Team, Inc. (NYSE: TISI) (“TEAM” or the “Company”),

a global, leading provider of specialty industrial services

offering clients access to a full suite of conventional,

specialized, and proprietary mechanical, heat-treating, and

inspection services, today reported its financial results for the

second quarter ended June 30, 2023.

Second Quarter 2023

Highlights1:

- Increased revenues to

$239.5 million, up 8% over the 2022 second quarter.

- Improved gross margin to

$60.9 million and 25.4% of revenue, up roughly 190 basis

points from the 2022 second quarter.

- Reported net loss of $15.8 million,

an improvement of $12.4 million over the 2022 second quarter.

- Grew consolidated Adjusted EBITDA2

to $17.4 million (7.3% of consolidated revenue), up from $5.7

million (2.6% of consolidated revenue) in the 2022 second

quarter.

- Reduced ongoing cash selling,

general and administrative expenses by $3.2 million over the 2022

period, and a total of $8.3 million year-to-date in 2023.

- On August 1, 2023, successfully

repaid the Company’s remaining $41.2 million of convertible notes

with proceeds from the previously announced June 2023 refinancing

transaction.

1. Unless otherwise specified, the financial

information and discussion in this earnings release is based on the

Company’s continuing operations (IHT and MS segments) and excludes

results of its discontinued operations (Quest Integrity).

2. See the accompanying reconciliation of

non-GAAP financial measures at the end of this press release.

“We are encouraged with the progress reflected

in our second quarter results, which delivered strong revenue

growth and Adjusted EBITDA of $17.4 million, more than triple the

prior year period. More importantly, we saw the benefits from our

improved cost efficiency, with our gross margin growing by 190

basis points to 25.4% of revenue and our Adjusted EBITDA margin

expanding to 7.3% of revenue. Both of our operating segments also

outperformed the 2022 period, with segment level Adjusted EBITDA

margin improving by 160 basis points in our Inspection and Heat

Treating segment, and 340 basis points in our Mechanical Services

segment,” said Keith D. Tucker, TEAM’s Chief Executive Officer.

“Our stronger operating leverage and lower cost structure resulted

in nearly 66% of incremental revenue growth falling through to

Adjusted EBITDA, further demonstrating the tangible progress made

to date in our efforts to improve TEAM’s financial and operational

strength while maintaining best in class safety and service

quality.”

Mr. Tucker then went on to note the Company’s

recent financing transactions, “In June, we successfully closed a

series of refinancing transactions that allowed us to repay in full

our existing senior secured term loan and, on August 1, repaid in

full our remaining outstanding convertible notes. These

transactions simplified our capital structure, extended our next

debt maturity to August 2025 and successfully eliminated the

conditions that led to the going concern disclosure in our 2022

fiscal year-end annual report and our first quarter report.”

“Looking to the third quarter, we see generally

stronger activity levels across both our segments, driven by

healthy customer end markets, which should provide further

opportunities to capture accretive revenue growth. We are

particularly excited about our state-of-the-art aerospace facility,

where our activity levels continue to increase. Additionally, while

we have made significant progress throughout our operation in

reducing costs and improving cash flow, management remains focused

on addressing underperforming components of the business and

identifying further opportunities to improve efficiency and

margins, the details of which we expect to share during the third

quarter,” concluded Tucker.

Financial Results

On November 1, 2022, the Company closed the sale

of its Quest Integrity business. Financial information, performance

metrics and discussions for comparative period 2022 are based on

the Company’s continuing operations (Inspection and Heat Treating

(IHT) and Mechanical Services (MS) segments) and exclude results of

discontinued operations (Quest Integrity) except where stated

otherwise.

Second quarter revenues were up

$18.0 million to $239.5 million as compared to $221.5

million in the prior-year quarter, primarily due to higher callout

and turnaround activity in the IHT segment and higher activity

levels in leak repair and hot tapping services across the MS

segment. Unfavorable foreign exchange rate movements in the 2023

second quarter reduced consolidated revenue growth by $1.8 million.

In the second quarter of 2023, consolidated gross margin was $60.9

million, or 25.4% of revenue, up 190 basis points from 23.5%, or

$52.1 million, in the same quarter a year ago. Gross margin was

positively impacted by direct margin improvement and lower indirect

costs as a percent of revenue attributable to the Company’s ongoing

expense reduction program, increased operational efficiency,

improved pricing, and favorable project mix.

Selling, general and administrative expenses for

the second quarter were $56.3 million, down $6.6 million, or 10.5%

from the second quarter of 2022, mainly due to savings from the

Company’s ongoing cost reduction efforts and lower professional

fees. After adjusting for expenses not representative of the

Company’s ongoing operations, and removing $6.1 million and $5.7

million, respectively, of noncash expenses consisting of

depreciation and amortization and share-based compensation expense,

our cash selling, general and administrative expenses declined by

$3.2 million.

Consolidated net loss in the second quarter of

2023 was $15.8 million ($3.61 loss per share) compared to a net

loss from continuing operations of $28.2 million ($6.53 loss per

share) in the second quarter of 2022. The Company’s adjusted

measure of net income/loss, consolidated Adjusted EBIT, a non-GAAP

financial measure, was income of $7.7 million in the second quarter

of 2023 compared to a loss of $3.9 million in the prior year’s

comparable quarter. Consolidated Adjusted EBITDA, a non-GAAP

financial measure, was $17.4 million for the second quarter of 2023

compared to $5.7 million for the prior year quarter, with the

improvement driven by the factors noted above. (See the

accompanying reconciliation of non-GAAP financial measures at the

end of this earnings release.)

Adjusted Net Loss, consolidated Adjusted EBIT,

and consolidated Adjusted EBITDA are non-GAAP financial measures

that exclude certain items that are not indicative of TEAM’s

ongoing operations. A reconciliation of these non-GAAP financial

measures to the most comparable GAAP financial measures is

presented at the end of this earnings release.

Segment Results

The following table illustrates the composition

of the Company’s revenue and operating income (loss) by segment for

the quarter ended June 30, 2023 and 2022 (in thousands):

|

|

|

TEAM, INC. AND SUBSIDIARIES |

|

SEGMENT INFORMATION |

|

(unaudited, in thousands) |

| |

|

|

|

|

| |

|

Three Months EndedJune 30, |

|

Better (Worse) |

| |

|

2023 |

|

2022 |

|

$ |

|

% |

| Revenues |

|

|

|

|

|

|

|

|

|

IHT |

|

$ |

116,740 |

|

|

$ |

114,124 |

|

|

$ |

2,616 |

|

|

2.3 |

% |

|

MS |

|

|

122,752 |

|

|

|

107,416 |

|

|

|

15,336 |

|

|

14.3 |

% |

| |

|

$ |

239,492 |

|

|

$ |

221,540 |

|

|

$ |

17,952 |

|

|

8.1 |

% |

| |

|

|

|

|

|

|

|

|

| Operating income

(loss) |

|

|

|

|

|

|

|

|

|

IHT |

|

$ |

6,548 |

|

|

$ |

5,514 |

|

|

$ |

1,034 |

|

|

18.8 |

% |

|

MS |

|

|

12,720 |

|

|

|

6,984 |

|

|

|

5,736 |

|

|

82.1 |

% |

|

Corporate and shared support services |

|

|

(14,672 |

) |

|

|

(23,292 |

) |

|

|

8,620 |

|

|

37.0 |

% |

| |

|

$ |

4,596 |

|

|

$ |

(10,794 |

) |

|

$ |

15,390 |

|

|

142.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues. IHT revenues

increased by $2.6 million or 2.3% and benefited from a $4.6 million

or 5% increase in IHT U.S. revenue due to higher callout and

turnaround activity and a $1.1 million increase in IHT other

international revenue, partially offset by a $3.1 million decrease

in Canada revenue due to lower turnaround activity. MS revenue

increased by $15.3 million or 14.3%, attributable to a $4.8 million

or 8.9% increase in U.S. revenue due to higher activity in leak

repair, callout activity and hot tapping services and a $10.0

million revenue increase in other international regions and MS

Canada.

Operating income (loss). IHT

operating income increased by $1.0 million due to higher activity

and higher margins in Canada and other international regions;

partially offset by higher labor related costs in U.S. operations.

MS operating income increased by $5.7 million as compared to the

prior year quarter, driven by higher revenue and margins from the

Company’s U.S., Canada and other international operations.

Operating income from U.S. and other international operations

increased by $3.4 million and $2.8 million, respectively, partially

offset by a decrease in operating income from TEAM’s domestic valve

business. Corporate operating loss decreased by $8.6 million due to

lower professional fees and lower severance cost in the current

quarter compared to the prior year quarter, and lower overall costs

due to the Company’s ongoing cost reduction efforts.

|

|

|

TEAM, INC. AND SUBSIDIARIES |

|

SEGMENT INFORMATION |

|

(unaudited, in thousands) |

| |

|

|

|

|

| |

|

Six Months EndedJune 30, |

|

Better (Worse) |

| |

|

2023 |

|

2022 |

|

$ |

|

% |

| Revenues |

|

|

|

|

|

|

|

|

|

IHT |

|

$ |

218,569 |

|

|

$ |

209,721 |

|

|

$ |

8,848 |

|

|

4.2 |

% |

|

MS |

|

|

223,200 |

|

|

|

200,857 |

|

|

|

22,343 |

|

|

11.1 |

% |

| |

|

$ |

441,769 |

|

|

$ |

410,578 |

|

|

$ |

31,191 |

|

|

7.6 |

% |

| |

|

|

|

|

|

|

|

|

| Operating income

(loss) |

|

|

|

|

|

|

|

|

|

IHT |

|

$ |

11,271 |

|

|

$ |

5,648 |

|

|

$ |

5,623 |

|

|

99.6 |

% |

|

MS |

|

|

15,913 |

|

|

|

7,497 |

|

|

|

8,416 |

|

|

112.3 |

% |

|

Corporate and shared support services |

|

|

(30,334 |

) |

|

|

(46,346 |

) |

|

|

16,012 |

|

|

34.5 |

% |

| |

|

$ |

(3,150 |

) |

|

$ |

(33,201 |

) |

|

$ |

30,051 |

|

|

90.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues. IHT revenues

increased by $8.8 million or 4.2%, primarily driven by an increase

of $13.2 million in IHT U.S. revenue due to higher callout and

turnaround activity, partially offset by lower activity in Canada.

MS revenue increased by $22.3 million or 11.1%, consisting of an

$8.8 million increase in the U.S. market primarily attributable to

higher activity in callout, hot tapping and leak repair services, a

$9.3 million increase in other international operations primarily

attributable to higher turnaround activity, leak repair services

and product sales, and a $3.5 million increase in Canada.

Operating income (loss). IHT

operating income increased by $5.6 million or 99.6%, driven by

higher activity and improved margins in the U.S. and cost

reductions in Canada. MS operating income increased by $8.4 million

as compared to the prior year period. Operating income from the

U.S., other international and Canada operations increased by $4.2

million, $2.1 million and $2.1 million, respectively, driven by

higher activity and improved margins. Corporate operating loss

decreased by $16.0 million due to lower professional fees and lower

severance cost in the current year period as compared to the prior

year period and lower overall costs due to the Company’s ongoing

cost reduction efforts.

Balance Sheet and Liquidity

On June 30, 2023, the Company had

$61.8 million of total liquidity, consisting of consolidated

cash and cash equivalents of $25.0 million (excluding

$5.4 million of restricted cash) and $36.8 million of undrawn

availability (excluding availability utilized on August 1 to repay

the Company’s convertible notes) under its various credit

facilities.

The Company’s total debt as of June 30, 2023 was

$310.9 million as compared to $285.9 million as of fiscal year

ended 2022. The Company’s net debt (total debt less cash and cash

equivalents), a non-GAAP financial measure, was $280.5 million at

June 30, 2023.

On August 8, 2023, after repaying the Company’s convertible

notes on August 1, the Company had $54.7 million of total

liquidity, consisting of consolidated cash and cash equivalents of

$21.3 million (excluding $5.3 million of restricted cash)

and approximately $33.4 million of undrawn availability under

its various credit facilities.

Non-GAAP Financial Measures

The non-GAAP financial measures in this earnings

release are provided to enable investors, analysts and management

to evaluate TEAM’s performance excluding the effects of certain

items that management believes impact the comparability of

operating results between reporting periods. These measures should

be used in addition to, and not in lieu of, results prepared in

conformity with generally accepted accounting principles (“GAAP”).

A reconciliation of each of the non-GAAP financial measures to the

most directly comparable historical GAAP financial measure is

contained in the accompanying schedule for each of the fiscal

periods indicated.

About Team, Inc.

Headquartered in Sugar Land, Texas, Team, Inc.

(NYSE: TISI) is a global, leading provider of specialty industrial

services offering clients access to a full suite of conventional,

specialized, and proprietary mechanical, heat-treating, and

inspection services. We deploy conventional to highly specialized

inspection, condition assessment, maintenance, and repair services

that result in greater safety, reliability, and operational

efficiency for our client’s most critical assets. Through locations

in more than 20 countries, we unite the delivery of technological

innovation with over a century of progressive, yet proven integrity

and reliability management expertise to fuel a better tomorrow. For

more information, please visit www.teaminc.com.

Certain forward-looking information contained

herein is being provided in accordance with the provisions of the

Private Securities Litigation Reform Act of 1995. We have made

reasonable efforts to ensure that the information, assumptions, and

beliefs upon which this forward-looking information is based are

current, reasonable, and complete. However, such forward-looking

statements involve estimates, assumptions, judgments, and

uncertainties. They include but are not limited to statements

regarding the Company’s financial prospects and the implementation

of cost saving measures. There are known and unknown factors that

could cause actual results or outcomes to differ materially from

those addressed in the forward-looking information. Although it is

not possible to identify all of these factors, they include, among

others, the Company’s ability to continue as a going concern; the

Company’s ability to execute on its cost management actions; the

Company’s ability to generate sufficient cash from operations,

access its credit facility, or maintain its compliance with

covenants under its credit facility and credit agreement; the

Company’s ability to manage inflationary pressures on its operating

costs; the Company’s ability to successfully divest assets on terms

that are favorable to the Company; the Company’s ability to repay,

refinance or restructure our debt and the debt of certain of our

subsidiaries; anticipated or expected purchases or sales of assets;

the impact to the Company’s business, financial condition, results

of operations and cash flows due to negative market conditions,

including from the lingering impact of widespread public health

crises, epidemics and pandemics, threats of domestic and global

economic recession and future economic uncertainties, particularly

in industries in which we are heavily dependent; seasonal and other

variation, such as severe weather conditions (including conditions

influenced by climate change) and the nature of the Company’s

clients’ industry; the Company’s ability to expand into new markets

(including low carbon energy transition) and attract clients in new

industries may be limited due to its competition’s breadth of

service offerings and intellectual property; the Company’s

significant debt and high leverage which could have a negative

impact on its financing options, liquidity position and ability to

manage increases in interest rates; the timing of new client

contracts and termination of existing contracts may result in

unpredictable fluctuations in the Company’s cash flows and

financial results; the risk of non-payment and/or delays in payment

of receivables from the Company’s clients; the Company may not be

able to continue to meet the New York Stock Exchange’s (“NYSE”)

continued listing requirements and rules, and the NYSE may delist

the Company’s common stock, which could negatively affect the

Company, the price of the Company’s common stock and its

shareholders’ ability to sell the Company’s common stock; the

Company’s financial forecasts are based upon estimates and

assumptions that may materially differ from actual results; the

Company may incur liabilities and suffer negative financial or

reputational impacts relating to occupational health and safety

matters; changes in laws or regulations in the local jurisdictions

that the Company conducts its business; the outcome of tax

examinations; changes in tax laws, and other tax matters; foreign

currency exchange rate and interest rate fluctuations; the

inherently uncertain outcome of current and future litigation; if

the Company fails to maintain effective internal controls, it may

not be able to report its financial results accurately or timely or

prevent or detect fraud, which could have a material adverse effect

on its business; acts of terrorism, war or political or civil

unrest in the U.S. or elsewhere, changes in laws and regulations,

or the imposition of economic or trade sanctions affecting

international commercial transactions and such known factors as are

detailed in the Company’s Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K, each as filed

with the Securities and Exchange Commission, and in other reports

filed by the Company with the Securities and Exchange Commission

from time to time. Accordingly, there can be no assurance that the

forward-looking information contained herein, including statement

regarding the Company’s financial prospects and the implementation

of cost saving measures, will occur or that objectives will be

achieved. We assume no obligation to publicly update or revise any

forward-looking statements made today or any other forward-looking

statements made by the Company, whether as a result of new

information, future events or otherwise, except as may be required

by law.

Contact:Nelson M. HaightExecutive Vice

President, Chief Financial Officer(281) 388-5521

|

|

|

TEAM, INC. AND SUBSIDIARIES |

|

SUMMARY OF CONSOLIDATED OPERATING RESULTS |

|

(unaudited, in thousands, except per share

data) |

| |

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 30, |

|

June 30, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

239,492 |

|

|

$ |

221,540 |

|

|

$ |

441,769 |

|

|

$ |

410,578 |

|

| Operating

expenses |

|

|

178,576 |

|

|

|

169,426 |

|

|

|

333,851 |

|

|

|

317,334 |

|

|

Gross margin |

|

|

60,916 |

|

|

|

52,114 |

|

|

|

107,918 |

|

|

|

93,244 |

|

| Selling, general, and

administrative expenses |

|

|

56,320 |

|

|

|

62,908 |

|

|

|

111,068 |

|

|

|

126,429 |

|

| Restructuring and

other related charges, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

16 |

|

|

Operating income (loss) |

|

|

4,596 |

|

|

|

(10,794 |

) |

|

|

(3,150 |

) |

|

|

(33,201 |

) |

| Interest expense,

net |

|

|

(16,691 |

) |

|

|

(18,476 |

) |

|

|

(33,432 |

) |

|

|

(37,055 |

) |

| Loss on debt

extinguishment |

|

|

(1,582 |

) |

|

|

— |

|

|

|

(1,582 |

) |

|

|

— |

|

| Other income,

net |

|

|

13 |

|

|

|

3,259 |

|

|

|

648 |

|

|

|

6,438 |

|

| Loss before income

taxes |

|

|

(13,664 |

) |

|

|

(26,011 |

) |

|

|

(37,516 |

) |

|

|

(63,818 |

) |

| Less: (Provision)

benefit for income taxes |

|

|

(2,089 |

) |

|

|

(2,191 |

) |

|

|

(2,948 |

) |

|

|

(2,717 |

) |

| Net loss from

continuing operations |

|

|

(15,753 |

) |

|

|

(28,202 |

) |

|

|

(40,464 |

) |

|

|

(66,535 |

) |

| Net income from

discontinued operations |

|

|

— |

|

|

|

6,650 |

|

|

|

— |

|

|

|

12,521 |

|

| Net loss |

|

$ |

(15,753 |

) |

|

$ |

(21,552 |

) |

|

$ |

(40,464 |

) |

|

$ |

(54,014 |

) |

| Basic net loss per

common share: |

|

|

|

|

|

|

|

|

|

Loss from continuing operations |

|

|

(3.61 |

) |

|

|

(6.53 |

) |

|

|

(9.30 |

) |

|

|

(16.45 |

) |

|

Income from discontinued operations |

|

|

— |

|

|

|

1.54 |

|

|

|

— |

|

|

|

3.10 |

|

|

Total |

|

$ |

(3.61 |

) |

|

$ |

(4.99 |

) |

|

$ |

(9.30 |

) |

|

$ |

(13.35 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted-average

number of shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

4,362 |

|

|

|

4,318 |

|

|

|

4,353 |

|

|

|

4,045 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TEAM, INC. AND SUBSIDIARIES |

|

SUMMARY CONSOLIDATED BALANCE SHEET

INFORMATION |

|

(in thousands) |

| |

|

|

|

| |

June 30, |

|

December 31, |

| |

2023 |

|

2022 |

| |

(unaudited) |

|

|

| |

|

|

|

|

Cash and cash equivalents |

$ |

30,437 |

|

|

$ |

58,075 |

|

| |

|

|

|

| Other current

assets |

|

296,318 |

|

|

|

289,478 |

|

| |

|

|

|

| Property, plant, and

equipment, net |

|

131,956 |

|

|

|

138,099 |

|

| |

|

|

|

| Other non-current

assets |

|

127,974 |

|

|

|

130,993 |

|

| |

|

|

|

|

Total assets |

$ |

586,685 |

|

|

$ |

616,645 |

|

| |

|

|

|

| Current portion of

long-term debt and finance lease obligations |

$ |

4,547 |

|

|

$ |

280,993 |

|

| |

|

|

|

| Other current

liabilities |

|

154,019 |

|

|

|

167,871 |

|

| |

|

|

|

| Long-term debt and

finance lease obligations, net of current maturities |

|

306,334 |

|

|

|

4,942 |

|

| |

|

|

|

| Other non-current

liabilities |

|

41,913 |

|

|

|

45,079 |

|

| |

|

|

|

| Stockholders’

equity |

|

79,872 |

|

|

|

117,760 |

|

| |

|

|

|

|

Total liabilities and stockholders’ equity |

$ |

586,685 |

|

|

$ |

616,645 |

|

|

|

|

|

|

|

|

|

|

|

|

|

TEAM INC. AND SUBSIDIARIES |

|

SUMMARY CONSOLIDATED CASH FLOW

INFORMATION1 |

|

(unaudited, in thousands) |

| |

|

|

| |

|

Six Months Ended June 30, |

| |

|

2023 |

|

20221 |

| |

|

|

|

|

| |

|

|

|

|

|

Net loss |

|

$ |

(40,464 |

) |

|

$ |

(54,014 |

) |

| |

|

|

|

|

| Depreciation and

amortization expense |

|

|

19,085 |

|

|

|

19,609 |

|

| |

|

|

|

|

| Loss on debt

extinguishment |

|

|

1,582 |

|

|

|

— |

|

| |

|

|

|

|

| Amortization of debt

issuance costs, debt discounts and deferred financing

costs |

|

|

16,229 |

|

|

|

12,077 |

|

| |

|

|

|

|

| Deferred income

taxes |

|

|

730 |

|

|

|

(357 |

) |

| |

|

|

|

|

| Non-cash compensation

cost |

|

|

627 |

|

|

|

(59 |

) |

| |

|

|

|

|

| Write-off of deferred

loan costs |

|

|

— |

|

|

|

2,748 |

|

| |

|

|

|

|

| Working Capital and

Other |

|

|

(21,406 |

) |

|

|

(33,395 |

) |

| |

|

|

|

|

|

Net cash used in operating activities |

|

|

(23,617 |

) |

|

|

(53,391 |

) |

| |

|

|

|

|

| Capital

expenditures |

|

|

(5,073 |

) |

|

|

(14,001 |

) |

| |

|

|

|

|

| Proceeds from disposal

of assets |

|

|

332 |

|

|

|

5,119 |

|

| |

|

|

|

|

|

Net cash used in investing activities |

|

|

(4,741 |

) |

|

|

(8,882 |

) |

| |

|

|

|

|

| Borrowings (payments)

under ABL Facility, net |

|

|

(21,093 |

) |

|

|

66,053 |

|

| |

|

|

|

|

| Borrowings under

Eclipse Term Loans |

|

|

27,398 |

|

|

|

— |

|

| |

|

|

|

|

| Payments for debt

issuance costs |

|

|

(5,327 |

) |

|

|

(10,640 |

) |

| |

|

|

|

|

| Issuance of common

stock, net of issuance costs |

|

|

— |

|

|

|

9,696 |

|

| |

|

|

|

|

| Other |

|

|

(495 |

) |

|

|

(323 |

) |

| |

|

|

|

|

|

Net cash provided by financing activities |

|

|

483 |

|

|

|

64,786 |

|

| |

|

|

|

|

| Effect of exchange

rate changes |

|

|

237 |

|

|

|

(382 |

) |

| |

|

|

|

|

| Net change in cash and

cash equivalents |

|

$ |

(27,638 |

) |

|

$ |

2,131 |

|

|

1 |

|

Consolidated statement of cash flow for 2022 includes cash flows

from discontinued operations. |

|

|

|

|

|

|

|

TEAM, INC. AND SUBSIDIARIES |

|

SEGMENT INFORMATION |

|

(unaudited, in thousands) |

| |

| |

|

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Revenues |

|

|

|

|

|

|

|

|

|

IHT |

|

$ |

116,740 |

|

|

$ |

114,124 |

|

|

$ |

218,569 |

|

|

$ |

209,721 |

|

|

MS |

|

|

122,752 |

|

|

|

107,416 |

|

|

|

223,200 |

|

|

|

200,857 |

|

| |

|

$ |

239,492 |

|

|

$ |

221,540 |

|

|

$ |

441,769 |

|

|

$ |

410,578 |

|

| |

|

|

|

|

|

|

|

|

| Operating income

(loss) |

|

|

|

|

|

|

|

|

|

IHT |

|

$ |

6,548 |

|

|

$ |

5,514 |

|

|

$ |

11,271 |

|

|

$ |

5,648 |

|

|

MS |

|

|

12,720 |

|

|

|

6,984 |

|

|

|

15,913 |

|

|

|

7,497 |

|

|

Corporate and shared support services |

|

|

(14,672 |

) |

|

|

(23,292 |

) |

|

|

(30,334 |

) |

|

|

(46,346 |

) |

| |

|

$ |

4,596 |

|

|

$ |

(10,794 |

) |

|

$ |

(3,150 |

) |

|

$ |

(33,201 |

) |

| |

|

|

|

|

|

|

|

|

| Segment Adjusted

EBIT1 |

|

|

|

|

|

|

|

|

|

IHT |

|

$ |

7,541 |

|

|

$ |

5,539 |

|

|

$ |

12,304 |

|

|

$ |

5,689 |

|

|

MS |

|

|

12,819 |

|

|

|

7,038 |

|

|

|

16,288 |

|

|

|

7,551 |

|

|

Corporate and shared support services |

|

|

(12,699 |

) |

|

|

(16,473 |

) |

|

|

(26,652 |

) |

|

|

(32,321 |

) |

| |

|

$ |

7,661 |

|

|

$ |

(3,896 |

) |

|

$ |

1,940 |

|

|

$ |

(19,081 |

) |

| |

|

|

|

|

|

|

|

|

| Segment Adjusted

EBITDA1 |

|

|

|

|

|

|

|

|

|

IHT |

|

$ |

10,729 |

|

|

$ |

8,635 |

|

|

$ |

18,546 |

|

|

$ |

12,039 |

|

|

MS |

|

|

17,523 |

|

|

|

11,672 |

|

|

|

25,745 |

|

|

|

17,069 |

|

|

Corporate and shared support services |

|

|

(10,807 |

) |

|

|

(14,629 |

) |

|

|

(22,639 |

) |

|

|

(29,785 |

) |

| |

|

$ |

17,445 |

|

|

$ |

5,678 |

|

|

$ |

21,652 |

|

|

$ |

(677 |

) |

___________________

|

1 |

|

See the accompanying reconciliation of non-GAAP financial measures

at the end of this earnings release. |

|

|

|

|

TEAM, INC. AND

SUBSIDIARIESNon-GAAP Financial

Measures(Unaudited)

The Company uses supplemental non-GAAP financial

measures which are derived from the consolidated financial

information, including adjusted net income (loss); adjusted net

income (loss) per share; earnings before interest and taxes

(“EBIT”); Adjusted EBIT; adjusted earnings before interest, taxes,

depreciation, and amortization (“Adjusted EBITDA”) and free cash

flow to supplement financial information presented on a GAAP

basis.

The Company defines adjusted net income (loss)

and adjusted net income (loss) per share to exclude the following

items: non-routine legal costs and settlements, non-routine

professional fees, restructuring charges, loss on debt

extinguishment, certain severance charges, and certain other items

that we believe are not indicative of core operating activities.

Consolidated Adjusted EBIT, as defined by us, excludes the costs

excluded from adjusted net income (loss) as well as income tax

expense (benefit), interest charges, foreign currency (gain) loss,

and items of other (income) expense. Consolidated Adjusted EBITDA

further excludes from consolidated Adjusted EBIT depreciation,

amortization and non-cash share-based compensation costs. Segment

Adjusted EBIT is equal to segment operating income (loss) excluding

costs associated with non-routine legal costs and settlements,

non-routine professional fees, loss on debt extinguishment, certain

severance charges, and certain other items as determined by

management. Segment Adjusted EBITDA further excludes from segment

Adjusted EBIT depreciation, amortization, and non-cash share-based

compensation costs. Free cash flow is defined as net cash provided

by (used in) operating activities minus capital expenditures. Net

debt is defined as the sum of the current and long-term portions of

debt, including finance lease obligations, less cash and cash

equivalents.

Management believes these non-GAAP financial

measures are useful to both management and investors in their

analysis of our financial position and results of operations. In

particular, adjusted net income (loss), adjusted net income (loss)

per share, consolidated Adjusted EBIT, and consolidated Adjusted

EBITDA are meaningful measures of performance that are commonly

used by industry analysts, investors, lenders, and rating agencies

to analyze operating performance in our industry, perform

analytical comparisons, benchmark performance between periods, and

measure our performance against externally communicated targets.

Our segment Adjusted EBIT and segment Adjusted EBITDA are also used

as a basis for the chief operating decision maker to evaluate the

performance of our reportable segments. Free cash flow is used by

our management and investors to analyze our ability to service and

repay debt and return value directly to stakeholders.

Non-GAAP financial measures have important

limitations as analytical tools, because they exclude some, but not

all, items that affect net earnings and operating income. These

measures should not be considered substitutes for their most

directly comparable U.S. GAAP financial measures and should be read

only in conjunction with financial information presented on a GAAP

basis. Further, our non-GAAP financial measures may not be

comparable to similarly titled measures of other companies who may

calculate non-GAAP financial measures differently, limiting the

usefulness of those measures for comparative purposes. The

liquidity measure of free cash flow does not represent a precise

calculation of residual cash flow available for discretionary

expenditures. Reconciliations of each non-GAAP financial measure to

its most directly comparable GAAP financial measure are presented

below.

|

|

|

TEAM, INC. AND SUBSIDIARIES |

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES |

|

(unaudited, in thousands except per share

data) |

| |

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Adjusted Net

Loss: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(15,753 |

) |

|

$ |

(28,202 |

) |

|

$ |

(40,464 |

) |

|

$ |

(66,535 |

) |

|

Professional fees and other1 |

|

|

2,647 |

|

|

|

4,693 |

|

|

|

4,368 |

|

|

|

10,037 |

|

|

Legal costs2 |

|

|

200 |

|

|

|

1,200 |

|

|

|

200 |

|

|

|

1,728 |

|

|

Severance charges, net3 |

|

|

217 |

|

|

|

1,008 |

|

|

|

522 |

|

|

|

2,358 |

|

|

Natural disaster insurance recovery |

|

|

— |

|

|

|

(872 |

) |

|

|

— |

|

|

|

(872 |

) |

|

Loss on debt extinguishment |

|

|

1,582 |

|

|

|

— |

|

|

|

1,582 |

|

|

|

— |

|

|

Tax impact of adjustments and other net tax items4 |

|

|

(7 |

) |

|

|

(3 |

) |

|

|

(85 |

) |

|

|

(7 |

) |

| Adjusted Net

Loss |

|

$ |

(11,114 |

) |

|

$ |

(22,176 |

) |

|

$ |

(33,877 |

) |

|

$ |

(53,291 |

) |

| |

|

|

|

|

|

|

|

|

| Adjusted Net Loss per

common share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(2.55 |

) |

|

$ |

(5.14 |

) |

|

$ |

(7.78 |

) |

|

$ |

(13.17 |

) |

| |

|

|

|

|

|

|

|

|

| Consolidated Adjusted

EBIT and Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(15,753 |

) |

|

$ |

(28,202 |

) |

|

$ |

(40,464 |

) |

|

$ |

(66,535 |

) |

|

Provision for income taxes |

|

|

2,089 |

|

|

|

2,191 |

|

|

|

2,948 |

|

|

|

2,717 |

|

|

Gain on equipment sale |

|

|

7 |

|

|

|

(1,172 |

) |

|

|

(296 |

) |

|

|

(3,485 |

) |

|

Interest expense, net |

|

|

16,691 |

|

|

|

18,476 |

|

|

|

33,432 |

|

|

|

37,055 |

|

|

Professional fees and other1 |

|

|

2,647 |

|

|

|

4,693 |

|

|

|

4,368 |

|

|

|

10,037 |

|

|

Legal costs2 |

|

|

200 |

|

|

|

1,200 |

|

|

|

200 |

|

|

|

1,728 |

|

|

Severance charges, net3 |

|

|

217 |

|

|

|

1,008 |

|

|

|

522 |

|

|

|

2,358 |

|

|

Foreign currency gain |

|

|

143 |

|

|

|

(1,029 |

) |

|

|

(34 |

) |

|

|

(1,691 |

) |

|

Pension credit5 |

|

|

(162 |

) |

|

|

(189 |

) |

|

|

(318 |

) |

|

|

(393 |

) |

|

Natural disaster insurance recovery |

|

|

— |

|

|

|

(872 |

) |

|

|

— |

|

|

|

(872 |

) |

|

Loss on debt extinguishment |

|

|

1,582 |

|

|

|

— |

|

|

|

1,582 |

|

|

|

— |

|

| Consolidated Adjusted

EBIT |

|

|

7,661 |

|

|

|

(3,896 |

) |

|

|

1,940 |

|

|

|

(19,081 |

) |

|

Depreciation and amortization |

|

|

|

|

|

|

|

|

|

Amount included in operating expenses |

|

|

3,694 |

|

|

|

3,914 |

|

|

|

7,413 |

|

|

|

8,072 |

|

|

Amount included in SG&A expenses |

|

|

5,845 |

|

|

|

5,095 |

|

|

|

11,672 |

|

|

|

10,391 |

|

|

Total depreciation and amortization |

|

|

9,539 |

|

|

|

9,009 |

|

|

|

19,085 |

|

|

|

18,463 |

|

|

Non-cash share-based compensation costs |

|

|

245 |

|

|

|

565 |

|

|

|

627 |

|

|

|

(59 |

) |

| Consolidated Adjusted

EBITDA |

|

$ |

17,445 |

|

|

$ |

5,678 |

|

|

$ |

21,652 |

|

|

$ |

(677 |

) |

| |

|

|

|

|

|

|

|

|

| Free Cash

Flow: |

|

|

|

|

|

|

|

|

|

Cash used in operating activities |

|

$ |

(5,854 |

) |

|

$ |

(511 |

) |

|

$ |

(23,617 |

) |

|

$ |

(56,486 |

) |

|

Capital expenditures |

|

|

(2,381 |

) |

|

|

(5,279 |

) |

|

|

(5,073 |

) |

|

|

(11,416 |

) |

| Free Cash

Flow |

|

$ |

(8,235 |

) |

|

$ |

(5,790 |

) |

|

$ |

(28,690 |

) |

|

$ |

(67,902 |

) |

____________________________________

|

1 |

|

For the three and six months ended June 30, 2023, includes $1.6

million and $3.2 million, respectively related to debt financing

and $0.7 million and $0.8 million, respectively, related to lease

extinguishment charges. For the three and six months ended June 30,

2022, includes $4.7 million and $10.0 million, respectively,

related to costs associated with the debt financing and corporate

support. |

|

2 |

|

Primarily relates to accrued legal matters and legal fees. |

|

3 |

|

For the three and six months ended June 30, 2023, primarily related

to costs associated with staff reductions. For the three months

ended June 30, 2022, includes $1.0 million primarily related to

customary severance costs associated with staff reductions. For the

six months ended June 30, 2022, includes $1.3 million related to

customary severance costs associated with executive departures and

$1.1 million associated with severance across multiple corporate

departments. |

|

4 |

|

Represents the tax effect of the adjustments. |

|

5 |

|

Represents pension credits for the U.K. pension plan based on the

difference between the expected return on plan assets and the cost

of the discounted pension liability. The pension plan was frozen in

1994 and no new participants have been added since that date.

Accruals for future benefits ceased in connection with a plan

curtailment in 2013. |

|

|

|

|

|

|

|

TEAM, INC. AND SUBSIDIARIES |

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(Continued) |

|

(unaudited, in thousands) |

| |

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

|

|

| Segment Adjusted EBIT

and Adjusted EBITDA: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| IHT |

|

|

|

|

|

|

|

|

|

Operating income |

|

$ |

6,548 |

|

|

$ |

5,514 |

|

|

$ |

11,271 |

|

|

$ |

5,648 |

|

|

Severance charges, net1 |

|

|

165 |

|

|

|

25 |

|

|

|

205 |

|

|

|

41 |

|

|

Professional fees and other |

|

|

828 |

|

|

|

— |

|

|

|

828 |

|

|

|

— |

|

|

Adjusted EBIT |

|

|

7,541 |

|

|

|

5,539 |

|

|

|

12,304 |

|

|

|

5,689 |

|

|

Depreciation and amortization |

|

|

3,188 |

|

|

|

3,096 |

|

|

|

6,242 |

|

|

|

6,350 |

|

|

Adjusted EBITDA |

|

$ |

10,729 |

|

|

$ |

8,635 |

|

|

$ |

18,546 |

|

|

$ |

12,039 |

|

| |

|

|

|

|

|

|

|

|

| MS |

|

|

|

|

|

|

|

|

|

Operating income |

|

$ |

12,720 |

|

|

$ |

6,984 |

|

|

$ |

15,913 |

|

|

$ |

7,497 |

|

|

Severance charges, net1 |

|

|

52 |

|

|

|

54 |

|

|

|

308 |

|

|

|

54 |

|

|

Professional fees and other |

|

|

47 |

|

|

|

— |

|

|

|

67 |

|

|

|

— |

|

|

Adjusted EBIT |

|

|

12,819 |

|

|

|

7,038 |

|

|

|

16,288 |

|

|

|

7,551 |

|

|

Depreciation and amortization |

|

|

4,704 |

|

|

|

4,634 |

|

|

|

9,457 |

|

|

|

9,518 |

|

|

Adjusted EBITDA |

|

$ |

17,523 |

|

|

$ |

11,672 |

|

|

$ |

25,745 |

|

|

$ |

17,069 |

|

| |

|

|

|

|

|

|

|

|

| Corporate and shared

support services |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(35,021 |

) |

|

$ |

(40,700 |

) |

|

$ |

(67,648 |

) |

|

$ |

(79,680 |

) |

|

Provision for income taxes |

|

|

2,089 |

|

|

|

2,191 |

|

|

|

2,948 |

|

|

|

2,717 |

|

|

Gain on equipment sale |

|

|

7 |

|

|

|

(1,172 |

) |

|

|

(296 |

) |

|

|

(3,485 |

) |

|

Interest expense, net |

|

|

16,691 |

|

|

|

18,476 |

|

|

|

33,432 |

|

|

|

37,055 |

|

|

Foreign currency gain |

|

|

143 |

|

|

|

(1,029 |

) |

|

|

(34 |

) |

|

|

(1,691 |

) |

|

Pension credit2 |

|

|

(162 |

) |

|

|

(189 |

) |

|

|

(318 |

) |

|

|

(393 |

) |

|

Professional fees and other3 |

|

|

1,772 |

|

|

|

4,693 |

|

|

|

3,473 |

|

|

|

10,037 |

|

|

Legal costs4 |

|

|

200 |

|

|

|

1,200 |

|

|

|

200 |

|

|

|

1,728 |

|

|

Severance charges, net1 |

|

|

— |

|

|

|

929 |

|

|

|

9 |

|

|

|

2,263 |

|

|

Loss on debt extinguishment |

|

|

1,582 |

|

|

|

— |

|

|

|

1,582 |

|

|

|

— |

|

|

Natural disaster insurance recovery |

|

|

— |

|

|

|

(872 |

) |

|

|

— |

|

|

|

(872 |

) |

|

Adjusted EBIT |

|

|

(12,699 |

) |

|

|

(16,473 |

) |

|

|

(26,652 |

) |

|

|

(32,321 |

) |

|

Depreciation and amortization |

|

|

1,647 |

|

|

|

1,279 |

|

|

|

3,386 |

|

|

|

2,595 |

|

|

Non-cash share-based compensation costs |

|

|

245 |

|

|

|

565 |

|

|

|

627 |

|

|

|

(59 |

) |

|

Adjusted EBITDA |

|

$ |

(10,807 |

) |

|

$ |

(14,629 |

) |

|

$ |

(22,639 |

) |

|

$ |

(29,785 |

) |

___________________

|

1 |

|

For the three and six months ended June 30, 2023, primarily related

to costs associated with staff reductions. For the three months

ended June 30, 2022, includes $1.0 million primarily related to

customary severance costs associated with staff reductions. For the

six months ended June 30, 2022, includes $1.3 million related to

customary severance costs associated with executive departures and

$1.1 million associated with severance across multiple corporate

departments. |

|

2 |

|

Represents pension credits for the U.K. pension plan based on the

difference between the expected return on plan assets and the cost

of the discounted pension liability. The pension plan was frozen in

1994 and no new participants have been added since that date.

Accruals for future benefits ceased in connection with a plan

curtailment in 2013. |

|

3 |

|

For the three and six months ended June 30, 2023, includes $1.6

million and $3.2 million, respectively related to debt financing

and $0.7 million and $0.8 million, respectively, related to lease

extinguishment charges. For the three and six months ended June 30,

2022, includes $4.7 million and $10.0 million, respectively,

related to costs associated with the debt financing and corporate

support. |

|

4 |

|

Primarily relates to accrued legal matters and legal fees. |

|

|

|

|

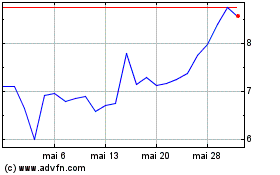

Team (NYSE:TISI)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Team (NYSE:TISI)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024