Altius Announces $65 Million Offering of Common Shares

28 Avril 2014 - 9:07PM

Marketwired Canada

NOT FOR DISTRIBUTION TO THE U.S. NEWSWIRE SERVICES, OR FOR DISSEMINATION IN THE

UNITED STATES

Altius Minerals Corporation ("Altius" or the "Company") (TSX:ALS) announces that

the Company has filed a preliminary prospectus in connection with an offering of

common shares (the "Common Shares") for aggregate gross proceeds of up to $65

million (the "Offering"). The Offering will be conducted by a syndicate of

investment dealers co-led by Scotia Capital Inc. and Haywood Securities Inc.,

and including BMO Nesbitt Burns Inc., Sprott Private Wealth L.P., Raymond James

Ltd. and Salman Partners Inc. (collectively, the "Agents"). The Agents have the

option to purchase up to an additional 15% of the Common Shares sold under and

on the same terms as the Offering at any time until 30 days following the

closing date of the Offering (the "Over-Allotment Option"). In the event that

the maximum offering size is reached and the Over-Allotment Option is exercised

in its entirety, the aggregate gross proceeds of the Offering will be $74.75

million.

The Common Shares are being offered by way of a short form prospectus, which has

been filed in all of the provinces and territories of Canada and in the United

States on a private placement basis pursuant to an exemption from the

registration requirements of the United States Securities Act of 1933, as

amended, and applicable state securities laws. Closing of the Offering is

anticipated to occur on or about May 12, 2014 and is subject to receipt of

applicable regulatory approvals including the approval of the Toronto Stock

Exchange.

Pursuant to an arrangement agreement (the "Arrangement Agreement") dated

December 24, 2013 among the Company, Sherritt International Corporation

("Sherritt"), Prairie Mines & Royalty Ltd., a wholly-owned subsidiary of

Sherritt, Westmoreland Coal Company and certain other parties, the Company will

indirectly acquire a 52.4% interest in a portfolio of 11 producing coal and

potash royalties (the "PMRL Royalty Business") located in the provinces of

Alberta and Saskatchewan for a purchase price of $240.9 million. A right of

first refusal acquisition option for royalty interests related to the Genesee

Mine has been waived by the third party holder meaning that Altius will acquire

all of the royalty interests within the PMRL Royalty Business. The Arrangement

Agreement also provides for the acquisition by the Company of Sherritt's 50%

interest (the "Sherritt CDP Interest") in Carbon Development Partnership ("CDP")

for a purchase price of $21 million. In addition to acquiring the Sherritt CDP

Interest pursuant to the Arrangement Agreement, Altius will also indirectly

acquire OTPPB SCP Inc.'s 50% interest in CDP following the closing of the

Offering (the "OTPPB CDP Acquisition", and together with the acquisition of the

PMRL Royalty Business and Sherritt CDP Interest, the "Acquisition") for a

purchase price of $21 million. Closing of the acquisition of the PMRL Royalty

Business and the Sherritt CDP Interest is expected to occur on or about April

30, 2014, whereas closing of the OTPPB CDP Acquisition is expected to occur

following completion of the Offering.

The Company intends to finance the $261.9 million purchase price for the PMRL

Royalty Business and Sherritt CDP Interest through a senior secured

non-revolving credit facility in the amount of up to $140 million, a $7.2

million unsecured loan and available cash and marketable securities on hand. The

Company intends to use the net proceeds of the Offering (i) to complete the

OTPPB CDP Acquisition, (ii) to repay the $7.2 million unsecured loan, (iii) to

repay $20 million of borrowings under the credit facility, and (iv) for general

corporate purposes.

The securities offered have not been and will not be registered under the U.S.

Securities Act of 1933, as amended (the "US Securities Act") or the securities

laws of any state of the United States and, accordingly, such securities may not

be offered, sold or delivered, in the United States, except in transactions

exempt from the registration requirements of the U.S. Securities Act and any

applicable state securities laws. This press release shall not constitute an

offer to sell or the solicitation of an offer to buy securities in the United

States, nor shall there be any sale of these securities in any jurisdiction in

which such offer, solicitation or sale would be unlawful.

About Altius

Altius is focused on the mining and resources sector through prospect generation

and the creation and acquisition of royalties.

Altius holds an effective 0.3% net smelter return royalty on the producing

Voisey's Bay nickel-copper-cobalt mine and is currently finalizing the

acquisition of royalty interests for 11 production stage coal and potash mines

that are located in western Canada.

It has a 3% gross sales royalty on the development stage Kami iron ore project

of Alderon Iron Ore Corp. ("Alderon"), a 2% gross sales royalty for the advanced

exploration stage Central Mineral Belt uranium project of Paladin Energy

Limited, and several other resource stage project royalties. Its project

generation pipeline contains a diversified portfolio of exploration stage

projects and royalties, many of which are being advanced through various

partner-funding arrangements.

Altius has also built a portfolio of directly and indirectly held junior

resource investments, including an approx. 25% shareholding in Alderon

(TSX:ADV), an approx. 8% shareholding in Virginia Mines Inc. (TSX:VGQ), and a

approx. 5.9% shareholding in Callinan Royalties Inc. (TSX VENTURE:CAA).

Altius has 27,595,821 shares issued and outstanding that are listed on Canada's

Toronto Stock Exchange. It is a member of both the S&P/TSX Small Cap and S&P/TSX

Global Mining Indices.

Caution Regarding Forward-Looking Statements and Information

This news release contains forward-looking information about the Offering, the

expected use of proceeds from the Offering and the Acquisition. The

forward-looking statements in this news release are subject to a number of risks

and uncertainties that could cause actual events or results to differ materially

from current expectations, including those related to the business generally,

which are set out in materials filed with the securities regulatory authorities

in Canada from time to time, including the risk section of the Company's annual

Management's Discussion and Analysis report, Annual Information Form and the

short form preliminary prospectus. No assurance can be given that the Offering

or the Acquisition will be completed or the timing of same.

The Company does not undertake to update any forward-looking statements that may

be made from time to time by or on behalf of the Company other than as required

by applicable securities laws.

This Offering is only made by short form prospectus. Copies of the short form

prospectus may be obtained from any of the Agents. Investors should read the

short form prospectus before making an investment decision. There will not be

any sale of the securities being offered until a receipt for the final short

form prospectus has been issued.

FOR FURTHER INFORMATION PLEASE CONTACT:

Altius Minerals Corporation

Chad Wells

1.877.576.2209

709.576.3441 (FAX)

info@altiusminerals.com

www.altiusminerals.com

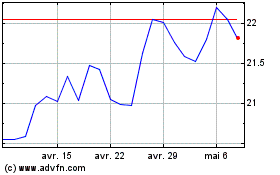

Altius Minerals (TSX:ALS)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Altius Minerals (TSX:ALS)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024