Anaergia Sees Significantly Improved Conditions for Its European Operations and Signs Two New Contracts in Italy

16 Mars 2022 - 11:30AM

Business Wire

Anaergia Inc. (“Anaergia” or the “Company”) (TSX: ANRG) notes

several developments that are having a positive impact on the

company’s European operations.

Key developments affecting Anaergia are:

- Materially higher European gas prices. Tight natural gas

markets in Europe, already evident prior to the start of the

European military conflict last month, resulted in record high

prices in that region. In the fourth quarter of 2021, natural gas

prices in Europe were close to five times higher than where they

were trading during 2020, and the International Energy Agency (IEA)

was already forecasting an all-time high average price of US$26

/MMBTU (source: International Energy Agency: Gas Market Report Q1

2022).

- The current security concerns have accelerated the European

Union’s resolve to restructure its energy sector. Last week, the

European Commission proposed an outline of a plan to make European

countries more energy self-sufficient. This strategy will “seek to

diversify gas supplies, speed up the roll-out of renewable gases”

to produce “larger volumes of biomethane” (renewable natural gas or

“RNG”) and thereby reduce reliance on Russian gas by two thirds in

2022 and completely phase out its use by 2030. This plan

specifically mentions increasing supplies of RNG and sets a target

for the EU to produce 1,260,000,000 MMTBU (35 billion cubic meters)

of biomethane (RNG) by 2030, double the previously proposed target

(source: REPowerEU: Joint European action for more affordable,

secure and sustainable energy).

- Individual countries already announced plans to dramatically

increase RNG in their gas networks. Denmark, for example, plans to

increase the share of renewable gas in its network from the current

25% to 100% within the next seven years. All major western European

nations have significant programs for supporting the roll out of

more RNG plants following the RED II directive from Brussels, with

Germany set to become a major and newly strengthened market.

Anaergia is a leading player in the European market with

well-established offices in five significant countries and

references in many European countries. The above listed

developments mean that the number of opportunities for sales or

investment will increase significantly and the profitability of the

seven plants currently under construction, and owned by Anaergia,

will be much higher than previously expected.

As an illustration of the growth trend, Anaergia’s Italian

office has just closed the sale of capital equipment for two

significant projects for which Anaergia will supply $45 million in

technology.

Financial conditions are improving on two fronts: first, the

projects we own get the wholesale price of gas, which as pointed

out above, has increased dramatically; second, there are green

certificates that are guaranteed by governments, which are being

traded at a higher price than the guaranteed base. Assuming an RNG

price of US$26 /MMBTU, as previously forecasted for 2022 by the

IEA, which is well below the average market price of the last six

months, and the green certificate price guaranteed by the

government, the estimated annualized EBITDA for the seven plants

would increase from an initially forecasted total of approximately

$58 million to approximately $97 million. These plants are starting

their ramp-ups during the second quarter of this year with the last

one to come on stream during the third quarter of 2023.

“Anaergia’s companies have been engaged in building renewable

energy infrastructure in Europe for decades,” noted Andrew Benedek,

Anaergia’s Chairman and CEO. “At this time, there is more

widespread recognition of the need for RNG infrastructure in

Europe, and there are more lucrative financial incentives to build,

than ever before. Already about half of our revenue originates in

Europe. Given the market conditions, our growth in Europe is likely

to accelerate. During the next several years, we will continue to

expand our presence in Europe by providing our world-leading

technological solutions for projects and we will continue to

increase the number of facilities owned and operated by us.”

About Anaergia

Anaergia was created to eliminate a major source of greenhouse

gases by cost effectively turning organic waste into renewable

natural gas (“RNG”), fertilizer and water, using proprietary

technologies. With a proven track record from delivering

world-leading projects on four continents, Anaergia is uniquely

positioned to provide end-to-end solutions for extracting organics

from waste, implementing high efficiency anaerobic digestion,

upgrading biogas, producing fertilizer and cleaning water. Our

customers are in the municipal solid waste, municipal wastewater,

agriculture, and food processing industries. In each of these

markets Anaergia has built many successful plants including some of

the largest in the world. Anaergia owns and operates some of the

plants it builds, and it also operates plants that are owned by its

customers.

Forward-Looking Statements

This news release may contain forward-looking information within

the meaning of applicable securities legislation, which reflects

the Company’s current expectations regarding future events.

Forward-looking information is based on a number of assumptions and

is subject to a number of risks and uncertainties, many of which

are beyond the Company’s control. Actual results could differ

materially from those projected herein. Anaergia does not undertake

any obligation to update such forward-looking information, whether

as a result of new information, future events or otherwise, except

as expressly required under applicable securities laws.

For further information please see: www.anaergia.com

Source: Anaergia, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220316005478/en/

For media relations: Melissa Bailey, Director, Marketing &

Corporate Communications, Melissa.Bailey@Anaergia.com For investor

relations: IR@Anaergia.com

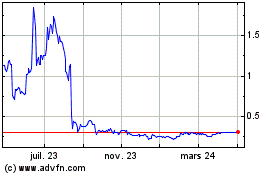

Anaergia (TSX:ANRG)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

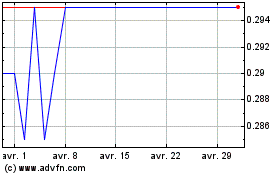

Anaergia (TSX:ANRG)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025