Brookfield Renewable Acquires Distributed Generation Platform, Increasing Total Portfolio to Approximately 2,000 Megawatts of...

11 Décembre 2020 - 1:15PM

Brookfield Renewable (

NYSE: BEP,

BEPC; TSX: BEP.UN, BEPC), alongside its

institutional partners, today announced that it has entered into a

definitive agreement with Exelon Generation Company (NASDAQ: EXC)

to acquire a distributed generation development platform comprising

360 megawatts of operating distributed solar across nearly 600

sites throughout the U.S. with an additional over 700 megawatts

under development. This transaction represents an

opportunity to acquire a high-quality operating portfolio with a

strong development pipeline of advanced-stage projects and a

dedicated PPA origination team with a consistent track record of

delivering high value projects to customers. The portfolio is

contracted under long-term power purchase agreements, and

Brookfield Renewable intends to leverage its scale, and operating

and commercial capabilities to drive additional value.

“We entered the distributed generation space in

2017, as we identified a significant opportunity to build a

high-quality scale business in a rapidly growing market. Since

then, we have expanded the business as cost declines in solar

technology and decarbonization ambitions from commercial and

industrial clients accelerated,” said Connor Teskey, CEO of

Brookfield Renewable. “Today, we are owners of one of the leading

distributed generation businesses in the U.S., with deep operating,

development and origination capabilities, and an approximately

2,000 megawatt portfolio that generates high-quality contracted

cash flows that are diversified by geography and customer. This

investment represents the continuation of this strategy and

furthers our goal of partnering with corporates and other

institutions to help them achieve their decarbonization

objectives.”

The total purchase price of the portfolio is

expected to be approximately $810 million. The transaction is

subject to customary closing conditions and is expected to close in

the first half of 2021.

Brookfield Renewable operates

one of the world’s largest publicly traded, pure-play renewable

power platforms. Our portfolio consists of hydroelectric, wind,

solar and storage facilities in North America, South

America, Europe and Asia, and totals over 19,000

megawatts of installed capacity and an 18,000 megawatt development

pipeline. Investors can access its portfolio either through

Brookfield Renewable Partners L.P. (NYSE: BEP; TSX: BEP.UN),

a Bermuda-based limited partnership, or Brookfield Renewable

Corporation (NYSE, TSX: BEPC), a Canadian corporation. Further

information is available

at www.bep.brookfield.com and www.bep.brookfield.com/bepc.Important

information may be disseminated exclusively via the website;

investors should consult the site to access this information.

Brookfield Renewable is the flagship listed

renewable power company of Brookfield Asset Management, a leading

global alternative asset manager with approximately $575

billion of assets under management.

|

Contact information: |

|

|

Media: |

Investors: |

|

Claire Holland |

Robin Kooyman |

|

Senior Vice President – Communications |

Senior Vice President – Investor Relations |

|

(416) 369-8236 |

(416) 649-8172 |

|

claire.holland@brookfield.com |

robin.kooyman@brookfield.com |

Cautionary Statement Regarding

Forward-looking Statements

This news release contains forward-looking

statements and information within the meaning of Canadian

securities laws and “forward-looking statements” within the meaning

of Section 27A of the U.S. Securities Act of 1933, as

amended, Section 21E of the U.S. Securities Exchange Act

of 1934, as amended, “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995 and in any

applicable Canadian securities regulations. Forward-looking

statements may include estimates, plans, expectations, opinions,

forecasts, projections, guidance or other statements that are not

statements of fact. Forward-looking statements can be identified by

the use of words such as “believes” and “may” or variations of such

words and phrases and include statements regarding the ability of

BEP and BEPC to successfully close and realize the full benefit of

the transaction with Exelon Generation Company, including their

ability to successfully integrate the employees and operating

assets of the business being acquired and to build-out its

development pipeline. Although BEP and BEPC believe that these

forward-looking statements and information are based upon

reasonable assumptions and expectations, the reader should not

place undue reliance on them, or any other forward-looking

statements or information in this news release. The future

performance and prospects of BEP and BEPC are subject to a number

of known and unknown risks and uncertainties. Factors that could

cause actual results of BEP and BEPC to differ materially from

those contemplated or implied by the statements in this news

release include: general economic conditions; interest rate

changes; availability of equity and debt financing; the performance

of the Units and Exchangeable Shares or the stock exchanges

generally; and other risks and factors described in the documents

filed by BEP and BEPC with securities regulators in Canada and the

United States including under “Risk Factors” in (i) BEP’s most

recent Annual Report on Form 20-F and (ii) the prospectus of BEPC

dated June 29, 2020 in respect of the special distribution of

Exchangeable Shares to unitholders of BEP, and other risks and

factors that are described therein.

Except as required by law, BEP and BEPC do not

undertake any obligation to publicly update or revise any

forward-looking statements or information, whether written or oral,

whether as a result of new information, future events or

otherwise.

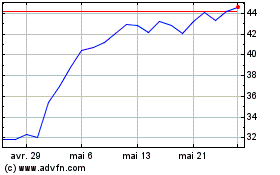

Brookfield Renewable (TSX:BEPC)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Brookfield Renewable (TSX:BEPC)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025