Crescita Therapeutics Announces Renewal of Normal Course Issuer Bid

15 Décembre 2021 - 1:45PM

Business Wire

Crescita Therapeutics Inc. (TSX: CTX) (OTC US: CRRTF)

(“Crescita” or the “Company”) announced today that

the Toronto Stock Exchange (the “TSX”) has approved the

Company’s renewal of its existing normal course issuer bid

(“NCIB”) for a portion of its common shares (“Common

Shares”) as appropriate opportunities arise from time to

time.

Pursuant to the NCIB notice filed with the TSX, the Company

intends to acquire up to a maximum of 1,000,000 Common Shares, or

approximately 5.3% of its public float as of December 14, 2021 for

cancellation over the next 12 months. As of December 14, 2021, the

Company had 20,982,752 issued and outstanding Common Shares.

Purchases under the NCIB will be made through the facilities of

the TSX or through a Canadian alternative trading system and in

accordance with applicable regulatory requirements at a price per

Common Share representative of the market price at the time of

acquisition. The number of Common Shares that can be purchased

pursuant to the NCIB is subject to a current daily maximum of 3,770

Common Shares (which is equal to 25% of 15,081 being the average

daily trading volume from June 1, 2021 through to November 30,

2021), subject to the Company’s ability to make one block purchase

of Common Shares per calendar week that exceeds such limits. All

Common Shares purchased under the NCIB will be cancelled upon their

purchase. The Company intends to fund the purchases out of its

available resources.

The Company may begin to purchase Common Shares on December 17,

2021 and the NCIB will terminate on December 16, 2022 or such

earlier time as the Company completes its purchases pursuant to the

NCIB or provides notice of termination.

The Company has also renewed its automatic securities purchase

plan in connection with its NCIB that contains strict parameters

regarding how its Common Shares may be repurchased during times

when it would ordinarily not be permitted to purchase Common Shares

due to regulatory restrictions or self-imposed blackout periods.

The automatic securities purchase plan is effective

immediately.

Pursuant to the Company’s previous normal course issuer bid that

commenced on November 30, 2020 and ended on November 29, 2021,

135,824 Common Shares at a weighted average price of $0.68 per

share were purchased. Purchases were made on behalf of the Company

by its broker through the facilities of the TSX. Crescita was

permitted to acquire up to 1,000,000 Common Shares under its

previous normal course issuer bid.

About Crescita Therapeutics Inc.

Crescita (TSX: CTX and OTC US: CRRTF) is a growth-oriented,

innovation-driven Canadian commercial dermatology company with

in-house R&D and manufacturing capabilities. The Company offers

a portfolio of high-quality, science-based non-prescription

skincare products and early to commercial stage prescription

products. We also own multiple proprietary transdermal delivery

platforms that support the development of patented formulations to

facilitate the delivery of active ingredients into or through the

skin.

Forward Looking Statements

Certain statements contained in this news release constitute

forward-looking information within the meaning of applicable

securities laws. In some cases, forward-looking information can be

identified by such terms such as “may”, “might”, “will”, “could”,

“should”, “would”, “occur”, “expect”, “plan”, “anticipate”,

“believe”, “intend”, “estimate”, “predict”, “potential”,

“continue”, “likely”, “schedule”, or the negative thereof or other

similar expressions concerning matters that are not historical

facts. Some of the specific forward-looking statements in this news

release include, but are not limited to, statements with respect to

the number of Common Shares to be acquired under the NCIB and other

related matters. The Company has based these forward-looking

statements on factors and assumptions about future events and

financial trends that it

believes may affect its financial condition, financial

performance, business strategy and financial needs. Although the

forward-looking statements contained in this news release are based

upon assumptions that management of the Company believe are

reasonable based on information currently available to management,

there can be no assurance that actual results will be consistent

with these forward-looking statements. Forward-looking statements

necessarily involve known and unknown risks and uncertainties, many

of which are beyond the Company’s control, including, among other

things, the risks identified in materials filed under the Company’s

profile at www.sedar.com from time to time. The forward-looking

statements made in this news release relate only to events or

information as of the date hereof. Except as required by applicable

Canadian law, the Company undertakes no obligation to update or

revise publicly any forward-looking statements, whether as a result

of new information, future events or otherwise, after the date on

which the statements are made or to reflect the occurrence of

unanticipated events.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211215005516/en/

Crescita Therapeutics Investor Relations Linda Kisa, CPA,

CA Email: lkisa@crescitatx.com

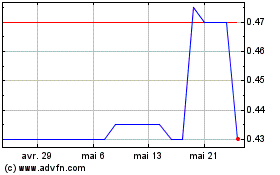

Crescita Therapeutics (TSX:CTX)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Crescita Therapeutics (TSX:CTX)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024