- Third quarter earnings per diluted share of $2.75, up 10%

- Third quarter operating income up 11%

- Third quarter net income up 9%

Union Pacific Corporation (NYSE: UNP) today reported 2024 third

quarter net income of $1.7 billion, or $2.75 per diluted share.

This compares to 2023 third quarter net income of $1.5 billion, or

$2.51 per diluted share.

“Our third quarter results demonstrate the success of our

strategy,” said Union Pacific Chief Executive Officer Jim Vena.

“Improved safety and service performance supported solid revenue

growth that we converted into double-digit improvement in third

quarter operating income and earnings per share. The entire Union

Pacific team is focused on delivering for our customers and

shareholders; and is energized to build on these accomplishments to

drive sustainable long-term success.”

Third Quarter Summary: 2024 vs. 2023

Financial Results: Strong Operating Income Growth Driven by

Increased Revenue, Volume, Core Pricing Gains, and Operating

Efficiency

- Operating revenue of $6.1 billion grew 3% driven by increased

volume and core pricing gains, partially offset by business mix and

reduced fuel surcharge revenue.

- Freight revenue excluding fuel surcharge revenue grew 5% as

revenue carloads grew 6%.

- Operating ratio was 60.3%, an improvement of 310 basis points.

Lower quarterly fuel prices positively impacted the operating ratio

120 basis points.

- Operating income of $2.4 billion increased 11%.

Operating Performance: Solid Service and Operational

Efficiency Gains While Handling Volume Growth; Quarterly Record for

Workforce Productivity

- Union Pacific’s year-to-date reportable personal injury and

reportable derailment rates both improved.

- Quarterly freight car velocity improved 5% to 210 daily miles

per car.

- Quarterly locomotive productivity improved 5% to 135 gross

ton-miles (GTMs) per horsepower day.

- Quarterly workforce productivity improved 12% to 1,102 car

miles per employee.

- Fuel consumption rate increased 1% to 1.058, measured in

gallons of fuel per thousand GTMs.

2024 Outlook

Updated

- Fourth quarter results expected to be consistent sequentially

from third quarter while improving year-over-year versus the fourth

quarter 2023.

Affirmed

- Profitability outlook continues positive momentum with strong

service product, improving network efficiency, and solid

pricing

- Share repurchases of ~$1.5 billion in 2024

- Pricing dollars in excess of inflation dollars

- No change to long-term capital allocation strategy

- Capital plan of $3.4 billion

Third Quarter 2024 Earnings Conference Call

Union Pacific will provide a webcast for its third quarter 2024

earnings release presentation live at

https://investor.unionpacific.com and via teleconference on

Thursday, October 24, 2024, at 8:45 a.m. Eastern Time. Participants

may join the conference call by dialing 877-407-8293 (or for

international participants, 201-689-8349).

ABOUT UNION PACIFIC

Union Pacific (NYSE: UNP) delivers the goods families and

businesses use every day with safe, reliable, and efficient

service. Operating in 23 western states, the company connects its

customers and communities to the global economy. Trains are the

most environmentally responsible way to move freight, helping Union

Pacific protect future generations. More information about Union

Pacific is available at www.up.com.

Supplemental financial information is attached.

This news release and related materials contain statements about

the Company’s future that are not statements of historical fact,

including specifically the statements regarding the potential

impacts of public health crises, including pandemics, epidemics and

the outbreak of other contagious diseases, such as the coronavirus

and its variant strains (COVID); the Russia-Ukraine and

Israel-Hamas wars and other geopolitical tensions in the middle

east, and any impacts on our business operations, financial

results, liquidity, and financial position, and on the world

economy (including customers, employees, and supply chains),

including as a result of fluctuations in volume and carloadings;

expectations as to general macroeconomic conditions, including

slowdowns and recessions, domestically or internationally, and

volatility in interest rates and fuel prices; closing of customer

manufacturing, distribution, or production facilities; expectations

as to operational or service improvements; expectations as to

hiring challenges; availability of employees; expectations

regarding the effectiveness of steps taken or to be taken to

improve operations, service, infrastructure improvements, and

transportation plan modifications; expectations as to cost savings,

revenue growth, and earnings; the time by which goals, targets, or

objectives will be achieved; projections, predictions,

expectations, estimates, or forecasts as to business, financial,

and operational results, future economic performance, and general

economic conditions; proposed new products and services; estimates

of costs relating to environmental remediation and restoration;

estimates and expectations regarding tax matters; expectations that

claims, litigation, environmental costs, commitments, contingent

liabilities, labor negotiations or agreements, cyberattacks or

other matters. These statements are, or will be, forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements also generally include, without

limitation, information, or statements regarding: projections,

predictions, expectations, estimates, or forecasts as to the

Company’s and its subsidiaries’ business, financial, and

operational results, and future economic performance; and

management’s beliefs, expectations, goals, and objectives and other

similar expressions concerning matters that are not historical

facts.

Forward-looking statements should not be read as a guarantee of

future performance or results and will not necessarily be accurate

indications of the times that, or by which, such performance or

results will be achieved. Forward-looking information, including

expectations regarding operational and financial improvements and

the Company’s future performance or results are subject to risks

and uncertainties that could cause actual performance or results to

differ materially from those expressed in the statement. Important

factors, including risk factors, could affect the Company’s and its

subsidiaries’ future results and could cause those results or other

outcomes to differ materially from those expressed or implied in

the forward-looking statements. Information regarding risk factors

and other cautionary information are available in the Company’s

Annual Report on Form 10-K for 2023, which was filed with the SEC

on February 9, 2024. The Company updates information regarding risk

factors if circumstances require such updates in its periodic

reports on Form 10-Q and its subsequent Annual Reports on Form 10-K

(or such other reports that may be filed with the SEC).

Forward-looking statements speak only as of, and are based only

upon information available on, the date the statements were made.

The Company assumes no obligation to update forward-looking

information to reflect actual results, changes in assumptions, or

changes in other factors affecting forward-looking information. If

the Company does update one or more forward-looking statements, no

inference should be drawn that the Company will make additional

updates with respect thereto or with respect to other

forward-looking statements. References to the Company’s website are

provided for convenience and, therefore, information on or

available through the website is not, and should not be deemed to

be, incorporated by reference herein.

UNION PACIFIC CORPORATION AND

SUBSIDIARY COMPANIES

Condensed Consolidated Statements of

Income (unaudited)

Millions, Except Per Share Amounts and

3rd Quarter

Year-to-Date

Percentages, For the Periods Ended

September 30,

2024

2023

%

2024

2023

%

Operating Revenues

Freight revenues

$

5,768

$

5,545

4

%

$

17,022

$

16,770

2

%

Other revenues

323

396

(18

)

1,107

1,190

(7

)

Total operating revenues

6,091

5,941

3

18,129

17,960

1

Operating Expenses

Compensation and benefits

1,228

1,201

2

3,638

3,649

-

Purchased services and materials

644

668

(4

)

1,901

1,971

(4

)

Fuel

610

702

(13

)

1,893

2,132

(11

)

Depreciation

602

580

4

1,792

1,729

4

Equipment and other rents

237

235

1

672

718

(6

)

Other

354

378

(6

)

1,045

1,086

(4

)

Total operating expenses

3,675

3,764

(2

)

10,941

11,285

(3

)

Operating Income

2,416

2,177

11

7,188

6,675

8

Other income, net

87

106

(18

)

282

383

(26

)

Interest expense

(314

)

(334

)

(6

)

(957

)

(1,009

)

(5

)

Income before income taxes

2,189

1,949

12

6,513

6,049

8

Income tax expense

(518

)

(421

)

23

(1,528

)

(1,322

)

16

Net Income

$

1,671

$

1,528

9

%

$

4,985

$

4,727

5

%

Share and Per Share

Earnings per share - basic

$

2.75

$

2.51

10

%

$

8.19

$

7.76

6

%

Earnings per share - diluted

$

2.75

$

2.51

10

$

8.18

$

7.75

6

Weighted average number of shares -

basic

607.6

608.7

-

608.7

609.3

-

Weighted average number of shares -

diluted

608.6

609.8

-

609.7

610.3

-

Dividends declared per share

$

1.34

$

1.30

3

$

3.94

$

3.90

1

Operating Ratio

60.3

%

63.4

%

(3.1

)

pts

60.4

%

62.8

%

(2.4

)

pts

Effective Tax Rate

23.7

%

21.6

%

2.1

pts

23.5

%

21.9

%

1.6

pts

1

UNION PACIFIC CORPORATION AND SUBSIDIARY COMPANIES

Freight Revenues Statistics

(unaudited)

3rd Quarter

Year-to-Date

For the Periods Ended September 30,

2024

2023

%

2024

2023

%

Freight Revenues (Millions)

Grain & grain products

$

923

$

825

12

%

$

2,767

$

2,658

4

%

Fertilizer

208

194

7

612

563

9

Food & refrigerated

269

259

4

832

777

7

Coal & renewables

405

488

(17

)

1,132

1,422

(20

)

Bulk

1,805

1,766

2

5,343

5,420

(1

)

Industrial chemicals & plastics

598

557

7

1,763

1,638

8

Metals & minerals

529

556

(5

)

1,574

1,654

(5

)

Forest products

322

333

(3

)

1,002

1,012

(1

)

Energy & specialized markets

672

611

10

2,009

1,856

8

Industrial

2,121

2,057

3

6,348

6,160

3

Automotive

601

609

(1

)

1,871

1,821

3

Intermodal

1,241

1,113

12

3,460

3,369

3

Premium

1,842

1,722

7

5,331

5,190

3

Total

$

5,768

$

5,545

4

%

$

17,022

16,770

2

%

Revenue Carloads (Thousands)

Grain & grain products

206

183

13

%

616

582

6

%

Fertilizer

53

51

4

162

144

13

Food & refrigerated

45

45

-

137

133

3

Coal & renewables

192

231

(17

)

527

650

(19

)

Bulk

496

510

(3

)

1,442

1,509

(4

)

Industrial chemicals & plastics

169

163

4

502

484

4

Metals & minerals

186

206

(10

)

540

604

(11

)

Forest products

53

54

(2

)

161

161

-

Energy & specialized markets

152

146

4

453

429

6

Industrial

560

569

(2

)

1,656

1,678

(1

)

Automotive

202

210

(4

)

627

623

1

Intermodal [a]

909

763

19

2,446

2,246

9

Premium

1,111

973

14

3,073

2,869

7

Total

2,167

2,052

6

%

6,171

6,056

2

%

Average Revenue per Car

Grain & grain products

$

4,498

$

4,486

-

%

$

4,495

$

4,563

(1

)%

Fertilizer

3,872

3,818

1

3,775

3,921

(4

)

Food & refrigerated

6,099

5,847

4

6,090

5,850

4

Coal & renewables

2,101

2,114

(1

)

2,147

2,187

(2

)

Bulk

3,641

3,465

5

3,706

3,592

3

Industrial chemicals & plastics

3,534

3,406

4

3,509

3,381

4

Metals & minerals

2,847

2,688

6

2,918

2,736

7

Forest products

6,157

6,197

(1

)

6,235

6,305

(1

)

Energy & specialized markets

4,415

4,201

5

4,431

4,331

2

Industrial

3,791

3,612

5

3,833

3,671

4

Automotive

2,968

2,894

3

2,983

2,921

2

Intermodal [a]

1,365

1,459

(6

)

1,414

1,500

(6

)

Premium

1,657

1,769

(6

)

1,735

1,809

(4

)

Average

$

2,662

$

2,702

(1

)%

$

2,758

$

2,769

-

%

[a]

For intermodal shipments each container or

trailer equals one carload.

2

UNION PACIFIC CORPORATION AND

SUBSIDIARY COMPANIES

Condensed Consolidated Statements of

Financial Position (unaudited)

Sep. 30,

Dec. 31,

Millions, Except Percentages

2024

2023

Assets

Cash and cash equivalents

$

947

$

1,055

Short-term investments

20

16

Other current assets

3,182

3,077

Investments

2,649

2,605

Properties, net

58,036

57,398

Operating lease assets

1,345

1,643

Other assets

1,391

1,338

Total assets

$

67,570

$

67,132

Liabilities and Common Shareholders'

Equity

Debt due within one year

$

1,652

$

1,423

Other current liabilities

3,714

3,683

Debt due after one year

29,761

31,156

Operating lease liabilities

934

1,245

Deferred income taxes

13,199

13,123

Other long-term liabilities

1,726

1,714

Total liabilities

50,986

52,344

Total common shareholders' equity

16,584

14,788

Total liabilities and common shareholders'

equity

$

67,570

$

67,132

3

UNION PACIFIC CORPORATION AND

SUBSIDIARY COMPANIES

Condensed Consolidated Statements of Cash

Flows (unaudited)

Year-to-Date

Millions, for the Periods Ended September

30,

2024

2023

Operating Activities

Net income

$

4,985

$

4,727

Depreciation

1,792

1,729

Deferred and other income taxes

77

59

Other - net

(170

)

(531

)

Cash provided by operating activities

6,684

5,984

Investing Activities

Capital investments*

(2,530

)

(2,582

)

Other - net

104

(68

)

Cash used in investing activities

(2,426

)

(2,650

)

Financing Activities

Dividends paid

(2,403

)

(2,380

)

Debt repaid

(2,220

)

(2,179

)

Share repurchase programs

(831

)

(705

)

Debt issued

800

1,599

Other - net

279

125

Cash used in financing activities

(4,375

)

(3,540

)

Net change in cash, cash equivalents, and

restricted cash

(117

)

(206

)

Cash, cash equivalents, and restricted

cash at beginning of year

1,074

987

Cash, cash equivalents, and restricted

cash at end of period

$

957

$

781

Free Cash Flow**

Cash provided by operating activities

$

6,684

$

5,984

Cash used in investing activities

(2,426

)

(2,650

)

Dividends paid

(2,403

)

(2,380

)

Free cash flow

$

1,855

$

954

*

Capital investments include locomotive and

freight car early lease buyouts of $96 million in 2024 and $14

million in 2023.

**

Free cash flow is a non-GAAP measure;

however, we believe this measure is important to management and

investors in evaluating our financial performance and measures our

ability to generate cash without additional external financing.

4

UNION PACIFIC CORPORATION AND

SUBSIDIARY COMPANIES

Operating and Performance Statistics

(unaudited)

3rd Quarter

Year-to-Date

For the Periods Ended September 30,

2024

2023

%

2024

2023

%

Operating/Performance

Statistics

Freight car velocity (daily miles per

car)*

210

200

5

%

205

199

3

%

Average train speed (miles per hour)*

23.3

23.6

(1

)

23.5

23.9

(2

)

Average terminal dwell time (hours)*

22.4

23.5

(5

)

22.8

23.6

(3

)

Locomotive productivity (GTMs per

horsepower day)

135

129

5

135

126

7

Gross ton-miles (GTMs) (millions)

215,993

208,678

4

628,828

622,932

1

Train length (feet)

9,580

9,537

-

9,472

9,337

1

Intermodal service performance index

(%)

86

85

1

pts

90

85

5

pts

Manifest/Automotive service performance

index (%)

89

84

5

pts

87

83

4

pts

Intermodal car trip plan compliance

(%)**

76

75

1

pts

80

75

5

pts

Manifest/Automotive car trip plan

compliance (%)**

68

64

4

pts

66

63

3

pts

Workforce productivity (car miles per

employee)

1,102

985

12

1,044

984

6

Total employees (average)

29,946

31,624

(5

)

30,518

31,800

(4

)

Locomotive Fuel Statistics

Average fuel price per gallon consumed

$

2.60

$

3.12

(17

)%

$

2.71

$

3.07

(12

)%

Fuel consumed in gallons (millions)

229

219

5

681

677

1

Fuel consumption rate***

1.058

1.052

1

1.084

1.087

-

Revenue Ton-Miles (Millions)

Grain & grain products

20,451

17,649

16

%

61,095

56,551

8

%

Fertilizer

3,056

2,982

2

9,913

9,071

9

Food & refrigerated

4,624

4,643

-

14,234

13,700

4

Coal & renewables

19,746

23,367

(15

)

54,980

66,728

(18

)

Bulk

47,877

48,641

(2

)

140,222

146,050

(4

)

Industrial chemicals & plastics

7,483

7,492

-

22,979

21,797

5

Metals & minerals

8,414

9,253

(9

)

24,780

27,409

(10

)

Forest products

5,355

5,636

(5

)

16,598

17,000

(2

)

Energy & specialized markets

10,420

9,621

8

31,235

28,937

8

Industrial

31,672

32,002

(1

)

95,592

95,143

-

Automotive

4,558

4,624

(1

)

13,973

13,711

2

Intermodal

19,928

17,765

12

55,505

53,452

4

Premium

24,486

22,389

9

69,478

67,163

3

Total

104,035

103,032

1

%

305,292

308,356

(1

)%

*

Surface Transportation Board (STB)

reported performance measures.

**

Methodology used to report is not

comparable with the reporting to the STB under docket number EP

770.

***

Fuel consumption is computed as follows:

gallons of fuel consumed divided by gross ton-miles in

thousands.

5

UNION PACIFIC CORPORATION AND

SUBSIDIARY COMPANIES

Condensed Consolidated Statements of

Income (unaudited)

2024

Millions, Except Per Share Amounts and

Percentages,

1st Qtr

2nd Qtr

3rd Qtr

Year-to-Date

Operating Revenues

Freight revenues

$

5,616

$

5,638

$

5,768

$

17,022

Other revenues

415

369

323

1,107

Total operating revenues

6,031

6,007

6,091

18,129

Operating Expenses

Compensation and benefits

1,223

1,187

1,228

3,638

Purchased services and materials

613

644

644

1,901

Fuel

658

625

610

1,893

Depreciation

594

596

602

1,792

Equipment and other rents

216

219

237

672

Other

355

336

354

1,045

Total operating expenses

3,659

3,607

3,675

10,941

Operating Income

2,372

2,400

2,416

7,188

Other income, net

92

103

87

282

Interest expense

(324

)

(319

)

(314

)

(957

)

Income before income taxes

2,140

2,184

2,189

6,513

Income tax expense

(499

)

(511

)

(518

)

(1,528

)

Net Income

$

1,641

$

1,673

$

1,671

$

4,985

Share and Per Share

Earnings per share - basic

$

2.69

$

2.75

$

2.75

$

8.19

Earnings per share - diluted

$

2.69

$

2.74

$

2.75

$

8.18

Weighted average number of shares -

basic

609.2

609.4

607.6

608.7

Weighted average number of shares -

diluted

610.2

610.3

608.6

609.7

Dividends declared per share

$

1.30

$

1.30

$

1.34

$

3.94

Operating Ratio

60.7

%

60.0

%

60.3

%

60.4

%

Effective Tax Rate

23.3

%

23.4

%

23.7

%

23.5

%

6

UNION PACIFIC CORPORATION AND

SUBSIDIARY COMPANIES

Freight Revenue Statistics (unaudited)

2024

1st Qtr

2nd Qtr

3rd Qtr

Year-to-Date

Freight Revenues (Millions)

Grain & grain products

$

943

$

901

$

923

$

2,767

Fertilizer

201

203

208

612

Food & refrigerated

285

278

269

832

Coal & renewables

388

339

405

1,132

Bulk

1,817

1,721

1,805

5,343

Industrial chemicals & plastics

572

593

598

1,763

Metals & minerals

515

530

529

1,574

Forest products

338

342

322

1,002

Energy & specialized markets

679

658

672

2,009

Industrial

2,104

2,123

2,121

6,348

Automotive

611

659

601

1,871

Intermodal

1,084

1,135

1,241

3,460

Premium

1,695

1,794

1,842

5,331

Total

$

5,616

$

5,638

$

5,768

$

17,022

Revenue Carloads (Thousands)

Grain & grain products

210

200

206

616

Fertilizer

47

62

53

162

Food & refrigerated

46

46

45

137

Coal & renewables

177

158

192

527

Bulk

480

466

496

1,442

Industrial chemicals & plastics

164

169

169

502

Metals & minerals

170

184

186

540

Forest products

53

55

53

161

Energy & specialized markets

154

147

152

453

Industrial

541

555

560

1,656

Automotive

207

218

202

627

Intermodal [a]

739

798

909

2,446

Premium

946

1,016

1,111

3,073

Total

1,967

2,037

2,167

6,171

Average Revenue per Car

Grain & grain products

$

4,494

$

4,493

$

4,498

$

4,495

Fertilizer

4,271

3,311

3,872

3,775

Food & refrigerated

6,231

5,943

6,099

6,090

Coal & renewables

2,189

2,156

2,101

2,147

Bulk

3,787

3,692

3,641

3,706

Industrial chemicals & plastics

3,486

3,507

3,534

3,509

Metals & minerals

3,030

2,885

2,847

2,918

Forest products

6,297

6,249

6,157

6,235

Energy & specialized markets

4,416

4,462

4,415

4,431

Industrial

3,886

3,825

3,791

3,833

Automotive

2,947

3,033

2,968

2,983

Intermodal [a]

1,468

1,421

1,365

1,414

Premium

1,792

1,766

1,657

1,735

Average

$

2,855

$

2,768

$

2,662

$

2,758

[a]

For intermodal shipments each container or

trailer equals one carload.

7

UNION PACIFIC CORPORATION AND

SUBSIDIARY COMPANIES

Non-GAAP Measures Reconciliation to GAAP

(unaudited)

Debt / Net Income

Millions, Except Ratios

Sep. 30,

Dec. 31,

for the Trailing Twelve Months Ended

[a]

2024

2023

Debt

$

31,413

$

32,579

Net income

6,637

6,379

Debt / net income

4.7

5.1

Adjusted Debt / Adjusted

EBITDA*

Millions, Except Ratios

Sep. 30,

Dec. 31,

for the Trailing Twelve Months Ended

[a]

2024

2023

Net income

$

6,637

$

6,379

Add:

Income tax expense

2,060

1,854

Depreciation

2,381

2,318

Interest expense

1,288

1,340

EBITDA

$

12,366

$

11,891

Adjustments:

Other income, net

(390

)

(491

)

Interest on operating lease liabilities

[b]

47

58

Adjusted EBITDA

$

12,023

$

11,458

Debt

$

31,413

$

32,579

Operating lease liabilities

1,283

1,600

Adjusted debt

$

32,696

$

34,179

Adjusted debt / adjusted EBITDA

2.7

3.0

[a]

The trailing twelve months income

statement information ended September 30, 2024, is recalculated by

taking the twelve months ended December 31, 2023, subtracting the

nine months ended September 30, 2023, and adding the nine months

ended September 30, 2024.

[b]

Represents the hypothetical interest

expense we would incur (using the incremental borrowing rate) if

the property under our operating leases were owned or accounted for

as finance leases.

*

Adjusted debt (total debt plus operating

lease liabilities plus after-tax unfunded pension and OPEB (other

post-retirement benefit) obligations) to adjusted EBITDA (earnings

before interest, taxes, depreciation, amortization, and adjustments

for other income and interest on present value of operating leases)

is considered a non-GAAP financial measure by SEC Regulation G and

Item 10 of SEC Regulation S-K and may not be defined and calculated

by other companies in the same manner. We believe this measure is

important to management and investors in evaluating the Company’s

ability to sustain given debt levels (including leases) with the

cash generated from operations. In addition, a comparable measure

is used by rating agencies when reviewing the Company’s credit

rating. Adjusted debt to adjusted EBITDA should be considered in

addition to, rather than as a substitute for, other information

provided in accordance with GAAP. The most comparable GAAP measure

is debt to net income ratio. The tables above provide

reconciliations from net income to adjusted EBITDA, debt to

adjusted debt, and debt to net income to adjusted debt to adjusted

EBITDA. At September 30, 2024, and December 31, 2023, the

incremental borrowing rate on operating leases was 3.7% and 3.6%,

respectively. Pension and OPEB were funded at September 30, 2024,

and December 31, 2023.

8

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024333210/en/

Union Pacific Investor contact: Brad Stock at

402-544-4227 or bkstock@up.com Union Pacific Media contact:

Clarissa Beyah at 402-957-4793 or cbeyah@up.com

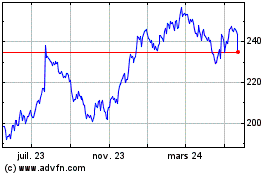

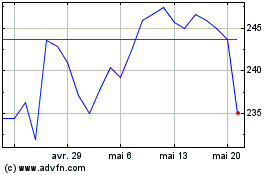

Union Pacific (NYSE:UNP)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Union Pacific (NYSE:UNP)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024