Atrium Mortgage Investment Corporation Announces Increase to Bought Deal Financing

10 Juillet 2018 - 8:59PM

THIS NEWS RELEASE IS NOT FOR DISTRIBUTION TO U.S.

NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES.

Atrium Mortgage Investment Corporation (TSX:AI) (TSX:AI.DB)

(TSX:AI.DB.A) (TSX:AI.DB.B) (TSX:AI.DB.C) (“Atrium”) announced

today that as a result of strong demand it has increased the size

of its previously announced bought deal financing with a syndicate

of underwriters bookrun by TD Securities Inc. and RBC Capital

Markets and co-led by CIBC Capital Markets, pursuant to which the

underwriters will now purchase $30 million aggregate principal

amount of 5.50% convertible unsecured subordinated debentures of

Atrium due December 31, 2025 at a price of $1,000 per debenture.

Atrium has also granted to the underwriters an over-allotment

option to purchase up to an additional $4.5 million aggregate

principal amount of debentures at the same price, exercisable in

whole or in part at any time for a period of up to 30 days

following closing of the offering, to cover over-allotments. If the

over-allotment option is exercised in full, the gross proceeds of

the offering will total $34,500,000.

The offering of debentures is expected to close

on or about July 18, 2018 and is subject to certain conditions

including, but not limited to, the receipt of all necessary

approvals, including the approval of the Toronto Stock

Exchange.

A prospectus supplement to Atrium’s short form

base shelf prospectus dated October 10, 2017 will be filed by no

later than July 11, 2018 with the securities regulatory authorities

in all provinces of Canada, except Québec. No securities regulatory

authority has either approved or disapproved of the contents of

this news release. The securities being offered have not been, and

will not be, registered under the United States Securities Act of

1933, as amended, or any state securities laws, and may not be

offered or sold in the United States unless an exemption from

registration is available. This news release is for information

purposes only and does not constitute an offer to sell or a

solicitation of an offer to buy any securities of Atrium in any

jurisdiction.

About Atrium

Canada’s Premier Non-Bank

Lender™

Atrium is a non-bank provider of residential and

commercial mortgages that lends in major urban centres in Canada

where the stability and liquidity of real estate are high. Atrium’s

objectives are to provide its shareholders with stable and secure

dividends and preserve shareholders’ equity by lending within

conservative risk parameters.

Atrium is a Mortgage Investment Corporation

(MIC) as defined in the Income Tax Act (Canada), so is not taxed on

income provided that its taxable income is paid to its shareholders

in the form of dividends within 90 days after December 31 each

year. Such dividends are generally treated by shareholders as

interest income, so that each shareholder is in the same position

as if the mortgage investments made by the company had been made

directly by the shareholder. For further information, please refer

to regulatory filings available at www.sedar.com or Atrium’s

website at www.atriummic.com.

Forward-Looking Statements This

news release contains forward-looking statements. Much of this

information can be identified by words such as “expect to,”

“expected,” “will,” “estimated” or similar expressions suggesting

future outcomes or events and includes the expected closing date of

the offering. Atrium believes the expectations reflected in such

forward-looking statements are reasonable but no assurance can be

given that these expectations will prove to be correct and such

forward-looking statements should not be unduly relied upon.

Forward-looking statements are based on current

information and expectations that involve a number of risks and

uncertainties, which could cause actual results or events to differ

materially from those anticipated. These risks include, but are not

limited to, risks associated with the ability to satisfy

regulatory, stock exchange and commercial closing conditions of the

offering, the uncertainty associated with accessing capital markets

and the risks related to Atrium’s business, including those

identified in Atrium’s annual information form for the year ended

December 31, 2017 under the heading “Risk Factors” (a copy of which

may be obtained at www.sedar.com). Forward-looking statements

contained in this news release are made as of the date hereof and

are subject to change. All forward-looking statements in this news

release are qualified by these cautionary statements. Except as

required by applicable law, Atrium undertakes no obligation to

update any forward-looking statement, whether as a result of new

information, future events or otherwise.

For further information, please

contact

| Robert G. Goodall

|

|

|

|

|

|

|

|

Jennifer Scoffield |

| President and Chief

Executive Officer |

|

|

|

|

|

|

|

Chief Financial

Officer |

(416)

867-1053info@atriummic.comwww.atriummic.com

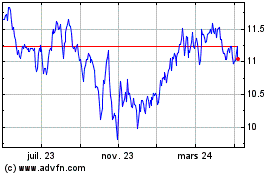

Atrium Mortgage Investment (TSX:AI)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

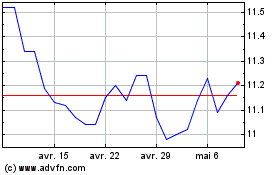

Atrium Mortgage Investment (TSX:AI)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025