Altus Group Releases its Q3 2024 Pan-European Dataset Analysis on CRE Valuation Trends

13 Novembre 2024 - 12:00PM

Altus Group Limited (“Altus”) (TSX: AIF), a leading provider of

asset and fund intelligence for commercial real estate (“CRE”),

today released its Q3 2024 Pan-European dataset analysis on

European property market valuation trends.

Each quarter, Altus Group centralizes and

standardizes CRE valuation data for the European market, pulling

insights into the factors driving commercial property valuations.

The Q3 2024 aggregate dataset included Pan-European open-ended

diversified funds, representing €29 billion in assets under

management. The funds cover 17 countries and primarily span the

industrial, office, retail and residential property sectors.

"The third quarter marked the first time in two

years that the movement in property values across the Pan-European

valuation dataset turned positive," said Phil Tily, Senior Vice

President at Altus Group. “We are seeing green shoots emerge across

all main property sectors which, combined with last week’s second

European Central Bank rate cut this year, points to greater

stability ahead.”

Despite a continued uptick in valuation yields,

CRE values across the Pan-European valuation dataset were up 0.63%

across all commercial property types, a noteworthy improvement

after two years of declines. Valuation yields continued to increase

across all property types for a tenth consecutive quarter, putting

moderate downward pressure on values. In Q3, low single-digit yield

increases accounted for -0.5% value change across the data set,

compared to -0.7% in the prior quarter and compared to -1.4% in the

opening three months of the year. The key drivers of the

appreciation in values were improvements in cash flows and a

reduction in projected capital modelled into valuations.

Key highlights by sector include:

- Retail: emerged as

the strongest performing sector in Q3 with values up 1.3% over Q2

2024, with positive appreciation across all sub property types.

Supermarkets, which service the most essential side of the retail

sector, stood out with both a positive yield impact and

strengthening cashflow over the period.

- Residential:

values increased by 0.53% over Q2 2024, benefiting from an above

average 0.75% cashflow effect. Values in the two largest

residential markets in the dataset, Netherlands and Germany, were

both up, 0.9 and 0.3%, respectively.

- Industrial: the

sector finished at the lower end of the hierarchy, but a net

positive trade-off between cashflow gains and further yield

increases ensured that values continued to rise, up 0.4% over the

previous quarter.

- Office: after

eight consecutive quarters of declines, values finally turned

positive in Q3, up 0.6% over the previous quarter. However, when

factoring in the amount of capital expenditure during the quarter,

the return on appreciation was still technically negative within

the sector.

- Other: outside of

the main sectors, hotel assets had another comparatively strong

quarter. Ongoing investor interest in this sub property type was

reflected in a positive yield impact which helped values rise by

more than average for the quarter.

For a detailed review of the sector trends by

asset class, please click here.

About Altus Group

Altus Group is a leading provider of asset and

fund intelligence for commercial real estate. We deliver

intelligence as a service to our global client base through a

connected platform of industry-leading technology, advanced

analytics, and advisory services. Trusted by the largest CRE

leaders, our capabilities help commercial real estate investors,

developers, proprietors, lenders, and advisors manage risks and

improve performance returns throughout the asset and fund

lifecycle. Altus Group is a global company headquartered in Toronto

with approximately 2,900 employees across North America, EMEA and

Asia Pacific. For more information about Altus (TSX: AIF) please

visit www.altusgroup.com.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Elizabeth LambeDirector, Global Communications,

Altus Group+1-416-641-9787elizabeth.lambe@altusgroup.com

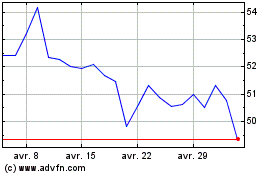

Altus (TSX:AIF)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Altus (TSX:AIF)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024