TDCX Inc. (NYSE: TDCX) (“TDCX” or the “Company”), an

award-winning digital customer experience (CX) solutions provider

for technology and blue-chip companies, today announced its

unaudited financial results for the fourth quarter and full year

ended December 31, 2023.

Full Year 2023 Financial Highlights2

- Total revenue of US$499.3 million, down 0.9% year-on-year, or

up 3.0% in constant currency terms1, which included a 3.9% point

negative impact of foreign exchange rates compared with the prior

year

- Profit for the year was US$91.1 million, up 14.5% year-on-year,

primarily driven by cost optimization efforts, lower tax, higher

interest income and a net reversal of equity settled share-based

payment expense

Fourth Quarter 2023 Financial Highlights2

- Total revenue of US$120.4 million, down 10.1% year-on-year, or

down 5.3% in constant currency terms1, which included a 4.8% point

negative impact of foreign exchange rates compared with the prior

year period

- Profit for the period was US$24.2 million, up 27.8%

year-on-year, primarily driven by cost optimization efforts, lower

tax, higher interest income and a net reversal of equity settled

share-based payment expense

Mr. Laurent Junique, Chief Executive Officer and Founder of

TDCX, said, “Market uncertainties and a challenging macroeconomic

environment continue to dampen business sentiment. This has had a

knock-on impact on TDCX. Despite these pressures, we delivered

within our guidance, and remain focused on the long term,

particularly on improving our operations and delivering client

value propositions.”

(US$ million2, except for

%)

FY 2022

FY 2023

% Change

Q4 2022

Q4 2023

% Change

Revenue

503.7

499.3

-0.9%

(+3.0% on a constant currency

basis)1

134.0

120.4

-10.1%

(-5.3% on a constant currency

basis)1

Profit for the period

79.6

91.1

+14.5%

19.0

24.2

+27.8%

Net profit margin (%)

15.8%

18.3%

14.2%

20.1%

EBITDA3

136.7

136.9

+0.1%

32.4

35.6

+9.7%

EBITDA Margins3

(%)

27.1%

27.4%

24.2%

29.5%

Adjusted EBITDA3,4

150.2

131.0

-12.8%

40.1

32.8

-18.3%

Adjusted EBITDA Margins3,4

(%)

29.8%

26.2%

29.9%

27.2%

Adjusted Net Income3,4

93.4

85.2

-8.7%

25.5

21.2

-16.8%

Business Highlights

Sustained client growth

- Client count5 up 15% year-on-year, bringing total client count

to 97 as of December 31, 2023, compared with 84 as of December 31,

2022

- Newly launched clients in Q4 23 include a global digital

payments company and a professional chauffeur portal

Improved revenue diversification

- Revenue from clients outside the top five rose 44% year-on-year

in FY 23

- Revenue mix from top five clients lowered to 73% in FY 23, from

81% in FY 22

Contribution from new geographies

- Revenue from new geographies6 was four times in FY 23 versus FY

22

Detailed Financial Information on the

Form 6-K

Please refer to

https://investors.tdcx.com/financials/quarterly-results/default.aspx

for the detailed financial information contained in Form 6-K.

__________________ 1 Revenue at constant currency is calculated

by translating the revenue of our local subsidiaries in each period

in the respective local functional currencies to the presentation

currency of the Company and its subsidiaries, using the average

currency conversion rates in effect during the comparable prior

period, rather than at the actual currency conversion rates in

effect during the current reporting period.

2 FX rate of US$1 = S$1.3186, being the approximate rate in

effect as of December 31, 2023, assumed in converting financials

from SG dollar to U.S. dollar.

3 For a discussion of the use of non-IFRS financial measures,

see “Non-IFRS Financial Measures”.

4 The reported amounts for Adjusted EBITDA and Adjusted Net

Income for the three months and full year ended December 31, 2023

include adjustments for certain items (i.e., acquisition-related

professional fees and net foreign exchange gains or losses) which

were not included in similar non-IFRS financial measures previously

reported in prior periods. The amount of adjustment for net foreign

exchange loss or gain previously reported in prior periods did not

include unrealized losses or gains resulting from change in fair

value of derivatives. In order to place the current disclosure in

the appropriate context and enhance its comparability, similar

adjustments have been made for net foreign exchange loss and net

foreign exchange gain, Adjusted EBITDA and Adjusted Net Income for

the three months and full year ended December 31, 2022.

5 “Client count” refers to launched campaigns that are revenue

generating.

6 Refers to sites in Colombia, India, Romania, South Korea, Hong

Kong, Türkiye, Vietnam, Brazil and Indonesia.

Webcast and Conference Call Information

The Company will not host a conference call to discuss the

results. Please reach out to the Investor Relations or Public

Relations contacts listed below with any questions.

About TDCX INC.

Singapore-headquartered TDCX provides transformative digital CX

solutions, enabling world-leading and disruptive brands to acquire

new customers, to build customer loyalty and to protect their

online communities.

TDCX helps clients achieve their customer experience aspirations

by harnessing technology, human intelligence and its global

footprint. It serves clients in fintech, gaming, technology, travel

and hospitality, digital advertising and social media, streaming

and e-commerce. TDCX’s expertise and strong footprint in Asia has

made it a trusted partner for clients, particularly high-growth,

new economy companies, looking to tap the region’s growth

potential.

TDCX’s commitment to delivering positive outcomes for our

clients extends to its role as a responsible corporate citizen. Its

Corporate Social Responsibility program focuses on positively

transforming the lives of its people, its communities and the

environment.

TDCX employs more than 17,800 employees across 30 campuses

globally, specifically in Brazil, Colombia, Hong Kong, India,

Indonesia, Japan, Malaysia, Mainland China, Philippines, Romania,

Singapore, South Korea, Spain, Thailand, Türkiye, and Vietnam. For

more information, please visit www.tdcx.com.

Convenience Translation The Company’s financial

information is stated in Singapore dollars, the legal currency of

Singapore. Unless otherwise noted, all translations from Singapore

dollars to U.S. dollars and from U.S. dollars to Singapore dollars

in this press release were made at a rate of S$1.3186 to US$1.00,

the approximate rate in effect as of December 31, 2023. We make no

representation that any Singapore dollar or U.S. dollar amount

could have been, or could be, converted into U.S. dollars or

Singapore dollar, as the case may be, at any particular rate, the

rate stated herein, or at all.

Non-IFRS Financial Measures To supplement our

consolidated financial statements, which are prepared and presented

in accordance with IFRS, we use the following non-IFRS financial

measures to help evaluate our operating performance:

“EBITDA” represents profit for the year/ period before interest

expense, interest income, income tax expense and depreciation and

amortization expense. “EBITDA margin” represents EBITDA as a

percentage of revenue.

“Adjusted EBITDA” represents profit for the year/ period before

interest expense, interest income, income tax expense, depreciation

and amortization expense, acquisition-related professional fees,

net foreign exchange gains or losses and equity-settled share-based

payment expense (or net reversal) incurred in connection with our

Performance Share Plan. “Adjusted EBITDA margin” represents

Adjusted EBITDA as a percentage of revenue.

“Adjusted Net Income” represents profit for the year/ period

before acquisition-related professional fees, net foreign exchange

gains or losses and equity-settled share-based payment expense (or

net reversal) incurred in connection with our Performance Share

Plan, net of any tax impact of such adjustments.

Revenue at constant currency is calculated by translating the

revenue of our local subsidiaries in each period in the respective

local functional currencies to the presentation currency of the

Company and its subsidiaries, using the average currency conversion

rates in effect during the comparable prior period, rather than at

the actual currency conversion rates in effect during the current

reporting period.

We believe that EBITDA, EBITDA Margin, Adjusted EBITDA, Adjusted

EBITDA Margin, Adjusted Net Income, Revenue at Constant Currency

and Revenue Growth at Constant Currency help us to compare our

operating performance on a consistent basis by removing the impact

of items not directly resulting from our core operations, and

thereby help us to identify underlying trends in our operating

results, enhancing our understanding of past performance and future

prospects.

We exclude items from Adjusted EBITDA and Adjusted Net Income,

including acquisition-related professional fees, net foreign

exchange gains or losses and equity-settled share-based payment

expense (or net reversal) incurred in connection with our

Performance Share Plan, as they are not indicative of our ongoing

operating performance, and adjusting for such items is meaningful

and useful to readers to understand the underlying performance of

the business by eliminating the impact of certain items that may

obscure trends in the underlying performance of the business.

The above non-IFRS financial measures have limitations as

analytical tools and should not be considered in isolation or

construed as an alternative to revenue, net income, or any other

measure of performance or as an indicator of our operating

performance. The non-IFRS financial measures presented here may not

be comparable to similarly titled measures presented by other

companies because other companies may calculate similarly titled

measures differently. For more information on the non-IFRS

financial measures, including full reconciliations to the nearest

IFRS measure, please see the form 6-K section captioned “Non-IFRS

Financial Measures” or the presentation slides.

Safe Harbor Statement This announcement contains

forward-looking statements. These statements are made under the

“safe harbor” provisions of the U.S. Private Securities Litigation

Reform Act of 1995. In some cases, you can identify these

forward-looking statements by the use of words such as “outlook,”

“believes,” “expects,” “potential,” “continues,” “may,” “will,”

“should,” “could,” “seeks,” “predicts,” “intends,” “trends,”

“plans,” “estimates,” “anticipates” or the negative version of

these words or other comparable words. The Company may also make

written or oral forward-looking statements in its periodic reports

to the U.S. Securities and Exchange Commission (the “SEC”), in its

annual report to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or

employees to third parties. Statements that are not historical

facts, including statements about the Company’s beliefs and

expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: the performance of TDCX’s largest

clients; the successful implementation of its business strategy;

the continued service of the Founder and certain of its key

employees and management; its ability to compete effectively; its

ability to navigate difficulties and successfully expand its

operations into countries in which it has no prior operating

experience; its ability to maintain its pricing, control costs or

continue to grow its business; its ability to attract and retain

enough highly trained employees; its compliance with service level

and performance requirements by, and contractual obligations with,

its clients; its exposure to various risks in Southeast Asia and

other parts of the world; its contractual relationship with key

clients; clients and prospective clients’ spending on omnichannel

CX solutions and content, trust and safety services; its ability to

successfully identify, acquire and integrate companies; its

spending on employee salaries and benefits expenses; and its

involvement in any disputes, legal, regulatory, and other

proceedings arising out of its business operations. Further

information regarding these and other risks is included in the

Company’s filings with the SEC. All information provided in this

press release and in its attachment is as of the date of this press

release, and the Company undertakes no obligation to update any

forward-looking statement, except as required under applicable

law.

UNAUDITED CONDENSED INTERIM

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

For the three months ended

December 31,

2023

2022

US$’000

S$’000

S$’000

Revenue

120,434

158,804

176,671

Employee benefits expense

(74,472

)

(98,199

)

(114,810

)

Depreciation and amortization

expense

(8,112

)

(10,696

)

(10,672

)

Rental and maintenance

expense

(1,819

)

(2,398

)

(2,690

)

Recruitment expense

(1,943

)

(2,562

)

(3,404

)

Transport and travelling

expense

(328

)

(432

)

(666

)

Telecommunication and technology

expense

(2,411

)

(3,179

)

(3,271

)

Interest expense

(453

)

(597

)

(549

)

Other operating expense (1)

(5,039

)

(6,644

)

(9,472

)

Share of profit from an

associate

-

-

4

Interest income

2,666

3,515

1,426

Other operating income

1,140

1,503

395

Profit before income

tax

29,663

39,115

32,962

Income tax expense

(5,419

)

(7,146

)

(7,952

)

Profit for the period

24,244

31,969

25,010

Item that will not be

reclassified to profit or loss:

Remeasurement of retirement

benefit obligation

(36

)

(47

)

924

Item that may be reclassified

subsequently to profit or loss:

Exchange differences on

translation of foreign operations

(8,313

)

(10,961

)

(16,179

)

Total comprehensive income for

the period

15,895

20,961

9,755

Profit

attributable to:

- Owners of TDCX Inc.

24,242

31,967

25,010

- Non-controlling interests

2

2

-

24,244

31,969

25,010

Total

comprehensive income attributable to:

- Owners of TDCX Inc.

15,893

20,959

9,755

- Non-controlling interests

2

2

-

15,895

20,961

9,755

Basic earnings per share (in US$

or S$) (2)

0.17

0.22

0.17

Diluted earnings per share (in

US$ or S$) (2)

0.17

0.22

0.17

_______________________________

(1) We reported foreign exchange gains or losses, as applicable,

on a net basis for the relevant period under the “other operating

expense” line item. (2) Basic and diluted earnings per share

For the three months ended

December 31,

2023

2022

Weighted average number of

ordinary shares for the purposes of basic earnings per share

144,210,719

144,921,462

Weighted average number of

ordinary shares for the purposes of diluted earnings per share

144,210,719

144,921,462

The translation of Singapore Dollar amounts into United States

Dollar amounts (“USD”) for the unaudited condensed interim

consolidated statement of profit or loss and other comprehensive

income above are included solely for the convenience of readers

outside of Singapore and have been made at the rate of S$1.3186 to

US$1.00, the approximate rate of exchange at December 31, 2023.

Such translations should not be construed as representations that

the Singapore Dollar amounts could be converted into USD at that or

any other rate.

Comparison of the Three Months Ended December 31, 2023 and

2022

Revenue. Our revenue decreased by 10.1% to S$158.8

million (US$120.4 million) for the three months ended December 31,

2023 from S$176.7 million for the three months ended December 31,

2022 primarily driven by a 36.7% decrease in revenue from content,

trust and safety services, a 12.1% decrease in revenue from sales

and digital marketing services and 1.9% decrease in revenue from

omnichannel CX solutions services rendered. Revenue from other

services increased by 20.9%.

- Our revenue from omnichannel CX solutions services decreased by

1.9% to S$96.5 million (US$73.2 million) from S$98.5 million for

the corresponding period of 2022 primarily impacted by lower

volumes requirement by existing clients in the digital advertising

and media and fintech sectors, buffered partially by increased

demand by clients in the gaming, technology, travel and

hospitality, e-commerce, fast-moving consumer goods verticals and

new food delivery customer.

- Our revenue from sales and digital marketing services decreased

by 12.1% to S$43.0 million (US$32.6 million) from S$48.9 million

for the same period of 2022 mainly attributed to declined volume

requirements of existing campaign by key digital advertising

clients and media and e-commerce sectors.

- Our revenue from content, trust and safety services decreased

by 36.7% to S$17.7 million (US$13.5 million) from S$28.1 million

for the same period of 2022 primarily due to the contraction of

volumes requirement by the digital advertising and media vertical

client.

- Our revenue from our other service fees increased by 20.9% to

S$1.5 million (US$1.1 million) from S$1.2 million for the same

period of 2022 primarily due to an expansion of existing

campaigns.

The following table sets forth our service provided by amount

for the three months ended December 31, 2023 and 2022.

For the three months ended

December 31,

2023

2022

US$’000

S$’000

S$’000

Revenue by service

Omnichannel CX solutions

73,216

96,542

98,452

Sales and digital marketing

32,634

43,032

48,942

Content, trust and safety

13,460

17,749

28,052

Other service fees #

1,124

1,481

1,225

Total revenue

120,434

158,804

176,671

# Other service fees comprise revenue from other business

process services and revenue from other services.

Employee Benefits Expense. Our employee benefits expense

decreased by 14.5% to S$98.2 million (US$74.5 million) from S$114.8

million for the same period of 2022 due mainly to a reversal of

equity-settled share-based payment expense resulting from revised

vesting expectation of the remaining tranche against the backdrop

of more headwinds in the recent business dynamics that also

contributed to the lower headcount volume requirements by customer

campaigns.

Depreciation and Amortization Expense. Our depreciation

and amortization expense remained stable during the two comparative

periods.

Rental and Maintenance Expense. Our rental and

maintenance expenses decreased by 10.9% to S$2.4 million (US$1.8

million) from S$2.7 million for the same period of 2022 primarily

due to the decreased technology device renting and relocation of

office space by the Korean unit from co-working space to a long

term leased facilities in 2023.

Recruitment Expense. Our recruitment expense decreased by

24.7% to S$2.6 million (US$1.9 million) from S$3.4 million for the

same period of 2022, primarily due to lower hiring activities in

several key operating sites reflecting the volume downturn.

Transport and Travelling Expense. Our transport and

travelling expenses decreased by 35.1% to S$0.4 million (US$0.3

million) from S$0.7 million for the same period of 2022 primarily

due to lower logistical costs incurred by the Philippines site on

the back of the reduction in the remote and work from home working

arrangements in 2023.

Telecommunication and Technology Expense. Our

telecommunication and technology expenses remained stable during

the two comparative periods.

Interest Expense. Our interest expense increased by 8.7%

to $0.6 million (US$0.5 million) from $0.5 million for the same

period of 2022 on account of mainly higher lease liability interest

from office spaces taken up by new and existing sites.

Other Operating Expense. Our other operating expense

decreased by 29.9% to S$6.6 million (US$5.0 million) from S$9.5

million for the same period of 2022 primarily due to lower net

foreign exchange loss.

Share of Profit from an Associate. This relates to our

share of profit from an associated company in Hong Kong which later

became a wholly-owned subsidiary on October 13, 2022 following the

acquisition of the controlling shares in that business.

Interest Income. Our interest income increased by 146.5%

to S$3.5 million (US$2.7 million) from S$1.4 million for the same

period of 2022 primarily due to higher placements of excess liquid

funds in interest earning deposits as well as the increase in

interest rates in 2023.

Other Operating Income. Our other operating income

increased by 280.5% to S$1.5 million (US$1.1 million) from S$0.4

million for the same period of 2022 primarily due to the increase

in the fair value gain of financial assets measured at fair value

through profit or loss.

Profit Before Income Tax. As a result of the foregoing,

we achieved a profit before income tax of S$39.1 million (US$29.7

million) for the three months ended December 31, 2023 (S$33.0

million for the corresponding period of 2022).

Income Tax Expense. Our income tax expense decreased by

10.1% to S$7.1 million (US$5.4 million) from S$7.9 million for the

same period of 2022 primarily due to the reinstatement of tax

incentive in the Philippines that was suspended in 2022 and one-off

prosperity tax levied in Malaysia that was implemented in 2022.

Profit for the Period. As a result of the foregoing, our

profit for the period increased by 27.8% to S$32.0 million (US$24.2

million) from S$25.0 million for the same period of 2022.

Exchange differences on translation of foreign

operations. Exchange differences on translation of foreign

operations recognized in other comprehensive income was a loss of

S$11.0 million (US$8.3 million) and a loss of S$16.2 million for

the same period in 2022, resulting from the strengthening of the

Singapore Dollar against the respective functional currencies of

the foreign operations. The exchange losses on translation of

foreign operations for the period decreased by 32.3% as compared to

the same period in 2022 as the extent of strengthening of the

Singapore Dollar against those functional currencies is lesser in

2023.

Total Comprehensive Income for the Period. As a result of

the foregoing, our total comprehensive income for the period

increased by 114.9% to S$21.0 million (US$15.9 million) from S$9.8

million for the same period of 2022.

Additional Adjustments to Certain Non-IFRS Financial

Measures

With effect from January 1, 2023, we have decided to include

adjustments for net foreign exchange gains or losses and

acquisition-related professional fees in Adjusted EBITDA, Adjusted

Net Income and Adjusted EPS, in addition to an adjustment for

equity-settled share-based payment expense (or net reversal) that

was included in such previously reported non-IFRS measures in prior

periods. Over the course of the previous year, we have identified

such additional items as not indicative of our ongoing operating

performance, and adjusting for such items is meaningful and useful

to readers to understand the underlying performance of the business

by eliminating the impact of certain items that may obscure trends

in the underlying performance of the business. For further

information, see “Non-IFRS Financial Measures” below.

Share Repurchase Program

On March 14, 2022, we announced that the board of directors had

approved a US$30.0 million share repurchase program. The share

repurchase program commenced on March 14, 2022. The repurchase

program has no expiration date and may be suspended, modified or

discontinued at any time without prior notice. We expect to fund

repurchases under this program with our existing cash balance.

Our proposed repurchases may be made from time to time on the

open market at prevailing market prices, in privately negotiated

transactions, in block trades, and/or through other legally

permissible means, depending on market conditions and in accordance

with applicable rules and regulations and its insider trading

policy. Our board of directors will review the share repurchase

program periodically and may authorize adjustment of its terms and

size. All share repurchases are subject to and will be carried out,

if at all, in accordance with applicable regulatory

requirements.

From October 1, 2023 to December 31, 2023, we purchased 418,187

American Depositary Shares (ADSs) at a cost of US$2,169,000 under

our share repurchase program. No repurchases of ADSs were made from

January 1, 2024 to March 4, 2024.

NON-IFRS FINANCIAL MEASURES

EBITDA, EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted Net Income, Adjusted Net Income margin, Adjusted EPS,

revenue at constant currency, and revenue growth at constant

currency are non-IFRS financial measures. TDCX monitors EBITDA,

EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted

Net Income, Adjusted Net Income margin, Adjusted EPS, revenue at

constant currency and revenue growth at constant currency because

they assist the Company in comparing its operating performance on a

consistent basis by removing the impact of items not directly

resulting from its core operations.

EBITDA, EBITDA margin, Adjusted EBITDA and Adjusted EBITDA

margin

“EBITDA” represents profit for the period before interest

expense, interest income, income tax expense, and depreciation and

amortization expense. “EBITDA margin” represents EBITDA as a

percentage of revenue. “Adjusted EBITDA” represents profit for the

period before interest expense, interest income, income tax

expense, depreciation and amortization expense, equity-settled

share-based payment expense (or net reversal) incurred in

connection with our Performance Share Plan, net foreign exchange

gain or loss and acquisition-related professional fees. “Adjusted

EBITDA margin” represents Adjusted EBITDA as a percentage of

revenue.

For the three months ended

December 31,

2023

2022 (4)

US$’000

S$’000

Margin

S$’000

Margin

Revenue

120,434

158,804

—

176,671

—

Profit for the period and net

profit margin

24,244

31,969

20.1

%

25,010

14.2

%

Adjustments for:

Depreciation and amortization

expense

8,112

10,696

6.7

%

10,672

6.0

%

Income tax expense

5,419

7,146

4.5

%

7,952

4.5

%

Interest expense

453

597

0.4

%

549

0.3

%

Interest income

(2,666

)

(3,515

)

(2.2

%)

(1,426

)

(0.8

%)

EBITDA and EBITDA margin

35,562

46,893

29.5

%

42,757

24.2

%

Adjustment:

Equity-settled share-based

payment

(net reversal) / expense (1)

(4,255

)

(5,610

)

(3.5

%)

4,112

2.3

%

Net foreign exchange loss (2)

1,343

1,771

1.1

%

6,025

3.4

%

Acquisition-related professional

fees (3)

107

141

0.1

%

—

—

Adjusted EBITDA and Adjusted

EBITDA margin

32,757

43,195

27.2

%

52,894

29.9

%

For the Full Year ended December

31,

2023

2022 (5)

US$’000

S$’000

Margin

S$’000

Margin

Revenue

499,280

658,351

—

664,120

—

Profit for the period and net

profit margin

91,120

120,150

18.3

%

104,938

15.8

%

Adjustments for:

Depreciation and amortization

expense

33,069

43,605

6.6

%

39,731

6.0

%

Income tax expense

19,948

26,304

4.0

%

37,049

5.5

%

Interest expense

1,651

2,177

0.3

%

1,936

0.3

%

Interest income

(8,867

)

(11,692

)

(1.8

%)

(3,348

)

(0.5

%)

EBITDA and EBITDA margin

136,921

180,544

27.4

%

180,306

27.1

%

Adjustment:

Equity-settled share-based

payment

(net reversal) / expense (1)

(6,907

)

(9,108

)

(1.4

%)

19,465

2.9

%

Net foreign exchange gain (2)

(323

)

(426

)

(0.1

%)

(1,761

)

(0.2

%)

Acquisition-related professional

fees (3)

1,271

1,676

0.3

%

—

—

Adjusted EBITDA and Adjusted

EBITDA margin

130,962

172,686

26.2

%

198,010

29.8

%

_______________________________

(1) Refer to equity-settled share-based payment expense (or net

reversal) arising from TDCX Performance Share Plan.

(2) Refer to realized and unrealized losses or gains resulting

from changes in exchange rates between the functional currency and

the currency in which a foreign currency transaction is

denominated, net of unrealized losses or gains resulting from

change in fair value of derivatives. The amount of adjustment for

net foreign exchange loss or gain previously reported in prior

periods did not include unrealized losses or gains resulting from

change in fair value of derivatives. In order to place the current

disclosure in the appropriate context and enhance its

comparability, similar adjustments have been made for net foreign

exchange loss and net foreign exchange gain for the three months

and full year ended December 31, 2022.

(3) Refer to fees incurred on third-party service providers in

connection with a discontinued acquisition.

(4) The reported amounts for Adjusted EBITDA for the three

months ended December 31, 2023 include adjustments for certain

items (i.e., acquisition-related professional fees and net foreign

exchange gains or losses) which were not included in similar

non-IFRS financial measures previously reported in prior periods.

In order to place the current disclosure in the appropriate context

and enhance its comparability, similar adjustments have been made

for Adjusted EBITDA for the three months ended December 31,

2022.

(5) The reported amounts for Adjusted EBITDA for the full year

ended December 31, 2023 include adjustments for certain items

(i.e., acquisition-related professional fees and net foreign

exchange gains or losses) which were not included in similar

non-IFRS financial measures previously reported in prior periods.

In order to place the current disclosure in the appropriate context

and enhance its comparability, similar adjustments have been made

for Adjusted EBITDA for the full year ended December 31, 2022.

Adjusted Net Income and Adjusted Net Income margin

“Adjusted Net Income” represents profit for the period before

equity-settled share-based payment expense (or net reversal)

incurred in connection with our Performance Share Plan, net foreign

exchange gain or loss and acquisition-related professional fees,

net of any tax impact of such adjustments. “Adjusted Net Income

margin” represents Adjusted Net Income as a percentage of

revenue.

For the three months ended

December 31,

2023

2022 (4)

US$’000

S$’000

Margin

S$’000

Margin

Profit for the period and net

profit margin

24,244

31,969

20.1

%

25,010

14.2

%

Adjustment for:

Equity-settled share-based

payment

(net reversal) / expense (1)

(4,255

)

(5,610

)

(3.5

%)

4,112

2.3

%

Net foreign exchange loss (2)

1,097

1,447

0.9

%

4,466

2.5

%

Acquisition-related professional

fees (3)

107

141

0.1

%

—

—

Adjusted Net Income and Adjusted

Net Income margin

21,193

27,947

17.6

%

33,588

19.0

%

For the Full Year ended December

31,

2023

2022 (5)

US$’000

S$’000

Margin

S$’000

Margin

Profit for the period and net

profit margin

91,120

120,150

18.3

%

104,938

15.8

%

Adjustment for:

Equity-settled share-based

payment

(net reversal) / expense (1)

(6,907

)

(9,108

)

(1.4

%)

19,465

2.9

%

Net foreign exchange gain (2)

(265

)

(349

)

(0.1

%)

(1,291

)

(0.2

%)

Acquisition-related professional

fees (3)

1,271

1,676

0.3

%

—

—

Adjusted Net Income and Adjusted

Net Income margin

85,219

112,369

17.1

%

123,112

18.5

%

_______________________________

(1) Refer to equity-settled share-based payment expense (or net

reversal) arising from TDCX Performance Share Plan.

(2) Refer to realized and unrealized losses or gains resulting

from changes in exchange rates between the functional currency and

the currency in which a foreign currency transaction is

denominated, net of unrealized losses or gains resulting from

change in fair value of derivatives and net of tax effects. The

amount of adjustment for net foreign exchange loss or gain

previously reported in prior periods did not include unrealized

losses or gains resulting from change in fair value of derivatives.

In order to place the current disclosure in the appropriate context

and enhance its comparability, similar adjustments have been made

for net foreign exchange loss and net foreign exchange gain for the

three months and full year ended December 31, 2022.

(3) Refer to fees incurred on third-party service providers in

connection with a discontinued acquisition.

(4) The reported amounts for Adjusted Net Income for the three

months ended December 31, 2023 include adjustments for certain

items (i.e., acquisition-related professional fees and net foreign

exchange gains or losses) which were not included in similar

non-IFRS financial measures previously reported in prior periods.

In order to place the current disclosure in the appropriate context

and enhance its comparability, similar adjustments have been made

for Adjusted Net Income for the three months ended December 31,

2022.

(5) The reported amounts for Adjusted Net Income for the full

year ended December 31, 2023, include adjustments for certain items

(i.e., acquisition-related professional fees and net foreign

exchange gains or losses) which were not included in similar

non-IFRS financial measures previously reported in prior periods.

In order to place the current disclosure in the appropriate context

and enhance its comparability, similar adjustments have been made

for Adjusted Net Income for the full year ended December 31,

2022.

Adjusted EPS

“Adjusted EPS” represents earnings available to shareholders

excluding the impact of equity-settled share-based payment expense

(or net reversal), net foreign exchange gain or loss and

acquisition-related professional fees.

Adjusted EPS is calculated as earnings available to shareholders

excluding the impact of equity-settled share-based payment expense

(or net reversal), net foreign exchange gain or loss and

acquisition-related professional fees, divided by the diluted

weighted-average number of shares outstanding.

For the three months ended

December 31,

2023

2022 (4)

Amount

Per Share

Amount

Per Share

Amount

Per Share

US$’000

US$

S$’000

S$

S$’000

S$

Reported earnings available to

shareholders and EPS

24,242

0.17

31,967

0.22

25,010

0.17

Adjustments for:

Equity-settled share-based

payment (net reversal) / expense (1)

(4,255

)

(0.03

)

(5,610

)

(0.04

)

4,112

0.03

Net foreign exchange loss (2)

1,097

0.01

1,447

0.01

4,466

0.03

Acquisition-related professional

fees (3)

107

—*

141

—*

—

—

Adjusted earnings available to

shareholders and Adjusted EPS

21,191

0.15

27,945

0.19

33,588

0.23

For the Full Year ended December

31,

2023

2022 (5)

Amount

Per Share

Amount

Per Share

Amount

Per Share

US$’000

US$

S$’000

S$

S$’000

S$

Reported earnings available to

shareholders and EPS

91,076

0.63

120,092

0.83

104,936

0.72

Adjustments for:

Equity-settled share-based

payment (net reversal) / expense (1)

(6,907

)

(0.05

)

(9,108

)

(0.06

)

19,465

0.13

Net foreign exchange gain (2)

(265

)

—*

(349

)

—*

(1,291

)

—*

Acquisition-related professional

fees (3)

1,271

0.01

1,676

0.01

—

—

Adjusted earnings available to

shareholders and Adjusted EPS

85,175

0.59

112,311

0.78

123,110

0.85

* Amount is immaterial on a per share basis.

_________________________

(1) Refer to equity-settled share-based payment expense arising

from TDCX Performance Share Plan.

(2) Refer to realized and unrealized losses or gains resulting

from changes in exchange rates between the functional currency and

the currency in which a foreign currency transaction is

denominated, net of unrealized losses or gains resulting from

change in fair value of derivatives and net of tax effects. The

amount of adjustment for net foreign exchange loss or gain

previously reported in prior periods did not include unrealized

losses or gains resulting from change in fair value of derivatives.

In order to place the current disclosure in the appropriate context

and enhance its comparability, similar adjustments have been made

for net foreign exchange loss and net foreign exchange gain for the

three months and full year ended December 31, 2022.

(3) Refer to fees incurred on third-party service providers in

connection with a discontinued acquisition.

(4) The reported amounts for Adjusted EPS for the three months

ended December 31, 2023 include adjustments for certain items

(i.e., acquisition-related professional fees and net foreign

exchange gains or losses) which were not included in similar

non-IFRS financial measures previously reported in prior periods.

In order to place the current disclosure in the appropriate context

and enhance its comparability, similar adjustments have been made

for Adjusted EPS for the three months ended December 31, 2022.

(5) The reported amounts for Adjusted EPS for the full year

ended December 31, 2023 include adjustments for certain items

(i.e., acquisition-related professional fees and net foreign

exchange gains or losses) which were not included in similar

non-IFRS financial measures previously reported in prior periods.

In order to place the current disclosure in the appropriate context

and enhance its comparability, similar adjustments have been made

for Adjusted EPS for the full year ended December 31, 2022.

Revenue at Constant Currency and Revenue Growth at Constant

Currency

Revenue at constant currency, which is revenue adjusted for the

translation effect of foreign currencies so that certain financial

results can be viewed without the impact of fluctuations in foreign

currency exchange rates, thereby facilitating period-to-period

comparisons of our business performance. Revenue at constant

currency is calculated by translating the revenue of our local

subsidiaries in each period in the respective local functional

currencies to TDCX Inc.’s and its consolidated subsidiaries’

(together, the “Group”) presentation currency, using the average

currency conversion rates in effect during the comparable prior

period (rather than at the actual currency conversion rates in

effect during the current reporting period). Revenue growth at

constant currency means the period-over-period change in revenue at

constant currency compared against revenue in the prior period.

For the three months ended

December 31,

2023

2023

2022

S$’000

S$’000

S$’000

As reported

At constant currency

As reported

Revenue growth as reported

Foreign exchange impact

Revenue growth at constant

currency

Revenue

158,804

167,318

176,671

(10.1)%

4.8%

(5.3)%

For the Full Year ended December

31,

2023

2023

2022

S$’000

S$’000

S$’000

As reported

At constant currency

As reported

Revenue growth as reported

Foreign exchange impact

Revenue growth at constant

currency

Revenue

658,351

684,143

664,120

(0.9)%

3.9%

3.0%

The Company has not reconciled non-IFRS forward-looking revenue

growth at constant currency to its most directly comparable IFRS

measure, as permitted by Item 10(e)(1)(i)(B) of Regulation S-K. The

revenue growth outlook indicated for 2024 is calculated and

presented at constant currency, as it would require unreasonable

efforts to predict factors that are out of the Company’s control or

are not readily predictable, such as currency exchange movements

over the course of an entire year.

The Company uses revenue at constant currency and revenue growth

at constant currency, which are supplemental non-IFRS financial

measures, to provide better comparability of revenue trends

period-over-period (without the impact of fluctuations in foreign

currency exchange rates) because it is a global company that

transacts business in multiple currencies and reports financial

information in the Group’s functional reporting currency. Foreign

currency exchange rate fluctuations affect the amounts reported by

the Company in the Group’s functional reporting currency with

respect to its foreign revenues. Generally, when the Group’s

functional reporting currency dollar either strengthens or weakens

against other currencies, revenue at constant currency rates and

revenue growth at constant currency rates will be higher or lower

than revenue and revenue growth reported at actual exchange

rates.

The Company believes that non-IFRS financial measures such as

EBITDA, EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted Net Income, Adjusted Net Income margin, Adjusted EPS,

revenue at constant currency and revenue growth at constant

currency help us to identify underlying trends in our operating

results, enhancing our understanding of past performance and future

prospects.

While the Company believes that such non-IFRS financial measures

provide useful information to investors in understanding and

evaluating the Company’s results of operations in the same manner

as its management, the Company’s use of such non-IFRS financial

measures have limitations as analytical tools and you should not

consider these in isolation or as a substitute for analysis of the

Company’s results of operations or financial condition as reported

under IFRS.

TDCX’s non-IFRS financial measures do not reflect all items of

income and expense that affect the Company’s operations and do not

represent the residual cash flow available for discretionary

expenditures. Further, these non-IFRS measures may differ from the

non-IFRS information used by other companies, including peer

companies, and therefore their comparability may be limited. The

Company compensates for these limitations by reconciling the

non-IFRS financial measures to the nearest IFRS performance

measure, all of which should be considered when evaluating

performance. The Company encourages you to review the company’s

financial information in its entirety and not rely on any single

financial measure.

The translation of Singapore Dollar amounts into United States

Dollar amounts for the unaudited condensed interim consolidated

statement of profit or loss and other comprehensive income above

are included solely for the convenience of readers outside of

Singapore and have been made at the rate of S$1.3186 to US$1.00,

the approximate rate of exchange at December 31, 2023. Such

translations should not be construed as representations that the

Singapore Dollar amounts could be converted into USD at that or any

other rate.

UNAUDITED CONDENSED INTERIM

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

For the Full Year ended December

31,

2023

2022

US$’000

S$’000

S$’000

Revenue

499,280

658,351

664,120

Employee benefits expense

(321,986

)

(424,571

)

(436,350

)

Depreciation and amortization

expense

(33,069

)

(43,605

)

(39,731

)

Rental and maintenance

expense

(9,116

)

(12,021

)

(9,980

)

Recruitment expense

(7,666

)

(10,109

)

(14,201

)

Transport and travelling

expense

(1,192

)

(1,572

)

(1,637

)

Telecommunication and technology

expense

(10,394

)

(13,705

)

(11,822

)

Interest expense

(1,651

)

(2,177

)

(1,936

)

Other operating expense (1)

(15,161

)

(19,991

)

(14,699

)

Share of profit from an

associate

-

-

139

Interest income

8,867

11,692

3,348

Other operating income

3,156

4,162

4,736

Profit before income

tax

111,068

146,454

141,987

Income tax expenses

(19,948

)

(26,304

)

(37,049

)

Profit for the year

91,120

120,150

104,938

Item that will not be

reclassified to profit or loss:

Remeasurement of retirement

benefit obligation

(36

)

(47

)

924

Item that may be reclassified

subsequently to profit or loss:

Exchange differences on

translation of foreign operations

(11,062

)

(14,586

)

(14,432

)

Total comprehensive income for

the year

80,022

105,517

91,430

Profit

attributable to:

- Owners of the Group

91,076

120,092

104,936

- Non-controlling interests

44

58

2

91,120

120,150

104,938

Total

comprehensive income attributable to:

- Owners of the Group

79,978

105,459

91,428

- Non-controlling interests

44

58

2

80,022

105,517

91,430

Basic earnings per share (in S$)

(2)

0.63

0.83

0.72

Diluted earnings per share (in

S$) (2)

0.63

0.83

0.72

_______________________________

(1) We reported foreign exchange gains or losses, as applicable,

on a net basis for the relevant period under the “other operating

expense” line item. (2) Basic and diluted earnings per share

For the Full Year ended December

31,

2023

2022

Weighted average number of

ordinary shares for the purposes of basic earnings per share

144,785,247

145,298,557

Weighted average number of

ordinary shares for the purposes of diluted earnings per share

144,825,713

145,298,557

UNAUDITED CONDENSED INTERIM

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As of December 31, 2023

As of December 31, 2022

US$’000

S$’000

S$’000

ASSETS

Current assets

Cash and cash equivalents

342,671

451,849

389,100

Fixed and pledged deposits

-

-

6,551

Trade receivables

81,711

107,744

88,808

Contract assets

39,469

52,044

58,808

Other receivables

10,706

14,117

15,885

Financial assets measured at fair

value through profit or loss

42,803

56,440

29,776

Income tax receivable

194

256

354

Total current assets

517,554

682,450

589,282

Non-current assets

Pledged deposits

453

597

584

Goodwill and intangible

assets

2,052

2,706

2,924

Other receivables

4,870

6,421

5,019

Plant and equipment

23,368

30,813

41,292

Right-of-use assets

30,912

40,760

35,236

Deferred tax assets

2,535

3,342

3,463

Total non-current assets

64,190

84,639

88,518

Total assets

581,744

767,089

677,800

LIABILITIES AND EQUITY

Current liabilities

Trade payables (1)

2,388

3,149

5,354

Accrued operating expenses

(1)

34,708

45,766

44,369

Lease liabilities

20,306

26,775

17,818

Provision for reinstatement

cost

1,742

2,297

5,282

Income tax payable

8,596

11,335

16,560

Total current liabilities

67,740

89,322

89,383

Non-current

liabilities

Lease liabilities

12,773

16,843

20,644

Provision for reinstatement

cost

5,302

6,992

3,572

Defined benefit obligation

1,918

2,529

1,497

Deferred tax liabilities

896

1,182

852

Total non-current liabilities

20,889

27,546

26,565

Capital, reserves and

non-controlling interests

Share capital

15

20

19

Reserves

142,502

187,903

219,590

Retained earnings

350,567

462,257

342,260

Equity attributable to owners of

the Group

493,084

650,180

561,869

Non-controlling interests

31

41

(17

)

Total equity

493,115

650,221

561,852

Total liabilities and

equity

581,744

767,089

677,800

The translation of Singapore Dollar amounts into United States

Dollar amounts for the unaudited condensed interim consolidated

statement of financial position above are included solely for the

convenience of readers outside of Singapore and have been made at

the rate of S$1.3186 to US$1.00, the approximate rate of exchange

at December 31, 2023. Such translations should not be construed as

representations that the Singapore Dollar amounts could be

converted into USD at that or any other rate.

(1) As at December 31, 2023, we have segregated the Other

payable balance reported in prior periods’ statement of financial

position to Trade Payable and Accrued Operating Expenses to better

reflect the nature of payables. As a result, the comparative

figures in the statement of financial position of December 31, 2022

have been adjusted to conform to the current year’s

presentation.

UNAUDITED CONDENSED INTERIM

CONSOLIDATED STATEMENT OF CASH FLOWS

For the Full Year ended December

31,

2023

2022

US$’000

S$’000

S$’000

Operating activities

Profit before income tax

111,068

146,454

141,987

Adjustments for:

Depreciation and amortization

expense

33,069

43,605

39,731

Impairment loss on plant and

equipment

275

362

—

Allowance on trade and other

receivables

—

—

104

Changes in fair value of

financial assets at FVTPL

(1,362

)

(1,796

)

—

Equity-settled share-based

payment (net reversal) / expense

(6,907

)

(9,108

)

19,465

Provision for reinstatement

cost

—

—

387

Bank loan transaction cost

33

43

50

Interest income

(8,867

)

(11,692

)

(3,348

)

Interest expense

1,651

2,177

1,936

Retirement benefit service

cost

705

930

753

Loss on disposal and write-off of

plant and equipment

50

66

18

Share of profit from an

associate

—

—

(139

)

Fair value gain on previously

held equity interest

—

—

(139

)

Operating cash flows before

movements in working capital

129,715

171,041

200,805

Trade receivables

(16,276

)

(21,462

)

677

Contract assets

3,680

4,852

(12,601

)

Other receivables

(195

)

(257

)

(6,611

)

Trade payables and accrued

operating expenses

1,637

2,158

17,031

Cash generated from

operations

118,561

156,332

199,301

Interest received

8,867

11,692

3,348

Income tax paid

(23,514

)

(31,006

)

(38,140

)

Income tax refunded

121

159

42

Net cash from operating

activities

104,035

137,177

164,551

Investing activities

Purchase of plant and

equipment

(8,950

)

(11,801

)

(24,466

)

Proceeds from sales of plant and

equipment

23

30

136

Payment for restoration of

office

(61

)

(81

)

—

Placement of fixed deposits

—

—

(154

)

Withdrawal of fixed deposits

4,796

6,324

1,900

Dividend income from

associate

—

—

161

Acquisition of a subsidiary, net

of cash acquired

—

—

(4,214

)

Investment in financial assets

measured at fair value through profit or loss

(19,674

)

(25,942

)

(3,032

)

Net cash used in investing

activities

(23,866

)

(31,470

)

(29,669

)

Financing activities

Dividends paid

(30

)

(39

)

(39

)

Drawdown of bank loan

—

—

600

Repayment of lease

liabilities

(18,178

)

(23,970

)

(19,729

)

Interest paid

—

—

(215

)

Repayment of bank loan

—

—

(17,449

)

Repurchase of American Depositary

Shares

(6,998

)

(9,228

)

(13,620

)

Proceeds from issuance of

shares

—

—

1

Net cash used in financing

activities

(25,206

)

(33,237

)

(50,451

)

Net increase in cash and cash

equivalents

54,963

72,470

84,431

Effect of foreign exchange rate

changes on cash held in foreign currencies

(7,378

)

(9,721

)

(8,478

)

Cash and cash equivalents at

beginning of period

295,086

389,100

313,147

Cash and cash equivalents at

end of period

342,671

451,849

389,100

The translation of Singapore Dollar amounts into United States

Dollar amounts for the unaudited condensed interim consolidated

statement of cash flows above are included solely for the

convenience of readers outside of Singapore and have been made at

the rate of S$1.3186 to US$1.00, the approximate rate of exchange

at December 31, 2023. Such translations should not be construed as

representations that the Singapore Dollar amounts could be

converted into USD at that or any other rate.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240306726798/en/

For enquiries, please contact: Investors / Analysts:

Joana Cheong investors@tdcx.com

Media: Eunice Seow eunice.seow@tdcx.com

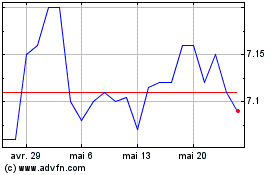

TDCX (NYSE:TDCX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

TDCX (NYSE:TDCX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024