Walker & Dunlop Secures $113 Million Acquisition Financing for Class-A Property in Bay Area

13 Novembre 2024 - 12:00AM

Business Wire

Walker & Dunlop, Inc. announced today that it facilitated

the $113 million acquisition financing for Franklin 299, a Class-A

multifamily community in one of the most explosive growth markets

in the Bay area.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241112083143/en/

299 Franklin (Photo: Business Wire)

The Walker & Dunlop Multifamily Finance team, led by Jeff

Burns, Chris Botsford, Rene Alvarez, Jeff Conahan, and Matt

DeMarche, arranged the financing on behalf of longtime client

Acacia Capital. Despite the highly competitive financing landscape,

the team identified Fannie Mae as the lender willing to expedite

the project with an aggressive offer. The entire process closed in

an impressive 19 days with the application being signed on

September 27, rate locked on September 30, and deal closing on

October 16.

"We were happy to work alongside Acacia to exceed their

expectations and close this deal in record time," said Jeff Burns,

managing director of Multifamily Finance at Walker & Dunlop.

"Our team's swift and strategic approach allowed us to navigate the

competitive landscape effectively, ensuring that we not only met

but surpassed our client's goals."

Built in 2015, the 304-unit, fully market-rate apartment

community consists of fully appointed studio, one-, and two-bedroom

residences, including 11 direct-access townhomes, with an overall

average unit size of 845 square feet. Amenities include access to a

rooftop deck, expansive state-of-the-art fitness center, swimming

pool and spa deck, business and resident lounges, bicycle parking,

and electric vehicle charging stations.

Located in the heart of the San Francisco Peninsula, equidistant

between San Francisco and San Jose, Redwood City is a haven for

some of the world's top intellectual minds, evident in the city's

burgeoning life science and technology industries. The property’s

strategic location is near major employment centers of San

Francisco, Oyster Point, the Peninsula, and Silicon Valley. In

addition to a wide variety of upscale restaurants, entertainment

venues, and high-end retailers, the city also boasts a strong sense

of community, exemplified by weekly farmers markets and public

concerts in the summer months.

Walker & Dunlop is one of the top providers of capital to

the U.S. multifamily market; in 2023 the firm originated over $24

billion in debt financing volume, including lending over $20

billion for multifamily properties. To learn more about our

capabilities and financing options, visit our website.

About Walker & Dunlop

Walker & Dunlop (NYSE: WD) is one of the largest commercial

real estate finance and advisory services firms in the United

States. Our ideas and capital create communities where people live,

work, shop, and play. The diversity of our people, breadth of our

brand and technological capabilities make us one of the most

insightful and client-focused firms in the commercial real estate

industry.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112083143/en/

Investors: Kelsey Duffey Investor Relations Phone

301.202.3207 investorrelations@walkeranddunlop.com

Media: Nina H. von Waldegg VP, Public Relations Phone

301.564.3291 info@walkeranddunlop.com

Phone 301.215.5500

7272 Wisconsin Avenue, Suite 1300 Bethesda, Maryland 20814

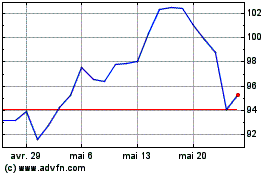

Walker & Dunlop (NYSE:WD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Walker & Dunlop (NYSE:WD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024