UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 033-57981, 333-168421 and 333-271213

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

WORTHINGTON INDUSTRIES, INC.

DEFERRED PROFIT SHARING PLAN

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

Worthington Enterprises, Inc.

200 West Old Wilson Bridge Road

Columbus, OH 43085

TABLE OF CONTENTS

The Financial Statements and Supplemental Schedule for the Worthington Industries, Inc. Deferred Profit Sharing Plan identified below are being filed with this Annual Report on Form 11-K:

SIGNATURES

The Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

WORTHINGTON INDUSTRIES, INC. DEFERRED PROFIT SHARING PLAN |

|

|

|

|

|

|

By: |

Administrative Committee, |

|

|

|

Plan Administrator |

|

|

|

|

|

|

By: |

/s/ Patrick J. Kennedy |

Date: June 14, 2024 |

|

|

Patrick J. Kennedy, Member |

WORTHINGTON INDUSTRIES, INC.

DEFERRED PROFIT SHARING PLAN

FINANCIAL STATEMENTS AND SUPPLEMENTAL SCHEDULE

WITH

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

December 31, 2023 and 2022

Report of Independent Registered Public Accounting Firm

To the Plan Administrator and Plan Participants of

Worthington Industries, Inc. Deferred Profit Sharing Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of Worthington Industries, Inc. Deferred Profit Sharing Plan (the “Plan”) as of December 31, 2023 and 2022 and the related statements of changes in net assets available for benefits for the years then ended, and the related notes and schedule (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2023 and 2022, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental Schedule of Assets Held for Investment Purposes at End of Year as of December 31, 2023 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with Department of Labor’s (DOL) Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

MEADEN & MOORE, LTD.

We have served as the Plan’s auditor since 2004.

Cleveland, Ohio

June 14, 2024

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

Worthington Industries, Inc.

Deferred Profit Sharing Plan

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Assets |

|

|

|

|

|

|

Receivable - employer contributions |

|

$ |

581,182 |

|

|

$ |

347,827 |

|

Notes receivable from participants |

|

|

12,665,601 |

|

|

|

11,014,359 |

|

Total receivables |

|

|

13,246,783 |

|

|

|

11,362,186 |

|

Investments |

|

|

|

|

|

|

Plan's interest in Master Trust assets at fair value |

|

|

795,932,509 |

|

|

|

612,685,376 |

|

Plan's interest in Master Trust assets at contract value |

|

|

55,415,207 |

|

|

|

51,981,125 |

|

Total investments |

|

|

851,347,716 |

|

|

|

664,666,501 |

|

Total assets |

|

|

864,594,499 |

|

|

|

676,028,687 |

|

|

|

|

|

|

|

|

Liabilities |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

Net assets available for benefits |

|

$ |

864,594,499 |

|

|

$ |

676,028,687 |

|

See accompanying notes

STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

Worthington Industries, Inc.

Deferred Profit Sharing Plan

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

Contributions: |

|

|

|

|

|

|

Employer |

|

$ |

21,349,872 |

|

|

$ |

19,787,939 |

|

Participant |

|

|

35,423,094 |

|

|

|

32,784,850 |

|

Rollover |

|

|

3,829,727 |

|

|

|

2,418,156 |

|

Total contributions |

|

|

60,602,693 |

|

|

|

54,990,945 |

|

|

|

|

|

|

|

|

Investment income (loss): |

|

|

|

|

|

|

Interest on notes receivable from participants |

|

|

662,430 |

|

|

|

496,910 |

|

Plan's interest in Master Trust net investment gain (loss) |

|

|

153,824,622 |

|

|

|

(146,086,237 |

) |

Total investment income (loss) |

|

|

154,487,052 |

|

|

|

(145,589,327 |

) |

|

|

|

|

|

|

|

Other income |

|

|

743,088 |

|

|

|

758,335 |

|

|

|

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

Benefits paid to participants and other deductions |

|

|

83,976,446 |

|

|

|

65,053,276 |

|

Administrative expenses |

|

|

598,664 |

|

|

|

589,432 |

|

Total deductions |

|

|

84,575,110 |

|

|

|

65,642,708 |

|

|

|

|

|

|

|

|

Net increase (decrease) before net assets transferred |

|

|

131,257,723 |

|

|

|

(155,482,755 |

) |

Net assets transferred from other qualified plans |

|

|

57,318,769 |

|

|

|

- |

|

Net assets transferred to the Worthington Industries, Inc. Retirement Savings Plan for Collectively Bargained Employees |

|

|

(10,680 |

) |

|

|

- |

|

Net increase (decrease) in net assets |

|

|

188,565,812 |

|

|

|

(155,482,755 |

) |

Net assets available for benefits at beginning of year |

|

|

676,028,687 |

|

|

|

831,511,442 |

|

Net assets available for benefits at end of year |

|

$ |

864,594,499 |

|

|

$ |

676,028,687 |

|

See accompanying notes

NOTES TO FINANCIAL STATEMENTS

Worthington Industries, Inc.

Deferred Profit Sharing Plan

The following description of the Worthington Industries, Inc. Deferred Profit Sharing Plan (as previously amended, the “Plan”) provides only general information. Participants should refer to the Plan document for a complete description of the Plan’s provisions.

General:

The Plan is a defined contribution plan covering all non-union employees of Worthington Enterprises, Inc. (“Worthington Enterprises”) and its subsidiaries who are participating employers under the Plan (together with Worthington Enterprises, collectively, the “Company”) who meet the tenure, hour and age requirements specified in the Plan. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”). The trustee for the Plan is Fidelity Management Trust Company (the “Trustee”). Worthington Enterprises is the sponsor of the Plan (the “Plan Sponsor”).

The Plan is one of two plans within the Worthington Industries Deferred Profit Sharing Plan Master Trust (the “Master Trust”). The other plan within the Master Trust is the Worthington Industries, Inc. Retirement Savings Plan for Collectively Bargained Employees (the “Union Plan”).

Corporate action:

On December 1, 2023, the Company completed the spin-off of its former steel processing business (the “Separation”) into a separate public company in a transaction intended to qualify as tax free to Worthington Enterprises’ shareholders. Also on December 1, 2023, Worthington Industries, Inc. changed its name to Worthington Enterprises, Inc., with such entity referred to herein as “Worthington Enterprises” for all past, present and future periods discussed in these financial statements. The Separation was achieved through Worthington Enterprises’ distribution of 100% of the outstanding common shares of Worthington Steel, Inc. (“Worthington Steel”) to holders of record of Worthington Enterprises common shares as of the close of business on November 21, 2023 (the “Record Date”). Each holder of record, which includes the participants of the Plan, received one common share of Worthington Steel for every one common share of Worthington Enterprises held on the Record Date. Worthington Steel is an independent, separate public company trading under the symbol “WS” on the NYSE.

Plan amendments:

In connection with the Separation, the Plan was amended to transfer the benefits obligations and related assets attributable to participants under the Union Plan who were actively employed in the “Worthington Steel Business,” as that term is defined under the Separation and Distribution Agreement by and between Worthington Steel and Worthington Enterprises, dated as of November 30, 2023, as of October 31, 2023 or who were not actively employed on October 31, 2023 but who were most recently employed in the Worthington Steel Business.

Effective January 1, 2023, Tempel Steel Company, LLC and General Tool & Instrument, LLC became participating employers in the Plan. On September 1, 2023, the Plan was amended, allowing the assets of the Tempel Steel Company Savings and Investment Plan (the “Tempel Plan”) and the General Tool & Instrument, LLC 401(k) Profit Sharing Plan (the “GTI Plan”) to become part of the Plan.

Eligibility:

All non-union, full-time employees of the Company age eighteen years and older are eligible to participate in the Plan. These employees are eligible to participate in the employer contribution component of the Plan after six months of employment. All non-union seasonal and part-time employees of the Company age eighteen years and older who have been employed for one year are eligible to participate in the Plan and in the employer contribution component of the Plan.

Contributions:

Employee deferral – Participants may make pre-tax and/or Roth contributions up to a maximum of 90% of their annual compensation. Contributions are subject to annual addition and other limitations imposed by the Internal Revenue Code (the “IRC”) as defined in the Plan document.

Newly eligible and previously opted out participants in the Plan who have otherwise not made an enrollment designation are subject to an automatic annual enrollment arrangement whereby 4% of their compensation is automatically contributed to the Plan. Participants may modify the automatic enrollment designation of 4% of compensation. Annually, all participants contributing less than 10% of their compensation will automatically have their pre-tax deferral increased by 1%, up to a maximum of 10%, unless they opt out of the automatic increase.

Employer contributions – The Company matches 50 cents per dollar of contributions of the first 4% of Plan participants’ compensation. The Company also makes an employer contribution of 3% of compensation on behalf of eligible participants irrespective of the amounts deferred by such participants. These contributions are made each pay period. As a safe harbor plan, the Company guarantees a minimum contribution of at least 3% of participants’ eligible compensation.

Additional Company contributions may be made at the option of the Plan Sponsor and will be allocated based on the unit credit method. The unit credit method uses the participating employees’ years of service and compensation to allocate any additional contribution.

Participant accounts – Each participant’s account is credited with the participant’s contributions, employer matching contributions, employer contributions, earnings and losses thereon and an allocation of the Plan’s administrative expenses, to the extent not paid by the Company.

Rollover contributions from other plans are also accepted, provided certain specified conditions are met.

Investment Options:

Participants direct their contributions among the Plan’s investment options. All contributions are allocated to the designated investment options according to each participant’s election, although, to the extent that a participant receiving a contribution does not make an allocation election, the participant’s contribution is invested in the applicable Fidelity Freedom Fund, as determined by the age of the participant.

Contributions to the Worthington Enterprises common shares fund are limited to not more than 25% of the total contributions made by or for a participant to the Plan. A participant will be prohibited from making investment exchanges to the Worthington Enterprises common shares fund if the participant’s investment in the fund equals or exceeds 25% of such participant’s total accounts.

Additionally, as the result of the Separation, the Plan has an investment fund consisting of Worthington Steel common shares, which is a non-employer stock fund. The Worthington Steel common shares fund shall be permitted as an investment option under the Plan for approximately 18 months after December 1, 2023. No new investments, transfers to, or purchases were made in the Worthington Steel share fund on or after December 1, 2023.

Vesting:

All participants are 100% vested in all contributions and related earnings credited to their accounts.

Forfeitures:

Forfeited nonvested balances consist of uncashed distribution checks or unallocated revenue sharing funds. At December 31, 2023 and 2022, forfeited nonvested accounts were $18,135 and $8,672, respectively. The Company did not use any forfeitures to offset Company contributions to the Plan in 2023 or 2022. The Company used forfeitures of $14,270 and $9,300 to offset fees in 2023 and 2022, respectively.

Revenue Sharing:

The Plan has a revenue-sharing agreement whereby the Trustee returns a portion of the investment fees to the recordkeeper to offset the Plan’s administrative expenses. Effective January 1, 2018, if the revenue received by the Trustee from mutual fund service providers exceeds the amount owed under the Plan, the Trustee remits the excess to the Plan’s trust on a quarterly basis. Such amounts may be applied to pay Plan administrative expenses or allocated to the accounts of the Plan participants. Revenue sharing funds in excess of qualified reimbursable Plan expenses is reported as “Other income” in the Statements of Changes in Net Assets Available for Benefits. At December 31, 2023 and 2022, the ending balances in the revenue sharing account were $32,550 and $6,632, respectively. The Plan may make a payment to the Trustee for administrative expenses not covered by revenue sharing.

Notes Receivable from Participants:

Participants may borrow from their Plan accounts up to a maximum equal to the lesser of $50,000 or 50% of their account balance. Loans are to be repaid over a period not to exceed 5 years, except when used for the purchase of a primary residence.

Each loan is secured by the remaining balance in the participant’s account and bears interest at rates established by the Trustee. Principal and interest are paid ratably through payroll deductions. Loans are valued at unpaid principal balance plus accrued unpaid interest.

Other Plan Provisions:

Normal retirement age under the Plan is 62, or when the sum of the participant’s age and years of service equals 70. The Plan also provides for early payment of benefits to in-service employees, with certain restrictions, after reaching age 59-1/2.

Effective March 1, 2018, the Plan was amended regarding the disposition of dividends paid on Worthington Enterprises common shares attributable to the employee stock ownership plan feature. Such dividends may be: (a) paid in cash directly to participants; (b) paid to the Plan and subsequently distributed to participants in cash no later than 90 days after the close of the Plan year in which the dividends are paid to the Plan; (c) paid to the Plan and reinvested in Worthington Enterprises common shares; or (d) paid to the Plan and reinvested in accordance with participant’s investment directions for contributions. If a participant fails to make an election, such dividends are to be paid to the Plan and reinvested in Worthington Enterprises common shares.

Payment of Benefits:

Benefit payments are recorded when paid. Upon termination of service due to death, disability, retirement or other reasons, a participant may receive the value of the vested interest in his or her account as a lump-sum distribution.

Hardship Withdrawals:

Hardship withdrawals are permitted in accordance with Internal Revenue Service (the “IRS”) guidelines.

2.Summary of Significant Accounting Policies

Basis of Accounting:

The Plan’s transactions are reported on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Investment contracts held by a defined contribution plan are required to be reported at fair value.

Investment Valuation and Income Recognition:

The Master Trust’s investments in mutual funds and common shares are stated at fair value as of year-end. Fair values for mutual funds and common shares are determined by the respective quoted market prices.

The Plan holds investments in fully benefit-responsive investment contracts, which are reported at contract value. Contract value is the relevant measurement attribute for that portion of the net assets available for benefits of a defined-contribution plan attributable to fully benefit-responsive investment contracts because contract value is the amount participants would receive if they were to initiate a permitted transaction under the terms of the Plan. The Plan invests in investment contracts through the Master Trust. The Plan holds interest in the New York Life Anchor Account (the “SVF”), a stable value fund that is a pooled account with New York Life Insurance Company (“New York Life”), made available to participating plans through a group annuity contract. Contributions to the SVF are directed to a New York Life pooled separate account that invests primarily in a diversified portfolio of high-quality, fixed income securities, which are owned by New York Life. Additionally, as a result of the assets transferred from the Tempel Plan, the Plan invests in fully benefit-responsive traditional guaranteed investment contracts (“traditional GICs”), issued by the Empower Annuity Insurance Company (“Empower”). See “Note 5 – Benefit-Responsive Contracts” for additional information.

The Master Trust’s common collective trusts represent investments held in pooled funds. These funds are valued at redemption price, which is based on the fund’s net asset value using the asset value per share practical expedient for the units held by the Plan on the last business day of the fiscal year, as determined by the issuers of the funds based on the fair value of the underlying investments.

Purchases and sales of securities are recorded on a trade-date basis using fair market value. Dividends are recorded on the ex-dividend date. Interest is recorded on the accrual basis.

Use of Estimates:

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts in the financial statements and accompanying notes. Actual results could differ from those estimates.

Plan Termination:

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA.

Plan-to-Plan Transfers:

Participants within the Plan are permitted to transfer their respective account to another plan provided by the Company in the event they change employers within the affiliate group. This activity is presented on a net-basis on the Statements of Changes in Net Assets Available for Benefits.

The assets of the Tempel Plan and the GTI Plan were transferred to the Plan. The assets of the Tempel Plan and the GTI Plan, with a fair value of approximately $50,430,000 and $6,100,000, respectively, became assets of the Plan as of September 1, 2023. Effective October 31, 2023, the assets of the Union Plan attributable to individuals who were actively employed in the Worthington Steel Business, were transferred to the Plan. The fair value of the assets transferred to the Plan was approximately $770,000.

Recently Adopted Accounting Standards:

There were no new accounting pronouncements adopted by the Plan in the year ended December 31, 2023.

The Plan received a determination letter from the IRS dated April 5, 2016, stating that the Plan is qualified under Section 401(a) of the IRC, and, therefore, the related Master Trust is exempt from taxation. Subsequent to this determination by the IRS, the Plan was amended. Once qualified, the Plan is required to operate in conformity with the IRC to maintain its qualification. The Plan Sponsor believes the Plan, as amended, is being operated in compliance with the applicable requirements of the IRC and, therefore, believes that the Plan is qualified and the related Master Trust is tax-exempt.

U.S. GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken uncertain tax positions that more-likely-than-not would not be sustained upon examination by applicable taxing authorities. The Plan administrator has analyzed tax positions taken by the Plan and has concluded that, as of December 31, 2023, there were no uncertain tax positions taken, or expected to be taken, that would require recognition of a liability or that would require disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, currently no audits are in progress for any tax periods.

Each participating retirement plan has a divided interest in the Master Trust. Net investment income (loss) for the Plan is based upon its actual holdings of the net assets of the Master Trust.

Investments at fair value of the Master Trust and the Plan’s interest in the Master Trust consisted of the following at December 31:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

2022 |

|

|

|

Master Trust |

|

|

Plan's Interest

in Master Trust |

|

|

Master Trust |

|

|

Plan's Interest

in Master Trust |

|

Investments at fair value: |

|

|

|

|

|

|

|

|

|

|

|

|

Mutual funds |

|

$ |

388,910,616 |

|

|

$ |

385,113,893 |

|

|

$ |

317,217,163 |

|

|

$ |

313,682,544 |

|

Worthington Enterprises common shares |

|

|

36,840,705 |

|

|

|

36,453,338 |

|

|

|

34,442,933 |

|

|

|

34,092,660 |

|

Worthington Steel common shares |

|

|

17,856,658 |

|

|

|

17,681,689 |

|

|

|

- |

|

|

|

- |

|

Common collective trust funds |

|

|

362,966,530 |

|

|

|

356,406,592 |

|

|

|

270,392,026 |

|

|

|

264,910,172 |

|

Total investments at fair value |

|

|

806,574,509 |

|

|

|

795,655,512 |

|

|

|

622,052,122 |

|

|

|

612,685,376 |

|

Pending trade receivable |

|

|

276,997 |

|

|

|

276,997 |

|

|

|

- |

|

|

|

- |

|

Total |

|

$ |

806,851,506 |

|

|

$ |

795,932,509 |

|

|

$ |

622,052,122 |

|

|

$ |

612,685,376 |

|

Net investment income (loss) of the Master Trust consisted of the following for the years ended December 31:

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

2022 |

|

Investment income (loss) for the Master Trust: |

|

|

|

|

|

|

Interest and dividend income |

|

$ |

16,438,452 |

|

|

$ |

14,166,260 |

|

Net appreciation (depreciation) in fair value of investments: |

|

|

|

|

|

|

Mutual funds and common collective trust funds |

|

|

115,425,273 |

|

|

|

(159,340,273 |

) |

Worthington Enterprises common shares |

|

|

20,994,850 |

|

|

|

(3,061,288 |

) |

Worthington Steel common shares |

|

|

2,970,612 |

|

|

|

- |

|

Total investment income (loss) |

|

$ |

155,829,187 |

|

|

$ |

(148,235,301 |

) |

At December 31, 2023 and 2022, the Master Trust held 640,003 and 692,746 common shares of Worthington Enterprises, respectively. The Master Trust received cash dividends from Worthington Enterprises of $742,396 and $751,239 for the years ended December 31, 2023 and 2022, respectively.

5.Benefit-Responsive Contracts

The Plan holds an interest in the SVF, a stable value fund that is a pooled account with New York Life. Contributions to the SVF are directed to a New York Life pooled separate account that invests primarily in a diversified portfolio of high-quality, fixed income securities, which are owned by New York Life. The SVF is credited with earnings on the underlying investments and charged for participant withdrawals and administrative expenses. The investment contract issuer, New York Life, is contractually obligated to repay the principal and a specified interest rate that is guaranteed to the Plan. Additionally, the Plan invests in fully benefit-responsive investment contracts, including traditional GICs. A traditional GIC is an investment contract issued by an insurance company or bank that provides for the payment of a specified rate of interest to the Plan and for the repayment of principal when the contract matures.

The SVF and the traditional GICs are fully benefit-responsive investment contracts reported at contract value in the Statements of Net Assets Available for Benefits. Benefit responsiveness is defined as the extent to which a contract’s terms and the Plan permit or require participant-initiated withdrawals at contract value. Contract value is the relevant measure for fully benefit-responsive investment contracts because this is the amount received by participants if they were to initiate permitted transactions under the terms of the Plan. Contract value, as reported to the Plan by New York Life and Empower, represents contributions made under each contract, plus earnings, less participant withdrawals and administrative expenses.

Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investments at contract value. There are no reserves against contract value for credit risk of the contract issuer or otherwise. Certain events limit the ability of the Plan to transact at contract value with the contract issuer of the SVF and the traditional GICs. However, the Plan administrator is not aware of the occurrence or likely occurrence of any such events, which would limit the Plan’s ability to transact at contract value with participants.

The crediting interest rate for the SVF and the traditional GICs is reset daily by the contract issuer but cannot be less than zero. The crediting interest rate is based upon a formula and is a function of timing of the cash flow activity, overall interest rates, the reinvestment of maturing proceeds and the impact of credit losses and impairments.

6.Party-in-Interest Transactions

Certain Plan investments are shares of mutual funds managed by the Trustee; therefore, transactions involving these funds qualify as party-in-interest transactions. In addition, the Plan has arrangements with other service providers and these arrangements also qualify as party-in-interest transactions.

The Plan offers common shares of Worthington Enterprises as an investment option. As a result, Worthington Enterprises qualifies as a party-in-interest.

The Company provides certain administrative and accounting services at no cost to the Plan and may pay for the cost of services incurred in the operation of the Plan.

7.Risks and Uncertainties

The Plan provides for various investment options. These investments are exposed to various risks, such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities and the level of uncertainty related to changes in the value of investment securities, it is possible that changes in the near or long term could materially affect participants’ account balances and the amounts reported in the Statements of Net Assets Available for Benefits and the Statements of Changes in Net Assets Available for Benefits.

Fair value is the price that would be received to sell an asset, or paid to transfer a liability, in an orderly transaction between market participants at the measurement date. In determining fair value, the Plan utilizes certain assumptions that market participants would use in pricing the asset or liability, including assumptions about the risks inherent in the inputs to the valuation technique. These inputs can be readily observable, market corroborated, or generally unobservable inputs. The Plan utilizes valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs. Based on the examination of the inputs used in the valuation techniques, the Plan is required to provide the following information according to the fair value hierarchy. The fair value hierarchy ranks the quality and reliability of the information used to determine fair values. Financial assets and liabilities carried at fair value are classified and disclosed in one of the following three categories:

Level 1: Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access.

Level 2: Inputs to the valuation methodology include:

•Quoted prices for similar assets or liabilities in active markets;

•Quoted prices for identical or similar assets or liabilities in inactive markets;

•Inputs other than quoted prices that are observable for the asset or liability; and

•Inputs that are derived principally from or corroborated by observable market data by correlation or other means.

Level 3: Inputs to the valuation methodology are unobservable and significant to the fair value measurement.

A financial instrument’s categorization within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement. See the description within “Note 2 - Summary of Significant Accounting Policies,” as to the investment valuation methodology for each class of assets noted in the below table. There have been no changes in the methodologies used at December 31, 2023 and 2022.

Investments Measured at Net Asset Value (NAV)

In accordance with FASB ASU No. 2015-07, Fair Value Measurement (Topic 820): Disclosures for Investments in Certain Entities that Calculate Net Asset Value per Share (or Its Equivalent), investments that are measured at fair value using the NAV per share practical expedient have not been classified in the fair value hierarchy table below. The fair value amounts are included in the table below in order to reconcile to the amounts presented in the Statement of Net Assets Available for Benefits. These investments include the target date funds.

The following table shows the assets of the Master Trust measured at fair value on a recurring basis, as of December 31, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements at Reporting Date Using: |

|

|

|

|

|

|

Quoted

Prices in

Active

Markets |

|

|

Significant

Other

Observable

Inputs |

|

|

Significant

Unobservable

Inputs |

|

Description |

|

Total |

|

|

(Level 1) |

|

|

(Level 2) |

|

|

(Level 3) |

|

Master Trust assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Mutual funds |

|

$ |

388,910,616 |

|

|

$ |

388,910,616 |

|

|

$ |

- |

|

|

$ |

- |

|

Worthington Enterprises common shares |

|

|

36,840,705 |

|

|

|

36,840,705 |

|

|

|

- |

|

|

|

- |

|

Worthington Steel common shares |

|

|

17,856,658 |

|

|

|

17,856,658 |

|

|

|

- |

|

|

|

- |

|

Total assets in the fair value hierarchy |

|

|

443,607,979 |

|

|

|

443,607,979 |

|

|

|

- |

|

|

|

- |

|

Common collective trust funds measured at net asset value |

|

|

362,966,530 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Pending trade receivable |

|

|

276,997 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Total |

|

$ |

806,851,506 |

|

|

$ |

443,607,979 |

|

|

$ |

- |

|

|

$ |

- |

|

The following table shows the assets of the Master Trust measured at fair value on a recurring basis, as of December 31, 2022:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements at Reporting

Date Using: |

|

|

|

|

|

|

Quoted

Prices in

Active

Markets |

|

|

Significant

Other

Observable

Inputs |

|

|

Significant

Unobservable

Inputs |

|

Description |

|

Total |

|

|

(Level 1) |

|

|

(Level 2) |

|

|

(Level 3) |

|

Master Trust assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Mutual funds |

|

$ |

317,217,163 |

|

|

$ |

317,217,163 |

|

|

$ |

- |

|

|

$ |

- |

|

Worthington Enterprises common shares |

|

|

34,442,933 |

|

|

|

34,442,933 |

|

|

|

- |

|

|

|

- |

|

Total assets in the fair value hierarchy |

|

|

351,660,096 |

|

|

|

351,660,096 |

|

|

|

- |

|

|

|

- |

|

Common collective trust funds measured at net asset value |

|

|

270,392,026 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Total |

|

$ |

622,052,122 |

|

|

$ |

351,660,096 |

|

|

$ |

- |

|

|

$ |

- |

|

Management evaluates events occurring subsequent to the date of the financial statements in determining the accounting for and disclosure of transactions and events that affect the financial statements. Subsequent events have been evaluated through the filing date of this Annual Report on Form 11-K.

On February 5, 2024 and March 21, 2024, approximately $445,996,000 and $37,240, respectively, was transferred from the Plan to the Worthington Steel, Inc. 401(k) Retirement Savings Plan as part of the Separation.

SCHEDULE OF ASSETS HELD FOR INVESTMENT PURPOSES AT END OF YEAR

Form 5500, Schedule H, Part IV, Line 4i

Worthington Industries, Inc.

Deferred Profit Sharing Plan

EIN 31-1189815, Plan Number 333

|

|

|

|

|

|

|

|

|

|

|

December 31, 2023 |

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

(b) |

|

(c) |

|

(d) |

|

(e) |

|

|

|

Identity of Issue, Borrower, Lessor, or Similar Party |

|

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par, or Maturity Value |

|

Cost |

|

Current Value |

|

* |

|

Worthington Industries Deferred Profit Sharing Plan Master Trust |

|

Master Trust |

|

N/A |

|

$ |

851,347,716 |

|

* |

|

Participant notes receivable |

|

Interest rates ranging from 4.25% to 10.25% |

|

N/A |

|

|

12,665,601 |

|

|

|

|

|

|

|

|

|

$ |

864,013,317 |

|

*Party-in-Interest to the Plan |

|

|

|

|

|

|

|

Exhibit 23

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Plan Administrator

Worthington Industries, Inc. Deferred Profit Sharing Plan

We consent to the incorporation by reference in the Registration Statements (No. 033-57981, No. 333-168421 and No. 333-271213) filed on Form S-8 of Worthington Enterprises, Inc. (formerly known as Worthington Industries, Inc.) and the Worthington Industries, Inc. Deferred Profit Sharing Plan of our report dated June 14, 2024 with respect to the financial statements and supplemental schedule of the Worthington Industries, Inc. Deferred Profit Sharing Plan as of and for the fiscal years ended December 31, 2023 and 2022, which report appears in the Annual Report on Form 11-K of the Worthington Industries, Inc. Deferred Profit Sharing Plan for the fiscal year ended December 31, 2023.

Meaden & Moore, Ltd.

Certified Public Accountants

Cleveland, Ohio

June 14, 2024

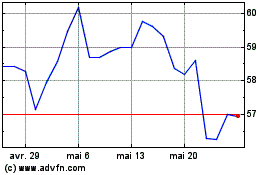

Worthington Enterprises (NYSE:WOR)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Worthington Enterprises (NYSE:WOR)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024