Brookfield Renewable to Issue CDN$425 Million of Green Bonds

12 Août 2020 - 12:11AM

Brookfield Renewable Partners L.P. (TSX: BEP.UN; NYSE: BEP)

(“Brookfield Renewable”) today announced that it has agreed to

issue CDN$425 million aggregate principal amount of medium-term

notes, Series 14, due August 13, 2050, which will bear interest at

a rate of 3.33% per annum, payable semi-annually (the “Notes”).

Brookfield Renewable Partners ULC (“Finco”), a subsidiary of

Brookfield Renewable, will be the issuer of the Notes, which will

be fully and unconditionally guaranteed by Brookfield Renewable and

certain of its key holding subsidiaries.

“We are pleased to announce the issuance of our

fifth corporate-level green bond offering, which brings our total

green issuances to date to over $3 billion and further strengthens

our position as a leading issuer of sustainable capital,” said

Sachin Shah, Chief Executive Officer of Brookfield Renewable. “The

issuance meaningfully extends the duration of our corporate debt

profile while reducing our cost of borrowing and reflects the

high-quality nature of our renewable power portfolio.”

The Notes will be issued pursuant to a base

shelf prospectus dated July 17, 2019 and a related prospectus

supplement and pricing supplement to be dated August 11, 2020. The

issue is expected to close on or about August 13, 2020 subject to

customary closing conditions.

The Notes will represent Brookfield Renewable’s

fifth corporate-level green bond offering in Canada. Brookfield

Renewable intends to use the net proceeds from the sale of the

Notes to repay indebtedness incurred by Brookfield Renewable to

fund Eligible Investments (as defined in Brookfield Renewable’s

Green Bond and Preferred Securities Framework dated February 2020),

including the early redemption of the 4.79% medium term notes

issued by Finco due February 7, 2022. The Green Bond and Preferred

Securities Framework is available on Brookfield Renewable’s website

and described in the prospectus supplement in respect of the

offering.

The Notes have been rated BBB+ by Standard &

Poor's Rating Services and BBB (high) with a stable trend by DBRS

Limited.

The Notes are being offered through a syndicate

of agents led by CIBC Capital Markets, BMO Capital Markets and RBC

Capital Markets and including National Bank Financial Markets,

Scotiabank, HSBC, TD Securities, Mizuho Securities, MUFG, SMBC

Nikko and Industrial Alliance Securities Inc.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy the securities in

any jurisdiction, nor shall there be any offer or sale of the

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful. The securities being offered have not been

approved or disapproved by any regulatory authority nor has any

such authority passed upon the accuracy or adequacy of the short

form base shelf prospectus or the prospectus supplement. The offer

and sale of the securities has not been and will not be registered

under the United States Securities Act of 1933, as amended (the

“U.S. Securities Act”) or any state securities laws and may not be

offered or sold in the United States or to United States persons

absent registration or an applicable exemption from the

registration requirements of the U.S. Securities Act and applicable

state securities laws.

Brookfield Renewable

Brookfield Renewable operates

one of the world’s largest publicly traded, pure-play renewable

power platforms. Our portfolio consists of hydroelectric, wind,

solar and storage facilities in North America, South America,

Europe and Asia, and totals over 19,000 megawatts of installed

capacity and an 18,000 megawatt development pipeline. Investors can

access its portfolio either through Brookfield Renewable Partners

L.P. (NYSE: BEP; TSX: BEP.UN), a Bermuda-based limited partnership,

or Brookfield Renewable Corporation (NYSE, TSX: BEPC), a Canadian

corporation. Further information is available at

www.bep.brookfield.com and www.bep.brookfield.com/bepc. Important

information may be disseminated exclusively via the website;

investors should consult the site to access this information.

Brookfield Renewable is the flagship listed

renewable power company of Brookfield Asset Management, a leading

global alternative asset manager with over $525 billion of assets

under management.

Contact information:

|

Media: |

Investors: |

| Claire Holland |

Cara Silverman |

| Senior Vice President – Communications |

Manager - Investor Relations |

| (416) 369-8236 |

(416) 649-8172 |

| claire.holland@brookfield.com |

cara.silverman@brookfield.com |

Cautionary Statement Regarding

Forward-looking Statements

Note: This news release contains forward-looking

statements and information within the meaning of applicable

securities laws. Forward-looking statements may include estimates,

plans, expectations, opinions, forecasts, projections, guidance or

other statements that are not statements of fact. Forward-looking

statements can be identified by the use of words such as “will”,

“expect” and “intend”, or variations of such words and phrases.

Forward-looking statements in this news release include statements

regarding the closing, the terms and the use of proceeds of the

offering of Notes. Although Brookfield Renewable believes that such

forward-looking statements and information are based upon

reasonable assumptions and expectations, no assurance is given that

such expectations will prove to have been correct. The reader

should not place undue reliance on forward-looking statements and

information as such statements and information involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of Brookfield Renewable

to differ materially from anticipated future results, performance

or achievement expressed or implied by such forward-looking

statements and information. Except as required by law, Brookfield

Renewable does not undertake any obligation to publicly update or

revise any forward-looking statements or information, whether

written or oral, whether as a result of new information, future

events or otherwise.

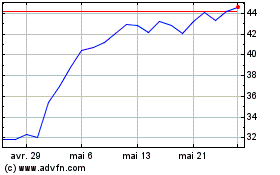

Brookfield Renewable (TSX:BEPC)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Brookfield Renewable (TSX:BEPC)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025