UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-10603

Western Asset Premier Bond Fund

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 47th Floor, New York,

NY 10018

(Address of principal executive offices) (Zip code)

Marc A. De Oliveira.

Franklin Templeton

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area

code:

1-888-777-0102

Date of fiscal year end: December 31

Date of reporting period: June 30, 2024

| ITEM

1. | REPORT TO STOCKHOLDERS. |

The Semi-Annual Report to Stockholders is filed

herewith.

Semi-Annual Report

June 30, 2024

WESTERN ASSET

PREMIER BOND FUND (WEA)

Fund objective

The Fund’s investment objective is to provide current income and capital appreciation by investing primarily in a diversified portfolio of investment grade bonds.

Under normal market conditions, the Fund expects to invest substantially all (but

at least 80%) of its total managed assets in bonds, including corporate bonds, U.S. government

and agency securities and mortgage-related securities, and at least 65% of its total managed

assets in bonds that, at the time of purchase, are of investment grade quality. The

Fund may invest up to 35% of its total managed assets in bonds of below investment grade quality

(commonly referred to as “junk bonds”) at the time of purchase. The Fund may invest in securities or instruments other than bonds (including preferred stock) and may invest

up to 10% of its total managed assets in instruments denominated in currencies other than

the U.S. dollar. The Fund may invest in a variety of derivative instruments for investment

or risk management purposes. The Fund expects that the average effective duration of its portfolio

will range between 3.5 and seven years, although this target duration may change from

time to time. Trust preferred interests and capital securities are considered bonds

and not preferred stock for purposes of the foregoing guidelines.

Western Asset Premier Bond Fund

Letter from the president

Dear Shareholder,

We are pleased to provide the semi-annual report of Western Asset Premier Bond Fund

for the six-month reporting period ended June 30, 2024. Please read on for Fund performance

information during the Fund’s reporting period.

Special shareholder notice

Effective March 1, 2024, the named portfolio management team responsible for the day-to-day oversight of the Fund is as follows: Michael Buchanan, Ryan Brist, Blanton Keh and

Christopher Kilpatrick.

As always, we remain committed to providing you with excellent service and a full

spectrum of investment choices. We also remain committed to supplementing the support

you receive from your financial advisor. One way we accomplish this is through our

website, www.franklintempleton.com. Here you can gain immediate access to market and investment information, including:

•

Fund prices and performance,

•

Market insights and commentaries from our portfolio managers, and

•

A host of educational resources.

We look forward to helping you meet your financial goals.

Jane Trust, CFA

President and Chief Executive Officer

Western Asset Premier Bond Fund

(This page intentionally left blank.)

For the six months ended June 30, 2024, Western Asset Premier Bond Fund returned 0.92%

based on its net asset value (“NAV”)i and 0.98% based on its New York Stock Exchange (“NYSE”) market price per share. The Fund’s unmanaged benchmarks, the Bloomberg U.S. Corporate High Yield Indexii and the Bloomberg U.S. Credit Indexiii, returned 2.58% and -0.46%, respectively, for the same period.

The Fund has a practice of seeking to maintain a relatively stable level of distributions

to shareholders. This practice has no impact on the Fund’s investment strategy and may reduce the Fund’s NAV. The Fund’s manager believes the practice helps maintain the Fund’s competitiveness and may benefit the Fund’s market price and premium/discount to the Fund’s NAV.

During the six-month period, the Fund made distributions to shareholders totaling

$0.42 per share. As of June 30, 2024, the Fund estimates that all of the distributions were

sourced from net investment income.* The performance table shows the Fund’s six-month total return based on its NAV and market price as of June 30, 2024. Past performance is no guarantee of future results.

Performance Snapshot as of June 30, 2024 (unaudited)

|

|

|

|

|

|

|

|

|

|

All figures represent past performance and are not a guarantee of future results.

Performance figures for periods shorter than one year represent cumulative figures and are not

annualized.

** Total returns are based on changes in NAV or market price, respectively. Returns

reflect the deduction of all Fund expenses, including management fees, operating expenses, and

other Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that

investors may pay on distributions or the sale of shares.

† Total return assumes the reinvestment of all distributions, including returns of capital, if any, at NAV.

‡ Total return assumes the reinvestment of all distributions, including returns of capital, if any, in additional shares in accordance with the Fund’s Dividend Reinvestment Plan.

Looking for additional information?

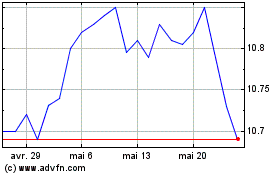

The Fund is traded under the symbol “WEA” and its closing market price is available in most newspapers under the NYSE listings. The daily NAV is available online under the

symbol “XWEAX” on most financial websites. Barron’s and The Wall Street Journal’s Monday edition both carry closed-end fund tables that provide additional information.

In

*

This estimate is not for tax purposes. The Fund will issue a Form 1099 with final

composition of the distributions for tax purposes after year-end. A return of capital is not taxable and results in

a reduction in the tax basis of a shareholder’s investment. For more information about a distribution’s composition, please refer to the Fund’s distribution press release or, if applicable, the Section 19 notice located in the

press release section of our website, www.franklintempleton.com.

Western Asset Premier Bond Fund Semi-Annual Report

Performance review (cont’d)

addition, the Fund issues a quarterly press release that can be found on most major

financial websites as well as www.franklintempleton.com.

In a continuing effort to provide information concerning the Fund, shareholders may

call 1-888-777-0102 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern

Time, for the Fund’s current NAV, market price and other information.

Thank you for your investment in the Western Asset Premier Bond Fund. As always, we

appreciate that you have chosen us to manage your assets and we remain focused on

achieving the Fund’s investment goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

RISKS: The Fund is a diversified closed-end management investment company designed primarily as a long-term investment and not as a trading vehicle. The Fund is not

intended to be a complete investment program and, due to the uncertainty inherent in all investments,

there can be no assurance that the Fund will achieve its investment objective. The Fund’s common shares are traded on the NYSE. Similar to stocks, the Fund’s share price will fluctuate with market conditions and, at the time of sale, may be worth more or less than the original investment.

Shares of closed-end funds often trade at a discount to their net asset value. Diversification

does not assure against market loss. The Fund’s investments are subject to a number of risks, including credit, inflation and interest rate risks. As interest rates rise, bond

prices fall, reducing the value of a fixed income investment’s price. The Fund may invest in high-yield bonds (commonly referred to as “junk” bonds), which are rated below investment grade and carry more risk than higher-rated securities. To the extent that the Fund invests in asset-backed,

mortgage-backed or mortgage-related securities, its exposure to prepayment and extension risks may

be greater than if it invested in other fixed income securities. Leverage may result

in greater volatility of NAV and the market price of common shares and increases a shareholder’s risk of loss. Investing in foreign securities is subject to certain risks not associated with

domestic investing, such as currency fluctuations and social, political, and economic uncertainties

which could result in significant volatility. These risks are magnified in emerging or developing

markets. Emerging market and developing market countries tend to have economic, political,

and legal systems that are less developed and are less stable than those of more developed countries.

The Fund may make significant investments in derivative instruments. Derivative instruments

can be illiquid, may disproportionately increase losses, and have a potentially large impact

on Fund performance. The market values of securities or other assets will fluctuate, sometimes

sharply and unpredictably, due to changes in general market conditions, overall economic trends

or events, governmental actions or intervention, actions taken by the U.S. Federal Reserve

or

Western Asset Premier Bond Fund Semi-Annual Report

foreign central banks, market disruptions caused by trade disputes or other factors,

political developments, armed conflicts, economic sanctions and countermeasures in response

to sanctions, major cybersecurity events, investor sentiment, the global and domestic

effects of a pandemic, and other factors that may or may not be related to the issuer of the security

or other asset. The Fund may also invest in money market funds, including funds affiliated with the Fund’s investment advisers.

This material is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in

connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided

for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

All investments are subject to risk including the possible loss of principal. Past

performance is no guarantee of future results. All index performance reflects no deduction for fees,

expenses or taxes. Please note that an investor cannot invest directly in an index.

i

Net asset value (NAV) is calculated by subtracting total liabilities, including liabilities

associated with financial leverage (if any), from the closing value of all securities held by the Fund (plus

all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The NAV

fluctuates with changes in the market prices of securities in which the Fund has invested. However, the price

at which an investor may buy or sell shares of the Fund is the Fund’s market price as determined by supply of and demand for the Fund’s shares.

ii

The Bloomberg U.S. Corporate High Yield Index covers the universe of fixed-rate, non-investment

grade debt, including corporate and non-corporate sectors. Pay-in-kind (“PIK”) bonds, Eurobonds and debt issues from countries designated as emerging markets are excluded, but Canadian and global bonds (SEC registered)

of issuers in non-emerging market countries are included. Original issue zero coupon bonds, step-up

coupon structures and 144A securities are also included.

iii

The Bloomberg U.S. Credit Index is an index composed of corporate and non-corporate

debt issues that are investment grade (rated Baa3/BBB or higher).

Important data provider notices and terms available at www.franklintempletondatasources.com.

Western Asset Premier Bond Fund Semi-Annual Report

(This page intentionally left blank.)

Fund at a glance† (unaudited)

Investment breakdown (%) as a percent of total investments

†

The bar graph above represents the Fund’s portfolio as of June 30, 2024, and December 31, 2023, and does not include derivatives, such as forward foreign currency contracts. The Fund is actively

managed. As a result, the composition of the Fund’s investments is subject to change at any time.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Schedule of investments (unaudited)

June 30, 2024

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

Corporate Bonds & Notes — 113.5%

|

Communication Services — 12.6%

|

Diversified Telecommunication Services — 3.9%

|

Altice Financing SA, Senior Secured Notes

|

|

|

|

|

Altice Financing SA, Senior Secured Notes

|

|

|

|

|

Altice France Holding SA, Senior Secured

Notes

|

|

|

|

|

Altice France SA, Senior Secured Notes

|

|

|

|

|

British Telecommunications PLC, Senior

Notes

|

|

|

|

|

Lumen Technologies Inc., Senior Notes

|

|

|

|

|

Orange SA, Junior Subordinated Notes

(2.375% to 4/15/25 then EUR 5 year Swap

Rate + 2.359%)

|

|

|

|

|

|

|

|

|

|

|

Verizon Communications Inc., Senior Notes

|

|

|

|

|

Verizon Communications Inc., Senior Notes

|

|

|

|

|

Total Diversified Telecommunication Services

|

|

|

|

Banijay Entertainment SASU, Senior

Secured Notes

|

|

|

|

|

Netflix Inc., Senior Notes

|

|

|

|

|

Walt Disney Co., Senior Notes

|

|

|

|

|

Walt Disney Co., Senior Notes

|

|

|

|

|

Warnermedia Holdings Inc., Senior Notes

|

|

|

|

|

|

|

|

Interactive Media & Services — 0.1%

|

Match Group Holdings II LLC, Senior Notes

|

|

|

|

|

|

|

Charter Communications Operating LLC/

Charter Communications Operating Capital

Corp., Senior Secured Notes

|

|

|

|

|

Comcast Corp., Senior Notes

|

|

|

|

|

Comcast Corp., Senior Notes

|

|

|

|

|

DirecTV Financing LLC/DirecTV Financing

Co-Obligor Inc., Senior Secured Notes

|

|

|

|

|

DISH DBS Corp., Senior Notes

|

|

|

|

|

DISH DBS Corp., Senior Notes

|

|

|

|

|

DISH DBS Corp., Senior Notes

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Time Warner Cable LLC, Senior Secured

Notes

|

|

|

|

|

|

|

|

Wireless Telecommunication Services — 3.0%

|

CSC Holdings LLC, Senior Notes

|

|

|

|

|

CSC Holdings LLC, Senior Notes

|

|

|

|

|

CSC Holdings LLC, Senior Notes

|

|

|

|

|

Millicom International Cellular SA, Senior

Notes

|

|

|

|

|

Sprint Capital Corp., Senior Notes

|

|

|

|

|

Sprint Capital Corp., Senior Notes

|

|

|

|

|

T-Mobile USA Inc., Senior Notes

|

|

|

|

|

Vmed O2 UK Financing I PLC, Senior Secured

Notes

|

|

|

|

|

Vmed O2 UK Financing I PLC, Senior Secured

Notes

|

|

|

|

|

Total Wireless Telecommunication Services

|

|

|

|

Total Communication Services

|

|

Consumer Discretionary — 18.2%

|

Automobile Components — 2.7%

|

Adient Global Holdings Ltd., Senior Notes

|

|

|

|

|

American Axle & Manufacturing Inc., Senior

Notes

|

|

|

|

|

American Axle & Manufacturing Inc., Senior

Notes

|

|

|

|

|

Garrett Motion Holdings Inc./Garrett LX I

Sarl, Senior Notes

|

|

|

|

|

JB Poindexter & Co. Inc., Senior Notes

|

|

|

|

|

ZF North America Capital Inc., Senior Notes

|

|

|

|

|

ZF North America Capital Inc., Senior Notes

|

|

|

|

|

Total Automobile Components

|

|

|

|

Ford Motor Co., Senior Notes

|

|

|

|

|

General Motors Co., Senior Notes

|

|

|

|

|

General Motors Co., Senior Notes

|

|

|

|

|

General Motors Co., Senior Notes

|

|

|

|

|

Mercedes-Benz Finance North America LLC,

Senior Notes

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

June 30, 2024

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

|

|

Nissan Motor Acceptance Co. LLC, Senior

Notes

|

|

|

|

|

Volkswagen Group of America Finance LLC,

Senior Notes

|

|

|

|

|

|

|

|

|

|

Amazon.com Inc., Senior Notes

|

|

|

|

|

Marks & Spencer PLC, Senior Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ritchie Bros Holdings Inc., Senior Notes

|

|

|

|

|

Diversified Consumer Services — 1.1%

|

APCOA Parking Holdings GmbH, Senior

Secured Notes

|

|

|

|

|

APCOA Parking Holdings GmbH, Senior

Secured Notes

|

|

|

|

|

Carriage Services Inc., Senior Notes

|

|

|

|

|

WW International Inc., Senior Secured

Notes

|

|

|

|

|

Total Diversified Consumer Services

|

|

Hotels, Restaurants & Leisure — 7.2%

|

888 Acquisitions Ltd., Senior Secured Notes

|

|

|

|

|

Carnival PLC, Senior Notes

|

|

|

|

|

IRB Holding Corp., Senior Secured Notes

|

|

|

|

|

Las Vegas Sands Corp., Senior Notes

|

|

|

|

|

Marston’s Issuer PLC, Secured Notes (SONIA

+ 2.669%)

|

|

|

|

|

NCL Corp. Ltd., Senior Notes

|

|

|

|

|

NCL Corp. Ltd., Senior Notes

|

|

|

|

|

NCL Corp. Ltd., Senior Secured Notes

|

|

|

|

|

NCL Finance Ltd., Senior Notes

|

|

|

|

|

Royal Caribbean Cruises Ltd., Senior Notes

|

|

|

|

|

Royal Caribbean Cruises Ltd., Senior Notes

|

|

|

|

|

|

|

|

|

|

|

Sands China Ltd., Senior Notes

|

|

|

|

|

Wheel Bidco Ltd., Senior Secured Notes

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Hotels, Restaurants & Leisure — continued

|

Wynn Macau Ltd., Senior Notes

|

|

|

|

|

Wynn Macau Ltd., Senior Notes

|

|

|

|

|

Total Hotels, Restaurants & Leisure

|

|

Household Durables — 0.5%

|

Lennar Corp., Senior Notes

|

|

|

|

|

Lennar Corp., Senior Notes

|

|

|

|

|

|

|

|

|

|

Global Auto Holdings Ltd./AAG FH UK Ltd.,

Senior Notes

|

|

|

|

|

Michaels Cos. Inc., Senior Secured Notes

|

|

|

|

|

Sally Holdings LLC/Sally Capital Inc., Senior

Notes

|

|

|

|

|

|

|

|

|

|

Total Consumer Discretionary

|

|

|

|

|

|

Anheuser-Busch Cos. LLC/Anheuser-Busch

InBev Worldwide Inc., Senior Notes

|

|

|

|

|

|

|

JBS USA Holding Lux Sarl/JBS USA Food

Co./JBS Lux Co. Sarl, Senior Notes

|

|

|

|

|

Kraft Heinz Foods Co., Senior Notes

|

|

|

|

|

|

|

|

|

|

Altria Group Inc., Senior Notes

|

|

|

|

|

Reynolds American Inc., Senior Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Equipment & Services — 0.2%

|

Noble Finance II LLC, Senior Notes

|

|

|

|

|

Oil, Gas & Consumable Fuels — 21.2%

|

Anadarko Finance Co., Senior Notes

|

|

|

|

|

Burlington Resources LLC, Senior Notes

|

|

|

|

|

Cheniere Energy Partners LP, Senior Notes

|

|

|

|

|

Columbia Pipeline Group Inc., Senior Notes

|

|

|

|

|

Continental Resources Inc., Senior Notes

|

|

|

|

|

Continental Resources Inc., Senior Notes

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

June 30, 2024

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Oil, Gas & Consumable Fuels — continued

|

Crescent Energy Finance LLC, Senior Notes

|

|

|

|

|

Devon Energy Corp., Senior Notes

|

|

|

|

|

Diamondback Energy Inc., Senior Notes

|

|

|

|

|

Ecopetrol SA, Senior Notes

|

|

|

|

|

Ecopetrol SA, Senior Notes

|

|

|

|

|

Energy Transfer LP, Junior Subordinated

Notes (6.625% to 2/15/28 then 3 mo. USD

LIBOR + 4.155%)

|

|

|

|

|

EOG Resources Inc., Senior Notes

|

|

|

|

|

EQM Midstream Partners LP, Senior Notes

|

|

|

|

|

EQM Midstream Partners LP, Senior Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hilcorp Energy I LP/Hilcorp Finance Co.,

Senior Notes

|

|

|

|

|

KazMunayGas National Co. JSC, Senior

Notes

|

|

|

|

|

Kinder Morgan Inc., Senior Notes

|

|

|

|

|

Kinder Morgan Inc., Senior Notes

|

|

|

|

|

NGPL PipeCo LLC, Senior Notes

|

|

|

|

|

Occidental Petroleum Corp., Senior Notes

|

|

|

|

|

|

|

|

|

|

|

Pan American Energy LLC, Senior Notes

|

|

|

|

|

Petrobras Global Finance BV, Senior Notes

|

|

|

|

|

Petroleos del Peru SA, Senior Notes

|

|

|

|

|

Petroleos Mexicanos, Senior Notes

|

|

|

|

|

Puma International Financing SA, Senior

Notes

|

|

|

|

|

Range Resources Corp., Senior Notes

|

|

|

|

|

Range Resources Corp., Senior Notes

|

|

|

|

|

Rockies Express Pipeline LLC, Senior Notes

|

|

|

|

|

Sabine Pass Liquefaction LLC, Senior

Secured Notes

|

|

|

|

|

SilverBow Resources Inc., Secured Notes (3

mo. Term SOFR + 7.750%)

|

|

|

|

|

Southern Natural Gas Co. LLC, Senior Notes

|

|

|

|

|

Summit Midstream Holdings LLC/Summit

Midstream Finance Corp., Secured Notes

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Oil, Gas & Consumable Fuels — continued

|

Targa Resources Partners LP/Targa

Resources Partners Finance Corp., Senior

Notes

|

|

|

|

|

Targa Resources Partners LP/Targa

Resources Partners Finance Corp., Senior

Notes

|

|

|

|

|

Tengizchevroil Finance Co. International Ltd.,

Senior Secured Notes

|

|

|

|

|

Transcontinental Gas Pipe Line Co. LLC,

Senior Notes

|

|

|

|

|

Transportadora de Gas del Peru SA, Senior

Notes

|

|

|

|

|

Venture Global LNG Inc., Senior Secured

Notes

|

|

|

|

|

Western Midstream Operating LP, Senior

Notes

|

|

|

|

|

Western Midstream Operating LP, Senior

Notes

|

|

|

|

|

Western Midstream Operating LP, Senior

Notes

|

|

|

|

|

Williams Cos. Inc., Senior Notes

|

|

|

|

|

Williams Cos. Inc., Senior Notes

|

|

|

|

|

|

|

|

|

|

|

Total Oil, Gas & Consumable Fuels

|

|

|

|

|

|

|

|

|

|

|

Banco Mercantil del Norte SA, Junior

Subordinated Notes (6.625% to 1/24/32

then 10 year Treasury Constant Maturity

Rate + 5.034%)

|

|

|

|

|

Bank of America Corp., Subordinated Notes

|

|

|

|

|

Bank of Nova Scotia, Senior Notes

|

|

|

|

|

Barclays PLC, Subordinated Notes

|

|

|

|

|

BBVA Bancomer SA, Subordinated Notes

(5.125% to 1/17/28 then 5 year Treasury

Constant Maturity Rate + 2.650%)

|

|

|

|

|

BNP Paribas SA, Junior Subordinated Notes

(7.375% to 8/19/25 then USD 5 year ICE

Swap Rate + 5.150%)

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

June 30, 2024

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

|

|

BPCE SA, Subordinated Notes

|

|

|

|

|

Citigroup Inc., Junior Subordinated Notes

(5.950% to 5/15/25 then 3 mo. Term SOFR +

4.167%)

|

|

|

|

|

Citigroup Inc., Subordinated Notes

|

|

|

|

|

Citigroup Inc., Subordinated Notes

|

|

|

|

|

Comerica Bank, Senior Notes

|

|

|

|

|

Credit Agricole SA, Junior Subordinated

Notes (8.125% to 12/23/25 then USD 5 year

ICE Swap Rate + 6.185%)

|

|

|

|

|

HSBC Holdings PLC, Junior Subordinated

Notes (6.000% to 5/22/27 then USD 5 year

ICE Swap Rate + 3.746%)

|

|

|

|

|

HSBC Holdings PLC, Senior Notes (3.973%

to 5/22/29 then 3 mo. Term SOFR + 1.872%)

|

|

|

|

|

HSBC Holdings PLC, Subordinated Notes

(8.113% to 11/3/32 then SOFR + 4.250%)

|

|

|

|

|

Intesa Sanpaolo SpA, Subordinated Notes

|

|

|

|

|

JPMorgan Chase & Co., Junior Subordinated

Notes (6.100% to 10/1/24 then 3 mo. Term

SOFR + 3.592%)

|

|

|

|

|

JPMorgan Chase & Co., Subordinated Notes

|

|

|

|

|

Lloyds Banking Group PLC, Junior

Subordinated Notes (7.500% to 9/27/25

then USD 5 year ICE Swap Rate + 4.496%)

|

|

|

|

|

Lloyds Banking Group PLC, Subordinated

Notes

|

|

|

|

|

PNC Financial Services Group Inc., Senior

Notes

|

|

|

|

|

PNC Financial Services Group Inc., Senior

Notes (5.812% to 6/12/25 then SOFR +

1.322%)

|

|

|

|

|

Santander UK Group Holdings PLC,

Subordinated Notes

|

|

|

|

|

Truist Financial Corp., Senior Notes (5.711%

to 1/24/34 then SOFR + 1.922%)

|

|

|

|

|

UniCredit SpA, Subordinated Notes (7.296%

to 4/2/29 then USD 5 year ICE Swap Rate +

4.914%)

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

|

|

Charles Schwab Corp., Junior Subordinated

Notes (4.000% to 12/1/30 then 10 year

Treasury Constant Maturity Rate + 3.079%)

|

|

|

|

|

CME Group Inc., Senior Notes

|

|

|

|

|

Credit Suisse AG AT1 Claim

|

|

|

|

|

UBS AG/Stamford CT, Senior Notes

|

|

|

|

|

Daimler Truck Finance North America LLC,

Senior Notes

|

|

|

|

|

Goldman Sachs Group Inc., Senior Notes

(2.640% to 2/24/27 then SOFR + 1.114%)

|

|

|

|

|

KKR Group Finance Co. VI LLC, Senior Notes

|

|

|

|

|

Morgan Stanley, Senior Notes (2.699% to

1/22/30 then SOFR + 1.143%)

|

|

|

|

|

UBS Group AG, Junior Subordinated Notes

(6.875% to 8/7/25 then USD 5 year ICE

Swap Rate + 4.590%)

|

|

|

|

|

UBS Group AG, Senior Notes (6.537% to

8/12/32 then SOFR + 3.920%)

|

|

|

|

|

|

|

|

Financial Services — 3.3%

|

AerCap Ireland Capital DAC/AerCap Global

Aviation Trust, Senior Notes

|

|

|

|

|

Ahold Lease USA Inc. Pass-Through-Trust,

Senior Secured Notes

|

|

|

|

|

Global Aircraft Leasing Co. Ltd., Senior

Notes (6.500% Cash or 7.250% PIK)

|

|

|

|

|

GTCR W Dutch Finance Sub BV, Senior

Secured Notes

|

|

|

|

|

Jane Street Group/JSG Finance Inc., Senior

Secured Notes

|

|

|

|

|

VFH Parent LLC/Valor Co-Issuer Inc., Senior

Secured Notes

|

|

|

|

|

VistaJet Malta Finance PLC/Vista

Management Holding Inc., Senior Notes

|

|

|

|

|

|

|

|

|

|

MetLife Inc., Junior Subordinated Notes

|

|

|

|

|

Nuveen Finance LLC, Senior Notes

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

June 30, 2024

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Mortgage Real Estate Investment Trusts (REITs) — 0.3%

|

Starwood Property Trust Inc., Senior Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AbbVie Inc., Senior Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Care Equipment & Supplies — 0.8%

|

Becton Dickinson and Co., Senior Notes

|

|

|

|

|

Solventum Corp., Senior Notes

|

|

|

|

|

Total Health Care Equipment & Supplies

|

|

Health Care Providers & Services — 7.2%

|

Centene Corp., Senior Notes

|

|

|

|

|

CHS/Community Health Systems Inc., Senior

Secured Notes

|

|

|

|

|

CVS Health Corp., Senior Notes

|

|

|

|

|

CVS Health Corp., Senior Notes

|

|

|

|

|

CVS Health Corp., Senior Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CVS Pass-Through Trust, Secured Trust

|

|

|

|

|

CVS Pass-Through Trust, Secured Trust

|

|

|

|

|

CVS Pass-Through Trust, Senior Secured

Trust

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Humana Inc., Senior Notes

|

|

|

|

|

Legacy LifePoint Health LLC, Senior Secured

Notes

|

|

|

|

|

Sotera Health Holdings LLC, Senior Secured

Notes

|

|

|

|

|

Tenet Healthcare Corp., Secured Notes

|

|

|

|

|

UnitedHealth Group Inc., Senior Notes

|

|

|

|

|

Total Health Care Providers & Services

|

|

|

|

Endo Finance Holdings Inc., Senior Secured

Notes

|

|

|

|

|

Par Pharmaceutical Inc., Escrow

|

|

|

|

|

Pfizer Inc., Senior Notes

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Pharmaceuticals — continued

|

Pfizer Investment Enterprises Pte Ltd., Senior

Notes

|

|

|

|

|

Teva Pharmaceutical Finance Netherlands III

BV, Senior Notes

|

|

|

|

|

Teva Pharmaceutical Finance Netherlands III

BV, Senior Notes

|

|

|

|

|

Teva Pharmaceutical Finance Netherlands III

BV, Senior Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aerospace & Defense — 2.4%

|

Avolon Holdings Funding Ltd., Senior Notes

|

|

|

|

|

Avolon Holdings Funding Ltd., Senior Notes

|

|

|

|

|

|

|

|

|

|

|

Bombardier Inc., Senior Notes

|

|

|

|

|

TransDigm Inc., Senior Secured Notes

|

|

|

|

|

Total Aerospace & Defense

|

|

|

|

Masterbrand Inc., Senior Notes

|

|

|

|

|

Standard Industries Inc., Senior Notes

|

|

|

|

|

|

|

|

Commercial Services & Supplies — 1.4%

|

CoreCivic Inc., Senior Notes

|

|

|

|

|

GEO Group Inc., Senior Notes

|

|

|

|

|

GEO Group Inc., Senior Secured Notes

|

|

|

|

|

GFL Environmental Inc., Senior Secured

Notes

|

|

|

|

|

Total Commercial Services & Supplies

|

|

|

|

Cellnex Finance Co. SA, Senior Notes

|

|

|

|

|

Titan International Inc., Senior Secured

Notes

|

|

|

|

|

|

|

|

Passenger Airlines — 3.2%

|

American Airlines Group Inc., Senior Notes

|

|

|

|

|

American Airlines Inc., Senior Secured

Notes

|

|

|

|

|

Delta Air Lines Inc., Senior Notes

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

June 30, 2024

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Passenger Airlines — continued

|

Delta Air Lines Inc., Senior Notes

|

|

|

|

|

Delta Air Lines Inc., Senior Secured Notes

|

|

|

|

|

Spirit Loyalty Cayman Ltd./Spirit IP Cayman

Ltd., Senior Secured Notes

|

|

|

|

|

Spirit Loyalty Cayman Ltd./Spirit IP Cayman

Ltd., Senior Secured Notes

|

|

|

|

|

United Airlines Pass-Through Trust

|

|

|

|

|

|

|

|

Trading Companies & Distributors — 2.7%

|

Air Lease Corp., Senior Notes

|

|

|

|

|

Ashtead Capital Inc., Senior Notes

|

|

|

|

|

H&E Equipment Services Inc., Senior Notes

|

|

|

|

|

United Rentals North America Inc., Secured

Notes

|

|

|

|

|

United Rentals North America Inc., Senior

Notes

|

|

|

|

|

Total Trading Companies & Distributors

|

|

|

|

|

|

|

Information Technology — 2.9%

|

Communications Equipment — 0.3%

|

Viasat Inc., Senior Notes

|

|

|

|

|

Viasat Inc., Senior Secured Notes

|

|

|

|

|

Total Communications Equipment

|

|

Electronic Equipment, Instruments & Components — 0.2%

|

EquipmentShare.com Inc., Secured Notes

|

|

|

|

|

Semiconductors & Semiconductor Equipment — 1.1%

|

Broadcom Corp./Broadcom Cayman Finance

Ltd., Senior Notes

|

|

|

|

|

Foundry JV Holdco LLC, Senior Secured

Notes

|

|

|

|

|

Texas Instruments Inc., Senior Notes

|

|

|

|

|

Total Semiconductors & Semiconductor Equipment

|

|

|

|

Cloud Software Group Inc., Senior Secured

Notes

|

|

|

|

|

Technology Hardware, Storage & Peripherals — 0.9%

|

Seagate HDD Cayman, Senior Notes

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Technology Hardware, Storage & Peripherals — continued

|

Seagate HDD Cayman, Senior Notes

|

|

|

|

|

Western Digital Corp., Senior Notes

|

|

|

|

|

Total Technology Hardware, Storage & Peripherals

|

|

|

|

Total Information Technology

|

|

|

|

|

|

Braskem Netherlands Finance BV, Senior

Notes

|

|

|

|

|

|

|

|

|

|

|

Orbia Advance Corp. SAB de CV, Senior

Notes

|

|

|

|

|

Sasol Financing USA LLC, Senior Notes

|

|

|

|

|

|

|

|

Construction Materials — 0.4%

|

Smyrna Ready Mix Concrete LLC, Senior

Secured Notes

|

|

|

|

|

Containers & Packaging — 0.0%††

|

|

|

|

|

|

|

|

|

ArcelorMittal SA, Senior Notes

|

|

|

|

|

First Quantum Minerals Ltd., Secured Notes

|

|

|

|

|

Freeport Indonesia PT, Senior Notes

|

|

|

|

|

Freeport-McMoRan Inc., Senior Notes

|

|

|

|

|

Freeport-McMoRan Inc., Senior Notes

|

|

|

|

|

Glencore Funding LLC, Senior Notes

|

|

|

|

|

Teck Resources Ltd., Senior Notes

|

|

|

|

|

Vale Overseas Ltd., Senior Notes

|

|

|

|

|

|

|

|

Paper & Forest Products — 1.4%

|

Suzano Austria GmbH, Senior Notes

|

|

|

|

|

Suzano Austria GmbH, Senior Notes

|

|

|

|

|

Total Paper & Forest Products

|

|

|

|

|

|

|

|

|

|

|

Vornado Realty LP, Senior Notes

|

|

|

|

|

Hotel & Resort REITs — 0.1%

|

Service Properties Trust, Senior Notes

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

June 30, 2024

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Real Estate Management & Development — 0.1%

|

Cushman & Wakefield US Borrower LLC,

Senior Secured Notes

|

|

|

|

|

|

|

|

|

|

|

|

Electric Utilities — 1.1%

|

Comision Federal de Electricidad, Senior

Notes

|

|

|

|

|

Pacific Gas and Electric Co., First Mortgage

Bonds

|

|

|

|

|

Vistra Operations Co. LLC, Senior Notes

|

|

|

|

|

|

|

|

Independent Power and Renewable Electricity Producers — 0.5%

|

Minejesa Capital BV, Senior Secured Notes

|

|

|

|

|

|

|

|

|

|

Total Corporate Bonds & Notes (Cost — $146,572,093)

|

|

|

|

Consumer Discretionary — 3.5%

|

Diversified Consumer Services — 0.1%

|

WW International Inc., Initial Term Loan (1

mo. Term SOFR + 3.614%)

|

|

|

|

|

Hotels, Restaurants & Leisure — 3.4%

|

Caesars Entertainment Inc., Incremental

Term Loan B1 (3 mo. Term SOFR + 2.750%)

|

|

|

|

|

Flutter Entertainment Public Ltd. Co., Term

Loan B (3 mo. Term SOFR + 2.250%)

|

|

|

|

|

Four Seasons Hotels Ltd., 2024 Repricing

Term Loan (1 mo. Term SOFR + 2.000%)

|

|

|

|

|

Hilton Worldwide Finance LLC, Term Loan B4

(1 mo. Term SOFR + 1.750%)

|

|

|

|

|

Scientific Games International Inc., Term

Loan B1 (1 mo. Term SOFR + 2.750%)

|

|

|

|

|

Total Hotels, Restaurants & Leisure

|

|

|

|

Total Consumer Discretionary

|

|

|

|

Oil, Gas & Consumable Fuels — 0.4%

|

Buckeye Partners LP, Term Loan B2

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

|

|

|

|

Blackhawk Network Holdings Inc., Term Loan

B (1 mo. Term SOFR + 5.000%)

|

|

|

|

|

TransUnion Intermediate Holdings Inc., Term

Loan B7 (1 mo. Term SOFR + 2.000%)

|

|

|

|

|

|

|

|

Financial Services — 2.7%

|

Boost Newco Borrower LLC, Initial USD Term

Loan (3 mo. Term SOFR + 3.000%)

|

|

|

|

|

Citadel Securities LP, 2024 Term Loan B (1

mo. Term SOFR + 2.250%)

|

|

|

|

|

Nexus Buyer LLC, Amendment No. 5 Term

Loan (1 mo. Term SOFR + 4.500%)

|

|

|

|

|

|

|

|

|

|

Asurion LLC, New Term Loan B10 (1 mo.

Term SOFR + 4.100%)

|

|

|

|

|

Mortgage Real Estate Investment Trusts (REITs) — 0.3%

|

Starwood Property Mortgage LLC, Term Loan

B (1 mo. Term SOFR + 3.250%)

|

|

|

|

|

|

|

|

|

|

|

|

Life Sciences Tools & Services — 0.4%

|

IQVIA Inc., Term Loan B4 (3 mo. Term SOFR +

2.000%)

|

|

|

|

|

|

|

|

|

Passenger Airlines — 0.9%

|

Delta Air Lines Inc., Initial Term Loan (3 mo.

Term SOFR + 3.750%)

|

|

|

|

|

United Airlines Inc., Term Loan B (1 mo. Term

SOFR + 2.750%)

|

|

|

|

|

|

|

|

Trading Companies & Distributors — 0.2%

|

United Rentals North America Inc.,

Restatement Term Loan (1 mo. Term SOFR +

1.750%)

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

June 30, 2024

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Information Technology — 1.3%

|

Electronic Equipment, Instruments & Components — 0.5%

|

Coherent Corp., Term Loan B1 (1 mo. Term

SOFR + 2.500%)

|

|

|

|

|

Semiconductors & Semiconductor Equipment — 0.4%

|

MKS Instruments Inc., 2023 Dollar Term

Loan B (1 mo. Term SOFR + 2.500%)

|

|

|

|

|

|

|

DCert Buyer Inc., First Lien Initial Term Loan

(1 mo. Term SOFR + 4.000%)

|

|

|

|

|

Modena Buyer LLC, Term Loan

|

|

|

|

|

|

|

|

|

|

Total Information Technology

|

|

|

|

Construction Materials — 0.5%

|

Summit Materials LLC, Term Loan B2 (3 mo.

Term SOFR + 2.500%)

|

|

|

|

|

Containers & Packaging — 0.6%

|

Berry Global Inc., Term Loan AA (1 mo. Term

SOFR + 1.864%)

|

|

|

|

|

Paper & Forest Products — 0.7%

|

Asplundh Tree Expert LLC, 2021 Refinancing

Term Loan (1 mo. Term SOFR + 1.850%)

|

|

|

|

|

|

|

|

|

|

|

|

Electric Utilities — 0.6%

|

Vistra Operations Co. LLC, 2018 Incremental

Term Loan (1 mo. Term SOFR + 2.000%)

|

|

|

|

|

|

|

Total Senior Loans (Cost — $17,415,248)

|

|

|

|

|

|

Angolan Government International Bond,

Senior Notes

|

|

|

|

|

|

|

Argentine Republic Government

International Bond, Senior Notes

|

|

|

|

|

Provincia de Buenos Aires, Senior Notes,

Step bond (6.375% to 9/1/24 then 6.625%)

|

|

|

|

|

Provincia de Cordoba, Senior Notes

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

|

|

Colombia Government International Bond,

Senior Notes

|

|

|

|

|

Dominican Republic — 0.3%

|

Dominican Republic International Bond,

Senior Notes

|

|

|

|

|

|

|

Indonesia Government International Bond,

Senior Notes

|

|

|

|

|

Indonesia Government International Bond,

Senior Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mexico Government International Bond,

Senior Notes

|

|

|

|

|

Mexico Government International Bond,

Senior Notes

|

|

|

|

|

Mexico Government International Bond,

Senior Notes

|

|

|

|

|

|

|

|

|

|

Panama Government International Bond,

Senior Notes

|

|

|

|

|

|

|

Peruvian Government International Bond,

Senior Notes

|

|

|

|

|

|

|

Saudi Government International Bond,

Senior Notes

|

|

|

|

|

|

|

Total Sovereign Bonds (Cost — $11,578,871)

|

|

Collateralized Mortgage Obligations(n) — 6.1%

|

280 Park Avenue Mortgage Trust, 2017-280P

F (1 mo. Term SOFR + 3.127%)

|

|

|

|

|

Bear Stearns ALT-A Trust, 2004-3 A1 (1 mo.

Term SOFR + 0.754%)

|

|

|

|

|

CHL Mortgage Pass-Through Trust, 2005-7

1A1 (1 mo. Term SOFR + 0.384%)

|

|

|

|

|

Citigroup Commercial Mortgage Trust, 2015-

GC29 D

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

June 30, 2024

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

Collateralized Mortgage Obligations(n) — continued

|

Citigroup Commercial Mortgage Trust,

2015-P1 D

|

|

|

|

|

Citigroup Commercial Mortgage Trust,

2015-P1 E

|

|

|

|

|

CSAIL Commercial Mortgage Trust, 2015-C3

C

|

|

|

|

|

Federal Home Loan Mortgage Corp. (FHLMC)

REMIC, Structured Agency Credit Risk Debt

Notes, 2020-DNA6 B1 (30 Day Average

SOFR + 3.000%)

|

|

|

|

|

Federal Home Loan Mortgage Corp. (FHLMC)

REMIC, Structured Agency Credit Risk Debt

Notes, 2021-DNA7 B2 (30 Day Average

SOFR + 7.800%)

|

|

|

|

|

Federal Home Loan Mortgage Corp. (FHLMC)

REMIC, Structured Agency Credit Risk Debt

Notes, 2022-DNA2 M2 (30 Day Average

SOFR + 3.750%)

|

|

|

|

|

Federal Home Loan Mortgage Corp. (FHLMC)

REMIC, Structured Agency Credit Risk Debt

Notes, 2022-DNA6 M2 (30 Day Average

SOFR + 5.750%)

|

|

|

|

|

Federal National Mortgage Association

(FNMA), 2004-W15 1A2

|

|

|

|

|

Federal National Mortgage Association

(FNMA) — CAS, 2023-R06 1M2 (30 Day

Average SOFR + 2.700%)

|

|

|

|

|

Federal National Mortgage Association

(FNMA) — CAS, 2024-R02 1M2 (30 Day

Average SOFR + 1.800%)

|

|

|

|

|

GS Mortgage Securities Corp. Trust, 2024-

70P E

|

|

|

|

|

Hawaii Hotel Trust, 2019-MAUI F (1 mo.

Term SOFR + 3.047%)

|

|

|

|

|

Impac CMB Trust, 2004-10 2A (1 mo. Term

SOFR + 0.754%)

|

|

|

|

|

Impac CMB Trust, 2005-2 2A2 (1 mo. Term

SOFR + 0.914%)

|

|

|

|

|

MAFI II Remic Trust, 1998-BI B1

|

|

|

|

|

MERIT Securities Corp., 2011-PA B3 (1 mo.

USD LIBOR + 2.250%)

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

Collateralized Mortgage Obligations(n) — continued

|

Morgan Stanley Capital Trust, 2015-UBS8 C

|

|

|

|

|

Morgan Stanley Capital Trust, 2016-BNK2 B

|

|

|

|

|

Prime Mortgage Trust, 2005-2 2XB, IO

|

|

|

|

|

Prime Mortgage Trust, 2005-5 1X, IO

|

|

|

|

|

RAMP Trust, 2005-SL2 APO, STRIPS, PO

|

|

|

|

|

Sequoia Mortgage Trust, 2003-2 A2 (6 mo.

Term SOFR + 1.108%)

|

|

|

|

|

Structured Asset Securities Corp., 1998-RF2

A

|

|

|

|

|

Structured Asset Securities Corp. Mortgage

Pass-Through Certificates, 2003-9A 2A2

|

|

|

|

|

UBS Commercial Mortgage Trust, 2018-C15

C

|

|

|

|

|

|

|

Total Collateralized Mortgage Obligations (Cost — $7,697,103)

|

|

Asset-Backed Securities — 1.6%

|

American Home Mortgage Investment Trust,

2007-A 4A (1 mo. Term SOFR + 1.014%)

|

|

|

|

|

Bayview Financial Asset Trust, 2007-SR1A

M1 (1 mo. Term SOFR + 0.914%)

|

|

|

|

|

Bayview Financial Asset Trust, 2007-SR1A

M4 (1 mo. Term SOFR + 1.614%)

|

|

|

|

|

Financial Asset Securities Corp. Trust,

2005-1A 1A3B (1 mo. Term SOFR + 0.524%)

|

|

|

|

|

GSAMP Trust, 2003-SEA2 A1

|

|

|

|

|

Indymac Manufactured Housing Contract

Pass-Through Certificates, 1997-1 A5

|

|

|

|

|

Morgan Stanley ABS Capital Inc. Trust,

2003-SD1 A1 (1 mo. Term SOFR + 1.114%)

|

|

|

|

|

Morgan Stanley ABS Capital Inc. Trust,

2004-HE7 M1 (1 mo. Term SOFR + 1.014%)

|

|

|

|

|

Origen Manufactured Housing Contract

Trust, 2006-A A2

|

|

|

|

|

Origen Manufactured Housing Contract

Trust, 2007-A A2

|

|

|

|

|

|

|

Total Asset-Backed Securities (Cost — $1,953,345)

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

June 30, 2024

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

Convertible Bonds & Notes — 0.7%

|

Communication Services — 0.7%

|

|

|

DISH Network Corp., Senior Notes

|

|

|

|

|

DISH Network Corp., Senior Notes

|

|

|

|

|

|

|

Total Convertible Bonds & Notes (Cost — $1,075,174)

|

|

U.S. Government & Agency Obligations — 0.3%

|

U.S. Government Obligations — 0.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total U.S. Government & Agency Obligations (Cost — $433,585)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Common Stocks (Cost — $51,926)

|

|

|

|

|

|

|

|

|

|

|

|

|

Passenger Airlines — 0.0%††

|

flyExclusive Inc. (Cost — $8,421)

|

|

|

|

|

Total Investments before Short-Term Investments (Cost — $186,785,766)

|

|

|

|

|

|

|

|

|

Short-Term Investments — 4.9%

|

U.S. Treasury Bills — 4.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total U.S. Treasury Bills (Cost — $5,993,210)

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Western Asset Premier Bond Fund

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

Money Market Funds — 0.4%

|

Western Asset Premier Institutional

Government Reserves, Premium Shares

(Cost — $540,780)

|

|

|

|

|

|

|

Total Short-Term Investments (Cost — $6,533,990)

|

|

Total Investments — 149.0% (Cost — $193,319,756)

|

|

Liabilities in Excess of Other Assets — (49.0)%

|

|

Total Net Assets — 100.0%

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

June 30, 2024

Western Asset Premier Bond Fund

|

|

Face amount denominated in U.S. dollars, unless otherwise noted.

|

|

|

Represents less than 0.1%.

|

|

|

Non-income producing security.

|

|

|

Security is exempt from registration under Rule 144A of the Securities Act of 1933.

This security may be resold in

transactions that are exempt from registration, normally to qualified institutional

buyers. This security has been

deemed liquid pursuant to guidelines approved by the Board of Trustees.

|

|

|

All or a portion of this security is pledged as collateral pursuant to the loan agreement (Note 5).

|

|

|

Security has no maturity date. The date shown represents the next call date.

|

|

|

Security is exempt from registration under Regulation S of the Securities Act of 1933.

Regulation S applies to

securities offerings that are made outside of the United States and do not involve

direct selling efforts in the

United States. This security has been deemed liquid pursuant to guidelines approved

by the Board of Trustees.

|

|

|

Variable rate security. Interest rate disclosed is as of the most recent information

available. Certain variable rate

securities are not based on a published reference rate and spread but are determined

by the issuer or agent and

are based on current market conditions. These securities do not indicate a reference

rate and spread in their

description above.

|

|

|

All or a portion of this security is held by the counterparty as collateral for open

reverse repurchase agreements.

|

|

|

Security is fair valued in accordance with procedures approved by the Board of Trustees (Note 1).

|

|

|

Security is valued using significant unobservable inputs (Note 1).

|

|

|

Payment-in-kind security for which the issuer has the option at each interest payment

date of making interest

payments in cash or additional securities.

|

|

|

|

|

|

Interest rates disclosed represent the effective rates on senior loans. Ranges in

interest rates are attributable to

multiple contracts under the same loan.

|

|

|

Senior loans may be considered restricted in that the Fund ordinarily is contractually

obligated to receive approval

from the agent bank and/or borrower prior to the disposition of a senior loan.

|

|

|

All or a portion of this loan has not settled as of June 30, 2024. Interest rates

are not effective until settlement

date. Interest rates shown, if any, are for the settled portion of the loan.

|

|

|

Collateralized mortgage obligations are secured by an underlying pool of mortgages

or mortgage pass-through

certificates that are structured to direct payments on underlying collateral to different

series or classes of the

obligations. The interest rate may change positively or inversely in relation to one

or more interest rates, financial

indices or other financial indicators and may be subject to an upper and/or lower

limit.

|

|

|

Rate shown represents yield-to-maturity.

|

|

|

Rate shown is one-day yield as of the end of the reporting period.

|

|

|

In this instance, as defined in the Investment Company Act of 1940, an “Affiliated Company” represents Fund

ownership of at least 5% of the outstanding voting securities of an issuer, or a company

which is under common

ownership or control with the Fund. At June 30, 2024, the total market value of investments

in Affiliated

Companies was $540,780 and the cost was $540,780 (Note 8).

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Western Asset Premier Bond Fund

Abbreviation(s) used in this schedule:

|

|

|

|

Connecticut Avenue Securities

|

|

|

|

|

|

|

|

|

|

|

|

Intercontinental Exchange

|

|

|

|

|

|

|

|

|

|

|

|

London Interbank Offered Rate

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate Mortgage Investment Conduit

|

|

|

|

Secured Overnight Financing Rate

|

|

|

|

Sterling Overnight Index Average

|

|

|

|

Separate Trading of Registered Interest and Principal Securities

|

|

|

|

|

At June 30, 2024, the Fund had the following open reverse repurchase agreements:

|

|

|

|

|

Face Amount

of Reverse

Repurchase

Agreements

|

Asset Class

of Collateral*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Refer to the Schedule of Investments for positions held at the counterparty as collateral

for reverse repurchase

agreements.

|

|

|

Including accrued interest.

|

At June 30, 2024, the Fund had the following open forward foreign currency contracts:

|

|

|

|

|

Unrealized

Appreciation

(Depreciation)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Morgan Stanley & Co. Inc.

|

|

|

Net unrealized appreciation on open forward foreign currency contracts

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Schedule of investments (unaudited) (cont’d)

June 30, 2024

Western Asset Premier Bond Fund

Abbreviation(s) used in this table:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Statement of assets and liabilities (unaudited)

June 30, 2024

|

|

|

Investments in unaffiliated securities, at value (Cost — $192,778,976)

|

|

Investments in affiliated securities, at value (Cost — $540,780)

|

|

Foreign currency, at value (Cost — $263,129)

|

|

|

|

|

|

|

|

Receivable for securities sold

|

|

Unrealized appreciation on forward foreign currency contracts

|

|

Principal paydown receivable

|

|

Dividends receivable from affiliated investments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payable for open reverse repurchase agreements (Note 3)

|

|

|

|

|

Payable for securities purchased

|

|

Interest and commitment fees payable

|

|

Investment management fee payable

|

|

Administration fee payable

|

|

Unrealized depreciation on forward foreign currency contracts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares, no par value, unlimited number of shares authorized, 11,865,600 shares

issued and outstanding

|

|

Total distributable earnings (loss)

|

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Statement of operations (unaudited)

For the Six Months Ended June 30, 2024

|

|

|

|

|

|

Dividends from affiliated investments

|

|

Dividends from unaffiliated investments

|

|

Less: Foreign taxes withheld

|

|

|

|

|

|

|

|

Interest expense (Notes 3 and 5)

|

|

Investment management fee (Note 2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock exchange listing fees

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Fee waivers and/or expense reimbursements (Note 2)

|

|

|

|

|

|

|

|

Realized and Unrealized Gain (Loss) on Investments, Forward Foreign Currency Contracts

and

Foreign Currency Transactions (Notes 1, 3 and 4):

|

|

|

|

Investment transactions in unaffiliated securities

|

|

Forward foreign currency contracts

|

|

Foreign currency transactions

|

|

|

|

|

Change in Net Unrealized Appreciation (Depreciation) From:

|

|

Investments in unaffiliated securities

|

|

Forward foreign currency contracts

|

|

|

|

|

Change in Net Unrealized Appreciation (Depreciation)

|

|

Net Loss on Investments, Forward Foreign Currency Contracts and Foreign Currency

Transactions

|

|

Increase in Net Assets From Operations

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Statements of changes in net assets

For the Six Months Ended June 30, 2024 (unaudited)

and the Year Ended December 31, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in net unrealized appreciation (depreciation)

|

|

|

Increase in Net Assets From Operations

|

|

|

Distributions to Shareholders From (Note 1):

|

|

|

Total distributable earnings

|

|

|

Decrease in Net Assets From Distributions to Shareholders

|

|

|

Increase (Decrease) in Net Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

Statement of cash flows (unaudited)

For the Six Months Ended June 30, 2024

Increase (Decrease) in Cash:

|

|

Cash Flows from Operating Activities:

|

|

Net increase in net assets resulting from operations

|

|

Adjustments to reconcile net increase in net assets resulting from operations to net

cash

provided (used) by operating activities:

|

|

Purchases of portfolio securities

|

|

Sales of portfolio securities

|

|

Net purchases, sales and maturities of short-term investments

|

|

Net amortization of premium (accretion of discount)

|

|

Decrease in receivable for securities sold

|

|

Increase in interest receivable

|

|

Increase in prepaid expenses

|

|

Decrease in dividends receivable from affiliated investments

|

|

Increase in principal paydown receivable

|

|

Increase in payable for securities purchased

|

|

Increase in investment management fee payable

|

|

Decrease in Trustees’ fees payable

|

|

Increase in administration fee payable

|

|

Increase in interest and commitment fees payable

|

|

Decrease in accrued expenses

|

|

Net realized loss on investments

|

|

Change in net unrealized appreciation (depreciation) of investments and forward foreign

currency contracts

|

|

Net Cash Used in Operating Activities*

|

|

Cash Flows from Financing Activities:

|

|

Distributions paid on common stock (net of distributions payable)

|

|

Proceeds from loan facility borrowings

|

|

Increase in payable for open reverse repurchase agreements

|

|

Net Cash Provided by Financing Activities

|

|

Net Increase in Cash and Restricted Cash

|

|

Cash and restricted cash at beginning of period

|

|

Cash and restricted cash at end of period

|

|

|

|

Included in operating expenses is $1,699,227 paid for interest and commitment fees

on borrowings.

|

The following table provides a reconciliation of cash (including foreign currency)

and restricted cash reported within the Statement of Assets and Liabilities that sums to the total of such amounts

shown on the Statement of

Cash Flows.

|

|

|

|

|

|

|

|

|

Total cash and restricted cash shown in the Statement of Cash Flows

|

|

See Notes to Financial Statements.

Western Asset Premier Bond Fund 2024 Semi-Annual Report

For a common share outstanding throughout each year ended December 31, unless otherwise

noted:

|

|

|

|

|

|

|

|

|

Net asset value, beginning of period

|

|

|

|

|

|

|

Income (loss) from operations:

|

|

|

|

|

|

|

|

|

Net realized and unrealized gain (loss)

|

|

|

|

|

|

|

Total income (loss) from

operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Anti-dilutive impact of repurchase plan

|

|

|

|

|

|

|

Net asset value, end of period

|

|

|

|

|

|

|

Market price, end of period

|

|

|

|

|

|

|

Total return, based on NAV5,6

|

|

|