Vince Holding Corp. Significantly Reduces

Debt

Brendan Hoffman Expected to Become CEO of Vince

Holding Corp.

Vince Holding Corp., (NYSE: VNCE) (“VNCE” or the “Company”), a

global contemporary retailer, today announced that P180, a new

venture focused on accelerating growth and profitability in the

luxury apparel sector, acquired a majority stake in VNCE (the “P180

Acquisition”) from affiliates of Sun Capital Partners, Inc.

(collectively, “Sun Capital”).

In conjunction with the P180 Acquisition, Brendan Hoffman is

expected to assume the role of Chief Executive Officer of VNCE

effective on or around February 3, 2025, subject to finalization of

his employment terms. With this transition, David Stefko is

expected to step down as Interim CEO of VNCE and continue to serve

on the VNCE Board of Directors. In addition, Matthew Garff resigned

from the VNCE Board of Directors in connection with the P180

Acquisition.

"VNCE is the perfect partner for P180; the brand's dominance in

the luxury contemporary market aligns seamlessly with our

acquisition strategy. In addition, as VNCE has evolved its

operating model, we believe having access to the technology and

team of CaaStle, founded by Christine Hunsicker, my co-founder at

P180, will further advance the company’s momentum in driving

improved profitability while enhancing its omni-channel

experience." Mr. Hoffman added, "Personally, I have a strong

connection to the Vince brand, having served as VNCE CEO for five

years. I am excited to lead the team again as we continue to unlock

new growth opportunities, drive innovation, enhance the brand's

market position, and focus on monetizing the Company’s inventory to

ensure continued long-term success."

"P180's acquisition represents a transformative opportunity for

VNCE. With this transaction, we will gain the operational expertise

and cutting-edge digital capabilities needed to drive the brand's

future success,” commented Michael Mardy, Chairman of VNCE. “On

behalf of the Board and the organization, I would also like to

thank Dave for stepping into the interim CEO role for the past

year. Through his leadership, the company has continued to execute

and deliver results by operating a healthier full price model. We

are glad to have Dave remain on the Board and are excited to

welcome Brendan back to lead the organization into its next

chapter."

This acquisition marks the third strategic deal for P180 since

its inception in 2024 and follows its recent investment with the

prestigious fashion label Altuzarra and digital partnership with

the multi-brand premium retailer elysewalker.

VNCE Significantly Reduces Debt

Simultaneously with the P180 Acquisition, an indirectly wholly

owned subsidiary of VNCE, V Opco, LLC (“V Opco”), amended its

existing credit agreement (the “ABL Credit Facility”) with Bank of

America, N.A. (“BofA”). The amendment consents to, among other

things, the change in control in connection with the P180

Acquisition, as well as a partial pay down of the subordinated debt

(“Sun Debt Facility”) with SK Financial Services, LLC, an affiliate

of Sun Capital, through increased borrowings under the ABL Credit

Facility. On the same day, V Opco paid $15 million to SK Financial

Services, LLC using proceeds from the ABL Credit Facility, which

resulted in a pay-down of $20 million under the Sun Debt Facility

(the “Sun Debt Paydown”).

In addition, P-180 acquired and assumed $7 million of the loans

(the “P-180 Assumed Loan”) outstanding pursuant to the Sun Debt

Facility and immediately thereafter cancelled such $7 million (the

“P-180 Debt Forgiveness”).

Following the Sun Debt Paydown and P-180 Debt Forgiveness, the

outstanding principal amount of subordinated loans is reduced by

approximately $27 million with $7.5 million remaining outstanding

under the Sun Debt Facility, which will continue to accrue

payment-in-kind interest in accordance with, and otherwise be

subject to, the terms and conditions therein.

Immediately following the P-180 Acquisition, P180 beneficially

owned approximately 65% of all outstanding shares of common stock

of VNCE and affiliates of Sun Capital continue to beneficially own

approximately 2% of the Company’s outstanding common stock.

As part of the terms to the transactions described above, P-180

agreed to reimburse the Company for certain fees and expenses

incurred in connection with such transactions, including the

Company’s legal fees as well as the consent fee to BofA.

About P180:

P180, a new venture co-founded by Christine Hunsicker (founder

and CEO of CaaStle, Inc.) and Brendan Hoffman, is dedicated to

driving brand and retailer profitability by providing operational

expertise and access to leading industry resources, including

CaaStle's innovative monetization platform. P180's core mission is

to invest in or acquire brands and retailers that stand to benefit

from digital expertise and inventory monetization.

About VNCE:

Vince Holding Corp. is a global retail company that operates the

Vince brand women's and men's ready to wear business. Vince,

established in 2002, is a leading global luxury apparel and

accessories brand best known for creating elevated yet understated

pieces for every day effortless style. Vince Holding Corp. operates

47 full-price retail stores, 14 outlet stores, and its e-commerce

site, vince.com and through its subscription service Vince Unfold,

www.vinceunfold.com, operated by CaaStle, as well as through

premium wholesale channels globally. Please visit www.vince.com for

more information.

Forward-Looking Statements: This document contains

forward-looking statements under the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include statements

regarding, among other things, our planned transformation program

and our current expectations about possible or assumed future

results of operations of the Company and are indicated by words or

phrases such as "may," "will," "should," "believe," "expect,"

"seek," "anticipate," "intend," "estimate," "plan," "target,"

"project," "forecast," "envision" and other similar phrases.

Although we believe the assumptions and expectations reflected in

these forward-looking statements are reasonable, these assumptions

and expectations may not prove to be correct and we may not achieve

the results or benefits anticipated. These forward-looking

statements are not guarantees of actual results, and our actual

results may differ materially from those suggested in the

forward-looking statements. These forward-looking statements

involve a number of risks and uncertainties, some of which are

beyond our control, including, without limitation: our ability to

successfully manage the transition of VNCE majority ownership to

P180 and to execute P180’s strategies for the Company; our ability

to execute and realize the enhanced profitability expectations of

our planned transformation program; our ability to maintain the

license agreement with ABG Vince, a subsidiary of Authentic Brands

Group; ABG Vince's expansion of the Vince brand into other

categories and territories; ABG Vince's approval rights and other

actions; our ability to maintain adequate cash flow from operations

or availability under our revolving credit facility to meet our

liquidity needs; our ability to realize the benefits of our

strategic initiatives; general economic conditions; further

impairment of our goodwill; the execution and management of our

direct-to-consumer business growth plans; our ability to make lease

payments when due; our ability to maintain our larger wholesale

partners; our ability to remediate the identified material weakness

in our internal control over financial reporting; our ability to

comply with domestic and international laws, regulations and

orders; our ability to anticipate and/or react to changes in

customer demand and attract new customers, including in connection

with making inventory commitments; our ability to remain

competitive in the areas of merchandise quality, price, breadth of

selection and customer service; our ability to attract and retain

key personnel; seasonal and quarterly variations in our revenue and

income; our ability to mitigate system security risk issues, such

as cyber or malware attacks, as well as other major system

failures; our ability to optimize our systems, processes and

functions; our ability to comply with privacy-related obligations;

our ability to ensure the proper operation of the distribution

facilities by third-party logistics providers; fluctuations in the

price, availability and quality of raw materials; commodity, raw

material and other cost increases; the extent of our foreign

sourcing; our reliance on independent manufacturers; other tax

matters; and other factors as set forth from time to time in our

Securities and Exchange Commission filings, including those

described under "Item 1A—Risk Factors" in our Annual Report on Form

10-K and Quarterly Reports on Form 10-Q. We intend these

forward-looking statements to speak only as of the time of this

release and do not undertake to update or revise them as more

information becomes available, except as required by law.

This press release is also available on the Vince Holding Corp.

website (http://investors.vince.com/).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250122591243/en/

VNCE Investor Relations Contact: Caitlin Churchill ICR,

Inc. Caitlin.Churchill@icrinc.com

P180 Media Contacts: Jacqueline Renaud Vice President

Lividini & Co. Jacqueline@lividini.com

Morgan Tanacea Senior Director Lividini & Co.

Morgan@lividini.com

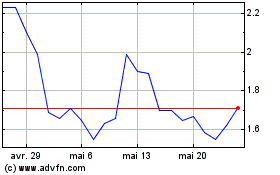

Vince (NYSE:VNCE)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Vince (NYSE:VNCE)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025