Brookfield Renewable Partners L.P. (the

“

Partnership”) (NYSE: BEP; TSX: BEP.UN),

Brookfield Renewable Corporation (“

BEPC” and

together with the Partnership, “

Brookfield

Renewable”) (NYSE/TSX: BEPC) and Brookfield Asset

Management Inc. (“

Brookfield Asset Management”)

(NYSE: BAM; TSX: BAM.A) announced today the pricing of the

previously announced secondary public offering of 15,000,000 class

A exchangeable subordinate voting shares (the “

Exchangeable

Shares”) of BEPC at a price of $51.50 per share by

subsidiaries of Brookfield Asset Management (the “

Selling

Shareholders”). The offering is expected to close on

February 16, 2021, subject to customary closing conditions. In

addition, one of the Selling Shareholders has granted the

underwriters a 30-day option to purchase up to 2,250,000 additional

Exchangeable Shares. Brookfield Renewable is not issuing any

Exchangeable Shares in the offering and will not receive any of the

proceeds from the offering.

Each Exchangeable Share is structured with the

intention of providing an economic return equivalent to one

non-voting limited partnership unit (a “Unit”) of

the Partnership (subject to adjustment to reflect certain capital

events). Each Exchangeable Share will be exchangeable at the option

of the holder for one Unit (subject to adjustment to reflect

certain capital events) or its cash equivalent (the form of payment

to be determined at the election of Brookfield Renewable).

Upon closing of the offering, it is anticipated

that Brookfield Asset Management will own an approximate 48% equity

interest in Brookfield Renewable, on a fully exchanged-basis (and

48% if the over-allotment option is exercised in full), which

includes 26% of the issued and outstanding Exchangeable Shares (and

25% if the over-allotment option is exercised in full).

Barclays, J.P. Morgan, Morgan Stanley,

Scotiabank, BMO Capital Markets, CIBC Capital Markets, HSBC,

National Bank Financial Inc., RBC Capital Markets, TD Securities

Inc. and Wells Fargo Securities are acting as joint book-running

managers for the offering.

The offering is being made only by means of a

prospectus.

A registration statement relating to these

securities has been filed with, and declared effective by, the U.S.

Securities and Exchange Commission. Brookfield Renewable will also

be filing a prospectus supplement to its base shelf prospectus

dated September 2, 2020 with securities regulatory authorities in

Canada. Copies of these documents may be obtained by visiting EDGAR

on the SEC website at www.sec.gov or by visiting SEDAR at

www.sedar.com.

You may also request a copy of these documents

from Barclays Capital Inc., c/o Broadridge Financial Solutions,

1155 Long Island Avenue, Edgewood, New York, USA 11717, telephone:

1-888-603-5847, email: barclaysprospectus@broadridge.com; J.P.

Morgan Securities Canada Inc., c/o Broadridge Financial Solutions,

1155 Long Island Avenue, Edgewood, New York, USA 11717, telephone:

1-888-603-9204, email: prospectus-eq_fi@jpmchase.com; J.P. Morgan

Securities LLC, c/o Broadridge Financial Solutions, 1155 Long

Island Avenue, Edgewood, New York, USA 11717, telephone:

1-888-603-9204, email: prospectus-eq_fi@jpmchase.com; Scotia

Capital Inc., Attention: Equity Capital Markets, Scotia Plaza, 64th

Floor, 40 King Street West, Toronto, Ontario, CA M5H 3Y2,

telephone: 1-416-863-7704, email: equityprospectus@scotiabank.com;

and Scotia Capital (USA) Inc., Attention: Equity Capital Markets,

250 Vesey Street, 24th Floor, New York, New York, USA 10281,

telephone: 1-212-225-6853, email:

equityprospectus@scotiabank.com.

Any distribution of securities in Canada may not

exceed the available capacity under Brookfield Renewable’s base

shelf prospectus, as may be amended.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Brookfield Renewable

Brookfield Renewable operates one of the world’s

largest publicly traded, pure-play renewable power platforms. Our

portfolio consists of hydroelectric, wind, solar and storage

facilities in North America, South America, Europe and Asia, and

totals approximately 20,000 megawatts of installed capacity and an

approximately 23,000 megawatt development pipeline. Investors can

access our portfolio either through Brookfield Renewable Partners

L.P. (NYSE: BEP; TSX: BEP.UN), a Bermuda-based limited partnership,

or Brookfield Renewable Corporation (NYSE, TSX: BEPC), a Canadian

corporation.

Brookfield Renewable is the flagship listed

renewable power company of Brookfield Asset Management, a leading

global alternative asset manager with approximately $600 billion of

assets under management.

|

Contact information: |

|

| Media: |

Investors: |

| Claire Holland |

Robin Kooyman |

| Senior Vice President – Communications |

Senior Vice President – Investor

Relations |

| (416) 369-8236 |

(416) 649-8172 |

| claire.holland@brookfield.com |

robin.kooyman@brookfield.com |

Cautionary Statement Regarding Forward-looking

Statements

This news release contains forward-looking

statements and information within the meaning of applicable

securities laws. The words “will”, “should”, “propose,” “expect”,

“believe”, derivatives thereof and other expressions which are

predictions of or indicate future events, trends or prospects and

which do not relate to historical matters identify the above

mentioned and other forward-looking statements. Forward-looking

statements in this news release include statements regarding the

offering. Although Brookfield Renewable believes that these

forward-looking statements and information are based upon

reasonable assumptions and expectations, you should not place undue

reliance on them, or any other forward-looking statements or

information in this news release. The future performance and

prospects of Brookfield Renewable are subject to a number of known

and unknown risks and uncertainties. Factors that could cause

actual results of Brookfield Renewable to differ materially from

those contemplated or implied by the statements in this news

release include (without limitation) the failure to satisfy the

customary closing conditions of the offering, our inability to

identify sufficient investment opportunities and complete

transactions, including weather conditions and other factors which

may impact generation levels at facilities; adverse outcomes with

respect to outstanding, pending or future litigation; economic

conditions in the jurisdictions in which Brookfield Renewable

operates; ability to sell products and services under contract or

into merchant energy markets; changes to government regulations,

including incentives for renewable energy; ability to complete

development and capital projects on time and on budget; inability

to finance operations or fund future acquisitions due to the status

of the capital markets; health, safety, security or environmental

incidents; regulatory risks relating to the power markets in which

Brookfield Renewable operates, including relating to the regulation

of our assets, licensing and litigation; risks relating to internal

control environment; contract counterparties not fulfilling their

obligations; changes in operating expenses, including employee

wages, benefits and training, governmental and public policy

changes, and other risks associated with the construction,

development and operation of power generating facilities. For

further information on these known and unknown risks, please see

“Risk Factors” included in (i) the Form 20-F of the Partnership and

(ii) the prospectuses of Brookfield Renewable filed with U.S. and

Canadian securities authorities in connection with this offering,

and other risks and factors that are described therein.

The foregoing list of important factors that may

affect future results is not exhaustive. The forward-looking

statements represent our views as of the date of this news release

and should not be relied upon as representing our views as of any

subsequent date. While we anticipate that subsequent events and

developments may cause our views to change, we disclaim any

obligation to update the forward-looking statements, other than as

required by applicable law.

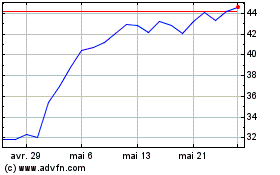

Brookfield Renewable (TSX:BEPC)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Brookfield Renewable (TSX:BEPC)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025