false000162806300016280632023-11-072023-11-070001628063srg:Seven00SeriesACumulativeRedeemablePreferredSharesOfBeneficialInterestParValue001PerShareMember2023-11-072023-11-070001628063us-gaap:CommonStockMember2023-11-072023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 07, 2023 |

SERITAGE GROWTH PROPERTIES

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Maryland |

001-37420 |

38-3976287 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

500 Fifth Avenue, Suite 1530 |

|

New York, New York |

|

10110 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 212 355-7800 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A common shares of beneficial interest, par value $0.01 per share |

|

SRG |

|

New York Stock Exchange |

7.00% Series A cumulative redeemable preferred shares of beneficial interest, par value $0.01 per share |

|

SRG-PA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 8, 2023, the Company issued a press release regarding its financial results for the three and nine months ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this report.

In addition, on November 8, 2023, the Company published certain supplementary financial information relating to the three and nine months ended September 30, 2023. Such information is furnished as Exhibit 99.2 to this report.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD.

On November 8, 2023, Seritage Growth Properties (the “Company”) announced that on November 7, 2023 it made a voluntary prepayment in the amount of $40 million under its $1.6 billion Senior Secured Term Loan Agreement, dated July 31, 2018, among the Company, Seritage Growth Properties, L.P. and Berkshire Hathaway Life Insurance Company of Nebraska (as amended by amendment no. 1, dated May 5, 2020, by amendment no. 2, dated November 24, 2021, and by amendment no. 3, dated June 16, 2022, the “Term Loan Agreement”). Following the prepayment, the Company has repaid $1.24 billion since December 2021 and $360 million remains outstanding under the Term Loan Agreement. The prepayment will also reduce the Company's total annual interest expense related to the term loan facility by approximately $2.8 million.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

SERITAGE GROWTH PROPERTIES |

|

By: |

|

/s/ Matthew Fernand |

|

|

Matthew Fernand |

|

|

Chief Legal Officer |

Date: November 8, 2023

Exhibit 99.1

Seritage Growth Properties Reports Third Quarter 2023 Operating Results

New York – November 8, 2023– Seritage Growth Properties (NYSE: SRG) (the “Company”), a national owner and developer of retail, residential and mixed-use properties today reported financial and operating results for the three and nine months ended September 30, 2023.

“We continue to make significant progress on asset sales, grossing more than $156 million during the quarter. We now have a line of sight to a portfolio of approximately 25 assets comprised of many of our best properties in prime markets around the country. Our team's operational discipline has allowed us to reduce run rate G&A, a trend we expect to continue into 2024. We remain focused on our balance sheet, keeping ample cash balances while using excess proceeds to progressively pay down our debt. Looking ahead, we will press on with our plan of sale with a continued focus on delivering value to our shareholders,” said Andrea L. Olshan, Chief Executive Officer and President.

Sale Highlights:

•Generated $156.8 million of gross proceeds during the quarter ended September 30, 2023 from sales including:

•$48.2 million in gross proceeds from two income producing Multi-Tenant Retail assets reflecting a 7.5% blended capitalization rate;

•$8.4 million in gross proceeds from two income producing Non-Core assets reflecting a 6.7% blended capitalization rate;

•$6.2 million in gross proceeds from two vacant / non-income producing Non-Core assets sold at $11.79 PSF eliminating $0.6M of carry costs; and

•$94.0 million in gross proceeds from monetizing three unconsolidated entity interests.

•Subsequent to quarter end, generated $78.6 million of gross proceeds from sales including:

•$27.5 million in gross proceeds from one income producing Multi-Tenant Retail asset reflecting a 6.4% capitalization rate; and

•$51.1 million in gross proceeds from five vacant / non-income producing Non-Core assets sold at $64.28 PSF eliminating $1.7M of carry costs.

•The Company has eight assets under contract for anticipated gross proceeds of $78.0 million. All assets for sale are subject to customary closing conditions. Of these eight assets, three are for sale with no due diligence contingencies for total anticipated gross proceeds of $11.8 million, four assets are under contract for sale subject to customary due diligence for total anticipated gross proceeds of $28.7 million and one asset is subject to a buyer termination right for anticipated gross proceeds of $37.5 million including:

•$37.5 million in gross proceeds from one income producing Multi-Tenant Retail asset reflecting a 5.8% capitalization rate;

•$9.2 million in gross proceeds from two income producing Non-Core assets reflecting a 6.4% blended capitalization rate; and

•$31.3 million in gross proceeds from five vacant / non-income producing Non-Core assets sold at $39.56 PSF eliminating $1.8M of carry costs.

1

•The Company has accepted offers on and is currently negotiating definitive purchase and sale agreements on seven assets for total gross proceeds of approximately $59.0 million including:

•$28.0 million in gross proceeds from one income producing Multi-Tenant Retail asset reflecting a 7.7% capitalization rate;

•$2.7 million in gross proceeds from one income producing Non-Core asset reflecting a 5.5% capitalization rate;

•$8.5 million in gross proceeds from two vacant / non-income producing Non-Core assets sold at $37.59 PSF eliminating $0.4M of carry costs; and

•$19.8 million in gross proceeds from monetizing three unconsolidated entity interests.

Financial Highlights:

For the three months ended September 30, 2023:

•As of September 30, 2023, the Company had cash on hand of $114.8 million, including $16.0 million of restricted cash. As of November 3, 2023, the Company had cash on hand of $187.9 million, including $16.0 million of restricted cash, prior to making an additional principal prepayment of $40 million on November 7, 2023.

•Net loss attributable to common shareholders of ($3.8) million, or ($0.07) per share.

•Total Net Operating Income (“Total NOI”) of $1.1 million.

•During the quarter, the Company made $150 million in principal repayments on the Company’s term loan facility having a maturity date of July 31, 2025 (the “Term Loan Facility”), reducing the balance of the Term Loan Facility to $400 million at September 30, 2023. Subsequent to quarter end, the Company made an additional $40 million principal repayment reducing the balance of the Term Loan Facility to $360 million.

Other Highlights

•Signed three leases covering 12 thousand square feet in the third quarter at an average projected annual net rent of $55.94 PSF.

•One ground floor lease covering approximately 8 thousand square feet at a Multi-Tenant Retail asset at a projected annual net rent of $46.00 PSF;

•One ground floor lease covering approximately 500 square feet at a Premier asset at a projected annual net rent of $260.00 PSF; and

•One upper floor lease covering approximately 3.6 thousand square feet at a Premier asset at a projected annual net rent of $50.15 PSF.

•Opened five tenants in the third quarter totaling approximately 41 thousand square feet (36 thousand square feet at share) at an average net rent of $65.36 PSF ($67.38 PSF at share).

Future Sales Projections

The data below provides additional information regarding current estimated gross sales proceeds per asset in the portfolio as of November 7, 2023 excluding assets under contract or in PSA negotiation, which are described above. The assets listed below are either being marketed or are to be marketed and, as a result, any sales thereof are anticipated to occur in 2024 and beyond. Sales projections are based on the Company’s latest forecasts and assumptions, but the Company cautions that actual results may differ materially. In addition, see “Market Update” below and the “Risk Factors” section contained in the Company’s filings with the Securities and Exchange Commission for discussion of the risks associated with such estimated gross sale proceeds.

Gateway Markets

•One Multi-Tenant Asset $25 - $30 million

•Nine Premier Assets (Dallas & UTC are each assumed to be sold in two transactions)

•One Asset $15 - $20 million

•One Asset $35 - $40 million

•One Asset $40 - $45 million

•One Asset $45 - $50 million

•One Asset $50 - $60 million

•One Asset $70 - $80 million

•One Asset $100 - $150 million

•Two Assets $200 – $300 million

2

Primary Markets

•Three Multi-Tenant Assets

•One Asset $25 - $30 million

•Two Assets $30 - $35 million

•Two Joint Venture Assets $5 - $10 million

•Three Assets $5 - $10 million

•One Asset $30 - $35 million

Secondary Markets

•One Residential Asset with adjacent Retail asset $5 - 10 million

•One Joint Venture Asset $5 - $10 million

•One Non-Core Asset under $5 million

Tertiary Markets

•One Non-Core Asset under $5 million

Portfolio

The table below represents a summary of the Company’s properties by planned usage as of September 30, 2023:

(in thousands except number of leases and acreage data):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Planned Usage |

|

Total |

|

Built SF / Acreage (1) |

|

Leased SF (1)(2) |

|

|

% Leased |

|

Avg. Acreage / Site |

|

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

Multi-Tenant Retail |

|

7 |

|

1,135 sf / 111 acres |

|

|

793 |

|

|

69.8.% |

|

|

15.9 |

|

Residential (3) |

|

2 |

|

33 sf / 19 acres |

|

|

33 |

|

|

100.0% |

|

|

9.5 |

|

Premier |

|

4 |

|

228 sf / 69 acres |

|

|

138 |

|

|

60.4% |

|

|

17.2 |

|

Non-Core (4) |

|

20 |

|

2,941 sf / 259 acres |

|

|

119 |

|

|

4.0% |

|

|

12.9 |

|

Unconsolidated |

|

|

|

|

|

|

|

|

|

|

|

|

Other Joint Ventures |

|

6 |

|

457 sf / 77 acres |

|

|

11 |

|

|

2.3% |

|

|

12.8 |

|

Premier |

|

3 |

|

158 sf / 57 acres |

|

|

106 |

|

|

67.4% |

|

|

19.0 |

|

(1) Square footage is presented at the Company’s proportional share.

(2) Based on signed leases at September 30, 2023.

(3) Square footage represents built ancillary retail space whereas acreage represents both retail and residential acreage.

(4) Represents assets the Company previously designated for sale.

Multi-Tenant Retail

During the three months ended September 30, 2023, the Company invested $0.5 million in its Multi-Tenant retail properties. The remaining capital expenditures in the Multi-Tenant retail portfolio are primarily comprised of tenant improvements.

The table below provides a summary of all Multi-Tenant Retail signed and in negotiation leases as of September 30, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands except number of leases and PSF data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of |

|

|

Leased |

|

|

% of Total |

|

|

Gross Annual Base |

|

|

% of |

|

|

Gross Annual |

|

Tenant |

|

Leases |

|

|

GLA |

|

|

Leasable GLA |

|

|

Rent ("ABR") |

|

|

Total ABR |

|

|

Rent PSF ("ABR PSF") |

|

In-place retail leases |

|

|

29 |

|

|

|

649.4 |

|

|

|

57.2 |

% |

|

$ |

15,648.0 |

|

|

|

83.7 |

% |

|

$ |

24.10 |

|

SNO retail leases (1)(2) |

|

|

7 |

|

|

|

143.3 |

|

|

|

12.6 |

% |

|

$ |

3,054.8 |

|

|

|

16.3 |

% |

|

|

21.32 |

|

Tenants in lease negotiation |

|

|

2 |

|

|

|

104.0 |

|

|

|

9.2 |

% |

|

$ |

696.2 |

|

|

N/A |

|

|

|

6.69 |

|

Total retail leases |

|

|

38 |

|

|

|

896.7 |

|

|

|

79.0 |

% |

|

$ |

19,399.0 |

|

|

|

100.0 |

% |

|

$ |

21.63 |

|

(1) SNO = signed not yet opened leases. |

|

(2) SNO GLA and rent include one tenant expansion signed in Q2 2023 not counted as a lease. |

|

3

During the three months ended September 30, 2023, the Company signed one new lease at its retail properties totaling approximately 8 thousand square feet at an average base rent of $46.12 PSF stabilized net. Additionally, the Company generated a leasing pipeline of over 100 thousand square feet. The Company has 649 thousand leased square feet and approximately 143 thousand square feet signed but not opened. The Company has total occupancy of 69.8% for its Multi-Tenant retail properties. As of September 30, 2023, there is an additional approximately 343 thousand square feet available for lease.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands except number of leases and PSF data) |

|

Number of |

|

|

Leased |

|

|

Gross Annual Base |

|

|

Gross Annual |

|

|

|

|

SNO Leases |

|

|

GLA |

|

|

Rent ("ABR") |

|

|

Rent PSF ("ABR PSF") |

|

|

As of June 30, 2023 |

|

|

8 |

|

|

|

164.4 |

|

|

|

3,146.5 |

|

|

$ |

19.14 |

|

|

Opened |

|

|

(1 |

) |

|

|

(1.2 |

) |

|

|

(52.3 |

) |

|

|

43.58 |

|

|

Sold / terminated |

|

|

(1 |

) |

|

|

(28.0 |

) |

|

|

(413.0 |

) |

|

|

14.75 |

|

|

Signed |

|

|

1 |

|

|

|

8.1 |

|

|

|

373.6 |

|

|

|

43.12 |

|

|

As of September 30, 2023 |

|

|

7 |

|

|

|

143.3 |

|

|

|

3,054.8 |

|

|

$ |

21.32 |

|

|

Premier Mixed-Use

The Company has three premier mixed-use projects in the active leasing/tenant opening stage: Aventura, FL, Santa Monica, CA and San Diego, CA. As of September 30, 2023, the Company has 245 thousand in-place leased square feet (144 thousand square feet at share), 105 thousand square feet signed but not opened (100 thousand square feet at share), and 193 thousand square feet available for lease (142 thousand square feet at share).

The table below provides a summary of all signed leases at Premier assets as of September 30, 2023, including unconsolidated entities at the Company’s proportional share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of |

|

|

Leased |

|

|

% of Total |

|

|

Gross Annual |

|

|

% of |

|

|

Gross Annual |

|

Tenant |

Leases |

|

|

GLA |

|

|

Leasable GLA |

|

|

Base Rent ("ABR") |

|

|

Total ABR |

|

|

Rent PSF ("ABR PSF") |

|

In-place retail leases |

|

27 |

|

|

|

63.9 |

|

|

|

16.6 |

% |

|

$ |

4,481.6 |

|

|

|

26.8 |

% |

|

$ |

70.13 |

|

In-place office leases |

|

2 |

|

|

|

79.9 |

|

|

|

20.7 |

% |

|

$ |

5,219.6 |

|

|

|

31.4 |

% |

|

|

65.33 |

|

SNO retail leases as of June 30, 2023(1) |

|

18 |

|

|

|

107.1 |

|

|

|

|

|

$ |

8,298.0 |

|

|

|

|

|

|

77.48 |

|

Opened |

|

(3 |

) |

|

|

(17.0 |

) |

|

|

|

|

$ |

(1,403.5 |

) |

|

|

|

|

|

82.56 |

|

Terminated |

|

(1 |

) |

|

|

(22.0 |

) |

|

|

|

|

$ |

(1,820.3 |

) |

|

|

|

|

|

82.74 |

|

Signed |

|

2 |

|

|

|

4.1 |

|

|

|

|

|

$ |

312.8 |

|

|

|

|

|

|

76.29 |

|

SNO retail leases as of September 30, 2023(1) |

|

16 |

|

|

|

72.2 |

|

|

|

18.7 |

% |

|

$ |

5,387.0 |

|

|

|

32.4 |

% |

|

|

74.61 |

|

SNO office leases as of June 30, 2023(1) |

|

3 |

|

|

|

46.2 |

|

|

|

|

|

$ |

2,108.5 |

|

|

|

|

|

|

45.64 |

|

Opened |

|

(1 |

) |

|

|

(18.2 |

) |

|

|

|

|

$ |

(999.8 |

) |

|

|

|

|

|

54.93 |

|

Lease amendment |

|

— |

|

|

|

— |

|

|

|

|

|

$ |

432.5 |

|

|

|

|

|

|

— |

|

SNO retail leases as of September 30, 2023(1) |

|

2 |

|

|

|

28.0 |

|

|

|

7.3 |

% |

|

$ |

1,541.2 |

|

|

|

9.3 |

% |

|

|

55.04 |

|

Total diversified leases as of September 30, 2023 |

|

47 |

|

|

|

244.0 |

|

|

|

63.3 |

% |

|

$ |

16,629.4 |

|

|

|

100.0 |

% |

|

$ |

68.15 |

|

(1) SNO = Signed not yet opened leases |

|

|

|

|

|

|

|

|

|

|

(2) In thousands except number of leases and PSF data |

|

|

|

|

|

|

|

|

|

|

During the three months ended September 30, 2023, the Company invested $10.1 million in its consolidated premier development and operating properties and an additional $0.5 million into its unconsolidated premier entities.

Aventura

During the third quarter of 2023, the Company continued to advance 216 thousand square feet of office and retail leasing at the project in Aventura, FL. The Company is finalizing construction on the asset and opened its first tenants to the public in July 2023 with approximately 58 thousand square feet representing 27% of the asset opened through November 3, 2023 and will continue with rolling openings going forward.

With 58.4% leased through November 3, 2023, the Company has 90 thousand square feet or 41.6% available for lease, of which approximately 32 thousand square feet or 14.8% is in lease negotiation and has leasing activity on over an additional 14 thousand square feet or 6.5%. This leasing percentage reflects two leases that were terminated due to those tenants failure to perform representing approximately 24 thousand square feet or 10.9%.

4

Financial Summary

The table below provides a summary of the Company’s financial results for the three and nine months ended September 30, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands except per share amounts) |

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, 2023 |

|

|

September 30, 2022 |

|

|

September 30, 2023 |

|

|

September 30, 2022 |

|

Net loss attributable to Seritage

common shareholders |

|

$ |

(2,127 |

) |

|

$ |

(4,664 |

) |

|

$ |

(162,270 |

) |

|

$ |

(170,074 |

) |

Net loss per share attributable to Seritage

common shareholders |

|

|

(0.04 |

) |

|

|

(0.08 |

) |

|

|

(2.89 |

) |

|

|

(3.57 |

) |

Total NOI |

|

|

1,119 |

|

|

|

12,150 |

|

|

|

7,218 |

|

|

|

33,245 |

|

For the quarter ended September 30, 2023:

•Total NOI for the third quarter of 2023 reflects the impact of $(0.6) million Total NOI relating to sold properties.

Total NOI is comprised of:

|

|

|

|

|

|

|

|

|

(in thousands) |

|

Three Months Ended September 30, |

|

Consolidated Properties |

|

2023 |

|

|

2022 |

|

Multi-tenant retail |

|

$ |

2,749 |

|

|

$ |

4,154 |

|

Premier |

|

|

(589 |

) |

|

|

(632 |

) |

Residential |

|

|

57 |

|

|

|

— |

|

Non-Core |

|

|

(1,310 |

) |

|

|

(422 |

) |

Sold |

|

|

(601 |

) |

|

|

6,897 |

|

Total |

|

|

306 |

|

|

|

9,997 |

|

Unconsolidated Properties |

|

|

|

|

Residential |

|

|

277 |

|

|

|

282 |

|

Premier |

|

|

64 |

|

|

|

2,158 |

|

Other joint ventures |

|

|

472 |

|

|

|

(287 |

) |

Total |

|

|

813 |

|

|

|

2,153 |

|

Total NOI |

|

$ |

1,119 |

|

|

$ |

12,150 |

|

As of September 30, 2023, the Company had cash on hand of $114.8 million, including $16.0 million of restricted cash. The Company expects to use these sources of liquidity, together with a combination of future sales, to pay its financing obligations and fund its operations and development activity. The availability of funding from sales of assets is subject to various conditions, and there can be no assurance that such transactions will be consummated. For more information on our liquidity position, including our going concern analysis, please see the notes to the consolidated financial statements included in Part I, Item 1 and in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” each in our Quarterly Report on Form 10-Q.

Dividends

On February 15, 2023, the Company’s Board of Trustees declared a preferred stock dividend of $0.4375 per each Series A Preferred Share. The preferred dividend was paid on April 17, 2023 to holders of record on March 31, 2023.

On April 27, 2023, the Company’s Board of Trustees declared a preferred stock dividend of $0.4375 per each Series A Preferred Share. The preferred dividend was paid on July 14, 2023 to holders of record on June 30, 2023.

On July 23, 2023, the Company’s Board of Trustees declared a preferred stock dividend of $0.4375 per each Series A Preferred Share. The preferred dividend was paid on October 13, 2023 to holders of record on September 30, 2023.

On October 30, 2023, the Company’s Board of Trustees declared a preferred stock dividend of $0.4375 per each Series A Preferred Share. The preferred dividend will be paid on January 16, 2024 to holders of record on December 29, 2023.

The Company’s Board of Trustees does not expect to declare dividends on its common shares until such time as the Term Loan Facility has been repaid in full.

Strategic Review

At the 2022 Annual Meeting of Shareholders on October 24, 2022, Seritage shareholders approved the Company’s Plan of Sale. The strategic review process remains ongoing as the Company executes the Plan of Sale, and the Company remains open minded to pursuing value maximizing alternatives, including a potential sale of the Company. There can be no assurance regarding the success of the process.

5

Market Update

As the Company has previously disclosed, the Company, along with the commercial real estate market as a whole, has experienced and continues to experience progressively more challenging market conditions as a result of a variety of factors. These conditions have applied and continue to apply downward pricing pressure on all of our assets. In making decisions regarding whether and when to transact on each of the Company’s remaining assets, the Company will consider various factors including, but not limited to, the breadth of the buyer universe, macroeconomic conditions, the availability and cost of financing, as well as corporate, operating and other capital expenses required to carry the asset. If these challenging market conditions persist, then we expect that they will impact the Plan of Sale proceeds from our assets and the amounts and timing of distributions to shareholders.

Supplemental Report

A Supplemental Report will be available in the Investors section of the Company’s website, www.seritage.com.

Non-GAAP Financial Measures

The Company makes references to NOI and Total NOI which are financial measures that include adjustments to accounting principles generally accepted in the United States (“GAAP”).

Neither of NOI or Total NOI are measures that (i) represent cash flow from operations as defined by GAAP; (ii) are indicative of cash available to fund all cash flow needs, including the ability to make distributions; (iii) are alternatives to cash flow as a measure of liquidity; or (iv) should be considered alternatives to net income (which is determined in accordance with GAAP) for purposes of evaluating the Company’s operating performance. Reconciliations of these measures to the respective GAAP measures the Company deems most comparable have been provided in the tables accompanying this press release.

Net Operating Income ("NOI”) and Total NOI

NOI is defined as income from property operations less property operating expenses. Other real estate companies may use different methodologies for calculating NOI, and accordingly the Company’s depiction of NOI may not be comparable to other real estate companies. The Company believes NOI provides useful information regarding Seritage, its financial condition, and results of operations because it reflects only those income and expense items that are incurred at the property level.

The Company also uses Total NOI, which includes its proportional share of unconsolidated properties. This form of presentation offers insights into the financial performance and condition of the Company as a whole given the Company’s ownership of unconsolidated properties that are accounted for under GAAP using the equity method.

The Company also considers NOI and Total NOI to be a helpful supplemental measure of its operating performance because it excludes from NOI variable items such as termination fee income, as well as non-cash items such as straight-line rent and amortization of lease intangibles.

Forward-Looking Statements

This document contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond the Company’s control, which may cause actual results to differ significantly from those expressed in any forward-looking statement. Factors that could cause or contribute to such differences include, but are not limited to: declines in retail, real estate and general economic conditions; the impact of the COVID-19 pandemic on the business of the Company’s tenants and business, income, cash flow, results of operations, financial condition, liquidity, prospects, ability to service the Company’s debt obligations and ability to pay dividends and other distributions to shareholders; risks relating to redevelopment activities; contingencies to the commencement of rent under leases; the terms of the Company’s indebtedness and other legal requirements to which the Company is subject; failure to achieve expected occupancy and/or rent levels within the projected time frame or at all; the impact of ongoing negative operating cash flow on the Company’s ability to fund operations and ongoing development; the Company’s ability to access or obtain sufficient sources of financing to fund the Company’s liquidity needs; the Company’s relatively limited history as an operating company; and environmental, health, safety and land use laws and regulations. For additional discussion of these and other applicable risks, assumptions and uncertainties, see the “Risk Factors” and forward-looking statement disclosure contained in the Company’s filings with the Securities and Exchange Commission, including the Company’s annual report on Form 10-K for the year ended December 31, 2022 and any subsequent Form 10-Qs. While the Company believes that its forecasts and assumptions are reasonable, the Company cautions that actual results may differ materially. The Company intends the forward-looking statements to speak only as of the time made and do not undertake to update or revise them as more information becomes available, except as required by law.

6

About Seritage Growth Properties

Seritage is principally engaged in the ownership, development, redevelopment, management and leasing of retail and mixed-use properties throughout the United States. As of September 30, 2023, the Company’s portfolio consisted of interests in 42 properties comprised of approximately 5.6 million square feet of gross leasable area (“GLA”) or build-to-suit leased area, approximately 126 acres held for or under development and approximately 2.9 million square feet or approximately 259 acres to be disposed of. The portfolio consists of approximately 4.3 million square feet of GLA held by 33 wholly owned properties (such properties, the “Consolidated Properties”) and 1.2 million square feet of GLA held by 9 unconsolidated entities (such properties, the “Unconsolidated Properties”).

Contact

Seritage Growth Properties

(212) 355-7800

IR@Seritage.com

7

Seritage Growth Properties

Consolidated Balance SheetS

(In thousands, except share and per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

ASSETS |

|

|

|

|

|

|

Investment in real estate |

|

|

|

|

|

|

Land |

|

$ |

108,366 |

|

|

$ |

172,813 |

|

Buildings and improvements |

|

|

324,781 |

|

|

|

463,616 |

|

Accumulated depreciation |

|

|

(35,119 |

) |

|

|

(57,330 |

) |

|

|

|

398,028 |

|

|

|

579,099 |

|

Construction in progress |

|

|

131,015 |

|

|

|

185,324 |

|

Net investment in real estate |

|

|

529,043 |

|

|

|

764,423 |

|

Real estate held for sale |

|

|

110,616 |

|

|

|

455,617 |

|

Investment in unconsolidated entities |

|

|

208,672 |

|

|

|

382,597 |

|

Cash and cash equivalents |

|

|

98,886 |

|

|

|

133,480 |

|

Restricted cash |

|

|

15,962 |

|

|

|

11,459 |

|

Tenant and other receivables, net |

|

|

20,638 |

|

|

|

41,495 |

|

Lease intangible assets, net |

|

|

930 |

|

|

|

1,791 |

|

Prepaid expenses, deferred expenses and other assets, net |

|

|

31,543 |

|

|

|

50,859 |

|

Total assets (1) |

|

$ |

1,016,290 |

|

|

$ |

1,841,721 |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

Term loan facility, net |

|

$ |

400,000 |

|

|

$ |

1,029,754 |

|

Accounts payable, accrued expenses and other liabilities |

|

|

56,028 |

|

|

|

89,368 |

|

Total liabilities (1) |

|

|

456,028 |

|

|

|

1,119,122 |

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' Equity |

|

|

|

|

|

|

Class A common shares $0.01 par value; 100,000,000 shares authorized;

56,182,522 and 56,052,546 shares issued and outstanding

as of September 30, 2023 and December 31, 2022, respectively |

|

|

562 |

|

|

|

561 |

|

Series A preferred shares $0.01 par value; 10,000,000 shares authorized;

2,800,000 shares issued and outstanding as of September 30, 2023 and

December 31, 2022; liquidation preference of $70,000 |

|

|

28 |

|

|

|

28 |

|

Additional paid-in capital |

|

|

1,361,384 |

|

|

|

1,360,411 |

|

Accumulated deficit |

|

|

(802,801 |

) |

|

|

(640,531 |

) |

Total shareholders' equity |

|

|

559,173 |

|

|

|

720,469 |

|

Non-controlling interests |

|

|

1,089 |

|

|

|

2,130 |

|

Total equity |

|

|

560,262 |

|

|

|

722,599 |

|

Total liabilities and equity |

|

$ |

1,016,290 |

|

|

$ |

1,841,721 |

|

(1) The Company's consolidated balance sheets include assets and liabilities of consolidated variable interest entities ("VIEs"). See Note 2. The consolidated balance sheets, as of September 30, 2023, include the following amounts related to our consolidated VIEs, excluding the Operating Partnership: $3.3 million of land, $2.8 million of building and improvements, $(0.8) million of accumulated depreciation and $2.0 million of other assets included in other line items. The Company's consolidated balance sheets as of December 31, 2022, include the following amounts related to our consolidated VIEs, excluding the Operating Partnership: $6.6 million of land, $3.9 million of building and improvements, $(1.0) million of accumulated depreciation and $4.0 million of other assets included in other line items. |

|

8

Seritage Growth Properties

Consolidated Statements of OPERATIONS

(In thousands, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

REVENUE |

|

|

|

|

|

|

|

|

|

|

|

|

Rental income |

|

$ |

4,525 |

|

|

$ |

23,253 |

|

|

$ |

10,459 |

|

|

$ |

81,755 |

|

Management and other fee income |

|

|

523 |

|

|

|

248 |

|

|

|

1,152 |

|

|

|

2,355 |

|

Total revenue |

|

|

5,048 |

|

|

|

23,501 |

|

|

|

11,611 |

|

|

|

84,110 |

|

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

Property operating |

|

|

4,564 |

|

|

|

9,700 |

|

|

|

17,945 |

|

|

|

31,535 |

|

Real estate taxes |

|

|

1,204 |

|

|

|

6,483 |

|

|

|

4,910 |

|

|

|

21,056 |

|

Depreciation and amortization |

|

|

2,913 |

|

|

|

9,169 |

|

|

|

11,628 |

|

|

|

31,772 |

|

General and administrative |

|

|

8,030 |

|

|

|

10,811 |

|

|

|

30,349 |

|

|

|

30,996 |

|

Litigation settlement |

|

|

— |

|

|

|

533 |

|

|

|

— |

|

|

|

35,533 |

|

Total expenses |

|

|

16,711 |

|

|

|

36,696 |

|

|

|

64,832 |

|

|

|

150,892 |

|

Gain on sale of real estate, net |

|

|

18,506 |

|

|

|

45,433 |

|

|

|

64,386 |

|

|

|

112,449 |

|

(Loss) gain on sale of interest in unconsolidated entities |

|

|

(916 |

) |

|

|

(139 |

) |

|

|

6,407 |

|

|

|

(139 |

) |

Impairment of real estate assets |

|

|

— |

|

|

|

(10,275 |

) |

|

|

(107,043 |

) |

|

|

(120,609 |

) |

Equity in income (loss) of unconsolidated entities |

|

|

993 |

|

|

|

(2,275 |

) |

|

|

(49,077 |

) |

|

|

(69,071 |

) |

Interest and other income |

|

|

2,030 |

|

|

|

(1,047 |

) |

|

|

17,484 |

|

|

|

(937 |

) |

Interest expense |

|

|

(9,763 |

) |

|

|

(21,916 |

) |

|

|

(37,493 |

) |

|

|

(67,167 |

) |

Loss before income taxes |

|

|

(813 |

) |

|

|

(3,414 |

) |

|

|

(158,557 |

) |

|

|

(212,256 |

) |

Provision for income taxes |

|

|

(89 |

) |

|

|

(67 |

) |

|

|

(38 |

) |

|

|

(295 |

) |

Net loss |

|

|

(902 |

) |

|

|

(3,481 |

) |

|

|

(158,595 |

) |

|

|

(212,551 |

) |

Net loss attributable to non-controlling interests |

|

|

— |

|

|

|

42 |

|

|

|

— |

|

|

|

46,152 |

|

Net loss attributable to Seritage |

|

$ |

(902 |

) |

|

$ |

(3,439 |

) |

|

$ |

(158,595 |

) |

|

$ |

(166,399 |

) |

Preferred dividends |

|

|

(1,225 |

) |

|

|

(1,225 |

) |

|

|

(3,675 |

) |

|

|

(3,675 |

) |

Net loss attributable to Seritage common shareholders |

|

$ |

(2,127 |

) |

|

$ |

(4,664 |

) |

|

$ |

(162,270 |

) |

|

$ |

(170,074 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share attributable to Seritage Class A

common shareholders - Basic |

|

$ |

(0.04 |

) |

|

$ |

(0.08 |

) |

|

$ |

(2.89 |

) |

|

$ |

(3.57 |

) |

Net loss per share attributable to Seritage Class A

common shareholders - Diluted |

|

$ |

(0.04 |

) |

|

$ |

(0.08 |

) |

|

$ |

(2.89 |

) |

|

$ |

(3.57 |

) |

Weighted average Class A common shares

outstanding - Basic |

|

|

56,183 |

|

|

|

55,361 |

|

|

|

56,139 |

|

|

|

47,600 |

|

Weighted average Class A common shares

outstanding - Diluted |

|

|

56,183 |

|

|

|

55,361 |

|

|

|

56,139 |

|

|

|

47,600 |

|

9

Reconciliation of Net Loss to NOI and Total NOI (in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

NOI and Total NOI |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net loss |

|

$ |

(902 |

) |

|

$ |

(3,481 |

) |

|

$ |

(158,595 |

) |

|

$ |

(212,551 |

) |

Termination fee income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(369 |

) |

Management and other fee income |

|

|

(523 |

) |

|

|

(248 |

) |

|

|

(1,152 |

) |

|

|

(2,355 |

) |

Depreciation and amortization |

|

|

2,913 |

|

|

|

9,169 |

|

|

|

11,628 |

|

|

|

31,772 |

|

General and administrative expenses |

|

|

8,030 |

|

|

|

10,811 |

|

|

|

30,349 |

|

|

|

30,996 |

|

Litigation settlement |

|

|

— |

|

|

|

533 |

|

|

|

— |

|

|

|

35,533 |

|

Equity in loss of unconsolidated entities |

|

|

(993 |

) |

|

|

2,275 |

|

|

|

49,077 |

|

|

|

69,071 |

|

Loss (gain) on sale of interest in unconsolidated entities |

|

|

916 |

|

|

|

139 |

|

|

|

(6,407 |

) |

|

|

139 |

|

Gain on sale of real estate, net |

|

|

(18,506 |

) |

|

|

(45,433 |

) |

|

|

(64,386 |

) |

|

|

(112,449 |

) |

Impairment of real estate assets |

|

|

— |

|

|

|

10,275 |

|

|

|

107,043 |

|

|

|

120,609 |

|

Interest and other income |

|

|

(2,030 |

) |

|

|

1,047 |

|

|

|

(17,484 |

) |

|

|

937 |

|

Interest expense |

|

|

9,763 |

|

|

|

21,916 |

|

|

|

37,493 |

|

|

|

67,167 |

|

(Benefit) provision for income taxes |

|

|

89 |

|

|

|

67 |

|

|

|

38 |

|

|

|

295 |

|

Straight-line rent |

|

|

1,504 |

|

|

|

2,873 |

|

|

|

16,142 |

|

|

|

(1,447 |

) |

Above/below market rental expense |

|

|

45 |

|

|

|

54 |

|

|

|

138 |

|

|

|

175 |

|

NOI |

|

$ |

306 |

|

|

$ |

9,997 |

|

|

$ |

3,884 |

|

|

$ |

27,523 |

|

Unconsolidated entities |

|

|

|

|

|

|

|

|

|

|

|

|

Net operating income of unconsolidated entities |

|

|

3,445 |

|

|

|

2,450 |

|

|

|

6,404 |

|

|

|

6,563 |

|

Straight-line rent |

|

|

(2,629 |

) |

|

|

(305 |

) |

|

|

(3,069 |

) |

|

|

(860 |

) |

Above/below market rental expense |

|

|

(3 |

) |

|

|

8 |

|

|

|

(1 |

) |

|

|

19 |

|

Total NOI |

|

$ |

1,119 |

|

|

$ |

12,150 |

|

|

$ |

7,218 |

|

|

$ |

33,245 |

|

10

Exhibit 99.2

1

Forward-Looking Statements

Certain statements contained herein constitute forward-looking statements as such term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are not guarantees of future performance. They represent our intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Our future results, financial condition and business may differ materially from those expressed in these forward-looking statements. You can find many of these statements by looking for words such as “approximates,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “projects,” “would,” “may” or other similar expressions in the Company’s Annual Report on Form 10-K. Many of the factors that will determine the outcome of these and our other forward-looking statements are beyond our ability to control or predict. For further discussion of factors that could materially affect the outcome of our forward-looking statements, see “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 and in any of our subsequent Form 10-Qs. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on our forward-looking statements, which speak only as of the date hereof. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances occurring after the date hereof. The following discussion should be read in conjunction with the condensed consolidated financial statements and notes thereto included in Part 1 of the Quarterly Report.

2

Financial Information

3

Summary Information

September 30, 2023

(in thousands, except per share and PSF amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

Financial Results |

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

Net loss attributable to Seritage

common shareholders |

|

$ |

(2,127 |

) |

|

$ |

(4,664 |

) |

|

$ |

(162,270 |

) |

|

$ |

(170,074 |

) |

Total NOI |

|

$ |

1,119 |

|

|

$ |

12,150 |

|

|

$ |

7,218 |

|

|

$ |

33,245 |

|

Net loss per share attributable to Seritage

common shareholders |

|

$ |

(0.04 |

) |

|

$ |

(0.08 |

) |

|

$ |

(2.89 |

) |

|

$ |

(3.57 |

) |

Wtd. avg. shares - EPS |

|

|

56,183 |

|

|

|

55,361 |

|

|

|

56,139 |

|

|

|

47,600 |

|

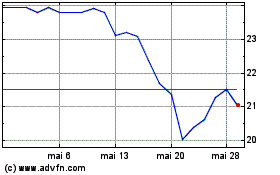

Stock trading price range |

|

$7.19 to $9.69 |

|

|

$5.40 to $14.06 |

|

|

$7.19 to $12.70 |

|

|

$5.21 to $14.45 |

|

4

Consolidated Balance Sheets (unaudited)

September 30, 2023

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

ASSETS |

|

|

|

|

|

|

Investment in real estate |

|

|

|

|

|

|

Land |

|

$ |

108,366 |

|

|

$ |

172,813 |

|

Buildings and improvements |

|

|

324,781 |

|

|

|

463,616 |

|

Accumulated depreciation |

|

|

(35,119 |

) |

|

|

(57,330 |

) |

|

|

|

398,028 |

|

|

|

579,099 |

|

Construction in progress |

|

|

131,015 |

|

|

|

185,324 |

|

Net investment in real estate |

|

|

529,043 |

|

|

|

764,423 |

|

Real estate held for sale |

|

|

110,616 |

|

|

|

455,617 |

|

Investment in unconsolidated entities |

|

|

208,672 |

|

|

|

382,597 |

|

Cash and cash equivalents |

|

|

98,886 |

|

|

|

133,480 |

|

Restricted cash |

|

|

15,962 |

|

|

|

11,459 |

|

Tenant and other receivables, net |

|

|

20,638 |

|

|

|

41,495 |

|

Lease intangible assets, net |

|

|

930 |

|

|

|

1,791 |

|

Prepaid expenses, deferred expenses and other assets, net |

|

|

31,543 |

|

|

|

50,859 |

|

Total assets (1) |

|

$ |

1,016,290 |

|

|

$ |

1,841,721 |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

Term loan facility, net |

|

$ |

400,000 |

|

|

$ |

1,029,754 |

|

Accounts payable, accrued expenses and other liabilities |

|

|

56,028 |

|

|

|

89,368 |

|

Total liabilities (1) |

|

|

456,028 |

|

|

|

1,119,122 |

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' Equity |

|

|

|

|

|

|

Class A common shares $0.01 par value; 100,000,000 shares authorized;

56,182,522 and 56,052,546 shares issued and outstanding

as of September 30, 2023 and December 31, 2022, respectively |

|

|

562 |

|

|

|

561 |

|

Series A preferred shares $0.01 par value; 10,000,000 shares authorized;

2,800,000 shares issued and outstanding as of September 30, 2023 and

December 31, 2022; liquidation preference of $70,000 |

|

|

28 |

|

|

|

28 |

|

Additional paid-in capital |

|

|

1,361,384 |

|

|

|

1,360,411 |

|

Accumulated deficit |

|

|

(802,801 |

) |

|

|

(640,531 |

) |

Total shareholders' equity |

|

|

559,173 |

|

|

|

720,469 |

|

Non-controlling interests |

|

|

1,089 |

|

|

|

2,130 |

|

Total equity |

|

|

560,262 |

|

|

|

722,599 |

|

Total liabilities and equity |

|

$ |

1,016,290 |

|

|

$ |

1,841,721 |

|

(1) The Company's consolidated balance sheets include assets and liabilities of consolidated variable interest entities ("VIEs"). See Note 2. The consolidated balance sheets, as of September 30, 2023, include the following amounts related to our consolidated VIEs, excluding the Operating Partnership: $3.3 million of land, $2.8 million of building and improvements, $(0.8) million of accumulated depreciation and $2.0 million of other assets included in other line items. The Company's consolidated balance sheets as of December 31, 2022, include the following amounts related to our consolidated VIEs, excluding the Operating Partnership: $6.6 million of land, $3.9 million of building and improvements, $(1.0) million of accumulated depreciation and $4.0 million of other assets included in other line items. |

|

5

Consolidated Statements of Operations (unaudited)

September 30, 2023

(in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

REVENUE |

|

|

|

|

|

|

|

|

|

|

|

|

Rental income |

|

$ |

4,525 |

|

|

$ |

23,253 |

|

|

$ |

10,459 |

|

|

$ |

81,755 |

|

Management and other fee income |

|

|

523 |

|

|

|

248 |

|

|

|

1,152 |

|

|

|

2,355 |

|

Total revenue |

|

|

5,048 |

|

|

|

23,501 |

|

|

|

11,611 |

|

|

|

84,110 |

|

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

Property operating |

|

|

4,564 |

|

|

|

9,700 |

|

|

|

17,945 |

|

|

|

31,535 |

|

Real estate taxes |

|

|

1,204 |

|

|

|

6,483 |

|

|

|

4,910 |

|

|

|

21,056 |

|

Depreciation and amortization |

|

|

2,913 |

|

|

|

9,169 |

|

|

|

11,628 |

|

|

|

31,772 |

|

General and administrative |

|

|

8,030 |

|

|

|

10,811 |

|

|

|

30,349 |

|

|

|

30,996 |

|

Litigation settlement |

|

|

— |

|

|

|

533 |

|

|

|

— |

|

|

|

35,533 |

|

Total expenses |

|

|

16,711 |

|

|

|

36,696 |

|

|

|

64,832 |

|

|

|

150,892 |

|

Gain on sale of real estate, net |

|

|

18,506 |

|

|

|

45,433 |

|

|

|

64,386 |

|

|

|

112,449 |

|

(Loss) gain on sale of interest in unconsolidated entities |

|

|

(916 |

) |

|

|

(139 |

) |

|

|

6,407 |

|

|

|

(139 |

) |

Impairment of real estate assets |

|

|

— |

|

|

|

(10,275 |

) |

|

|

(107,043 |

) |

|

|

(120,609 |

) |

Equity in income (loss) of unconsolidated entities |

|

|

993 |

|

|

|

(2,275 |

) |

|

|

(49,077 |

) |

|

|

(69,071 |

) |

Interest and other income |

|

|

2,030 |

|

|

|

(1,047 |

) |

|

|

17,484 |

|

|

|

(937 |

) |

Interest expense |

|

|

(9,763 |

) |

|

|

(21,916 |

) |

|

|

(37,493 |

) |

|

|

(67,167 |

) |

Loss before income taxes |

|

|

(813 |

) |

|

|

(3,414 |

) |

|

|

(158,557 |

) |

|

|

(212,256 |

) |

Provision for income taxes |

|

|

(89 |

) |

|

|

(67 |

) |

|

|

(38 |

) |

|

|

(295 |

) |

Net loss |

|

|

(902 |

) |

|

|

(3,481 |

) |

|

|

(158,595 |

) |

|

|

(212,551 |

) |

Net loss attributable to non-controlling interests |

|

|

— |

|

|

|

42 |

|

|

|

— |

|

|

|

46,152 |

|

Net loss attributable to Seritage |

|

$ |

(902 |

) |

|

$ |

(3,439 |

) |

|

$ |

(158,595 |

) |

|

$ |

(166,399 |

) |

Preferred dividends |

|

|

(1,225 |

) |

|

|

(1,225 |

) |

|

|

(3,675 |

) |

|

|

(3,675 |

) |

Net loss attributable to Seritage common shareholders |

|

$ |

(2,127 |

) |

|

$ |

(4,664 |

) |

|

$ |

(162,270 |

) |

|

$ |

(170,074 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share attributable to Seritage Class A

common shareholders - Basic |

|

$ |

(0.04 |

) |

|

$ |

(0.08 |

) |

|

$ |

(2.89 |

) |

|

$ |

(3.57 |

) |

Net loss per share attributable to Seritage Class A

common shareholders - Diluted |

|

$ |

(0.04 |

) |

|

$ |

(0.08 |

) |

|

$ |

(2.89 |

) |

|

$ |

(3.57 |

) |

Weighted average Class A common shares

outstanding - Basic |

|

|

56,183 |

|

|

|

55,361 |

|

|

|

56,139 |

|

|

|

47,600 |

|

Weighted average Class A common shares

outstanding - Diluted |

|

|

56,183 |

|

|

|

55,361 |

|

|

|

56,139 |

|

|

|

47,600 |

|

6

Total Net Operating Income

September 30, 2023

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

NOI and Total NOI |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net loss |

|

$ |

(902 |

) |

|

$ |

(3,481 |

) |

|

$ |

(158,595 |

) |

|

$ |

(212,551 |

) |

Termination fee income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(369 |

) |

Management and other fee income |

|

|

(523 |

) |

|

|

(248 |

) |

|

|

(1,152 |

) |

|

|

(2,355 |

) |

Depreciation and amortization |

|

|

2,913 |

|

|

|

9,169 |

|

|

|

11,628 |

|

|

|

31,772 |

|

General and administrative expenses |

|

|

8,030 |

|

|

|

10,811 |

|

|

|

30,349 |

|

|

|

30,996 |

|

Litigation settlement |

|

|

— |

|

|

|

533 |

|

|

|

— |

|

|

|

35,533 |

|

Equity in loss of unconsolidated entities |

|

|

(993 |

) |

|

|

2,275 |

|

|

|

49,077 |

|

|

|

69,071 |

|

Loss (gain) on sale of interest in unconsolidated entities |

|

|

916 |

|

|

|

139 |

|

|

|

(6,407 |

) |

|

|

139 |

|

Gain on sale of real estate, net |

|

|

(18,506 |

) |

|

|

(45,433 |

) |

|

|

(64,386 |

) |

|

|

(112,449 |

) |

Impairment of real estate assets |

|

|

— |

|

|

|

10,275 |

|

|

|

107,043 |

|

|

|

120,609 |

|

Interest and other income |

|

|

(2,030 |

) |

|

|

1,047 |

|

|

|

(17,484 |

) |

|

|

937 |

|

Interest expense |

|

|

9,763 |

|

|

|

21,916 |

|

|

|

37,493 |

|

|

|

67,167 |

|

(Benefit) provision for income taxes |

|

|

89 |

|

|

|

67 |

|

|

|

38 |

|

|

|

295 |

|

Straight-line rent |

|

|

1,504 |

|

|

|

2,873 |

|

|

|

16,142 |

|

|

|

(1,447 |

) |

Above/below market rental expense |

|

|

45 |

|

|

|

54 |

|

|

|

138 |

|

|

|

175 |

|

NOI |

|

$ |

306 |

|

|

$ |

9,997 |

|

|

$ |

3,884 |

|

|

$ |

27,523 |

|

Unconsolidated entities |

|

|

|

|

|

|

|

|

|

|

|

|

Net operating income of unconsolidated entities |

|

|

3,445 |

|

|

|

2,450 |

|

|

|

6,404 |

|

|

|

6,563 |

|

Straight-line rent |

|

|

(2,629 |

) |

|

|

(305 |

) |

|

|

(3,069 |

) |

|

|

(860 |

) |

Above/below market rental expense |

|

|

(3 |

) |

|

|

8 |

|

|

|

(1 |

) |

|

|

19 |

|

Total NOI |

|

$ |

1,119 |

|

|

$ |

12,150 |

|

|

$ |

7,218 |

|

|

$ |

33,245 |

|

7

Additional Information

September 30, 2023

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

As of |

|

Debt Summary |

|

September 30, 2023 |

|

|

December 31, 2022 |

|

Term Loan Facility (drawn / undrawn) |

|

$400,000 / 400,000 |

|

|

$1,030,000 / 400,000 |

|

Interest rate / undrawn rate |

|

7.00% / 1.00% |

|

|

7.00% / 1.00% |

|

Maturity |

|

July 2025 |

|

|

July 2023 |

|

|

|

|

|

|

|

|

Prepaid Expenses, Deferred Expenses and Other Assets |

|

September 30, 2023 |

|

|

December 31, 2022 |

|

Right of Use Asset |

|

$ |

14,653 |

|

|

$ |

16,161 |

|

Prepaid insurance |

|

|

6,109 |

|

|

|

5,492 |

|

Other prepaid expenses |

|

|

4,207 |

|

|

|

4,133 |

|

Deferred expenses |

|

|

3,834 |

|

|

|

17,367 |

|

Other assets |

|

|

1,747 |

|

|

|

5,551 |

|

FF&E |

|

|

751 |

|

|

|

1,129 |

|

Prepaid real estate taxes |

|

|

242 |

|

|

|

1,026 |

|

Total prepaid expenses, deferred expenses and other assets |

|

$ |

31,543 |

|

|

$ |

50,859 |

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

Accrued development expenditures |

|

$ |

21,668 |

|

|

$ |

37,983 |

|

Accounts payable and accrued expenses |

|

|

18,837 |

|

|

|

25,454 |

|

Lease liability |

|

|

5,397 |

|

|

|

5,916 |

|

Accrued real estate taxes |

|

|

4,067 |

|

|

|

8,638 |

|

Prepaid rental income |

|

|

2,241 |

|

|

|

4,977 |

|

Accrued interest |

|

|

1,416 |

|

|

|

3,286 |

|

Below-market leases |

|

|

1,340 |

|

|

|

1,560 |

|

Common and preferred dividends and OP

Unit distributions payable |

|

|

1,062 |

|

|

|

1,554 |

|

Total accounts payable, accrued expenses and

other liabilities |

|

$ |

56,028 |

|

|

$ |

89,368 |

|

8

Additional Information (cont’d)

September 30, 2023

(in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

Rental Revenue Detail |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

Rental income |

|

$ |

4,319 |

|

|

$ |

19,004 |

|

|

|

9,048 |

|

|

|

66,998 |

|

Tenant reimbursements |

|

|

206 |

|

|

|

4,249 |

|

|

|

1,411 |

|

|

|

14,387 |

|

Termination income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

370 |

|

Total |

|

$ |

4,525 |

|

|

$ |

23,253 |

|

|

$ |

10,459 |

|

|

$ |

81,755 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Select Non-Cash Items |

|