonstrated sufficient stability with lithium metal to achieve this, and that this result sets a new high-water mark for lithium-metal battery performance.

This result is especially meaningful because the A0 prototype cell has the same number of layers as our production-intent cell and uses our proprietary cell format. Together with the higher-loading cathode results reported in our Q1 2023 shareholder letter, we have now separately demonstrated three key aspects of our production-intent cell design: 24 layers, higher cathode loading (~5mA/cm2), and our new cell format. When these aspects are combined with improvements to packaging efficiency and manufacturing process control and automation for improved reliability, it forms the core of our first commercial product, QSE-5. QSE-5 is designed to have ~5 amp-hours (Ah) of capacity; for reference, the 2170 battery used in several leading EV models has a typical capacity of ~4.5–5 Ah.

It’s important to keep in mind that, since QSE-5 will have higher-loading cathodes and more efficient packaging than our A0 prototype cell, it will sustain higher current densities and be built with tighter margins, resulting in more stress on the cell. We also must continue to work on producing these cells in large volumes with high quality and reliability. These factors present significant challenges. Nevertheless, we believe this remarkable result makes clear that our technology can achieve disruptive performance at commercial-intent layer counts, further increasing our confidence in the transformative potential of our technology and product roadmap.

Customer Engagement

Our primary focus is on QSE-5 development, with the goal of enabling superior performance in a range of potential automotive applications, across motorsport, passenger and commercial vehicles, including motorcycles, cars, trucks and SUVs. As we reported last quarter, we are collaborating closely with a prospective launch customer in the automotive sector for QSE-5. While the scale of this initial application is small by design, it represents an important vehicle proof of concept that we believe has high visibility and the potential to lead to other programs in the future.

We are pleased with the progress the joint teams have made so far on module and pack integration and system design, though significant work remains. For example, we continue to refine and finalize the design parameters of QSE-5, which will determine the specific thermal and mechanical behavior of the cell.

Beyond automotive, we remain engaged with prospective customers in the consumer electronics sector, and in Q3, we entered into a technology evaluation agreement with a leading global consumer electronics player. We believe the ability of our solid-state platform to maintain good cycling performance with zero externally applied pressure meets a key design requirement for these applications. The single-layer sister1 cells that we first reported on in our Q3 2022 shareholder letter have now achieved between 1,500 to 2,000 cycles to ~80% discharge energy retention with zero externally applied pressure. For reference, we believe 500 to 1,000 charge-discharge cycles represents a key life cycle threshold for many consumer electronics applications.

___________________Discharge energy retention vs cycle count for single-layer pouch cells with zero externally applied pressure

1 As part of any prospective customer shipment, we build additional cells with the same design, which we refer to as sister cells, and test them in our own labs under conditions intended to replicate those in our customers’ labs.

Product Development

Our planned first commercial product is QSE-5, which uses the proprietary format first demonstrated in A0 prototypes last year. This innovative format is a hybrid of conventional pouch and prismatic cell designs to address the uniaxial expansion of lithium metal as it plates and strips during charging and discharging. We call this novel format FlexFrame.

FlexFrame combines a rigid frame, which provides structural stability, with a flexible polymer layer, which allows the face of the cell to expand and contract within the fixed exterior dimensions of the frame.

A key technical goal for the year is to improve cell packaging efficiency relative to the A0 prototype cells we shipped to prospective customers in 2022. This involves reducing the space taken up by the inactive material and FlexFrame package, as well as increasing the amount of active material in the cell, which we expect will enable the final commercial design to reach our energy density targets. When comparing the A0 prototype to our current B0 FlexFrame packaging prototype, as shown above and on the cover of this letter, the B0 prototypes are designed to pack the same number of layers, with more energy per layer, into a slimmer cell package.

We plan to provide a detailed look at the innovative FlexFrame architecture in an upcoming webinar.

Manufacturing Scale Up

As we previously reported, in Q2 we finished installing equipment for Raptor, our next-generation fast separator heat treatment process. Raptor is designed to deliver up to three times as much throughput using similar equipment as our last-generation process, while applying less energy per separator. In Q3, we began process qualification of Raptor equipment on schedule.

Process qualification involves producing films, gathering data to characterize their quality and consistency, and using that feedback to refine our process specs. We are pleased with early returns from qualification testing, and while there is work remaining to dial in this process, we continue to target

deployment of Raptor by the end of the year. We also continue to make progress on our next-generation Cobra process, which is planned to support higher-volume B-sample production from our consolidated QS-0 pre-pilot line.

Along with separator heat treatment equipment, in Q3 we took delivery, installed, and commissioned key pieces of equipment related to process automation, such as unit-cell assembly equipment as pictured below. More automation not only increases our cell production capacity, but also reduces manual handling, which is a common source of run-to-run variation and tends to adversely impact reliability. We plan to continue process development and automation deployment to enable higher quality, consistency, and throughput as we build out our manufacturing capability.

Overall, we are pleased with our manufacturing scale up progress, but more work remains, including continuing to drive our defect reduction and quality improvement initiatives, integrating advanced metrology and data collection, and developing additional process automation.

Newly installed automated cell assembly equipment

|

|

|

Introducing Dr. Siva Sivaram, President In Q3, we welcomed Dr. Siva Sivaram as our new President to help bring our battery technology into high-volume production. Dr. Sivaram brings extensive experience in high-volume manufacturing of advanced technology products. Most recently, Dr. Sivaram served as President at Western Digital, a global leader in solid-state and magnetic data storage, with tens of millions of units shipped and more than $18B in revenue in FY2022. Before that, he held leadership roles at pioneering technology companies, including SanDisk, Matrix Semiconductor and Intel. |

“I joined QuantumScape to help ramp our technology into a product that can be delivered to our customers in high volumes. The level of sophistication of the technology, in its materials set, processes, integration, and product specifications is truly impressive, and the performance results we have demonstrated provide a solid platform on which we can build high volume production. The extent of customer interaction and engagement with top-tier automotive and consumer electronics partners is equally encouraging. Finally, one of the most important aspects is the quality and commitment of the team. Now as we transition from technology development into manufacturing, we need to put enhanced focus on process and defect control, equipment and data automation, training, and infrastructure, and build on our culture of focused product execution. I am looking forward to this new phase of the company’s growth.”

Financial Outlook

For the third quarter, capital expenditures were $18M. GAAP operating expenses were $121M. Cash operating expenses, defined as operating expenses less stock-based compensation and depreciation, were $63.5M. For the full-year 2023, we maintain our guidance on cash operating expenses of $225M to $275M and revise our capex guidance to $75M to $100M. Approximately one third of the lower capex forecast is driven by realized savings; the remaining approximate two thirds relates to shifts in capex timing. Despite these changes in the timing of capex, we continue to target low-volume B samples in 2024 off our Raptor process and higher-volume B samples in 2025 off our Cobra process. During Q3, our capex primarily went toward facility and equipment spend for our consolidated QS-0 pre-pilot line, including for our Raptor process. For the remainder of the year, our capex will continue to be allocated toward QS-0.

During the quarter, we raised $300M in gross proceeds from our public follow-on offering. We ended Q3 with over $1.1B in liquidity and continue to look for opportunities to optimize our spending and be prudent with our strong balance sheet. We now forecast that our cash runway will extend into 2026. Any additional funds raised from capital markets activity, including under our ATM prospectus supplement, would further extend this cash runway. Longer term, our capital requirements will be a function of our industrialization business model, which we believe could reflect a mix of wholly owned production, joint venture, and licensing relationships. As always, we encourage investors to read more on our financial information, business outlook and risk factors in our quarterly and annual SEC filings on our investor relations website.

Strategic Outlook

Our focus for 2023 is simple: turn the corner from prototype to product. Our key milestones are all aimed at advancing product development to build a sufficient level of technical and manufacturing maturity to enable initial production of QSE-5. With just a few months remaining in the year, we are maintaining aggressive near-term schedules and remain focused on bringing a potentially disruptive first product to market in the near future.

But strategically, our mission is bigger than a series of near-term objectives. We have been pursuing a next-generation electric vehicle battery for over a decade, and with a mission as challenging and as important as this, long-term thinking is indispensable. Moreover, the market opportunity for our technology platform is massive, potentially in the hundreds of billions of dollars annually for decades

to come.

With that in mind, this year we have also taken steps to strengthen our long-term strategic position. For example, this quarter we seized the opportunity to fortify our balance sheet, extending our forecasted cash runway into 2026 and securing funding for pivotal development and deployment milestones — including higher-volume B samples based on our Cobra separator process — which, if achieved, would have a transformative effect on our business. We have also built on our strong customer relationships and deepened our engagement with a prospective launch customer for our first product. And we continue to add manufacturing experience and technical excellence to our team at every level.

At the close of Q3, we feel prepared to face the inevitable and innumerable short-term challenges on the way to our goal, because we have laid a strong foundation for long-term success. We look forward to reporting on the challenges, and the successes, in the quarters to come.

|

|

|

|

Jagdeep Singh |

Kevin Hettrich |

Founder, CEO & Chairman |

CFO |

QuantumScape Corporation

Condensed Consolidated Balance Sheets (Unaudited)

(In Thousands)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Assets |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents ($3,480 and $3,395 as of September 30, 2023 and December 31, 2022, respectively, for joint venture) |

|

$ |

250,824 |

|

|

$ |

235,393 |

|

Marketable securities |

|

|

876,612 |

|

|

|

826,340 |

|

Prepaid expenses and other current assets |

|

|

10,129 |

|

|

|

10,591 |

|

Total current assets |

|

|

1,137,565 |

|

|

|

1,072,324 |

|

Property and equipment, net |

|

|

321,903 |

|

|

|

295,934 |

|

Right-of-use assets - finance lease |

|

|

25,858 |

|

|

|

28,013 |

|

Right-of-use assets - operating lease |

|

|

57,112 |

|

|

|

60,782 |

|

Other assets |

|

|

23,327 |

|

|

|

18,353 |

|

Total assets |

|

$ |

1,565,765 |

|

|

$ |

1,475,406 |

|

Liabilities, redeemable non-controlling interest and stockholders’ equity |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

9,618 |

|

|

$ |

21,420 |

|

Accrued liabilities |

|

|

10,025 |

|

|

|

7,477 |

|

Accrued compensation and benefits |

|

|

18,938 |

|

|

|

13,061 |

|

Operating lease liability, short-term |

|

|

4,886 |

|

|

|

3,478 |

|

Finance lease liability, short-term |

|

|

2,829 |

|

|

|

1,373 |

|

Total current liabilities |

|

|

46,296 |

|

|

|

46,809 |

|

Operating lease liability, long-term |

|

|

58,881 |

|

|

|

62,560 |

|

Finance lease liability, long-term |

|

|

35,859 |

|

|

|

38,005 |

|

Other liabilities |

|

|

11,711 |

|

|

|

8,488 |

|

Total liabilities |

|

|

152,747 |

|

|

|

155,862 |

|

Redeemable non-controlling interest |

|

|

1,749 |

|

|

|

1,704 |

|

Stockholders’ equity |

|

|

|

|

|

|

Preferred stock |

|

|

— |

|

|

|

— |

|

Common stock |

|

|

49 |

|

|

|

44 |

|

Additional paid-in-capital |

|

|

4,184,840 |

|

|

|

3,771,181 |

|

Accumulated other comprehensive loss |

|

|

(6,323 |

) |

|

|

(17,873 |

) |

Accumulated deficit |

|

|

(2,767,297 |

) |

|

|

(2,435,512 |

) |

Total stockholders’ equity |

|

|

1,411,269 |

|

|

|

1,317,840 |

|

Total liabilities, redeemable non-controlling interest and stockholders’ equity |

|

$ |

1,565,765 |

|

|

$ |

1,475,406 |

|

QuantumScape Corporation

Condensed Consolidated Statements of Operations and Comprehensive Loss (Unaudited)

(In Thousands, Except per Share Amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

88,154 |

|

|

$ |

87,582 |

|

|

$ |

251,548 |

|

|

$ |

214,060 |

|

General and administrative |

|

|

32,716 |

|

|

|

33,072 |

|

|

|

102,842 |

|

|

|

93,124 |

|

Total operating expenses |

|

|

120,870 |

|

|

|

120,654 |

|

|

|

354,390 |

|

|

|

307,184 |

|

Loss from operations |

|

|

(120,870 |

) |

|

|

(120,654 |

) |

|

|

(354,390 |

) |

|

|

(307,184 |

) |

Other income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(593 |

) |

|

|

(600 |

) |

|

|

(1,795 |

) |

|

|

(1,807 |

) |

Interest income |

|

|

10,479 |

|

|

|

3,487 |

|

|

|

24,075 |

|

|

|

5,813 |

|

Other income (expense) |

|

|

382 |

|

|

|

114 |

|

|

|

370 |

|

|

|

335 |

|

Total other income |

|

|

10,268 |

|

|

|

3,001 |

|

|

|

22,650 |

|

|

|

4,341 |

|

Net loss |

|

|

(110,602 |

) |

|

|

(117,653 |

) |

|

|

(331,740 |

) |

|

|

(302,843 |

) |

Less: Net income (loss) attributable to non-controlling interest, net of tax of $0 |

|

|

15 |

|

|

|

7 |

|

|

|

45 |

|

|

|

(2 |

) |

Net loss attributable to common stockholders |

|

$ |

(110,617 |

) |

|

$ |

(117,660 |

) |

|

$ |

(331,785 |

) |

|

$ |

(302,841 |

) |

Net loss |

|

$ |

(110,602 |

) |

|

$ |

(117,653 |

) |

|

$ |

(331,740 |

) |

|

$ |

(302,843 |

) |

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on marketable securities |

|

|

3,392 |

|

|

|

(2,933 |

) |

|

|

11,550 |

|

|

|

(17,870 |

) |

Total comprehensive loss |

|

|

(107,210 |

) |

|

|

(120,586 |

) |

|

|

(320,190 |

) |

|

|

(320,713 |

) |

Less: Comprehensive income (loss) attributable to non-controlling interest |

|

|

15 |

|

|

|

7 |

|

|

|

45 |

|

|

|

(2 |

) |

Comprehensive loss attributable to common stockholders |

|

$ |

(107,225 |

) |

|

$ |

(120,593 |

) |

|

$ |

(320,235 |

) |

|

$ |

(320,711 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted net loss per share |

|

$ |

(0.23 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.73 |

) |

|

$ |

(0.70 |

) |

Basic and Diluted weighted-average common shares outstanding |

|

|

471,752 |

|

|

|

434,051 |

|

|

|

452,503 |

|

|

|

431,654 |

|

QuantumScape Corporation

Condensed Consolidated Statements of Cash Flows (Unaudited)

(In Thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(110,602 |

) |

|

$ |

(117,653 |

) |

|

$ |

(331,740 |

) |

|

$ |

(302,843 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

11,644 |

|

|

|

8,469 |

|

|

|

31,177 |

|

|

|

18,975 |

|

Amortization of right-of-use assets and non-cash lease expense |

|

|

1,950 |

|

|

|

1,973 |

|

|

|

5,825 |

|

|

|

5,671 |

|

Amortization of premiums and accretion of discounts on marketable securities |

|

|

(5,343 |

) |

|

|

791 |

|

|

|

(10,855 |

) |

|

|

4,504 |

|

Stock-based compensation expense |

|

|

40,391 |

|

|

|

33,578 |

|

|

|

128,373 |

|

|

|

92,985 |

|

Impairment of fixed assets |

|

|

6,342 |

|

|

|

7,806 |

|

|

|

6,342 |

|

|

|

7,806 |

|

Other |

|

|

(27 |

) |

|

|

(134 |

) |

|

|

474 |

|

|

|

474 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Prepaid expenses and other assets |

|

|

(4,118 |

) |

|

|

155 |

|

|

|

(3,985 |

) |

|

|

5,393 |

|

Accounts payable, accrued liabilities and accrued compensation |

|

|

(1,527 |

) |

|

|

8,815 |

|

|

|

(5,544 |

) |

|

|

9,516 |

|

Other long-term liabilities |

|

|

(248 |

) |

|

|

— |

|

|

|

(348 |

) |

|

|

2,100 |

|

Operating lease liability |

|

|

(1,019 |

) |

|

|

(175 |

) |

|

|

(2,270 |

) |

|

|

311 |

|

Net cash used in operating activities |

|

|

(62,557 |

) |

|

|

(56,375 |

) |

|

|

(182,551 |

) |

|

|

(155,108 |

) |

Investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(17,976 |

) |

|

|

(54,079 |

) |

|

|

(70,708 |

) |

|

|

(121,004 |

) |

Proceeds from maturities of marketable securities |

|

|

249,645 |

|

|

|

215,150 |

|

|

|

702,128 |

|

|

|

634,390 |

|

Proceeds from sales of marketable securities |

|

|

— |

|

|

|

— |

|

|

|

1,477 |

|

|

|

15,105 |

|

Purchases of marketable securities |

|

|

(440,681 |

) |

|

|

(151,460 |

) |

|

|

(731,461 |

) |

|

|

(402,247 |

) |

Net cash provided (used) by investing activities |

|

|

(209,012 |

) |

|

|

9,611 |

|

|

|

(98,564 |

) |

|

|

126,244 |

|

Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from exercise of stock options and employee stock purchase plan |

|

|

2,297 |

|

|

|

1,967 |

|

|

|

9,930 |

|

|

|

6,934 |

|

Proceeds from issuance of common stock, net of issuance costs paid |

|

|

288,431 |

|

|

|

— |

|

|

|

288,431 |

|

|

|

— |

|

Principal payment for finance lease |

|

|

(650 |

) |

|

|

(610 |

) |

|

|

(1,290 |

) |

|

|

(809 |

) |

Net cash provided by financing activities |

|

|

290,078 |

|

|

|

1,357 |

|

|

|

297,071 |

|

|

|

6,125 |

|

Net increase (decrease) in cash, cash equivalents and restricted cash |

|

|

18,509 |

|

|

|

(45,407 |

) |

|

|

15,956 |

|

|

|

(22,739 |

) |

Cash, cash equivalents and restricted cash at beginning of period |

|

|

250,363 |

|

|

|

360,891 |

|

|

|

252,916 |

|

|

|

338,223 |

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

268,872 |

|

|

$ |

315,484 |

|

|

$ |

268,872 |

|

|

$ |

315,484 |

|

Supplemental disclosure of cash flow information |

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

593 |

|

|

$ |

600 |

|

|

$ |

1,195 |

|

|

$ |

1,207 |

|

Purchases of property and equipment, not yet paid |

|

$ |

7,289 |

|

|

$ |

13,828 |

|

|

$ |

7,289 |

|

|

$ |

13,828 |

|

Common stock issuance costs, accrued but not paid |

|

$ |

277 |

|

|

$ |

— |

|

|

$ |

277 |

|

|

$ |

— |

|

Net Loss to Adjusted EBITDA

Adjusted EBITDA is a non-GAAP supplemental measure of operating performance that does not represent and should not be considered an alternative to operating loss or cash flow from operations, as determined by GAAP. Adjusted EBITDA is defined as net income (loss) before interest expense, non-controlling interest, revaluations, impairments, stock-based compensation and depreciation and amortization expense. We use Adjusted EBITDA to measure the operating performance of our business, excluding specifically identified items that we do not believe directly reflect our core operations and may not be indicative of our recurring operations. Adjusted EBITDA may not be comparable to similarly titled measures provided by other companies due to potential differences in methods of calculations. A reconciliation of Adjusted EBITDA to net loss is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in Thousands) |

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

GAAP net loss attributable to Common Stockholders |

|

$ |

(110,617 |

) |

|

$ |

(117,660 |

) |

|

$ |

(331,785 |

) |

|

$ |

(302,841 |

) |

Interest expense (income), net |

|

|

(9,886 |

) |

|

|

(2,887 |

) |

|

|

(22,280 |

) |

|

|

(4,006 |

) |

Other expense (income), net |

|

|

(382 |

) |

|

|

(114 |

) |

|

|

(370 |

) |

|

|

(335 |

) |

Net gain (loss) attributable to non-controlling interests |

|

|

15 |

|

|

|

7 |

|

|

|

45 |

|

|

|

(2 |

) |

Stock-based compensation |

|

|

40,391 |

|

|

|

33,578 |

|

|

|

128,373 |

|

|

|

92,985 |

|

Impairment of fixed assets and cancellation charges |

|

|

— |

|

|

|

11,254 |

|

|

|

— |

|

|

|

11,254 |

|

Non-GAAP operating loss |

|

$ |

(80,479 |

) |

|

$ |

(75,822 |

) |

|

$ |

(226,017 |

) |

|

$ |

(202,945 |

) |

Depreciation and amortization expense(1) |

|

|

17,986 |

|

|

|

8,469 |

|

|

|

37,519 |

|

|

|

18,975 |

|

Adjusted EBITDA |

|

$ |

(62,493 |

) |

|

$ |

(67,353 |

) |

|

$ |

(188,498 |

) |

|

$ |

(183,970 |

) |

|

|

(1) |

Includes accelerated depreciation and impairment for assets no longer in use of approximately $6.3 million for the three and nine months ended September 30, 2023 |

Management’s Use of Non-GAAP Financial Measures

This letter includes certain non-GAAP financial measures as defined by SEC rules. These non-GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. There are a number of limitations related to the use of these non-GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. We urge you to review the reconciliations of our non-GAAP financial measures to the most directly comparable U.S. GAAP financial measures set forth in this letter, and not to rely on any single financial measure to evaluate our business.

Forward-Looking Statements

This letter contains forward-looking statements within the meaning of the federal securities laws and information based on management’s current expectations as of the date of this letter. All statements other than statements of historical fact contained in this letter, including statements regarding the future development of the Company’s battery technology, the anticipated benefits of the Company’s technologies and the performance of its batteries, plans and objectives for future operations, forecasted cash usage, including spending and investment, are forward-looking statements. When used in this letter, the words “may,” “will,” “can,” “estimate,” “aim,” “pro forma,” “expect,” “plan,” “believe,” “focus,” “potential,” “predict,” “target,” “should,” “would,” “could,” “continue,” “project,” “intend,” “anticipates,” “reiterate,” “seek,” “working toward,” “progress toward,” “prospective” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations, assumptions, hopes, beliefs, intentions, and strategies regarding future events and are based on currently available information as to the outcome and timing of future events.

These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Many of these factors are outside the Company’s control and are difficult to predict. Factors that may cause such differences include but are not limited to ones listed here. The Company faces significant challenges in its attempts to develop a solid-state battery cell and produce it at high volumes and may not be able to successfully develop its solid-state battery cell or build high volumes of multilayer cells in commercially relevant area and with higher layer count. The Company could encounter significant delays and/or technical challenges in replicating the performance seen in its single-layer and early multilayer cells, in achieving the high quality, consistency, reliability, safety, cost, and throughput required for commercial production and sale (e.g., unanticipated contamination issues), and in developing a cell architecture that meets all the technical requirements. The Company has encountered delays and other obstacles in acquiring, installing and operating new manufacturing equipment for automated and/or continuous-flow processes, including vendor delays and other supply chain disruptions and challenges in optimizing its complex manufacturing processes. The Company may encounter delays and cost overruns in hiring the engineers it needs to expand its development and production efforts, delays in building out or scaling up QS-0, and delays in establishing supply relationships for necessary materials, components or equipment. Delays in increasing production of engineering samples have slowed the Company’s development efforts in the past. These or other sources of delay could impact our delivery of A-samples and B-samples and delay or prevent successful commercialization of our products. Delays or difficulties in meeting technical milestones or scaling up QS-0 could cause prospective customers and joint venture partners not to purchase cells from our pre-production line or not to proceed with a manufacturing joint venture. The Company may be unable to adequately control the costs associated with its operations and the components necessary to build its solid-state battery cells at competitive prices. The Company’s spending may be higher than currently anticipated. The Company may not be successful in competing in the battery market industry or establishing and maintaining confidence in its long-term business prospects among current and future partners and customers. The Company is at an early stage of testing its battery technology for use in consumer electronics applications, and we may discover technical or other hurdles that impede our ability to serve that market. The Company cautions that the foregoing list of factors is not exclusive. The Company cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made.

Except as otherwise required by applicable law, the Company disclaims any duty to update any forward-looking statements. Should underlying assumptions prove incorrect, actual results and projections could differ materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that could materially affect the Company’s actual results can be found in the Company’s periodic filings with the SEC. The Company’s SEC filings are available publicly on the SEC’s website at www.sec.gov.

Exhibit 99.2

QuantumScape Reports Third Quarter 2023 Business and Financial Results

SAN JOSE, Calif. – October 25, 2023 – QuantumScape Corporation (NYSE: QS), a leader in developing next-generation solid-state lithium-metal batteries, today announced its business and financial results for the third quarter of 2023, which ended September 30.

The company posted a letter to shareholders on its Investor Relations website, ir.quantumscape.com, that details third-quarter financial results and provides a business update.

QuantumScape will host a live webcast today at 2 p.m. Pacific Time (5 p.m. Eastern Time), accessible via its IR Events page. Jagdeep Singh, co-founder and chief executive officer, Kevin Hettrich, chief financial officer, and Dr. Siva Sivaram, president, will participate on the call.

An archive of the webcast will be available shortly after the call for 12 months.

About QuantumScape Corporation

QuantumScape is on a mission to transform energy storage with solid-state lithium-metal battery technology. The company’s next-generation batteries are designed to enable greater energy density, faster charging and enhanced safety to support the transition away from legacy energy sources toward a lower carbon future. For more information, visit www.quantumscape.com.

For Investors

ir@quantumscape.com

For Media

media@quantumscape.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

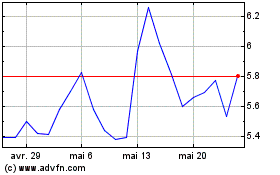

Quantumscape (NYSE:QS)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Quantumscape (NYSE:QS)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024