Exxon to Create 'Low Carbon' Business Unit as It Faces Activists

02 Février 2021 - 12:13AM

Dow Jones News

By Christopher M. Matthews

Exxon Mobil Corp. is forming a business unit that will focus

exclusively on technologies to lower carbon emissions, as the oil

giant faces increasing pressure to step up its sustainability

investments.

Exxon said Monday that the new business, dubbed "low carbon

solutions," would invest $3 billion through 2025 on lower emission

energy technologies, primarily on carbon capture and storage

projects, which gather carbon emissions from industrial processes

or directly from the air and deposit them underground. Those

investments would represent roughly 3% to 4% of Exxon's planned

annual capital expenditures.

Exxon has a large research-and-development division that has

invested in carbon capture for years, and Exxon says it has

captured more carbon than any other company. Currently, the only

large-scale use for captured carbon is to help produce more fossil

fuels by pumping in the gas to squeeze more oil and gas out of the

ground.

"With our demonstrated leadership in carbon capture and

emissions reduction technologies, Exxon Mobil is committed to

meeting the demand for affordable energy while reducing emissions,"

Exxon Chief Executive Darren Woods said.

Exxon is expected to report a fourth consecutive quarterly loss

for the first time in modern history on Tuesday after previously

disclosing that it would write down as much as $20 billion in

assets. It endured one of its worst financial performances ever in

2020 and has already posted more than $2 billion in losses through

the first three quarters of 2020.

Following the outbreak of the new coronavirus last year, Exxon

discussed a merger with its top U.S. rival, Chevron Corp., The Wall

Street Journal reported Sunday. The talks were described as

preliminary and aren't currently ongoing.

The company's woes have helped draw the attention of activist

investors. One of them, Engine No. 1 LLC, has argued that the

company should focus more on investments in clean energy while

cutting costs elsewhere to preserve its dividend. The firm

nominated four directors to Exxon's board last week and called for

it to make strategic changes to its business plan.

As the Journal previously reported, Exxon also has been in talks

with another activist, D.E. Shaw Group, and has been planning to

announce one or more new board members, additional spending cuts

and investments in new technologies to help it reduce its carbon

emissions.

Rivals such as BP PLC and Royal Dutch Shell PLC have embarked on

bold strategies to remake their business as regulatory and investor

pressure to reduce carbon emissions mounts. Both have said they

would invest heavily in renewable energy -- a strategy that their

investors so far haven't rewarded.

Exxon hasn't invested substantially in renewables, instead

choosing to double down on oil and gas, arguing the world will need

vast amounts of fossil fuels for decades to come.

Some in the industry see carbon capture as a way to lower the

carbon footprint of fossil fuels, potentially allowing producers to

continue pumping oil and gas as some countries tighten regulations

on carbon emissions.

The only current, large-scale commercial use for captured carbon

is for a process called enhanced oil recovery, in which carbon is

pumped into older oil and gas reservoirs to increase pressure and

produce more fossil fuels. Exxon's largest carbon capture project,

in Wyoming, sells the gathered carbon to oil and gas companies.

Exxon said Monday that carbon capture projects could become more

commercially attractive with government support. It has supported

an existing tax credit in the U.S. for companies that capture and

store carbon.

Write to Christopher M. Matthews at

christopher.matthews@wsj.com

(END) Dow Jones Newswires

February 01, 2021 17:58 ET (22:58 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

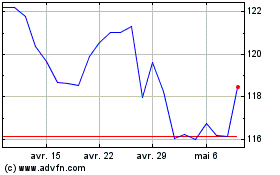

Exxon Mobil (NYSE:XOM)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Exxon Mobil (NYSE:XOM)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024