0001535929false00015359292024-01-092024-01-090001535929us-gaap:CommonStockMember2024-01-092024-01-090001535929voya:DepositarySharesMember2024-01-092024-01-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 9, 2024

VOYA FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

Delaware | | 001-35897 | | No. | 52-1222820 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

230 Park Avenue | | | | | |

New York | New York | | | | 10169 |

(Address of principal executive offices) | | | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 309-8200

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Common Stock, $.01 Par Value | VOYA | New York Stock Exchange |

| Depositary Shares, each representing a 1/40th | VOYAPrB | New York Stock Exchange |

| interest in a share of 5.35% Fixed-Rate Non-Cumulative Preferred Stock, Series B, $0.01 par value |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On January 10, 2024, Voya Financial, Inc. (the “Company”) announced that Christine Hurtsellers, the Chief Executive Officer ("CEO") of Voya Investment Management ("IM"), has informed the Company of her decision to retire later this year.

In connection with her retirement, the Company and Ms. Hurtsellers have entered into an agreement, dated as of January 9, 2024, pursuant to which:

•Ms. Hurtsellers will continue as an employee to serve as a strategic advisor to IM and the Company in supporting the transition of her successor until her retirement later this year;

•For her role as an advisor, Ms. Hurtsellers will continue to receive a base salary (annualized at $300,000) in accordance with normal payroll practices and will remain eligible for annual incentive and long-term incentive awards payable in respect of services rendered in 2023; and

•Upon completion of such role, Ms. Hurtsellers will be eligible for an additional cash incentive award to be paid in 2025.

Item 7.01 Regulation FD Disclosure

On January 10, 2024, the Company issued a press release announcing the retirement of Christine Hurtsellers, the CEO of IM. The press release announcing Ms. Hurtsellers' retirement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

As provided in General Instruction B.2 of Form 8-K, the information provided pursuant to this Item 7.01 shall not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, as amended, or incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Voya Financial, Inc.

(Registrant)

By: /s/ My Chi To

Name: My Chi To

Title: Executive Vice President, Chief Legal Officer and Corporate Secretary

Dated: January 10, 2024

Voya Financial announces leadership-succession plan for Voya Investment Management and new head of investments

Voya Investment Management Chief Executive Officer Christine Hurtsellers announces plans to retire in 2024; Matt Toms, currently Voya Investment Management global chief investment officer, named her successor.

Eric Stein joins Voya Investment Management as head of investments and chief investment officer, fixed income.

NEW YORK, Jan. 10, 2024 — Voya Financial, Inc. (NYSE: VOYA), announced today that Christine Hurtsellers, chief executive officer (CEO) of Voya Investment Management (IM), has informed the company of her decision to retire later this year. Matt Toms, global chief investment officer (CIO) of Voya IM, will succeed Hurtsellers as CEO, effective immediately, and Hurtsellers will now serve as a strategic advisor to the company until her retirement. Toms has also joined Voya Financial’s Executive Committee and will now report to Heather Lavallee, CEO, Voya Financial. Hurtsellers will also continue to report to Lavallee.

Voya also announced today that Eric Stein, who most recently served as CIO, fixed income, at Morgan Stanley Investment Management (MSIM), has joined Voya IM as head of investments and CIO, fixed income. Stein reports to Toms.

“I am grateful to Christine for her amazing leadership and stewardship of our Investment Management business,” said Lavallee. “Over her almost 20-year career with Voya IM, including seven years of service as CEO, Christine achieved a number of strategic, financial and operational outcomes, including the successful integration of several acquisitions that have expanded our asset management capabilities and global reach. I am thankful for having had the benefit of Christine’s insights, drive and passion for our business, and I wish her and her family all the best as she begins her transition to retirement.

“Also, I am excited to have Matt leading Voya IM as it executes on its growth strategy and continues to build on its strong pipeline across institutional and retail markets in the U.S. and internationally. Matt has been global CIO since 2022, has 30 years of asset management expertise, and has great insights into the needs of our clients. His deep knowledge and experience with our firm, and his passion for our clients, will serve him well as he leads Voya IM into its next stage of growth,” added Lavallee.

“We have made great progress in evolving Voya IM to become the global firm that we are today,” said Hurtsellers. “The growth and expansion that we have achieved is the result of the hard work of our colleagues, who have always prioritized the needs of our clients. After almost 20 years at Voya, and as I look ahead to retirement and the ability to attend to my family’s

needs, I am grateful for and proud of all that the team has accomplished over the years. In the meantime, I look forward to working closely with Matt and Heather — and to engaging with our clients, intermediaries and employees — to ensure a smooth transition.”

As Voya IM’s global CIO, Toms led the firm’s more than 300 investment professionals who are managing approximately $310 billion in assets under management across fixed income, equities, multi-asset solutions and alternative strategies. Previously, Toms served as CIO, fixed income. Prior to joining Voya IM in 2009, Toms worked with Calamos Investments, where he established and grew its fixed income business. He also previously held roles with Northern Trust and Lincoln National.

“It’s an honor to be leading Voya IM, and I am excited about the opportunities ahead,” said Toms. “Over the past several years, we have successfully grown our capabilities and our reach to serve the expanding needs of our clients, and I’m looking forward to working with the many talented professionals across our firm to continue our growth trajectory. I also want to express my tremendous gratitude to Christine for her leadership and guidance. I am grateful to have her insights and perspective as we make a smooth transition.”

Stein, in his new role as head of investments as well as CIO, fixed income, will directly lead the public fixed income investment team as well as oversee the broader equities, income and growth, and multi-asset strategies and solutions investment teams. Chris Lyons, head of private fixed income and alternatives investments, will continue to report to Toms.

As CIO, fixed income at MSIM, Stein was responsible for overseeing 275 professionals and the management of investment strategies for MSIM’s approximately $200 billion fixed income platform, including agency mortgage-backed securities, emerging markets, floating-rate loans, high-yield, investment grade credit, multi-sector, municipals and securitized strategies.

Prior to MSIM, Eric held several portfolio management roles at Eaton Vance since 2009, including most recently serving as CIO for Eaton Vance’s entire fixed income group, which included investment teams across high-yield, bank loan, municipal investments, emerging market debt/global macro, securitized, investment grade corporate and multi-asset investment disciplines.

“I am excited to have Eric on the Voya IM leadership team,” added Toms. “His more than 20 years of investment experience and demonstrated expertise in leading sizable teams throughout his career will no doubt bring great value to our investment teams and our clients. Equally important, Eric’s approach to money management aligns fully with the collaborative approach of our investment professionals at Voya IM. I am looking forward to having his leadership and insights as we execute on our growth plans.”

Media Contact: Investor Contact:

Christopher Breslin Michael Katz

(212) 309-8941 (212) 309-8999

Christopher.Breslin@voya.com IR@voya.com

About Voya Financial®

Voya Financial, Inc. (NYSE: VOYA), is a leading health, wealth and investment company with approximately 9,000 employees who are focused on achieving Voya’s aspirational vision: Clearing your path to financial confidence and a more fulfilling life. Through products, solutions and technologies, Voya helps its 14.7 million individual, workplace and institutional clients become well planned, well invested and

well protected. Benefitfocus, a Voya company, extends the reach of Voya’s workplace benefits and savings offerings by providing benefits administration capabilities to 16.5 million individual subscription employees across employer and health plan clients. Certified as a “Great Place to Work” by the Great Place to Work® Institute, Voya is purpose-driven and committed to conducting business in a way that is economically, ethically, socially and environmentally responsible. Voya has earned recognition as: one of the World’s Most Ethical Companies® by Ethisphere; a member of the Bloomberg Gender-Equality Index; and a “Best Place to Work for Disability Inclusion” on the Disability Equality Index. For more information, visit voya.com. Follow Voya Financial on Facebook, LinkedIn and Twitter @Voya.

VOYA-IR VOYA-CF VOYA-IM

# # #

v3.23.4

Document And Entity Information

|

Jan. 09, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 09, 2024

|

| Entity Registrant Name |

VOYA FINANCIAL, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35897

|

| Entity Tax Identification Number |

52-1222820

|

| Entity Address, Address Line One |

230 Park Avenue

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10169

|

| City Area Code |

212

|

| Local Phone Number |

309-8200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001535929

|

| Amendment Flag |

false

|

| Common Stock, $.01 Par Value |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $.01 Par Value

|

| Trading Symbol |

VOYA

|

| Security Exchange Name |

NYSE

|

| Depositary Shares, each representing a 1/40th |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares, each representing a 1/40th

|

| Trading Symbol |

VOYAPrB

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=voya_DepositarySharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

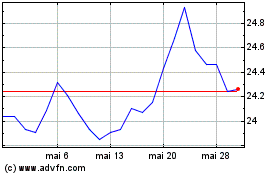

Voya Financial (NYSE:VOYA-B)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Voya Financial (NYSE:VOYA-B)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024