CN announces plan to buy back, through private agreements, up to five million common shares under current 33-million share repur

03 Décembre 2007 - 10:15PM

Marketwired

MONTREAL, QUEBEC (NYSE: CNI) announced today that it intends to

purchase for cancellation up to five million of its common shares

outstanding, or approximately one per cent of its common share

outstanding at Nov. 30, 2007, pursuant to private agreements

between CN and an arm's-length third-party seller. The purchase(s)

will form part of CN's 33-million share repurchase program

announced on July 23, 2007.

Such purchase(s) will be made pursuant to an issuer bid

exemption order issued by the Ontario Securities Commission and

will take place by way of one or several purchases before the end

of February 2008. The price that CN will pay for the common shares

purchased by it under such agreements will be negotiated by CN and

the seller, provided that in no circumstances will the price paid

for the shares be greater than the closing market price of CN's

common shares on the Toronto Stock Exchange on the date of the

purchase.

This news release contains forward-looking statements. CN

cautions that, by their nature, forward-looking statements involve

risk, uncertainties and assumptions, and while there may be a risk

of recession in the United States economy, the Company's assumption

is that positive economic conditions in North America and globally

will continue, which assumption may not materialize, and that its

results could differ materially from those expressed or implied in

such statements. Important factors that could cause such

differences include, but are not limited to, industry competition,

legislative and/or regulatory developments, compliance with

environmental laws and regulations, various events which could

disrupt operations, including natural events such as severe

weather, droughts, floods and earthquakes, the effects of adverse

general economic and business conditions, inflation, currency

fluctuations, changes in fuel prices, labour disruptions,

environmental claims, investigations or proceedings, other types of

claims and litigation, and other risks detailed from time to time

in reports filed by CN with securities regulators in Canada and the

United States. Reference should be made to CN's most recent Form

40-F filed with the United States Securities and Exchange

Commission, its Annual Information Form filed with the Canadian

securities regulators, and its 2006 Annual Consolidated Financial

Statements and Notes thereto and Management's Discussion and

Analysis (MD&A), as well as its 2007 quarterly consolidated

financial statements and MD&A, for a summary of major

risks.

CN - Canadian National Railway Company and its operating railway

subsidiaries - spans Canada and mid-America, from the Atlantic and

Pacific oceans to the Gulf of Mexico, serving the ports of

Vancouver, Prince Rupert, B.C., Montreal, Halifax, New Orleans, and

Mobile, Ala., and the key metropolitan areas of Toronto, Buffalo,

Chicago, Detroit, Duluth, Minn./Superior, Wis., Green Bay, Wis.,

Minneapolis/St. Paul, Memphis, St. Louis, and Jackson, Miss., with

connections to all points in North America. For more information on

CN, visit the company's website at www.cn.ca.

www.cn.ca

Contacts: CN Mark Hallman (Media) Director, Communications,

Media & Eastern Region (905) 669-3384 CN Robert Noorigian

(Investment Community) Vice-President, Investor Relations (514)

399-0052

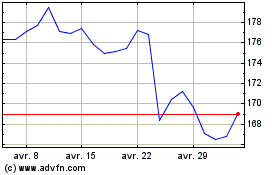

Canadian National Railway (TSX:CNR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Canadian National Railway (TSX:CNR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024