Exxon Mobil Corporation (NYSE:XOM): -0- *T Fourth Quarter Twelve

Months -------------- --------------- 2005 2004 % 2005 2004 %

------- ------ --- ------- ------- --- Net Income

--------------------------- $ Millions 10,710 8,420 27 36,130

25,330 43 $ Per Common Share Assuming Dilution 1.71 1.30 32 5.71

3.89 47 Earnings Excluding Special Items

--------------------------- $ Millions 10,320 8,420 23 33,860

25,880 31 $ Per Common Share Assuming Dilution 1.65 1.30 27 5.35

3.97 35 Capital and Exploration Expenditures - $ Millions 5,331

4,233 17,699 14,885 *T Exxon Mobil Corporation (NYSE:XOM) today

reported fourth quarter 2005 results. Earnings excluding special

items were $10,320 million ($1.65 per share), an increase of $1,900

million from the fourth quarter of 2004. Fourth quarter net income

included a special gain of $390 million from the resolution of a

previously disclosed litigation issue. Including this gain, net

income of $10,710 million ($1.71 per share) increased by $2,290

million. ExxonMobil's Chairman Rex W. Tillerson Commented:

"ExxonMobil's fourth quarter earnings excluding special items were

$10,320 million, up 23% from fourth quarter 2004, reflecting higher

crude oil and natural gas realizations and improved refining and

marketing margins. Net income for the fourth quarter was $10,710

million, up 27% from 2004. "There is a great deal of public

interest in global energy prices. We recognize that consumers

worldwide want and need reliable supplies of affordable energy --

to fuel their vehicles, light and heat their homes and run their

businesses. Our strong financial results will continue to allow us

to make significant, long-term investments required to do our part

in meeting the world's energy needs. "ExxonMobil continued its

active investment program in the fourth quarter, spending $5.3

billion on capital and exploration projects, bringing full year

spending to $17.7 billion, an increase of 19% or $2.8 billion

versus 2004. "The Corporation distributed a total of $6.8 billion

to shareholders in the fourth quarter through dividends and share

purchases to reduce shares outstanding. Distributions to

shareholders totaled $23.2 billion for the full year, an increase

of 56% or $8.3 billion versus 2004." FOURTH QUARTER HIGHLIGHTS --

Earnings excluding special items were $10,320 million, an increase

of 23% or $1,900 million from the fourth quarter of 2004. -- Net

income of $10,710 million includes a special gain of $390 million

from the previously disclosed litigation issue. -- Cash flow from

operations and asset sales was approximately $11.9 billion,

including asset sales of $1.4 billion. -- Share purchases to reduce

shares outstanding of $5.0 billion were at the same level as the

third quarter of 2005. -- Earnings per share excluding special

items were $1.65, an increase of 27%, reflecting strong earnings

and the reduction in the number of shares outstanding. --

Production from the multi-phase Sakhalin 1 project started on

schedule during the fourth quarter. This initial phase of the

project is expected to produce 250 thousand barrels per day (gross)

of liquids and 130 million cubic feet per day (gross) of gas by the

end of 2006. Fourth Quarter 2005 vs. Fourth Quarter 2004 Upstream

earnings were $7,038 million, up $2,151 million from the fourth

quarter of 2004 reflecting higher crude oil and natural gas

realizations. On an oil-equivalent basis, production decreased by

1% from the fourth quarter of 2004. Excluding the residual impact

of hurricanes Katrina and Rita, as well as divestment and

entitlement effects, production increased 2%. Liquids production of

2,629 kbd (thousands of barrels per day) was 64 kbd higher. Higher

production from projects in West Africa, Azerbaijan and the North

Sea was partly offset by the impact of mature field decline, the

residual effect of hurricanes Katrina and Rita, and entitlement and

divestment impacts. Excluding the impact of the hurricanes,

entitlement effects, and divestments, liquids production increased

by 6%. Fourth quarter natural gas production was 9,822 mcfd

(millions of cubic feet per day) compared with 10,430 mcfd last

year. Higher volumes from projects in Qatar, the North Sea and

North America were more than offset by the impact of mature field

decline, lower European demand, maintenance activity, the residual

effect of hurricanes Katrina and Rita, as well as entitlement and

divestment impacts. Earnings from U.S. Upstream operations were

$1,787 million, $403 million higher than the fourth quarter of

2004. Non-U.S. Upstream earnings were $5,251 million, up $1,748

million from 2004. Downstream earnings were $2,390 million, up $46

million from the fourth quarter 2004. Higher refining and marketing

margins were partly offset by residual impacts from hurricanes

Katrina and Rita. Petroleum product sales were 8,322 kbd, 124 kbd

lower than last year's fourth quarter, primarily due to the

hurricanes. U.S. Downstream earnings were $1,158 million, up $282

million. Non-U.S. Downstream earnings of $1,232 million were $236

million lower than the fourth quarter of 2004. Chemical earnings

excluding special items were $835 million, down $413 million from

the same quarter a year ago primarily due to reduced margins from

increased feedstock costs. Prime product sales of 6,292 kt

(thousands of metric tons) were down 657 kt from last year's fourth

quarter, largely due to the hurricanes. Corporate and financing

recorded a gain of $57 million, up $116 million mainly due to

higher interest income. During the fourth quarter of 2005, Exxon

Mobil Corporation purchased 92 million shares of its common stock

for the treasury at a gross cost of $5.3 billion. These purchases

included $5.0 billion to reduce the number of shares outstanding

and the balance to offset shares issued in conjunction with the

company benefits plans and programs. Shares outstanding were

reduced from 6,222 million at the end of the third quarter to 6,133

million at the end of the fourth quarter. Purchases may be made in

both the open market and through negotiated transactions, and may

be increased, decreased or discontinued at any time without prior

notice. Full Year 2005 vs. Full Year 2004 Net income of $36,130

million ($5.71 per share) increased $10,800 million from 2004. Net

income for 2005 included special items totaling $2,270 million.

Excluding special items in both periods, earnings increased by $8

billion versus 2004. FULL YEAR HIGHLIGHTS -- Earnings excluding

special items were $33,860 million, an increase of 31%, with strong

contributions from all segments of the business. Net income

increased by 43%. -- Earnings per share excluding special items

increased by 35% reflecting strong earnings and the reduction in

the number of shares outstanding. -- Special items of $2,270

million included a $1,620 million special gain related to Gasunie,

a $460 million positive impact from the sale of the Corporation's

stake in Sinopec, a $390 million gain from the previously disclosed

litigation issue, and a charge of $200 million for Allapattah. Net

income for 2004 included a $550 million special charge for

Allapattah. -- Cash flow from operations and asset sales was

approximately $54.2 billion, including $6.0 billion from asset

sales. -- The Corporation distributed a total of $23.2 billion to

shareholders in 2005 through dividends and share purchases to

reduce shares outstanding, an increase of $8.3 billion versus 2004.

-- Capital and exploration expenditures were $17.7 billion, an

increase of $2.8 billion versus 2004. Upstream earnings excluding

special items were $22,729 million, an increase of $6,054 million

from 2004. Higher liquids and natural gas realizations were partly

offset by lower production. On an oil-equivalent basis, production

decreased 3.6% from last year. Excluding the impact of hurricanes

Katrina and Rita, as well as divestment and entitlement effects,

production decreased by 1%. Liquids production of 2,523 kbd

decreased by 48 kbd from 2004. Higher production from projects in

West Africa, the North Sea and North America was more than offset

by mature field decline, the impact of hurricanes Katrina and Rita,

maintenance activity, as well as entitlement and divestment

impacts. Excluding the impact of the hurricanes, entitlement

effects, and divestments, liquids production increased 1.5%.

Natural gas production of 9,251 mcfd, decreased 613 mcfd from 2004.

Higher volumes from projects in Qatar, the North Sea and North

America were more than offset by mature field decline, the impact

of hurricanes Katrina and Rita, maintenance activity, lower

European demand, as well as entitlement and divestment impacts.

Earnings from U.S. Upstream operations for 2005 were $6,200

million, an increase of $1,252 million. Earnings outside the U.S.,

excluding special items, were $16,529 million, $4,802 million

higher than 2004. Downstream earnings excluding special items were

$7,882 million, an increase of $1,626 million from 2004 reflecting

stronger worldwide refining margins partly offset by weaker

marketing margins. Petroleum product sales of 8,257 kbd increased

from 8,210 kbd in 2004. U.S. Downstream earnings excluding special

items were $4,111 million, up $1,375 million. Non-U.S. Downstream

earnings, excluding special items, were $3,771 million, $251

million higher than last year. Chemical earnings excluding special

items were $3,403 million, down $25 million from 2004 due to lower

volumes. Prime product sales were 26,777 kt, down 1,011 kt from

2004, largely due to the hurricanes. Corporate and financing

expenses of $154 million decreased by $325 million mainly due to

higher interest income. Gross share purchases in 2005 were $18,221

million which reduced shares outstanding by 4.2%. Estimates of key

financial and operating data follow. Financial data, except per

share amounts, are expressed in millions of dollars. ExxonMobil

will discuss financial and operating results and other matters on a

webcast at 10 a.m. central time on January 30, 2006. To listen to

the event live or in archive, go to our website at

www.exxonmobil.com. Statements in this release relating to future

plans, projections, events, or conditions are forward-looking

statements. Actual results, including project plans, timing, and

capacities, could differ materially due to changes in long-term oil

or gas prices or other market conditions affecting the oil and gas

industry; political events or disturbances; reservoir performance;

the outcome of commercial negotiations; severe weather events;

changes in technical or operating conditions; and other factors

discussed under the heading "Factors Affecting Future Results" on

our website and in Item 1 of ExxonMobil's 2004 Form 10-K. We assume

no duty to update these statements as of any future date.

Consistent with previous practice this press release includes both

net income and earnings excluding special items. Earnings that

exclude special items are a non-GAAP financial measure and are

included to help facilitate comparisons of base business

performance across periods. A reconciliation to net income is shown

in Attachment II. The release also includes cash flow from

operations and asset sales. Because of the regular nature of our

asset management and divestment program, we believe it is useful

for investors to consider sales proceeds together with cash

provided by operating activities when evaluating cash available for

investment in the business and financing activities. Calculation of

this cash flow is shown in Attachment II. Further information on

ExxonMobil's frequently used financial and operating measures is

contained on pages 28 and 29 in the 2004 Form 10-K and is also

available through the Investor Information section of our website

at www.exxonmobil.com. -0- *T Attachment I EXXON MOBIL CORPORATION

FOURTH QUARTER 2005 ----------------------------------- (millions

of dollars, unless noted) Fourth Quarter Twelve Months

--------------- ----------------- 2005 2004 2005 2004 -------

------- -------- -------- Earnings / Earnings Per Share Total

revenues and other income 99,662 83,365 370,998 298,035 Total costs

and other deductions 81,944 70,100 311,566 256,794 Income before

income taxes 17,718 13,265 59,432 41,241 Income taxes 7,008 4,845

23,302 15,911 Net income (U.S. GAAP) 10,710 8,420 36,130 25,330 Net

income per common share (dollars) 1.72 1.31 5.76 3.91 Net income

per common share - assuming dilution (dollars) 1.71 1.30 5.71 3.89

Other Financial Data Dividends on common stock Total 1,795 1,738

7,185 6,896 Per common share (dollars) 0.29 0.27 1.14 1.06 Millions

of common shares outstanding At December 31 6,133 6,401 Average -

assuming dilution 6,211 6,461 6,322 6,519 Shareholders' equity at

December 31 111,058 101,756 Capital employed at December 31 121,181

112,630 Income taxes 7,008 4,845 23,302 15,911 Excise taxes 7,829

7,288 30,742 27,263 All other taxes 10,871 11,419 44,571 43,605

Total taxes 25,708 23,552 98,615 86,779 ExxonMobil's share of

income taxes of equity companies 466 294 2,226 1,180 Attachment II

EXXON MOBIL CORPORATION FOURTH QUARTER 2005

------------------------- (millions of dollars) Fourth Quarter

Twelve Months -------------- --------------- 2005 2004 2005 2004

------- ------ ------- ------- Net Income (U.S. GAAP) Upstream

United States 1,787 1,384 6,200 4,948 Non-U.S. 5,251 3,503 18,149

11,727 Downstream United States 1,158 876 3,911 2,186 Non-U.S.

1,232 1,468 4,081 3,520 Chemical United States 281 425 1,186 1,020

Non-U.S. 944 823 2,757 2,408 Corporate and financing 57 (59) (154)

(479) Corporate total 10,710 8,420 36,130 25,330 Special Items

Upstream Non-U.S. 0 0 1,620 0 Downstream United States 0 0 (200)

(550) Non-U.S. 0 0 310 0 Chemical Non-U.S. 390 0 540 0 Corporate

total 390 0 2,270 (550) Earnings Excluding Special Items Upstream

United States 1,787 1,384 6,200 4,948 Non-U.S. 5,251 3,503 16,529

11,727 Downstream United States 1,158 876 4,111 2,736 Non-U.S.

1,232 1,468 3,771 3,520 Chemical United States 281 425 1,186 1,020

Non-U.S. 554 823 2,217 2,408 Corporate and financing 57 (59) (154)

(479) Corporate total 10,320 8,420 33,860 25,880 Cash flow from

operations and asset sales (billions of dollars) Net cash provided

by operating activities (U.S. GAAP) 10.5 12.4 48.2 40.6 Sales of

subsidiaries, investments and property, plant and equipment 1.4 0.7

6.0 2.7 Cash flow from operations and asset sales 11.9 13.1 54.2

43.3 Attachment III EXXON MOBIL CORPORATION FOURTH QUARTER 2005

------------------------- Fourth Quarter Twelve Months

-------------- ------------- 2005 2004 2005 2004 ------ -------

------ ------ Net production of crude oil and natural gas liquids,

thousands of barrels daily (kbd) United States 431 534 477 557

Canada 356 357 346 355 Europe 539 564 546 583 Asia Pacific 154 189

169 202 Africa 795 612 666 572 Other 354 309 319 302 Worldwide

2,629 2,565 2,523 2,571 Natural gas production available for sale,

millions of cubic feet daily (mcfd) United States 1,620 1,810 1,739

1,947 Canada 912 951 918 972 Europe 4,804 5,370 4,315 4,614 Asia

Pacific 1,132 1,382 1,268 1,519 Other 1,354 917 1,011 812 Worldwide

9,822 10,430 9,251 9,864 Oil-equivalent production (koebd)(a) 4,266

4,303 4,065 4,215 (a) Gas converted to oil-equivalent at 6 million

cubic feet = 1 thousand barrels Attachment IV EXXON MOBIL

CORPORATION FOURTH QUARTER 2005 ------------------------ Fourth

Quarter Twelve Months -------------- --------------- 2005 2004 2005

2004 ------- ------ ------- ------- Petroleum product sales (kbd)

United States 2,900 2,993 2,915 2,872 Canada 641 643 620 615 Europe

2,155 2,167 2,115 2,139 Asia Pacific 1,837 1,751 1,786 1,689 Other

789 892 821 895 Worldwide 8,322 8,446 8,257 8,210 Gasolines,

naphthas 3,274 3,380 3,274 3,301 Heating oils, kerosene, diesel

2,632 2,609 2,560 2,517 Aviation fuels 649 722 700 698 Heavy fuels

754 693 711 659 Specialty products 1,013 1,042 1,012 1,035 Total

8,322 8,446 8,257 8,210 Refinery throughput (kbd) United States

1,669 1,881 1,794 1,850 Canada 479 470 466 468 Europe 1,717 1,701

1,672 1,663 Asia Pacific 1,484 1,491 1,490 1,423 Other 303 309 301

309 Worldwide 5,652 5,852 5,723 5,713 Chemical prime product sales,

thousands of metric tons (kt) United States 2,228 2,871 10,369

11,521 Non-U.S. 4,064 4,078 16,408 16,267 Worldwide 6,292 6,949

26,777 27,788 Attachment V EXXON MOBIL CORPORATION FOURTH QUARTER

2005 ------------------------- (millions of dollars) Fourth Quarter

Twelve Months -------------- --------------- 2005 2004 2005 2004

------- ------ ------- ------- Capital and Exploration Expenditures

Upstream United States 542 520 2,142 1,922 Non-U.S. 3,852 2,774

12,328 9,793 Total 4,394 3,294 14,470 11,715 Downstream United

States 213 175 753 775 Non-U.S. 535 496 1,742 1,630 Total 748 671

2,495 2,405 Chemical United States 61 79 243 262 Non-U.S. 108 177

411 428 Total 169 256 654 690 Other 20 12 80 75 Worldwide 5,331

4,233 17,699 14,885 Exploration expenses charged to income included

above Consolidated affiliates United States 54 41 157 192 Non-U.S.

278 268 795 891 Equity companies - ExxonMobil share United States 0

9 0 9 Non-U.S. 0 16 17 27 Worldwide 332 334 969 1,119 Attachment VI

EXXON MOBIL CORPORATION NET INCOME ------------------------ $

Millions $ Per Common Share ---------------- ------------------

2001 -------------------- First Quarter 5,000 0.72 Second Quarter

4,460 0.66 Third Quarter 3,180 0.46 Fourth Quarter 2,680 0.39 Year

15,320 2.23 2002 -------------------- First Quarter 2,090 0.30

Second Quarter 2,640 0.40 Third Quarter 2,640 0.39 Fourth Quarter

4,090 0.60 Year 11,460 1.69 2003 -------------------- First Quarter

7,040 1.05 Second Quarter 4,170 0.63 Third Quarter 3,650 0.55

Fourth Quarter 6,650 1.01 Year 21,510 3.24 2004

-------------------- First Quarter 5,440 0.83 Second Quarter 5,790

0.89 Third Quarter 5,680 0.88 Fourth Quarter 8,420 1.31 Year 25,330

3.91 2005 -------------------- First Quarter 7,860 1.23 Second

Quarter 7,640 1.21 Third Quarter 9,920 1.60 Fourth Quarter 10,710

1.72 Year 36,130 5.76 *T

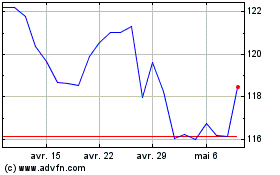

Exxon Mobil (NYSE:XOM)

Graphique Historique de l'Action

De Sept 2024 à Oct 2024

Exxon Mobil (NYSE:XOM)

Graphique Historique de l'Action

De Oct 2023 à Oct 2024