Activist Wins Exxon Board Seats After Questioning Oil Giant's Climate Strategy -- Update

27 Mai 2021 - 12:37AM

Dow Jones News

By Christopher M. Matthews

An activist investor's successful campaign to win seats on the

board of Exxon Mobil Corp. represents a historic defeat for the oil

giant, one that will likely force it to more directly confront

growing shareholder concerns about climate change.

Exxon said Wednesday a preliminary vote count showed

shareholders backed two nominees of Engine No. 1, an upstart hedge

fund owning a tiny fraction of the oil giant's stock. The final

vote wasn't tallied as of late Wednesday afternoon, and the final

composition of the board was unclear.

Exxon Chief Executive Darren Woods was also re-elected to the

board along with seven of Exxon's candidates, while the vote was

too close to call for five nominees, the company said.

The vote culminated one of the most expensive proxy fights ever.

It was an enormous blow to Mr. Woods, who personally campaigned

against Engine No. 1.

"We welcome all of our new directors and look forward to working

with them constructively," Mr. Woods said in a statement.

Engine No. 1 sought four seats on Exxon's board and argued the

Texas oil giant should commit to carbon neutrality, effectively

bringing its emissions to zero -- both from the company and its

products -- by 2050, as some peers have.

It nominated four directors -- Gregory Goff, Kaisa Hietala,

Alexander Karsner and Anders Runevad -- and Mr. Goff and Ms.

Hietala were elected Wednesday, according to the preliminary tally.

Mr. Goff is the former chief executive of Andeavor, which was one

the largest U.S. refiners before being purchased for more than $20

billion by Marathon Petroleum Corp. in 2018, while Ms. Hietala is a

former executive vice president of renewable products at Finnish

refiner Neste Oyj.

Engine No. 1 accused Exxon's board of presiding over the

company's demise and argued its own candidates had the

qualifications to help Exxon better navigate the energy

transition.

The hedge fund called for Exxon to gradually diversify its

investments to be ready for a world that will need fewer fossil

fuels in coming decades. Exxon defended its strategy to expand

drilling, saying demand for fuels and plastics will remain strong

for years to come, and pointed to a new carbon capture and storage

business unit as evidence it is taking climate change

seriously.

Peter Bryant, a managing partner at business consultant Clareo,

said Exxon was vulnerable because it hasn't provided a good return

from fossil fuels for years and doesn't get credit from

sustainability-focused investors because it hasn't invested in

renewable energy.

"It's the worst of both worlds," Mr. Bryant said.

Andrew Logan, senior director for oil and gas at Ceres, a

nonprofit focused on sustainability that supported Engine No. 1's

campaign, said it would be difficult for Mr. Woods to retain his

position as CEO after the vote.

"That certainly calls his leadership into question," Mr. Logan

said. "There is no going back to the Exxon of old nor should there

be."

Exxon and Mr. Woods had made a series of changes, long sought by

some investors, since the campaign began, including creating a

business unit for carbon emissions-reducing technologies and

disclosing for the first time the emissions from Exxon

products.

But Engine No. 1 said those moves were inadequate. Despite a

series of calls and meetings, the two sides were unable to agree to

a common set of directors. The fund said Exxon had proposed a deal

of sorts, offering Engine No. 1 in January a chance to rubber-stamp

and take credit for three candidates Exxon later appointed to the

board. Engine No. 1 said it refused.

Exxon said it reviewed Engine No. 1's candidates and determined

they didn't meet the board's standards. In an interview last week,

Exxon lead director Kenneth Frazier said Exxon had asked the fund

to sign a nondisclosure agreement that would have allowed it to

review board candidates Exxon ultimately proposed, but the fund

declined.

Exxon and Engine No. 1 spent much of their time courting

institutional investors. But the company has more than two million

shareholders, many of them individual investors, and they played a

key role in the outcome.

Elizabeth Wilder has owned Exxon stock her entire life after

inheriting it from her grandfather, a former Exxon employee. Ms.

Wilder, a self-described homemaker in Houston, said she previously

always backed management's board nominees. This time, she voted for

three of Engine No. 1's candidates.

"Exxon has failed spectacularly by every available measure:

stock value, relative diminishment of value compared to peers,

capital allocation, environmental stewardship reporting," Ms.

Wilder said. "The people who oversaw the past decade of wealth

destruction should be held accountable."

Write to Christopher M. Matthews at

christopher.matthews@wsj.com

(END) Dow Jones Newswires

May 26, 2021 18:32 ET (22:32 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

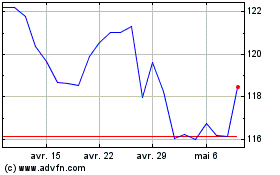

Exxon Mobil (NYSE:XOM)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Exxon Mobil (NYSE:XOM)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024