UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934 (Amendment No. 4)

SIGNA Sports United N.V.

(Name of Issuer)

Ordinary Shares, nominal value €0.12 per share

(Title of Class of Securities)

N80029106

(CUSIP Number)

SIGNA International Sports Holding GmbH Maximiliansplatz 12

80333 München Germany

+49 89 2323 7278 3547

Attention: Wolfram Keil

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

August 7, 2023

(Date of Event which Requires Filing of this Statement)

With copies to:

Dr. Stephan Hutter

Skadden, Arps, Slate, Meagher & Flom LLP

Taunustor 1, TaunusTurm

60310 Frankfurt am Main Germany

+49 69 742 20170

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section of the Exchange Act but shall be subject to all other provisions of the Exchange Act (however, see the Notes).

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 2 of 31 |

| | |

| | | | | | | | | | | |

| 1 | NAME OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) SIGNA International Sports Holding GmbH |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS OO |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) ☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION Germany |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH | 7 | SOLE VOTING POWER 0 |

| 8 | SHARED VOTING POWER 186,386,837 |

| 9 | SOLE DISPOSITIVE POWER 0 |

| 10 | SHARED DISPOSITIVE POWER 186,386,837 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 186,386,837 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 50.5%* |

| 14 | TYPE OF REPORTING PERSON HC, CO |

* Percentage calculated based on 387,549,017 ordinary shares outstanding according to the Issuer as of the date hereof, excluding 51,000,000 Earn-out Shares (as defined below) and assuming the conversion of all of the SH Convertible Notes (as defined below) in accordance with the terms and conditions of the SH Convertible Notes at the initial conversion price and assuming that all PIK interest is outstanding and conversion to occur on the last day of the conversion period.

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 3 of 31 |

| | |

| | | | | | | | | | | |

| 1 | NAME OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) SIGNA Retail Sports Holding GmbH |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS OO |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) ☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION Switzerland |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH | 7 | SOLE VOTING POWER 0 |

| 8 | SHARED VOTING POWER 186,386,837 |

| 9 | SOLE DISPOSITIVE POWER 0 |

| 10 | SHARED DISPOSITIVE POWER 186,386,837 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 186,386,837 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 50.5%* |

| 14 | TYPE OF REPORTING PERSON HC, CO |

* Percentage calculated based on 387,549,017 ordinary shares outstanding according to the Issuer as of the date hereof, excluding 51,000,000 Earn-out Shares (as defined below) and assuming the conversion of all of the SH Convertible Notes (as defined below) in accordance with the terms and conditions of the SH Convertible Notes at the initial conversion price and assuming that all PIK interest is outstanding and conversion to occur on the last day of the conversion period.

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 4 of 31 |

| | |

| | | | | | | | | | | |

| 1 | NAME OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) SIGNA European Invest AG |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS OO |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) ☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION Switzerland |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH | 7 | SOLE VOTING POWER 0 |

| 8 | SHARED VOTING POWER 186,386,837 |

| 9 | SOLE DISPOSITIVE POWER 0 |

| 10 | SHARED DISPOSITIVE POWER 186,386,837 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 186,386,837 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 50.5%* |

| 14 | TYPE OF REPORTING PERSON HC, CO |

* Percentage calculated based on 387,549,017 ordinary shares outstanding according to the Issuer as of the date hereof, excluding 51,000,000 Earn-out Shares (as defined below) and assuming the conversion of all of the SH Convertible Notes (as defined below) in accordance with the terms and conditions of the SH Convertible Notes at the initial conversion price and assuming that all PIK interest is outstanding and conversion to occur on the last day of the conversion period.

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 5 of 31 |

| | |

| | | | | | | | | | | |

| 1 | NAME OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) SIGNA European Invest Holding AG |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS OO |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) ☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION Switzerland |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH | 7 | SOLE VOTING POWER 0 |

| 8 | SHARED VOTING POWER 200,961,771 |

| 9 | SOLE DISPOSITIVE POWER 0 |

| 10 | SHARED DISPOSITIVE POWER 200,961,771 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 200,961,771 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 54.4%* |

| 14 | TYPE OF REPORTING PERSON HC, CO |

* Percentage calculated based on 387,549,017 ordinary shares outstanding according to the Issuer as of the date hereof, excluding 51,000,000 Earn-out Shares (as defined below) and assuming the conversion of all of the SH Convertible Notes (as defined below) in accordance with the terms and conditions of the SH Convertible Notes at the initial conversion price and assuming that all PIK interest is outstanding and conversion to occur on the last day of the conversion period.

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 6 of 31 |

| | |

| | | | | | | | | | | |

| 1 | NAME OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) SIGNA Retail GmbH |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS OO |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) ☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION Austria |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH | 7 | SOLE VOTING POWER 0 |

| 8 | SHARED VOTING POWER 200,961,771 |

| 9 | SOLE DISPOSITIVE POWER 0 |

| 10 | SHARED DISPOSITIVE POWER 200,961,771 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 200,961,771 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 54.4%* |

| 14 | TYPE OF REPORTING PERSON HC, CO |

* Percentage calculated based on 387,549,017 ordinary shares outstanding according to the Issuer as of the date hereof, excluding 51,000,000 Earn-out Shares (as defined below) and assuming the conversion of all of the SH Convertible Notes (as defined below) in accordance with the terms and conditions of the SH Convertible Notes at the initial conversion price and assuming that all PIK interest is outstanding and conversion to occur on the last day of the conversion period.

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 7 of 31 |

| | |

| | | | | | | | | | | |

| 1 | NAME OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) SIGNA Retail Beteiligung GmbH |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS OO |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) ☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION Austria |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH | 7 | SOLE VOTING POWER 0 |

| 8 | SHARED VOTING POWER 200,961,771 |

| 9 | SOLE DISPOSITIVE POWER 0 |

| 10 | SHARED DISPOSITIVE POWER 200,961,771 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 200,961,771 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 54.4%* |

| 14 | TYPE OF REPORTING PERSON HC, CO |

* Percentage calculated based on 387,549,017 ordinary shares outstanding according to the Issuer as of the date hereof, excluding 51,000,000 Earn-out Shares (as defined below) and assuming the conversion of all of the SH Convertible Notes (as defined below) in accordance with the terms and conditions of the SH Convertible Notes at the initial conversion price and assuming that all PIK interest is outstanding and conversion to occur on the last day of the conversion period.

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 8 of 31 |

| | |

| | | | | | | | | | | |

| 1 | NAME OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) SIGNA AT 2020 Sieben GmbH |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS OO |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) ☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION Austria |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH | 7 | SOLE VOTING POWER 0 |

| 8 | SHARED VOTING POWER 200,961,771 |

| 9 | SOLE DISPOSITIVE POWER 0 |

| 10 | SHARED DISPOSITIVE POWER 200,961,771 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 200,961,771 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 54.4% |

| 14 | TYPE OF REPORTING PERSON HC, CO |

* Percentage calculated based on 387,549,017 ordinary shares outstanding according to the Issuer as of the date hereof, excluding 51,000,000 Earn-out Shares (as defined below) and assuming the conversion of all of the SH Convertible Notes (as defined below) in accordance with the terms and conditions of the SH Convertible Notes at the initial conversion price and assuming that all PIK interest is outstanding and conversion to occur on the last day of the conversion period.

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 9 of 31 |

| | |

| | | | | | | | | | | |

| 1 | NAME OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) SIGNA Holding GmbH |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS OO |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) ☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION Austria |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH | 7 | SOLE VOTING POWER 0 |

| 8 | SHARED VOTING POWER 219,034,689 |

| 9 | SOLE DISPOSITIVE POWER 0 |

| 10 | SHARED DISPOSITIVE POWER 219,034,689 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 219,034,689 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 59.3%* |

| 14 | TYPE OF REPORTING PERSON HC, CO |

* Percentage calculated based on 387,549,017 ordinary shares outstanding according to the Issuer as of the date hereof, excluding 51,000,000 Earn-out Shares (as defined below) and assuming the conversion of all of the SH Convertible Notes (as defined below) in accordance with the terms and conditions of the SH Convertible Notes at the initial conversion price and assuming that all PIK interest is outstanding and conversion to occur on the last day of the conversion period.

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 10 of 31 |

| | |

| | | | | | | | | | | |

| 1 | NAME OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) Supraholding GmbH & Co. KG |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS OO |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) ☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION Austria |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH | 7 | SOLE VOTING POWER 0 |

| 8 | SHARED VOTING POWER 219,034,689 |

| 9 | SOLE DISPOSITIVE POWER 0 |

| 10 | SHARED DISPOSITIVE POWER 219,034,689 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 219,034,689 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 59.3%* |

| 14 | TYPE OF REPORTING PERSON HC, CO |

* Percentage calculated based on 387,549,017 ordinary shares outstanding according to the Issuer as of the date hereof, excluding 51,000,000 Earn-out Shares (as defined below) and assuming the conversion of all of the SH Convertible Notes (as defined below) in accordance with the terms and conditions of the SH Convertible Notes at the initial conversion price and assuming that all PIK interest is outstanding and conversion to occur on the last day of the conversion period.

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 11 of 31 |

| | |

| | | | | | | | | | | |

| 1 | NAME OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) Familie Benko Privatstiftung |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS OO |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) ☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION Austria |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH | 7 | SOLE VOTING POWER 0 |

| 8 | SHARED VOTING POWER 219,034,689 |

| 9 | SOLE DISPOSITIVE POWER 0 |

| 10 | SHARED DISPOSITIVE POWER 219,034,689 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 219,034,689 |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 59.3%* |

| 14 | TYPE OF REPORTING PERSON HC, OO |

* Percentage calculated based on 387,549,017 ordinary shares outstanding according to the Issuer as of the date hereof, excluding 51,000,000 Earn-out Shares (as defined below) and assuming the conversion of all of the SH Convertible Notes (as defined below) in accordance with the terms and conditions of the SH Convertible Notes at the initial conversion price and assuming that all PIK interest is outstanding and conversion to occur on the last day of the conversion period.

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 12 of 31 |

| | |

Item 1. Security and Issuer.

This Amendment No. 4 (“Amendment No. 4”) to Schedule 13D relates to the ordinary shares, nominal value €0.12 per share, of SIGNA Sports United N.V., a public limited liability company incorporated under the laws of the Netherlands (the “Issuer” or “Company”), and amends and supplements the initial statement on Schedule 13D filed on December 22, 2021, as amended by Amendment No. 1 to the Schedule 13D filed on February 10, 2023, as amended by amendment No. 2 to the Schedule 13D filed on April 28, 2023 and as amended by Amendment No. 3 to the Schedule 13D filed on July 7, 2023 (as amended, the “Schedule 13D”). Except as specifically provided herein, this Amendment No. 4 does not modify any of the information previously reported in the Schedule 13D. Capitalized terms used but not defined in this Amendment No. 4 shall have the same meanings ascribed to them in the Schedule 13D.

Item 2. Identity and Background.

Item 2 of the Schedule 13D is hereby amended and restated as follows:

This Schedule 13D is being filed jointly by (each, a “Reporting Person” and, collectively, the “Reporting Persons”):

(i)SIGNA International Sports Holding GmbH (“SISH”);

(ii)SIGNA Retail Sports Holding GmbH (“SRSH”);

(iii)SIGNA European Invest AG (“EI”);

(iv)SIGNA European Invest Holding AG (“EIH”);

(v)SIGNA Retail GmbH (“SR”);

(vi)SIGNA Retail Beteiligung GmbH (“SRB“);

(vii)SIGNA AT 2020 Sieben GmbH (“AT 2020/7”);

(viii)SIGNA Holding GmbH (“SH”);

(ix)Supraholding GmbH & Co. KG (“SHKG”); and

(x)Familie Benko Privatstiftung (“FBP”).

SISH is a German limited liability company (Gesellschaft mit beschränkter Haftung), with its principal business address at Maximiliansplatz 12, D- 80333 Munich, Germany. The principal business of SISH is to function as a holding company. Current information concerning the identity and background of the directors and officers of SISH is set forth in Annex A hereto. The shareholding of SISH in the Issuer includes shares held directly by it, shares held by SISH Beteiligung GmbH & Co. KG (“SISH KG”) (See Item 5 below) and shares held by SISH Verwaltung II GmbH & Co. KG (“SISH II KG”) (See Item 5 below), each a German limited liability partnership (Kommanditgesellschaft) wholly owned and controlled by SISH. All of the share capital of SISH is held by SRSH.

SRSH is a Swiss limited liability company (Gesellschaft mit beschränkter Haftung), with its principal business address at Bärengasse 29, CH-8001 Zurich, Switzerland. The principal business of SRSH is to function as a

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 13 of 31 |

| | |

holding company. Current information concerning the identity and background of the directors and officers of SRSH is set forth in Annex A hereto. All of the share capital of SRSH is held by EI.

EI is a Swiss stock corporation (Aktiengesellschaft), with its principal business address at Bärengasse 29, CH-8001 Zurich, Switzerland. The principal business of EI is to function as a holding company. Current information concerning the identity and background of the directors and officers of EI is set forth in Annex A hereto. All of the share capital of EI is held by EIH.

EIH is a Swiss stock corporation (Aktiengesellschaft), with its principal business address at Bärengasse 29, CH-8001 Zurich, Switzerland. The principal business of EIH is to function as a holding company. Current information concerning the identity and background of the directors and officers of EIH is set forth in Annex A hereto. The majority of the share capital of EIH is held by SR.

SR is an Austrian limited liability company (Gesellschaft mit beschränkter Haftung), with its principal business address at Freyung 3, A-1010 Vienna, Austria. The principal business of SR is to function as a holding company. Current information concerning the identity and background of the directors and officers of SR is set forth in Annex A hereto. The majority of the share capital of SR is held by SRB.

SRB is an Austrian limited liability company (Gesellschaft mit beschränkter Haftung), with its principal business address at Freyung 3, A-1010 Vienna, Austria. The principal business of SRB is to function as a holding company. Current information concerning the identity and background of the directors and officers of SRB is set forth in Annex A hereto. All of the share capital of SRB is held by AT 2020/7.

AT 2020/7 is an Austrian limited liability company (Gesellschaft mit beschränkter Haftung), with its principal business address at Freyung 3, A-1010 Vienna, Austria. The principal business of AT 2020/7 is to function as a holding company. Current information concerning the identity and background of the directors and officers of AT 2020/7 is set forth in Annex A hereto. All of the share capital of AT 2020/7 is held by SH.

SH is an Austrian limited liability company (Gesellschaft mit beschränkter Haftung), with its principal business address at Maria-Theresien-Straße 31, A-6020 Innsbruck, Austria. The principal business of SH is to function as a holding company. Current information concerning the identity and background of the directors and officers of SH is set forth in Annex A hereto. The majority of the share capital of SH is held by SHKG.

SHKG is an Austrian limited liability partnership (Kommanditgesellschaft), with its principal business address at Maria-Theresien-Straße 31, A-6020 Innsbruck, Austria. The principal business of SHKG is to function as a holding company. Current information concerning the identity and background of the directors and officers of SHKG as well as its general partner (Komplementär) is set forth in Annex A hereto. The majority of the share capital of SHKG is held, directly and/or indirectly, by FBP.

FBP is an Austrian private trust (Privatstiftung), with its principal business address at Maria-Theresien-Straße 31, A-6020 Innsbruck, Austria. The principal business of FBP is to function as a holding company with respect to SH. FBP has an independent management board which controls its own succession, and the trustors do not have a right of revocation (Widerrufsrecht). Current information concerning the identity and background of the members of the management board of FBP is set forth in Annex A hereto. FBP controls, directly and through its participation in SHKG, the majority of the share capital of SH.

During the past five years, none of the Reporting Persons and, to the best of the Reporting Persons’ knowledge, no person identified in Annex A, has been (a) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (b) a party to any civil proceeding of a judicial or administrative body of competent jurisdiction as a result of which such person was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws, or finding any violation with respect to such laws.

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 14 of 31 |

| | |

Item 3. Source and Amount of Funds or Other Consideration.

Item 3 of the Schedule 13D is hereby amended and restated as follows:

The information set forth in Items 4 and 6 of this Schedule 13D is hereby incorporated by reference into this Item 3.

Item 4. Purpose of Transaction.

Item 4 of the Schedule 13D is hereby amended and restated as follows:

The information set forth in Items 3 and 6 of this Schedule 13D is hereby incorporated by reference into this Item 4.

Background and Merger Agreement

On June 10, 2021, Yucaipa Acquisition Corporation (“Yucaipa”), SIGNA Sports United GmbH (Gesellschaft mit beschränkter Haftung) and wholly owned subsidiary of the Issuer (“SSU”), SIGNA Sports United B.V. (“TopCo”), Olympics I Merger Sub, LLC (“Merger Sub”) and SISH entered into the Business Combination Agreement (the “Business Combination Agreement”), pursuant to which, on December 13, 2021, Yucaipa merged with and into Merger Sub, with Merger Sub as the surviving company in the merger (the “Merger”), and each issued and outstanding Class A ordinary share, par value of $0.0001 per share, of Yucaipa and Class B ordinary share, par value of $0.0001 per share, of Yucaipa were exchanged for a claim for a corresponding equity security in Merger Sub, which claim was contributed as a contribution in kind to TopCo in exchange for one ordinary share of TopCo (the “TopCo Ordinary Shares”). Immediately thereafter, TopCo issued TopCo Ordinary Shares, deemed to have an aggregate value of $2,462 million, to the shareholders of SSU’s capital stock immediately prior to the closing of the Business Combination (as defined below) in exchange for the contribution by such shareholders of all of the paid up shares (Geschäftsanteile) of SSU (such exchange, the “Exchange”); immediately after giving effect to the Exchange, TopCo changed its legal form to a Dutch public limited liability company and changed its name to SIGNA Sports United N.V. The Business Combination (as defined below) closed on December 14, 2021 (the “Closing Date”).

In connection with the Business Combination, (i) SISH and SISH KG received an aggregate of 166,740,623 Shares for their shares in SSU, and (ii) in accordance with the terms of the Earn-Out Agreement (as defined below), TopCo issued 51,000,000 Shares to SISH (the “Earn-Out Shares”), on the terms and subject to the conditions set forth in the Earn-Out Agreement.

In addition, in accordance with the terms of the definitive transaction agreement for the Wiggle Acquisition (as defined below), SSU consummated the acquisition of Mapil Topco Limited (the “Wiggle Acquisition”), substantially concurrently with the closing of the Business Combination. The Merger, the Exchange, the Wiggle Acquisition and the other transactions contemplated by the Business Combination Agreement are hereinafter referred to as the “Business Combination.”

Earn-Out Agreement

Concurrently with the execution of the Business Combination Agreement, SISH entered into an Earn-Out Agreement (the “Original Earn-Out Agreement”) with TopCo and Yucaipa pursuant to which, among other matters, TopCo issued or caused to be issued to SISH 51,000,000 Earn-Out Shares that will vest (in whole or in part) upon, among other things, the achievement of certain earn-out thresholds (as described below) prior to the fifth anniversary of the Closing Date.

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 15 of 31 |

| | |

Pursuant to the terms and conditions set forth in the Original Earn-Out Agreement, the Earn-Out Shares described above will vest if the following conditions are achieved prior to the fifth anniversary of the Closing Date: (a) 16.667% of the Earn-Out Shares shall vest upon the occurrence of the closing price of a Share (the “Share Price”) is greater than $12.50 for a period of more than 20 days out of 31 consecutive trading days, (b) an additional 16.667% of the Earn-Out Shares shall vest upon the occurrence of the Share Price being greater than $15.00 for a period of more than 20 days out of 30 consecutive trading days, (c) an additional 16.667% of the Earn-Out Shares shall vest upon the occurrence of the Share Price being greater than $17.50 for a period of more than 20 days out of 30 consecutive trading days, (d) an additional 16.667% of the Earn-Out Shares shall vest upon the occurrence of the Share Price being greater than $20.00 for a period of more than 20 days out of 30 consecutive trading days, (e) an additional 16.667% of the Earn-Out Shares shall vest upon the occurrence of the Share Price being greater than $22.50 for a period of more than 20 days out of 30 consecutive trading days, and (f) an additional 16.667% of the Earn-Out Shares shall vest upon the occurrence of the Share Price being greater than $25.00 for a period of more than 20 days out of 30 consecutive trading days.

The foregoing description of the Original Earn-Out Agreement does not purport to be complete and is subject to, and qualified in its entirety by, reference to the Form of Earn-Out Agreement, included as Exhibit 10.12 to Amendment No. 6 to the Issuer’s Registration Statement on Form F-4 filed on November 24, 2021.

On September 28, 2022, the Issuer, Olympics I Merger Sub, LLC, a Cayman Islands limited liability company and the surviving entity following the merger between Olympics I Merger Sub and Yucaipa at the closing of the Business Combination, and SIGNA Sport Projektbeteiligung AG, a Swiss stock corporation (the “Current Holder”) entered into the Amended and Restated Earn-Out Agreement, pursuant to which, among other things, the parties thereto agreed to amend and restate the Original Earn-Out Agreement to (i) extend the vesting period for the Earn-Out Shares from five years to ten years from the closing of the Business Combination and (ii) provide the Current Holder with the ability to transfer the Earn-Out Shares to any third party that provides financing, directly or indirectly, to the Issuer, in each case, on the terms and subject to the conditions set forth therein.

A copy of the Amended and Restated Earn-Out Agreement was filed on Form 6-K as Exhibit 10.1 and is incorporated herein by reference, and the foregoing description of the Amended and Restated Earn-Out Agreement is qualified in its entirety by reference thereto.

TopCo Articles of Association

Certain provisions of the articles of association of TopCo that became effective at the Closing (the “TopCo Articles of Association”) provide that certain directors of TopCo (“TopCo Directors”), on the basis of a binding nomination by SISH, are appointed until SISH, alone or together with its affiliates, no longer holds at least 10% of TopCo’s issued share capital. Pursuant to such provisions, SISH may nominate (i) three TopCo Directors for as long as the SISH Interest Percentage (as defined in Topco’s Articles of Association) exceeds 30%; (ii) two Directors for as long as the SISH Interest Percentage exceeds 20% and is less than 30%; and (iii) one Director for as long as the SISH Interest Percentage exceeds 10% and is less than 20%. All other TopCo Directors may be appointed on the basis of a binding nomination by the Board of Directors of TopCo, provided any that such nomination can only be overruled by two-thirds of the votes cast representing more than half of TopCo’s issued share capital.

Dieter Berninghaus, Wolfram Keil and Mike Özkan, as employees of, or otherwise associated with SISH, or one of its affiliates and TopCo Directors, in such capacity, may have influence over the corporate activities of the Issuer, including activities which may relate to items described in subparagraphs (a) through (j) of Item 4 of Schedule 13D.

SIGNA Holding Revolving Credit Facilities

On May 3, 2022 the Issuer entered into a revolving credit facility with SH in the amount of €50.0 million, as amended on February 6, 2023 to provide for an additional €50 million increase option (“RCF I”). On July 25, 2022,

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 16 of 31 |

| | |

the Issuer entered into an additional revolving credit facility with SH in the amount of €50.0 million (“RCF II”). The SH RCF I and RCF II have been drawn and are available to fund the Issuer’s working capital needs, capital expenditures and general corporate purposes. The entering into the SH RCF I and RCF II was approved by the audit committee of the Issuer in accordance with the applicable procedures set out in the Issuer’s related party transactions policy as well as by the Issuer’s Board of Directors.

SIGNA Holding Convertible Bond Subscription

On September 28, 2022, the Issuer entered into a convertible bond subscription agreement with SH to issue €100 million convertible bonds (“Initial Convertible Bonds”) to SIGNA Holding with a closing date on October 4, 2022, which was subsequently sold and transferred to EIH. The Initial Convertible Bonds mature on October 4, 2028 and are divided into bonds in bearer form with a principal amount of €1.0 million each. Interest is payable quarterly from October 4, 2022, at a rate of three-month EURIBOR plus 4% per annum (which will increase to 5% per annum and 6% per annum on October 4, 2026 and October 4, 2027, respectively). PIK Interest accrues from October 4, 2022 at a rate of 7% per annum (which will increase to 8% per annum and 9% per annum on October 4, 2026 and October 4, 2027, respectively) as if it were payable quarterly in arrears on each interest payment date. Bondholders may convert the Initial Convertible Bonds at any time into fully paid ordinary shares of the Issuer with a nominal value of €0.12 each. The initial conversion price for the Initial Convertible Bonds is €10.3686. Bondholders have the right to increase the principal amount of the Initial Convertible Bonds by an additional aggregate principal amount of up to €200.0 million as of the closing of the Initial Convertible Bonds issuance and until and including September 30, 2023 in one or more tranches with minimum denominations of €1.0 million. The Bondholders may convert the Initial Convertible Bonds into 14,574,934 ordinary shares of the Issuer in accordance with the terms and conditions of the Initial Convertible Bonds at the initial conversion price and assuming that all PIK interest is outstanding and conversion to occur on the last day of the conversion period. The issuance of the Initial Convertible Bonds to SIGNA Holding has been approved by the audit committee of the Issuer in accordance with the applicable procedures set out in the Issuer’s related party transactions policy as well as by the Issuer’s Board of Directors.

SIGNA Holding Equity Commitment Letter

On February 6, 2023, SH and the Issuer entered into an equity commitment letter (the “Equity Commitment Letter”) pursuant to which SH agreed to provide the Issuer with an equity-linked funding of an additional €130.0 million and the right of the Issuer (put right) to issue and sell additional convertible bonds to SH at the same terms and conditions as the Initial Convertible Bonds, in one or more tranches until and including September 30, 2024 for an aggregate additional principal amount of €130.0 million (“Additional Convertible Bonds”). Any subsequent exercise of the put right pursuant to the equity commitment letter will reduce, Euro for Euro, the available amount under the upsize option granted by the Issuer to SH of up to €200.0 million in connection with the issuance of the Initial Convertible Bonds. The equity commitment letter providing the Issuer with the right to issue the Additional Convertible Bonds to SH was required to address the Issuer’s precarious liquidity situation since October 1, 2022 and to provide the Issuer with a going-concern perspective until mid-February 2024. Simultaneously with signing the equity commitment letter, the Issuer entered into an amendment agreement to the RCF I with SH on February 6, 2023 (the “RCF I Amendment”). The purpose of the RCF I Amendment is to provide the Issuer with a bridge financing in the amount of up to

€50.0 million until the respective tranches under the Additional Convertible Bonds have been issued and settled. Any amounts drawn under the additional €50.0 million in funding available to the Issuer under the amended RCF I will be repaid by issuing Additional Convertible Bonds in accordance with the terms and conditions of the equity commitment letter to SH. The entering into the equity commitment letter with SH and the Company’s right to issue the Additional Convertible Bonds to SH as required has been approved by the audit committee of the Issuer in accordance with the applicable procedures set out in the Issuer’s related party transactions policy as well as by the Board of Directors.

Under the Equity Commitment Letter and pursuant to a subscription agreement between the Company and SH dated April 17, 2023, the Company issued a first tranche of Additional Convertible Bonds to SH for a principal amount of €48.0 million (“First Additional Convertible Bonds Tap Issue”).

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 17 of 31 |

| | |

On June 23, 2023 the Company delivered a second put notice to SH under the Equity Commitment Letter and the Company and SH entered into a subscription agreement relating to a second tranche of Additional Convertible Bonds for an additional aggregate principal amount of €47.0 million on the same day (“Second Additional Convertible Bonds Tap Issue”, and collectively with the Initial Convertible Bonds and First Additional Convertible Bonds Tap Issue, the “SH Convertible Notes”).

On August 7, 2023 the Company delivered a third put notice to SH under the Equity Commitment Letter and the Company and SH entered into a subscription agreement relating to a third tranche of Additional Convertible Bonds for an additional aggregate principal amount of €29.0 million on the same day (“Third Additional Convertible Bonds Tap Issue”, and collectively with the Initial Convertible Bonds, the First Additional Convertible Bonds Tab Issue and the Second Additional Convertible Bonds Tap Issue, the “SH Convertible Notes”).

The Reporting Persons acquired the Shares disclosed herein for investment purposes. The Reporting Persons intend to review their investment in the Issuer on an ongoing basis. Depending on various factors (including, without limitation, the Issuer’s financial position and strategic direction, actions taken by the Issuer’s board of directors, development of the price of the Shares, other investment opportunities available to the Reporting Persons, concentration of positions in the portfolios managed by the Reporting Persons, market conditions and general economic and industry conditions), the Reporting Persons may take such actions with respect to their investment in the Issuer as they deem appropriate, including, without limitation, purchasing or selling Shares, engaging in hedging or similar transactions with respect to the securities of or relating to the Issuer and/or otherwise changing their intention with respect to any and all matters referred to in Item 4 of this Schedule 13D.

Other than as set forth in this Schedule 13D, the Reporting Persons have no present plans or proposals which relate to or would result in the matters set forth in clauses (a) through (j) of Item 4 of Schedule 13D; provided that the Reporting Persons may, at any time, review or reconsider their position with respect to the Issuer and the market and reserve the right to develop and/or amend any such plans or proposals.

Item 5. Interest in Securities of the Issuer.

Item 5 of the Schedule 13D is hereby amended and restated as follows:

(a) and (b)

The information contained in rows 7, 8, 9, 10, 11 and 13 on the cover pages of this Schedule 13D is incorporated by reference in its entirety into this

Item 5.

As of the date hereof, the Reporting Persons beneficially own an aggregate of 219,034,689 Shares, representing 59.3% of the outstanding Shares (not taking into account the Earn-out Shares). The shareholding of the Reporting Persons includes: (a) 161,691,626 Shares held directly by SISH (representing 43.8% of the outstanding Shares (not taking into account the Earn-out Shares and including the Ordinary Shares underlying the SH Convertible Notes)), (b) 5,975,668 shares held by SISH KG (representing 1.6% of the outstanding Shares (not taking into account the Earn-out Shares and including the Shares underlying the SH Convertible Notes)), (c) 18,719,543 shares held by SISH II KG (representing 5.1% of the outstanding Shares (not taking into account the Earn-out Shares and including the Shares underlying the SH Convertible Notes), (d) 14,574,934 Shares underlying the Initial Convertible Bonds held directly by EIH (representing 3.9% of the outstanding Shares less the Earn-out Shares and including the Shares underlying the SH Convertible Notes), (e) 6,995,968 Shares underlying the First Additional Convertible Bonds Tap Issue held directly by SH (representing 1.9% of the outstanding Shares less the Earn-out Shares and including the Shares underlying the SH Convertible Notes), (f) 6,850,219 Shares underlying the Second Additional Convertible Bonds Tap Issue held directly by SH (representing 1.9% of the outstanding shares less the Earn-out Shares and including the Shares underlying the SH Convertible Notes), and (g) 4,226,731 Shares underlying the Third Additional Convertible Bonds Tap Issue held directly by SH (representing 1.1% of the outstanding shares less the Earn-out Shares and including the Shares underlying the SH Convertible Notes). Calculations of the percentage of Shares beneficially owned are based on (x) 336,549,017 Shares outstanding according to the Issuer as of the day of this Schedule 13D, which excludes 51,000,000 Earn-out Shares, and (y) includes the Shares underlying SH Convertible Notes beneficially owned by the Reporting Persons .

(c)Other than as disclosed in this Schedule 13D, the Reporting Persons have not engaged in any transaction during the past 60 days involving

Shares.

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 18 of 31 |

| | |

(d) No person is known by the Reporting Persons to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the Shares beneficially owned by the Reporting Persons and described in this Item 5.

(e)Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

The information set forth in Item 4 of this Schedule 13D is hereby incorporated by reference into this Item 6.

Registration Rights Agreement

At the closing of the Business Combination, SISH and certain other Pre-Closing SSU Shareholders, Yucaipa, Yucaipa Sponsor, the Yucaipa Initial Shareholders (as defined below) and the parties set forth on Schedules 2 and 3 thereto, entered into a Registration Rights Agreement (the “Registration Rights Agreement”) providing for, among other matters, and subject to the terms thereof, customary registration rights with respect to their respective Shares, including demand and piggy-back rights subject to cut-back provisions. The Registration Rights Agreement also provides that TopCo will file a shelf registration statement to register the Shares covered by the Registration Rights Agreement as soon as practicable but no later than 30 calendar days following the closing of the Business Combination.

The foregoing description of the Registration Rights Agreement does not purport to be complete and is subject to, and qualified in its entirety by, reference to the Registration Rights Agreement, included as Exhibit 10.10 to Amendment No. 6 to the Issuer’s Registration Statement on Form F-4 filed on November 24, 2021.

Item 7. Material to be Filed as Exhibits.

Item 7 of the Schedule 13D is hereby amended and restated as follows:

99.1Joint Filing Agreement, dated as of December 20, 2021.

99.2Business Combination Agreement, dated as of June 10, 2021, by and among Yucaipa Acquisition Corporation, SIGNA Sports United GmbH, SIGNA Sports United B.V., Olympics Merger Sub and SIGNA International Sports Holding GmbH (incorporated by reference to Exhibit 2.1 to Amendment No. 6 to the Issuer’s Registration Statement on Form F-4 filed on November 24, 2021).

99.4Form of Earn-Out Agreement (incorporated by reference to Exhibit 10.12 to Amendment No. 6 to the Issuer’s Registration Statement on Form F-4 filed on November 24, 2021).

99.5Form of Registration Rights Agreement (incorporated by reference to Exhibit 10.10 to Amendment No. 6 to the Issuer’s Registration Statement on Form F-4 filed on November 24, 2021).

99.6Subscription agreement, dated as of September 28, 2022, by and among SIGNA Holding GmbH and SIGNA Sports United N.V. (incorporated by reference to Exhibit 10.1 to the Issuer’s report on Form 6-K filed on September 28, 2022)

99.7Amendment Agreement to Earn-out Agreement, dated September 28, 2022 (incorporated by reference to Exhibit 10.2 to the Issuer’s report on Form 6-K filed on September 28, 2022)

99.8Terms and conditions of the Initial Convertible Bonds (incorporated by reference to Exhibit 4.1 to the Issuer’s report on Form 6-K filed on October 6, 2022)

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 19 of 31 |

| | |

99.9Equity commitment letter dated as of February 6, 2023, by and among SIGNA Holding GmbH and SIGNA Sports United N.V. (incorporated by reference to Exhibit 4.27 to the Issuer’s annual report on Form 20-F filed on February 7, 2023)

99.10RCF I Amendment dated as of February 6, 2023, by and among SIGNA Holding GmbH and SIGNA Sports United N.V. (incorporated by reference to Exhibit 4.28 to the Issuer’s annual report on Form 20-F filed on February 7, 2023)

99.11Terms and conditions of the Initial Convertible Bonds and the Additional Convertible Bonds (incorporated by reference to Exhibit 4.1 to the Issuer’s report on Form 6-K filed on April 20, 2023)

99.12Subscription agreement, dated as of April 17, 2023, by and among SIGNA Holding GmbH and SIGNA Sports United N.V. (incorporated by reference to Exhibit 4.2 to the Issuer’s report on Form 6-K filed on April 20, 2023)

99.13Subscription agreement, dated as of June 23, 2023, by and among SIGNA Holding GmbH and SIGNA Sports United N.V. (incorporated by reference to Exhibit 4.1 to the Issuer’s report on Form 6-K filed on June 27, 2023)

99.14Subscription agreement, dated as of August 7, 2023, by and among SIGNA Holding GmbH and SIGNA Sports United N.V. (incorporated by reference to Exhibit 4.2 to the Issuer’s report on Form 6-K filed on August 9, 2023)

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 20 of 31 |

| | |

SIGNATURES

After reasonable inquiry and to the best of his or her knowledge and belief, each of the undersigned certifies that the information in this Schedule 13D is true, complete and correct.

| | | | | | | | |

| Date: August 21, 2023 | SIGNA INTERNATIONAL SPORTS HOLDING GMBH |

| | |

| | By: | /s/ Wolfram Keil |

| Name: | Wolfram Keil |

| Title: | Managing Director |

| | |

| Date: August 21, 2023 | SIGNA RETAIL SPORTS HOLDING GMBH |

| | |

| By: | /s/ Mike Özkan |

| Name: | Mike Özkan |

| Title: | Managing Director |

| | |

| By: | /s/ Wolfram Keil |

| Name: | Wolfram Keil |

| Title: | Managing Director |

| | |

| Date: August 21, 2023 | SIGNA EUROPEAN INVEST AG |

| | |

| By: | /s/ Wolfram Keil |

| Name: | Wolfram Keil |

| Title: | Director |

| | |

| Date: August 21, 2023 | SIGNA EUROPEAN INVEST HOLDING AG |

| | |

| By: | /s/ Wolfram Keil |

| Name: | Wolfram Keil |

| Title: | Director |

| | |

| Date: August 21, 2023 | SIGNA RETAIL GMBH |

| | |

| By: | /s/ Wolfram Keil |

| Name: | Wolfram Keil |

| Title: | Managing Director |

| | |

| By: | /s/ Franz Hillebrand |

| Name: | Franz Hillebrand |

| Title: | Managing Director |

| | |

| Date: August 21, 2023 | SIGNA RETAIL BETEILIGUNG GMBH |

| | |

| By: | /s/ Dr. Marcus Mühlberger |

| Name: | Dr. Marcus |

| Title: | Managing Director |

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 21 of 31 |

| | |

| | | | | | | | |

| Date: August 21, 2023 | SIGNA AT 2020 SIEBEN GMBH |

| | |

| | By: | /s/ Wolfram Keil |

| Name: | Wolfram Keil |

| Title: | Managing Director |

| | |

| By: | /s/ Franz Hillebrand |

| Name: | Franz Hillebrand |

| Title: | Managing Director |

| | |

| Date: August 21, 2023 | SIGNA HOLDING GMBH |

| | |

| By: | /s/ Dr. Marcus Mühlberger |

| Name: | Dr. Marcus Mühlberger |

| Title: | Managing Director |

| | |

| Date: August 21, 2023 | SUPRAHOLDING GMBH & CO. KG |

| | |

| By: | /s/ Dr. Marcus Mühlberger |

| Name: | Dr. Marcus Mühlberger |

| Title: | Managing Director |

| | |

| Date: August 21, 2023 | FAMILIE BENKO PRIVATSTIFTUNG |

| | |

| By: | /s/ Dr. Marcus Mühlberger |

| Name: | Dr. Marcus Mühlberger |

| Title: | Member of the Management Board |

| | |

| By: | /s/ Mag. Karin Fuhrmann |

| Name: | Mag. Karin Fuhrmann |

| Title: | Member of the Management Board |

| | |

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 22 of 31 |

| | |

ANNEX A

SIGNA INTERNATIONAL SPORTS HOLDING GMBH

The directors and executive officers of SISH and their respective positions, principal occupation and business addresses are identified below:

| | | | | | | | | | | | | | |

| Name and Present Position with SISH | | Citizenship | | Principal Occupation / Business Address(es) |

| | | | |

| Wolfram Keil; Sole Managing Director | | Germany | | Maximiliansplatz 12, D-8033 Munich, Germany |

| | | | |

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 23 of 31 |

| | |

SIGNA RETAIL SPORTS HOLDING GMBH

The directors and executive officers of SRSH and their respective positions, principal occupation and business addresses are identified below:

| | | | | | | | | | | | | | |

| Name and Present Position with SRSH | | Citizenship | | Principal Occupation / Business Address(es) |

| | | | |

| Wolfram Keil; Managing Director | | Germany | | Bärengasse 29, CH-8001 Zurich, Switzerland |

| Mike Özkan; Managing Director | | Germany | | Bärengasse 29, CH-8001 Zurich, Switzerland |

| Robert Leingruber; Authorized Representative (Zeichnungsberechtigter) | | Austria | | Bärengasse 29, CH-8001 Zurich, Switzerland |

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 24 of 31 |

| | |

SIGNA EUROPEAN INVEST AG

The directors and executive officers of EI and their respective positions, principal occupation and business addresses are identified below:

| | | | | | | | | | | | | | |

| Name and Present Position with EI | | Citizenship | | Principal Occupation / Business Address(es) |

| | | | |

| Wolfram Keil; Managing Director | | Germany | | Bärengasse 29, CH-8001 Zurich, Switzerland |

| Robert Leingruber; Authorized Representative (Zeichnungsberechtigter) | | Austria | | Bärengasse 29, CH-8001 Zurich, Switzerland |

Anne dos Santos Capela; Authorized Representative (Zeichnungsberechtigte) | | Germany | | Bärengasse 29, CH-8001 Zurich, Switzerland |

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 25 of 31 |

| | |

SIGNA EUROPEAN INVEST HOLDING AG

The directors and executive officers of EIH and their respective positions, principal occupation and business addresses are identified below:

| | | | | | | | | | | | | | |

| Name and Present Position with EIH | | Citizenship | | Principal Occupation / Business Address(es) |

| | | | |

| Wolfram Keil; Managing Director | | Germany | | Bärengasse 29, CH-8001 Zurich, Switzerland |

| Robert Leingruber; Authorized Representative (Zeichnungsberechtigter) | | Austria | | Bärengasse 29, CH-8001 Zurich, Switzerland |

Anne dos Santos Capela; Authorized Representative (Zeichnungsberechtigte) | | Germany | | Bärengasse 29, CH-8001 Zurich, Switzerland |

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 26 of 31 |

| | |

SIGNA RETAIL GMBH

The directors and executive officers of SR and their respective positions, principal occupation and business addresses are identified below:

| | | | | | | | | | | | | | |

| Name and Present Position with SR | | Citizenship | | Principal Occupation / Business Address(es) |

| | | | |

| Wolfram Keil; Managing Director | | Germany | | Freyung 3, A-1010 Vienna, Austria |

Franz Hillebrand; Managing Director | | Austria | | Freyung 3, A-1010 Vienna, Austria |

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 27 of 31 |

| | |

SIGNA RETAIL BETEILIGUNG GMBH

The directors and executive officers of SRB and their respective positions, principal occupation and business addresses are identified below:

| | | | | | | | | | | | | | |

| Name and Present Position with SRB | | Citizenship | | Principal Occupation / Business Address(es) |

| | | | |

| Dr. Marcus Mühlberger; Managing Director | | Austria | | Maria-Theresien-Straße 31, A-6020 Innsbruck, Austria |

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 28 of 31 |

| | |

SIGNA AT 2020 SIEBEN GMBH

The directors and executive officers of AT 2020/7 and their respective positions, principal occupation and business addresses are identified below:

| | | | | | | | | | | | | | |

| Name and Present Position with AT 2020/7 | | Citizenship | | Principal Occupation / Business Address(es) |

| | | | |

| Wolfram Keil; Managing Director | | Germany | | Maria-Theresien-Straße 31, A-6020 Innsbruck, Austria |

Franz Hillebrand; Managing Director | | Austria | | Maria-Theresien-Straße 31, A-6020 Innsbruck, Austria |

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 29 of 31 |

| | |

SIGNA HOLDING GMBH

The directors and executive officers of SH and their respective positions, principal occupation and business addresses are identified below:

| | | | | | | | | | | | | | |

| Name and Present Position with SH | | Citizenship | | Principal Occupation / Business Address(es) |

| | | | |

| DI Christoph Stadlhuber; Managing Director | | Austria | | Freyung 3, A-1010 Vienna, Austria |

| Dr. Marcus Mühlberger; Managing Director | | Austria | | Maria-Theresien-Straße 31, A-6020 Innsbruck, Austria |

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 30 of 31 |

| | |

SUPRAHOLDING GMBH & CO. KG

The directors and executive officers of SHKG and their respective positions, principal occupation and business addresses are identified below:

| | | | | | | | | | | | | | |

| Name and Present Position with SHKG | | Citizenship | | Principal Occupation / Business Address(es) |

| | | | |

| Supraholding GmbH; general partner (Komplementär) of SHKG; represented by its sole managing director Dr. Marcus Mühlberger | | Austria | | Maria-Theresien-Straße 31, A-6020 Innsbruck, Austria |

| | | | | | | | |

| CUSIP No. N80029106 | Schedule 13D | Page 31 of 31 |

| | |

FAMILIE BENKO PRIVATSTIFTUNG

The directors and executive officers of FBP and their respective positions, principal occupation and business addresses are identified below:

| | | | | | | | | | | | | | |

| Name and Present Position with FBP | | Citizenship | | Principal Occupation / Business Address(es) |

| | | | |

| Dr. Dieter Spranz; Chairman of the Management Board | | Austria | | Maria-Theresien-Straße 31, A-6020 Innsbruck, Austria |

| Dr. Marcus Mühlberger; Member of the Management Board | | Austria | | Maria-Theresien-Straße 31, A-6020 Innsbruck, Austria |

Mag. Karin Fuhrmann; Member of the Management Board | | Austria | | Maria-Theresien-Straße 31, A-6020 Innsbruck, Austria |

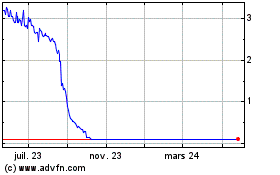

SIGNA Sports United NV (NYSE:SSU)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

SIGNA Sports United NV (NYSE:SSU)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024