Nevada Gold Mines (NGM) has come a long way since 2019 when Barrick

and Newmont pooled their assets in the state to create the world’s

largest gold mining complex and is now making a strong start to the

new year on the back of performance improvements and new growth

prospects.

Emphasizing this point here today, Mark Bristow,

president and chief executive of operator and majority shareholder

Barrick Gold Corporation (NYSE:GOLD)(TSX:ABX), said operational

highlights of the past year included a record production by the

post-merger Cortez and the continuing turnaround at Turquoise

Ridge, which is beginning to live up to its Tier One1 status again.

The most significant development, however, was the completion of

the Goldrush permitting process at the end of 2023. This enabled

Cortez to accelerate the development of a key project which will

already make a significant production contribution this year.

Bristow said far from being a mature gold district,

Northern Nevada was still highly prospective for new world-class

discoveries. The Barrick-owned Fourmile, for example, is expected

to more than triple its current mineral resource of 0.48 million

ounces2 at 10.04 g/t indicated in addition to 2.7 million ounces2

at 10.1g/t inferred, as well as uplifting the grade as orebody

modelling and evaluation continue with a view to commence a

pre-feasibility study at the end of 2024. In the meantime,

brownfields exploration has delivered an exciting pipeline of

near-mine growth opportunities across Carlin, Cortez and Turquoise

Ridge.

“The complex now boasts a production growth profile

that goes well beyond 10 years as the geologists step up the

replacement of the ounces depleted by mining,” Bristow said.

In line with the Barrick group’s transition to

renewable energy, NGM completed the commissioning of the first 100

megawatt phase of its solar power project in the last quarter of

2023, with the second 100 megawatt scheduled to come on stream in

the second half of this year.

NGM also continues to invest in developing a new

generation of skilled entrants to the mining industry. Last year,

270 people enrolled in its training mine, of whom 95% graduated. Of

these, 84% are now employed by NGM.

NGM has similarly invested $4.5 million in the

establishment of three children’s learning centers in its

communities aligned with its mining schedules to alleviate the

shortage of childcare services in the areas around its mines. The

provision of strong childcare benefits is expected to attract

younger employees, and particularly women, to an aging and

male-dominated industry. Its latest social infrastructure

development project is a $10 million recreation center, based on

the principle that a healthier community will deliver a healthier

workforce.

About Nevada Gold MinesNevada Gold

Mines is operated by Barrick Gold Corporation (NYSE:GOLD)(TSX:ABX)

and is a joint venture between Barrick (61.5%) and Newmont (38.5%)

that combined their significant assets across Nevada in 2019 to

create the single largest gold-producing complex in the world.

Enquiries:Barrick COO North

America Christine Keener+1 865 209

0781christine.keener@barrick.com

NGM Executive Managing DirectorPeter

Richardson+1 775 934

3238peter.richardson@nevadagoldmines.com

Barrick Investor and Media RelationsKathy

du Plessis+44 20 7557 7738barrick@dpapr.com

Website: www.barrick.com

Technical InformationThe

scientific and technical information contained in this press

release has been reviewed and approved by: Simon Bottoms, CGeol,

MGeol, FGS, FAusIMM, Mineral Resource Management and Evaluation

Executive; and Craig Fiddes, SME-RM, Lead - Resource Modeling,

Nevada Gold Mines — each a “Qualified Person” as defined in

National Instrument 43-101 - Standards of Disclosure for Mineral

Projects.

Endnote 1 A Tier One Gold Asset is

an asset with a $1,300/oz reserve with potential to deliver a

minimum 10-year life, annual production of at least 500,000 ounces

of gold and with all in sustaining costs per ounce in the lower

half of the industry cost curve.

Endnote 2Estimated in accordance

with National Instrument 43-101 - Standards of Disclosure for

Mineral Projects as required by Canadian securities regulatory

authorities. Estimates are as of December 31, 2023, unless

otherwise noted. Indicated resources of 1.5 million tonnes grading

10.04 g/t, representing 0.48 million ounces of gold. Inferred

resources of 8.2 million tonnes grading 10.1 g/t, representing 2.7

million ounces of gold. Complete mineral reserve and mineral

resource data for all mines and projects referenced in this press

release, including tonnes, grades, and ounces, can be found in the

Mineral Reserves and Mineral Resources Tables included in the

Barrick press release entitled “Geologically Driven Asset

Management Delivers Third Successive Year of Reserve Growth at

Sustained Quality, While Unlocking Embedded Growth Portfolio” dated

February 8, 2024. Fourmile is currently 100% owned by Barrick. As

previously disclosed, Barrick anticipates Fourmile being

contributed to the Nevada Gold Mines joint venture if certain

criteria are met following the completion of drilling and the

requisite feasibility work.

Cautionary Statement on Forward-Looking

InformationCertain information contained or incorporated

by reference in this press release, including any information as to

our strategy, projects, plans or future financial or operating

performance, constitutes “forward-looking statements”. All

statements, other than statements of historical fact, are

forward-looking statements. The words “positioned”, “prospects”,

“create”, “growth”, “develop”, “expect”, “continue”, “deliver”,

“will”, “can”, “could”, and similar expressions identify

forward-looking statements. In particular, this press release

contains forward-looking statements including, without limitation,

with respect to: Barrick’s plans and expected completion and

benefits of growth projects at Nevada Gold Mines, including the

Goldrush project and the Fourmile project; Barrick’s

forward-looking production guidance, including the estimated

10-year production profile for Nevada Gold Mines and anticipated

production growth from Barrick’s organic project pipeline and

reserve replacement; estimates of future costs and projected future

cash flows, capital, operating and exploration expenditures and

mine life and production rates including for the Goldrush project

and the Fourmile project; the anticipated timeline for the

commencement of a prefeasibility study for the Fourmile project;

our ability to convert resources into reserves and replace reserves

net of depletion from production; mine life and production rates;

maintenance and processing initiatives at Nevada Gold Mines; our

ability to identify new Tier One assets and the potential for

existing assets to attain Tier One status; Barrick’s exploration

strategy and planned exploration activities, including in North

America; potential mineralization and metal or mineral recoveries,

including near-mine exploration upside potential; joint ventures

and partnerships; Barrick’s strategy, plans, targets and goals in

respect of environmental and social governance issues at Nevada

Gold Mines, including the solar power project, support for

childcare services, social infrastructure and health and safety

initiatives; and expectations regarding future price assumptions,

financial performance and other outlook or guidance.

Forward-looking statements are necessarily based upon a number of

estimates and assumptions including material estimates and

assumptions related to the factors set forth below that, while

considered reasonable by the Company as at the date of this press

release in light of management’s experience and perception of

current conditions and expected developments, are inherently

subject to significant business, economic and competitive

uncertainties and contingencies. Known and unknown factors could

cause actual results to differ materially from those projected in

the forward-looking statements and undue reliance should not be

placed on such statements and information. Such factors include,

but are not limited to: fluctuations in the spot and forward price

of gold, copper or certain other commodities (such as silver,

diesel fuel, natural gas and electricity); risks associated with

projects in the early stages of evaluation and for which additional

engineering and other analysis is required; risks related to the

possibility that future exploration results will not be consistent

with the Company’s expectations, that quantities or grades of

reserves will be diminished, and that resources may not be

converted to reserves; risks associated with the fact that certain

of the initiatives described in this press release are still in the

early stages and may not materialize; changes in mineral production

performance, exploitation and exploration successes; risks that

exploration data may be incomplete and considerable additional work

may be required to complete further evaluation, including but not

limited to drilling, engineering and socioeconomic studies and

investment; the speculative nature of mineral exploration and

development; changes in national and local government legislation,

taxation, controls or regulations and/or changes in the

administration of laws, policies and practices; expropriation or

nationalization of property and political or economic developments

in the United States or other countries in which Barrick does or

may carry on business in the future; risks relating to political

instability in certain of the jurisdictions in which Barrick

operates; timing of receipt of, or failure to comply with,

necessary permits and approvals; non-renewal of or failure to

obtain key licenses by governmental authorities; failure to comply

with environmental and health and safety laws and regulations;

increased costs and physical and transition risks related to

climate change, including extreme weather events, resource

shortages, emerging policies and increased regulations relating to

greenhouse gas emission levels, energy efficiency and reporting of

risks; contests over title to properties, particularly title to

undeveloped properties, or over access to water, power and other

required infrastructure; the liability associated with risks and

hazards in the mining industry, and the ability to maintain

insurance to cover such losses; damage to the Company’s reputation

due to the actual or perceived occurrence of any number of events,

including negative publicity with respect to the Company’s handling

of environmental matters or dealings with community groups, whether

true or not; risks related to operations near communities that may

regard Barrick’s operations as being detrimental to them;

litigation and legal and administrative proceedings; operating or

technical difficulties in connection with mining or development

activities, including geotechnical challenges, tailings dam and

storage facilities failures, and disruptions in the maintenance or

provision of required infrastructure and information technology

systems; increased costs, delays, suspensions and technical

challenges associated with the construction of capital projects;

risks associated with working with partners in jointly controlled

assets; risks related to disruption of supply routes which may

cause delays in construction and mining activities, including

disruptions in the supply of key mining inputs due to the invasion

of Ukraine by Russia and conflicts in the Middle East; risk of loss

due to acts of war, terrorism, sabotage and civil disturbances;

risks associated with Barrick’s infrastructure, information

technology systems and the implementation of Barrick’s

technological initiatives, including risks related to

cyber-attacks, cybersecurity breaches, or similar network or system

disruptions; the impact of global liquidity and credit availability

on the timing of cash flows and the values of assets and

liabilities based on projected future cash flows; the impact of

inflation, including global inflationary pressures driven by supply

chain disruptions and global energy cost increases following the

invasion of Ukraine by Russia; adverse changes in our credit

ratings; fluctuations in the currency markets; risks related to the

demands placed on the Company’s management, the ability of

management to implement its business strategy and enhanced

political risk in certain jurisdictions; uncertainty whether some

or all of Barrick’s targeted investments and projects will meet the

Company’s capital allocation objectives and internal hurdle rate;

whether benefits expected from recent transactions being realized;

business opportunities that may be presented to, or pursued by, the

Company; our ability to successfully integrate acquisitions or

complete divestitures; risks related to competition in the mining

industry; employee relations including loss of key employees;

availability and increased costs associated with mining inputs and

labor; and risks associated with diseases, epidemics and pandemics

including the effects and potential effects of the global Covid-19

pandemic.

In addition, there are risks and hazards associated

with the business of mineral exploration, development and mining,

including environmental hazards, industrial accidents, unusual or

unexpected formations, pressures, cave-ins, flooding and gold

bullion, copper cathode or gold or copper concentrate losses (and

the risk of inadequate insurance, or inability to obtain insurance,

to cover these risks). Many of these uncertainties and

contingencies can affect our actual results and could cause actual

results to differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, us. Readers

are cautioned that forward-looking statements are not guarantees of

future performance. All of the forward-looking statements made in

this press release are qualified by these cautionary statements.

Specific reference is made to the most recent Form 40-F/Annual

Information Form on file with the SEC and Canadian provincial

securities regulatory authorities for a more detailed discussion of

some of the factors underlying forward-looking statements and the

risks that may affect Barrick’s ability to achieve the expectations

set forth in the forward-looking statements contained in this press

release.

We disclaim any intention or obligation to update

or revise any forward-looking statements whether as a result of new

information, future events or otherwise, except as required by

applicable law.

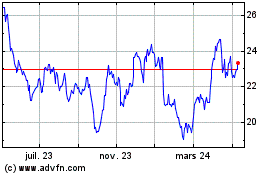

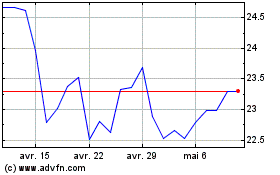

Barrick Gold (TSX:ABX)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Barrick Gold (TSX:ABX)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024