MONTREAL, QUEBEC (NYSE: CNI) today reported its financial and

operating results for the quarter and year ended Dec. 31, 2007.

Fourth-quarter 2007 highlights

- Diluted earnings per share were C$1.68, including a C$0.57 per

share benefit from a deferred income tax recovery, C$0.13 per share

from the sale of CN's Central Station Complex (CSC) in Montreal,

and C$0.08 per share from the sale of the Company's investment in

English Welsh and Scottish Railway (EWS). Excluding these items, CN

reported adjusted diluted EPS of C$0.90, which was flat compared

with adjusted diluted EPS for the fourth quarter of 2006. (1)

- Net income was C$833 million, which included a deferred income

tax recovery of C$284 million, as well as after-tax gains of C$64

million on the CSC sale and C$41 million from the EWS investment

sale. Excluding these items, adjusted net income was C$444 million.

(1)

- 2006 fourth-quarter net income was C$499 million, including a

deferred income tax recovery of C$27 million, or five cents per

diluted share. Excluding the deferred income tax recovery,

fourth-quarter 2006 adjusted net income was C$472 million (adjusted

diluted EPS of C$0.90). (1)

- Fourth-quarter 2007 revenues declined three per cent to

C$1,941 million, with operating expenses declining three per cent

to C$1,205 million.

- Operating income for the final quarter of 2007 declined three

per cent to C$736 million, while CN's operating ratio was

essentially flat at 62.1 per cent.

- The strengthening Canadian dollar relative to the U.S. dollar,

which affected the conversion of CN's U.S. dollar-denominated

revenues and expenses, resulted in a reduction to fourth-quarter

2007 net income of approximately C$25 million, or C$0.05 per

diluted share.

E. Hunter Harrison, president and chief executive officer, said:

"CN faced strong headwinds in 2007 but we turned in a solid

performance for both the quarter and the year. The major challenges

were weak housing markets in the U.S., the continuing strength of

the Canadian dollar that affected our U.S. dollar-denominated

revenues, a strike in the first quarter, and a number of

weather-related issues, particularly in western Canada.

"During the final quarter of 2007, four of our commodity groups

- intermodal, petroleum and chemicals, metals and minerals, and

coal - generated increased revenues. However, tough market

conditions reduced forest products revenues by 19 per cent.

Operating expenses declined three per cent in the quarter, allowing

the Company to deliver an operating ratio of 62.1 per cent.

"We are very pleased with the start in the fourth quarter of our

new Prince Rupert intermodal service. Transit times have been

consistently on target. It's this kind of performance that

underscores the value of the product offering and commitment of all

the parties involved - CN, the Port of Prince Rupert and Maher

Terminals - to deliver a highly competitive service."

Harrison said 2008 will be challenging in some areas, but the

year ahead also offers the Company opportunities for growth.

"We're cautious about the state of the North American economy,

continued weakness in the U.S. housing market, and the strength of

the Canadian dollar vis-a-vis the U.S. dollar. At the same time, we

see opportunities for new traffic, the strongest being intermodal

as a result of the new Prince Rupert gateway for containerized

goods moving between Asia and North America. We also see a number

of opportunities in bulk and industrial products, including those

related to the continuing oil boom in western Canada. Our recent

acquisitions have strengthened our freight franchise in that

region."

2008 financial outlook

For 2008, CN expects the Canadian-U.S. dollar exchange rate to

be in the range of C$0.95-C$1.00, the price for crude oil (West

Texas Intermediate) to be around US$90 per barrel, and North

American economic growth to be approximately 1.7 per cent. With

this outlook, CN expects to take advantage of a number of

opportunities and is targeting to deliver revenue growth in the

range of six to eight per cent this year. With continued

productivity improvements, the Company expects 2008 diluted

earnings per share growth to be in the range of mid-to-high single

digit, compared with adjusted diluted EPS of C$3.40 in 2007, and

2008 free cash flow to be in the order of C$750 million. (1)

In 2008, CN also plans to invest approximately C$1.5 billion in

capital programs, of which more than C$1 billion will be targeted

on track infrastructure to maintain a safe railway and improve the

productivity and fluidity of the network.

Please see "Forward-Looking Statements" below for additional

information.

Fourth-quarter 2007 results

Net income for the fourth quarter of 2007 was C$833 million,

including a deferred income tax recovery of C$284 million (C$0.57

per diluted share) resulting from the enactment of corporate income

tax rate changes in Canada, and the after-tax gains on the sale of

the CSC of C$64 million (C$0.13 per diluted share) and the

Company's investment in EWS of C$41 million (C$0.08 per diluted

share). Excluding the three items, CN reported adjusted diluted EPS

of C$0.90. (1)

Fourth-quarter 2006 net income was C$499 million (C$0.95 per

diluted share), including a deferred income tax recovery of C$27

million (C$0.05 per diluted share) attributable to the resolution

of matters relating to prior years' income taxes. Excluding the

deferred income tax recovery, fourth-quarter 2006 adjusted net

income was C$472 million (adjusted diluted EPS of C$0.90). (1)

Fourth-quarter 2007 revenues declined three per cent to C$1,941

million. The decrease was mainly due to the translation impact of a

stronger Canadian dollar on U.S. dollar-denominated revenues and

weakness in the forest products market.

Revenue ton-miles, a measurement of the relative weight and

distance of rail freight transported by the Company, increased by

three per cent during fourth-quarter 2007 versus the comparable

period of 2006. Rail freight revenue per revenue ton-mile, a

measurement of yield defined as revenue earned on the movement of a

ton of freight over one mile, declined six per cent over the same

period in 2006.

Operating expenses for the fourth quarter decreased three per

cent to C$1,205 million, largely as a result of decreased labor and

fringe benefits expense and the translation impact of a stronger

Canadian dollar on U.S. dollar-denominated expenses. These factors

were partially offset by significantly higher fuel expense.

The operating ratio, defined as operating expenses as a

percentage of revenues, was 62.1 per cent during the quarter,

compared with 62.2 per cent for the fourth quarter of 2006, a

0.1-point decrease.

Full-year 2007 results

Net income for 2007 was C$2,158 million, with diluted earnings

per share of C$4.25. The 2007 results included a deferred income

tax recovery of C$328 million (C$0.64 per diluted share) resulting

mainly from the enactment of corporate income tax rate changes in

Canada, as well as the gains on the sale of the CSC of C$64 million

(C$0.13 per diluted share) and the Company's investment in EWS of

C$41 million (C$0.08 per diluted share). Year-earlier net income

was C$2,087 million (C$3.91 per diluted share). Included in the

2006 figures was a deferred income tax recovery of C$277 million

(C$0.51 per diluted share), resulting from the enactment of lower

corporate income tax rates in Canada and the resolution of matters

pertaining to prior years' income taxes.

Excluding benefits from favorable tax adjustments and major

asset sales, adjusted net income for 2007 was C$1,725 million, or

C$3.40 per diluted share, compared with adjusted 2006 net income of

C$1,810 million, or C$3.40 per diluted share. (1)

Revenues for 2007 totaled C$7,897 million, compared with C$7,929

million for 2006. The decline in revenues was mainly a result of

the translation impact of the stronger Canadian dollar on U.S.

dollar-denominated revenues, weakness in specific markets,

particularly forest products, the United Transportation Union (UTU)

strike, and adverse weather conditions in the first half of 2007.

Largely offsetting these factors were the impact of net freight

rate increases, which included lower fuel surcharge revenues as a

result of applicable fuel prices, and an overall improvement in

traffic mix.

Revenue ton-miles for 2007 declined one per cent from the

comparable period of 2006, while rail freight revenue per ton-mile

was essentially flat.

Operating expenses increased two per cent to C$5,021 million,

mainly due to increased fuel costs and equipment rents, which were

partly offset by the translation impact of a stronger Canadian

dollar and decreased labor and fringe benefits expense.

Operating income declined five per cent to C$2,876 million. The

operating ratio was 63.6 per cent in 2007, compared with 61.8 per

cent in 2006, a 1.8-point increase.

In addition to the weather conditions and operational challenges

in the first half of 2007, CN's results in 2007 included the impact

of the first-quarter 2007 strike by 2,800 UTU members, for which

the Company estimated the negative impact on first-quarter 2007

operating income and net income to be approximately C$50 million

and C$35 million, respectively, (C$0.07 per diluted share).

The strengthening Canadian dollar relative to the U.S. dollar,

which affected the conversion of CN's U.S. dollar-denominated

revenues and expenses, resulted in a reduction to net income of

approximately C$35 million, or C$0.07 per diluted share.

The financial results in this press release were determined on

the basis of U.S. generally accepted accounting principles (U.S.

GAAP).

(1) Please see discussion and reconciliation of non-GAAP

adjusted performance measures in the attached supplementary

schedule, Non-GAAP Measures.

Forward-Looking Statements

This news release contains forward-looking statements. CN

cautions that, by their nature, forward-looking statements involve

risk, uncertainties and assumptions. In addition to the other

assumptions contained in this release, the Company assumes that,

although there is an increasing risk of recession in the U.S.

economy, growth in North America and globally will continue to slow

down in 2008, but that a recession will not take place. The Company

cautions that this as well as its other assumptions may not

materialize. The Company's results could differ materially from

those expressed or implied in such forward-looking statements.

Important factors that could cause such differences include, but

are not limited to, industry competition, legislative and/or

regulatory developments, compliance with environmental laws and

regulations, various events which could disrupt operations,

including natural events such as severe weather, droughts, floods

and earthquakes, the effects of adverse general economic and

business conditions, inflation, currency fluctuations, changes in

fuel prices, labor disruptions, environmental claims,

investigations or proceedings, other types of claims and

litigation, and other risks detailed from time to time in reports

filed by CN with securities regulators in Canada and the United

States. Reference should be made to CN's most recent Form 40-F

filed with the United States Securities and Exchange Commission,

its Annual Information Form filed with the Canadian securities

regulators, and its 2006 Annual Consolidated Financial Statements

and Notes thereto and Management's Discussion and Analysis

(MD&A), as well as its 2007 unaudited interim consolidated

financial statements and MD&A, for a summary of major

risks.

CN assumes no obligation to update or revise forward-looking

statements to reflect future events, changes in circumstances, or

changes in beliefs, unless required by applicable laws. In the

event CN does update any forward-looking statement, no inference

should be made that CN will make additional updates with respect to

that statement, related matters, or any other forward-looking

statement.

CN - Canadian National Railway Company and its operating railway

subsidiaries - spans Canada and mid-America, from the Atlantic and

Pacific oceans to the Gulf of Mexico, serving the ports of

Vancouver, Prince Rupert, B.C., Montreal, Halifax, New Orleans, and

Mobile, Ala., and the key metropolitan areas of Toronto, Buffalo,

Chicago, Detroit, Duluth, Minn./Superior, Wis., Green Bay, Wis.,

Minneapolis/St. Paul, Memphis, St. Louis, and Jackson, Miss., with

connections to all points in North America. For more information on

CN, visit the company's website at www.cn.ca.

CANADIAN NATIONAL RAILWAY COMPANY

CONSOLIDATED STATEMENT OF INCOME (U.S. GAAP)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(In millions, except per share data)

Three months ended Year ended

December 31 December 31

------------------ ----------------

2007 2006 2007 2006

----------------------------------------------------------------------------

(Unaudited)

Revenues $ 1,941 $ 2,000 $ 7,897 $ 7,929

----------------------------------------------------------------------------

Operating expenses

Labor and fringe benefits 340 474 1,701 1,823

Purchased services and material 259 271 1,045 1,027

Fuel 307 227 1,026 892

Depreciation and amortization 173 167 677 650

Equipment rents 60 63 247 198

Casualty and other 66 42 325 309

----------------------------------------------------------------------------

Total operating expenses 1,205 1,244 5,021 4,899

----------------------------------------------------------------------------

Operating income 736 756 2,876 3,030

Interest expense (85) (80) (336) (312)

Other income 159 27 166 11

----------------------------------------------------------------------------

Income before income taxes 810 703 2,706 2,729

Income tax recovery (expense) 23 (204) (548) (642)

----------------------------------------------------------------------------

Net income $ 833 $ 499 $ 2,158 $ 2,087

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Earnings per share

Basic $ 1.70 $ 0.97 $ 4.31 $ 3.97

Diluted $ 1.68 $ 0.95 $ 4.25 $ 3.91

Weighted-average number of shares

Basic 489.8 515.5 501.2 525.9

Diluted 495.9 523.6 508.0 534.3

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Certain of the comparative figures have been reclassified in order to be

consistent with the 2007 presentation as discussed herein. As a result of

the Company's expansion of its existing non-rail transportation services, in

combination with its rail service, the Company has become primarily

responsible for the fulfillment of the transportation of goods involving

non-rail activities. In order to be consistent with the presentation of

other non-rail transportation services, the Company reclassified certain

operating expenses incurred for non-rail transportation services, which were

previously netted with their related revenues, to reflect the gross

reporting of revenues where appropriate. This change had no impact on the

Company's operating income and net income, as both revenues and operating

expenses were increased by $58 million and $213 million in the three months

and year ended December 31, 2006, respectively. In addition, the Company

reclassified its non-rail transportation revenues to Other revenues.

Previously, various revenues for non-rail transportation services were

reported in both Rail freight revenues and Other revenues.

These unaudited interim consolidated financial statements, expressed in

Canadian dollars, and prepared in accordance with U.S. generally accepted

accounting principles (U.S. GAAP), contain all adjustments (consisting of

normal recurring accruals) necessary to present fairly Canadian National

Railway Company's (the Company) financial position as at December 31, 2007

and December 31, 2006, and its results of operations, changes in

shareholders' equity and cash flows for the three months and years ended

December 31, 2007 and 2006. These consolidated financial statements have

been prepared using accounting policies consistent with those used in

preparing the Company's 2007 Annual Consolidated Financial Statements and

should be read in conjunction with such statements, notes thereto and

Management's Discussion and Analysis (MD&A).

CANADIAN NATIONAL RAILWAY COMPANY

CONSOLIDATED BALANCE SHEET (U.S. GAAP)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(In millions)

December 31 December 31

2007 2006

----------------------------------------------------------------------------

(Unaudited)

Assets

Current assets:

Cash and cash equivalents $ 310 $ 179

Accounts receivable 370 692

Material and supplies 162 189

Deferred income taxes 68 84

Other 138 192

----------------------------------------------------------------------------

1,048 1,336

Properties 20,413 21,053

Intangible and other assets 1,999 1,615

----------------------------------------------------------------------------

Total assets $ 23,460 $ 24,004

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Liabilities and shareholders' equity

Current liabilities:

Accounts payable and accrued charges $ 1,282 $ 1,823

Current portion of long-term debt 254 218

Other 54 73

----------------------------------------------------------------------------

1,590 2,114

Deferred income taxes 4,908 5,215

Other liabilities and deferred credits 1,422 1,465

Long-term debt 5,363 5,386

Shareholders' equity:

Common shares 4,283 4,459

Accumulated other comprehensive loss (31) (44)

Retained earnings 5,925 5,409

----------------------------------------------------------------------------

10,177 9,824

----------------------------------------------------------------------------

Total liabilities and shareholders' equity $ 23,460 $ 24,004

----------------------------------------------------------------------------

----------------------------------------------------------------------------

These unaudited interim consolidated financial statements, expressed in

Canadian dollars, and prepared in accordance with U.S. GAAP, contain all

adjustments (consisting of normal recurring accruals) necessary to present

fairly the Company's financial position as at December 31, 2007 and December

31, 2006, and its results of operations, changes in shareholders' equity and

cash flows for the three months and years ended December 31, 2007 and 2006.

These consolidated financial statements have been prepared using accounting

policies consistent with those used in preparing the Company's 2007 Annual

Consolidated Financial Statements and should be read in conjunction with

such statements, notes thereto and MD&A.

CANADIAN NATIONAL RAILWAY COMPANY

CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY (U.S. GAAP)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(In millions)

Three months ended Year ended

December 31 December 31

------------------ ----------------

2007 2006 2007 2006

----------------------------------------------------------------------------

(Unaudited)

Common shares

Balance, beginning of period $ 4,359 $ 4,476 $ 4,459 $ 4,580

Stock options exercised and

other 6 43 89 133

Share repurchase programs (82) (60) (265) (254)

----------------------------------------------------------------------------

Balance, end of period $ 4,283 $ 4,459 $ 4,283 $ 4,459

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Accumulated other comprehensive loss

Balance, beginning of period $ (257) $ (520) $ (44) $ (222)

Other comprehensive income (loss):

Unrealized foreign exchange

gain (loss) on:

Translation of the net

investment in foreign

operations (90) 246 (1,004) 32

Translation of U.S. dollar-

denominated long-term debt

designated as a hedge of the net

investment in U.S. subsidiaries 22 (196) 788 (33)

Pension and other postretirement

benefit plans:

Net actuarial gain arising

during the period 391 - 391 -

Prior service cost arising

during the period (12) - (12) -

Amortization of net actuarial

loss included in net periodic

benefit cost 11 - 49 -

Amortization of prior service

cost included in net periodic

benefit cost 5 - 21 -

Minimum pension liability

adjustment - 1 - 1

Derivative instruments (1) - (1) (57)

----------------------------------------------------------------------------

Other comprehensive income

(loss) before income taxes 326 51 232 (57)

Income tax recovery (expense) (100) 11 (219) (179)

----------------------------------------------------------------------------

Other comprehensive income (loss) 226 62 13 (236)

----------------------------------------------------------------------------

Adjustment to reflect the funded

status of benefit plans:

Net actuarial gain (net of income

tax expense of $(200) for 2006) - 434 - 434

Prior service cost (net of income

tax recovery of $14 for 2006) - (31) - (31)

Reversal of minimum pension

liability adjustment (net of

income tax expense of $(6) for

2006) - 11 - 11

----------------------------------------------------------------------------

Balance, end of period $ (31) $ (44) $ (31) $ (44)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Retained earnings

Balance, beginning of period $ 5,557 $ 5,306 $ 5,409 $ 4,891

Adoption of new accounting

pronouncements (1) - - 95 -

----------------------------------------------------------------------------

Restated balance, beginning

of period 5,557 5,306 5,504 4,891

Net income 833 499 2,158 2,087

Share repurchase programs (363) (313) (1,319) (1,229)

Dividends (102) (83) (418) (340)

----------------------------------------------------------------------------

Balance, end of period $ 5,925 $ 5,409 $ 5,925 $ 5,409

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) On January 1, 2007, the Company adopted Financial Accounting

Standards Board (FASB) Interpretation (FIN) No. 48, "Accounting for

Uncertainty in Income Taxes," and early adopted the measurement date

provisions of Statement of Financial Accounting Standards (SFAS) No.

158, "Employers' Accounting for Defined Benefit Pension and Other

Postretirement Plans, an amendment of FASB Statements No. 87, 88,

106, and 132(R )." The application of FIN No. 48 on January 1, 2007

had the effect of decreasing the net deferred income tax liability and

increasing Retained earnings by $98 million. The application of SFAS No.

158 on January 1, 2007 had the effect of decreasing Retained earnings

by $3 million.

CANADIAN NATIONAL RAILWAY COMPANY

CONSOLIDATED STATEMENT OF CASH FLOWS (U.S. GAAP)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(In millions)

Three months ended Year ended

December 31 December 31

------------------ ----------------

2007 2006 2007 2006

----------------------------------------------------------------------------

(Unaudited)

Operating activities

Net income $ 833 $ 499 $ 2,158 $ 2,087

Adjustments to reconcile net

income to net cash provided

from operating activities:

Depreciation and amortization 172 167 678 653

Deferred income taxes (207) 23 (82) 3

Gain on sale of Central Station

Complex (92) - (92) -

Gain on sale of investment

in English Welsh and Scottish

Railway (61) - (61) -

Other changes in:

Accounts receivable 267 403 229 (17)

Material and supplies 44 18 18 (36)

Accounts payable and accrued

charges 120 48 (351) 197

Other net current assets and

liabilities (12) (34) 39 58

Other (122) (61) (119) 6

----------------------------------------------------------------------------

Cash provided from operating

activities 942 1,063 2,417 2,951

----------------------------------------------------------------------------

Investing activities

Property additions (490) (472) (1,387) (1,298)

Acquisitions, net of cash acquired (25) (26) (25) (84)

Sale of Central Station Complex 351 - 351 -

Sale of investment in English

Welsh and Scottish Railway 114 - 114 -

Other, net 26 14 52 33

----------------------------------------------------------------------------

Cash used by investing

activities (24) (484) (895) (1,349)

----------------------------------------------------------------------------

Financing activities

Issuance of long-term debt 846 183 4,171 3,308

Reduction of long-term debt (1,120) (234) (3,589) (3,089)

Issuance of common shares due

to exercise of stock options

and related excess tax benefits

realized 4 42 77 120

Repurchase of common shares (445) (373) (1,584) (1,483)

Dividends paid (102) (83) (418) (340)

----------------------------------------------------------------------------

Cash used by financing activities (817) (465) (1,343) (1,484)

----------------------------------------------------------------------------

Effect of foreign exchange

fluctuations on U.S. dollar-

denominated cash and cash

equivalents (5) 9 (48) (1)

----------------------------------------------------------------------------

Net increase in cash and cash

equivalents 96 123 131 117

Cash and cash equivalents,

beginning of period 214 56 179 62

----------------------------------------------------------------------------

Cash and cash equivalents,

end of period $ 310 $ 179 $ 310 $ 179

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Supplemental cash flow information

Net cash receipts from

customers and other $ 2,209 $ 2,425 $ 8,139 $ 7,946

Net cash payments for:

Employee services, suppliers

and other expenses (979) (1,043) (4,323) (4,130)

Interest (67) (67) (340) (294)

Workforce reductions (7) (8) (31) (45)

Personal injury and

other claims (28) (47) (86) (107)

Pensions (25) (66) (75) (112)

Income taxes (161) (131) (867) (307)

----------------------------------------------------------------------------

Cash provided from operating

activities $ 942 $ 1,063 $ 2,417 $ 2,951

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Certain of the 2006 comparative figures have been reclassified in order to

be consistent with the 2007 presentation.

CANADIAN NATIONAL RAILWAY COMPANY

SELECTED RAILROAD STATISTICS (1) (U.S. GAAP)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Three months ended Year ended

December 31 December 31

------------------ ----------------

2007 2006 2007 2006

----------------------------------------------------------------------------

(Unaudited)

Statistical operating data

Rail freight revenues ($ millions) 1,763 1,824 7,186 7,254

Gross ton miles (GTM)(millions) 89,315 88,407 347,898 352,972

Revenue ton miles (RTM)(millions) 47,151 45,966 184,148 185,610

Carloads (thousands) 1,205 1,146 4,744 4,824

Route miles (includes Canada and

the U.S.) 20,421 20,264 20,421 20,264

Employees (end of period) 22,696 22,250 22,696 22,250

Employees (average for the

period) 22,796 22,196 22,389 22,092

----------------------------------------------------------------------------

Productivity

Operating ratio (%) 62.1 62.2 63.6 61.8

Rail freight revenue per RTM

(cents) 3.74 3.97 3.90 3.91

Rail freight revenue per

carload ($) 1,463 1,592 1,515 1,504

Operating expenses per GTM (cents) 1.35 1.41 1.44 1.39

Labor and fringe benefits expense

per GTM (cents) 0.38 0.54 0.49 0.52

GTMs per average number of

employees (thousands) 3,918 3,983 15,539 15,977

Diesel fuel consumed

(U.S. gallons in millions) 102 101 392 401

Average fuel price

($/U.S. gallon) 2.70 2.16 2.40 2.13

GTMs per U.S. gallon of fuel

consumed 876 875 887 880

----------------------------------------------------------------------------

Financial ratio

Debt to total capitalization

ratio (% at end of period) 35.6 36.3 35.6 36.3

----------------------------------------------------------------------------

Safety indicators

Injury frequency rate per

200,000 person hours (2) 2.1 2.0 1.9 2.1

Accident rate per million

train miles (2) 3.6 2.0 2.7 2.4

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Includes data relating to companies acquired as of the date of

acquisition.

(2) Based on Federal Railroad Administration (FRA) reporting criteria.

For 2006, the Injury frequency rate per 200,000 person hours and

the Accident rate per million train miles, prepared on a proforma

basis to include the acquisitions of Mackenzie Northern Railway and

Savage Alberta Railway, Inc., as of January 1, 2006, would have been

2.1 and 2.3, respectively, for the three months ended December 31, 2006,

and 2.1 and 2.5, respectively, for the year ended December 31, 2006.

Certain of the 2006 comparative figures have been reclassified in order to

be consistent with the 2007 presentation as discussed herein. Certain

statistical data and related productivity measures are based on estimated

data available at such time and are subject to change as more complete

information becomes available.

CANADIAN NATIONAL RAILWAY COMPANY

SUPPLEMENTARY INFORMATION (U.S. GAAP)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Three months ended Year ended

December 31 December 31

-------------------- --------------------

Variance Variance

Fav Fav

2007 2006 (Unfav) 2007 2006 (Unfav)

----------------------------------------------------------------------------

(Unaudited)

Revenues (millions of dollars)

Petroleum and chemicals 306 300 2% 1,226 1,171 5%

Metals and minerals 195 192 2% 826 835 (1%)

Forest products 336 414 (19%) 1,552 1,747 (11%)

Coal 98 93 5% 385 370 4%

Grain and fertilizers 350 351 - 1,311 1,258 4%

Intermodal 362 353 3% 1,382 1,394 (1%)

Automotive 116 121 (4%) 504 479 5%

Other revenues 178 176 1% 711 675 5%

---------------------------------------- --------------------

1,941 2,000 (3%) 7,897 7,929 -

Revenue ton miles (millions)

Petroleum and chemicals 8,473 7,930 7% 32,761 31,868 3%

Metals and minerals 4,305 4,026 7% 16,719 17,467 (4%)

Forest products 9,156 10,049 (9%) 39,808 42,488 (6%)

Coal 3,432 3,209 7% 13,776 13,727 -

Grain and fertilizers 12,550 11,791 6% 45,359 44,096 3%

Intermodal 8,493 8,237 3% 32,607 32,922 (1%)

Automotive 742 724 2% 3,118 3,042 2%

---------------------------------------- --------------------

47,151 45,966 3% 184,148 185,610 (1%)

Rail freight revenue / RTM (cents)

Rail freight revenue per

RTM 3.74 3.97 (6%) 3.90 3.91 -

Commodity groups:

Petroleum and chemicals 3.61 3.78 (4%) 3.74 3.67 2%

Metals and minerals 4.53 4.77 (5%) 4.94 4.78 3%

Forest products 3.67 4.12 (11%) 3.90 4.11 (5%)

Coal 2.86 2.90 (1%) 2.79 2.70 3%

Grain and fertilizers 2.79 2.98 (6%) 2.89 2.85 1%

Intermodal 4.26 4.29 (1%) 4.24 4.23 -

Automotive 15.63 16.71 (6%) 16.16 15.75 3%

---------------------------------------- --------------------

Carloads (thousands)

Petroleum and chemicals 151 145 4% 599 590 2%

Metals and minerals 261 203 29% 1,010 981 3%

Forest products 134 154 (13%) 584 667 (12%)

Coal 86 94 (9%) 361 411 (12%)

Grain and fertilizers 162 157 3% 601 594 1%

Intermodal 346 332 4% 1,324 1,326 -

Automotive 65 61 7% 265 255 4%

---------------------------------------- --------------------

1,205 1,146 5% 4,744 4,824 (2%)

Rail freight revenue / carload (dollars)

Rail freight revenue

per carload 1,463 1,592 (8%) 1,515 1,504 1%

Commodity groups:

Petroleum and chemicals 2,026 2,069 (2%) 2,047 1,985 3%

Metals and minerals 747 946 (21%) 818 851 (4%)

Forest products 2,507 2,688 (7%) 2,658 2,619 1%

Coal 1,140 989 15% 1,066 900 18%

Grain and fertilizers 2,160 2,236 (3%) 2,181 2,118 3%

Intermodal 1,046 1,063 (2%) 1,044 1,051 (1%)

Automotive 1,785 1,984 (10%) 1,902 1,878 1%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Certain of the 2006 comparative figures have been reclassified in order to

be consistent with the 2007 presentation, as discussed herein. Such

statistical data and related productivity measures are based on estimated

data available at such time and are subject to change as more complete

information becomes available.

CANADIAN NATIONAL RAILWAY COMPANY

NON-GAAP MEASURES unaudited

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Adjusted performance measures

During the three months and year ended December 31, 2007, the Company

reported adjusted net income of $444 million, or $0.90 per diluted share,

and $1,725 million, or $3.40 per diluted share, respectively. These adjusted

figures exclude the impact of a net deferred income tax recovery of $284

million ($0.57 per diluted share) in the fourth quarter and $328 million

($0.64 per diluted share) for the year ended December 31, 2007 that resulted

mainly from the enactment of corporate income tax rate changes in Canada.

Also excluded from adjusted net income for both the three- and twelve-month

periods were the gains on sale of the Central Station Complex of $92 million

or $64 million after-tax ($0.13 per diluted share), and the Company's

investment in English Welsh and Scottish Railway of $61 million or

$41 million after-tax ($0.08 per diluted share).

During the three months and year ended December 31, 2006, the Company

reported adjusted net income of $472 million, or $0.90 per diluted share and

$1,810 million, or $3.40 per diluted share, respectively. These adjusted

figures exclude the impact of a deferred income tax recovery of $27 million

($0.05 per diluted share) in the fourth quarter and $277 million ($0.51 per

diluted share) for the year ended December 31, 2006 that resulted primarily

from the enactment of lower corporate income tax rates in Canada and the

resolution of matters pertaining to prior years' income taxes.

Management believes that adjusted net income and adjusted earnings per share

are useful measures of performance that can facilitate period-to-period

comparisons, as they exclude items that do not necessarily arise as part of

the normal day-to-day operations of the Company and could distort the

analysis of trends in business performance. The exclusion of such items in

adjusted net income and adjusted earnings per share does not, however, imply

that such items are necessarily non-recurring. These adjusted measures do

not have any standardized meaning prescribed by GAAP and may, therefore, not

be comparable to similar measures presented by other companies. The reader

is advised to read all information provided in the Company's 2007 Annual

Consolidated Financial Statements, Notes thereto and Management's Discussion

and Analysis (MD&A). The following tables provide a reconciliation of net

income and earnings per share, as reported for the three months and years

ended December 31, 2007 and 2006, to the adjusted performance measures

presented herein.

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Three months ended Year ended

December 31, 2007 December 31, 2007

----------------------------- -----------------------------

In millions,

except per

share data Reported Adjustments Adjusted Reported Adjustments Adjusted

----------------------------------------------------------------------------

Revenues $ 1,941 $ - $ 1,941 $ 7,897 $ - $ 7,897

Operating

expenses 1,205 - 1,205 5,021 - 5,021

----------------------------------------------------------------------------

Operating income 736 - 736 2,876 - 2,876

----------------------------------------------------------------------------

Interest

expense (85) - (85) (336) - (336)

Other income 159 (153) 6 166 (153) 13

----------------------------------------------------------------------------

Income before

income taxes 810 (153) 657 2,706 (153) 2,553

Income tax

recovery

(expense) 23 (236) (213) (548) (280) (828)

----------------------------------------------------------------------------

Net income $ 833 $ (389) $ 444 $ 2,158 $ (433) $ 1,725

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Basic earnings

per share $ 1.70 $ (0.79) $ 0.91 $ 4.31 $ (0.87) $ 3.44

Diluted earnings

per share $ 1.68 $ (0.78) $ 0.90 $ 4.25 $ (0.85) $ 3.40

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Three months ended Year ended

December 31, 2006 December 31, 2006

----------------------------- ------------------------------

In millions,

except per

share data Reported Adjustments Adjusted Reported Adjustments Adjusted

----------------------------------------------------------------------------

Revenues $ 2,000 $ - $ 2,000 $ 7,929 $ - $ 7,929

Operating

expenses 1,244 - 1,244 4,899 - 4,899

----------------------------------------------------------------------------

Operating income 756 - 756 3,030 - 3,030

----------------------------------------------------------------------------

Interest expense (80) - (80) (312) - (312)

Other income 27 - 27 11 - 11

----------------------------------------------------------------------------

Income before

income taxes 703 - 703 2,729 - 2,729

Income tax expense (204) (27) (231) (642) (277) (919)

----------------------------------------------------------------------------

Net income $ 499 $ (27) $ 472 $ 2,087 $ (277) $ 1,810

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Basic earnings

per share $ 0.97 $ (0.05) $ 0.92 $ 3.97 $ (0.53) $ 3.44

Diluted earnings

per share $ 0.95 $ (0.05) $ 0.90 $ 3.91 $ (0.51) $ 3.40

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Free cash flow

The Company generated $635 million and $828 million of free cash flow for

the three months and year ended December 31, 2007, compared to $212 million

and $1,343 million for the same periods in 2006. Free cash flow does not

have any standardized meaning prescribed by GAAP and therefore, may not be

comparable to similar measures presented by other companies. The Company

believes that free cash flow is a useful measure of performance as it

demonstrates the Company's ability to generate cash after the payment of

capital expenditures and dividends. The Company defines free cash flow as

cash provided from operating activities, excluding changes in the accounts

receivable securitization program and changes in cash and cash equivalents

resulting from foreign exchange fluctuations, less cash used by investing

activities and the payment of dividends, calculated as follows:

----------------------------------------------------------------------------

Three months ended Year ended

December 31 December 31

------------------ ----------------

In millions 2007 2006 2007 2006

----------------------------------------------------------------------------

Cash provided from operating

activities $ 942 $ 1,063 $ 2,417 $ 2,951

Cash used by investing

activities (24) (484) (895) (1,349)

----------------------------------------------------------------------------

Cash provided before financing

activities 918 579 1,522 1,602

----------------------------------------------------------------------------

Adjustments:

Change in accounts receivable

securitization (176) (293) (228) 82

Dividends paid (102) (83) (418) (340)

Effect of foreign exchange

fluctuations on U.S. dollar-

denominated cash and cash

equivalents (5) 9 (48) (1)

----------------------------------------------------------------------------

Free cash flow $ 635 $ 212 $ 828 $ 1,343

----------------------------------------------------------------------------

----------------------------------------------------------------------------

www.cn.ca

Contacts: CN Mark Hallman (Media) Director, Communications,

Media (905) 669-3384 CN Robert Noorigian (Investment Community)

Vice-President, Investor Relations (514) 399-0052

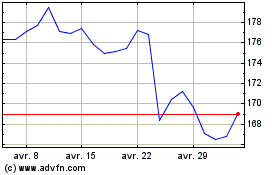

Canadian National Railway (TSX:CNR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Canadian National Railway (TSX:CNR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024