Oil Slump Sets Scene for Mergers

28 Janvier 2016 - 11:41PM

Dow Jones News

By Bradley Olson and Sarah Kent

Here's how bad things are getting in the oil patch: In some

cases it is now cheaper for energy companies to buy one another

rather than drill for crude.

A year-and-a-half on from the start of the worst crude-oil price

crash in a generation, the biggest U.S. and European energy

companies have delayed projects and made such deep budget cuts that

they will soon struggle to replace the oil they pump out of the

ground with new reserves. That conundrum could have serious

implications for Exxon Mobil Corp., BP PLC, Chevron Corp. and Royal

Dutch Shell PLC because oil-and-gas reserves are critical to

evaluating their growth prospects.

Exxon and its peers are set to begin reporting fourth-quarter

earnings this week, starting with Chevron on Friday. Analysts

estimate that combined profits at the four biggest publicly traded

Western oil companies will be about $22 billion, the weakest

results since 1998, according to S&P Capital IQ. Shell,

Chevron, Exxon and BP declined to comment.

Facing poor returns for drilling and severe challenges to

long-term growth, some big oil companies have little choice but to

turn to deals, said Anish Kapadia, an energy analyst at Tudor

Pickering Holt & Co.

"The obvious conclusion is to go out and buy something," he

said. "The valuations are getting quite attractive."

Past energy downturns drove many of the biggest oil companies to

strike deals, with big companies buying smaller rivals such as

Anadarko Petroleum Corp.'s takeover of Union Pacific Resources in

2000. Equally matched energy conglomerates also lashed themselves

together the last time oil traded in a $20-a-barrel range in the

late 1990s, including Exxon's tie-up with Mobil and Chevron's with

Texaco. Deal-making is likely to return this year if prices

continue to languish around $30 a barrel, or drop ever further,

analysts say.

"If prices stay this low, we're going to see much more

distressed companies and that will drive M&A," said Luke

Parker, research director at Wood Mackenzie. Then again, any signs

of a sustained recovery could also prompt an uptick in deals as

companies look to start spending again, he added.

Bankers and analysts have been predicting a wave of deals almost

since crude prices began to fall from over $100 a barrel in the

summer of 2014, but they never materialized. Last year was the

slowest year for oil-and-gas transactions in over a decade,

according to Wood Mackenzie. The average monthly deal count fell by

over a third compared with 2013 and 2014, with only 14 deals

announced with a value higher than $1 billion.

The only sizable acquisition by a big energy companies so far is

Shell's $50 billion purchase of BG Group PLC, which Shell and BG

shareholders approved this week and is expected to close in

February. The deal will boost Shell's oil-and-gas reserves by about

25% and increase its production by 20% to 3.7 million barrels of

oil equivalent a day.

Many U.S. oil producers that tap shale formations have fought

for a year to avoid a sale, including Apache Corp.--which fended

off an overture by Anadarko last fall--and Whiting Petroleum Corp.,

once the biggest producer in North Dakota's Bakken Shale, which

entertained offers last year before turning to Wall Street for more

debt and equity. Just as potential sellers were reluctant to accept

offers they considered too low as they hoped for a rebound in oil

prices, many potential buyers were also put off by the extreme

volatility in oil prices and wondered if any deal struck would look

expensive if crude prices fell ever further.

Both impediments are gone now that hopes for a quick rebound

have been dashed. Forecasters at most major banks and ratings firms

are predicting oil prices will average under $50 a barrel this

year, and a few energy economists now predict that oil prices could

stay low through 2017 and into 2018.

At current prices U.S. shale producers are losing more than $2

billion a week, according to consulting firm AlixPartners LLP. That

means as oil's crash grinds on, some shale companies may be forced

to fall into the arms of a willing buyer this year.

Oil-patch deals now look more attractive than they have in

years, said Robin Bertram, the oil-and-gas resource evaluation

leader at Deloitte LLP. That is especially true for some of the

biggest oil companies, which largely sat on the sidelines during

the U.S. shale boom.

"With the low price environment, you will see the economics

around drilling getting worse and worse," he said. "More companies

will be buying assets rather than continuing to develop."

Write to Bradley Olson at Bradley.Olson@wsj.com and Sarah Kent

at sarah.kent@wsj.com

(END) Dow Jones Newswires

January 28, 2016 17:26 ET (22:26 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

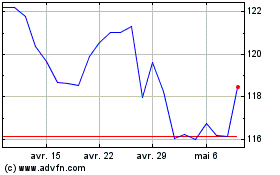

Exxon Mobil (NYSE:XOM)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Exxon Mobil (NYSE:XOM)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024