Taro Pharmaceutical Industries Ltd. (NYSE: TARO) (“Taro” or the

“Company”) today announced that it has called an extraordinary

general meeting of its shareholders (the “Extraordinary General

Meeting”), to be held on May 22, 2024, at 10:00 a.m., Israel time,

and a class meeting (the “Ordinary Class Meeting” and together with

the Extraordinary General Meeting, the “Meetings”) of the holders

of the Company’s ordinary shares (the “Ordinary Shares”), to be

held on May 22, 2024, at 11:00 a.m., Israel time, or immediately

after the conclusion of the Extraordinary General Meeting,

whichever is later, at Meitar Law Offices located at 16 Abba Hillel

Road, 10th Floor, Ramat Gan, Israel. Following the Ordinary Class

Meeting, a class meeting of the holders of the Company’s founders’

shares (the “Founder Shares”) will be held.

At the Meetings, Taro shareholders will be asked to consider and

vote on the approval, pursuant to Section 320 of the Companies Law,

5759-1999 of the State of Israel (together with the regulations

promulgated thereunder, the “Companies Law”), of the merger of Taro

with Libra Merger Ltd., a company formed under the laws of the

State of Israel (“Merger Sub”), under the control of Sun

Pharmaceutical Industries Limited, a corporation organized under

the laws of India (“Sun Pharma”), and a direct, wholly owned

subsidiary of Alkaloida Chemical Company ZRT (f/k/a Alkaloida

Chemical Company Exclusive Group Limited), a company formed under

the laws of Hungary (“Alkaloida”), The Taro Development

Corporation, a company formed under the laws of New York (“TDC”),

and Sun Pharma Holdings, a corporation formed under the laws of

Mauritius (“SPH”), including approval of: (i) the Agreement of

Merger, dated as of January 17, 2024, by and among Sun Pharma,

Alkaloida, Merger Sub, TDC, SPH and Taro (the “Merger Agreement”);

(ii) the merger transaction pursuant to Sections 314 through 327 of

the Companies Law, whereby Merger Sub will merge with and into

Taro, with Taro surviving and becoming an indirect wholly owned

subsidiary of Sun Pharma and its affiliates (the “Merger”); and

(iii) all other transactions contemplated by the Merger Agreement

(collectively, the “Transactions”).

Record holders of Taro’s outstanding Ordinary Shares as of the

close of business in New York City on April 15, 2024, are entitled

to notice of and to one vote at the Meetings or any adjournment or

postponement thereof per Ordinary Share held.

Each of Sun Pharma, Alkaloida, TDC and SPH has agreed to vote or

cause to be voted in favor of the Transactions all of the Ordinary

Shares it beneficially owns and has the power to vote or cause to

be voted, equal to 78.5% of the issued and outstanding Ordinary

Shares and all of the Founder Shares beneficially owned by each of

them (which constitute 100% of the Founder Shares), which together

represent 85.7% of the aggregate voting power of Taro.

If the Merger is completed, Taro will become a privately held

company and its shares will no longer be listed on the NYSE. After

careful consideration, the special committee (the “Special

Committee”) of Taro’s board of directors (the “Board”), composed

entirely of independent directors of the Board, unanimously

determined that the Transactions are advisable and fair to, and in

the best interests of, the minority shareholders, and Taro’s audit

committee of the Board (the “Audit Committee”) unanimously

determined that the Transactions are advisable and fair to, and in

the best interests of, Taro and its shareholders, and each of these

committees unanimously recommended that the Board approve the

Transactions. The Board has (i) upon such recommendations,

unanimously (a) determined that the merger is advisable and fair

to, and in the best interests of, Taro and its shareholders, (b)

approved the Transactions and (c) determined to recommend to the

shareholders of Taro the approval of the Transactions and (ii)

determined that, considering the financial position of the merging

companies, no reasonable concern exists that the surviving company

in the merger will be unable to fulfill the obligations of Taro to

its creditors. If the Transactions are approved at the Meetings, it

is expected that the Transactions will close in late June.

Additional Information About the Merger

On January 17, 2024, Taro furnished to the U.S. Securities and

Exchange Commission (the “SEC”) a current report on Form 6-K

regarding the Merger, which includes as an exhibit thereto the

Merger Agreement. All parties desiring details regarding the Merger

are urged to review these documents, which are available at the

SEC’s website (http://www.sec.gov) and Taro’s website

(http://www.taro.com).

In connection with the Transactions, Taro will prepare and mail

to its shareholders a proxy statement that will include a copy of

the merger agreement. In addition, in connection with the Merger,

Taro and certain other participants in the merger have prepared and

filed with the SEC a Schedule 13E-3 Transaction Statement that

includes Taro’s proxy statement as an exhibit thereto (as amended,

the “Schedule 13E-3”). The Schedule 13E-3 was filed with the SEC on

February 15, 2024, and amendments to the Schedule 13E-3 filed with

the SEC on March 11, 2024, March 20, 2024, and April 15, 2024,

respectively. INVESTORS AND SHAREHOLDERS ARE URGED TO READ

CAREFULLY AND IN THEIR ENTIRETY THE SCHEDULE 13E-3, INCLUDING ALL

AMENDMENTS AND OTHER MATERIALS FILED WITH THE SEC WHEN THEY BECOME

AVAILABLE, AS THEY CONTAIN IMPORTANT INFORMATION ABOUT TARO, THE

MERGER, AND RELATED MATTERS. Shareholders also will be able to

obtain these documents, as well as other filings containing

information about Taro, the Merger and related matters, without

charge from the SEC’s website (http://www.sec.gov) and Taro’s

website (http://www.taro.com).

Taro and its directors and certain of its executive officers and

other employees may be deemed to be participants in the

solicitation of proxies from Taro’s shareholders with respect to

the Merger. Information regarding the persons who may be considered

“participants” in the solicitation of proxies are set forth in the

Schedule 13E-3 and proxy statement.

This announcement is neither a solicitation of proxy, an offer

to purchase nor a solicitation of an offer to sell any securities,

and it is not a substitute for any proxy statement or other

materials that may be filed with or furnished to the SEC should the

Merger proceed.

About Taro Pharmaceutical Industries Ltd. (NYSE:

TARO)

Taro Pharmaceutical Industries Ltd. is a multinational,

science-based pharmaceutical company dedicated to meeting the needs

of its customers through the discovery, development, manufacturing

and marketing of the highest quality healthcare products. For

further information on Taro Pharmaceutical Industries Ltd., please

visit the Company’s website at www.taro.com.

Forward-Looking Statements

This announcement contains forward-looking statements,

including, but not limited to, the anticipated timing of closing

the transaction and statements regarding the funding and

consummation of the transactions. These forward-looking statements

can be identified by terminology such as “will,” “expects,”

“anticipates,” “future,” “intends,” “plans,” “believes,”

“estimates,” “confident” and similar statements. Statements that

are not historical or current facts, including statements about

beliefs and expectations, are forward-looking statements.

Forward-looking statements involve factors, risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied in these forward-looking statements. Such

factors, risks and uncertainties include the possibility that the

merger will not occur on the timeline anticipated, or at all, if

events arise that result in the termination of the Agreement, or if

one or more of the various closing conditions to the merger are not

satisfied or waived, or if the regulatory review process takes

longer than anticipated and other risks and uncertainties discussed

in documents filed with the SEC by the Company as well as the

Schedule 13E-3 and the proxy statement filed by the Company. All

information provided in this press release is as of the date of the

press release, and the Company undertakes no duty to update such

information, except as required under applicable law.

Further information on these and other factors is included in

filings the Company makes with the SEC from time to time, including

the section titled “Risk Factors” in the Company’s most recent Form

20-F, as well as the Form 6-K and Schedule 13E-3 (which includes

the proxy statement) filed by the Company. These documents are

available on the SEC Filings section of the Investor Relations

section of the Company’s website at: https://taro.gcs-web.com/.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240412630482/en/

Investor Relations Contacts Taro

Pharmaceutical Industries Ltd. William J. Coote VP, CFO

(914) 345-9001 William.Coote@taro.com

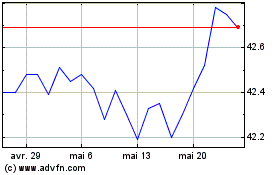

Taro Pharmaceutical Indu... (NYSE:TARO)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Taro Pharmaceutical Indu... (NYSE:TARO)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024