Sunoco LP (NYSE: SUN) (“Sunoco” or “SUN”) and NuStar Energy L.P.

(NYSE: NS) (“NuStar” or “NS”) today announced the expiration of the

waiting period under the Hart-Scott-Rodino Antitrust Improvements

Act of 1976 (the “HSR Act”), in connection with Sunoco’s pending

acquisition of NuStar.

The expiration of the waiting period under the HSR Act satisfies

an important condition necessary for the completion of the

transaction.

A NuStar unitholder vote is scheduled for May 1, 2024 at 9:00 am

Central Time. The details of the NuStar Special Meeting, including

the terms of the proposed acquisition, have been outlined in the

NuStar Definitive Proxy Statement, filed on April 3, 2024 with the

Securities and Exchange Commission (the “SEC”). The transaction is

expected to close shortly after unitholder approval.

NuStar unitholders are anticipated to receive Sunoco’s

distributions for the first quarter of 2024 following the closing

of the transaction.

Sunoco LP (NYSE: SUN) is a master limited partnership

with core operations that include the distribution of motor fuel to

approximately 10,000 convenience stores, independent dealers,

commercial customers and distributors located in more than 40 U.S.

states and territories as well as refined product transportation

and terminalling assets in the U.S. and Europe. SUN's general

partner is owned by Energy Transfer LP (NYSE: ET).

About NuStar

NuStar Energy L.P. (NYSE: NS) is an independent liquids terminal

and pipeline operator. NuStar currently has approximately 9,500

miles of pipeline and 63 terminal and storage facilities that store

and distribute crude oil, refined products, renewable fuels,

ammonia and specialty liquids. The partnership’s combined system

has approximately 49 million barrels of storage capacity, and

NuStar has operations in the United States and Mexico. For more

information, visit NuStar Energy L.P.’s website at

www.nustarenergy.com and its Sustainability page at

https://sustainability.nustarenergy.com/.

Forward Looking Statements

This current report on Form 8-K contains “forward-looking

statements” within the meaning of the federal securities laws,

including Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”), and Section 21E of the Securities Exchange

Act of 1934, as amended. In this context, forward-looking

statements often address future business and financial events,

conditions, expectations, plans or ambitions, and often include,

but are not limited to, words such as “believe,” “expect,” “may,”

“will,” “should,” “could,” “would,” “anticipate,” “estimate,”

“intend,” “plan,” “seek,” “see,” “target” or similar expressions,

or variations or negatives of these words, but not all

forward-looking statements include such words. Forward-looking

statements by their nature address matters that are, to different

degrees, uncertain, such as statements about the consummation of

the proposed transaction and the anticipated benefits thereof. All

such forward-looking statements are based upon current plans,

estimates, expectations and ambitions that are subject to risks,

uncertainties and assumptions, many of which are beyond the control

of Sunoco and NuStar, that could cause actual results to differ

materially from those expressed in such forward-looking statements.

Important risk factors that may cause such a difference include,

but are not limited to: the completion of the proposed transaction

on anticipated terms and timing, or at all, NuStar unitholder

approval; anticipated tax treatment, unforeseen liabilities, future

capital expenditures, revenues, expenses, earnings, synergies,

economic performance, indebtedness, financial condition, losses,

prospects, business and management strategies for the management,

expansion and growth of the combined company’s operations,

including the possibility that any of the anticipated benefits of

the proposed transaction will not be realized or will not be

realized within the expected time period; the ability of Sunoco and

NuStar to integrate the business successfully and to achieve

anticipated synergies and value creation; potential litigation

relating to the proposed transaction that could be instituted

against Sunoco, NuStar or the directors of their respective general

partners; the risk that disruptions from the proposed transaction

will harm Sunoco’s or NuStar’s business, including current plans

and operations and that management’s time and attention will be

diverted on transaction-related issues; potential adverse reactions

or changes to business relationships, including with employees,

suppliers, customers, competitors or credit rating agencies,

resulting from the announcement or completion of the proposed

transaction; rating agency actions and Sunoco and NuStar’s ability

to access short- and long-term debt markets on a timely and

affordable basis; potential business uncertainty, including the

outcome of commercial negotiations and changes to existing business

relationships during the pendency of the proposed transaction that

could affect Sunoco’s and/or NuStar’s financial performance and

operating results; certain restrictions during the pendency of the

merger that may impact NuStar’s ability to pursue certain business

opportunities or strategic transactions or otherwise operate its

business; dilution caused by Sunoco’s issuance of additional units

representing limited partner interests in connection with the

proposed transaction; fees, costs and expenses and the possibility

that the transaction may be more expensive to complete than

anticipated; those risks described in Item 1A of Sunoco’s Annual

Report on Form 10-K, filed with the SEC on February 16, 2024, and

its subsequent Quarterly Reports on Form 10-Q and Current Reports

on Form 8-K; those risks described in Item 1A of NuStar’s Annual

Report on Form 10-K, filed with the SEC on February 22, 2024, and

its subsequent Quarterly Reports on Form 10-Q and Current Reports

on Form 8-K; and those risks that will be more fully described in

the registration statement on Form S-4, filed with the SEC and

subsequently declared effective on April 3, 2024 (the “Registration

Statement”). The disclosures set forth on the Registration

Statement are incorporated by reference in this presentation. While

the list of factors presented here is, and the list of factors to

be presented in the registration statement and the proxy

statement/prospectus are considered representative, no such list

should be considered to be a complete statement of all potential

risks and uncertainties. Unlisted factors may present significant

additional obstacles to the realization of forward-looking

statements. Readers are cautioned not to place undue reliance on

this forward-looking information, which is as of the date of this

current report on Form 8-K. Sunoco and NuStar do not intend to

update these statements unless required by the securities laws to

do so, and Sunoco and NuStar undertake no obligation to publicly

release the result of any revisions to any such forward-looking

statements that may be made to reflect events or circumstances

after the date of this current report on Form 8-K.

Important Information about the Transaction and Where to Find

It

In connection with the proposed transaction between Sunoco and

NuStar, Sunoco filed a Registration Statement on March 20, 2024,

which includes a prospectus with respect to Sunoco’s units to be

issued in the proposed transaction and a proxy statement for

NuStar’s unitholders (the “Proxy Statement/Prospectus”), and each

party may file other documents regarding the proposed transaction

with the SEC. The Registration Statement was declared effective by

the SEC on April 3, 2024. NuStar filed the Definitive Proxy

Statement/Prospectus on Schedule DEFM14A with the SEC on April 3,

2024, and it was first mailed to NuStar unitholders on or about

April 3, 2024. This current report on Form 8-K is not a substitute

for the Registration Statement, Proxy Statement/Prospectus or any

other document that Sunoco or NuStar (as applicable) may file with

the SEC in connection with the proposed transaction. BEFORE MAKING

ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS

OF SUNOCO AND NUSTAR ARE URGED TO READ THE REGISTRATION STATEMENT,

THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS

THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY

AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN

THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR

WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION

AND RELATED MATTERS. Investors and security holders may obtain free

copies of the Registration Statement and the Proxy

statement/Prospectus, as well as other filings containing important

information about Sunoco or NuStar, without charge at the SEC’s

website, at http://www.sec.gov. Copies of the documents filed with

the SEC by Sunoco will be available free of charge on Sunoco’s

website at www.sunocolp.com. Copies of the documents filed with the

SEC by NuStar will be available free of charge on NuStar’s website

at www.nustarenergy.com. The information included on, or accessible

through, Sunoco’s or NuStar’s website is not incorporated by

reference into this current report on Form 8-K.

Participants in the Solicitation

Sunoco, NuStar and the directors and certain executive officers

of their respective general partners may be deemed to be

participants in the solicitation of proxies in respect of the

proposed transaction. Information about the directors and executive

officers of NuStar’s general partner is set forth in (i) its proxy

statement for its 2024 annual meeting of unitholders

(https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1110805/000111080524000010/ns-20240306.htm),

which was filed with the SEC on March 6, 2024, including under the

sections entitled “Information About Our Executive Officers”,

“Compensation Discussion and Analysis”, “Summary Compensation

Table”, “Pay Ratio”, “Grants of Plan-Based Awards During the Year

Ended December 31, 2023”, “Outstanding Equity Awards at December

31, 2023”, “Option Exercises and Units Vested During the Year Ended

December 31, 2023”, “Pension Benefits for the Year Ended December

31, 2023”, “Nonqualified Deferred Compensation for the Year Ended

December 31, 2023”, “Potential Payments Upon Termination or Change

of Control”, “Pay Versus Performance”, “Director Compensation” and

“Security Ownership”, (ii) in its Annual Report on Form 10-K for

the year ended December 31, 2023

(https://www.sec.gov/ix?doc=/Archives/edgar/data/1110805/000111080524000007/ns-20231231.htm),

which was filed with the SEC on February 22, 2024, including under

the sections entitled “Item. 10. Directors, Executive Officers and

Corporate Governance,” “Item 11. Executive Compensation,” “Item 12.

Security Ownership of Certain Beneficial Owners and Management and

Related Unitholder Matters” and “Item 13. Certain Relationships and

Related Transactions and Director Independence” and (iii)

subsequent statements of changes in beneficial ownership on file

with the SEC. Information about the directors and executive

officers of Sunoco’s general partner is set forth in (i) its Annual

Report on Form 10-K for the year ended December 31, 2023,

(https://www.sec.gov/ix?doc=/Archives/edgar/data/1552275/000155227524000013/sun-20231231.htm)

which was filed with the SEC on February 16, 2024, including under

the sections entitled “Item. 10. Directors, Executive Officers and

Corporate Governance,” “Item 11. Executive Compensation,” “Item 12.

Security Ownership of Certain Beneficial Owners and Management and

Related Unitholder Matters” and “Item 13. Certain Relationships and

Related Transactions, and Director Independence” and (ii)

subsequent statements of changes in beneficial ownership on file

with the SEC. Additional information regarding the participants in

the proxy solicitation and a description of their direct or

indirect interests, by security holdings or otherwise, will be

contained in the Proxy statement/Prospectus and other relevant

materials filed with the SEC when they become available.

No Offer or Solicitation

This current report on Form 8-K is for informational purposes

only and is not intended to, and shall not, constitute an offer to

sell or the solicitation of an offer to buy any securities or a

solicitation of any vote or approval, nor shall there be any offer,

issuance, exchange, transfer, solicitation or sale of securities in

any jurisdiction in which such offer, issuance, exchange, transfer,

solicitation or sale would be in contravention of applicable law.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240408162735/en/

SUN Investors: Scott Grischow (214) 840-5660

scott.grischow@sunoco.com

SUN Media: Vicki Granado (214) 981-0761

vicki.granado@sunoco.com

NS Investors: Pam Schmidt (210) 918-2854

pam.schmidt@nustarenergy.com

NS Media: Chris Cho (210) 918-3953

chris.cho@nustarenergy.com

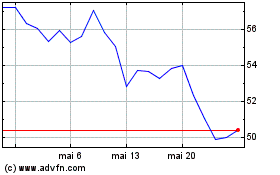

Sunoco (NYSE:SUN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Sunoco (NYSE:SUN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024