CN announces US$650 million debt offering

25 Avril 2008 - 12:33AM

Marketwired

MONTREAL, QUEBEC (NYSE: CNI) today announced the terms of a

US$650 million debt offering of US$325 million 4.95 per cent Notes

due 2014, and US$325 million 5.55 per cent Notes due 2018. CN

expects to close the financing on May 1, 2008.

CN plans to use the estimated net proceeds of US$643 million

from the offering to repay a portion of its commercial paper

outstanding, and to reduce its accounts receivable securitization

program. The indebtedness being repaid was incurred for general

corporate purposes, including CN's share repurchase program.

The debt offering is being made in the United States under the

shelf registration statement CN filed on Dec. 17, 2007.

Book-running managers of the debt offering are Banc of America

Securities LLC and Wachovia Securities Capital Markets, LLC. Other

managers are BMO Capital Markets, BNP PARIBAS, Citi Markets &

Banking, J.P. Morgan Securities, RBC Capital Markets and Scotia

Capital.

A copy of the prospectus for the offering to which this

communication relates may be obtained by contacting Banc of America

Securities LLC, Prospectus Department, 100 West 33rd Street, 3rd

Floor, New York, N.Y., 10001; toll free: 1-800-294-1322 or Wachovia

Capital Markets, LLC, 301 S. College Street, Charlotte, N.C.,

28202; toll free: 1-800-326-5897.

Forward-Looking Statements

This news release contains forward-looking statements. Such

forward-looking statements include, without limitation, statements

relating to a debt offering, the anticipated closing and the use of

net proceeds of such offering. CN cautions that, by their nature,

forward-looking statements involve risk, uncertainties and

assumptions. The Company cautions that these assumptions may not

materialize. Reference should be made to CN's most recent Form 40-F

filed with the United States Securities and Exchange Commission,

its Annual Information Form filed with the Canadian securities

regulators, and its 2007 Annual Consolidated Financial Statements

and 2008 Quarterly Financial Statements and Notes thereto and

related Management's Discussion and Analysis (MD&A), for a

summary of major risks.

CN assumes no obligation to update or revise forward-looking

statements to reflect future events, changes in circumstances, or

changes in beliefs, unless required by applicable laws. In the

event CN does update any forward-looking statement, no inference

should be made that CN will make additional updates with respect to

that statement, related matters, or any other forward-looking

statement.

CN - Canadian National Railway Company and its operating railway

subsidiaries - spans Canada and mid-America, from the Atlantic and

Pacific oceans to the Gulf of Mexico, serving the ports of

Vancouver, Prince Rupert, B.C., Montreal, Halifax, New Orleans, and

Mobile, Ala., and the key metropolitan areas of Toronto, Buffalo,

Chicago, Detroit, Duluth, Minn./Superior, Wis., Green Bay, Wis.,

Minneapolis/St. Paul, Memphis, St. Louis, and Jackson, Miss., with

connections to all points in North America.

www.cn.ca

Contacts: CN Mark Hallman (Media) Director Communications, Media

(905) 669-3384 CN Robert Noorigian (Investment Community)

Vice-President Investor Relations (514) 399-0052

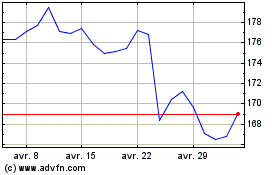

Canadian National Railway (TSX:CNR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Canadian National Railway (TSX:CNR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024