Sears Roebuck Acceptance Corp. Commences Tender Offers for 7% Notes Due 2042 and 7.40% Notes Due 2043

13 Mai 2005 - 3:45PM

PR Newswire (US)

Sears Roebuck Acceptance Corp. Commences Tender Offers for 7% Notes

Due 2042 and 7.40% Notes Due 2043 GREENVILLE, Del., May 13

/PRNewswire/ -- Sears Roebuck Acceptance Corp. ("SRAC"), a direct

wholly-owned finance subsidiary of Sears, Roebuck and Co. and an

indirect wholly-owned subsidiary of Sears Holdings Corporation

(NASDAQ:SHLD), announced today that it has commenced tender offers

to purchase for cash any and all of its outstanding 7% Notes due

2042 (NYSE:SRJNYSE:andNYSE:CUSIPNYSE:NumberNYSE:812404408) at a

fixed price of $25.65 per $25 principal amount of the 7% Notes and

for any and all of its outstanding 7.40% Notes due 2043

(NYSE:SRLNYSE:andNYSE:CUSIPNYSE:NumberNYSE:812404507) at a fixed

price of $25.75 per $25 principal amount of the 7.40% Notes (the

"Offers"). These fixed prices include all accrued and unpaid

interest; no additional interest will be paid on the tendered

Notes. The 7% Notes have an aggregate principal amount outstanding

of approximately $111 million, and the 7.40% Notes have an

aggregate principal amount outstanding of approximately $94

million. The Offers are made upon the terms and subject to the

conditions set forth in the Offer to Purchase dated May 13, 2005

and related documents. Each Offer will expire at 5:00 p.m. New York

City time on Monday, June 13, 2005 unless earlier extended or

terminated. Settlement is expected to occur within three business

days of the acceptance of Notes tendered into the Offer. Each of

the Offers is independent of and not conditioned upon the other

Offer. Each Offer may be amended, extended or terminated

individually. The Offers are not conditioned on any minimum amount

of Notes being tendered. Merrill Lynch & Co. will act as dealer

manager and Global Bondholder Services Corporation will act as

information agent and depositary for the Offers. If a holder of the

7% Notes or 7.4% Notes desires to tender those securities pursuant

to the Offers, the holder may do so by following the instructions

in the offering documents. SRAC announced earlier this week that it

had filed an application to voluntarily delist all of its debt

securities that are currently listed on the New York Stock Exchange

and deregister these securities with the Securities and Exchange

Commission. The securities to be delisted and deregistered are the

7% Notes and 7.40% Notes and SRAC's 6.75% Notes due September 2005

(NYSE:SRAC05). SRAC expects the delisting to be effective in the

beginning of June 2005. Upon delisting of these debt securities,

SRAC expects the suspension of its reporting obligations, and the

related reporting obligations with respect to the guarantor of the

debt, Sears, Roebuck and Co., under the federal securities laws to

occur as soon as practicable following the delisting and prior to

the expiration of the Offers. This press release is neither an

offer to purchase nor a solicitation of an offer to sell the 7%

Notes or the 7.40% Notes. The Offers are made only on the terms and

subject to the conditions described in the offering documents that

SRAC is distributing today. Holders of the 7% Notes or the 7.40%

Notes with questions about the Offers should call Merrill Lynch

& Co. toll-free at 888-654-8637 or the information agent

toll-free at 866-612-1500. Holders who want copies of the offering

documents should call the information agent toll- free at

866-612-1500. About Sears Holdings Corporation Sears Holdings

Corporation is the nation's third largest broadline retailer, with

approximately $55 billion in annual revenues, and with

approximately 3,800 full-line and specialty retail stores in the

United States and Canada. Sears Holdings is the leading home

appliance retailer as well as a leader in tools, lawn and garden,

home electronics and automotive repair and maintenance. Key

proprietary brands include Kenmore, Craftsman and DieHard, and a

broad apparel offering, including such well-known labels as Lands'

End, Jaclyn Smith and Joe Boxer, as well as the Apostrophe and

Covington brands. It also has Martha Stewart Everyday products,

which are offered exclusively in the U.S. by Kmart and in Canada by

Sears Canada. The company is the nation's largest provider of home

services, with more than 14 million service calls made annually.

For more information, visit Sears Holdings' website at

http://www.searsholdings.com/ . About Sears, Roebuck and Co. Sears,

Roebuck and Co., a wholly owned subsidiary of Sears Holdings

Corporation (NASDAQ:SHLD), is a leading broadline retailer

providing merchandise and related services. Sears, Roebuck offers

its wide range of home merchandise, apparel and automotive products

and services through more than 2,400 Sears-branded and affiliated

stores in the United States and Canada, which includes

approximately 870 full-line and 1,100 specialty stores in the U.S.

Sears, Roebuck also offers a variety of merchandise and services

through sears.com, landsend.com, and specialty catalogs. Sears,

Roebuck offers consumers leading proprietary brands including

Kenmore, Craftsman, DieHard and Lands' End -- among the most

trusted and preferred brands in the U.S. The company is the

nation's largest provider of home services, with more than 14

million service calls made annually. For more information, visit

the Sears, Roebuck website at http://www.sears.com/ or the Sears

Holdings Corporation website at http://www.searsholdings.com/ .

About Sears Roebuck Acceptance Corp. SRAC is a wholly owned finance

subsidiary of Sears, Roebuck and Co. It raises funds through the

issuance of unsecured commercial paper and long-term debt, which

includes medium-term notes and discrete underwritten debt. SRAC

continues to support 100% of its outstanding commercial paper

through its investment portfolio and committed credit facilities.

For more information, visit the Sears Roebuck Acceptance Corp.

website at http://www.sracweb.com/ . Forward-Looking Statements

This press release contains "forward-looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995.

Such statements include, but are not limited to, statements about

the delisting and deregistration of the Notes and the suspension of

SRAC's reporting obligation and the related reporting obligation of

Sears, Roebuck and Co. These statements are forward-looking

statements based on assumptions about the future that are subject

to risks and uncertainties, and actual results may differ

materially from those projected in the forward-looking statements.

Such risks include factors which are outside the control of Sears

Holdings, Sears, Roebuck and SRAC. These forward-looking statements

speak only as of the time first made, and no undertaking has been

made to update or revise them as more information becomes

available. Additional discussion of certain risks and uncertainties

can be found in the 2004 Annual Reports on Form 10-K of Sears,

Roebuck and Co., Kmart Holding Corporation and SRAC filed with the

SEC and available at the SEC's Internet site ( http://www.sec.gov/

). DATASOURCE: Sears Roebuck Acceptance Corp. CONTACT: Chris

Brathwaite of Sears, +1-847-286-4681 Web site:

http://www.sracweb.com/ http://www.searsholdings.com/

http://www.sears.com/

Copyright

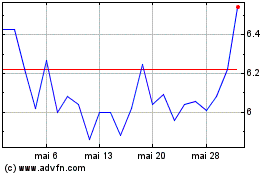

Scully Royalty (NYSE:SRL)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Scully Royalty (NYSE:SRL)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024