A.M. Best Affirms Ratings of Co-operators General Insurance Company, Its Subsidiary and Co-operators Life Insurance Company

21 Mai 2014 - 4:50PM

Business Wire

A.M. Best has affirmed the financial strength rating

(FSR) of A- (Excellent) and issuer credit ratings (ICR) of “a-” of

Co-operators General Insurance Company (Co-operators

General) and its subsidiary, The Sovereign General Insurance

Company (Sovereign) (Alberta).

In addition, A.M. Best has affirmed the FSR of A (Excellent) and

ICR of “a” of Co-operators Life Insurance Company

(Co-operators Life) (Saskatchewan). The outlook for all ratings is

stable.

Concurrently, A.M. Best has withdrawn the debt ratings of “bbb-”

of the preferred shares of CAD 100 million 5% non-cumulative

redeemable Class E preference shares, Series C [TSX: CCS.PR.C] and

CAD 115 million 7.25% non-cumulative five-year reset Class E

preference shares, Series D [TSX: CCS.PR.D] issued by Co-operators

General.

Co-operators General, Sovereign and Co-operators Life are part

of The Co-operators Group Limited. All companies are

domiciled in Ontario, unless otherwise specified.

The ratings of Co-operators General recognize its solid

risk-adjusted capitalization, profitable operating performance,

strong brand name recognition, product line and geographic

diversifications, as well as the effective use of its subsidiaries

and multiple channels of distribution.

Partially offsetting these strengths are strong competitive

market pressure, a trend of more frequent and severe losses from

storms across Canada, as well as the uncertainty surrounding the

impact of mandatory rate reductions in Ontario auto lines.

The ratings of Sovereign acknowledge its continued favorable

operating performance, solid risk-adjusted capital position and its

strategic position of importance to the entire organization.

Partially offsetting these positive rating factors are the soft

commercial lines pricing and historically higher expense ratio.

However, these concerns are mitigated by the explicit financial

support and guarantee provided by Co-operators General.

The ratings for Co-operators Life reflect its strong capital

position (both on an absolute and risk-adjusted basis), increased

operating earnings and growth in premiums within its core business

segments. The company offers a wide variety of products to

individual, group and credit union markets throughout Canada.

Partially offsetting these strengths are the continued losses in

Co-operators Life’s group business and the challenges it faces

regarding competition from larger players in the Canadian life

market. Furthermore, earnings have been constrained in recent

periods by the impact of the low interest environment, which has

led to some product redesigns.

The ratings and outlook of the organization could benefit from a

consistently favorable earnings trend that outperforms its peers

while maintaining strong risk-adjusted capitalization. However,

negative rating pressure could occur if an unfavorable earnings

trend develops and capital erodes.

The methodology used in determining these ratings is Best’s

Credit Rating Methodology, which provides a comprehensive

explanation of A.M. Best’s rating process and contains the

different rating criteria employed in the rating process. Best’s

Credit Rating Methodology can be found at

www.ambest.com/ratings/methodology.

A.M. Best Company is the world's oldest and most

authoritative insurance rating and information source. For more

information, visit www.ambest.com.

Copyright © 2014 by A.M. Best Company,

Inc. ALL RIGHTS RESERVED.

A.M. BestJacqalene Lentz—P/C, 908-439-2200, ext.

5762Senior Financial

Analystjacqalene.lentz@ambest.comorEdward Kohlberg—L/H,

908-439-2200, ext. 5664Senior Financial

Analystedward.kohlberg@ambest.comorRachelle Morrow,

908-439-2200, ext. 5378Senior Manager, Public

Relationsrachelle.morrow@ambest.comorJim Peavy,

908-439-2200, ext. 5644Assistant Vice President, Public

Relationsjames.peavy@ambest.com

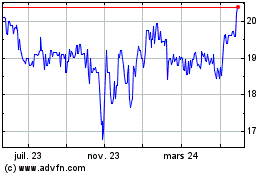

Co Operators General Ins... (TSX:CCS.PR.C)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

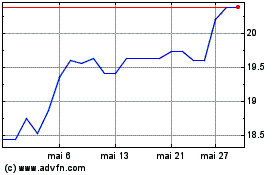

Co Operators General Ins... (TSX:CCS.PR.C)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025