Altius Provides 1st Quarter 2022 Project Generation Update

06 Avril 2022 - 1:55PM

Business Wire

Altius Minerals Corporation (ALS:TSX) (ATUSF: OTCQX)

(“Altius” or the “Corporation”) is pleased to update its Project

Generation (“PG”) business activities and its public junior

equities portfolio. The market value of equities in the portfolio

at March 31, 2022 was $67.3 million, compared to $55.5 million at

December 31, 2021. New investments for the quarter exceeded equity

sales for a net cost of $1,400,000.

The primary driver of the increase in portfolio valuation in the

quarter was due to receipt of payment shares from three different

public issuers related to projects sold by Altius as described

below.

- 8,000,000 common shares, being 16.8% of newly listed

Labrador Uranium Inc. (LUR:CSE), for sale of the

Corporation’s Labrador uranium projects in late 2021 -

https://consolidateduranium.com/news-releases/consolidated-uranium-announces-proposed-spin-out-of-labrador-uranium-inc-creating-a-new-labrador-focused-uranium-explorer-and/.

Labrador Uranium began trading on March 3rd, 2022, is

well-capitalized from an $8 million private placement in November

2021 and intends to commence drill testing of top priority targets,

including the Notakwanon uranium project, during the summer of

2022. Altius retains a 2% gross overriding royalty on its vended

claims.

- 13,427,507 common shares, being 19.9% of newly listed High

Tide Resources Inc. (HRTC:CSE), (“High Tide”) for the sale of

the Corporation’s Labrador West (Goethite Bay) iron ore project in

2019 -

http://avidiangold.com/wp-content/uploads/2019/08/Avidian-PR-HT-Aquires-Goethite-Bay-Project-v13-FINAL.pdf.

High Tide commenced trading on February 25th, 2022 and plans to

release a maiden resource and commence a PEA level study within the

next 12 months. Altius retains a 2.75% gross sales royalty on the

Labrador West project.

- 18,836,523 common shares in Technology Minerals Plc.

(TM1:LON) (“Technology Minerals”) for the sale of the

Corporation’s interest in the Metastur copper-cobalt-nickel project

joint venture in Austurias, Spain in late 2021 –

https://www.londonstockexchange.com/news-article/TM1/exploration-update-on-the-asturmet-project/15365584.

Technology Minerals commenced trading on the London Exchange in

November 2021. Altius retains a 1.5% net smelter return (“NSR”)

royalty on all concessions comprising the Metastur property.

An updated list of the public equity holdings has been posted to

the Altius website at

http://altiusminerals.com/projects/junior-equities.

Portfolio and Project Highlights

Altius increased its equity ownership in Orogen Royalties

Inc. (OGN:TSV-V) (“Orogen”) during the quarter to 29,315,015

common shares or 16.45% of the issued and outstanding shares of

Orogen before considering an additional 7,115,546 share purchase

warrants priced at $0.40 per warrant that it holds. Orogen realized

first revenue from its Ermitaño gold project royalty in Mexico that

is operated by First Majestic Silver Corp. while also announcing a

new gold discovery from the project at a target referred to as Luna

https://www.orogenroyalties.com/news/orogen-receives-first-royalty-payment-from-the-ermitano-deposit.

Orogen also holds a 1% NSR

royalty covering the Silicon project located near Beatty,

Nevada which is operated by

AngloGold Ashanti (“AGA”). As well, Altius directly holds a

1.5% NSR royalty covering the project. During the quarter

AGA announced a maiden

inferred resource of 3.37 million ounces of gold for the

Central-Silicon gold discovery while also continuing to advance

other discoveries within the project and royalty areas. For further

information please refer to the Altius news release of February 22,

2022 -

https://altiusminerals.com/storage/press-releases/2022-2-24-discoveries-update-final--1645710289.pdf.

Adventus Mining Corp. (ADZN:TSXV) (“Adventus”) announced

that it has entered into a US$235.5 million project finance package

with Wheaton Precious Metals Corp. and Trafigura Pte Ltd for its

Curipamba project in Ecuador -

https://www.adventusmining.com/news/122583. The package

consists of US$180 million in precious metal stream financing from

Wheaton and a US$55 million loan and offtake agreement with

Trafigura. Adventus also completed a $33.5 million equity financing

during the quarter that will be used to support pre-construction

costs for the El Domo mine at Curipamba, an initial drill program

at the Santiago Project, and for general corporate purposes and

working capital. In addition to its large equity holding in

Adventus, which it added to during the quarter, Altius holds a 2%

NSR royalty covering the Curipamba project.

Gungnir Resources Inc. (GUG:TSX-V) (“Gungnir”). During

the quarter Altius acquired 6.25 million units of Gungnir at a

price of 12 cents per unit, for a total investment of $750,000.

Gungnir is primarily focused on exploration of a collection of

discovery-stage nickel sulphide projects in Sweden.

In addition to the equity investment Altius paid $250,000 for

options to acquire GSR royalties covering two of Gungnir’s projects

as described in the following news release -

http://www.gungnirresources.com/news/2022/gungnir-resources-announces-1-million-strategic-investment-from-altius-minerals-including-equity-financing-and-royalty-option-on-nickel-assets.

Wolfden Resources Inc. (WLF:TSX-V). In February, Altius

completed an additional $1 million royalty investment to expand its

ownership of timber rights held by Wolfden at Picket Mountain,

Maine. Wolfden intends to use the proceeds to fund advancement of

its permitting process at the project.

Qualified Person

Lawrence Winter, Ph.D., P.Geo., Vice‐President of Exploration

for Altius, a Qualified Person as defined by National Instrument

43-101 - Standards of Disclosure for Mineral Projects, is

responsible for the scientific and technical data presented herein

and has reviewed, prepared and approved this release.

About Altius

Altius’s strategy is to create

per share growth through a diversified portfolio of royalty assets

that relate to long life, high margin operations. This strategy

further provides shareholders with exposures that are well aligned

with sustainability-related global growth trends including the

electricity generation transition from fossil fuel to renewables,

transportation electrification, reduced emissions from steelmaking

and increasing agricultural yield requirements. These macro-trends

each hold the potential to cause increased demand for many of

Altius’s commodity exposures including copper, renewable based

electricity, several key battery metals (lithium, nickel and

cobalt), clean iron ore, and potash. In addition, Altius runs a

successful Project Generation business that originates mineral

projects for sale to developers in exchange for equity positions

and royalties. Altius has 41,175,595 common shares issued and

outstanding that are listed on Canada’s Toronto Stock Exchange. It

is included in each of the S&P/TSX Small Cap, the S&P/TSX

Global Mining, and the S&P/TSX Canadian Dividend Aristocrats

indices.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220405006238/en/

Chad Wells Email: Cwells@altiusminerals.com Tel:

1.877.576.2209

Flora Wood Email: Fwood@altiusminerals.com Tel:

1.877.576.2209 Direct: +1(416)346.9020

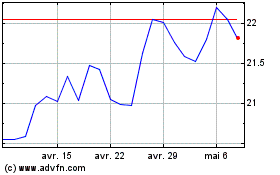

Altius Minerals (TSX:ALS)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Altius Minerals (TSX:ALS)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025