Brookfield Renewable today announced that the Toronto Stock

Exchange (the “

TSX”) has accepted notices filed by

Brookfield Renewable Partners L.P. (

TSX: BEP.UN;

NYSE: BEP) (“

BEP”) of its

intention to renew its normal course issuer bid for its limited

partnership units (“

Units”) and by Brookfield

Renewable Corporation (

TSX: BEPC;

NYSE:

BEPC) (“

BEPC” and together with BEP,

“

Brookfield Renewable”) of its intention to renew

its normal course issuer bid for its outstanding class A

exchangeable subordinate voting shares (“

Exchangeable

Shares”). Brookfield Renewable believes that in the event

that Units or Exchangeable Shares trade in a price range that does

not fully reflect their intrinsic value, the acquisition of Units

or Exchangeable Shares, as applicable, may represent an attractive

use of available funds.

Brookfield Renewable is authorized to repurchase

up to 13,750,520 Units and 8,610,184 Exchangeable Shares,

representing 5% of its issued and outstanding Units and

Exchangeable Shares, respectively. At the close of business on

December 2, 2021, there were 275,010,405 Units and 172,203,692

Exchangeable Shares issued and outstanding. Under Brookfield

Renewable’s normal course issuer bids, it may repurchase up to

44,591 Units and 54,448 Exchangeable Shares on the TSX during any

trading day, which represents 25% of the average daily trading

volume of 178,365 Units and 217,793 Exchangeable Shares,

respectively, for the six months ended November 30, 2021.

Repurchases under each normal course issuer bid

are authorized to commence on December 16, 2021 and each normal

course issuer bid will terminate on December 15, 2022, or earlier

should either BEP or BEPC complete its repurchases prior to such

date.

Under BEP’s prior normal course issuer bid that

commenced on December 16, 2020 and expires on December 15, 2021,

BEP previously sought and received approval from the TSX to

repurchase up to 13,740,072 Units (on a post-stock split basis).

BEP has not repurchased any Units under its existing normal course

issuer bid in the past 12 months.

Under BEPC’s prior normal course issuer bid that

commenced on December 16, 2020 and expires on December 15, 2021,

BEPC previously sought and received approval from the TSX to

repurchase up to 8,609,220 Exchangeable Shares (on a post-stock

split basis). BEPC has not repurchased any Exchangeable Shares

under its existing normal course issuer bid in the past 12

months.

All purchases will be made through the

facilities of the TSX, the New York Stock Exchange and/or

alternative trading systems, if eligible, and all Units and

Exchangeable Shares acquired under the applicable normal course

issuer bid will be cancelled. Repurchases will be subject to

compliance with applicable United States federal securities laws,

including Rule 10b-18 under the United States Securities Exchange

Act of 1934, as amended, as well as applicable Canadian securities

laws.

From time to time, when Brookfield Renewable

does not possess material non-public information about itself or

its securities, it may enter into an automatic purchase plan with

its broker to allow for the repurchase of Units or Exchangeable

Shares, as applicable, subject to certain trading parameters, at

times when Brookfield Renewable ordinarily would not be active in

the market due to its own internal trading blackout periods and

insider trading rules or otherwise. Any such plans entered into

with the broker of Brookfield Renewable will be adopted in

accordance with applicable Canadian and U.S. securities

laws including the requirements of Rule 10b5-1 under the United

States Securities Exchange Act of 1934, as amended. Outside of

these periods, Units and Exchangeable Shares will be repurchased in

accordance with management’s discretion and in compliance with

applicable law.

Brookfield Renewable operates

one of the world’s largest publicly traded, pure-play renewable

power platforms. Our portfolio consists of hydroelectric, wind,

solar and storage facilities in North America, South America,

Europe and Asia, and totals approximately 21,000 megawatts of

installed capacity and an approximately 36,000-megawatt development

pipeline. Investors can access its portfolio either through

Brookfield Renewable Partners L.P. (NYSE: BEP; TSX: BEP.UN), a

Bermuda-based limited partnership, or Brookfield Renewable

Corporation (NYSE, TSX: BEPC), a Canadian corporation. Further

information is available at https://bep.brookfield.com. Important

information may be disseminated exclusively via the website;

investors should consult the site to access this information.

Brookfield Renewable is the flagship listed

renewable power company of Brookfield Asset Management, a leading

global alternative asset manager with approximately $650 billion of

assets under management.

|

Contact information: |

|

|

Media: |

Investors: |

|

Kerrie McHugh |

Robin Kooyman |

|

Senior Vice President – Corporate

Communications |

Senior Vice President – Investor Relations |

|

(212) 618-3469 |

(416) 649-8172 |

|

Kerrie.mchugh@brookfield.com |

robin.kooyman@brookfield.com |

Cautionary Statement Regarding

Forward-looking Statements

This news release contains forward-looking

statements and information within the meaning of Canadian

securities laws and “forward-looking statements” within the meaning

of Section 27A of the U.S. Securities Act of 1933, as

amended, Section 21E of the U.S. Securities Exchange Act

of 1934, as amended, “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995 and in any

applicable Canadian securities regulations. Forward-looking

statements may include estimates, plans, expectations, opinions,

forecasts, projections, guidance or other statements that are not

statements of fact. Forward-looking statements can be identified by

the use of words such as “believes” and “may” or variations of such

words and phrases and include statements regarding potential future

repurchases by BEP and BEPC. Although BEP and BEPC believe

that these forward-looking statements and information are based

upon reasonable assumptions and expectations, the reader should not

place undue reliance on them, or any other forward-looking

statements or information in this news release. The future

performance and prospects of BEP and BEPC are subject to a number

of known and unknown risks and uncertainties. Factors that could

cause actual results of BEP and BEPC to differ materially from

those contemplated or implied by the statements in this news

release include: general economic conditions; interest rate

changes; availability of equity and debt financing; the performance

of the Units and Exchangeable Shares or the stock exchanges

generally; and other risks and factors described in the documents

filed by BEP and BEPC with securities regulators in Canada and the

United States including under “Risk Factors” in (i) BEP’s most

recent Annual Report on Form 20-F and (ii) BEPC’s most recent

Annual Report on Form 20-F, and other risks and factors that are

described therein.

Except as required by law, BEP and BEPC do not

undertake any obligation to publicly update or revise any

forward-looking statements or information, whether written or oral,

whether as a result of new information, future events or

otherwise.

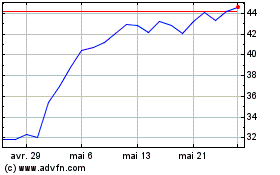

Brookfield Renewable (TSX:BEPC)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Brookfield Renewable (TSX:BEPC)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025