Dr. Reddy’s Laboratories Ltd. (BSE: 500124 | NSE: DRREDDY |

NYSE: RDY | NSEIFSC: DRREDDY) today announced its consolidated

financial results for the quarter and half year ended September 30,

2024. The information mentioned in this release is based on

consolidated financial statements under International Financial

Reporting Standards (IFRS).

Q2FY25

H1FY25

Revenues

₹ 80,162 Mn

[Up: 17% YoY; 4% QoQ]

₹ 156,889 Mn

[Up: 15% YoY]

Gross Margin

59.6%

[Q2FY24: 58.7%; Q1FY25: 60.4%]

60.0%

[H1FY24: 58.7%]

SG&A Expenses

₹ 23,007 Mn

[Up: 22% YoY; 1% QoQ]

₹ 45,698 Mn

[Up: 25% YoY]

R&D Expenses

₹ 7,271 Mn

[9.1% of Revenues]

₹ 13,464 Mn

[8.6% of Revenues]

EBITDA

₹ 22,803 Mn

[28.4% of Revenues]

₹ 44,402 Mn

[28.3% of Revenues]

Profit before Tax

₹ 19,167 Mn

[Flat YoY; Up: 2% QoQ]

₹ 37,988 Mn

[Up: 1% YoY]

Profit after Taxbefore Non-Controlling Interest

₹ 13,415 Mn

[Down: 9% YoY; 4% QoQ]

₹ 27,335 Mn

[Down: 5% YoY]

Profit after Taxattributable to Equity Holders

₹ 12,553 Mn

[Down: 15% YoY; 10% QoQ]

₹ 26,473 Mn

[Down: 8% YoY]

Commenting on the results, Co-Chairman & MD, G V Prasad

said: “We delivered another good quarter and maintained the

growth momentum across businesses. We made progress on our future

growth drivers, operationalized our venture with Nestlé and

completed the acquisition of Nicotinell® and related brands. We

will continue to drive efficiency, strengthen our core businesses,

and positively impact patient lives through science and

innovation.”

All amounts in millions, except EPS All US dollar amounts based on

convenience translation rate of 1 USD = ₹83.76

Dr. Reddy’s Laboratories Limited & Subsidiaries

Revenue Mix by Segment for the quarter

Particulars

Q2FY25

Q2FY24

YoY Gr %

Q1FY25

QoQ Gr%

(₹)

(₹)

(₹)

Global Generics

71,576

61,084

17

68,858

4

North America

37,281

31,775

17

38,462

(3)

Europe

5,770

5,286

9

5,265

10

India

13,971

11,860

18

13,252

5

Emerging Markets

14,554

12,163

20

11,878

23

Pharmaceutical Services and Active

Ingredients (PSAI)

8,407

7,034

20

7,657

10

Others

179

684

(74)

212

(16)

Total

80,162

68,802

17

76,727

4

Revenue Mix by Segment for the half year

Particulars

H1FY25

H1FY24

YoY Gr%

(₹)

(₹)

Global Generics

140,434

121,167

16

North America

75,743

63,776

19

Europe

11,035

10,333

7

India

27,223

23,342

17

Emerging Markets

26,433

23,716

11

PSAI

16,064

13,743

17

Others

391

1,276

(69)

Total

156,889

136,186

15

Consolidated Income Statement for the quarter

Particulars

Q2FY25

Q2FY24

YoY Gr %

Q1FY25

QoQ Gr%

($)

(₹)

($)

(₹)

($)

(₹)

Revenues

957

80,162

821

68,802

17

916

76,727

4

Cost of Revenues

387

32,393

339

28,434

14

363

30,383

7

Gross Profit

570

47,769

482

40,368

18

553

46,344

3

% of Revenues

59.6%

58.7%

60.4%

Selling, General & Administrative

Expenses

275

23,007

224

18,795

22

271

22,691

1

% of Revenues

28.7%

27.3%

29.6%

Research & Development Expenses

87

7,271

65

5,447

33

74

6,193

17

% of Revenues

9.1%

7.9%

8.1%

Impairment of Non-Current Assets, net

11

924

1

55

1580

0

5

Other (Income)/Expense, net

(12)

(984)

(21)

(1,796)

(45)

(6)

(470)

109

Results from Operating

Activities

210

17,551

213

17,867

(2)

214

17,925

(2)

Finance (Income)/Expense, net

(19)

(1,555)

(15)

(1,225)

27

(10)

(837)

86

Share of Profit of Equity Accounted

Investees, net of tax

(1)

(61)

(1)

(42)

45

(1)

(59)

3

Profit before Income Tax

229

19,167

228

19,134

0

225

18,821

2

% of Revenues

23.9%

27.8%

24.5%

Income Tax Expense

69

5,752

52

4,334

33

59

4,901

17

Profit for the Period

160

13,415

177

14,800

(9)

166

13,920

(4)

% of Revenues

16.7%

21.5%

18.1%

Attributable to Equity holders of the

parent company

150

12,553

177

14,800

(15)

166

13,920

(10)

Attributable to Non-controlling

interests

10

862

-

-

-

-

-

-

Diluted Earnings per Share

(EPS)^

0.18

15.04

0.21

17.76

(15)

0.20

16.69

(9)

^Historical numbers re-casted basis the

increased number of shares post share split

EBITDA Computation for the quarter

Particulars

Q2FY25

Q2FY24

Q1FY25

($)

(₹)

($)

(₹)

($)

(₹)

Profit before Income Tax

229

19,167

228

19,134

225

18,821

Interest (Income) / Expense, net*

(15)

(1,262)

(14)

(1,166)

(12)

(1,037)

Depreciation

31

2,629

29

2,437

30

2,508

Amortization

16

1,346

16

1,353

16

1,302

Impairment

11

924

1

55

0

5

EBITDA

272

22,803

260

21,813

258

21,599

% of Revenues

28.4%

31.7%

28.2%

*Includes income from Investment

Consolidated Income Statement for the half year

Particulars

H1FY25

H1FY24

YoY Gr %

($)

(₹)

($)

(₹)

Revenues

1,873

156,889

1,626

136,186

15

Cost of Revenues

749

62,776

672

56,265

12

Gross Profit

1,124

94,113

954

79,921

18

% of Revenues

60.0%

58.7%

Selling, General & Administrative

Expenses

546

45,698

436

36,497

25

% of Revenues

29.1%

26.8%

Research & Development Expenses

161

13,464

125

10,431

29

% of Revenues

8.6%

7.7%

Impairment of Non-Current Assets, net

11

929

1

66

1308

Other (Income)/Expense, net

(17)

(1,454)

(31)

(2,576)

(44)

Results from Operating

Activities

424

35,476

424

35,503

(0)

Finance (Income)/Expense, net

(29)

(2,392)

(24)

(2,009)

19

Share of Profit of Equity Accounted

Investees, net of tax

(1)

(120)

(1)

(85)

41

Profit before Income Tax

454

37,988

449

37,597

1

% of Revenues

24.2%

27.6%

Income Tax Expense

127

10,653

105

8,772

21

Profit for the Period

326

27,335

344

28,825

(5)

% of Revenues

17.4%

21.2%

Attributable to Equity holders of the

parent company

316

26,473

344

28,825

(8)

Attributable to Non-controlling

interests

10

862

-

-

-

Diluted Earnings per Share

(EPS)^

0.39

31.73

0.41

34.58

(8)

^Historical numbers re-casted basis the

increased number of shares post share split

EBITDA Computation for the half year

Particulars

H1FY25

H1FY24

($)

(₹)

($)

(₹)

Profit before Income Tax

454

37,988

449

37,597

Interest (Income) / Expense, net*

(27)

(2,300)

(22)

(1,851)

Depreciation

61

5,137

56

4,718

Amortization

32

2,648

32

2,656

Impairment

11

929

1

66

EBITDA

530

44,402

516

43,186

% of Revenues

28.3%

31.7%

Key Balance Sheet Items

Particulars

As on 30th Sep 2024

As on 30th Jun 2024

As on 30th Sep 2023

($)

(₹)

($)

(₹)

($)

(₹)

Cash and Cash Equivalents and Other

Investments

767

64,274

1,141

95,599

833

69,784

Trade Receivables

1,008

84,398

968

81,088

832

69,722

Inventories

860

72,039

819

68,568

676

56,592

Property, Plant, and Equipment

1,035

86,693

959

80,343

841

70,478

Goodwill and Other Intangible Assets

1,240

103,892

494

41,374

493

41,278

Loans and Borrowings (Current &

Non-Current)

580

48,540

366

30,675

158

13,230

Trade Payables

427

35,776

407

34,109

364

30,485

Equity

3,692

309,283

3,518

294,627

3,022

253,086

Key Business Highlights [for Q2FY25]

- Completed acquisition of the Nicotine Replacement Therapy

(‘NRT’) portfolio outside of the United States and paid upfront

cash consideration of GBP 458 million.

- Operationalized, Dr. Reddy’s and Nestlé Health Science

Limited, in August 2024 to undertake the business of

nutraceutical products and supplements in India and Nepal. 49% of

the shares in the subsidiary transferred to Nestlé India.

- Secured Marketing Authorization from European

Commission for our rituximab biosimilar, following a

positive opinion from the CHMP of the European Medicines

Agency.

- Received approval from the USFDA for Investigational New

Drug (IND) application for AUR-112, a highly differentiated

potent and selective inhibitor of MALT1, being developed for

treatment of lymphoid malignancies.

- Entered into a non-exclusive patent licensing agreement with

Takeda to commercialise Vonoprazan, a novel

gastrointestinal drug, in India.

ESG & other Updates [for Q2FY25]

- Recognised amongst ‘Top 15’ India's Most Sustainable

Companies, 2024 by Businessworld India

- Received ‘ESG Excellence Award’ 2024 in the ‘Large-cap

Pharmaceuticals & Healthcare’ category by KPMG

India

- ‘Voluntary Action Indicated’ (VAI) classification by the

United States Food and Drug Administration (USFDA) for two

of our formulations manufacturing facilities in Duvvada,

Visakhapatnam (FTO 7 and FTO 9), following their routine GMP

inspection in May 2024 as well as our API manufacturing

facility (CTO-6) in Srikakulam, Andhra Pradesh,

following their GMP Inspection in June 2024.

- Product-specific Pre-Approval Inspection (PAI) completed

by the USFDA at our formulations manufacturing facility

(FTO SEZ PU1) in Srikakulam, Andhra Pradesh in August 2024

and issued a Form 483 with three observations. The response to the

observations were submitted within stipulated timelines.

- Routine Good Manufacturing Practice (GMP) inspection concluded

by the USFDA at our R&D centre in Bachupally,

Hyderabad in September, 2024, with zero observations.

- Alteration in share capital of the Company by sub-division/

split of existing equity shares of face value of ₹5 each, fully

paid up, including the American Depository Shares, into 5 equity

shares of ₹1 each, fully paid-up, approved by the

shareholders as well as the Board of Directors of the

Company.

Revenue Analysis

- Q2FY25 consolidated revenues at ₹80.2 billion, YoY

growth of 17% and sequential growth of 4%. YoY growth was primarily

driven by growth in global generics revenues. QoQ growth was

primarily driven by global generics revenues in Emerging Markets,

India, Europe as well as PSAI. H1FY25 consolidated revenues

at ₹156.9 billion, YoY growth of 15%. The growth was driven by

strong performances in global generics in North America, India,

Emerging Markets as well as PSAI.

Global Generics (GG)

- Q2FY25 revenues at ₹71.6 billion, YoY growth of 17% and

QoQ growth of 4%. YoY growth was broad-based, driven by improved

sales volumes and new product launches. Sequential growth was

primarily driven by Emerging Markets and Europe. H1FY25

revenues at ₹140.4 billion, a YoY growth of 16%. The growth was

across all markets, driven by increase in sales volumes.

North America

- Q2FY25 revenues at ₹37.3 billion, YoY growth of 17% and

QoQ decline of 3%. YoY growth was largely on account of increase in

sales volumes, partly offset by price erosion. Sequential decline

was due to decrease in sales volumes. H1FY25 revenues at

₹75.7 billion, YoY growth of 19%. The growth was largely on account

of increase in sales volumes, partially offset by price

erosion.

- During the quarter, we launched four new products in the

region, all of which were launched in the U.S. A total of 7

products were launched during the half year ended September 30,

2024.

- During the quarter, we filed two new Abbreviated New Drug

Applications (ANDAs) with the USFDA, taking our year-to-date ANDA

filing count to three. As of September 30, 2024, 80 generic filings

were pending approval from the USFDA. These comprise of 75 ANDAs

and five New Drug Applications (NDAs) filed under Section 505(b)(2)

route of the US Federal Food, Drug, and Cosmetic Act. Of the 75

ANDAs, 44 are Paragraph IV applications, and we believe that 22 of

these have the ‘First to File’ status.

Europe

- Q2FY25 revenues at ₹5.8 billion, YoY growth of 9% and

QoQ growth of 10%. YoY growth was primarily on account of

leveraging the portfolio to launch new products, partly offset by

price erosion. QoQ growth was primarily on account of new product

launches.

- Germany at ₹3.2 billion, YoY growth

of 21% and QoQ growth of 16%. - UK at ₹1.6 billion, YoY

decline of 7% and QoQ growth of 3%. - Rest of Europe at ₹0.9

billion, YoY growth of 4% and QoQ growth of 2%.

H1FY25 revenues at ₹11.0 billion, YoY

growth of 7%. The growth was primarily on account of new product

launches and momentum in base business, partly offset by price

erosion.

- Germany at ₹6.0 billion, YoY growth

of 17%. - UK at ₹3.2 billion, YoY decline of 7%. - Rest

of Europe at ₹1.8 billion, YoY growth of 2%.

- During the quarter, we launched 8 new products in the region,

taking the year-to-date total to 20.

India

- Q2FY25 revenues at ₹14.0 billion, YoY growth of 18% and

QoQ growth of 5%. YoY growth was led by revenues from the vaccine

portfolio in-licensed from Sanofi, new products launched as well as

price increases. QoQ growth was on account of increase in sales

volumes and price, as well as new product launches. As per IQVIA,

our IPM rank was maintained at 10 for the quarter.

- H1FY25 revenues at ₹27.2 billion, YoY growth of 17%. YoY

growth was largely on account of revenues from in-licensed vaccine

portfolio, new products launched as well as higher prices.

- During the quarter, we launched three new brands in the

country, taking the year-to-date total to 16. We also integrated

the nutraceutical products under our subsidiary, ‘Dr. Reddy’s and

Nestlé Health Science Limited’ during the quarter.

Emerging Markets

- Q2FY25 revenues at ₹14.6 billion, YoY growth of 20% and

QoQ growth of 23%. YoY growth is attributable to market share

expansion as well as new product launches. QoQ growth was primarily

due to higher volumes in the base business.

- Revenues from Russia at ₹6.9

billion, YoY growth of 18% and QoQ growth of 24%.

- YoY growth was due to higher sales volumes

and price and new product launches, partly offset by unfavorable

currency exchange rate movements. - QoQ growth was largely on

account of market share expansion.

- Revenues from other Commonwealth of

Independent States (CIS) countries and Romania at ₹2.1 billion,

YoY decline of 2% and QoQ growth of 12%.

- YoY decline was primarily on account of

decline in base business volumes. - QoQ growth was largely driven

by higher base business volumes and increase in prices.

- Revenues from Rest of World (RoW)

territories at ₹5.6 billion, YoY growth of 32% YoY and QoQ

growth of 26%.

- YoY growth was due to momentum in base

business and contribution from new products. - QoQ growth was

largely driven by increase in base business volumes.

- H1FY25 revenues at ₹26.4 billion, YoY growth of 11%. The

growth is attributable to market share expansion and new product

launches, partly offset by unfavorable forex.

- Revenues from Russia at ₹12.4

billion, YoY growth of 9%. The growth was largely on account of

price increases in certain brands and improved volumes, partially

offset by unfavorable currency exchange rate movements. -

Revenues from other CIS countries and Romania at ₹4.1

billion, YoY decline of 2%. The decline was largely on account of

lower sales volumes. - Revenues from RoW territories at

₹10.0 billion, YoY growth of 22%. The growth is largely

attributable to higher base business volumes and new product

launches.

- During the quarter, we launched 22 new products across various

countries in the region, taking the year-to-date total to 39.

Pharmaceutical Services and Active Ingredients (PSAI)

- Q2FY25 revenues at ₹8.4 billion, YoY growth of 20% and

QoQ growth of 10%. YoY and QoQ growth was mainly driven by momentum

in base business volumes, growth in services business and revenues

from new products.

- H1FY25 revenues at ₹16.1 billion, with a growth of 17%

YoY. The growth was mainly driven by market share expansion, growth

in services business and revenues from new products.

- During the quarter, we filed 22 Drug Master Files (DMFs)

globally, taking the year-to-date count to 36.

Income Statement Highlights:

Gross Margin

- Q2FY25 at 59.6% (GG: 63.1%, PSAI: 30.0%), a YoY increase

of 92 basis points (bps) and a QoQ decline of 81 bps. The YoY

increase was on account of improvement in product mix and overhead

leverage, partly offset by price erosion. On a sequential basis,

the decline was primarily on account of change in mix.

H1FY25 at 60.0% (GG: 63.9%, PSAI: 26.7%), a YoY increase by

130 bps YoY. The expansion in margin was on account of favourable

product mix and productivity cost savings, partially offset by

price erosion in select markets.

Selling, General & Administrative (SG&A)

Expenses

- Q2FY25 at ₹23.0 billion, YoY increase of 22% and QoQ

increase of 1%. We incurred one-time acquisition related costs

towards NRT portfolio. Excluding the same, SG&A spend was at

28% of sales. H1FY25 at ₹45.7 billion, YoY increase of 25%.

The increase is largely on account of higher investments in sales

& marketing activities to strengthen our existing brands, new

business initiatives, including scaling up ‘Over-the-Counter’ (OTC)

and consumer health businesses, as well as higher personnel and

freight expenses.

Research & Development (R&D) Expenses

- Q2FY25 at ₹7.3 billion. As % to Revenues – Q2FY25: 9.1%

| Q2FY24: 7.9% | Q1FY25: 8.1%. H1FY25 at ₹13.5 billion. As %

to Revenues – H1FY25: 8.6% | H1FY24: 7.7%. R&D investments is

related to our ongoing development efforts across generics,

biosimilars, as well as our novel oncology assets.

Other Operating Income

- Q2FY25 at ₹1.0 billion as compared to ₹ 1.8 billion in

Q2FY24. H1FY25 at ₹1.5 billion as compared to ₹ 2.6 billion

in H1FY24.

Net Finance Income

- Q2FY25 at ₹1.6 billion compared to ₹1.2 billion in

Q2FY24. H1FY25 at ₹2.4 billion as compared to ₹2.0 billion

in H1FY24.

Profit before Tax

- Q2FY25 at ₹19.2 billion, flat YoY and a QoQ growth of

2%. As % to Revenues – Q2FY25: 23.9% | Q2FY24: 27.8% | Q1FY25:

24.5%. Excluding the impact of aforesaid mentioned one-time

acquisition related cost and impairment charge on non-current

assets; underlying profit before tax stood at 25.7% of revenues.

H1FY25 at ₹38.0 billion, a YoY increase of 1%. As % to

Revenues – H1FY25: 24.2% | H1FY24: 27.6%.

Income Tax

- Q2FY25 at ₹5.8 billion. As % to PBT – Q2FY25: 30% |

Q2FY24: 22.7% | Q1FY25: 26%. The higher tax for the quarter is on

account of reversal of a Deferred Tax Asset of Rs. 0.48 billion,

created in earlier period on land, pursuant to the amendment in the

Finance Act 2024, resulting in withdrawal of indexation benefit.

Excluding the impact of this one-time reversal, adjusted effective

tax rate for the quarter on the underlying PBT is 25.9%.

H1FY25: The ETR was 28.0% as compared to 23.3% in

H1FY24.

Profit after Tax before Non-Controlling Interests

- Q2FY25 at ₹13.4 billion, a YoY decline of 9% and a QoQ

decline of 4%. As % to Revenues – Q2FY25: 16.7% | Q2FY24: 21.5% |

Q1FY25: 18.1%. Excluding the impact of one-time acquisition related

cost, impairment charge on non-current assets, one-time tax

expense, underlying profit after tax before non-controlling

interests stood at 18.0% of revenues. H1FY25 at ₹27.3

billion, a YoY decline of 5%. As % to Revenues – H1FY25: 17.4% |

H1FY24: 21.2%.

Non-Controlling Interests (NCI)

- Q2FY25 at ₹0.9 billion. This primarily includes the

share in a one-time deferred tax asset recognized in the subsidiary

books (Dr. Reddy’s and Nestlé Health Science Limited) on account of

transfer of Dr. Reddy’s nutraceuticals business to the subsidiary

and consequently allocated to NCI.

Profit attributable to Equity Holders of Parent

Company

- Q2FY25 at ₹12.6 billion, a YoY decline of 15% and a QoQ

decline of 10%. As % to Revenues – Q2FY25: 15.7% | Q2FY24: 21.5% |

Q1FY25: 18.1%. Excluding the impact of one-time acquisition related

cost, impairment charge on non-current assets, one-time tax

expense, underlying profit after tax attributable to equity holders

of parent company stood at 19% of revenues. H1FY25 at ₹26.5

billion, a YoY decline of 8%. As % to Revenues – H1FY25: 16.9% |

H1FY24: 21.2%.

Diluted Earnings per Share (EPS)

- Q2FY25 is ₹15.04. H1FY25 is ₹31.73. The

Earnings per share has been arrived at on the increased number of

shares pursuant to the stock split of one fully paid-up equity

share of Rupees five each into five fully paid-up equity share of

Rupee one each.

Other Highlights:

Earnings before Interest, Tax, Depreciation and Amortization

(EBITDA)

- Q2FY25 at ₹22.8 billion, YoY growth of 5% and QoQ growth

of 6%. As % to Revenues – Q2FY25: 28.4% | Q2FY24: 31.7% | Q1FY25:

28.2%. Excluding the impact of one-time acquisition related cost,

EBITDA stood at 29.1% of sales.

- H1FY25 at ₹44.4 billion, a YoY growth of 3%. As % to

Revenues – H1FY25: 28.3% | H1FY24: 31.7%.

Others:

- Operating Working Capital: As on 30th September

2024 at ₹120.7 billion.

- Capital Expenditure: Q2FY25 at ₹7.4 billion.

- Free Cash Flow: Q2FY25 at ₹2.0 billion.

- Net Cash Surplus: As on 30th September 2024 at ₹18.9

billion

- Debt to Equity: As on 30th September 2024 is (0.06)

- ROCE: Q2FY25 at 28.5% (Annualized)

About key metrics and non-GAAP Financial Measures

This press release contains non-GAAP financial measures within

the meaning of Regulation G and Item 10(e) of Regulation S-K. Such

non-GAAP financial measures are measures of our historical

performance, financial position or cash flows that are adjusted to

exclude or include amounts from the most directly comparable

financial measure calculated and presented in accordance with

IFRS.

The presentation of this financial information is not intended

to be considered in isolation or as a substitute for, or superior

to, the financial information prepared and presented in accordance

with IFRS. Our non-GAAP financial measures are not based on any

comprehensive set of accounting rules or principles. These measures

may be different from non-GAAP financial measures used by other

companies, limiting their usefulness for comparison purposes.

We believe these non-GAAP financial measures provide investors

with useful supplemental information about the financial

performance of our business, enable comparison of financial results

between periods where certain items may vary independent of

business performance, and allow for greater transparency with

respect to key metrics used by management in operating our

business.

For more information on our non-GAAP financial measures and a

reconciliation of GAAP to non-GAAP measures, please refer to

"Reconciliation of GAAP to Non-GAAP

Results" table in this press release.

All amounts in millions, except EPS

Reconciliation of GAAP Measures to Non-GAAP Measures

Operating Working Capital

Particulars

As on 30th Sep 2024

(₹)

Inventories

72,039

Trade Receivables

84,398

Less:

Trade Payables

35,776

Operating Working Capital

120,661

Free Cash Flow

Particulars

Three months ended 30th Sep

2024

(₹)

Net cash generated from operating

activities

16,538

Less:

Taxes

(7,223)

Investments in Property, Plant &

Equipment, and Intangibles

(7,279)

Free Cash Flow before

Acquisitions

2,036

Less:

Acquisitions related Pay-out

(51,442)

Free Cash Flow

(49,406)

Net Cash Surplus and Debt to Equity

Particulars

As on 30th Sep 2024

(₹)

Cash and Cash Equivalents

11,330

Investments

52,944

Short-term Borrowings

(40,021)

Long-term Borrowings, Non-Current

(7,361)

Less:

Restricted Cash Balance – Unclaimed

Dividend and others

177

Lease liabilities (included in Long-term

Borrowings, Non-Current)

(3,561)

Equity Investments (Included in

Investments)

1,388

Net Cash Surplus

18,888

Equity

309,283

Net Debt/Equity

(0.06)

Computation of Return on Capital Employed

Particulars

As on 30th Sep 2024

(₹)

Profit before Tax

19,167

Less:

Interest and Investment Income (Excluding

forex gain/loss)

1,262

Earnings Before Interest and taxes

[A]

17,905

Average Capital Employed [B]

250,862

Annualized Return on Capital Employed

(A/B) (Ratio)

28.5%

Computation of Capital Employed:

Particulars

As on

Sep 30, 2024

Mar 31, 2024

Property Plant and Equipment

86,693

76,886

Intangibles

92,119

36,951

Goodwill

11,773

4,253

Investment in Equity Accounted

Associates

4,779

4,196

Other Current Assets

28,217

22,560

Other Investments

1,200

1,059

Other Non-Current Assets

1,510

1,632

Inventories

72,039

63,552

Trade Receivables

84,398

80,298

Derivative Financial Instruments

63

(299)

Less:

Other Liabilities

47,840

46,866

Provisions

5,260

5,444

Trade payables

35,776

30,919

Operating Capital Employed

293,865

207,859

Average Capital Employed

250,862

Computation of EBITDA

Refer page no. 3 & 4.

Earnings Call Details

The management of the Company will host an Earnings call to

discuss the Company’s financial performance and answer any

questions from the participants.

Date: November 5, 2024

Time: 19:30 pm IST | 09:00 am ET

Conference Joining Information

Option 1: Pre-register with the below

link and join without waiting for the operator

https://services.choruscall.in/DiamondPassRegistration/register?confirmationNumber=2636091&linkSecurityString=1174e664fe

Option 2: Join through below Dial-In

Numbers

Universal Access Number:

+91 22 6280 1219

+91 22 7115 8120

International Toll-Free Number:

USA: 1 866 746 2133

UK: 0 808 101 1573

Singapore: 800 101 2045

Hong Kong: 800 964 448

No password/pin number is necessary to dial in to any of the

above numbers. The operator will provide instructions on asking

questions before and during the call.

Play Back: The play back will be available after the

earnings call, till November 11th, 2024. For play back dial in

phone No: +91 22 7194 5757, and Playback Code is 03706.

Transcript: Transcript of the Earnings call will be

available on the Company’s website: www.drreddys.com

About Dr. Reddy’s: Dr. Reddy’s Laboratories Ltd. (BSE:

500124, NSE: DRREDDY, NYSE: RDY, NSEIFSC: DRREDDY) is a global

pharmaceutical company headquartered in Hyderabad, India.

Established in 1984, we are committed to providing access to

affordable and innovative medicines. Driven by our purpose of ‘Good

Health Can’t Wait’, we offer a portfolio of products and services

including APIs, generics, branded generics, biosimilars and OTC.

Our major therapeutic areas of focus are gastrointestinal,

cardiovascular, diabetology, oncology, pain management and

dermatology. Our major markets include – USA, India, Russia &

CIS countries, China, Brazil, and Europe. As a company with a

history of deep science that has led to several industry firsts, we

continue to plan and invest in businesses of the future. As an

early adopter of sustainability and ESG actions, we released our

first Sustainability Report in 2004. Our current ESG goals aim to

set the bar high in environmental stewardship; access and

affordability for patients; diversity; and governance.

For more information, log on to: www.drreddys.com.

Disclaimer: This press release may include statements of

future expectations and other forward-looking statements that are

based on the management’s current views and assumptions and involve

known or unknown risks and uncertainties that could cause actual

results, performance, or events to differ materially from those

expressed or implied in such statements. In addition to statements

which are forward-looking by reason of context, the words "may",

"will", "should", "expects", "plans", "intends", "anticipates",

"believes", "estimates", "predicts", "potential", or "continue" and

similar expressions identify forward-looking statements. Actual

results, performance or events may differ materially from those in

such statements due to without limitation, (i) general economic

conditions such as performance of financial markets, credit

defaults , currency exchange rates , interest rates , persistency

levels and frequency / severity of insured loss events (ii)

mortality and morbidity levels and trends, (iii) changing levels of

competition and general competitive factors, (iv) changes in laws

and regulations and in the policies of central banks and/or

governments, (v) the impact of acquisitions or reorganization ,

including related integration issues, and (vi) the susceptibility

of our industry and the markets addressed by our, and our

customers’, products and services to economic downturns as a result

of natural disasters, epidemics, pandemics or other widespread

illness, including coronavirus (or COVID-19), and (vii) other risks

and uncertainties identified in our public filings with the

Securities and Exchange Commission, including those listed under

the "Risk Factors" and "Forward-Looking Statements" sections of our

Annual Report on Form 20-F for the year ended March 31, 2024. The

company assumes no obligation to update any information contained

herein.” The company assumes no obligation to update any

information contained herein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105872905/en/

INVESTOR RELATIONS RICHA PERIWAL

richaperiwal@drreddys.com

AISHWARYA SITHARAM aishwaryasitharam@drreddys.com

MEDIA RELATIONS USHA IYER ushaiyer@drreddys.com

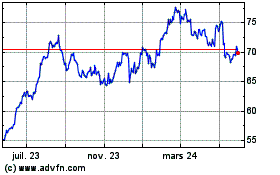

Dr Reddys Laboratories (NYSE:RDY)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

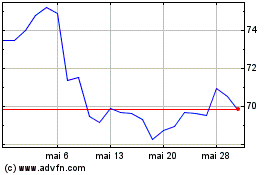

Dr Reddys Laboratories (NYSE:RDY)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024