SCHEDULE 13D/A

DATE OF EVENT WHICH REQUIRES FILING OF THIS STATEMENT

4/13/2022

1. NAME OF REPORTING PERSON

Bulldog Investors, LLP

2. CHECK THE BOX IF MEMBER OF A GROUP a[]

b[]

3. SEC USE ONLY

4. SOURCE OF FUNDS

WC

5. CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) AND 2(e) []

6. CITIZENSHIP OR PLACE OF ORGANIZATION

DE

7. SOLE VOTING POWER

5,000

8. SHARED VOTING POWER

164,644

9. SOLE DISPOSITIVE POWER

5,000

10. SHARED DISPOSITIVE POWER

164,644

11. AGGREGATE AMOUNT OWNED BY EACH REPORTING PERSON

169,644 (Footnote 1)

12. CHECK IF THE AGGREGATE AMOUNT EXCLUDES CERTAIN SHARES

[]

13. PERCENT OF CLASS REPRESENTED BY ROW 11

2.60%

14. TYPE OF REPORTING PERSON

IA

1. NAME OF REPORTING PERSON

Phillip Goldstein

2. CHECK THE BOX IF MEMBER OF A GROUP a[]

b[]

3. SEC USE ONLY

4. SOURCE OF FUNDS

WC

5. CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) AND 2(e) []

6. CITIZENSHIP OR PLACE OF ORGANIZATION

USA

7. SOLE VOTING POWER

5,000

8. SHARED VOTING POWER

323,998

9. SOLE DISPOSITIVE POWER

5,000

10. SHARED DISPOSITIVE POWER

323,998

11. AGGREGATE AMOUNT OWNED BY EACH REPORTING PERSON

328,998 (Footnote 1)

12. CHECK IF THE AGGREGATE AMOUNT EXCLUDES CERTAIN SHARES

[]

13. PERCENT OF CLASS REPRESENTED BY ROW 11

5.04%

14. TYPE OF REPORTING PERSON

IN

1. NAME OF REPORTING PERSON

Andrew Dakos

2. CHECK THE BOX IF MEMBER OF A GROUP a[]

b[]

3. SEC USE ONLY

4. SOURCE OF FUNDS

WC

5. CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) AND 2(e) []

6. CITIZENSHIP OR PLACE OF ORGANIZATION

USA

7. SOLE VOTING POWER

5,000

8. SHARED VOTING POWER

323,998

9. SOLE DISPOSITIVE POWER

5,000

10. SHARED DISPOSITIVE POWER

323,998

11. AGGREGATE AMOUNT OWNED BY EACH REPORTING PERSON

328,998 (Footnote 1)

12. CHECK IF THE AGGREGATE AMOUNT EXCLUDES CERTAIN SHARES

[]

13. PERCENT OF CLASS REPRESENTED BY ROW 11

5.04%

14. TYPE OF REPORTING PERSON

IN

Item 1. SECURITY AND ISSUER

TThis statement constitutes Amendment #3 to the schedule 13d

filed December 10, 2021. Except as specifically set forth

herein, the Schedule 13d remains unmodified.

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER

(a) As per the N-CSR filed on 2/8/2022 there were 6,526,000 shares of

common stock outstanding as of 11/30/2021. The percentages set forth

herein were derived using such number. Phillip Goldstein and Andrew

Dakos own Bulldog Investors, LLP, a registered investment advisor.

As of April 13, 2022 Bulldog Investors, LLP is deemed to be the beneficial

owner of 169,644 shares of TPZ (representing 2.60% of TPZ's outstanding

shares) solely by virtue of Bulldog Investors LLP's power to direct the

vote of,and dispose of, these shares.

Such shares are also beneficially owned by clients of Bulldog Investors,

LLP who are not members of any group.

As of April 13, 2022, each of Messrs. Goldstein and Dakos is deemed to be

the beneficial owner of 328,998 shares of TPZ (representing 5.04% of TPZ's

outstanding shares) by virtue of their power to direct the vote of, and

dispose of, these shares.

(b)Bulldog Investors,LLP has sole power to dispose of and vote 5,000 shares.

Bulldog Investors, LLP has shared power to dispose of and vote 164,644

shares. Certain of Bulldog Investors, LLP's clients (none of whom

beneficially own more than 5% of TPZ's shares) share this power with

Bulldog Investors, LLP. Messrs. Goldstein and Dakos are partners of Bulldog

Investors, LLP. Messrs. Goldstein and Dakos have shared power to dispose

of and vote an additional 159,354 shares.

c) Since the most recent filing on 3/4/22 the following shares of TPZ were

sold.

Date Shares Price

4/13/2022 (1,702) 14.5735

4/12/2022 (6,252) 14.5136

4/1/2022 (4,567) 14.4203

3/31/2022 (1,985) 14.382

3/30/2022 (2,625) 14.3221

3/25/2022 (16,390) 14.2973

3/23/2022 (3,568) 14.1000

3/22/2022 (310) 14.1790

3/21/2022 (6,122) 14.0205

3/17/2022 (7,200) 13.7656

3/16/2022 (2,800) 13.7000

3/15/2022 (8,086) 13.5000

3/10/2022 (314) 14.2000

3/8/2022 (2,100) 14.3500

3/7/2022 (2,357) 14.3506

|

d) Clients of Bulldog Investors, LLP and a closed-end investment fund for

which Messrs. Goldstein and Dakos have investment and voting authority

are entitled to receive any dividends or sales proceeds.

e) N/A

ITEM 6. CONTRACTS,ARRANGEMENTS,UNDERSTANDINGS OR RELATIONSHIPS

WITH RESPECT TO SECURITIES OF THE ISSUER.

N/A

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

None

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this

statement is true, complete and correct.

Dated: 4/14/2022

By: /S/ Phillip Goldstein

Name: Phillip Goldstein

By: /S/ Andrew Dakos

Name: Andrew Dakos

Bulldog Investors, LLP

By: /s/ Andrew Dakos

Andrew Dakos, Partner

Footnote 1: The reporting persons disclaim beneficial ownership except

to the extent of any pecuniary interest therein.

|

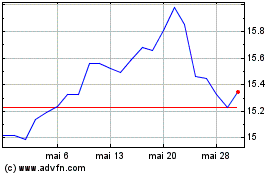

Tortoise Power and Energ... (NYSE:TPZ)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Tortoise Power and Energ... (NYSE:TPZ)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024