Vince Holding Corp. (NYSE:VNCE), a leading global contemporary

group (“Vince” or the “Company”), today reported its financial

results for the fourth quarter and fiscal 2021 ended January 29,

2022.

In this press release, the Company is presenting its historical

financial results in conformity with U.S. generally accepted

accounting principles ("GAAP") as well as on an "adjusted" basis.

Adjusted results presented in this press release are non-GAAP

financial measures. See "Non-GAAP Financial Measures" below for

more information about the Company's use of non-GAAP financial

measures and Exhibit 3 to this press release for a reconciliation

of GAAP measures to such non-GAAP measures.

Highlights for the fourth quarter ended January 29, 2022:

- Net sales increased 32.4% to $99.0 million as compared to $74.8

million in the same period last year reflecting a 25.6% increase in

Vince brand sales and a 121.3% increase in Rebecca Taylor and

Parker.

- Gross margin rate was 44.0% compared to 36.9% in the same

period last year.

- Income from operations was $1.8 million compared to a loss from

operations of $3.9 million in the same period last year.

- Net loss was $2.7 million or $(0.23) per share compared to a

net loss of $7.4 million or $(0.62) per share in the same period

last year.

Jack Schwefel, Chief Executive Officer, commented, “Although

there are currently many headwinds beyond our control, we are very

encouraged with the ongoing strength in our Vince brand. We have a

solid foundation with strong brand equity and deep customer

connections, which we will continue to leverage to further expand

awareness and drive long-term growth. As we head into 2022, while

we remain focused on executing our strategies including the

expansion of our omni-channel capabilities, digital transformation

and growing our men’s and international businesses, we will

continue to employ measures to mitigate the impact of supply chain

challenges and cost inflation by pulling forward inventory and

instituting additional prices increases. Longer term, we continue

to see ample opportunity to grow our brands and look forward to

driving market share gains as we capitalize on the increasing white

space in the contemporary luxury category.”

For the fourth quarter ended January 29, 2022:

- Total Company net sales increased 32.4% to $99.0 million

compared to $74.8 million in the fourth quarter of fiscal

2020.

- Gross profit was $43.6 million, or 44.0% of net sales, compared

to gross profit of $27.6 million, or 36.9% of net sales, in the

fourth quarter of fiscal 2020. The increase in the gross margin

rate was primarily due to lower year-over-year adjustments to

inventory reserves and lower promotional activity in the

direct-to-consumer channel, partially offset by higher freight

costs.

- Selling, general, and administrative expenses, were $41.8

million, or 42.2% of sales, compared to $31.5 million, or 42.1% of

sales, in the fourth quarter of fiscal 2020. The increase in

SG&A dollars was primarily the result of higher payroll and

compensation expense, increased investments in marketing, as well

as higher occupancy costs due to landlord rent concessions received

in the prior year.

- Income from operations was $1.8 million compared to a loss from

operations of $3.9 million in the same period last year.

- Income tax expense was $2.8 million as a result of an annual

non-cash deferred tax expense created by the amortization of

indefinite-lived goodwill and intangible assets for tax but not for

book purposes.

- Net loss was $2.7 million or $(0.23) per share compared to a

net loss of $7.4 million or $(0.62) per share in the same period

last year.

- The Company ended the quarter with 86 company-operated Vince

and Rebecca Taylor stores, a net increase of 15 stores since the

fourth quarter of fiscal 2020.

Vince Fourth Quarter Highlights

- Net sales increased 25.6% to $87.3 million as compared to the

fourth quarter of fiscal 2020.

- Wholesale segment sales increased 10.4% to $43.2 million

compared to the fourth quarter of fiscal 2020.

- Direct-to-consumer segment sales increased 45.2% to $44.1

million compared to the fourth quarter of fiscal 2020.

- Income from operations excluding unallocated corporate expenses

was $15.9 million compared to income of $12.0 million in the same

period last year.

Rebecca Taylor and Parker Fourth Quarter Highlights

- Net sales increased 121.3% to $11.7 million as compared to the

fourth quarter of fiscal 2020.

- Loss from operations was $1.3 million compared to a loss from

operations of $5.0 million in the same period last year.

Net Sales and Operating Results by

Segment:

Three Months Ended

January 29,

January 30,

(in thousands)

2022

2021(1)

Net Sales:

Vince Wholesale

$

43,212

$

39,139

Vince Direct-to-consumer

44,084

30,368

Rebecca Taylor and Parker

11,731

5,301

Total net sales

$

99,027

$

74,808

Income (loss) from operations:

Vince Wholesale

$

11,475

$

11,833

Vince Direct-to-consumer

4,391

177

Rebecca Taylor and Parker

(1,258

)

(5,007

)

Subtotal

14,608

7,003

Unallocated corporate(2)

(12,793

)

(10,921

)

Total income (loss) from operations

$

1,815

$

(3,918

)

(1)

Beginning with the fourth quarter of

fiscal 2021, the Company changed the allocation methodology for

certain corporate operational expenses between the Vince Wholesale

and Vince Direct-to-consumer segments. The prior period has been

updated to conform to the current allocation methodology. These

changes did not impact the Company’s previously reported

consolidated financial results.

(2)

Unallocated corporate expenses are related

to the Vince brand and are comprised of selling, general and

administrative expenses attributable to corporate and

administrative activities (such as marketing, design, finance,

information technology, legal and human resource departments), and

other charges that are not directly attributable to the Company’s

Vince Wholesale and Vince Direct-to-consumer reportable

segments.

For the fiscal year ended January 29, 2022:

- Total Company net sales increased 46.8% to $322.7 million

compared to $219.9 million in fiscal year 2020.

- Gross profit was $146.6 million, or 45.4% of net sales,

compared to gross profit of $88.6 million, or 40.3% of net sales,

in fiscal 2020. The increase in the gross margin rate was primarily

due to lower year-over-year adjustments to inventory reserves and

lower promotional activity in the direct-to-consumer channel,

partially offset by higher freight costs.

- Selling, general, and administrative expenses, were $146.1

million, or 45.3% of sales, compared to $122.8 million, or 55.9% of

sales, in fiscal 2020. The increase in SG&A dollars was

primarily the result of higher payroll and compensation expense,

increased investments in marketing, as well as higher occupancy

costs due to landlord rent concessions received in the prior

year.

- Operating income was $0.5 million compared to operating loss of

$61.1 million in fiscal 2020. Excluding non-cash asset impairment

charges, adjusted operating loss was $34.2 million in fiscal 2020.

Please refer to Exhibit 3 for a reconciliation of GAAP measures to

non-GAAP measures.

- Income tax expense was $4.6 million as a result of an annual

non-cash deferred tax expense created by the amortization of

indefinite-lived goodwill and intangible assets for tax but not for

book purposes.

- Net loss was $12.7 million or $(1.07) per share compared to a

net loss of $65.6 million or $(5.58) per share in the same period

last year. Net loss in fiscal 2021 includes $1.5 million of expense

related to the termination of the 2018 Term Loan Facility.

Excluding non-cash asset impairment charges and a TRA adjustment of

$2.3 million, adjusted net loss was $41.1 million in fiscal

2020.

Vince

- Net sales increased 47.6% to $283.5 million as compared to

fiscal 2020.

- Wholesale segment sales increased 39.8% to $147.8 million as

compared to fiscal 2020.

- Direct-to-consumer segment sales increased 57.2% to $135.7

million as compared to fiscal 2020.

- Income from operations excluding unallocated corporate expenses

was $56.7 million compared to income of $9.3 million in the same

period last year. Fiscal 2020 includes non-cash asset impairment

charges of $11.7 million.

Rebecca Taylor and Parker

- Net sales increased 40.8% to $39.1 million as compared to

fiscal 2020.

- Loss from operations was $9.2 million compared to a loss from

operations of $16.1 million in the same period last year. Fiscal

2020 includes non-cash asset impairment charges of $1.7

million.

Net Sales and Operating Results by

Segment:

Fiscal Year

(in thousands)

2021

2020 (1)

Net Sales:

Vince Wholesale

$

147,817

$

105,737

Vince Direct-to-consumer

135,720

86,326

Rebecca Taylor and Parker

39,146

27,807

Total net sales

$

322,683

$

219,870

Income (loss) from operations:

Vince Wholesale

$

45,839

$

34,462

Vince Direct-to-consumer

10,873

(25,137

)

Rebecca Taylor and Parker

(9,213

)

(16,112

)

Subtotal

47,499

(6,787

)

Unallocated corporate(2)

(47,016

)

(54,293

)

Total income (loss) from operations

$

483

$

(61,080

)

(1)

Beginning with the fourth quarter of

fiscal 2021, the Company changed the allocation methodology for

certain corporate operational expenses between the Vince Wholesale

and Vince Direct-to-consumer segments. The prior period has been

updated to conform to the current allocation methodology. These

changes did not impact the Company’s previously reported

consolidated financial results.

(2)

Unallocated corporate expenses are related

to the Vince brand and are comprised of selling, general and

administrative expenses attributable to corporate and

administrative activities (such as marketing, design, finance,

information technology, legal and human resource departments), and

other charges that are not directly attributable to the Company’s

Vince Wholesale and Vince Direct-to-consumer reportable

segments.

Balance Sheet

At the end of the fourth quarter of fiscal 2021, total

borrowings under the Company’s debt agreements totaled $92.7

million and the Company had $40.6 million of excess availability

under its revolving credit facility.

Net inventory at the end of the fourth quarter of fiscal 2021

was $78.6 million compared to $68.2 million at the end of the

fourth quarter of fiscal 2020. The Company remains comfortable with

the current composition of inventory in both level and

assortment.

During the year ended January 29, 2022, the Company issued and

sold 17,134 shares of common stock under the ATM program for

aggregate net proceeds of $150, at an average price of $8.75 per

share. Additional shares remain available under the program and

proceeds will be used as sources, along with cash from operations,

to fund future growth.

2021 Fourth Quarter Earnings Conference

Call

A conference call to discuss fourth quarter and fiscal year 2021

results will be held today, April 29, 2022, at 8:30 a.m. ET, hosted

by Vince Holding Corp. Chief Executive Officer, Jack Schwefel, and

Chief Financial Officer, David Stefko. During the conference call,

the Company may make comments concerning business and financial

developments, trends and other business or financial matters. The

Company's comments, as well as other matters discussed during the

conference call, may contain or constitute information that has not

been previously disclosed.

Those who wish to participate in the call may do so by dialing

(844) 200-6205, conference ID 685474. Any interested party will

also have the opportunity to access the call via the Internet at

http://investors.vince.com/. To listen to the live call, please go

to the website at least 15 minutes early to register and download

any necessary audio software. For those who cannot listen to the

live broadcast, a recording will be available for 12 months after

the date of the event. Recordings may be accessed at

http://investors.vince.com.

Non-GAAP Financial

Measures

In addition to reporting financial results in accordance with

GAAP, the Company has provided, with respect to financial results

relating to twelve months ended January 30, 2021, adjusted

operating income (loss), adjusted income (loss) before income

taxes, adjusted income taxes, adjusted net income (loss) and

adjusted earnings (loss) per share, which are non-GAAP measures, in

order to eliminate the effect of non-cash asset impairment charges

and the TRA adjustment. The Company believes that the presentation

of these non-GAAP measures facilitates an understanding of the

Company's continuing operations without the impact associated with

the aforementioned items. While these types of events can and do

recur periodically, they are excluded from the indicated financial

information due to their impact on the comparability of earnings

across periods. Non-GAAP financial measures should not be

considered in isolation from, or as a substitute for, financial

information prepared in accordance with GAAP. A reconciliation of

GAAP to non-GAAP results has been provided in Exhibit 3 to this

press release.

ABOUT VINCE HOLDING CORP.

Vince Holding Corp. is a global contemporary group, consisting

of three brands: Vince, Rebecca Taylor and Parker. Vince,

established in 2002, is a leading global luxury apparel and

accessories brand best known for creating elevated yet understated

pieces for every day effortless style. Known for its range of

luxury products, Vince offers women’s and men’s ready-to-wear,

footwear and accessories through 51 full-price retail stores, 18

outlet stores, and its e-commerce site, vince.com and through its

subscription service Vince Unfold, www.vinceunfold.com, as well as

through premium wholesale channels globally. Rebecca Taylor,

founded in 1996 in New York City, is a high-end women’s

contemporary womenswear line lauded for its signature prints,

romantic detailing, and vintage inspired aesthetic reimagined for a

modern era. The Rebecca Taylor collection is available at 18 retail

stores, through our e-commerce site at rebeccataylor.com and

through its subscription service Rebecca Taylor RNTD,

www.rebeccataylorrntd.com, as well as through major department and

specialty stores in the US and select international markets.

Parker, founded in 2008 in New York City, is a contemporary women’s

fashion brand that is trend focused. Please visit www.vince.com for

more information.

Forward-Looking Statements: This document, and any statements

incorporated by reference herein, contains forward-looking

statements under the Private Securities Litigation Reform Act of

1995. Forward-looking statements include statements regarding,

among other things, our current expectations about the Company's

future results and financial condition, revenues, store openings

and closings, margins, expenses and earnings and are indicated by

words or phrases such as “may,” “will,” “should,” “believe,”

“expect,” “seek,” “anticipate,” “intend,” “estimate,” “plan,”

“target,” “project,” “forecast,” “envision” and other similar

phrases. Although we believe the assumptions and expectations

reflected in these forward-looking statements are reasonable, these

assumptions and expectations may not prove to be correct and we may

not achieve the results or benefits anticipated. These

forward-looking statements are not guarantees of actual results,

and our actual results may differ materially from those suggested

in the forward-looking statements. These forward-looking statements

involve a number of risks and uncertainties, some of which are

beyond our control, including, without limitation: our ability to

realize the benefits of our strategic initiatives, including our

ability to successfully implement and execute our omni-channel and

customer strategies; our ability to expand our product offerings

into new product categories, including the ability to find suitable

licensing partners; the impact of the novel coronavirus (COVID-19)

pandemic on our business, results of operations and liquidity;

general economic conditions; the execution and management of our

international expansion, including our ability to promote our brand

and merchandise outside the U.S. and find suitable partners in

certain geographies; our current and future licensing arrangements;

our ability to continue having the liquidity necessary to service

our debt, meet contractual payment obligations, and fund our

operations; further impairment of our goodwill and indefinite-lived

intangible assets; the execution and management of our retail store

growth plans; our ability to make lease payments when due; our

ability to maintain our larger wholesale partners; the loss of

certain of our wholesale partners; the expected effects of the

acquisition of the Acquired Businesses on the Company; our ability

to remediate the identified material weakness in our internal

control over financial reporting; our ability to comply with

domestic and international laws, regulations and orders; our

ability to anticipate and/or react to changes in customer demand

and attract new customers, including in connection with making

inventory commitments; our ability to remain competitive in the

areas of merchandise quality, price, breadth of selection and

customer service; our ability to keep a strong brand image; our

ability to attract and retain key personnel; our ability to protect

our trademarks in the U.S. and internationally; seasonal and

quarterly variations in our revenue and income; our ability to

mitigate system security risk issues, such as cyber or malware

attacks, as well as other major system failures; ; our ability to

optimize our systems, processes and functions; our ability to

comply with privacy-related obligations; our ability to ensure the

proper operation of the distribution facilities by third-party

logistics providers; fluctuations in the price, availability and

quality of raw materials; commodity, raw material and other cost

increases; the extent of our foreign sourcing; our reliance on

independent manufacturers; other tax matters; and other factors as

set forth from time to time in our Securities and Exchange

Commission filings, including those described under “Item 1A—Risk

Factors” in our Annual Report on Form 10-K and Quarterly Reports on

Form 10-Q. We intend these forward-looking statements to speak only

as of the time of this release and do not undertake to update or

revise them as more information becomes available, except as

required by law.

Vince Holding Corp. and

Subsidiaries

Exhibit (1)

Condensed Consolidated Statements of

Operations

(Unaudited, amounts in thousands except

percentages, share and per share data)

Three Months Ended

Fiscal Year

January 29,

January 30,

January 29,

January 30,

2022

2021

2022

2021

Net sales

$

99,027

$

74,808

$

322,683

$

219,870

Cost of products sold

55,451

47,205

176,113

131,273

Gross profit

43,576

27,603

146,570

88,597

as a % of net sales

44.0

%

36.9

%

45.4

%

40.3

%

Impairment of goodwill and intangible

assets

—

—

—

13,848

Impairment of long-lived assets

—

—

—

13,026

Selling, general and administrative

expenses

41,761

31,521

146,087

122,803

as a % of net sales

42.2

%

42.1

%

45.3

%

55.9

%

Income (loss) from operations

1,815

(3,918

)

483

(61,080

)

as a % of net sales

1.8

%

(5.2

)%

0.1

%

(27.8

)%

Interest expense, net

1,764

1,701

8,606

5,007

Other income, net

—

—

—

(2,304

)

Income (loss) before income taxes

51

(5,619

)

(8,123

)

(63,783

)

Provision for income taxes

2,758

1,753

4,581

1,866

Net loss

$

(2,707

)

$

(7,372

)

$

(12,704

)

$

(65,649

)

Loss per share:

Basic loss per share

$

(0.23

)

$

(0.62

)

$

(1.07

)

$

(5.58

)

Diluted loss per share

$

(0.23

)

$

(0.62

)

$

(1.07

)

$

(5.58

)

Weighted average shares

outstanding:

Basic

11,962,787

11,804,027

11,902,307

11,769,689

Diluted

11,962,787

11,804,027

11,902,307

11,769,689

Vince Holding Corp. and

Subsidiaries

Exhibit (2)

Condensed Consolidated Balance

Sheets

(Unaudited, amounts in

thousands)

January 29,

January 30,

2022

2021

ASSETS

Current assets:

Cash and cash equivalents

$

1,056

$

3,777

Trade receivables, net

29,948

31,878

Inventories, net

78,564

68,226

Prepaid expenses and other current

assets

5,804

6,703

Total current assets

115,372

110,584

Property and equipment, net

17,117

17,741

Operating lease right-of-use assets

92,677

91,982

Intangible assets, net

75,835

76,491

Goodwill

31,973

31,973

Other assets

4,253

4,173

Total assets

$

337,227

$

332,944

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

46,722

$

40,216

Accrued salaries and employee benefits

6,244

4,231

Other accrued expenses

13,226

15,688

Short-term lease liabilities

22,700

22,085

Current portion of long-term debt

2,625

—

Total current liabilities

91,517

82,220

Long-term debt

88,869

84,485

Long-term lease liabilities

94,367

97,144

Deferred income tax liability and other

liabilities

6,694

2,888

Stockholders' equity

55,780

66,207

Total liabilities and stockholders'

equity

$

337,227

$

332,944

Vince Holding Corp. and

Subsidiaries

Exhibit (3)

Reconciliation of GAAP to Non-GAAP

measures

(Unaudited, amounts in

thousands)

For the three months ended

January 29, 2022

As Reported (GAAP)

Long-lived Assets Impairment

Charge

Goodwill and Intangibles

Impairment Charge

TRA Adjustment

As Adjusted (Non- GAAP)

Income from operations

$

1,815

$

—

$

—

$

—

$

1,815

Interest expense, net

1,764

—

—

—

1,764

Other (income) expense, net

—

—

—

—

—

Income before income taxes

51

—

—

—

51

Provision for income taxes

2,758

—

—

—

2,758

Net loss

$

(2,707

)

$

—

$

—

$

—

$

(2,707

)

Loss per share

$

(0.23

)

$

—

$

—

$

—

$

(0.23

)

(1)

For the three months ended

January 30, 2021

As Reported (GAAP)

Long-lived Assets Impairment

Charge

Goodwill and Intangibles

Impairment Charge

TRA Adjustment

As Adjusted (Non- GAAP)

Loss from operations

$

(3,918

)

$

—

$

—

$

—

$

(3,918

)

Interest expense, net

1,701

—

—

—

1,701

Other (income) expense, net

-

—

—

—

-

Loss before income taxes

(5,619

)

—

—

—

(5,619

)

Provision for income taxes

1,753

—

—

—

1,753

Net loss

$

(7,372

)

$

—

$

—

$

—

$

(7,372

)

Loss per share

$

(0.62

)

$

—

$

—

$

—

$

(0.62

)

(2)

(1)

Based on weighted-average shares

outstanding of 11,962,787 for the three months ended January 29,

2022, which excludes the effect of dilutive equity securities.

(2)

Based on weighted-average shares

outstanding of 11,804,027 for the three months ended January 30,

2021, which excludes the effect of dilutive equity securities.

For the twelve months ended

January 29, 2022

As Reported (GAAP)

Long-lived Assets Impairment

Charge

Goodwill and Intangibles

Impairment Charge

TRA Adjustment

As Adjusted (Non- GAAP)

Income from operations

$

483

$

—

$

—

$

—

$

483

Interest expense, net

8,606

—

—

—

8,606

Other (income) expense, net

—

—

—

—

—

Loss before income taxes

(8,123

)

—

—

—

(8,123

)

Provision for income taxes

4,581

—

—

—

4,581

Net loss

$

(12,704

)

$

—

$

—

$

—

$

(12,704

)

Loss per share

$

(1.07

)

$

—

$

—

$

—

$

(1.07

)

(3)

For the twelve months ended

January 30, 2021

As Reported (GAAP)

Long-lived Assets Impairment

Charge

Goodwill and Intangibles

Impairment Charge

TRA Adjustment

As Adjusted (Non- GAAP)

Loss from operations

$

(61,080

)

$

(13,026

)

$

(13,848

)

$

—

$

(34,206

)

Interest expense, net

5,007

—

—

—

5,007

Other (income) expense, net

(2,304

)

—

—

(2,320

)

16

(Loss) income before income taxes

(63,783

)

(13,026

)

(13,848

)

2,320

(39,229

)

Provision for income taxes

1,866

—

—

—

1,866

Net (loss) income

$

(65,649

)

$

(13,026

)

$

(13,848

)

$

2,320

$

(41,095

)

(Loss) earnings per share

$

(5.58

)

$

(1.11

)

$

(1.18

)

$

0.20

$

(3.49

)

(4)

(3)

Based on weighted-average shares

outstanding of 11,902,307 for the twelve months ended January 29,

2022, which excludes the effect of dilutive equity securities.

(4)

Based on weighted-average shares

outstanding of 11,769,689 for the twelve months ended January 30,

2021 which excludes the effect of dilutive equity securities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220429005153/en/

Investor Relations: ICR, Inc. Jean Fontana, 646-277-1214

Jean.fontana@icrinc.com

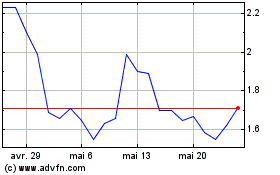

Vince (NYSE:VNCE)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Vince (NYSE:VNCE)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025