Avalon Advanced Materials Inc. (TSX:AVL)

(OTCQX:AVLNF) (“Avalon” or the “Company”) is pleased to announce

that it has entered into a preferred share purchase agreement (the

“Agreement”) with an entity managed by The Lind Partners, a New

York based asset management firm (“Lind”). The financing will

involve the issuance of 500 Series A1 Preferred Shares (the

“Preferred Shares”) on a private placement basis at a price of

$5,000 per Preferred Share for gross proceeds of $2,500,000. The

proceeds will be used for ongoing market development work,

metallurgical studies and preliminary engineering work on the

Separation Rapids Lithium Project and for general working capital

purposes. The transaction is expected to close the week of March 6,

2017.

The Preferred Shares do not carry a dividend and

have a redemption value per share that starts at $5,000 and

increases by $250 per share each quarter over the next 24 months,

to a cap of $6,750 per share. After the four month Hold Period

(defined below), the Preferred Shares can be converted by Lind into

common shares of the Company at a price per common share equal to

85% of the five-day volume weighted average price of the common

shares on the Toronto Stock Exchange (the “TSX”) immediately prior

to the date that notice of conversion is given.

In conjunction with the closing, Lind will

receive a commitment fee of $125,000 and 6,900,000 common share

purchase warrants. Each warrant entitles the holder to purchase one

common share of the Company at a price of $0.23 per common share

until 60 months after closing.

Pursuant to Canadian securities laws, the

securities issuable under this private placement will be subject to

a hold period (the “Hold Period”), which expires four months and

one day after closing. After the Hold Period, Lind has the basic

right to convert 25 Preferred Shares into common shares of the

Company on a monthly basis, subject to certain conversion limits

set out in the Agreement, however Lind is permitted to convert up

to 100 Preferred Shares on a monthly basis in the event such amount

does not exceed 20% of the Company's 20-day traded volume of common

shares on the TSX immediately prior to the date of delivery of a

conversion notice.

Lind will also be entitled to accelerate its

conversion right to the full amount of the redemption value

applicable at such time, or demand repayment of the applicable

redemption value per share in cash, upon the occurrence of certain

events as set out in the Agreement. The Company has the right to

redeem the Preferred Shares at any time after the Hold Period at a

small premium to the redemption value. The Company has floor price

protection such that if any conversion results in an effective

conversion price of less than $0.10 per common share, then the

Company has the right to deny the conversion and instead redeem the

Preferred Shares that were subject to that conversion for the

redemption amount in cash plus a 5% premium.

At any time while any Preferred Shares are

outstanding, Lind has the option of subscribing for up to an

additional 165 Series A2 Preferred Shares at a price of $5,000 per

share and under the same terms and conditions as the initial

financing, subject to certain triggering events and subject to the

prior approval of the TSX.

The Company has received conditional approval of

the TSX in connection with the completion of the Series A1

Preferred Share private placement.

Phillip Valliere, Managing Director at Lind

said, "We have been following Avalon’s progress for several years

and, having developed confidence in the management team, we feel

the time is right to invest in Avalon as it advances both its

clean-tech materials business at its Separation Rapids Lithium

Project as well as its East Kemptville Tin-Indium Project which is

expected to be in a position to generate cash flow within the next

two years.”

Don Bubar, Avalon’s President and CEO commented,

“We are pleased to have completed this innovative equity financing

arrangement with Lind. This preferred share model achieves a

balance that mitigates some of the risk of excessive dilution to

our shareholders while providing Lind with some downside

protection. The funds will allow us to accelerate our work programs

on the Separation Rapids Lithium Project where we hope to be moving

into the pilot plant phase later this year.”

This news release is not an offer of securities

for sale in the United States. The securities have not been and

will not be registered under the US Securities Act of 1933, as

amended (the “US Securities Act”), and may not be offered or sold

in the United States or to US persons (as defined in Regulation S

under the US Securities Act) absent registration or an applicable

exemption from registration. All currency reported in this release

is in Canadian dollars.

About The Lind PartnersThe Lind Partners is a

New York-based institutional fund management firm focused on

small-and mid-cap companies publicly traded in Canada, Australia

and the UK across mining, oil & gas, biotech and technology.

Lind employs a multi-strategy investment approach: direct

investments of new capital; participation in syndicated equity

placements; IPO/pre-IPO investments; and selective open market

trades. Since 2009, the Lind team has completed over 75 direct

investments totaling over $600 million in value.

About Avalon Advanced Materials Inc. Avalon

Advanced Materials Inc. is a Canadian mineral development

company specializing in niche market metals and minerals with

growing demand in new technology. The Company has three advanced

stage projects, all 100%-owned, providing investors with exposure

to lithium, tin and indium, as well as rare earth elements,

tantalum, niobium, and zirconium. Avalon is currently focusing on

its Separation Rapids Lithium Project, Kenora, ON and its East

Kemptville Tin-Indium Project, Yarmouth, NS. Social responsibility

and environmental stewardship are corporate cornerstones.

For questions and feedback, please e-mail the

Company at ir@AvalonAM.com, or phone Don Bubar, President & CEO

at 416-364-4938.

This news release contains “forward-looking

statements” within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and applicable Canadian

securities legislation. Forward-looking statements include, but are

not limited to, statements related to the anticipated closing of

the financing, how the Company plans to use the net proceeds from

the financing, that East Kemptville Tin-Indium Project is expected

to be in a position to generate cash flow within the next two years

and that the funds will allow the Company to accelerate its work

programs on the Separation Rapids Lithium Project where it hopes to

be moving into the pilot plant phase later this year. Generally,

these forward-looking statements can be identified by the use of

forward-looking terminology such as “potential”, “scheduled”,

“anticipates”, “continues”, “expects” or “does not expect”, “is

expected”, “scheduled”, “targeted”, “planned”, or “believes”, or

variations of such words and phrases or state that certain actions,

events or results “may”, “could”, “would”, “might” or “will be” or

“will not be” taken, reached or result, “will occur” or “be

achieved”. Forward-looking statements are subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

Avalon to be materially different from those expressed or implied

by such forward-looking statements. Forward-looking statements are

based on assumptions management believes to be reasonable at the

time such statements are made. Although Avalon has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. Factors that may cause

actual results to differ materially from expected results described

in forward-looking statements include, but are not limited to

market conditions, and the possibility of cost overruns or

unanticipated costs and expenses as well as those risk factors set

out in the Company’s current Annual Information Form, Management’s

Discussion and Analysis and other disclosure documents available

under the Company’s profile at www.SEDAR.com. There can be no

assurance that such statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Such forward-looking statements

have been provided for the purpose of assisting investors in

understanding the Company’s plans and objectives and may not be

appropriate for other purposes. Accordingly, readers should not

place undue reliance on forward-looking statements. Avalon does not

undertake to update any forward-looking statements that are

contained herein, except in accordance with applicable securities

laws.

Contact: ir@AvalonAM.com

Don Bubar, President & CEO

416-364-4938

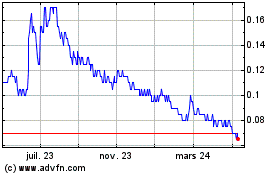

Avalon Advanced Materials (TSX:AVL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

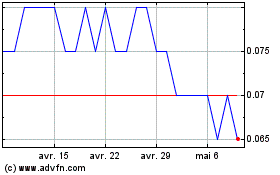

Avalon Advanced Materials (TSX:AVL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025