Schwab Survey: Two-Thirds of Traders Feel the Market Is Overvalued but Sentiment for the Quarter Ahead Remains Bullish

25 Février 2025 - 2:30PM

Business Wire

Bullishness among Schwab trader clients under

the age of 40 jumps from 47% in 4Q ’24 to 59% in 1Q ‘25

According to Charles Schwab’s latest quarterly trader client

sentiment survey, two out of three traders believe the market is

currently overvalued and cite mega cap tech and AI stocks among the

most crowded trades. That said, the bulls continue to outnumber the

bears among traders 51% to 34%. Those numbers are consistent with

the sentiment found during the fourth quarter of last year when 53%

of traders were bulls and 31% were bears. Notably, there’s been a

spike in bullishness among traders under the age of 40 from less

than half in 4Q ’24 to nearly six in ten now.

“It’s clear that the majority of traders believe there’s some

froth in the market but on balance they also feel like there’s

still more room for the bulls to run,” said James Kostulias, head

of Trading Services at Charles Schwab. “Our latest trader client

sentiment survey also shows a strong increase in bullishness among

younger traders at Schwab, as well as continued engagement across

all types of traders. More than half of traders plan to move

additional money into stocks in Q1.”

The survey found a significant drop in the number of traders who

believe the U.S. will enter a recession in 2025 with only a third

of traders saying it’s somewhat likely compared to 54% who said the

same in 4Q 2024. Additionally, two-thirds of traders believe

inflation will hold steady this year. When asked where rates will

go in 2025, the most common response among traders signaled cuts in

the range of 50 or fewer basis points.

Sector and asset class views

Looking across sectors, traders are most bullish on Energy, IT,

Finance, and Utilities. Notably, Finance saw a jump of 11 points

quarter over quarter. Traders are bearish on Real Estate and

Consumer Discretionary, and Health Care saw a drop of 17

points.

Bullish Sector Sentiment

4Q ‘24

1Q ‘25

Energy

59%

57%

Information Technology

55%

57%

Finance

37%

48%

Utilities

49%

44%

Industrials

37%

40%

Materials

37%

35%

Consumer Staples

36%

34%

Communications

34%

32%

Health Care

47%

30%

Consumer Discretionary

24%

24%

Real Estate

34%

20%

When asked about asset classes and types, traders report the

most positive sentiment toward domestic stocks, value stocks,

growth stocks, AI stocks, and equities in general. Bullishness on

cryptocurrencies and Spot Crypto ETFs both saw 10-point jumps.

Fewer traders are bullish on meme stocks and international

stocks.

Bullish sentiment over next three

months

4Q ‘24

1Q ‘25

Domestic stocks

55%

57%

Value stocks

56%

54%

Growth stocks

55%

53%

AI stocks

56%

52%

Equities in general

55%

51%

Mega Cap Tech stocks

48%

45%

Cryptocurrencies

28%

38%

Commodities

44%

36%

Fixed income

34%

33%

Spot Crypto ETFs

20%

30%

International stocks

26%

16%

Meme stocks

9%

11%

“Traders are likely reacting to sectors they believe stand to

benefit from the new administration in Washington,” said Kostulias.

“That extends to crypto too where the regulatory environment is

shifting fast and expected to become more friendly for the

sector.”

The new administration

Traders believe the new administration will be the greatest

single factor impacting the stock market in 2025. Its impact ranks

well ahead of factors including Fed policy, geopolitical conflict,

inflation, and corporate earnings, according to the survey.

Factors that will have the biggest

impact on the stock market in 2025

New U.S. presidential administration

68%

Fed policy

39%

Geopolitical conflict

36%

Inflation increasing

31%

U.S. corporate earnings

27%

Recession and/or recession fears

26%

The proliferation of AI

24%

About the Charles Schwab Trader Sentiment Survey

The Charles Schwab Trader Sentiment Survey is a quarterly study

exploring the outlooks, expectations, trading patterns and points

of view of clients at Charles Schwab–who actively trade equities or

trade options, futures, or forex. The study included 1,040 Active

Trader clients at Charles Schwab and was fielded from January 8-17,

2025.

About Charles Schwab

At Charles Schwab, we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at aboutschwab.com. Follow us on

X, Facebook, YouTube, and LinkedIn.

Disclosures

Content intended for educational/informational purposes only.

Not investment advice, or a recommendation of any security,

strategy, or account type.

Historical data should not be used alone when making investment

decisions. Please consult other sources of information and consider

your individual financial position and goals before making an

independent investment decision.

All investments involve risk including the possible loss of

principal. Please consider all risks and objectives before

investing.

©2025 Charles Schwab & Co., Inc. All rights reserved. Member

SIPC.

0225-YM63

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225063045/en/

Margaret Farrell Director, Corporate Communications (203)

434-2240 margaret.farrell@schwab.com

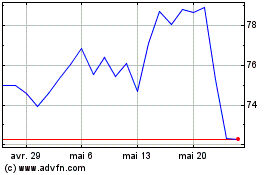

Charles Schwab (NYSE:SCHW)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Charles Schwab (NYSE:SCHW)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025