false

0001497770

0001497770

2024-09-12

2024-09-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or

15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 12, 2024

Walker &

Dunlop, Inc.

(Exact name of registrant as specified in its charter)

| Maryland |

|

001-35000 |

|

80-0629925 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

7272 Wisconsin Avenue

Suite 1300

Bethesda, MD |

|

20814 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (301) 215-5500

Not applicable

(Former name or former address if changed since

last report.)

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which registered |

| Common

Stock, Par Value $0.01 |

WD |

New York Stock Exchange |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

¨ Emerging

growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act.

Item 1.01. Entry into a Material Definitive Agreement.

On September 12, 2024, Walker &

Dunlop, Inc. (the “Company”) and Walker & Dunlop, LLC, the operating subsidiary of the Company (the “Seller”),

entered into Amendment No. 7 to Master Repurchase Agreement (the “Amendment”) with JPMorgan Chase Bank, N.A. (the

“Buyer”). The Amendment amends that certain Master Repurchase Agreement, dated as of August 26, 2019 (as amended

by the First Amendment, dated as of August 24, 2020, the Second Amendment, dated as of August 23, 2021, Amendment No. 3

to Master Repurchase Agreement, dated as of September 30, 2021, Amendment No. 4 to Master Repurchase Agreement, dated as of

September 15, 2022, Amendment No. 5 to Master Repurchase Agreement, dated as of December 29, 2022, and Amendment No. 6

to Master Repurchase Agreement, dated as of September 12, 2023, the “Repurchase Agreement”), by and among the

Company, the Seller, and the Buyer to, among other things, extend the Termination Date (as defined in the Repurchase Agreement) to September 11,

2025. The Company continues to guarantee the Seller’s obligations under the Repurchase Agreement, as amended by the Amendment.

The Repurchase Agreement is supplemented by an

Amended and Restated Letter, dated as of September 30, 2021 (as amended by that certain Amendment No. 1 to Amended and Restated

Side Letter, dated as of September 15, 2022 and as further amended by that certain Amendment No. 2 to Amended and Restated Side

Letter, dated as of September 12, 2023, the “Side Letter”), which sets forth certain fees, commitments and pricing

information relating to the Repurchase Agreement. The Side Letter is amended by Amendment No. 3 to Amended and Restated Side Letter,

dated as of September 12, 2024 (the “Side Letter Amendment”). The Side Letter Amendment revises, among other things,

the definition of Facility Amount (as defined in the Side Letter Amendment) and Non-Usage Fee (as defined in the Side Letter Amendment).

The foregoing description of the Amendment and

Side Letter Amendment does not purport to be complete and is qualified in its entirety by reference to the Amendment and Side Letter Amendment,

which is filed as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K.

The Buyer

and its affiliates have various relationships with the Company and its affiliates involving the provision of financial services, including

another credit facility under which the Company is a borrower and investment banking.

Item 2.03. Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 of this

Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item 9.01. Financial Statements and Exhibits.

Exhibit

Number |

Description |

| 10.1 |

Amendment No. 7 to Master Repurchase Agreement, dated as of September 12, 2024, by and among Walker & Dunlop, LLC, Walker & Dunlop, Inc., and JPMorgan Chase Bank, N.A. |

| 10.2 |

Amendment No. 3 to Amended and Restated Letter, dated as of September 12, 2024, by and among Walker & Dunlop, LLC, Walker & Dunlop, Inc., and JPMorgan Chase Bank, N.A. |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

WALKER & DUNLOP, INC. |

| |

(Registrant) |

| |

|

|

| Date: September 16, 2024 |

By: |

/s/ Daniel J. Groman |

| |

|

Name: Daniel J. Groman |

| |

|

Title: Interim General Counsel & Secretary |

Exhibit 10.1

EXECUTION

VERSION

AMENDMENT NO. 7 TO

MASTER REPURCHASE AGREEMENT

THIS AMENDMENT NO. 7 TO MASTER

REPURCHASE AGREEMENT (this “Amendment”), dated as of September 12, 2024 is made by and between WALKER &

DUNLOP, LLC, a Delaware limited liability company (“Seller”) and JPMORGAN CHASE BANK, N.A., a national banking

association (the “Buyer”). Capitalized terms used but not otherwise defined herein shall have the meanings given to

them in the Repurchase Agreement (as defined below).

WHEREAS, the Seller and the

Buyer are parties to that certain Master Repurchase Agreement, dated as of August 26, 2019 (as amended by that certain Correction

of Master Repurchase Agreement dated July 23, 2020, as further amended by that certain Amendment No. 1 to Master Repurchase

Agreement, dated as of August 24, 2020, as further amended by that certain Amendment No. 2 to Master Repurchase Agreement, dated

as of August 23, 2021, as further amended by that certain Amendment No. 3 to Master Repurchase Agreement, dated as of September 30,

2021, as further amended by that certain Amendment No. 4 to Master Repurchase Agreement, dated as of September 15, 2022, as

further amended by that certain Amendment No. 5 to Master Repurchase Agreement, dated as of December 29, 2022, as further amended

by that certain Amendment No. 6, dated as of September 12, 2023) and as amended hereby and as may be further amended, restated,

supplemented or otherwise modified from time to time, the “Repurchase Agreement”); and

WHEREAS, the Seller and the

Buyer have agreed to amend certain provisions of the Repurchase Agreement in the manner set forth herein.

NOW THEREFORE, in consideration

of the premises and the other mutual covenants contained herein, the parties hereto agree as follows:

SECTION 1. Amendments.

Effective as of the Effective Date (as defined below), the Repurchase Agreement is hereby amended as follows:

1.1 Section 2(a) of

the Repurchase Agreement is hereby amended by adding the following new definitions in their appropriate alphabetical order:

“Amendment No. 7 Effective

Date” means September 12, 2024.

1.2 Section 2(a) of

the Repurchase Agreement is hereby amended by deleting the definition of “Termination Date” in its entirety and replacing

such definition with the following:

“Termination Date”

means the earliest of (i) the Business Day, if any, that Seller or Buyer designates as the Termination Date by written notice given

to the other Party, (ii) the date of Declaration of the Termination Date pursuant to Section 11(b)(i) and (iii) September 11,

2025.

1.3 Section 10

of the Repurchase Agreement is hereby amended by adding the following new clause (aa) immediately at the end thereof:

(aa) If

either Seller hereafter enters into a mortgage warehousing or Servicing Rights repurchase agreement, credit agreement or similar credit

facility for the financing of Eligible Mortgage Loans with any Person other than Buyer or an Affiliate of Buyer that provides terms more

favorable to the buyer or lender thereunder than Sections 10(u)(i) (Leverage Ratio), 10(u)(ii) (Minimum Tangible Net Worth)

or 10(u)(iii) (Maintenance of Liquidity) of the Agreement (each, a “More Favorable Agreement”), Sellers shall

give Buyer notice thereof, and deliver a true, correct and complete copy of such More Favorable Agreement, prior to the extension (if

any) of the Termination Date following the date of such More Favorable Agreement. Buyer and Sellers will, in conjunction with the extension

(if any) of the Termination Date following the date of such More Favorable Agreement, enter into good faith discussions as to the inclusion

of such more favorable terms in the Agreement at the time of such extension. For the avoidance of doubt, (i) this clause shall not

include mortgage warehousing or Servicing Rights repurchase agreements, credit agreements or similar credit facilities in existence as

of the date hereof and amendments, modifications and restatements thereof, and (ii) no amendment or modification to the Agreement

shall be a precondition to the effectiveness of such more favorable terms.

SECTION 2. Effective

Date. This Amendment shall become effective as of the date of this Amendment (the “Effective Date”) so long as

the Buyer shall have received executed counterparts of this Amendment, executed by each of the parties hereto.

SECTION 3. Miscellaneous.

3.1 References

to Repurchase Agreement. Upon the effectiveness of this Amendment, each reference in the Repurchase Agreement to “this Agreement”,

“hereunder”, “hereof”, “herein”, or words of like import shall mean and be a reference to the Repurchase

Agreement as amended hereby, and each reference to the Repurchase Agreement in any other Transaction Document or any other document, instrument

or agreement, executed and/or delivered in connection with any Transaction Document shall mean and be a reference to the Repurchase Agreement

as amended hereby.

3.2 Representations,

Warranties and Covenants. Each of the Seller and the Parent hereby represent and warrant to Buyer, as of the date hereof and as of

the Effective Date, that (i) it is in full compliance with all of the terms and provisions set forth in each Transaction Document

to which it is a party on its part to be observed or performed, and (ii) no Default or Event of Default has occurred or is continuing.

Each of the Seller and the Parent hereby confirm, reaffirm and ratify its representations, warranties and covenants contained in each

Transaction Document to which it is a party.

3.3 Acknowledgements

of Seller. Each of the Seller and the Parent acknowledges that Buyer is in compliance with its undertakings and obligations under

the Repurchase Agreement and the other Transaction Documents.

3.4 Waivers.

(a) Each of the Seller and the Parent acknowledges and agrees that it has no defenses, rights of setoff, claims, counterclaims or

causes of action of any kind or description against Buyer arising under or in respect of the Repurchase Agreement or any other Transaction

Document and any such defenses, rights of setoff, claims, counterclaims or causes of action which may exist as of the date hereof are

hereby irrevocably waived, and (b) in consideration of Buyer entering into this Amendment, Seller hereby waives, releases and discharges

Buyer and Buyer’s officers, employees, representatives, agents, counsel and directors from any and all actions, causes of action,

claims, demands, damages and liabilities of whatever kind or nature, in law or in equity, now known or unknown, suspected or unsuspected

to the extent that any of the foregoing arise out of or from or in any way relating to or in connection with the Repurchase Agreement

or the other Transaction Documents, including, but not limited to, any action or failure to act under the Repurchase Agreement or the

other Transaction Documents on or prior to the date hereof, except, with respect to any such Person being released hereby, any actions,

causes of action, claims, demands, damages and liabilities arising out of such Person’s gross negligence or willful misconduct in

connection with the Repurchase Agreement or the other Transaction Documents.

3.5 Effect

on Repurchase Agreement. Except as expressly amended and modified by this Amendment, the Repurchase Agreement and each of the other

Transaction Documents shall continue to be, and shall remain, unmodified and in full force and effect in accordance with their respective

terms.

3.6 No

Novation, Effect of Agreement. The Seller, the Parent and the Buyer have entered into this Amendment solely to amend the terms

of the Repurchase Agreement and do not intend this Amendment or the transactions contemplated hereby to be, and this Amendment and the

transactions contemplated hereby shall not be construed to be, a novation of any of the obligations owing by the Seller or the Parent

under, or in connection with, the Repurchase Agreement or any of the other Transaction Documents. It is the intention of each

of the parties hereto that (i) the perfection and priority of all security interests securing the payment of the obligations of the

Seller and the Parent under the Repurchase Agreement and the other Transaction Documents are preserved, (ii) the liens and security

interests granted under the Repurchase Agreement continue in full force and effect, and (iii) any reference to the Repurchase Agreement

in any such Transaction Document shall be deemed to also reference this Amendment.

3.7 No

Waiver. The execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of

any Person under the Repurchase Agreement or any other document, instrument or agreement executed in connection therewith, nor constitute

a waiver of any provision contained therein.

3.8 Successors

and Assigns. This Amendment shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors

and assigns.

3.9 Counterparts;

Electronic Transmission.

(a) This

Amendment may be executed in counterparts (and by different parties hereto on different counterparts), each of which shall constitute

an original, but all of which when taken together shall constitute a single contract.

(b) Delivery

of an executed counterpart of a signature page of this Amendment or any other Transaction Document by telecopy, emailed pdf or any

other electronic means that reproduces an image of the actual executed signature page shall be effective as delivery of a manually

executed counterpart of this Amendment. The words “execution”, “signed”, “signature”, “delivery”

and words of like import in or relating to any document to be signed in connection with this Amendment and the transactions contemplated

hereby shall be deemed to include electronic signatures, deliveries or the keeping of records in electronic form, each of which shall

be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based

recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures

in Global and National Commerce Act, the New York State Electronic Signatures and Records Act and any other similar state laws based on

the Uniform Electronic Transactions Act; provided that nothing herein shall require Buyer to accept electronic signatures in any form

or format without its prior written consent.

3.10 Headings.

The descriptive headings of the various sections of this Amendment are inserted for convenience of reference only and shall not be deemed

to affect the meaning or construction of any of the provisions hereof.

3.11 Governing

Law; Consent to Jurisdiction.

(a) This

Amendment shall be governed by and construed in accordance with the internal laws of the State of New York, but giving effect to federal

law applicable to national banks.

(b) Seller

hereby irrevocably and unconditionally submits, for itself and its property, to the nonexclusive jurisdiction of the United States District

Court for the Southern District Of New York and of any New York state court sitting in the City of New York for purposes of all legal

proceedings arising out of or relating to this Amendment or the Transactions contemplated hereby, or for recognition or enforcement of

any judgment, and each Party hereby irrevocably and unconditionally agrees that all claims in respect of any such action or proceeding

may (and any such claims, cross-claims or third party claims brought against Buyer may only) be heard and determined in such state court

or, to the extent permitted by law, in such federal court. Seller hereby irrevocably waives, to the fullest extent it may effectively

do so, any objection that it may now or hereafter have to the laying of the venue of any such proceeding brought in such a court and any

claim that any such proceeding brought in such a court has been brought in an inconvenient forum. Nothing in this Section 3.11

shall affect the right of Buyer to bring any action or proceeding against Seller or its Property in the courts of other jurisdictions.

Each Party agrees that a final judgment in any such action or proceeding shall be conclusive and may be enforced in other jurisdictions

by suit on the judgment or in any other manner provided by law. Each Party consents to the service of any and all process in any such

action or proceeding by the mailing of copies of such process to it at its address for notices hereunder specified in Section 14

of the Repurchase Agreement.

[Remainder of page left intentionally blank]

IN

WITNESS WHEREOF, the Parties have caused this Amendment to be duly executed as of the date first above written.

SELLER:

| WALKER & DUNLOP, LLC,

as Seller |

|

| |

|

| By: |

/s/ Issa M. Bannourah |

|

| Name: |

Issa M. Bannourah |

|

| Title: |

Treasurer |

|

| |

|

| WALKER & DUNLOP, INC.,

as Parent |

|

| |

|

| By: |

/s/ Issa M. Bannourah |

|

| Name: |

Issa M. Bannourah |

|

| Title: |

Treasurer |

|

Signature

Page to Amendment No. 7 to Master Repurchase Agreement (JPM/Walker & Dunlop)

BUYER:

| JPMORGAN CHASE BANK, N.A.,

as Buyer |

|

| |

|

| By: |

/s/ Philippe Tsoukias |

|

| Name: |

Philippe Tsoukias |

|

| Title: |

Authorized Officer |

|

Signature

Page to Amendment No. 7 to Master Repurchase Agreement (JPM/Walker & Dunlop)

Exhibit 10.2

EXECUTION VERSION

AMENDMENT NO. 3 TO

AMENDED AND RESTATED SIDE LETTER

THIS AMENDMENT NO. 3 TO AMENDED

AND RESTATED SIDE LETTER, dated as of September 12, 2024 (this “Amendment”) is made by and between WALKER &

DUNLOP, LLC, a Delaware limited liability company (“Seller”) and JPMORGAN CHASE BANK, N.A., a national banking

association (the “Buyer”). Capitalized terms used but not otherwise defined herein shall have the meanings given to

them in the Repurchase Agreement (as defined below).

WHEREAS, the Seller and the

Buyer are parties to that certain Master Repurchase Agreement, dated as of August 26, 2019 (as amended by that certain Correction

of Master Repurchase Agreement dated July 23, 2020, as further amended by that certain Amendment No. 1 to Master Repurchase

Agreement, dated as of August 24, 2020, as further amended by that certain Amendment No. 2 to Master Repurchase Agreement, dated

as of August 23, 2021, as further amended by that certain Amendment No. 3 to Master Repurchase Agreement, dated as of September 30,

2021, as further amended by that certain Amendment No. 4 to Master Repurchase Agreement, dated as of September 15, 2022, as

further amended by that certain Amendment No. 5 to Master Repurchase Agreement, dated as of December 29, 2022, as further amended

by that certain Amendment No. 6 to Master Repurchase Agreement, dated as of September 12, 2023, as further amended by that certain

Amendment No. 7 to Master Repurchase Agreement, dated as of September 12, 2024, and as amended hereby and as may be further

amended, restated, supplemented or otherwise modified from time to time, the “Repurchase Agreement”); and

WHEREAS, in connection with

the Repurchase Agreement, the Seller and the Buyer entered into that certain amended and restated Side Letter, dated as of September 30,

2021 (as amended by that certain Amendment No. 1 to Amended and Restated Side Letter, dated as of September 15, 2022, as further

amended by that certain Amendment No. 2 to Amended and Restated Side Letter, dated as of September 12, 2023, and as amended,

restated, supplemented or otherwise modified from time to time, the “Side Letter”); and

WHEREAS, the Seller and the

Buyer have agreed to amend certain provisions of the Side Letter in the manner set forth herein.

NOW THEREFORE, in consideration

of the premises and the other mutual covenants contained herein, the parties hereto agree as follows:

SECTION 1. Amendments.

Effective as of the Effective Date (as defined below), the Side Letter is hereby amended to delete the stricken text (indicated textually

in the same manner as the following example: stricken text) and to add the bold and double-underlined

text (indicated textually in the same manner as the following example: bold

and double-underlined text) as set forth on the pages attached as Appendix A hereto.

SECTION 2. Effective

Date. This Amendment shall become effective as of the date of this Amendment (the “Effective Date”) so long as

the Buyer shall have received executed counterparts of this Amendment, executed by each of the parties hereto.

SECTION 3. Miscellaneous.

3.1 References

to Side Letter. Upon the effectiveness of this Amendment, each reference in the Side Letter to “this Side Letter”, “hereunder”,

“hereof”, “herein”, or words of like import shall mean and be a reference to the Side Letter as amended hereby,

and each reference to the Side Letter in any other Transaction Document or any other document, instrument or agreement, executed and/or

delivered in connection with any Transaction Document shall mean and be a reference to the Side Letter as amended hereby.

3.2 Representations,

Warranties and Covenants. Each of the Seller and the Parent hereby represent and warrant to Buyer, as of the date hereof and as of

the Effective Date, that (i) it is in full compliance with all of the terms and provisions set forth in each Transaction Document

to which it is a party on its part to be observed or performed, and (ii) no Default or Event of Default has occurred or is continuing.

Each of the Seller and the Parent hereby confirm, reaffirm and ratify its representations, warranties and covenants contained in each

Transaction Document to which it is a party.

3.3 Acknowledgements

of Seller. Each of the Seller and the Parent acknowledges that Buyer is in compliance with its undertakings and obligations under

the Side Letter and the other Transaction Documents.

3.4 Waivers.

(a) Each of the Seller and the Parent acknowledges and agrees that it has no defenses, rights of setoff, claims, counterclaims or

causes of action of any kind or description against Buyer arising under or in respect of the Side Letter or any other Transaction Document

and any such defenses, rights of setoff, claims, counterclaims or causes of action which may exist as of the date hereof are hereby irrevocably

waived, and (b) in consideration of Buyer entering into this Amendment, Seller hereby waives, releases and discharges Buyer and Buyer’s

officers, employees, representatives, agents, counsel and directors from any and all actions, causes of action, claims, demands, damages

and liabilities of whatever kind or nature, in law or in equity, now known or unknown, suspected or unsuspected to the extent that any

of the foregoing arise out of or from or in any way relating to or in connection with the Side Letter or the other Transaction Documents,

including, but not limited to, any action or failure to act under the Side Letter or the other Transaction Documents on or prior to the

date hereof, except, with respect to any such Person being released hereby, any actions, causes of action, claims, demands, damages and

liabilities arising out of such Person’s gross negligence or willful misconduct in connection with the Side Letter or the other

Transaction Documents.

3.5 Effect

on Side Letter. Except as expressly amended and modified by this Amendment, the Side Letter and each of the other Transaction Documents

shall continue to be, and shall remain, unmodified and in full force and effect in accordance with their respective terms.

3.6 No

Novation, Effect of Agreement. The Seller, the Parent and the Buyer have entered into this Amendment solely to amend the terms

of the Side Letter and do not intend this Amendment or the transactions contemplated hereby to be, and this Amendment and the transactions

contemplated hereby shall not be construed to be, a novation of any of the obligations owing by the Seller or the Parent under, or in

connection with, the Side Letter or any of the other Transaction Documents. It is the intention of each of the parties hereto

that (i) the perfection and priority of all security interests securing the payment of the obligations of the Seller and the Parent

under the Side Letter and the other Transaction Documents are preserved, (ii) the liens and security interests granted under the

Side Letter continue in full force and effect, and (iii) any reference to the Side Letter in any such Transaction Document shall

be deemed to also reference this Amendment.

3.7 No

Waiver. The execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of

any Person under the Side Letter or any other document, instrument or agreement executed in connection therewith, nor constitute a waiver

of any provision contained therein.

3.8 Successors

and Assigns. This Amendment shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors

and assigns.

3.9 Counterparts;

Electronic Transmission.

(a) This

Amendment may be executed in counterparts (and by different parties hereto on different counterparts), each of which shall constitute

an original, but all of which when taken together shall constitute a single contract.

(b) Delivery

of an executed counterpart of a signature page of this Amendment or any other Transaction Document by telecopy, emailed pdf or any

other electronic means that reproduces an image of the actual executed signature page shall be effective as delivery of a manually

executed counterpart of this Amendment. The words “execution”, “signed”, “signature”, “delivery”

and words of like import in or relating to any document to be signed in connection with this Amendment and the transactions contemplated

hereby shall be deemed to include electronic signatures, deliveries or the keeping of records in electronic form, each of which shall

be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based

recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures

in Global and National Commerce Act, the New York State Electronic Signatures and Records Act and any other similar state laws based on

the Uniform Electronic Transactions Act; provided that nothing herein shall require Buyer to accept electronic signatures in any form

or format without its prior written consent.

3.10 Headings.

The descriptive headings of the various sections of this Amendment are inserted for convenience of reference only and shall not be deemed

to affect the meaning or construction of any of the provisions hereof.

3.11 Governing

Law; Consent to Jurisdiction.

(a) This

Amendment shall be governed by and construed in accordance with the internal laws of the State of New York, but giving effect to federal

law applicable to national banks.

(b) Seller

hereby irrevocably and unconditionally submits, for itself and its property, to the nonexclusive jurisdiction of the United States District

Court for the Southern District Of New York and of any New York state court sitting in the City of New York for purposes of all legal

proceedings arising out of or relating to this Amendment or the Transactions contemplated hereby, or for recognition or enforcement of

any judgment, and each Party hereby irrevocably and unconditionally agrees that all claims in respect of any such action or proceeding

may (and any such claims, cross-claims or third party claims brought against Buyer may only) be heard and determined in such state court

or, to the extent permitted by law, in such federal court. Seller hereby irrevocably waives, to the fullest extent it may effectively

do so, any objection that it may now or hereafter have to the laying of the venue of any such proceeding brought in such a court and any

claim that any such proceeding brought in such a court has been brought in an inconvenient forum. Nothing in this Section 3.11

shall affect the right of Buyer to bring any action or proceeding against Seller or its Property in the courts of other jurisdictions.

Each Party agrees that a final judgment in any such action or proceeding shall be conclusive and may be enforced in other jurisdictions

by suit on the judgment or in any other manner provided by law. Each Party consents to the service of any and all process in any such

action or proceeding by the mailing of copies of such process to it at its address for notices hereunder specified in Section 14

of the Repurchase Agreement.

[Remainder of page left intentionally blank]

IN

WITNESS WHEREOF, the Parties have caused this Amendment to be duly executed as of the date first above written.

SELLER:

| WALKER & DUNLOP, LLC,

as Seller |

|

| |

|

| By: |

/s/ Issa M. Bannourah |

|

| Name: |

Issa M. Bannourah |

|

| Title: |

Treasurer |

|

| |

|

| WALKER & DUNLOP, INC.,

as Parent |

|

| |

|

| By: |

/s/ Issa M. Bannourah |

|

| Name: |

Issa M. Bannourah |

|

| Title: |

Treasurer |

|

Signature

Page to Amendment No. 3 to A&R Side Letter (JPM – Walker & Dunlop)

BUYER:

| JPMORGAN CHASE BANK, N.A.,

as Buyer |

|

| |

|

| By: |

/s/ Philippe Tsoukias |

|

| Name: |

Philippe Tsoukias |

|

| Title: |

Authorized Signatory |

|

Signature

Page to Amendment No. 3 to A&R Side Letter (JPM – Walker & Dunlop)

APPENDIX A

September 1512,

20222024

Walker & Dunlop, LLC

Walker & Dunlop, Inc.

75017272

Wisconsin Avenue, Suite 1200E1300

Bethesda, Maryland 20814

Attention: Stephen

TheobaldIssa M. Bannourah

| Re: | Master Repurchase Agreement, dated as of August 26, 2019 among JPMorgan Chase Bank, N.A., as buyer,

Walker & Dunlop, LLC, as seller and Walker & Dunlop, Inc., as parent. |

Ladies and Gentlemen:

This amended and restated

letter (this “Side Letter”) sets forth certain fees, commitments and pricing information relating to the agreement

among JPMorgan Chase Bank, N.A., as buyer (“Buyer”), Walker & Dunlop, LLC, as seller (“Seller”),

and Walker & Dunlop, Inc., as parent (“Parent”), pursuant to which Seller engages Buyer to enter into

reverse repurchase arrangements whereby Seller from time to time sells to Buyer, and simultaneously agrees to repurchase on a date certain

or on demand, certain mortgage loans (the “Mortgage Loans”) pursuant to the Master Repurchase Agreement, dated as of

August 26, 2019 (as supplemented, amended or restated, the “Agreement”) among Buyer, Seller and Parent. This is

the “Side Letter” as defined and referenced in the Agreement. Capitalized terms defined in the Agreement and used, but not

defined differently, in this Side Letter have the same meanings here as there.

Buyer and Seller agree, for

good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, as follows:

1. Discretionary

Transactions Agreement.

2. Commitment.

Subject to the terms and conditions set forth in the Agreement, Buyer (i) agrees

to consider, on an uncommitted and wholly discretionary basis, enteringand

is committed to enter into Transactions from time to time under the Agreement, as supplemented by this Side Letter, with respect

to Eligible Mortgage Loans having a maximum Aggregate Purchase Price outstanding at any one time of up to One

Billion Dollars ($1,000,000,000Fifty Million Dollars ($50,000,000) (such

maximum committed amount, the “Committed Facility Amount”), from the date hereof until the Termination Date, and (ii) agrees

to consider engaging,

on an uncommitted and wholly discretionary basis, in additional Transactions

from time to time when the Committed Facility Amount is fully funded and outstanding, having up to an additional maximum aggregate Purchase

Price outstanding at any one time of up to Nine Hundred Fifty Million Dollars ($950,000,000) (such maximum amount, the “Uncommitted

Facility Amount”) from the date hereof until the Termination Date.

such that the sum of the Committed Facility Amount and the Uncommitted Facility

Amount is equal to One Billion Dollars ($1,000,000,000)

during the period from (and including) the date hereof through the Termination Date – is the amount referred to in the Agreement

and this Side Letter as

the “Facility Amount”).

Walker & Dunlop, LLC

Walker & Dunlop, Inc.

September 1512,

20222024

Page 2

The Parties agree (1) that:

(x) notwithstanding

the provisions of Section 7(b)(xi) of the Agreement, Buyer may from time to time electively enter into one or more Transactions

with Seller; or

(y) another

event may occur, or other circumstances may exist;

after which the Aggregate Purchase Price shall

be greater than the Facility Amount, and (2) that notwithstanding the occurrence or existence of any such event or circumstances,

every Transaction shall be and remain fully subject to all of the other terms and conditions of the Agreement and all other related Transaction

Documents and entitled to all benefits thereof.

In addition, the Parties may

agree to increase or decrease the Committed Facility Amount,

the Uncommitted Facility Amount or both to any amount from time to time in the future by executing a letter agreement stating (i) the

new Committed Facility Amount and/or (ii) the new Uncommitted Facility

Amount and the period of time that itthe

same will be in effect. At the time of any reduction in the Committed

Facility Amount, the Uncommitted Facility Amount or both, whether

pursuant to a letter agreement decreasing the Facility Amounteither

or both of them or because the time limit for any increase in the Committed

Facility Amount or the Uncommitted Facility Amount shall have

expired, Seller shall be obligated, without notice or demand, to (i) make

a cash payment to Buyer in an amount equal to theany

excess of the Aggregate Purchase Price then funded and outstanding over the reducedagainst

the Committed Facility Amount over the then-effective Committed Facility Amount and (ii) make a cash payment to Buyer in an amount

equal to any excess of the Aggregate Purchase Price then funded and outstanding against the Uncommitted Facility Amount over the then-effective

Uncommitted Facility Amount, each such payment to be applied

by Buyer to reduce the Repurchase Prices of Purchased Mortgage Loans that are then subject to outstanding Transactions. Neither Parent’s

Guaranty nor any other (future) Guaranty, if any, shall be reduced, limited, canceled, terminated or impaired in any way by any such future

change in the Committed Facility Amount, the

Uncommitted Facility Amount or both, whether or not any Guarantor concurrently executes a confirmation of its Guaranty.

3. Purchase

Price.

For purposes of the Agreement

and all other Transaction Documents, “Purchase Price” means, on any day and for any Eligible Mortgage Loan, one hundred

percent (100%) of the lowest on that day of its (i) Outstanding Principal Balance and (ii) Takeout Value.

4. Pricing

Rate.

For purposes of the Agreement

and all other Transaction Documents, the “Pricing Rate” for each Purchased Mortgage Loan for each day during a calendar

month shall be the per annum percentage rate equal to the sum of the Adjusted Term SOFR Rate plus one hundred and forty-five basis

points (1.45%); provided that if Buyer, acting in its sole discretion, shall elect from time to time to give Seller a notice (which

notice may be via electronic mail) specifying a lower or higher Pricing Rate (or Pricing Rates) for a specified time period and specified

Purchased Mortgage Loan, such lower or higher Pricing Rate(s) specified in such notice shall be applicable for the time period and

Purchased Mortgage Loan specified in such notice, provided, however, for the avoidance of doubt, that in no event shall any such

specified Pricing Rate delivered by Buyer in accordance with the immediately preceding proviso exceed the sum of the Adjusted Term SOFR

Rate for that day plus one hundred and forty-five basis points (1.45%). [Amendment

No. 2 to A&R Side

Letter]

Walker & Dunlop, LLC

Walker & Dunlop, Inc.

September 1512,

20222024

Page 3

As used herein, the following

terms shall have the corresponding definitions:

“Adjusted Term SOFR

Rate” means the sum of (a) the Term SOFR Rate, plus (b) the SOFR Adjustment; provided that if the Adjusted

Term SOFR Rate as so determined would be less than zero, such rate shall be deemed to be zero for the purposes of calculating such rate.

“Alternate Rate”

is defined in Section 3(d) below.

“Benchmark

Conforming Changes” means any technical, administrative or operational changes (including changes to the definition of “Business

Day,” the timing and frequency of determining rates and making payments of Price Differential, timing of Transaction requests,

length of lookback periods and other technical, administrative or operational matters) that Buyer decides in its reasonable discretion

may be appropriate to reflect the implementation and administration of Pricing Rates based on the Term SOFR Rate, the Alternate Rate or

any other interest rate benchmark adopted by Buyer in accordance with the terms hereof and to permit the administration thereof by Buyer

in a manner substantially consistent with then-prevailing market practice (or, if Buyer decides that adoption of any portion of such prevailing

market practice is not administratively feasible or if Buyer determines that no prevailing market practice for the administration of such

interest rate benchmark then exists, in such other manner of administration as Buyer decides is reasonably necessary in connection with

the administration of this Side Letter and the other Transaction Documents).

“Benchmark Transition

Event” means the occurrence of one or more of the following events with respect to SOFR:

(i) a

public statement or publication of information by or on behalf of the SOFR Administrator announcing that such SOFR Administrator has ceased

or will cease to provide the Term SOFR Rate, permanently or indefinitely, provided that, at the time of such statement or publication,

there is no successor SOFR Administrator that will continue to provide the Term SOFR Rate; or

(ii) a

public statement or publication of information by the NYFRB, the Federal Reserve Board, or, as applicable, the regulatory supervisor for

the SOFR Administrator, an insolvency official with jurisdiction over the SOFR Administrator, a resolution authority with jurisdiction

over the SOFR Administrator or a court or an entity with similar insolvency or resolution authority over the SOFR Administrator, in each

case, which states that the SOFR Administrator has ceased or will cease to provide the Term SOFR Rate permanently or indefinitely, provided

that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Term SOFR

Rate; or

Walker & Dunlop, LLC

Walker & Dunlop, Inc.

September 1512,

20222024

Page 4

(iii) a

public statement or publication of information by the Federal Reserve Board, the NYFRB, the SOFR Administrator or the regulatory supervisor

for the SOFR Administrator (as applicable), announcing that the Term SOFR Rate is no longer, or as of a specified future date will no

longer be, representative.

“Business Day”

means any day other than a Saturday, Sunday or other day on which Buyer is authorized or required by law or regulation to remain closed;

provided that, when used in the context of the determination of the Term SOFR Rate, the term “Business Day”

shall also exclude any day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments

of its members be closed for the entire day for purposes of trading in United States government securities.

“Federal Reserve

Board” means the Board of Governors of the Federal Reserve System of the United States of America.

“Notice Date”

is defined in Section 3(d) below.

“NYFRB”

means the Federal Reserve Bank of New York.

“SOFR Adjustment”

means five basis points (0.05%) per annum.

“SOFR Administrator”

means the CME Group Benchmark Administration Limited (or a successor administrator of the secured overnight financing rate).

“SOFR Administrator’s

Website” means the SOFR Administrator’s website, currently accessed through the website https://www.cmegroup.com, or any

successor source for the secured overnight financing rate identified as such by the SOFR Administrator from time to time.

“Term SOFR Rate”

means the Term SOFR Screen Rate at approximately 5:00 a.m., Chicago time on, and as of, such date of determination.

“Term SOFR Screen

Rate” means, for any day and time, a rate per annum equal to the one month term secured overnight financing rate as published

by the SOFR Administrator on the SOFR Administrator’s Website or on the appropriate page of such other information service

that publishes such rate from time to time as shall be selected by Buyer in its reasonable discretion; provided that if the Term

SOFR Screen Rate as so determined would be less than zero, such rate shall be deemed to be zero for the purposes of calculating such rate.

(c) Benchmarks;

No Liability. The Pricing Rate is derived from an interest rate benchmark that may be discontinued or is, or may in the future

become, the subject of regulatory reform. Upon the occurrence of a Benchmark Transition Event, Section 3(d) below provides

a mechanism for determining an alternative rate of interest. Buyer does not warrant or accept any responsibility for, and shall not have

any liability with respect to, the administration, submission, performance or any other matter related to the Term SOFR Rate, or with

respect to any alternative or successor rate thereto, or replacement rate thereof, including without limitation, whether the composition

or characteristics of any such alternative, successor or replacement reference rate will be similar to, or produce the same value or economic

equivalence of, the existing interest rate being replaced or have the same volume or liquidity as did any existing interest rate prior

to its discontinuance or unavailability. Buyer and its Affiliates and/or other related entities may engage in transactions that affect

the calculation of the Pricing Rate or any alternative, successor or alternative rate (including any Alternate Rate) and/or any relevant

adjustments thereto, in each case, in a manner adverse to Seller. Buyer may select information sources or services in its reasonable discretion

to ascertain the Pricing Rate used for the purposes of the Agreement, any component thereof, or rates referenced in the definition thereof,

in each case pursuant to the terms of this Side Letter, and shall have no liability to Seller or any other person or entity for damages

of any kind, including direct or indirect, special, punitive, incidental or consequential damages, costs, losses or expenses (whether

in tort, contract or otherwise and whether at law or in equity), for any error or calculation of any such rate (or component thereof)

provided by any such information source or service.

Walker & Dunlop, LLC

Walker & Dunlop, Inc.

September 1512,

20222024

Page 5

(d) Alternate

Rate of Interest. If a Benchmark Transition Event occurs, Buyer may, by notice to Seller, amend this Side Letter to establish an alternate

rate of interest for the Term SOFR Rate that gives due consideration to the then-evolving or prevailing market convention for determining

a rate of interest for loans in US Dollars at such time (the “Alternate Rate”); Seller acknowledges that the Alternate

Rate may include a mathematical adjustment using any then-evolving or prevailing market convention or method for determining a spread

adjustment for the replacement of the Term SOFR Rate (which may include, if the Term SOFR Rate already contains such a spread, adding

that spread to the Alternate Rate). The Alternate Rate, together with all Benchmark Conforming Changes specified in any notice, shall

become effective at the later of (i) the fifth (5th) Business Day after Buyer has provided notice (including without limitation for

this purpose, by electronic means) to Seller (the “Notice Date”) and (ii) a date specified by Buyer in the notice,

without any further action or consent of Seller, so long as Buyer has not received, by 5:00 pm Eastern time on the Notice Date, written

notice of objection to the Alternate Rate from Seller. If, on the date the Term SOFR Rate actually becomes permanently unavailable pursuant

to a Benchmark Transition Event, an Alternate Rate has not been established in this manner, Transactions will, until an Alternate Rate

is so established, accrue Price Differential at the Prime Rate. In no event shall the Alternate Rate be less than zero. All determinations

by Buyer under this Section 3(d) shall be conclusive and binding absent manifest error.

(e) Illegality/Temporary

Unavailability. If:

(i) any

applicable domestic or foreign law, treaty, rule or regulation now or later in effect (whether or not it now applies to Buyer) or

the interpretation or administration thereof by a governmental authority charged with such interpretation or administration, or compliance

by Buyer with any guideline, request or directive of such an authority (whether or not having the force of law), shall make it unlawful

or impossible for Buyer to maintain or fund Transactions using a Pricing Rate based on the Term SOFR Rate; or

(ii) Buyer

determines (which determination shall be conclusive absent manifest error) that adequate and reasonable means do not exist for ascertaining

the Term SOFR Rate (including because the Term SOFR Screen Rate is not available or published on a current basis); or

Walker & Dunlop, LLC

Walker & Dunlop, Inc.

September 1512,

20222024

Page 6

(iii) Buyer

determines the Term SOFR Rate will not adequately and fairly reflect the cost to Buyer of funding Transactions using a Pricing Rate based

on the Term SOFR Rate;

then Buyer shall give notice

thereof to Seller as promptly as practicable thereafter and, until Buyer notifies Seller that the circumstances giving rise to such notice

no longer exist, (A) any Price Differential accruing on any Purchased Mortgage Loan purchased by Buyer in a Transaction whose Repurchase

Date has not yet occurred shall accrue, from and after the date of such circumstance or determination to and including the applicable

Repurchase Date, at the Alternate Rate (or, if no Alternate Rate has then been established, at the Prime Rate), and (B) any Purchased

Mortgage Loan purchased by Buyer in a Transaction whose Purchase Date occurs after the date of such circumstance or determination shall

accrue Price Differential at the Alternate Rate (or, if no Alternate Rate has then been established, at the Prime Rate).

In connection with the implementation

and/or administration of Pricing Rates based on the Term SOFR Rate, the Alternate Rate or any other interest rate benchmark adopted by

Buyer in accordance with the terms hereof, Buyer will have the right to make Benchmark Conforming Changes from time to time upon delivery

of written notice thereof to Seller and, notwithstanding anything to the contrary herein or in any other Transaction Document, any amendments

implementing such Benchmark Conforming Changes will become effective without any further action or consent of Seller.

5. Non-Usage

Fee.

Seller shall pay to Buyer

on each Remittance Date following the end of each whole or partial calendar quarter after the second calendar quarter of 2019, and on

the day the Agreement terminates, an amount (the “Non-Usage Fee”) equal to the product of (x) twenty-fivefifty

basis points (0.250.50%)

multiplied by the number of days in the quarter divided by 360, timesmultiplied

by (b) the positive result, if any, of subtracting from Fifty Million Dollars ($50,000,000),the

Committed Facility Amount from the average of the daily balances of Purchase Price outstanding at the end of each day during such

(whole or partial) calendar quarter; provided that no Non-Usage Fee shall be due with respect to any quarter for which the average

aggregate Purchase Price outstanding during such quarter is equal to or greater than Fifty Million Dollars

($50,000,000)the Committed Facility Amount. The Non-Usage

Fee, if any, for the calendar quarter in which the Agreement is terminated

shall be prorated based on the actual number of days the Agreement is effective during such calendar

quarter. Non-Usage Fee payments are not refundable in whole or in part for any reason whatsoever.

6. Upfront

Fee.

Seller

shall pay to Buyer on the Amendment No. 7

Effective Date and on the date which occurs every twelve (12) months thereafter prior to the day the Agreement terminates, an amount (the

“Upfront Fee”) equal to the product of (x) twelve and one half basis points (0.125%) multiplied by the Committed Facility

Amount. The Upfront Fee shall be fully earned on the Amendment No. 7 Effective Date and shall not refundable in whole or in part

for any reason whatsoever. The Upfront Fee shall be paid in immediately available funds prior to the Amendment No. 7 Effective Date

or any twelve (12) month anniversary of the same.

Walker & Dunlop, LLC

Walker & Dunlop, Inc.

September 1512,

20222024

Page 7

7. 5.

Package and Funding Fee.

Seller shall pay to Buyer

an amount (the “Package and Funding Fee”) equal to Two Hundred Fifty Dollars ($250) plus Buyer’s standard wire

transfer and shipping fees, as applicable, for each Purchased Mortgage Loan on the next Remittance Date following the applicable Purchase

Date.

8. 6.

Change in Facility Amount; Calculation of Fees.

(a) If

the Agreement is amended pursuant to its terms so as to increase or decrease the Facility Amount, all calculations of fees under this

Side Letter that are based on the Facility Amount shall be adjusted accordingly as of the date such amendment becomes effective.

(b) Buyer

shall calculate the amounts of the Pricing Rate, the Upfront Fee,

and the Non-Usage Fee and the results of such calculations shall be incontestable absent manifest error. Buyer shall advise Seller of

the periodic amounts of such rate and fees at least one (1) Business Day before payment is due.

9. 7.

Controlling Agreement.

In the event of any inconsistency

between the terms and provisions contained herein and those in the Agreement, the terms and provisions of this Side Letter shall govern.

10. 8.

Additional Fees.

All fees payable pursuant

to this Side Letter are in addition to any fees, expenses and indemnification amounts payable pursuant to the terms of the Agreement.

11. 9.

Confidentiality.

Buyer and Seller agree that

this Side Letter and all drafts hereof, the documents referred to herein or relating hereto and the transactions contemplated hereby are

confidential in nature and the Parties agree that, unless otherwise directed by a court of competent jurisdiction, each shall limit the

distribution of such documents and the discussion of such transactions to such of its officers, employees, attorneys, accountants and

agents as is required in order to fulfill its obligations under such documents and with respect to such transactions.

12. 10.

Term of Side Letter; Amendment; Payments.

(a) The

terms and provisions set forth in this Side Letter shall terminate upon the latest to occur of (a) the Termination Date, (b) the

day on which the Agreement is terminated and (c) the day on which all amounts due by Seller under the Transaction Documents have

been indefeasibly paid in full.

Walker & Dunlop, LLC

Walker & Dunlop, Inc.

September 1512,

20222024

Page 8

(b) No

amendment, waiver, supplement or other modification of this Side Letter shall be effective unless made in writing and executed by each

of the Parties.

(c) All

payments to be made by Seller to Buyer pursuant to this Side Letter shall be made by wire transfer in immediately available funds to the

account specified by Buyer.

13. 11.

Successors and Assigns.

(a)

The rights and obligations of Seller under this Side Letter shall not be assigned by Seller without the prior written consent of

Buyer and any such assignment without the prior written consent of Buyer shall be null and void.

(b)

Buyer may assign all or any portion of its rights, obligations and interest under this Side Letter at any time without the consent

of any Person; provided that, for so long as no Event of Default or Default has occurred and is continuing, any such assignment,

other than an assignment to an Affiliate of Buyer, is subject to the prior written consent of Seller. Seller’s consent shall not

be required if an Event of Default or Default has occurred and is continuing.

14. 12.

Counterparts.

This Side Letter may be executed

in any number of counterparts, each of which shall be deemed to be an original and all such counterparts shall constitute one and the

same instrument.

15. 13.

Governing Law; Consent to Jurisdiction.

(a) This

Side Letter shall be governed by and construed in accordance with the internal laws of the State of New York, but giving effect to federal

law applicable to national banks.

(b) Seller

hereby irrevocably and unconditionally submits, for itself and its property, to the nonexclusive jurisdiction of the United States District

Court for the Southern District Of New York and of any New York state court sitting in the City of New York for purposes of all legal

proceedings arising out of or relating to this Agreement or the Transactions contemplated hereby, or for recognition or enforcement of

any judgment, and each Party hereby irrevocably and unconditionally agrees that all claims in respect of any such action or proceeding

may (and any such claims, cross-claims or third party claims brought against Buyer may only) be heard and determined in such state court

or, to the extent permitted by law, in such federal court. Seller hereby irrevocably waives, to the fullest extent it may effectively

do so, any objection that it may now or hereafter have to the laying of the venue of any such proceeding brought in such a court and any

claim that any such proceeding brought in such a court has been brought in an inconvenient forum. Nothing in this Section 1314

shall affect the right of Buyer to bring any action or proceeding against Seller or its Property in the courts of other jurisdictions.

Each Party agrees that a final judgment in any such action or proceeding shall be conclusive and may be enforced in other jurisdictions

by suit on the judgment or in any other manner provided by law. Each Party consents to the service of any and all process in any such

action or proceeding by the mailing of copies of such process to it at its address for notices hereunder specified in Section 15

of the Agreement.

Walker & Dunlop, LLC

Walker & Dunlop, Inc.

September 1512,

20222024

Page 9

16. 14.

WAIVER OF JURY TRIAL

EACH PARTY WAIVES, TO THE FULLEST

EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY OR INDIRECTLY ARISING

OUT OF OR RELATING TO THE AGREEMENT, THIS SIDE LETTER, ANY OTHER TRANSACTION DOCUMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY OR THEREBY

(WHETHER BASED ON CONTRACT, TORT OR ANY OTHER THEORY). EACH PARTY (A) CERTIFIES THAT NO REPRESENTATIVE OR OTHER AGENT (INCLUDING

ANY ATTORNEY) OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION,

SEEK TO ENFORCE THE FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT AND THE OTHER PARTIES HAVE BEEN INDUCED TO ENTER INTO THIS SIDE

LETTER BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 1415.

(The remainder of this page is intentionally

blank; counterpart signature pages follow.)

Walker & Dunlop, LLC

Walker & Dunlop, Inc.

Counterpart signature page to Side Letter

Please confirm our mutual

agreement as set forth herein and acknowledge receipt of this Side Letter by executing the enclosed copy of this letter and returning

it to JPMorgan Chase Bank, N.A., 712 Main600

Travis Street, 5th20th

Floor North, Houston, TexasTX

77002, Attention: Lindsay Schelstrate email lindsay.r.schelstratePhilippe

Tsoukias email Philippe.tsoukias@jpmorgan.com, or fax (713) 216-5570. If you have any questions concerning this matter, please

contact me by email or by phone at (713) 216-3725216-0534.

| |

Very truly yours, |

| |

|

| |

JPMORGAN CHASE BANK, N.A., |

| |

Buyer |

| |

|

| |

By: |

|

| |

|

Grace

ChiPhilippe Tsoukias |

| |

|

Authorized Officer |

| CONFIRMED AND ACKNOWLEDGED: |

|

| |

|

| WALKER & DUNLOP, LLC, Seller |

|

| |

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

| |

|

| WALKER & DUNLOP, INC.,

Parent |

|

| |

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

Signature Page to Amended and Restated Side Letter (JPM/Walker & Dunlop)

v3.24.3

Cover

|

Sep. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 12, 2024

|

| Entity File Number |

001-35000

|

| Entity Registrant Name |

Walker &

Dunlop, Inc.

|

| Entity Central Index Key |

0001497770

|

| Entity Tax Identification Number |

80-0629925

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

7272 Wisconsin Avenue

|

| Entity Address, Address Line Two |

Suite 1300

|

| Entity Address, City or Town |

Bethesda

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20814

|

| City Area Code |

301

|

| Local Phone Number |

215-5500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, Par Value $0.01

|

| Trading Symbol |

WD

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

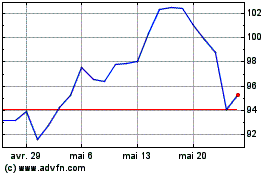

Walker & Dunlop (NYSE:WD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Walker & Dunlop (NYSE:WD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024