UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

___________________________________

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | Definitive Proxy Statement |

| |

| ☒ | Definitive Additional Materials |

| |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

The Travelers Companies, Inc.

_________________________________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

_________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| ☒ | | No fee required. |

| ☐ | | Fee paid previously with preliminary materials |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

May 6, 2024

RE: The Travelers Companies, Inc. (“Travelers” or the “Company”)

2024 Annual Meeting of Shareholders – May 15, 2024

Proposal 3 – Non-Binding Vote to Approve Executive Compensation

Dear Fellow Shareholders:

Introduction

We are writing to ask for your support by voting in accordance with the recommendations of our Board of Directors on all of the proposals included in our Proxy Statement, which was filed on April 2, 2024 and is available at https://investor.travelers.com/home/default.aspx and on the SEC website. Specifically, with this supplemental filing, we are asking that you vote “FOR” Item 3 – Non-Binding Vote to Approve Executive Compensation (referred to as the “Say-on-Pay Proposal”).

We are providing this supplement in response to concerns expressed by Institutional Shareholder Services (ISS), a proxy advisory firm, regarding the structure of our compensation program. Specifically, ISS notes that while the majority of long-term incentives are based on clearly disclosed multi-year goals, it raises concerns regarding the discretionary nature of the short-term incentive (STI) program.1 In ISS’ view, the discretionary nature of the STI program is particularly relevant because ISS believes a quantitative pay-for-performance misalignment exists for the year in review.

As we discuss below, we do not agree with ISS’ presumptive preference for a formulaic compensation model. We are not aware of any evidence to support the proposition that companies with formulaic compensation plans outperform those that apply discretion. To the contrary, as we discuss in more detail below, formulaic compensation models – without consideration of the factors that make a given company or industry, such as the property and casualty industry, unique – can lead to significant unintended consequences. Moreover, we believe that ISS’ methodology for identifying a quantitative pay-for-performance misalignment is flawed.

Travelers delivered very strong financial and operational results in 2023, building upon our exceptional results over the past decade, and Travelers’ compensation decisions for 2023 were directly linked to that performance. The structure of our executive compensation program has been stable over time, and our shareholders have approved our Say-On-Pay Proposal in all prior years. We believe that it is also important to underscore that the Compensation Committee’s decisions are informed by overall Company performance as well as the input and feedback of Travelers shareholders. In light of the numerous conversations the Company has had with its largest shareholders, and the results of the Company’s advisory vote on executive compensation over the years, the Company believes that a significant majority of its shareholders are supportive of the design and operation of the Company’s executive compensation program.

For these reasons, as discussed further below, we ask that you support our Say-on-Pay Proposal.

1 Travelers Chief Executive Officer received approximately 26% of his Total Compensation reflected in the Summary Compensation Table for the year ended December 31, 2023 pursuant to the STI program.

| | | | | |

| |

Executive Summary

•Travelers delivered very strong financial and operational results in 2023, building upon our exceptional results over the past decade, and Travelers’ compensation decisions for 2023 were directly linked to that performance. In evaluating the Company’s 2023 results, the Compensation Committee considered the Company’s very strong top- and bottom-line results, despite elevated industrywide catastrophe losses and a personal lines operating environment that, while improving, was difficult during the year. The Compensation Committee also considered that, while core income and core income per diluted share increased year-over-year, core income and core income per diluted share were below plan, primarily due to elevated industrywide catastrophe losses. Accordingly, despite very strong financial and operational results that exceeded prior year levels, the Compensation Committee determined to set incentive compensation for the named executive officers at levels lower than the prior year: •Annual cash bonus for our Chief Executive officer was down 11.8% year over year, while his long-term equity incentive award for the 2023 performance year was down 1.8%; and •Average annual cash bonus for our other named executives was down 5.4% year-over-year. As discussed in greater detail on pages 40 and 41 of The Compensation Discussion & Analysis section of our 2024 proxy statement, while the objectives and structure of our compensation program have been stable over time, compensation levels vary from year-to-year and correlate with our results, as demonstrated again by the Compensation Committee’s compensation decisions for the year ended December 31, 2023. •ISS’ analysis is largely based on two assertions that are not reflective of Travelers’ performance and/or the stability and benefits of its longstanding compensation program. •ISS’ presumptive preference for a formulaic compensation model is misguided. While ISS acknowledges that the annual bonus payout is based on financial metrics and disclosed targets, it is concerned that payouts are ultimately determined on a discretionary basis by our independent Compensation Committee. The Compensation Committee feels strongly that a formulaic approach to the determination of incentive compensation, particularly in the property and casualty insurance industry, could result in unintended consequences and is not an appropriate substitute for the Compensation Committee’s understanding of the Company’s results and how those results were achieved, as well as its informed and thorough deliberation and the application of its reasoned business judgment. As discussed in more detail below, ISS’ strict formulaic approach comes with particularly heightened risks for the property and casualty industry, where prudent risk management and long-term judgment are critical to protecting the solvency of an insurance carrier. •ISS notes that the discretionary nature of the STI program is particularly important to its recommendation for the year in review because it believes it has identified a quantitative pay-for-performance misalignment. We believe that ISS’ methodology for identifying a quantitative pay-for-performance misalignment is flawed. •ISS’ methodology depends upon Travelers’ Total Shareholder Return (TSR) at a particular time. Because of the inherent volatility of the financial markets and the impact of short-term trading on a particular stock, a view of performance primarily based on the stock price at a particular time can provide an incomplete picture. For example, Travelers stock price increased 12% from $190.49 as of December 31, 2023 to $213.01 as of February 6, 2024, the date of the Compensation Committee meeting at which incentive compensation decisions were made. If ISS had measured our TSR as of the date of the Compensation Committee meeting rather than as of December 31, 2023, we believe that ISS would not have identified a quantitative pay-for-performance misalignment. •The assumptions and methodology used by ISS for valuing stock options are not in accordance with GAAP and substantially overvalue these awards relative to what we are required to expense and disclose in our public fillings. If ISS valued stock options in accordance with GAAP or if Travelers replaced stock options with either restricted shares or performance shares in its long-term incentive compensation program, we believe that ISS would not have had a “high” quantitative pay-for-performance concern. •ISS’ peer group exacerbates the issues described above. If ISS had used the Compensation Comparison Group constructed by the Company’s independent Compensation Committee, based in part on the advice of its independent compensation consultant, we believe that ISS would not have identified a quantitative pay-for-performance misalignment. •Our compensation program has been stable over time and has been supported by our shareholders in all prior years. In addition, we engage with our shareholders throughout the year to better understand our shareholders’ perspectives, including their views with respect to our executive compensation program. The Company believes that a significant majority of its shareholders are supportive of the design and operation of the Company’s executive compensation program.

| |

| |

I.Travelers has delivered very strong financial and operational results in 2023, building upon our exceptional results over the past decade. Compensation decisions for 2023 were directly linked to that performance.

As more fully discussed on page 32 in our Compensation Discussion & Analysis section of our 2024 Proxy Statement, in setting this year’s compensation, the Compensation Committee considered the Company’s strong top- and bottom-line results, despite elevated industrywide catastrophe losses and a personal lines operating environment that, while improving, was difficult during the year. The Compensation Committee also considered that, while core income and core income per diluted share increased year-over-year, core income and core income per diluted share were below plan, primarily due to elevated industrywide catastrophe losses. Notwithstanding our very strong top- and bottom-line results that exceeded prior year levels, the Compensation Committee determined to set incentive compensation for the named executive officers at levels lower than the prior year, with the annual cash bonus for our Chief Executive Officer down 11.8% year over year, and the average annual cash bonus for our other named executives down 5.4% year-over-year.

As discussed in greater detail on pages 40-41 of our proxy statement, while the objectives and structure of our compensation program have been stable over time, compensation levels vary from year-to-year and correlate with our results, as demonstrated again by the Compensation Committee’s compensation decisions for the year ended December 31, 2023.

II.ISS’ analysis is largely based on two assertions that are not reflective of Travelers’ performance and/or the stability and benefits of our longstanding compensation program.

In its report, ISS expresses two primary concerns:

•While ISS acknowledges that the STI program payout is based on financial metrics and disclosed targets, it is concerned that payouts are ultimately determined by our independent Compensation Committee on a discretionary basis.

•In ISS’ view, the discretionary nature of the STI program is particularly relevant for the year in review because it believes it has identified a quantitative pay-for-performance misalignment.

We disagree and will address each of these points in turn.

•ISS’ presumptive preference for a formulaic compensation model is misguided.

In its report this year, ISS notes that while the majority of long-term incentives are based on clearly disclosed multi-year goals, it has significant concerns regarding the discretionary nature of the STI program.

As ISS acknowledges in its report, the annual bonus payout is based, in part, on financial metrics and disclosed targets, although the Compensation Committee uses its discretion to determine the ultimate payout. These targets, as well as the additional metrics and performance factors that the Compensation Committee considered in determining the 2023 bonus amounts, are described in detail on pages 46-51 of the Compensation Discussion & Analysis section of our 2024 Proxy Statement.

A formulaic approach to the determination of incentive compensation, particularly in the property and casualty insurance industry, could result in unintended consequences and is not an appropriate substitute for the Compensation Committee’s informed and thorough deliberation and the application of its reasoned business judgment. The Compensation Committee feels strongly that there is no substitute for its understanding of the Company’s results and how those results were achieved. The Compensation Committee’s current approach allows it to appropriately assess the quality of Travelers’ financial performance and ensures that executives are not unduly rewarded, or disadvantaged, based purely on the application of a mechanical formula.

We are not aware of any evidence to support the proposition that companies with formulaic compensation plans outperform those that apply discretion. To the contrary, this presumptive preference for formulaic compensation models – without consideration of the factors that make a given company or industry, such as the property and casualty industry, unique – could lead to significant unintended consequences that are adverse to the interests of shareholders, including the following:

•Incentivizing companies to emphasize short-term quantifiable metrics that are more easily measured, yet may not necessarily align with a particular company’s long-term objectives or risk management profile or appropriately reflect how the company’s annual results were actually achieved;

•Substituting ISS’ judgment for that of the independent compensation committee, thereby limiting an independent compensation committee’s ability to apply its reasoned business judgment, which board members are legally required to bring to all their other fiduciary duties; and

•Diminishing differentiation and competition among companies within an industry group and driving compensation practices to the mean.

ISS’ strict formulaic approach comes with particularly heightened risks for the property and casualty industry, where prudent risk management and long-term judgement are critical to protecting the solvency of the insurance carrier. For example, in the property and casualty insurance industry, an overly formulaic approach could create incentives for management to relax underwriting or investment standards to increase revenue and reported profit in the near-term while creating excessive risk for policyholders and shareholders over the longer term. Further, in an industry in which the results of management decisions may not be evident for many years and can only be assessed in the context of a variety of factors, including interest rates, reserve developments, catastrophes and weather, compensation decisions should only be made in the context of a specific organization and leadership team, rather than by reference to a one-size-fits all model. In other words, there is no substitute for sound judgment and expertise, particularly where prudent risk management and nuanced judgment is such a critical part of the equation. These essential qualities can rarely – if ever – be measured or evaluated solely by reference to a formula or financial metric. While financial and other objectives communicated to executives every fiscal year should be a part of most companies’ bonus programs, those objectives should be viewed as just the beginning, not the end of a compensation committee’s determination of an executive’s annual bonus.

You can see the effect of the Compensation Committee’s application of its thoughtful judgement in setting executive compensation and its longstanding pay-for-performance philosophy at work on pages 40 and 41 of the Compensation Discussion & Analysis section of our proxy statement. As illustrated by the chart on page 41, while the objectives and the structure of our compensation program have been stable over time, the Compensation Committee has thoughtfully applied its judgment over the years to both increase and decrease compensation levels to reflect our financial and operating results.

•ISS’ methodology for identifying a quantitative pay-for-performance misalignment is flawed.

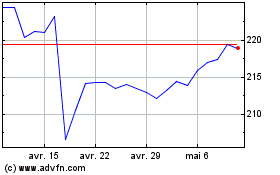

•Travelers’ Has Delivered a Strong Total Return to Shareholders Over Time. ISS’ methodology for determining a quantitative pay-for-performance misalignment depends upon Travelers’ TSR as of the year-end 2023. TSR is a measure of a company’s stock price performance that depends upon the market value of the company’s stock at a particular time. Because of the inherent volatility of the financial markets and the impact of short-term trading on a particular stock, we believe that quantitative pay-for-performance should not be based largely on the stock price at a particular time. If ISS had evaluated Travelers’ TSR as of a date that was different but close in time, such as February 6, 2024, the date of the Compensation Committee meeting at which incentive compensation decisions were made, a very different picture emerges.

These charts illustrate that point. As you can see, we have delivered significant value to our shareholders over both the short and long-term.

The following table further demonstrates that Travelers’ TSR has performed extremely well on an absolute basis, as well as in comparison to the ISS peer group:

Finally, while recognizing the inherent limitations of basing compensation decisions on TSR as discussed above, the following chart demonstrates that our CEO’s compensation since being appointed as CEO on December 1, 2015 is highly aligned with our TSR over that period. A claim of an apparent quantitative pay-for-performance misalignment is unfounded.

•The assumptions and methodology used by ISS for valuing stock options are not in accordance with GAAP or related SEC guidance. ISS applies its own assumptions and methodology for valuing stock options which are inconsistent with GAAP and related SEC guidance. As a result, ISS assigned a value to the options granted to our CEO in 2023 that was $2.3 million, or 41%, higher than the amount we are required to report in accordance with GAAP in our financial statements. For the total options granted to the CEO for 2021, 2022 and 2023, ISS assigned a value to the options that was $7.9 million, or 51%, higher than the amount we are required to report in accordance with GAAP in our financial statements.

This dramatically higher valuation also differs from the amount required by the SEC to be reported in the Summary Compensation Table in our proxy statement and is not consistent with what the Compensation Committee either considered or intended when making compensation decisions this past year. If ISS had calculated the option value in accordance with GAAP and as required by the SEC for financial statement purposes, we believe that ISS would not have had a “high” quantitative pay-for-performance concern.

Moreover, the adverse impact of ISS’ option valuation methodology is exacerbated by the fact that Travelers’ pay mix is more performance-based than Travelers’ peer group. Unlike many of its peers, Travelers’ pay mix does not include any time-based restricted stock. Instead, Travelers’ Compensation Committee relies more heavily on stock options. If the Compensation Committee awarded time-based restricted stock and stock options in the same mix as Travelers’ peer group, we believe that ISS would not have had a “high” quantitative pay-for-performance concern.

* * * * * * * * *

We appreciate your time and consideration on these matters and ask you to vote for “FOR” Item 3 – Non-Binding Vote to Approve Executive Compensation. Our Proxy Statement, this supplemental proxy material and our 2023 Annual Report are available at https://investor.travelers.com/home/default.aspx.

The Travelers Companies (NYSE:TRV)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

The Travelers Companies (NYSE:TRV)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024