Canacol Energy Ltd. (“Canacol” or the “Corporation”) (TSX:CNE;

OTCQX:CNNEF; BVC:CNEC) is pleased to provide its capital and gas

sales guidance for 2024. Dollar amounts are expressed in United

States dollars, with the exception of Canadian dollar unit prices

(“C$”) where indicated and otherwise noted.

The Corporation announces that its 2024 capital

budget is between $138 million and $151 million. Forecast average

realized contractual gas sales for 2024, which include downtime,

are anticipated to range between 160 and 177 million cubic feet per

day (“MMcfpd”). The Corporation’s firm 2024 take-or-pay contracts

alone average 124 MMcfpd, net of contractual downtime. The average

wellhead sales price, net of transportation costs, is approximately

$6.04/Mcf for our firm take-or-pay contracts. The average wellhead

sales price (including take or pay and interruptibles volumes), net

of transportation costs, is expected to average $6.59/Mcf.

Forecast interruptible sales include potential

sales to the Celsia-operated Tesorito gas-fired power plant, in

which the Corporation holds a 10% stake. The plant operates

intermittently to supply electricity to the national grid during

periods of high electrical demand. When operating at full capacity

the plant will consume approximately 40 million standard cubic feet

per day to generate around 200 MW of electricity.

Corporate Strategy Update

Charle Gamba, President and CEO of Canacol,

stated: “As we previously stated, the Corporation’s long-term plan

is focused on i) maintaining and growing our reserve base and

production from our core assets in the Lower Magdalena Valley

Basin, targeting the full use of existing transportation

infrastructure; ii) exploring high impact exploration opportunities

in the Middle Magdalena Valley Basin; iii) strategic entrance into

the gas market in Bolivia, and iv) continue to improve our ESG

scores.

For 2024, the Corporation is focused on the

following objectives:

1) In line with maintaining and

growing our reserves and production in our core gas assets in the

Lower Magdalena Valley Basin (“LMV”), we have planned comprehensive

development and exploration programs. We aim to optimize our

production and increase reserves by drilling up to 5 development

wells, install new compression and processing facilities as

required, and workover operations of producing wells in our key gas

fields. We will also drill 4 exploration wells, complete the

acquisition of 249 square kilometers of 3D seismic to add new

reserves and production and to identify new drilling prospects.

These development and exploration activities are planned to support

our robust EBITDA generation and allow us to capitalize on strong

market dynamics in 2024.

2) Maintaining a low cost of

capital, cash liquidity and balance sheet flexibility to invest for

the long term. In a year of expected, highly supportive gas market

dynamics, we are tactically prioritizing investments in the LMV and

have therefore decided to postpone drilling of the Pola 1

exploration well located in the Middle Magdalena Valley Basin to

2025.

3) Bolivia: achieve the

government’s approval of a fourth E&P contract that covers an

existing gas field reactivation, to begin development operations

with a view to adding reserves and production and commencing gas

sales in 2025.

4) Continue with our commitment

to our environmental, social and governance strategy.

2024 Corporate GuidanceProvided

below is the Corporation’s guidance for 2024:

|

Highlights |

2023E |

2024 Low End Guidance |

2024 High End Guidance |

|

Natural Gas Sales Volume (MMcfpd) |

178 |

160 |

177 |

|

EBITDA ($ millions) |

236 |

250 |

290 |

|

Capital Expenditures ($ millions) |

205 |

138 |

151 |

2024 Capital Program

|

|

2023E |

2024 Low End Guidance |

2024 High End Guidance |

|

Development and Maintenance |

$95 |

$73 |

$77 |

|

Exploration (Wells, Seismic, and EIA) |

$90 |

$48 |

$56 |

|

Administrative, social, environmental and other |

$20 |

$17 |

$18 |

|

Total capital expenditures |

$205 |

$138 |

$151 |

The 2024 capital program balances the continued

development of our existing reserves to optimize our production

with exploration, targeting the addition of new reserves and

production.

During the first half of 2024, we are planning

an active development drilling and workover program, coupled with

investments in additional compression and processing facilities, to

ensure that sufficient productive capacity exists to meet

potentially high gas demand during the first half of 2024 related

to the effects of El Nino. Our development plans include the

drilling of up to 5 new wells. Our exploration plans include the

drilling of 2 relatively low risk Cienaga de Oro prospects located

close to transportation infrastructure in our core producing area,

and 2 exploration wells targeting higher impact, slightly higher

risk prospects which have the potential to open up new production

areas.

2024 Financial Highlights

|

|

2023E |

2024 Low End Guidance |

2024 High End Guidance |

|

Natural gas sales volume (MMcfpd) |

178 |

160 |

177 |

|

Interruptible spot sales as a % of total |

17% |

23% |

30% |

|

Average gas sales price ($/Mcf) |

$5.41 |

$6.59 |

$6.59 |

|

Netback ($/Mcf) |

$4.11 |

$4.91 |

$4.99 |

|

EBITDA ($ millions) |

$236 |

$250 |

$290 |

|

Capital expenditures ($ millions) |

$205 |

$138 |

$151 |

As we have stated before, one of our long-term

corporate objectives is to reduce debt. However, given current

favorable gas market dynamics, the Corporation has decided to

maintain substantial investments in its key producing blocks

located in the Lower Magdalena Valley Basin, aimed at capitalizing

on the prevailing market conditions. As a result of favorable

market conditions that we expect to help us achieve high netbacks

during 2024, we anticipate ending 2024 with net debt to EBITDA

levels of 2.4x to 2.8x, which falls well below our debt covenants

of 3.25x to 3.5x.

A 5% increase/decrease in average sales price

(+/- $0.33/Mcf) will have an EBITDA impact of approximately $16

million and $18 million on the low end guidance and the high end

guidance, respectively.

The Corporation will continue to evaluate the

Return of Capital to Shareholders on a quarterly basis, in

accordance with the Corporation's policy, aiming to achieve a

balanced assessment of the Corporation’s strategy while being

conscious of the diverse interests of our stakeholders.

The Corporation will provide regular production

and operational updates on a quarterly basis starting with the

first quarter of 2024. Material changes with respect to

gas sales, exploration drilling results, or any other matters

during the quarter will continue to be disclosed in accordance with

applicable material information disclosure requirements.

About Canacol

Canacol is a natural gas exploration and

production company with operations focused in Colombia. The

Corporation's common stock trades on the Toronto Stock Exchange,

the OTCQX in the United States of America, and the Colombia Stock

Exchange under ticker symbol CNE, CNNEF, and CNE.C,

respectively.

Forward-Looking Statements

This news release contains "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995 and applicable Canadian securities legislation.

All statements other than statements of historical fact contained

in this news release may be forward-looking statements. Such

statements can generally be identified by words such as "may,"

"target," "could," "would," "will," "should," "believe," "expect,"

"anticipate," "plan," "intend," "foresee" and other similar words

or phrases. In particular, forward-looking statements herein

include, but are not limited to, statements relating to the

expectations regarding the use of proceeds of the proposed

offering. Such forward-looking statements involve known and unknown

risks, uncertainties and other factors that may cause actual

results or events to differ materially from those anticipated in

the forward-looking statements. Canacol believes that the

expectations reflected in such forward-looking statements are

reasonable, but no assurance can be given that these expectations

will prove to be correct and such forward-looking statements should

not be unduly relied upon. The forward-looking statements are

expressly qualified in their entirety by this cautionary statement.

The forward-looking statements are made as of the date of this news

release and Canacol assumes no obligation to update or revise them

to reflect new events or circumstances, except as expressly

required by applicable securities law. Further information

regarding risks and uncertainties relating to Canacol and its

securities can be found in the disclosure documents filed by

Canacol with the securities regulatory authorities, available at

www.sedar.com.

For more information please contact:

Investor Relations

South America: +571.621.1747 IR-SA@canacolenergy.com

Global: +1.403.561.1648 IR-GLOBAL@canacolenergy.com

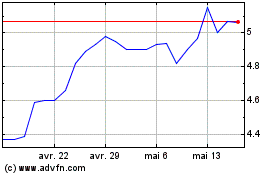

Canacol Energy (TSX:CNE)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Canacol Energy (TSX:CNE)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024