AirBoss of America Corp. (TSX: BOS) (OTCQX: ABSSF) (the “Company”

or “AirBoss”) today announced its first quarter 2024 results. The

Company's annual general and special meeting will be held on

Thursday, May 9th at 9:00 am (EDT). Along with the formal portion

of the meeting, management will provide a presentation including a

discussion of Q1 2024 results. The meeting will be accessible in

person, via live webcast or by dialing in to the numbers provided

later in this release. All dollar amounts are shown in thousands of

United States dollars ("US $" or "$"), except per share amounts,

unless otherwise noted.

Recent Highlights

- AirBoss

Manufactured Products' defense business was awarded a contract

valued at up to $45 million to provide its Bandolier multipurpose

energetic system to a NATO partner nation;

- Reduced

borrowings under our credit facilities by $11.1 million, in the

first quarter of 2024 ("Q1 2024");

- Reached a

settlement of the class action lawsuit pending against the Company

in Canada, subject to standard conditions and court approvals;

- Amended our

credit facilities to replace the leverage and interest coverage

ratios with minimum Adjusted EBITDA and liquidity requirements;

and

- Declared a

quarterly dividend of C$0.035 per common share.

"AirBoss remained focused on operational

execution, aggressive deleveraging and the implementation of our

recently-announced strategic transition during the first quarter of

2024, while continuing to navigate challenging economic headwinds,"

said Chris Bitsakakis, President and Co-CEO of AirBoss. "At AirBoss

Rubber Solutions, we experienced progressive traction compared to

the prior calendar quarter and saw volumes which increased during

Q1 2024. At Manufactured Products, the rubber molded and defense

product lines both experienced softness in the quarter. However, we

are encouraged by the recently announced Bandolier awards, totaling

up to $57 million, and the positive traction this product line has

experienced in the past twelve months. We also amended our credit

facilities during the quarter, replacing the leverage and interest

coverage ratios with minimum Adjusted EBITDA and liquidity

requirements, changes which we believe are in the best interest of

our shareholders and other stakeholders as they will enable us to

invest in our long-term growth and create sustainable value."

"As previously stated, we believe our shift in

strategic focus will help prioritize investments, drive long-term

shareholder value, growth and be accretive to the Company,” added

Gren Schoch, Chairman and Co-CEO. “Our priorities remain growing

the core Rubber Solutions segment, a renewed focus on core

competencies in the Manufactured Products segment and a focus on

adding new compounds and products, technical capabilities, and

geographic reach into selected North American and international

markets. We remain committed to our goal of growing AirBoss as a

global market leader in the custom rubber compounding market and

the industries which we serve."

|

Three-months ended March 31In thousands of

US dollars, except share data |

|

|

|

|

(unaudited) |

2024 |

|

2023 |

|

Financial results: |

|

|

|

|

Net sales |

103,490 |

|

|

117,076 |

|

Profit (loss) |

(4,927 |

) |

|

1,455 |

|

Adjusted Profit1 |

(4,927 |

) |

|

1,571 |

|

Earnings (loss) per share (US$) |

|

|

|

| –

Basic |

(0.18 |

) |

|

0.05 |

| –

Diluted |

(0.18 |

) |

|

0.05 |

|

Adjusted earnings per share1 (US$) |

|

|

|

| –

Basic |

(0.18 |

) |

|

0.06 |

| –

Diluted |

(0.18 |

) |

|

0.06 |

|

EBITDA1 |

4,317 |

|

|

10,168 |

|

Adjusted EBITDA1 |

4,317 |

|

|

10,320 |

| Net

cash provided by (used in) operating activities |

(5,567 |

) |

|

6,002 |

|

Free cash flow1 |

(7,378 |

) |

|

5,181 |

|

Dividends declared per share (CAD$) |

0.07 |

|

|

0.10 |

|

Capital additions |

2,159 |

|

|

1,105 |

|

Financial position: |

March 31, 2024 |

|

December 31, 2023 |

|

Total assets |

342,007 |

|

|

356,656 |

|

Debt2 |

119,400 |

|

|

131,092 |

| Net

Debt1 |

97,567 |

|

|

88,213 |

|

Shareholders' equity |

142,769 |

|

|

148,857 |

|

Outstanding shares* |

27,130,556 |

|

|

27,130,556 |

|

*27,130,556 at May 8, 2024 |

|

|

|

1 See Non-IFRS and Other Financial Measures.2

Debt as at March 31, 2024 and December 31, 2023 include

lease liabilities of $13,642 and $13,890, respectively.

Financial Results

Consolidated net sales in Q1 2024 decreased by

11.6% to $103,490 compared with the first quarter of 2023 ("Q1

2023"). The decrease was primarily attributable to lower sales at

both AirBoss Rubber Solutions ("ARS") and AirBoss Manufactured

Products ("AMP"). Consolidated gross profit for Q1 2024 decreased

by $7,764 to $14,173, compared with Q1 2023, driven primarily by

volume at AMP and specifically in the defense business with

additional softness experienced at the rubber molded products

operations. Gross profit as a percentage of net sales decreased to

13.7% in Q1 2024 compared with 18.7% for Q1 2023, primarily due to

reductions at AMP driven by volume and product mix, partially

offset by improvements at Rubber Solutions. Adjusted EBITDA for Q1

2024 decreased by 58.2%, compared to the same period in 2023.

Financial Position

The Company retains a $150 million credit

facility and a net debt to TTM Adjusted EBITDA ratio of 4.70x (from

3.30x at December 31, 2023).

Dividend

The Board of Directors of the Company has

approved a quarterly dividend of C$0.035 per common share, to be

paid on July 15, 2024 to shareholders of record at June 28,

2024.

Segment Results

In the Rubber Solutions segment, net sales for

Q1 2024 decreased by 3.1% to $65,469, from $67,556 in Q1 2023.

Volume was up 2.3% with increases in several sectors due to

increased momentum in the mining and industrial sectors especially

towards the end of the quarter. Tolling volume was down 23.2% while

non-tolling volume was up 3.6%. Gross profit at Rubber Solutions

for Q1 2024 increased by 27.9% to $11,033, from $8,625 in Q1 2023.

The increase in gross profit was primarily the result of volume

increases and product mix in addition to managing controllable

overhead costs including additional overhead reductions and

continuous improvement initiatives.

At Manufactured Products, net sales for Q1 2024

decreased by 26.2% to $42,341, from $57,399 in Q1 2023. The

decrease was primarily due to decreases across most of the defense

business products lines in addition to lower volumes in the rubber

molded products operations, specifically in SUV and light truck

platforms, driven by economic headwinds and softness which impacted

production schedules across certain OEMs and Tier 1 suppliers in

the quarter. Gross profit at Manufactured Products for Q1 2024

decreased to $3,140 from $13,312 in Q1 2023. This decrease was

primarily the result of unfavourable volume and product mix in the

defense business in addition to volume in the rubber molded

products operations, partially offset by operational cost

improvements and reduced overhead costs.

OVERVIEW

During Q1 2024, AirBoss maintained its focus on

operational execution, aggressive deleveraging activities and the

recently-announced strategic transition, despite continuing to deal

with challenging economic headwinds that impacted each segment to

varying degrees. The Company focused on risk mitigation plans in

response to these economic challenges and managing costs with

additional steps taken in Manufactured Products' defense business.

This included amending our credit facilities to replace the

leverage and interest coverage ratios with minimum Adjusted EBITDA

and liquidity requirements until the end of 2024. As disclosed

during Q1 2024, the Company completed a re-segmentation which

included a shift in reportable segments commencing with results for

the fourth quarter of 2023 ("Q4 2023") and the year ended December

31, 2023. AirBoss now reports results under two segments: (1)

AirBoss Rubber Solutions, and (2) AirBoss Manufactured

Products. The ARS segment consists of the former rubber solutions

segment and the rubber compounding operations at Acton Vale, Quebec

(previously included in the AirBoss Defense Group segment). The new

AMP segment consists of AirBoss Engineered Products, formerly a

standalone segment, and AirBoss Defense Group, formerly a

standalone segment (other than the rubber compounding operations at

Acton Vale, Quebec).

ARS experienced progressive traction over the

prior quarter and saw volumes bounce back in Q1 2024. This was in

contrast to AMP which experienced continued softness in Q1 2024 in

both the rubber molded products operations and the defense

business. The rubber molded products operations at AMP were

impacted by volume softness related to the original equipment

manufacturers (OEMs) shuttering production in the current quarter

as they rebalanced vehicle inventory levels. The defense business

saw continued softness which carried over from Q4 2023, supporting

the need for further overhead reductions to help mitigate the

volume softness. The ability to recover in volumes in 2024 for each

segment will remain subject to the ongoing challenges related to

continued inflation pressure and ongoing global geopolitical

challenges, and successful conversion of key opportunities.

ARS experienced improvements in most business

lines compared to Q4 2023, and Q1 2024 was a strong quarter with

respect to sales and EBITDA. Despite strong performance during the

earlier part of 2023, there was pronounced softness experienced at

the end of Q4 2023 as sales were impacted by customers focused on

reducing inventory levels. Building on the traction experienced in

Q1 2024, the segment remains focused on executing on its strategy

to deliver strong results with specialized products, expanded

production of a broader array of compounds (white and color) and

enhanced flexibility in attracting and fulfilling new business

through identified synergies and margin expansion. As a segment,

Rubber Solutions continued to invest in research and development to

support enhanced collaboration with customers.

AMP experienced continued softness in the rubber

molded products operations as a result of OEMs shuttering

production in the current quarter to rebalance vehicle inventory

levels, and the ongoing impact from labor disruptions which

impacted OEMs in the earlier part of the prior quarter. The

business continued its focus on managing costs and a commitment to

drive efficiencies and best-in-class automation, as well as

diversification of its product lines into adjacent sectors. The

defense business experienced continued softness across the product

portfolio throughout the quarter. Management continued its focus on

operational improvements and executed on additional cost cutting

measures. In addition, the defense business continued to work with

its key customers with a goal of leveraging opportunities aligned

with its growth initiatives, subject to timing as delays in the

conversion of these opportunities continued through the first

quarter of 2024.

The Company’s long-term priorities consist of

the following:

- Growing the core

Rubber Solutions segment by emphasizing rubber compounding as the

core driver for sustainable growth and productivity, focusing on

innovation in custom rubber compounding while aiming to expand

market share through organic and inorganic means, while striving to

achieve enhanced diversification by a broadening of product breadth

through technological advancements and investments in specialty

compound niches;

- Manufactured

Products' growth strategy will be focused on diversifying and

expanding its range of rubber molded products while simultaneously

narrowing the range of defense products through a renewed focus on

core competencies; and

- Undertaking a

strategic review of all product lines currently manufactured and

sold by the Company in its Manufactured Products segment while

targeting additional acquisition opportunities with a focus on

adding new compounds and products, technical capabilities, and

geographic reach into selected North American and international

markets.

AirBoss continues to focus on these long-term

priorities while investing in core areas of the business to expand

a solid foundation that will support long-term growth.

AirBoss General and Special Meeting and

Q1 Results Earnings Webcast

The Company's Annual and General Special Meeting

for Shareholders will occur on May 9, 2024 at 9:00 am (EDT) at the

Delta Hotel at 110 Erb St. W in Waterloo, Ontario. In addition to

the formal shareholders' meeting, management will provide a webcast

presentation including a discussion of Q1 2024 results.

For webcast access, please go online at

https://airboss.com/AnnualGeneralMeeting2024. We recommend that

viewers log in at least 15 minutes early before the meeting starts.

If watching the meeting online, it is important to remain connected

to the internet at all times during the meeting. It is each

person’s responsibility to ensure connectivity for the duration of

the meeting. The live webcast will include a facility for

shareholders to enter questions for management.

For telephone access, please dial in at

1-800-319-4610 or 1-416-915-3239, access code: 55506. Callers

should dial-in five to 10 minutes before the meeting starts and ask

to join the call. When prompted, the access code should be

provided.

AirBoss of America Corp.

AirBoss of America is a diversified developer,

manufacturer and provider of survivability solutions, advanced

custom rubber compounds and finished rubber products that are

designed to outperform in the most challenging environments.

Founded in 1989, the company operates through two divisions.

AirBoss Rubber Solutions is a North American custom rubber

compounder with 500 million turn pounds of annual capacity. AirBoss

Manufactured Products is a supplier of anti-vibration and rubber

molded solutions to the North American automotive market and other

sectors, and also a global supplier of personal and respiratory

protective equipment and technology for the defense, healthcare,

medical and first responder communities, through AirBoss Defense

Group. The Company’s shares trade on the TSX under the symbol BOS

and on the OTCQX under the symbol ABSSF. Visit www.airboss.com for

more information.

Non – IFRS and Other Financial

Measures: This earnings release is based on consolidated

financial statements prepared in accordance with International

Financial Reporting Standards (“IFRS”) and Non-IFRS Financial

Measures. Management believes that these measures provide useful

information to investors in measuring the financial performance of

the Company. These measures do not have a standardized meaning

prescribed by IFRS and therefore they may not be comparable to

similarly titled measures presented by other companies and should

not be construed as an alternative to other financial measures

determined in accordance with IFRS. These terms are not a measure

of performance under IFRS and should not be considered in isolation

or as a substitute for net income under IFRS.

EBITDA and Adjusted EBITDA are non-IFRS measures

used to measure the Company's ability to generate cash from

operations for debt service, to finance working capital and capital

expenditures, potential acquisitions and to pay dividends. EBITDA

is defined as earnings before income taxes, finance costs,

depreciation, and amortization. Adjusted EBITDA is defined as

EBITDA excluding impairment costs, acquisition costs, and

non-recurring costs. A reconciliation of profit (loss) to EBITDA

and Adjusted EBITDA is below.

|

Three-months ended March 31 (unaudited) |

|

|

|

In thousands of US dollars |

2024 |

2023 |

|

EBITDA: |

|

|

|

Profit (loss) |

(4,927 |

) |

1,455 |

|

Finance costs |

2,909 |

|

2,729 |

|

Depreciation and amortization |

5,379 |

|

5,537 |

|

Income tax expense |

956 |

|

447 |

|

EBITDA |

4,317 |

|

10,168 |

|

Professional fees related to AEP negotiations |

— |

|

152 |

|

Adjusted EBITDA |

4,317 |

|

10,320 |

In 2022, the Company negotiated improved

arrangements with automotive business' key suppliers and customers

to improve profitability. Professional fees related to these

activities are included in General & Administrative Costs on

the Statement of Profit and Loss.

Adjusted profit is a non-IFRS measure defined as profit before

impairment costs, acquisition costs and non-recurring costs. This

measure and Adjusted earnings per share are used to evaluate

operating results of the Company. A reconciliation of Profit to

Adjusted profit and Adjusted earnings per share is below.

|

Three-months ended March 31 (unaudited) |

|

|

|

In thousands of US dollars |

2024 |

2023 |

|

Adjusted profit: |

|

|

|

Profit (loss) |

(4,927 |

) |

1,455 |

|

Professional fees related to AEP negotiations (after tax) |

— |

|

116 |

|

Adjusted profit |

(4,927 |

) |

1,571 |

|

|

|

|

|

Basic weighted average number of shares outstanding |

27,131 |

|

27,092 |

|

Diluted weighted average number of shares outstanding |

27,131 |

|

27,702 |

|

|

|

|

|

Adjusted earnings per share (in US dollars): |

|

|

|

Basic |

(0.18 |

) |

0.06 |

|

Diluted |

(0.18 |

) |

0.06 |

Net Debt measures the financial indebtedness of

the Company assuming that all cash on hand is used to repay a

portion of the outstanding debt. A reconciliation of loans and

borrowings to Net Debt is below.

|

|

March 31, 2024 |

December 31, 2023 |

|

In thousands of US dollars |

(unaudited) |

|

|

Net debt: |

|

|

|

Loans and borrowings - current |

2,510 |

|

|

2,437 |

|

|

Loans and borrowings - non-current |

116,890 |

|

|

128,655 |

|

|

Leases included in loans and borrowings |

(13,642 |

) |

|

(13,890 |

) |

|

Cash and cash equivalents |

(8,191 |

) |

|

(28,989 |

) |

|

Net debt |

97,567 |

|

|

88,213 |

|

Free cash flow is a non-IFRS measure used to

evaluate cash flow after investing in the maintenance or expansion

of the Company's business. It is defined as cash provided by

operating activities, less cash expenditures on long-term assets. A

reconciliation of cash from operating activities to free cash flow

is below.

|

Three-months ended March 31 (unaudited) |

|

|

|

In thousands of US dollars |

2024 |

2023 |

|

Free cash flow: |

|

|

|

Net cash provided by (used in) operating activities |

(5,567 |

) |

6,002 |

|

|

Acquisition of property, plant and equipment |

(1,645 |

) |

(569 |

) |

|

Acquisition of intangible assets |

(170 |

) |

(252 |

) |

|

Proceeds from disposition |

4 |

|

— |

|

|

Free cash flow |

(7,378 |

) |

5,181 |

|

|

|

|

|

|

Basic weighted average number of shares outstanding |

27,131 |

|

27,092 |

|

|

Diluted weighted average number of shares outstanding |

27,131 |

|

27,702 |

|

|

|

|

|

|

Free cash flow per share (in US dollars): |

|

|

|

Basic |

(0.27 |

) |

0.19 |

|

|

Diluted |

(0.27 |

) |

0.19 |

|

AIRBOSS FORWARD-LOOKING INFORMATION

DISCLAIMER

Certain statements contained or incorporated by

reference herein, including those that express management’s

expectations or estimates of future developments or AirBoss’ future

performance, constitute “forward-looking information” or

“forward-looking statements” within the meaning of applicable

securities laws, and can generally be identified by words such as

“will”, “may”, “could”, “expects”, “believes”, “anticipates”,

“forecasts”, “plans”, “intends”, “should” or similar expressions.

These statements are not historical facts but instead represent

management’s expectations, estimates and projections regarding

future events and performance.

Statements containing forward-looking

information are necessarily based upon a number of opinions,

estimates and assumptions that, while considered reasonable by

management at the time the statements are made, are inherently

subject to significant business, economic and competitive risks,

uncertainties and contingencies. AirBoss cautions that such

forward-looking information involves known and unknown

contingencies, uncertainties and other risks that may cause

AirBoss’ actual financial results, performance or achievements to

be materially different from its estimated future results,

performance or achievements expressed or implied by the

forward-looking information. Numerous factors could cause actual

results to differ materially from those in the forward-looking

information, including without limitation: impact of general

economic conditions, notably including its impact on demand for

rubber solutions and products; dependence on key customers; global

defense budgets, notably in the Company’s target markets, and

success of the Company in obtaining new or extended defense

contracts; cyclical trends in the tire and automotive,

construction, mining and retail industries; sufficient availability

of raw materials at economical costs; weather conditions affecting

raw materials, production and sales; AirBoss’ ability to maintain

existing customers or develop new customers in light of increased

competition; AirBoss’ ability to successfully integrate

acquisitions of other businesses and/or companies or to realize on

the anticipated benefits thereof; AirBoss’ ability to successfully

develop and execute effective business strategies; changes in

accounting policies and methods, including uncertainties associated

with critical accounting assumptions and estimates; changes in the

value of the Canadian dollar relative to the US dollar; changes in

tax laws; current and future litigation; ability to obtain

financing on acceptable terms and ability to satisfy the covenants

set forth in such financing arrangements; environmental damage and

non-compliance with environmental laws and regulations; impact of

global health situations; potential product liability and warranty

claims and equipment malfunction. There is increased uncertainty

associated with future operating assumptions and expectations as

compared to prior periods. This list is not exhaustive of the

factors that may affect any of AirBoss’ forward-looking

information.

All of the forward-looking information in this

press release is expressly qualified by these cautionary

statements. Investors are cautioned not to put undue reliance on

forward-looking information. All subsequent written and oral

forward-looking information attributable to AirBoss or persons

acting on its behalf are expressly qualified in their entirety by

this notice. Forward-looking information contained herein is made

as of the date of this press release and, whether as a result of

new information, future events or otherwise, AirBoss disclaims any

intent or obligation to update publicly the forward-looking

information except as required by applicable laws. Risks and

uncertainties about AirBoss’ business are more fully discussed

under the heading “Risk Factors” in our most recent Annual

Information Form and are otherwise disclosed in our filings with

securities regulatory authorities which are available on SEDAR+ at

www.sedarplus.com.

Investor Contact: investor.relations@airboss.com

Media Contact: media@airboss.com

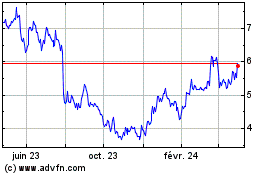

AirBoss of America (TSX:BOS)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

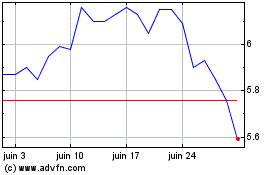

AirBoss of America (TSX:BOS)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024