Seritage Growth Properties (NYSE: SRG) (the “Company”), a

national owner and developer of retail, residential and mixed-use

properties today reported financial and operating results for the

three and nine months ended September 30, 2024.

"We have made tremendous strides in simplifying our portfolio

and improving our balance sheet while maintaining and enhancing our

best assets. Our near term priority is our pending term loan

maturity in July 2025, and we are simultaneously exploring multiple

options to determine which would be the most beneficial to our

shareholders. To this end, we are currently engaged in the

following: discussions with our current lender on a potential

extension of the maturity, in the market for a possible refinancing

of the debt with other lenders, pursuing other recapitalization

options, and continuing to explore other strategic alternatives. We

are doing all of this while continuing our plan of sale and further

reducing our debt,” said Andrea L. Olshan, Chief Executive

Officer.

Sale Highlights:

- Generated $24.0 million of gross proceeds from the sale of an

income producing asset reflecting a 8.5% capitalization rate.

- Subsequent to September 30, 2024, generated $17.1 million in

gross proceeds from a vacant/non-income producing asset sold at

$87.43 PSF eliminating $0.6 million of carry costs.

- As of November 12, 2024, the Company has five assets under

contract for anticipated gross proceeds of $87.9 million. All

assets for sale are subject to customary closing conditions. Of

these five assets, two are for sale with no due diligence

contingencies for total anticipated gross proceeds of $33.7 million

and three assets are under contract for sale subject to customary

due diligence for anticipated gross proceeds of $54.2 million at

share including:

- $33.7 million in gross proceeds from two vacant/non-income

producing properties to be sold at $95.90 PSF eliminating $0.6

million of carry costs; and

- $54.2 million in gross proceeds from monetizing three

unconsolidated entity interests.

- The Company has accepted an offer and is currently negotiating

a definitive purchase and sale agreement on one income producing

asset for gross proceeds of $29.9 million.

Financial Highlights:

For the three months ended September 30, 2024:

- As of September 30, 2024, the Company had cash on hand of $98.2

million, including $12.6 million of restricted cash. As of November

11, 2024, the Company had cash on hand of $87.7 million, including

$12.6 million of restricted cash.

- During the three months ended September 30, 2024, the Company

invested $3.3 million in its consolidated properties and $5.8

million in its unconsolidated entities.

- Net loss attributable to common shareholders of ($23.2)

million, or ($0.41) per share.

- Net Operating Income-cash basis at share (“NOI-cash basis at

share”) of (0.9) million.

Other Highlights

- Signed two leases covering 5.5 thousand square feet in the

third quarter at a projected average annual net rent of $65.57

PSF.

- Opened two tenants in the third quarter totaling approximately

6.5 thousand square feet at an average net rent of $63.11 PSF.

Future Sales Projections

The data below provides additional information regarding current

estimated gross sales proceeds per asset in the portfolio as of

November 12, 2024, excluding assets under contract or in PSA

negotiation, which are described above. The assets listed below are

either being marketed or are to be marketed at the appropriate time

based on market conditions and, as a result, any sales thereof are

anticipated to occur in 2025 and beyond. Sales projections,

including timing of sale, are based on the Company’s latest

forecasts and assumptions, but the Company cautions that actual

results may differ materially. In addition, see “Market Update”

below and the “Risk Factors” section contained in the Company’s

filings with the Securities and Exchange Commission for discussion

of the risks associated with such estimated gross sale

proceeds.

Gateway Markets

- One Multi-Tenant Asset $25 - $30 million

- Eight Premier Assets (Dallas & San Diego are each assumed

to be sold in two transactions)

- One Asset $15 - $20 million

- Two Assets $30 - $35 million, each

- One Assets $50 - $60 million

- One Asset $60 - $70 million

- One Asset $70 - $80 million

- One Asset $100 - $150 million

- One Asset $150 - $200 million

Primary Markets

- One Multi-Tenant Asset $25 - $30 million

- Three Joint Venture Assets $5 - $10 million, each

- One Joint Venture Asset under $5 million

Secondary Markets

- One Residential Asset with adjacent Retail asset $5 - $10

million

- One Non-Core Asset $5 - $10 million

Portfolio

The table below represents a summary of the Company’s properties

by planned usage as of September 30, 2024 (in thousands except

number of leases and acreage data):

Planned Usage

Total

Built SF / Acreage (1)

Leased SF (1)(2)

% Leased

Avg. Acreage / Site

Consolidated

Multi-Tenant Retail

3

507 sf / 63 acres

335

66.1%

20.9

Residential (3)

2

33 sf / 19 acres

33

100.0%

9.5

Premier

4

228 sf / 69 acres

182

79.8%

17.2

Non-Core (4)

4

681 sf /57 acres

-

0.0%

14.4

Unconsolidated

Other Joint Ventures

6

457 sf / 77 acres

11

2.3%

12.8

Premier

3

158 sf / 57 acres

106

67.4%

19.0

(1) Square footage is presented at the

Company’s proportional share.

(2) Based on signed leases at September

30, 2024.

(3) Square footage represents built

ancillary retail space whereas acreage represents both retail and

residential acreage. Retail and residential are counted

separately.

(4) Represents assets the Company previously designated for sale.

Multi-Tenant Retail

The table below provides a summary of all Multi-Tenant Retail

signed and in negotiation leases as of September 30, 2024 (in

thousands except for number of leases and PSF data):

Tenant

Number of

Leases

Leased GLA

% of Total Leasable

GLA

Gross Annual Base Rent

("ABR")

% of Total ABR

Gross Annual Rent PSF

("ABR PSF")

In-place retail leases

10

335.2

66.1

%

$

8,895.0

92.2

%

26.54

SNO retail leases (1)

-

-

-

-

-

-

Tenants in lease negotiation

1

102.0

20.1

%

749.5

7.8

%

7.35

Total retail leases

11

437.2

86.2

%

$

9,644.5

100.0

%

$

22.06

(1) SNO = signed not yet opened

leases.

During the three months ended September 30, 2024, the Company

has a leasing pipeline of over 102 thousand square feet. The

Company has 335 thousand leased square feet. The Company has total

occupancy of 66.1% for its Multi-Tenant retail properties. As of

September 30, 2024, there is an additional approximately 70

thousand square feet available for lease.

Number of SNO

Leases

Leased GLA

Gross Annual Base Rent

("ABR")

Gross Annual Rent PSF

("ABR PSF")

As of June 30, 2024

1

8.0

$

175.0

$

21.88

Sold / terminated

(1

)

(8.0

)

(175.0

)

(21.88

)

As of September 30, 2024

-

-

$

-

$

-

Premier Mixed-Use

As of September 30, 2024, the Company has 348 thousand in-place

leased square feet (241 thousand square feet at share), 47 thousand

square feet signed but not opened (47 thousand square feet at

share), and 148 thousand square feet available for lease (97

thousand square feet at share).

The table below provides a summary of all signed leases at

Premier assets as of September 30, 2024, including unconsolidated

entities at the Company’s proportional share (in thousands except

for number of leases and PSF data):

Tenant

Number of

Leases

Leased GLA

% of Total Leasable

GLA

Gross Annual Base Rent

("ABR")

% of Total ABR

Gross Annual Rent PSF

("ABR PSF")

In-place retail leases

40

133.4

34.6

%

$

9,487.4

47.2

%

$

71.12

In-place office leases

4

108.0

28.0

%

6,933.6

34.5

%

64.23

SNO retail leases as of June 30,

2024(1)

13

37.5

$

3,178.5

$

83.70

Opened

(2

)

(6.4

)

(407.0

)

63.59

Signed/amended

3

18.3

1,180.0

64.48

Terminated

(2

)

(2.7

)

(263.4

)

98.48

SNO retail leases as of September 30,

2024(1)

12

46.7

12.1

%

$

3,688.1

18.3

%

$

78.9

Total diversified leases as of

September 30, 2024

56

288.1

74.7

%

$

20,109.1

100.0

%

$

69.80

(1) SNO = Signed not yet opened leases

Aventura

During the third quarter of 2024, the Company continued to

advance 216 thousand square feet of office and retail leasing at

the project in Aventura, FL. With 78.7% leased through September

30, 2024, the Company has 47 thousand square feet or 21.3%

available for lease, of which approximately 13 thousand square feet

or 6.0% is in lease negotiation.

Financial Summary

The table below provides a summary of the Company’s financial

results for the three months ended September 30, 2024 (in thousands

except for per share amounts):

Three Months Ended

September 30, 2024

September 30, 2023

Net loss attributable to Seritage common

shareholders

$

(23,198

)

$

(2,127

)

Net loss per share attributable to

Seritage common shareholders

(0.41

)

(0.04

)

NOI-cash basis at share

(934

)

1,119

For the quarter ended September 30, 2024, NOI-cash basis at

share reflects the impact of ($0.5) million NOI-cash basis at share

relating to sold properties.

As of September 30, 2024, the Company had cash on hand of $98.2

million, including $12.6 million of restricted cash. The Company

expects to use these sources of liquidity, together with a

combination of future sales and/or potential alternative financing

arrangements, to pay its financing obligations and fund its

operations and development activity. The availability of funding

from sales of assets is subject to various conditions, and there

can be no assurance that such transactions will be consummated. For

more information on our liquidity position, including our going

concern analysis, please see the notes to the consolidated

financial statements included in Part I, Item 1 and in the section

titled “Management’s Discussion and Analysis of Financial Condition

and Results of Operations,” each in our Quarterly Report on Form

10-Q.

Litigation Matters

On July 1, 2024, a purported shareholder of the Company filed a

class action lawsuit in the U.S. District Court for the Southern

District of New York, captioned Zhengxu He, Trustee of the He &

Fang 2005 Revocable Living Trust v. Seritage Growth Properties,

Case No. 1:24:CV:05007, alleging that the Company, the Company’s

Chief Executive Officer, and the Company’s Chief Financial Officer

violated the federal securities laws. The complaint seeks to bring

a class action on behalf of all persons and entities that purchased

or otherwise acquired Company securities between July 7, 2022 and

May 10, 2024. The complaint alleges that the defendants violated

federal securities laws by issuing false, misleading, and/or

omissive disclosures concerning the Company’s alleged lack of

effective internal controls regarding the identification and review

of impairment indicators for investments in real estate and the

Company’s value and projected gross proceeds of certain real estate

assets. The complaint seeks compensatory damages in an unspecified

amount to be proven at trial, an award of reasonable costs and

expenses to the plaintiff and class counsel, and such other and

further relief as the court may deem just and proper. The Company

intends to vigorously defend itself against the allegations.

Dividends

On February 29, 2024, the Company’s Board of Trustees declared a

preferred stock dividend of $0.4375 per each Series A Preferred

Share. The preferred dividend was paid on April 15, 2024 to holders

of record on March 29, 2024.

On May 2, 2024, the Company’s Board of Trustees declared a

preferred stock dividend of $0.4375 per each Series A Preferred

Share. The preferred dividend was paid on July 15, 2024 to holders

of record on June 28, 2024.

On July 31, 2024, the Company’s Board of Trustees declared a

preferred stock dividend of $0.4375 per each Series A Preferred

Share. The preferred dividend was paid on October 15, 2024 to

holders of record on September 30, 2024.

On October 28, 2024, the Company’s Board of Trustees declared a

preferred stock dividend of $0.4375 per each Series A Preferred

Share. The preferred dividend will be paid on January 15, 2025 to

holders of record on December 31, 2024.

Strategic Review

At the 2022 Annual Meeting of Shareholders on October 24, 2022,

Seritage shareholders approved the Company’s Plan of Sale. The

strategic review process remains ongoing as the Company executes

the Plan of Sale, and the Company remains open minded to pursuing

value maximizing alternatives, including a potential sale of the

Company. There can be no assurance regarding the success of the

process.

Market Update

As the Company has previously disclosed, the Company, along with

the commercial real estate market as a whole, has experienced and

continues to experience challenging market conditions as a result

of a variety of factors. These conditions have applied and continue

to apply downward pricing pressure on all of our assets. In making

decisions regarding whether and when to transact on each of the

Company’s remaining assets, the Company has considered and will

continue to consider various factors including, but not limited to,

the breadth of the buyer universe, macroeconomic conditions, the

availability and cost of financing, as well as corporate, operating

and other capital expenses required to carry the asset. If these

challenging market conditions persist, then we expect that they

will impact the Plan of Sale proceeds from our assets and the

amounts and timing of distributions to shareholders.

Non-GAAP Financial

Measures

The Company makes references to NOI-cash basis and NOI-cash

basis at share which are financial measures that include

adjustments to accounting principles generally accepted in the

United States (“GAAP”).

Neither of NOI-cash basis or NOI-cash basis at share are

measures that (i) represent cash flow from operations as defined by

GAAP; (ii) are indicative of cash available to fund all cash flow

needs, including the ability to make distributions; (iii) are

alternatives to cash flow as a measure of liquidity; or (iv) should

be considered alternatives to net income (which is determined in

accordance with GAAP) for purposes of evaluating the Company’s

operating performance. Reconciliations of these measures to the

respective GAAP measures the Company deems most comparable have

been provided in the tables accompanying this press release.

Net Operating Income (Loss)-cash basis

("NOI-cash basis”) and Net Operating Income (Loss)-cash basis at

share ("NOI-cash basis at share")

NOI-cash basis is defined as income from property operations

less property operating expenses, adjusted for variable items such

as termination fee income, as well as non-cash items such as

straight-line rent and amortization of lease intangibles. Other

real estate companies may use different methodologies for

calculating NOI-cash basis, and accordingly the Company’s depiction

of NOI-cash basis may not be comparable to other real estate

companies. The Company believes NOI-cash basis provides useful

information regarding Seritage, its financial condition, and

results of operations because it reflects only those income and

expense items that are incurred at the property level.

The Company also uses NOI-cash basis at share, which includes

its proportional share of Unconsolidated Properties. The Company

does not control any of the joint ventures constituting such

properties and NOI-cash basis at share does not reflect our legal

claim with respect to the economic activity of such joint ventures.

We have included this adjustment because the Company believes this

form of presentation offers insights into the financial performance

and condition of the Company as a whole given the Company’s

ownership of Unconsolidated Properties that are accounted for under

GAAP using the equity method. The operating agreements of the

Unconsolidated Properties generally allow each investor to receive

cash distributions to the extent there is available cash from

operations. The amount of cash each investor receives is based upon

specific provisions of each operating agreement and varies

depending on certain factors including the amount of capital

contributed by each investor and whether any investors are entitled

to preferential distributions.

The Company also considers NOI-cash basis and NOI-cash basis at

share to be a helpful supplemental measure of its operating

performance because it excludes from NOI variable items such as

termination fee income, as well as non-cash items such as

straight-line rent and amortization of lease intangibles.

Due to the adjustments noted, NOI-cash basis and NOI-cash basis

at share should only be used as an alternative measure of the

Company’s financial performance..

Forward-Looking

Statements

This document contains forward-looking statements within the

meaning of the federal securities laws. Forward-looking statements

relate to expectations, beliefs, projections, future plans and

strategies, anticipated events or trends and similar expressions

concerning matters that are not historical facts. In some cases,

you can identify forward-looking statements by the use of

forward-looking terminology such as “may,” “should,” “expects,”

“intends,” “plans,” “anticipates,” “believes,” “estimates,”

“predicts,” “potential,” "will," "approximately," or "anticipates"

or the negative of these words and phrases or similar words or

phrases that are predictions of or indicate future events or trends

and that do not relate solely to historical matters.

Forward-looking statements involve known and unknown risks,

uncertainties, assumptions and contingencies, many of which are

beyond the Company’s control, which may cause actual results to

differ significantly from those expressed in any forward-looking

statement. Factors that could cause or contribute to such

differences include, but are not limited to: declines in retail,

real estate and general economic conditions; risks relating to

redevelopment activities; contingencies to the commencement of rent

under leases; the terms of the Company’s indebtedness and other

legal requirements to which the Company is subject; failure to

achieve expected occupancy and/or rent levels within the projected

time frame or at all; the impact of ongoing negative operating cash

flow on the Company’s ability to fund operations and ongoing

development; the Company’s ability to access or obtain sufficient

sources of financing to fund the Company’s liquidity needs;

environmental, health, safety and land use laws and regulations;

and possible acts of war, terrorist activity or other acts of

violence or cybersecurity incidents. For additional discussion of

these and other applicable risks, assumptions and uncertainties,

see the “Risk Factors” and forward-looking statement disclosure

contained in the Company’s filings with the Securities and Exchange

Commission, including the Company’s annual report on Form 10-K for

the year ended December 31, 2023 and any subsequent Form 10-Qs.

While the Company believes that its forecasts and assumptions are

reasonable, the Company cautions that actual results may differ

materially. The Company intends the forward-looking statements to

speak only as of the time made and do not undertake to update or

revise them as more information becomes available, except as

required by law.

About Seritage Growth

Properties

Prior to the adoption of the Company’s Plan of Sale (defined

below), Seritage was principally engaged in the ownership,

development, redevelopment, disposition, management and leasing of

diversified retail and mixed-use properties throughout the United

States. Seritage will continue to actively manage each remaining

location until such time as each property is sold. As of September

30, 2024, the Company’s portfolio consisted of interests in 21

properties comprised of approximately 2.7 million square feet of

gross leasable area (“GLA”) or build-to-suit leased area, and 342

acres of land. The portfolio consists of approximately 1.5 million

square feet of GLA and 208 acres held by 12 consolidated properties

(such properties, the “Consolidated Properties”) and 1.2 million

square feet of GLA and 134 acres held by nine unconsolidated

properties (such properties, the “Unconsolidated Properties”).

SERITAGE GROWTH

PROPERTIES

CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

and per share amounts)

(Unaudited)

September 30, 2024

December 31, 2023

ASSETS

Investment in real estate

Land

$

65,009

$

102,090

Buildings and improvements

235,330

344,972

Accumulated depreciation

(37,915

)

(36,025

)

262,424

411,037

Construction in progress

92,597

135,305

Net investment in real estate

355,021

546,342

Real estate held for sale

46,607

39,332

Investment in unconsolidated entities

199,307

196,437

Cash and cash equivalents

85,599

134,001

Restricted cash

12,613

15,699

Tenant and other receivables, net

8,508

12,246

Lease intangible assets, net

1,109

886

Prepaid expenses, deferred expenses and

other assets, net

26,258

28,921

Total assets (1)

$

735,022

$

973,864

LIABILITIES AND SHAREHOLDERS' EQUITY

Liabilities

Term loan facility

$

280,000

$

360,000

Accounts payable, accrued expenses and

other liabilities

36,228

50,700

Total liabilities (1)

316,228

410,700

Commitments and Contingencies (Note 9)

Shareholders' Equity

Class A common shares $0.01 par value;

100,000,000 shares authorized; 56,268,317 and 56,194,727 shares

issued and outstanding as of September 30, 2024 and December 31,

2023, respectively

562

562

Series A preferred shares $0.01 par value;

10,000,000 shares authorized; 2,800,000 shares issued and

outstanding as of September 30, 2024 and December 31, 2023;

liquidation preference of $70,000

28

28

Additional paid-in capital

1,363,148

1,361,742

Accumulated deficit

(946,202

)

(800,342

)

Total shareholders' equity

417,536

561,990

Non-controlling interests

1,258

1,174

Total equity

418,794

563,164

Total liabilities and equity

$

735,022

$

973,864

(1) The Company's consolidated balance

sheets include assets and liabilities of consolidated variable

interest entities ("VIEs"). See Note 2. The consolidated balance

sheets, as of September 30, 2024, include the following amounts

related to our consolidated VIEs, excluding the Operating

Partnership: $3.3 million of land, $2.8 million of building and

improvements, $(0.9) million of accumulated depreciation and $2.6

million of other assets included in other line items. The Company's

consolidated balance sheets as of December 31, 2023, include the

following amounts related to our consolidated VIEs, excluding the

Operating Partnership: $3.3 million of land, $2.8 million of

building and improvements, $(0.8) million of accumulated

depreciation and $2.4 million of other assets included in other

line items.

SERITAGE GROWTH

PROPERTIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per

share amounts)

(Unaudited)

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2024

2023

2024

2023

REVENUE

Rental income

$

2,899

$

4,525

$

12,790

$

10,459

Management and other fee income

352

523

450

1,152

Total revenue

3,251

5,048

13,240

11,611

EXPENSES

Property operating

4,258

4,564

12,091

17,945

Abandoned project costs

5,732

—

5,732

—

Real estate taxes

971

1,204

3,602

4,910

Depreciation and amortization

4,377

2,913

10,860

11,628

General and administrative

7,178

8,030

23,244

30,349

Total expenses

22,516

16,711

55,529

64,832

Gain on sale of real estate, net

4,184

18,506

7,357

64,386

Gain (loss) on sale of interest in

unconsolidated entities

—

(916

)

—

6,407

Impairment of real estate assets

—

—

(87,536

)

(107,043

)

Equity in income (loss) of unconsolidated

entities

118

993

(69

)

(49,077

)

Interest and other income (expense),

net

(872

)

2,030

1,268

17,484

Interest expense

(6,051

)

(9,763

)

(19,344

)

(37,493

)

Loss before income taxes

(21,886

)

(813

)

(140,613

)

(158,557

)

Provision for income taxes

(87

)

(89

)

(1,572

)

(38

)

Net loss

(21,973

)

(902

)

(142,185

)

(158,595

)

Preferred dividends

(1,225

)

(1,225

)

(3,675

)

(3,675

)

Net loss attributable to Seritage common

shareholders

$

(23,198

)

$

(2,127

)

$

(145,860

)

$

(162,270

)

Net loss per share attributable to

Seritage Class A common shareholders - Basic

$

(0.41

)

$

(0.04

)

$

(2.59

)

$

(2.89

)

Net loss per share attributable to

Seritage Class A common shareholders - Diluted

$

(0.41

)

$

(0.04

)

$

(2.59

)

$

(2.89

)

Weighted-average Class A common shares

outstanding - Basic

56,268

56,183

56,251

56,139

Weighted-average Class A common shares

outstanding - Diluted

56,268

56,183

56,251

56,139

Reconciliation of Net Loss to NOI-cash basis and NOI-cash

basis at share (in thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

NOI-cash basis and NOI-cash basis at

share

2024

2023

2024

2023

Net loss

$

(21,973

)

$

(902

)

$

(142,185

)

$

(158,595

)

Management and other fee income

(352

)

(523

)

(450

)

(1,152

)

Abandoned project costs

5,732

—

5,732

—

Depreciation and amortization

4,377

2,913

10,860

11,628

General and administrative expenses

7,178

8,030

23,244

30,349

Equity in income (loss) of unconsolidated

entities

(118

)

(993

)

69

49,077

Gain on sale of interest in unconsolidated

entities

—

916

—

(6,407

)

Gain on sale of real estate, net

(4,184

)

(18,506

)

(7,357

)

(64,386

)

Impairment of real estate assets

—

—

87,536

107,043

Interest and other income (expense),

net

872

(2,030

)

(1,268

)

(17,484

)

Interest expense

6,051

9,763

19,344

37,493

Provision (Benefit) for income taxes

87

89

1,572

38

Straight-line rent

5

1,504

251

16,142

Above/below market rental expense

69

45

145

138

NOI-cash basis

$

(2,256

)

$

306

$

(2,507

)

$

3,884

Unconsolidated

entities

Net operating income of unconsolidated

entities

1,461

3,445

4,012

6,404

Straight-line rent

(130

)

(2,629

)

(451

)

(3,069

)

Above/below market rental expense

(9

)

(3

)

(27

)

(1

)

NOI-cash basis at share

$

(934

)

$

1,119

$

1,027

$

7,218

Properties sold during third quarter of 2024:

City

State

Full / Partial Sale

Total SF (1)

2024 Qtr Sold

Temecula

CA

Full Site

126,500

Q3

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112544311/en/

Seritage Growth Properties (212) 355-7800 IR@Seritage.com

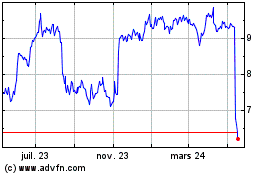

Seritage Growth Properties (NYSE:SRG)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

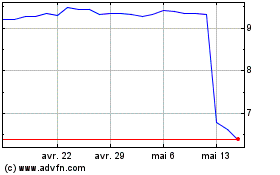

Seritage Growth Properties (NYSE:SRG)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025