Brookfield Renewable Partners L.P. (“

BEP”) (NYSE:

BEP; TSX: BEP.UN), Brookfield Renewable Corporation

(“

Brookfield Renewable Corporation” or

“

BEPC”) (NYSE,TSX: BEPC) (or together

“

Brookfield Renewable”) and TerraForm Power, Inc.

("

TerraForm Power" or "

TERP")

(Nasdaq: TERP) today jointly announced that TERP’s stockholders

voted to approve the previously announced merger transactions (the

“

Merger”) in which Brookfield Renewable will

acquire all of the outstanding shares of TERP, other than the

approximately 62% already owned by Brookfield Renewable and its

affiliates. The Merger is expected to close on July 31.

Brookfield Renewable also intends to complete

the previously announced special distribution of shares of

Brookfield Renewable Corporation on July 30. From an economic and

accounting perspective, the special distribution will be analogous

to a unit split as it does not result in any underlying change to

aggregate cash flows or net asset value except for the adjustment

for the aggregate number of units/shares outstanding.

Each BEP unitholder of record as of July 27 will

receive one (1) class A exchangeable subordinate voting share of

BEPC for every four (4) BEP units held. The shares will commence

regular-way trading on the Toronto Stock Exchange and the New York

Stock Exchange under the symbol “BEPC” on July 30.

“We look forward to completing the merger with

TerraForm Power”, said Sachin Shah, CEO of Brookfield Renewable.

“The transaction is immediately cash accretive and further enhances

Brookfield Renewable’s position as one of the largest, publicly

traded pure-play renewable power businesses globally. We are

also excited to be launching Brookfield Renewable Corporation,

which provides investors greater flexibility to invest in our

business.”

Merger Details

As consideration for the Merger, TERP

stockholders have elected to receive, for each share of TERP Class

A common stock held, either 0.47625 of a BEPC share or 0.47625 of a

BEP unit. TERP stockholders who did not make a valid election to

receive BEP units as consideration prior to 5:00 p.m. EST on July

28, 2020 will receive BEPC shares. BEPC expects to issue

37,035,241 shares as part of the Merger, which together with the

BEPC shares issued through the special distribution will bring

total BEPC shares outstanding to 114,877,953. BEP expects to

issue 4,034,469 units as part of the Merger, increasing total BEP

units outstanding to 315,405,318.

After completion of the Merger, Class A shares

of TERP common stock are expected to be delisted from the Nasdaq

Stock Market and deregistered under the Exchange Act (as defined

below).

BMO Capital Markets and Scotiabank served as

financial advisors and Cravath, Swaine & Moore LLP and Torys

LLP served as legal counsel to Brookfield Renewable.

Morgan Stanley & Co. LLC and Greentech

Capital Advisors served as financial advisors and Kirkland &

Ellis LLP and Richards, Layton & Finger, P.A. served as legal

counsel to the Special Committee of TERP’s Board of Directors.

Brookfield Renewable operates

one of the world’s largest publicly traded, pure-play renewable

power platforms. Our portfolio consists of hydroelectric, wind,

solar and storage facilities in North America, South America,

Europe and Asia, and totals over 19,000 megawatts of installed

capacity and a 15,000 megawatt development pipeline. Investors can

access its portfolio either through Brookfield Renewable Partners

L.P. (NYSE: BEP; TSX: BEP.UN), a Bermuda-based limited partnership,

or, following the special distribution, through Brookfield

Renewable Corporation (NYSE, TSX: BEPC), a Canadian corporation.

Further information is available at www.bep.brookfield.com.

Brookfield Renewable is the flagship listed

renewable power company of Brookfield Asset Management, a leading

global alternative asset manager with over $515 billion of assets

under management. For more information, go to

www.brookfield.com.

TerraForm Power owns and

operates a best-in-class renewable power portfolio of solar and

wind assets located primarily in North America and Western Europe,

totaling more than 4,200 MW of installed capacity underpinned by

long-term contracts. For more information about TerraForm Power,

please visit: www.terraformpower.com.

|

Brookfield Contact Information: |

|

| Media: |

Investors: |

| Claire Holland |

Cara Silverman |

| Senior Vice President – Communications |

Manager – Investor Relations |

| (416) 369-8236 |

(416) 649-8172 |

| claire.holland@brookfield.com |

cara.silverman@brookfield.com |

| |

|

| TerraForm Power Contact Information: |

|

| Sherif El-Azzazi |

|

| Head of Investor Relations |

|

| (646) 992-2437 |

|

| investors@terraform.com |

|

| |

|

Cautionary Statement Regarding

Forward-Looking StatementsThis press release contains

“forward-looking statements” within the meaning of Section 27A of

the U.S. Securities Act of 1933, as amended, Section 21E of the

U.S. Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and “safe harbor” provisions of the United States Private

Securities Litigation Reform Act of 1995. The words “will”,

“intend”, “should”, “could”, “target”, “growth”, “expect”,

“believe”, “plan”, derivatives thereof and other expressions which

are predictions of or indicate future events, trends or prospects

and which do not relate to historical matters identify the above

mentioned and other forward-looking statements. Forward-looking

statements in this press release include statements regarding BEPC,

the special distribution of the BEPC shares, the ability of

Brookfield Renewable to attract new investors, the Merger, the

prospects and benefits of the combined company and any other

statements regarding the parties’ future expectations, beliefs,

plans, objectives, financial conditions, assumptions or future

events or performance. Although Brookfield Renewable and TerraForm

Power believe that these forward-looking statements and information

are based upon reasonable assumptions and expectations, you should

not place undue reliance on them, or any other forward-looking

statements or information in this press release. The future

performance and prospects of Brookfield Renewable and TerraForm

Power are subject to a number of known and unknown risks and

uncertainties. Factors that could cause actual results of

Brookfield Renewable and TerraForm Power to differ materially from

those contemplated or implied by the statements in this press

release include failure to realize contemplated benefits from the

creation of BEPC, the special distribution of BEPC shares and the

Merger, including the possibility that the expected synergies and

value creation from the Merger will not be realized; the inability

to retain key personnel; and incurrence of significant costs in

connection with the Merger. For further information on these known

and unknown risks, please see “Risk Factors” included in TerraForm

Power’s definitive proxy statement regarding the Merger and its

most recent Annual Report on Form 10-K and subsequent Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K filed with the

Securities and Exchange Commission (“SEC”) and in BEP’s most recent

Annual Form 20-F and other risk factors that are described therein

and that are described in BEP’s and BEPC’s joint registration

statement on Form F-1/F-4, as filed with the SEC as an amendment to

Form F-1, and the final prospectus filed with the SEC and the

securities regulators in Canada in connection with the special

distribution of BEPC shares.

The foregoing list of important factors that may

affect future results is not exhaustive. The forward-looking

statements represent our views as of the date of this press release

and should not be relied upon as representing our views as of any

subsequent date. While we anticipate that subsequent events and

developments may cause our views to change, we disclaim any

obligation to update the forward-looking statements, other than as

required by applicable law.

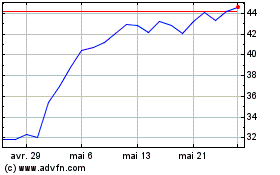

Brookfield Renewable (TSX:BEPC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Brookfield Renewable (TSX:BEPC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025