Turkcell Iletisim Hizmetleri A.S. (NYSE:TKC) (BIST:TCELL):

- Please note that all financial data is consolidated and

comprises that of Turkcell Iletisim Hizmetleri A.S. (the “Company”,

or “Turkcell”) and its subsidiaries and associates (together

referred to as the “Group”), unless otherwise stated.

- We have four reporting segments:

- "Turkcell Turkey" which comprises our telecom, digital services

and digital business services related businesses in Turkey (as used

in our previous releases in periods prior to Q115, this term

covered only the mobile businesses). All non-financial data

presented in this press release is unconsolidated and comprises

Turkcell Turkey only figures, unless otherwise stated. The terms

"we", "us", and "our" in this press release refer only to Turkcell

Turkey, except in discussions of financial data, where such terms

refer to the Group, and except where context otherwise

requires.

- “Turkcell International” which comprises all of our telecom and

digital services related businesses outside of Turkey.

- “Techfin” which comprises all of our financial services

businesses.

- “Other” which mainly comprises our non-group call center and

energy businesses, retail channel operations, smart devices

management and consumer electronics sales through digital channels

and intersegment eliminations.

- In this press release, a year-on-year comparison of our key

indicators is provided and figures in parentheses following the

operational and financial results for December 31, 2022 refer to

the same item as at December 31, 2021. For further details, please

refer to our consolidated financial statements and notes as at and

for December 31, 2022, which can be accessed via our website in the

investor relations section (www.turkcell.com.tr).

- Selected financial information presented in this press release

for the fourth quarter and for the full year of 2021 and 2022 is

based on Turkish Accounting Standards (TAS) / Turkish Financial

Reporting Standards (TFRS) figures in TRY terms unless otherwise

stated.

- In the tables used in this press release totals may not foot

due to rounding differences. The same applies to the calculations

in the text.

- Year-on-year and quarter-on-quarter percentage comparisons

appearing in this press release reflect mathematical

calculation.

Our Initial Assessment of the Earthquakes’

Impact

On February 6th, 2023, two high-magnitude earthquakes,

epicentered in Kahramanmaraş yet impacting 11 cities across

Southeastern Türkiye, have dramatically affected the lives of 14

million people. As Turkcell, we took immediate action after the

quakes as quickly and efficiently as possible to ensure the safety

of our colleagues and to provide communication to our 6.5 million

subscribers in the region. On the very first day, almost half of

our 3,300 base stations in the region was out of service mainly due

to power outage and destruction. We rapidly deployed more than

1,200 network personnel to the region to make the necessary

repairs. We swiftly reactivated 99% of our sites by deploying

around 250 mobile base stations and 1,400 electric generators to

compensate for one tower and around 150 base stations that were

destroyed. We began to provide Wi-Fi services via mobile base

stations in tent and container areas. While providing free

communication packages to subscribers, healthcare personnel and

emergency teams in the region, we have also provided 1-month of

free communication to subscribers in the state of emergency region.

Currently, 68% of our exclusive stores in the region are fully

operational and all our services continue to run uninterruptedly

through our digital channels and containers we have deployed in the

area.

We are deeply saddened by the lives lost, which include 21 of

our colleagues. We will continue providing aid and support for the

families of our colleagues who lost their lives, and for our

citizens affected by the earthquake, as we have done since the

first day of the disaster.

We have prepared our 2023 guidance1 considering all of the above

developments, and based upon the initial impact assessment of the

earthquake on our business. Accordingly, we target revenue growth

of between 55-57%, an EBITDA of around TRY34 billion and an

operational capex over sales ratio2 of around 22%.

We estimate a negative revenue impact of around TRY1.5 billion.

This arises from the steps we have taken to alleviate pressure on

our affected subscribers, such as free communication packages, the

cancellation of line opening-closing fees, the suspension fees, and

from shrinking customer demand in the longer term triggered by the

earthquakes’ impact on people’s purchasing power. In addition, we

expect an impact of around TRY400 million on operational expenses

due to personnel, infrastructure, and network expenses that we have

incurred to date, and will continue to incur in the region. We

expect a replacement CAPEX of circa TRY900 million for mobile and

fixed network investments, particularly in the regions that have

suffered extensive destruction. These assessments include the

effect of the earthquakes based on our initial impact analysis; and

all these estimations are already considered in the 2023 guidance.

However, potential measures that may arise subsequent to this

announcement and other developments over time may further affect

our guidance. We will continue to provide information as such

developments occur over the coming periods.

(1) Please note that this section contains forward-looking

statements based on our initial impact assessment of the

earthquake. Factors such as changes in the state of emergency

measures and potential aftershocks, as well as the risk factors

disclosed in our Annual Report on Form 20-F for 2021 filed with

U.S. Securities and Exchange Commission, could cause actual impacts

to differ materially from our expectations. (1) 2023 guidance

figures are based on TFRS, and do not include the effects of a

likely adoption of inflationary accounting in accordance with IAS

29. (2) Excluding license fee

NOTICE

We are publishing financial statements as of December 31, 2022

prepared in accordance with Turkish Accounting Standards/Turkish

Financial Reporting Standards (“TAS”/“TFRS”) only. These standards

are issued by the Public Oversight Accounting and Auditing

Standards Authority (“POA”) and are in full compliance with

IAS/IFRS Standards. In an announcement published by the POA on

January 20, 2022, it is stated that TAS 29 “Financial Reporting in

Hyperinflationary Economies” does not apply to TFRS financial

statements as of December 31, 2021. Since then and as of the

preparation date of our latest consolidated financial statements,

no new statement has been made by the POA about TAS 29 application.

Consequently, no TAS 29 adjustment was made to our consolidated

financial statements.

Financial statements prepared in accordance with IFRS should

apply IAS 29 “Financial Reporting in Hyperinflationary Economies”

as of December 31, 2022. In this context, financial statements

prepared in accordance with IFRS and TFRS would have significant

differences and would not be comparable as of December 31, 2022. We

intend to publish IFRS financial statements, compliant with IAS 29

to the extent that it remains applicable, with our Annual Report on

Form 20-F that will be filed to the U.S. Securities and Exchange

Commission.

Although we have not prepared a detailed comparison of

differences between IFRS (unadjusted according to IAS 29) and TFRS,

we have noted in our past financial statements that the most

significant differences have appeared in the lines Other Operating

Income/Expense, Finance Income/Expense, and Investment Activity

Income/Expense. In the past, revenue, net income and EBITDA have

generally not differed. While no assurance can be given that this

will be the case for Q4 2022, we are not at present aware of

changes that would cause other significant differences, other than

those resulting from the application of IAS 29.

FINANCIAL HIGHLIGHTS

TRY million

Q421

Q422

y/y%

FY21

FY22

y/y%

Revenue

10,192

16,044

57.4%

35,921

53,878

50.0%

EBITDA1

4,212

6,671

58.4%

15,014

21,994

46.5%

EBITDA Margin (%)

41.3%

41.6%

0.3pp

41.8%

40.8%

(1.0pp)

EBIT2

2,136

4,156

94.6%

7,722

12,516

62.1%

EBIT Margin (%)

21.0%

25.9%

4.9pp

21.5%

23.2%

1.7pp

Net Income

1,385

5,996

333.1%

5,031

11,053

119.7%

Net Income Exc. Fixed Asset Revaluation

Net Impact3

354

1,903

437.4%

3,509

6,445

83.7%

FULL YEAR HIGHLIGHTS

- Solid financial performance:

- Group revenues up 50.0% supported mainly by accelerated ARPU

growth, and strong subscriber net add performance as well as the

contribution of the digital business services and techfin

business

- EBITDA up 46.5% leading to an EBITDA margin of 40.8%; EBIT up

62.1% resulting in an EBIT margin of 23.2%

- Net income up 119.7% to TRY11.1 billion including a major

one-off (net TRY4.6 billion deferred tax income impact) resulting

from fixed asset revaluation; without the one-off net income rose

83.7% to TRY6.4 billion

- Free cash flow4 generation of TRY1.7 billion; net leverage5

level at 0.9x; net short FX position of US$25 million

- Robust operational momentum continued:

- Turkcell Turkey subscriber base up by 2.3 million net

additions; 1.9 million mobile postpaid net additions the highest

performance since 2009

- 220 thousand fixed subscriber net additions; 234 thousand fiber

net additions, best net add performance ever

- 887 thousand new fiber homepasses

- Mobile ARPU6 growth of 40.3%; residential fiber ARPU growth of

26.5%

- 2023 guidance7; revenue growth target of between 55-57%, EBITDA

target of around TRY34 billion, and operational capex over sales

ratio8 target of around 22%

FOURTH QUARTER HIGHLIGHTS

- Strong financial results:

- Group revenues up 57.4% on the back of the strong ARPU

performance of Turkcell Turkey and contribution from digital

business services and techfin business

- EBITDA up 58.4% leading to an EBITDA margin of 41.6%; EBIT up

94.6% resulting in an EBIT margin of 25.9%

- Net income up 333.1% to TRY6.0 billion (including TRY4.1

billion net impact of tax income resulting from fixed asset

revaluation)

- Robust operational performance maintained:

- Quarterly mobile postpaid subscriber net additions of 599

thousand; postpaid subscriber share at 68.1% of mobile subscriber

base

- Quarterly fixed subscriber net additions of 69 thousand

- Year-on-year mobile ARPU5 increased 55.6% mainly driven by

price adjustments, upsell to higher tariffs, and higher postpaid

share

- Residential fiber ARPU growth of 33.3% year-on-year mainly by

price adjustments and upsell efforts, as well as increased IPTV

penetration

- Average monthly data usage of 4.5G subscribers at 16.9 GB in

Q422; smartphone penetration at 87%

- Digital channels’ share9 in sales at 24.9%

(1) EBITDA is a non-GAAP financial measure. See page 20 for the

explanation of how we calculate Adjusted EBITDA and its

reconciliation to net income. (2) EBIT is a non-GAAP financial

measure and is equal to EBITDA minus depreciation and amortization

expenses. (3) Excludes the impact of fixed assets revaluation.

Please refer to table on page 22 for details. (4) Free cash flow

calculation includes EBITDA and the following items as per Turkish

Financial Reporting Standartds (TFRS) cash flow statement;

acquisition of property, plant and equipment, acquisition of

intangible assets, change in operating assets/liabilities, payment

of lease liabilities and income tax paid. (5) Starting from Q421,

we have revised the definition of our net debt calculation to

include "financial assets” reported under current and non-current

assets. Required reserves held in CBRT balances are also considered

in net debt calculation. We believe that these assets are highly

liquid and can be easily converted to cash without significant

change in value. (6) Excluding M2M (7) Please note that this

section contains forward-looking statements based on our initial

impact assessment of the earthquake. Factors such as changes in the

state of emergency measures and potential aftershocks, as well as

the risk factors disclosed in our Annual Report on Form 20-F for

2021 filed with U.S. Securities and Exchange Commission, could

cause actual impacts to differ materially from our expectations.

(7) 2023 guidance figures are based on TFRS, and do not include the

effects of a likely adoption of inflationary accounting in

accordance with IAS 29. (8) Excluding license fee (9) Share of all

sales from digital channels (including voice, data, services &

smart devices) in Turkcell Turkey consumer sales (excluding fixed

business) and equipment related revenues in other segment.

For further details, please refer to our consolidated financial

statements and notes as at December 31, 2022 via our website in the

investor relations section (www.turkcell.com.tr).

COMMENTS BY CEO, MURAT ERKAN

The disaster of the century…

Two devastating earthquakes, epicentered in Kahramanmaraş, with

magnitudes of 7.7 and 7.6 have marked themselves as the greatest

disaster of Türkiye’s modern history. The earthquakes that struck

Türkiye and Syria have claimed thousands of lives and placed our

country into deep mourning. We wish Allah’s mercy upon the victims,

among whom were 21 of our colleagues. We offer our sincere and

heartfelt condolences to those who lost their families and loved

ones. From the first moment of the earthquake, Turkcell made an

initial assessment to swiftly take all necessary actions. On the

first day of the earthquake, we lost approximately half of the

3,300 sites in the region. We deployed mobile base stations,

generators and batteries to the region and within four days

increased our active site rate to over 90%. We provided free voice,

SMS, and internet packages to close to 6.5 million subscribers in

the earthquake region. Additionally, we provided a “Kahraman Paketi

(Hero Package)” to meet the needs of emergency team and health care

professionals. We sustained free Wi-Fi and charging stations in the

region and supported victims with a donation commitment of TRY3.5

billion to the “Türkiye Tek Yürek (Türkiye One Heart)” quake relief

campaign. Being Türkiye’s Turkcell, we will remain by our people as

always.

In 2022, as inflationary pressures topped the agenda, the

tightening policies of Central Banks against inflation and concerns

over recession were in focus. Energy and commodity prices rose

massively in the wake of the Russia-Ukraine war. As we saw an

easing of the pandemic’s impact on Türkiye, the agenda turned to

deterioration in pricing behaviour and the expectation of high

inflation propping up consumer spending. Strong tourism inflows

that returned to pre-pandemic levels supported the current account

balance, as well as the telecommunication sector.

Best mobile postpaid subscriber net addition of the past 13

years

In 2022 we outperformed our expectations. At the start of the

year we targeted adding 1 million net subscribers and ended up

exceeding 2.3 million net subscriber additions thanks to our value

propositions that meet our customers’ needs, increased tourism

activity and strong demand from the corporate segment. By keeping

our focus of enlarging our mobile postpaid base which provides a

higher revenue contribution, we added 1.9 million subscribers, the

record of the past 13 years. Accordingly, the postpaid share in the

mobile base increased to 68.1%.

The mobile churn rate slightly increased to 2.7%, as we

deactivated a higher number of inactive subscribers in the fourth

quarter, since Türkiye had a greater tourist and visitor inflow in

2022 compared to the previous year. The Mobile Number Portability

(MNP) market, which was rationalized as our sequential price

increases were followed by competitors throughout the year, was

triggered by aggressive price offerings in the market during the

last quarter of the year.

With an awareness of Türkiye lagging behind OECD countries in

terms of speed and capacity of fixed broadband services, we

continued to invest to our fiber infrastructure to provide fiber

services that our customers demand. In 2022, we reached 887

thousand homes with our end-to-end fiber, and total fiber

homepasses reached 5.4 million. For the year we had a record net

fiber add of 234 thousand subscribers. Thanks to the increased

penetration of our complementary, content-rich TV+ service, and our

superior customer experience, the fiber churn rate decreased to an

all-time low of 1.1%. Moreover, we sustained our focus on high

speed internet packages. On the fiber subscriber acquisition side,

37% of the subscribers preferred speeds of 100 Mbps and above.

In line with our inflationary pricing policy, we have made

sequential price adjustments since December 2021, where inflation

began to rise. We have emphasized that price adjustments would be

reflected in ARPU growth with a lag, due to the contract-based

nature of our business. Accelerating from the first quarter of the

year, Mobile ARPU1 rose 55.6%, and Residential Fiber ARPU rose

33.3% year-over-year in the fourth quarter. For 2022, respective

ARPU growth levels were 40.3% and 26.5%. Mobile ARPU growth was

driven by sequential price adjustments, a higher postpaid

subscriber base and upsell efforts, whereas Fiber ARPU growth was

sustained by price adjustments, higher speed package preference of

new subscribers in particular and increasing IPTV penetration.

Our consolidated revenue increased by 50.0% year-over-year in

2022 to TRY53.9 billion. Rising 46.5% we registered TRY22.0 billion

EBITDA2. Thanks to our strong operational performance and the

contribution of TRY4.6 billion net deferred tax income arising from

fixed asset revaluation, net income realized at TRY11.1

billion.

The support of our strategic focus areas continues

In 2022, the standalone paid users3 of our digital services and

solutions, which are developed by Turkcell Engineers, increased by

1.1 million year-on-year to 5.1 million, while standalone revenues

rose 30.3%. Digital TV platform TV+ continues to differentiate

itself from the peers. According to 3rd quarter ICTA data, the pay

TV market reached 7.7 subscribers, where TV+, with its 15.9% market

share, is the only provider to have steadily increased its market

share since the second quarter of 2014. This performance is

attributable to its extensive sales network, strong brand

recognition and rich content. IPTV subscribers increased by 200

thousand year-on-year to 1.3 million while OTT TV users reached 1.0

million. With an effort to increase the international penetration

of BiP, our instant messaging app, we entered the 120 million

mobile user Pakistani market through a partnership agreement with

“Jazz” in December. Currently, 37% of 17.9 million BiP users3 are

from global markets.

The revenues of our digital business services, the greatest

supporter of the digital transformation of its customers, rose

88.3% year-on-year, exceeding TRY4.3 billion. End-to-end tailored

digital transformation projects, data center and cloud storage

services were the main focus areas contributing to growth. While we

have signed 2,800 system integrator and managed service projects to

date, we have a contract value (backlog) from system integration

projects of TRY2.8 billion to be realized beyond 2022, doubling the

level of last year.

Serving with Paycell and Financell brands, our techfin segment

sustained its strong contribution to topline growth this year. In

2022, Financell’s revenue rose 59.4% to TRY980 million, while its

loan portfolio reached TRY3.4 billion up from last year’s TRY2.1

billion. With its wide-range product portfolio, Paycell serves 7.7

million users3, and its revenues rose 87.2% to TRY877 million.

Mobile payment services “Pay Later”, driving 66% of the topline,

was the main driver of the growth, while POS solutions,

accelerating its reach from the last quarter of 2021, was also

supportive. During the year, Paycell launched new services almost

in every vertical of the Turkish techfin ecosystem. And as of

December, its users are able to invest in shares listed on the NYSE

and Nasdaq Stock Exchange via the Paycell application.

We entered 2023 with uncertainties

As we left 2022 behind, having experienced consecutive

macroeconomic and political challenges, we are entering 2023 with

hopes of healing our wounds caused by the greatest disaster of the

past century. Yet 2023 comes with series of challenges: the global

economies face recession concerns arising in the post pandemic

period, political uncertainty caused by the ongoing war in the

central-Europe, energy, commodity and labor cost pressure on

producer costs, and domestically, a much busier political agenda.

Therefore, we foresee that our guidance4 may change in the light of

changing conditions. At this stage, we target revenue growth of

55-57% and EBITDA of around TRY34 billion. We expect an operational

CAPEX over sales ratio of around 22%.

I would like to thank all of my colleagues those who have given

their all in tackling the impact of the devastating earthquakes. As

Türkiye’s Turkcell, we will continue working hard and heal our

wounds together.

(1) Excluding M2M (2) EBITDA is a non-GAAP financial measure.

See page 20 for the explanation of how we calculate Adjusted EBITDA

and its reconciliation to net income (3) 3-month active (4) Please

note that this section contains forward-looking statements based on

our initial impact assessment of the earthquake. Factors such as

changes in the state of emergency measures and potential

aftershocks, as well as the risk factors disclosed in our Annual

Report on Form 20-F for 2021 filed with U.S. Securities and

Exchange Commission, could cause actual impacts to differ

materially from our expectations. (4) 2023 guidance figures are

based on TFRS, and do not include the effects of a likely adoption

of inflationary accounting in accordance with IAS 29.

FINANCIAL AND OPERATIONAL REVIEW

Financial Review of Turkcell Group

Profit & Loss Statement (million

TRY)

Quarter

Year

Q421

Q422

y/y%

FY21

FY22

y/y%

Revenue

10,191.5

16,043.9

57.4%

35,920.5

53,878.5

50.0%

Cost of revenue1

(5,019.9)

(7,935.3)

58.1%

(17,938.1)

(27,310.6)

52.2%

Cost of revenue1/Revenue

(49.3%)

(49.5%)

(0.2pp)

(49.9%)

(50.7%)

(0.8pp)

Gross Margin1

50.7%

50.5%

(0.2pp)

50.1%

49.3%

(0.8pp)

Administrative expenses

(276.8)

(473.4)

71.0%

(919.0)

(1,519.0)

65.3%

Administrative expenses/Revenue

(2.7%)

(3.0%)

(0.3pp)

(2.6%)

(2.8%)

(0.2pp)

Selling and marketing expenses

(576.6)

(899.8)

56.1%

(1,778.5)

(2,700.1)

51.8%

Selling and marketing

expenses/Revenue

(5.7%)

(5.6%)

0.1pp

(5.0%)

(5.0%)

-

Net impairment losses on financial and

contract assets

(106.7)

(63.9)

(40.1%)

(271.2)

(354.9)

30.9%

EBITDA2

4,211.6

6,671.5

58.4%

15,013.8

21,993.8

46.5%

EBITDA Margin

41.3%

41.6%

0.3pp

41.8%

40.8%

(1.0pp)

Depreciation and amortization

(2,075.5)

(2,515.7)

21.2%

(7,291.9)

(9,478.0)

30.0%

EBIT3

2,136.1

4,155.8

94.6%

7,721.9

12,515.8

62.1%

EBIT Margin

21.0%

25.9%

4.9pp

21.5%

23.2%

1.7pp

Net finance income / (expense)

(6,645.2)

(3,424.2)

(48.5%)

(10,144.6)

(13,489.0)

33.0%

Finance income

2,569.6

(642.4)

(125.0%)

3,051.1

210.8

(93.1%)

Finance expense

(9,214.8)

(2,781.8)

(69.8%)

(13,195.7)

(13,699.8)

3.8%

Other income / (expense)

4,355.8

1,028.9

(76.4%)

6,409.6

6,800.9

6.1%

Investment activity income / (expense)

474.7

157.6

(66.8%)

464.1

1,779.9

283.5%

Non-controlling interests

(0.1)

0.9

n.m

(0.2)

1.0

n.m

Share of profit of equity accounted

investees

63.6

(10.0)

(115.7%)

90.1

(71.4)

(179.3%)

Income tax expense

999.7

4,087.3

308.9%

490.2

3,516.1

617.3%

Net Income

1,384.6

5,996.3

333.1%

5,031.1

11,053.2

119.7%

(1) Excluding depreciation and amortization expenses. (2) EBITDA

is a non-GAAP financial measure. See page 20 for the explanation of

how we calculate Adjusted EBITDA and its reconciliation to net

income. (3) EBIT is a non-GAAP financial measure and is equal to

EBITDA minus depreciation and amortization expenses.

Revenue of the Group grew by 57.4% year-on-year in Q422.

Turkcell Turkey’s growing customer base was the main driver of this

performance with strong ARPU growth as a result of price

adjustments to reflect inflationary impacts, larger postpaid

subscriber base, and upsell efforts. Solid demand for digital

business services and techfin also contributed to revenue

growth.

Turkcell Turkey revenues, comprising 78% of Group revenues, rose

61.9% year-on-year in Q422 to TRY12,449 million (TRY7,689

million).

- Consumer segment revenues grew 65.2% year-on-year on the back

of a larger subscriber base and price adjustments to reflect

inflationary impacts.

- Corporate segment revenues rose 75.8% year-on-year supported

by the strong momentum of digital business services, which grew

86.7% year-on-year.

- Standalone digital services revenues registered as part of

consumer and corporate segments grew 51.0% year-on-year in Q422.

The increased number of stand-alone paid users and price

adjustments of services were the main drivers of this growth.

Similar to the previous three quarters, in Q422 digital services

revenues growth was negatively impacted by regulatory decision that

amended the usage conditions of our voicemail service, the revenues

of which are reported under digital services, as of December 1st,

2021. Excluding this impact, growth would have been 69%.

- Wholesale revenues rose 35.9% year-on-year to TRY934 million

(TRY687 million), mainly due to customers’ data capacity upgrades

and the positive impact of currency movements.

Turkcell International revenues, comprising 11% of Group

revenues, rose 40.9% year-on-year to TRY1,813 million (TRY1,286

million) mainly due to lifecell’s performance and positive currency

effects.

Techfin segment revenues, comprising 4% of Group revenues, rose

76.8% year-on-year to TRY583 million (TRY330 million). This was

driven by a 93.6% rise in Paycell revenues and 64.4% growth the

finance company, Financell. Please refer to the Techfin section for

details.

Other subsidiaries' revenues, at 7% of Group revenues, including

mainly non-group call center and energy business revenues, digital

channels, and consumer electronics sales revenues, increased 35.4%

year-on-year to TRY1,199 million (TRY886 million).

For the full year, Turkcell Group revenues rose 50.0%.

Turkcell Turkey revenues grew 50.1% to TRY40,851 million

(TRY27,224 million).

- Consumer business rose 47.9% driven mainly by strong

subscriber net additions both in mobile and fixed segments, price

adjustments and upsell efforts.

- Corporate revenues rose 58.3% mainly supported by digital

business services revenue growth of 88.3%.

- Standalone digital services revenues from consumer and

corporate segments grew 30.3% driven mainly by expanding standalone

paid user base.

- Wholesale revenues grew 72.7% to TRY3,285 million (TRY1,903

million).

Turkcell International revenues rose 69.4% to TRY6,354 million

(TRY3,750 million).

Techfin segment revenues rose 71.9% to TRY1,849 million

(TRY1,076 million).

Other subsidiaries’ revenues were at TRY4,825 million (TRY3,871

million), indicating a 24.6% growth.

Cost of revenue (excluding depreciation and amortization)

increased to 49.5% (49.3%) as a percentage of revenues in Q422.

This was driven mainly by the increase in radio expenses (1.8pp)

and other cost items (1.3pp), despite the decline in

interconnection cost (1.6pp) and cost of goods sold (1.3pp) as a

percentage of revenues.

For the full year, cost of revenue (excluding depreciation and

amortization) rose to 50.7% (49.9%) as a percentage of revenues.

This was due mainly to the rise in radio expenses (2.0pp) and other

cost items (1.7pp), despite the decline in cost of goods sold

(1.7pp) and interconnection expenses (1.2pp) as a percentage of

revenues.

Administrative expenses increased to 3.0% (2.7%) as a

percentage of revenues in Q422.

For the full year, administrative expenses were at 2.8% (2.6%)

as a percentage of revenues.

Selling and marketing expenses decreased to 5.6% (5.7%)

as a percentage of revenues in Q422. This was driven mainly by the

decline in marketing expenses (0.2pp) despite the rise in selling

expenses (0.1pp) as a percentage of revenues.

For the full year, selling and marketing expenses were at 5.0%

(5.0%) as a percentage of revenues.

Net impairment losses on financial and contract assets

was at 0.4% (1.0%) as a percentage of revenues in Q422.

For the full year, net impairment losses on financial and

contract assets was at 0.7% (0.8%) as a percentage of revenues.

EBITDA1 rose by 58.4% year-on-year in Q422 leading to an

EBITDA margin of 41.6% (41.3%).

(1) EBITDA is a non-GAAP financial measure. See page 20 for the

explanation of how we calculate adjusted EBITDA and its

reconciliation to net income

- Turkcell Turkey’s EBITDA rose 60.2% to TRY5,208 million

(TRY3,252 million) leading to an EBITDA margin of 41.8%

(42.3%).

- Turkcell International EBITDA increased 46.9% to TRY923

million (TRY628 million) driving an EBITDA margin of 50.9% (48.8%)

on 2.1pp improvement.

- Techfin segment EBITDA rose 42.7% to TRY274 million (TRY192

million) with an EBITDA margin of 47.0% (58.2%).

- The EBITDA of other subsidiaries increased 90.3% to TRY267

million (TRY140 million).

For the full year, EBITDA grew 46.5% resulting in an EBITDA

margin of 40.8% (41.8%).

- Turkcell Turkey’s EBITDA rose 41.3% to TRY17,197 million

(TRY12,168 million) leading to an EBITDA margin of 42.1%

(44.7%).

- Turkcell International EBITDA increased 76.8% to TRY3,233

million (TRY1,828 million) driving an EBITDA margin of 50.9%

(48.8%) on 2.1pp improvement.

- Techfin segment EBITDA rose 41.1% to TRY902 million (TRY639

million) with an EBITDA margin of 48.8% (59.4%).

- The EBITDA of other subsidiaries rose 74.9% to TRY662 million

(TRY379 million).

Depreciation and amortization expenses increased 21.2%

year-on-year in Q422. For the full year depreciation and

amortization expenses increased 30.0%.

Net finance expense decreased to TRY3,424 million

(TRY6,645 million) in Q422. This was mainly driven by lower FX

losses.

For the full year, net finance expense increased to TRY13,489

million (TRY10,145 million) mainly due to lower fair value gain on

derivate instruments compared to FY21.

See Appendix A for details of net foreign exchange gain and

loss.

Net other operating income decreased to TRY1,029 million

(TRY4,356 million) in Q422. For the full year, net other operating

income increased to TRY6,801 million (TRY6,410 million) mainly due

to interest income from time deposits.

See Appendix A for details of net foreign exchange gain and

loss.

Net investment activity income was TRY158 million in Q422

compared to TRY475 million in Q421.

For the full year, net investment activity income increased to

TRY1,780 million (TRY464 million). This was driven mainly by the

fair value difference recognized on currency-protected time

deposits.

Income tax expense: The deferred tax income of TRY3,895

million (TRY1,016 million) and positive impact of current tax

expense of TRY193 million were reported, leading to an income tax

gain of TRY4,087 million in Q422.

For the full year, deferred tax income of TRY4,047 million and

current tax expense of TRY531 million were reported, leading to an

income tax gain of TRY3,516 million.

Please note that in Q422, we made use of the right introduced by

Law No. 7338, which allows the revaluation of properties and

depreciable economic assets under certain conditions. This resulted

in an impact on the deferred tax asset reported in Q422. For the

full year, net impact was at TRY4.6 billion. Please refer to our

consolidated financial statements and notes as at December 31, 2022

for details.

Net income of the Group increased by 333.1% to TRY5,996

million (TRY1,385 million) in Q422. This resulted mainly from

strong operational performance and the positive impact of deferred

tax income relating to the revaluation of assets as explained

above.

For the full year, group net income rose 119.7% to TRY11,053

million (TRY5,031 million) on the back of strong operational

performance and the deferred tax income impact despite lower

finance income. Without the deferred tax income impact, group net

income is TRY6,445 million.

Please note that in FY22 an impairment charge of TRY214 million

has been recognized on the assets of Ukraine in territories under

the control of Ukraine but not operating for more than 92 days and

those in territories invaded by Russia.

Total cash & debt: Consolidated cash as of December

31, 2022 increased to TRY25,961 million from TRY24,344 million as

of September 30, 2022. This was driven mainly by the positive

impact of currency movements. Excluding FX swap transactions, 51%

of our cash is in US$, 15% in EUR, and 32% in TRY.

Consolidated debt as of December 31, 2022 increased to TRY53,854

million from TRY51,922 million as of September 30, 2022 due mainly

to the impact of currency movements. Please note that TRY3,055

million of our consolidated debt is comprised of lease obligations.

Please note that 46% of our consolidated debt is in US$, 26% in

EUR, 3% in CNY, 5% in UAH, and 19% in TRY.

Net debt1 as of December 31, 2022 was at TRY20,838 million with

a net debt to EBITDA ratio of 0.9 times. Excluding finance company

consumer loans, our telco only net debt was at TRY17,473 million

with a leverage of 0.8 times.

Turkcell Group had a short FX position of US$25 million as at

the end of the year (Please note that this figure takes hedging

portfolio and advance payments into account). The short FX position

of US$25 million is in line with our FX neutral definition, which

is between -US$200 million and +US$200 million.

Capital expenditures: Capital expenditures, including

non-operational items, amounted to TRY6,434 million in Q422. For

the full year, capital expenditures including non-operational items

were at TRY16,361 million.

For Q422 and the full year, operational capital expenditures

(excluding license fees) at the Group level were at 27.8% and 20.2%

of total revenues, respectively.

Capital expenditures (million

TRY)

Quarter

Year

Q421

Q422

FY21

FY22

Operational Capex

2,686.3

4,454.3

7,629.8

10,859.4

License and Related Costs

-

317.5

-

317.5

Non-operational Capex (Including IFRS15

& IFRS16)

1,611.1

1,662.5

3,849.6

5,183.6

Total Capex

4,297.4

6,434.3

11,479.4

16,360.6

(1) Starting from Q421, we have revised the definition of our

net debt calculation to include "financial assets” reported under

current and non-current assets. Required reserves held in CBRT

balances are also considered in net debt calculation. We believe

that these assets are highly liquid and can be easily converted to

cash without significant change in value.

Summary of Operational Data

Quarter

Year

Q421

Q422

y/y %

FY21

FY22

y/y %

Number of subscribers (million)

39.4

41.7

5.8%

39.4

41.7

5.8%

Mobile Postpaid (million)

23.7

25.6

8.0%

23.7

25.6

8.0%

Mobile M2M (million)

3.3

4.0

21.2%

3.3

4.0

21.2%

Mobile Prepaid (million)

12.0

12.0

-

12.0

12.0

-

Fiber (thousand)

1,887.8

2,121.8

12.4%

1,887.8

2,121.8

12.4%

ADSL (thousand)

754.9

751.4

(0.5%)

754.9

751.4

(0.5%)

Superbox (thousand)1

603.6

670.7

11.1%

603.6

670.7

11.1%

Cable (thousand)

54.6

43.9

(19.6%)

54.6

43.9

(19.6%)

IPTV (thousand)

1,082.2

1,281.7

18.4%

1,082.2

1,281.7

18.4%

Churn (%)2

Mobile Churn (%)

2.5%

2.7%

0.2pp

2.0%

2.0%

-

Fixed Churn (%)

1.6%

1.3%

(0.3pp)

1.5%

1.4%

(0.1pp)

ARPU (Average Monthly Revenue per User)

(TRY)

Mobile ARPU, blended

54.6

83.8

53.5%

50.5

70.0

38.6%

Mobile ARPU, blended (excluding M2M)

59.5

92.6

55.6%

54.9

77.0

40.3%

Postpaid

68.2

101.6

49.0%

62.8

84.7

34.9%

Postpaid (excluding M2M)

78.3

118.7

51.6%

71.7

98.4

37.2%

Prepaid

28.6

47.9

67.5%

26.9

40.5

50.6%

Fixed Residential ARPU, blended

82.2

110.5

34.4%

77.9

98.7

26.7%

Residential Fiber ARPU

83.0

110.6

33.3%

78.4

99.2

26.5%

Average mobile data usage per user

(GB/user)

13.3

15.7

18.0%

13.3

14.7

10.5%

Mobile MoU (Avg. Monthly Minutes of

usage per subs) blended

548.7

533.6

(2.8%)

551.2

546.4

(0.9%)

(1) Superbox subscribers are included in mobile subscribers.

(2) Churn figures represent average monthly churn figures for

the respective quarters.

Turkcell Turkey subscriber base grew by 2.3 million net

additions in FY22 to 41.7 million, thanks to our customer-centric

strategy and differentiated value proposition offered to customers.

In addition, we achieved and doubled our 1 million net subscriber

additions target for the year on the back of our diversified

solutions that meet customer needs and our innovative campaigns

that facilitate their lives.

On the mobile front, our subscriber base expanded to 37.5

million on 1.9 million net annual additions in FY22. This was

driven by net additions from the postpaid subscriber base, which

reached 68.1% (66.4%) of total mobile subscribers. We had 599

thousand quarterly postpaid net additions in Q422. In FY22, we had

a net 10 thousand decline in our prepaid subscribers, due mainly to

the disconnection of 430 thousand inactive prepaid subscribers

during the quarter in line with our churn policy.

On the fixed front, our fiber subscriber base grew by 58

thousand net additions in Q422. In FY22, we had 234 thousand fiber

net additions, making the best net add performance ever. This

resulted mainly by focus on fiber network investments, and the

strong demand for high-speed and quality broadband connections. In

FY22, we had a net 14 thousand decline in our ADSL and cable

subscribers. Total fixed subscribers reached 2.9 million on 69

thousand quarterly and 220 thousand annual net additions.

Meanwhile, IPTV customers reached 1.3 million on 51 thousand

quarterly and 200 thousand annual net additions.

The average monthly mobile churn rate was at 2.7% in Q422, and

2.0% in FY22. Meanwhile, the average monthly fixed churn rate was

at 1.3% in Q422 and 1.4% in FY22 on the back of our superior

customer experience resulting from the speed and quality we offer

on our fiber infrastructure which plays an important role in

maintaining a healthy churn level.

Our mobile ARPU (excluding M2M) rose 55.6% year-on-year in Q422

driven mainly by price adjustments to reflect inflationary impacts

and upsell to higher tariffs, as well as larger postpaid subscriber

base. Mobile ARPU (excluding M2M) grew 40.3% for the full year

mainly on the same drivers.

Our residential fiber ARPU growth was 33.3% year-on-year in

Q422. This resulted mainly from price adjustments, upsell to higher

tariffs, and higher IPTV penetration at 67.0% in Q422. For the full

year, fiber residential ARPU rose 26.5%.

Average monthly mobile data usage per user rose 10.5% in FY22 to

14.7 GB with the increasing number and data consumption of 4.5G

users. Accordingly, the average mobile data usage of 4.5G users

reached 16.0 GB in FY22.

Total smartphone penetration on our network reached 87% in Q422.

93% of those smartphones were 4.5G compatible.

TURKCELL INTERNATIONAL

lifecell1 Financial

Data

Quarter

Year

Q421

Q422

y/y%

FY21

FY22

y/y%

Revenue (million UAH)

2,406.4

2,606.8

8.3%

8,482.7

9,411.7

11.0%

EBITDA (million UAH)

1,319.1

1,505.6

14.1%

4,751.2

5,446.5

14.6%

EBITDA margin (%)

54.8%

57.8%

3.0pp

56.0%

57.9%

1.9pp

Net income (million UAH)

237.9

408.8

71.8%

610.9

972.3

59.2%

Capex (million UAH)

1,319.3

997.4

(24.4%)

3,593.6

3,007.6

(16.3%)

Revenue (million TRY)

996.6

1,326.1

33.1%

2,805.7

4,773.6

70.1%

EBITDA (million TRY)

544.5

765.8

40.6%

1,566.4

2,763.4

76.4%

EBITDA margin (%)

54.6%

57.7%

3.1pp

55.8%

57.9%

2.1pp

Net income (million TRY)

98.1

207.8

111.8%

210.8

485.5

130.3%

(1) Since July 10, 2015, we hold a 100% stake in lifecell.

lifecell (Ukraine) had another positive revenue growth

performance. Accordingly, lifecell revenues rose 8.3% year-on-year

in Q422 in local currency terms on the back of ARPU growth

supported by price adjustments and increased data usage. lifecell’s

EBITDA grew 14.1% year-on-year leading to an EBITDA margin of

57.8%.

lifecell revenues in TRY terms grew 33.1% year-on-year in Q422

mainly due to price adjustments and the positive impact of currency

movements. lifecell’s EBITDA in TRY terms grew by 40.6%, leading to

an EBITDA margin of 57.7%.

For the full year, lifecell revenues in local currency terms

increased 11.0%, while its EBITDA rose 14.6% resulting in an EBITDA

margin of 57.9%. lifecell also continued to report positive net

income in 2022. In TRY terms, lifecell registered revenue growth of

70.1% with an EBITDA margin of 57.9%.

lifecell Operational Data

Quarter

Year

Q421

Q422

y/y%

FY21

FY22

y/y%

Number of subscribers

(million)2

10.1

10.2

1.0%

10.1

10.2

1.0%

Active (3 months)3

9.2

8.5

(7.6%)

9.2

8.5

(7.6%)

MOU (minutes) (12 months)

179.0

148.0

(17.3%)

180.9

156.9

(13.3%)

ARPU (Average Monthly Revenue per

User), blended (UAH)

80.2

86.0

7.2%

73.7

77.1

4.6%

Active (3 months) (UAH)

88.5

104.5

18.1%

83.2

91.5

10.0%

(2) We may occasionally offer campaigns and tariff schemes that

have an active subscriber life differing from the one that we

normally use to deactivate subscribers and calculate churn.

(3) Active subscribers are those who in the past three months

made a revenue generating activity.

The three-month active subscriber base of lifecell declined to

8.5 million in Q422, as people have fled the country because of the

ongoing war. Meanwhile, lifecell’s 3-month active ARPU rose 18.1%

year-on-year on the back of price adjustments and higher data

usage. Meanwhile, lifecell continued its leadership of the

Ukrainian market with 84.3% smartphone penetration as of the end of

Q422.

lifecell remained focused on ensuring the safety of its

employees and provide services to our Ukrainian customers.

Meanwhile, our network is largely operational. On average, around

23% of nearly 9 thousand sites are temporarily down as of December

31, 2022 on a daily basis. The conditions of sites in occupied

territories are unclear. At the end of December, around 92% of our

stores are open nationwide on a daily average. In Q422 daily

top-ups almost recovered to the pre-war period levels.

Additionally, ICT systems, such as billing and CRM are fully

operational. The country’s banking system continues to operate and

daily operations, including payments and collections continue as

normal. The cash position of lifecell is conducive to sustain its

operations.

BeST1

Quarter

Year

Q421

Q422

y/y%

FY21

FY22

y/y%

Number of subscribers (million)

1.5

1.5

-

1.5

1.5

-

Active (3 months)

1.1

1.1

-

1.1

1.1

-

Revenue (million BYN)

35.6

38.8

9.0%

145.7

146.2

0.3%

EBITDA (million BYN)

10.1

12.4

22.8%

38.1

44.2

16.0%

EBITDA margin (%)

28.5%

32.0%

3.5pp

26.1%

30.2%

4.1pp

Net loss (million BYN)

(7.5)

(103.1)

1,274.7%

(31.6)

(124.8)

294.9%

Capex (million BYN)

16.7

25.3

51.5%

63.5

81.4

28.2%

Revenue (million TRY)

157.3

288.1

83.2%

507.8

936.0

84.3%

EBITDA (million TRY)

44.7

92.1

106.0%

133.9

284.5

112.5%

EBITDA margin (%)

28.4%

32.0%

3.6pp

26.4%

30.4%

4.0pp

Net loss (million TRY)

(32.9)

(745.4)

2,165.7%

(109.9)

(871.4)

692.9%

(1) BeST, in which we hold a 100% stake, has operated in Belarus

since July 2008.

BeST revenues increased 9.0% year-on-year in local

currency terms in Q422. This was mainly due to the data and

outgoing voice revenues despite the decrease in handset sales

revenues. BeST registered an EBITDA of BYN12.4 million in Q422,

which led to an EBITDA margin of 32.0%. In Q422, financial

obligation based on Investment Agreement signed between the

Republic of Belarus, BeST and Turkcell has been booked in BeST

standalone financial statements. This has no negative impact on

consolidated financial statements since the previous obligation

related to investment agreement booked on consolidated level has

been reversed. BeST’s revenues in TRY terms increased 83.2%

year-on-year in Q422 with an EBITDA margin of 32.0%.

For the full year, BeST’s revenue in local currency terms

remained flat compared with the previous year. EBITDA rose 16.0%,

resulting in a 30.2% EBITDA margin on 4.1pp improvement. BeST’s

revenue in TRY terms rose 84.3% with an EBITDA margin of 30.4%.

In Q422, BeST continued to expand its 4G network in 6 regions,

reaching 4.1 thousand sites, which grew by 186 additions during the

quarter. Extended LTE coverage allows BeST to increase penetration

of 4G subscribers. Accordingly, 4G users comprised 78% of the

3-month active subscriber base as of Q422. Meanwhile, the average

monthly data consumption of 4G subscribers rose 14% year-on-year to

18.3 GB.

Moreover, asymmetric MTR (mobile termination rates) which came

into effect as of December 31, 2022 was a positive step towards

further strengthening a fair competitive market.

Kuzey Kıbrıs Turkcell2 (million

TRY)

Quarter

Year

Q421

Q422

y/y%

FY21

FY22

y/y%

Number of subscribers (million)

0.6

0.6

-

0.6

0.6

-

Revenue

90.1

147.8

64.0%

306.6

473.1

54.3%

EBITDA

35.3

65.2

84.7%

121.1

195.1

61.1%

EBITDA margin (%)

39.2%

44.1%

4.9pp

39.5%

41.2%

1.7pp

Net income

25.5

106.8

318.8%

68.3

175.6

157.1%

Capex

26.6

361.2

1,257.9%

74.2

458.9

518.5%

(2) Kuzey Kıbrıs Turkcell, in which we hold a 100% stake, has

operated in Northern Cyprus since 1999

Kuzey Kıbrıs Turkcell revenues increased by 64.0%

year-on-year in Q422 driven by higher voice and roaming revenues as

well as fixed broadband and handset sales revenues. In Q422, the

EBITDA of Kuzey Kıbrıs Turkcell grew 84.7% yielding a 44.1% EBITDA

margin.

For the full year, Kuzey Kıbrıs Turkcell revenues increased

54.3% with the same drivers. The EBITDA grew 61.1% leading to an

EBITDA margin of 41.2%. Meanwhile, Kıbrıs Telekom was entitled to

receive the 4G license for 18 years and the 5G license for 20

years.

TECHFIN

Paycell Financial Data (million

TRY)

Quarter

Year

Q421

Q422

y/y%

FY21

FY22

y/y%

Revenue

139.6

270.2

93.6%

468.4

876.9

87.2%

EBITDA

64.3

116.7

81.5%

222.4

387.8

74.4%

EBITDA Margin (%)

46.1%

43.2%

(2.9pp)

47.5%

44.2%

(3.3pp)

Net Income

48.7

83.3

71.0%

155.1

274.1

76.6%

Paycell’s revenue rose by 93.6% year-on-year in Q422. This

robust performance resulted mainly from the continued demand for

digital payments which we addressed with a diversified product

portfolio that includes mobile payment services, particularly the

Pay Later solution, as well as POS solutions and Paycell card. The

demand for digital payment services remained solid with changing

consumer behavior. Paycell’s EBITDA increased 81.5% year-on-year

leading to an EBITDA margin of 43.2% in Q422.

The quarterly transaction volume (non-group) of Pay Later

service exceed TRY1 billion, which was utilized by 3-month active

Pay Later users of 5.0 million in Q422 as well as higher merchant

penetration supported by the dual growth strategy of Paycell.

Meanwhile, the Paycell Card transaction volume more than doubled

year-on-year to TRY2.8 billion in Q422. In addition, the

transaction volume of POS solutions reached TRY4.4 billion in Q422.

Meanwhile, Paycell App added Stock Market (NYSE & Nasdaq)

feature, launched with commission-free campaign. Paycell also

continued to act as a market-place for gold, silver, and platinum

trading in Q422. Overall, Paycell's total transaction volume across

all services more than doubled to TRY11.8 billion year-on-year,

driven mainly by 17% year-on-year rise in Paycell’s total 3-month

active users to 7.7 million, and their increased usage.

For the full year, Paycell registered 87.2% revenue growth and

the total transaction volume of TRY37.1 billion more than doubled

year-on-year. Paycell’s EBITDA rose 74.4% year-on-year leading to

an EBITDA margin of 44.2%. The decrease in the EBITDA margin was

mainly due to the rise in personel expenses.

Financell Financial Data (million

TRY)

Quarter

Year

Q421

Q422

y/y%

FY21

FY22

y/y%

Revenue

190.4

313.1

64.4%

614.9

980.1

59.4%

EBITDA

128.9

160.9

24.8%

420.4

523.0

24.4%

EBITDA Margin (%)

67.7%

51.4%

(16.3pp)

68.4%

53.4%

(15.0pp)

Net Income

109.5

101.7

(7.1%)

334.6

318.6

(4.8%)

Financell’s revenue increased 64.4% year-on-year in Q422. This

growth was primarily due to the expansion of the loan portfolio and

the higher average interest rate on the loan portfolio compared to

the same period of last year. Meanwhile, Financell reported EBITDA

growth of 24.8% year-on-year, resulting in an EBITDA margin of

51.4% in Q422. The decrease in EBITDA margin was due to higher

funding costs compared to the Q421. Financell's net income declined

7.1% year-on-year.

Financell’s revenues rose by 59.4% for the full year and EBITDA

increased 24.4% yielding an EBITDA margin of 53.4%. Higher funding

cost compared to the previous year was the main reason for the

year-on-year decline in EBITDA margin.

Financell’s loan portfolio increased to TRY3.4 billion at the

end of Q422. Although the installment limitation on consumer loans

for telecom devices continued to limit the growth of the loan

portfolio, higher lending to corporate customers and greater

mobility supported the loan portfolio. Accordingly, Financell has

provided loans to over 22 thousand corporate customers. Financell’s

cost of risk decreased from 1.3% in Q322 to 1.0% in Q422 thanks to

customer portfolio improvement and successful collection

performance.

Turkcell Group Subscribers

Turkcell Group registered subscribers amounted to approximately

54.0 million as of December 31, 2022. This figure is calculated by

taking the number of subscribers of Turkcell Turkey, and of each of

our subsidiaries. It includes the total number of mobile, fiber,

ADSL, cable and IPTV subscribers of Turkcell Turkey, and the mobile

subscribers of lifecell, BeST, and Kuzey Kıbrıs Turkcell.

Turkcell Group Subscribers

Q421

Q322

Q422

y/y%

q/q%

Turkcell Turkey subscribers

(million)1

39.4

41.6

41.7

5.8%

0.2%

lifecell (Ukraine)

10.1

10.1

10.2

1.0%

1.0%

BeST (Belarus)

1.5

1.5

1.5

-

-

Kuzey Kıbrıs Turkcell

0.6

0.6

0.6

-

-

Turkcell Group Subscribers

(million)

51.6

53.8

54.0

4.7%

0.4%

(1) Subscribers to more than one service are counted separately

for each service.

OVERVIEW OF THE MACROECONOMIC ENVIRONMENT

The foreign exchange rates used in our financial reporting,

along with certain macroeconomic indicators, are set out below.

Quarter

Year

Q421

Q322

Q422

y/y%

q/q%

FY21

FY22

y/y%

GDP Growth (Turkey)

9.6%

4.0%

3.5%

(6.1pp)

(0.5pp)

11.4%

5.6%

(5.8pp)

Consumer Price Index

(Turkey)(yoy)

36.1%

83.5%

64.3%

28.2pp

(19.2pp)

36.1%

64.3%

28.2pp

US$ / TRY rate

Closing Rate

13.3290

18.5038

18.6983

40.3%

1.1%

13.3290

18.6983

40.3%

Average Rate

11.0757

17.8817

18.6010

67.9%

4.0%

8.8797

16.4900

85.7%

EUR / TRY rate

Closing Rate

15.0867

17.9232

19.9349

32.1%

11.2%

15.0867

19.9349

32.1%

Average Rate

12.6591

18.0379

18.9748

49.9%

5.2%

10.4810

17.3108

65.2%

US$ / UAH rate

Closing Rate

27.2782

36.5686

36.5686

34.1%

-

27.2782

36.5686

34.1%

Average Rate

26.8092

35.3497

36.5686

36.4%

3.4%

27.3362

32.4854

18.8%

US$ / BYN rate

Closing Rate

2.5481

2.4803

2.7364

7.4%

10.3%

2.5481

2.7364

7.4%

Average Rate

2.5019

2.5585

2.5055

0.1%

(2.1%)

2.5448

2.6098

2.6%

RECONCILIATION OF NON-GAAP FINANCIAL MEASUREMENTS: We

believe Adjusted EBITDA, among other measures, facilitates

performance comparisons from period to period and management

decision making. It also facilitates performance comparisons from

company to company. Adjusted EBITDA as a performance measure

eliminates potential differences caused by variations in capital

structures (affecting interest expense), tax positions (such as the

impact of changes in effective tax rates on periods or companies)

and the age and book depreciation of tangible assets (affecting

relative depreciation expense). We also present Adjusted EBITDA

because we believe it is frequently used by securities analysts,

investors and other interested parties in evaluating the

performance of other mobile operators in the telecommunications

industry in Europe, many of which present Adjusted EBITDA when

reporting their results.

Our Adjusted EBITDA definition includes Revenue, Cost of Revenue

excluding depreciation and amortization, Selling and Marketing

expenses, Administrative expenses and Net impairment losses on

financial and contract assets, but excludes finance income and

expense, other operating income and expense, investment activity

income and expense, share of profit of equity accounted investees

and minority interest.

Nevertheless, Adjusted EBITDA has limitations as an analytical

tool, and you should not consider it in isolation from, or as a

substitute for analysis of our results of operations, as reported

under TFRS. The following table provides a reconciliation of

Adjusted EBITDA, as calculated using financial data prepared in

accordance with TFRS to net profit, which we believe is the most

directly comparable financial measure calculated and presented in

accordance with TFRS.

Turkcell Group (million TRY)

Quarter

Year

Q421

Q422

y/y%

FY21

FY22

y/y%

Adjusted EBITDA

4,211.6

6,671.5

58.4%

15,013.8

21,993.8

46.5%

Depreciation and amortization

(2,075.5)

(2,515.7)

21.2%

(7,291.9)

(9,478.0)

30.0%

EBIT

2,136.1

4,155.8

94.6%

7,721.9

12,515.8

62.1%

Finance income

2,569.6

(642.4)

(125.0%)

3,051.1

210.8

(93.1%)

Finance expense

(9,214.8)

(2,781.8)

(69.8%)

(13,195.7)

(13,699.8)

3.8%

Other operating income / (expense)

4,355.8

1,028.9

(76.4%)

6,409.6

6,800.9

6.1%

Investment activity income / (expense)

474.7

157.6

(66.8%)

464.1

1,779.9

283.5%

Share of profit of equity accounted

investees

63.6

(10.0)

(115.7%)

90.1

(71.4)

(179.3%)

Consolidated profit before income tax

& minority interest

385.0

1,908.0

395.6%

4,541.1

7,536.1

66.0%

Income tax expense

999.7

4,087.3

308.9%

490.2

3,516.1

617.3%

Consolidated profit before minority

interest

1,384.7

5,995.3

333.0%

5,031.3

11,052.2

119.7%

NOTICE: This release includes forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933,

Section 21E of the Securities Exchange Act of 1934 and the Safe

Harbor provisions of the US Private Securities Litigation Reform

Act of 1995. This includes, in particular, our targets for revenue,

EBITDA and capex for 2022. More generally, all statements other

than statements of historical facts included in this press release,

including, without limitation, certain statements regarding the

launch of new businesses, our operations, financial position and

business strategy may constitute forward-looking statements. In

addition, forward-looking statements generally can be identified by

the use of forward-looking terminology such as, among others,

"will," "expect," "intend," "estimate," "believe", "continue" and

“guidance”.

Although Turkcell believes that the expectations reflected in

such forward-looking statements are reasonable at this time, it can

give no assurance that such expectations will prove to be correct.

All subsequent written and oral forward-looking statements

attributable to us are expressly qualified in their entirety by

reference to these cautionary statements. For a discussion of

certain factors that may affect the outcome of such forward looking

statements, see our Annual Report on Form 20-F for 2021 filed with

the U.S. Securities and Exchange Commission, and in particular the

risk factor section therein. We undertake no duty to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

The Company makes no representation as to the accuracy or

completeness of the information contained in this press release,

which remains subject to verification, completion and change. No

responsibility or liability is or will be accepted by the Company

or any of its subsidiaries, board members, officers, employees or

agents as to or in relation to the accuracy or completeness of the

information contained in this press release or any other written or

oral information made available to any interested party or its

advisers.

ABOUT TURKCELL: Turkcell is a digital operator

headquartered in Turkey, serving its customers with its unique

portfolio of digital services along with voice, messaging, data and

IPTV services on its mobile and fixed networks. Turkcell Group

companies operate in 4 countries – Turkey, Ukraine, Belarus, and

Northern Cyprus. Turkcell launched LTE services in its home country

on April 1st, 2016, employing LTE-Advanced and 3 carrier

aggregation technologies in 81 cities. Turkcell offers up to 10

Gbps fiber internet speed with its FTTH services. Turkcell Group

reported TRY53.9 billion revenue in FY22 with total assets of

TRY101.3 billion as of December 31, 2022. It has been listed on the

NYSE and the BIST since July 2000, and is the only NYSE-listed

company in Turkey. Read more at www.turkcell.com.tr.

Appendix A – Tables

Table: Net foreign exchange gain and loss details

Million TRY

Quarter

Year

Q421

Q422

y/y%

FY21

FY22

y/y%

Net FX loss before hedging

(4,137.2)

(383.0)

(90.7%)

(5,538.5)

(3,834.0)

(30.8%)

Swap interest income/(expense)

(89.2)

29.0

n.m

(422.4)

(127.0)

(69.9%)

Fair value gain on derivative financial

instruments

2,613.3

(945.3)

(136.2%)

3,312.8

(130.8)

(103.9%)

Net FX gain / (loss) after

hedging

(1,613.1)

(1,299.3)

(19.5%)

(2,648.1)

(4,091.7)

54.5%

Table: Income tax expense details

Million TRY

Quarter

Year

Q421

Q422

y/y%

FY21

FY22

y/y%

Current tax expense

(106.6)

192.8

n.m

(681.5)

(530.6)

(22.1%)

Deferred tax income / (expense)

1,106.3

3,894.6

252.0%

1,171.7

4,046.7

245.4%

Income Tax expense

999.7

4,087.4

308.9%

490.2

3,516.1

617.3%

Table: Fixed asset revaluation net impact

Million TRY

Q421

Million TRY

Q422

Tax effect of fixed asset revalution

1,137.3

Tax effect of fixed asset revalution

4,311.4

2% payment of fixed asset revalution

(106.7)

2% payment of fixed asset revalution

(217.6)

Total

1,030.6

Total

4,093.8

Million TRY

FY21

Million TRY

FY22

Tax effect of fixed asset revalution

1,680.7

Tax effect of fixed asset revalution

4,862.7

2% payment of fixed asset revalution

(158.2)

2% payment of fixed asset revalution

(254.0)

Total

1,522.5

Total

4,608.7

TURKCELL ILETISIM HIZMETLERI A.S.TURKISH ACCOUNTING STANDARDS

SELECTED FINANCIALS (TRY Million) Quarter Ended

Year Ended Quarter Ended Quarter Ended Year

Ended

Dec 31,

Dec 31,

Sep 30,

Dec 31,

Dec 31,

2021

2021

2022

2022

2022

Consolidated Statement of Operations Data Turkcell

Turkey

7,689.4

27,223.5

11,075.7

12,448.8

40,851.1

Turkcell International

1,286.4

3,750.1

1,634.7

1,812.6

6,353.6

Fintech

329.9

1,075.7

499.1

583.2

1,849.1

Other

885.9

3,871.2

1,453.0

1,199.4

4,824.7

Total revenues

10,191.5

35,920.5

14,662.5

16,043.9

53,878.5

Direct cost of revenues

(7,095.4)

(25,230.0)

(9,852.1)

(10,451.0)

(36,788.6)

Gross profit

3,096.2

10,690.6

4,810.4

5,592.9

17,089.8

General administraive expenses

(276.8)

(919.0)

(393.8)

(473.4)

(1,519.0)

Selling & marketing expenses

(576.6)

(1,778.5)

(683.7)

(899.8)

(2,700.1)

Other Operating income / (expenses)

4,355.8

6,409.6

2,414.8

1,028.9

6,800.9

Operating profit

6,598.6

14,402.7

6,147.8

5,248.5

19,671.6

Impairment losses and reversals of impairment losses determined in

accordance with TFRS 9

(106.7)

(271.2)

(140.4)

(63.9)

(354.9)

Investment Income

402.6

464.1

526.1

157.6

1,779.9

Investment Expense

72.1

-

-

-

-

Share on (loss) profit of investments valued by equity method

63.6

90.1

13.1

(10.0)

(71.4)

Income before financing costs

7,030.2

14,685.7

6,546.6

5,332.2

21,025.2

Financial income

2,569.6

3,051.1

4.2

(642.4)

210.8

Financial expenses

(9,214.8)

(13,195.7)

(3,654.0)

(2,781.8)

(13,699.8)

Profit from Continuing Operations Before Taxation

385.0

4,541.1

2,896.9

1,908.0

7,536.1

Tax income from continuing operations

999.7

490.2

(501.1)

4,087.3

3,516.1

Profit for the period

1,384.7

5,031.3

2,395.8

5,995.3

11,052.2

Non-controlling interest

(0.1)

(0.2)

(0.1)

0.9

1.0

Owners of the Parent

1,384.6

5,031.1

2,395.8

5,996.3

11,053.2

Earnings per share

0.6

2.3

1.1

2.7

5.1

Other Financial Data

Gross margin

30.4%

29.8%

32.8%

34.9%

31.7%

EBITDA(*)

4,211.6

15,013.8

5,990.3

6,671.5

21,993.8

Total Capex

4,297.4

11,479.4

3,897.8

6,434.3

16,360.6

Operational capex

2,686.3

7,629.8

2,513.0

4,454.3

10,859.4

Licence and related costs

-

-

-

317.5

317.5

Non-operational Capex

1,611.1

3,849.6

1,384.8

1,662.5

5,183.6

Consolidated Balance Sheet Data (at period end)

Cash and cash equivalents

18,628.7

18,628.7

24,344.2

25,960.7

25,960.7

Total assets

70,682.6

70,682.6

90,655.4

101,264.8

101,264.8

Long term debt

27,929.7

27,929.7

37,700.3

37,133.1

37,133.1

Total debt

36,778.1

36,778.1

51,921.7

53,854.4

53,854.4

Total liabilities

48,120.4

48,120.4

65,123.7

70,369.8

70,369.8

Total shareholders’ equity / Net Assets

22,562.3

22,562.3

25,531.8

30,891.1

30,891.1

(*) Please refer to the notes on reconciliation of Non-GAAP

Financial measures on page 20.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230309005468/en/

For further information please contact Turkcell

Investor Relations Tel: + 90 212 313 1888

investor.relations@turkcell.com.tr

Corporate Communications: Tel: + 90 212 313 2321

Turkcell-Kurumsal-Iletisim@turkcell.com.tr

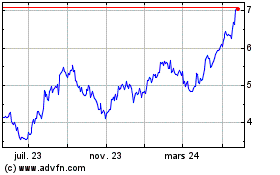

Turkcell lletism Hizmetl... (NYSE:TKC)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

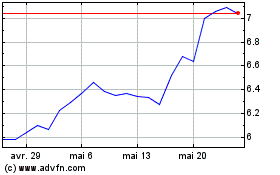

Turkcell lletism Hizmetl... (NYSE:TKC)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024