CN (TSX: CNR)(NYSE: CNI) today petitioned the United States Court

of Appeals for the District of Columbia Circuit for an expedited

ruling ordering the Surface Transportation Board (STB) to render a

final decision on the transportation merits of CN's proposed

acquisition of the principal lines of the Elgin, Joliet &

Eastern Railway Company (EJ&E), to allow the transaction to

close by the parties' Dec. 31, 2008, deadline.

"Given the substantial, wide-ranging public interest benefits of

our planned acquisition of the EJ&E, we cannot permit

regulatory delay to imperil this transaction," said CN President

and Chief Executive Officer E. Hunter Harrison.

"We are convinced - and many business and community leaders

agree - that the transaction will be good for the Chicago region as

a whole. It would ease rail congestion, which is critically

important to the region's economy and its continued role as one of

America's most important transportation hubs. If unaddressed, rail

congestion threatens $2 billion of dollars of production and 17,000

jobs in the Chicago region over the next 20 years.

"Second, the transaction would benefit the environment of the

overall Chicago region. For every community along the EJ&E line

in the suburbs of Chicago that would see increased train traffic as

a result of the transaction, nearly double that number along CN

lines in inner Chicago would see decreased rail operations. In

fact, roughly 60 communities inside the EJ&E arc would benefit

from reduced train traffic as a result of the transaction. That

would mean a better quality of life for residents of the Chicago

region, with less pollution, fewer idling trains and fewer blocked

crossings."

Faced with a Dec. 31, 2008, deadline for completing its purchase

of the EJ&E, CN last month proposed a reasonable compromise to

the STB that would have allowed the agency to rule on the

transportation merits of the EJ&E acquisition while completing

its environmental review of the transaction. During this

environmental review, CN proposed to maintain an "environmental

status quo" by which CN would not shift any of its trains to the

EJ&E until that review had been completed. But the agency last

week denied CN's petition.

"It is truly unfortunate that the STB rejected CN's compromise

solution given the impending deadline on our transaction," Harrison

said. "The agency's decision - and continuing uncertainty about the

timing of the STB's final decision on the transaction - leave us no

option but to ask the court to compel a final STB decision on the

transportation merits of the acquisition. We need the STB ruling

soon so that we will be in a position to close the transaction

before year-end."

CN's petition need not preclude full environmental review of the

transaction. If it is granted, that will be a choice for the

agency. The STB would have options to assure that if CN's petition

is granted, the agency can complete its environmental review of the

transaction, including its consideration of the comments of all

interested parties and its imposition of lawful mitigation before

the transaction would be able to have any adverse environmental

effects.

"The bottom line is that the benefits to Chicago's rail network

and environment from rerouting trains off congested city and inner

Chicago lines onto the underused EJ&E are too great to see this

transaction derailed," Harrison said. "We cannot allow controversy

created in some Chicago suburbs - and the regulatory delay it has

created - to jeopardize the transaction.

"CN appreciates the concerns of suburban communities, and it

continues to make substantial efforts to address potential adverse

impacts of the acquisition. But in the end we do not believe that

concerns from a small but vocal minority of residents should take

precedence over the broad public interest and the needs of a far

greater number of communities that would benefit from the

transaction.

"The transaction is not just about CN - it's also about an

efficient Chicago rail network, a sound regional economy, and a

better quality of life for more than four million Chicago-area

residents."

The STB designated the transaction as "minor" in November 2007

because CN's application did not pose anti-competitive issues. By

statute, the STB is required to issue a final decision on minor

transactions within 180 days of accepting an application for

consideration. In its November decision, however, the STB said it

would prepare an Environmental Impact Statement (EIS) on the

transaction and that its final decision would be extended beyond

the 180 days until the completion of the EIS. The agency's Section

of Environmental Analysis began its extensive environmental review

of this transaction in December 2007.

After 10 months of review, few competition issues have been

raised, yet the STB still has not made a final determination as to

whether the transaction passes the statutory competition test.

Other, more complicated transactions reviewed by the STB have

closed within a time period comparable to what CN seeks here. In

the case of the $10-billion Conrail merger in 1997 - a transaction

that traversed 24 states and the District of Columbia, 10,500 miles

of rail lines and 2,070 grade crossings - the STB finalized its

environmental review in 11 months and issued a decision on the

transaction two months later. By contrast, CN's $300-million

transaction involves small portions of only two states, 158 miles

of rail line and a total of 99 grade crossings.

CN-EJ&E BACKGROUNDER

CN's EJ&E transaction is good for Chicago

The transaction would significantly improve the fluidity of rail

operations in the Chicago region, resulting in faster transit times

and more reliable service for rail customers. It would enhance the

competitiveness of businesses in the region that use rail service,

while bringing some relief to communities that have more than their

share of freight trains today.

The Chicago area is the transportation hub of North America.

One-third of U.S. products shipped by rail move to, from, or

through the Chicago area each year. Rail traffic in this region

touches five million jobs nationwide every year, $782 billion in

output and $217 billion in wages. (2005 CREATE Feasibility

Study)

But it can take a freight train more than 24 hours to travel the

30 miles from Chicago's north side to its south side (Howard Street

on the north and 127th Street on the south). During the same time

period, a CN freight train can travel from Chicago to New Orleans

(about 900 miles).

If Chicago regional rail capacity and congestion are not

addressed, studies suggest that the Chicago area will lose $2

billion in production and 17,000 jobs over the next two decades.

(2005 CREATE Feasibility Study)

The transaction has more neighborhood benefits than negative

impacts

The transaction would provide reciprocal environmental benefits

- for every community along the EJ&E line in the suburbs of

Chicago that would see increased train traffic, nearly double that

number along CN lines in inner Chicago would experience a traffic

decrease. That means roughly one million people would have

additional trains in their communities, but more than 2.5 million

would have fewer trains. In fact, roughly 60 communities inside the

EJ&E arc would benefit from reduced train traffic as a result

of the transaction.

CN's EJ&E transaction will advance the objectives of

CREATE

Better use of the EJ&E would provide a head start for the

Chicago Region Environmental Transportation Efficiency (CREATE)

Program. CN is committing $400 million of private-sector investment

to create capacity on the Chicago rail network and by removing CN

rail operations from downtown Chicago. The government has not

provided comprehensive funding for CREATE, however. Without such

funding or some other congestion-reducing initiative, increased

rail congestion is expected in Chicago and the inner suburbs, with

increased delays to motorists and increased train idling in these

communities. Without moving trains onto the EJ&E, Chicago will

continue to have high levels of rail operations in more

densely-populated communities and less efficient rail

operations.

CN is committed to addressing the environmental impact of the

transaction

CN has already volunteered to provide reasonable mitigation for

the significant adverse impact of the transaction, as measured by

the sound standards used by the STB in prior cases. CN has

committed roughly $40 million for such mitigation, in addition to

the $300 million it would spend to acquire the EJ&E and $100

million for integration, new connections and infrastructure

improvements to add capacity on the EJ&E line and allow network

synergies to be realized over time.

In August, CN reached an agreement with the City of Joliet - a

community along the EJ&E line - that resolves the city's

outstanding concerns related to quiet zones, operations, and

communications arising from the transaction. CN continues to

negotiate voluntary mitigation agreements with many other willing

communities along the EJ&E, and remains an active participant

in the STB's environmental review of the transaction.

CN has undertakings with Amtrak, Metra and Gary/Chicago

International Airport on infrastructure access and service matters

arising from EJ&E transaction

- CN has pledged to Amtrak and the STB that, after acquiring the

EJ&E, it would permit the federal passenger train company to

remain on approximately 11 miles of CN's St. Charles Air Line

route, following the re-routing of CN trains off that line and onto

the EJ&E, until the Grand Crossing or other alternative

acceptable to Amtrak is available. This preserves Amtrak's access

to Chicago's Union Station and enables Amtrak to continue providing

service to and from downstate Illinois cities such as Champaign and

Carbondale. CN also agreed to cap Amtrak's costs for maintaining

this line at its current levels, indexed only for inflation in

future years.

- CN is having continuing discussions with Metra and, upon CN's

acquisition of control of the EJ&E lines, has committed to

reaching an agreement that would permit Metra's proposed STAR Line

commuter service, should it receive government approval and

funding, to jointly use enhanced EJ&E rail lines, which is

Metra's preferred option. Thus, the EJ&E transaction would not

impede the STAR project. Furthermore, moving CN freight trains off

its existing lines and onto the EJ&E could make it easier for

Metra to expand North Central Service Line service to communities

such as Wheeling, Buffalo Grove, Vernon Hills and Mundelein.

- The expansion of Gary/Chicago International Airport (GCIA) can

now proceed since the signing in June of a four-party preliminary

memorandum of understanding (PMOU) between GCIA, EJ&E, CSX

Corporation, and Norfolk Southern Corporation. The PMOU provides a

comprehensive framework for relocating the nearby EJ&E line, a

long unresolved matter that had been a key concern raised in

opposition to the CN/EJ&E transaction. CN assisted EJ&E in

the negotiations and is committed to honor the terms of the PMOU

upon regulatory approval of the EJ&E acquisition and to carry

out the needed line relocation.

CN and U. S. Steel, the indirect owner of the EJ&E,

announced on Sept. 26, 2007, an agreement under which CN would

acquire most of the EJ&E for $300 million, subject to

regulatory approval by the STB. CN has committed an additional $100

million for integration, new connections and infrastructure

improvements to add capacity on the EJ&E line and allow network

synergies to be realized over time. CN has also committed roughly

$40 million to mitigate the impacts of increased train traffic

along the EJ&E. More information on the transaction, including

a map of the areas served by the EJ&E and CN, is available by

clicking on the EJ&E Acquisition icon on the About CN section

of its website

http://www.cn.ca/about/EJE/about_EJE/en_About.shtml

Forward-Looking Statements

This news release contains forward-looking statements. CN

cautions that, by their nature, forward-looking statements involve

risk, uncertainties and assumptions. In addition to the other

assumptions contained in this release, the Company believes the

U.S. economy is currently experiencing recessionary conditions, but

assumes that it will recover within the next six to nine months,

and that the global economy will grow at a moderate pace throughout

this period. The Company cautions that these assumptions may not

materialize. The Company's results could differ materially from

those expressed or implied in such forward-looking statements.

Important factors that could cause such differences include, but

are not limited to, industry competition, legislative and/or

regulatory developments, compliance with environmental laws and

regulations, various events which could disrupt operations,

including natural events such as severe weather, droughts, floods

and earthquakes, the effects of adverse general economic and

business conditions, inflation, currency fluctuations, changes in

fuel prices, labor disruptions, environmental claims,

investigations or proceedings, other types of claims and

litigation, and other risks detailed from time to time in reports

filed by CN with securities regulators in Canada and the United

States. Reference should be made to CN's most recent Form 40-F

filed with the United States Securities and Exchange Commission,

its Annual Information Form filed with the Canadian securities

regulators, and its 2007 Annual Consolidated Financial Statements

and Notes thereto and Management's Discussion and Analysis

(MD&A), as well as its 2008 quarterly consolidated financial

statements and MD&A, for a summary of major risks.

CN assumes no obligation to update or revise forward-looking

statements to reflect future events, changes in circumstances, or

changes in beliefs, unless required by applicable laws. In the

event CN does update any forward-looking statement, no inference

should be made that CN will make additional updates with respect to

that statement, related matters, or any other forward-looking

statement.

CN - Canadian National Railway Company and its operating railway

subsidiaries - spans Canada and mid-America, from the Atlantic and

Pacific oceans to the Gulf of Mexico, serving the ports of

Vancouver, Prince Rupert, B.C., Montreal, Halifax, New Orleans, and

Mobile, Ala., and the key metropolitan areas of Toronto, Buffalo,

Chicago, Detroit, Duluth, Minn./Superior, Wis., Green Bay, Wis.,

Minneapolis/St. Paul, Memphis, and Jackson, Miss., with connections

to all points in North America. For more information on CN, visit

the company's website at www.cn.ca.

www.cn.ca

Contacts: CN Karen Phillips (Media) Vice-President North

American Government Affairs (202) 347-7196 CN Robert Noorigian

(Investment Community) Vice-President Investor Relations (514)

399-0052

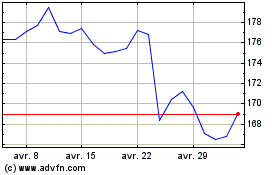

Canadian National Railway (TSX:CNR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Canadian National Railway (TSX:CNR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024