ServisFirst Bancshares, Inc. Ranks Third Among Top Publicly Traded Banks with between $10 Billion to $50 Billion in Assets

12 Juillet 2023 - 4:00PM

Business Wire

Second Year in a Row to Receive Third Place

Ranking

ServisFirst Bank, a subsidiary of ServisFirst Bancshares

(NYSE:SFBS), is pleased to announce they have ranked third in the

top publicly traded banks with between $10 billion to $50 billion

in assets, based on year-end 2022 data. Consulting firm Capital

Performance Group partners with American Banker to compile the

annual ranking, and this is the second year in a row that

ServisFirst Bancshares has achieved the third-place ranking.

In a recent interview with American Banker, Tom Broughton,

ServisFirst Bank Chairman, President, and CEO stated, “The company

managed to take advantage of excess funds on hand to make loans in

areas like commercial real estate. That helped the institution

maintain its strong results.”

The $14.6 billion-asset institution, ServisFirst Bancshares, had

noninterest expenses that were 1.06% of average assets, well below

the median of 1.97%. CPG primarily ranked the banks by their

three-year average return on average equity between 2020 and 2022.

The median ROAE for all banks in the $10 billion to $50 billion

asset category was 9.64%, a slight increase from the year-ago

figure of 9.13%. This metric was 17.03% for the top 10

performers.

“At the end of the day, it's about who can play defense better,"

said Claude Hanley, a partner at Capital Performance Group. “That

defense came in a few different varieties: They managed to maintain

their margin in the face of rising interest rates and slowing loan

demand, and they managed to maintain noninterest income.”

For more information regarding ServisFirst Bank’s recent

American Banker interview and ranking, please contact Krista Conlin

at Krista@KCProjects.net. For more about ServisFirst Bank, please

visit www.servisfirstbank.com.

ABOUT SERVISFIRST BANK

ServisFirst Bank is a full-service commercial bank focused on

commercial banking, correspondent banking, treasury management,

private banking and the professional consumer market, emphasizing

competitive products, state-of-the-art technology and a focus on

quality service. Recently, the Bank announced that its assets

exceed $14 billion. The Bank offers sophisticated treasury

management products, Internet banking, home mortgage lending,

remote deposit express banking, and highly competitive rates.

ServisFirst Bank was formed in May 2005, and has offices in

Atlanta, Birmingham, Charleston, Charlotte, Dothan, Huntsville,

Mobile, Montgomery, Nashville, Northwest Florida, Virginia Beach,

West Central Florida, and Western North Carolina. In April 2015,

and annually thereafter, ServisFirst Bank has earned

investment-grade ratings and a stable outlook from Kroll Bond

Rating Agency (KBRA), which measures companies’ financial

fundamentals. ServisFirst Bancshares, Inc. files periodic reports

with the U.S. Securities and Exchange Commission (SEC). Copies of

its filings may be obtained at www.servisfirstbancshares.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230712209068/en/

Krista Conlin, Krista@KCProjects.net

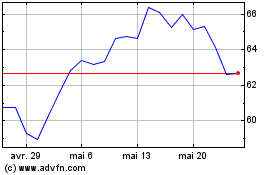

ServisFirst Bancshares (NYSE:SFBS)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

ServisFirst Bancshares (NYSE:SFBS)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025