Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) announced today the

total consideration payable in connection with its previously

announced tender offers to purchase for cash (i) up to

$1,697,486,675 aggregate purchase price, excluding accrued and

unpaid interest (the “Pool 1 Maximum Amount”), of its 4.250% Notes

due 2027, its 4.400% Notes due 2029, its 4.450% Notes due 2042, its

5.200% Notes due 2043, its 5.375% Notes due 2025 and its 5.400%

Notes due 2047 (collectively, the “Pool 1 Notes”), and (ii) up to

$500,000,000 aggregate purchase price, excluding accrued and unpaid

interest (the “Pool 2 Maximum Amount” and, together with the Pool 1

Maximum Amount, the “Maximum Amounts”), of its 6.750% Notes due

2039, its 6.800% Notes due 2037 and its 5.250% Notes due 2037

(collectively, the “Pool 2 Notes” and, together with the Pool 1

Notes, the “Notes”), subject to prioritized acceptance levels

listed in the table below (“Acceptance Priority Levels”) and the

terms and conditions of the tender offers.

References to "$" in this news release are to United States

dollars, unless otherwise indicated.

The table below sets forth, among other things, the aggregate

principal amount of each series of Notes validly tendered and not

validly withdrawn as of 5:00 p.m., New York City time, on September

9, 2022 (the “Early Tender Date”) and expected to be accepted for

purchase in each tender offer, the approximate proration factor for

such Notes and the Total Consideration for each series of such

Notes, as calculated at 10:00 a.m., New York City time, today,

September 12, 2022.

|

|

Title of Security |

CUSIP/ISIN |

Principal AmountOutstanding |

Maximum Amount(1) |

Acceptance

PriorityLevel(2) |

U.S.Treasury

ReferenceSecurity |

Bloomberg ReferencePage |

Fixed Spread |

Reference Yield |

Principal Amount Tendered at Early Tender

Date |

Principal Amount Expected to be Accepted |

Approximate Proration Factor |

Total Consideration(3)(4) |

|

|

4.250% Notes due 2027 |

15135UAM1 / US15135UAM1815135UAL3 / US15135UAL35 (144A)C23555AF9 /

USC23555AF96 (Reg S) |

$961,851,000 |

|

1 |

3.125% UST due 8/31/27 |

FIT1 |

+120 bps |

3.392% |

$588,945,000 |

$588,945,000 |

100% |

$985.96 |

|

Pool 1 Tender Offers |

4.400% Notes due 2029 |

448055AP8 / US448055AP89 |

$750,000,000 |

$1,697,486,675 |

2 |

2.750% UST due 8/15/32 |

FIT1 |

+155 bps |

3.285% |

$510,402,000 |

$510,402,000 |

100% |

$975.67 |

|

|

4.450% Notes due 2042 |

15135UAH2 / US15135UAH23 |

$155,264,000 |

|

3 |

3.375% UST due 8/15/42 |

FIT1 |

+255 bps |

3.682% |

$58,260,000 |

$58,260,000 |

100% |

$797.82 |

|

|

5.200% Notes due 2043 |

15135UAK5 / US15135UAK51 |

$57,726,000 |

|

4 |

3.375% UST due 8/15/42 |

FIT1 |

+255 bps |

3.682% |

$29,177,000 |

$29,177,000 |

100% |

$880.02 |

|

|

5.375% Notes due 2025 |

15135UAS8 / US15135UAS87 |

$665,674,000 |

|

5 |

3.125% UST due 8/15/25 |

FIT1 |

+70 bps |

3.562% |

$532,292,000 |

$532,292,000 |

100% |

$1,027.01 |

|

Pool 2 Tender Offers |

6.750%Notes due2039 |

15135UAF6 / US15135UAF66 |

$1,390,534,000 |

$500,000,000 |

1 |

3.375% UST due 8/15/42 |

FIT1 |

+215 bps |

3.682% |

$819,723,000 |

$455,112,000 |

55.56% |

$1,098.64 |

(1) $1,697,486,675 represents the maximum aggregate purchase

price payable, excluding accrued and unpaid interest, in respect of

the Pool 1 Notes that may be purchased in the tender offers.

$500,000,000 represents the maximum aggregate purchase price

payable, excluding accrued and unpaid interest, in respect of the

6.750% Notes due 2039 in Pool 2 which may be purchased in the

tender offers.(2) Subject to the Maximum Amounts and proration, the

principal amount of each series of Notes that is expected to be

purchased in each tender offer will be determined in accordance

with the applicable Acceptance Priority Level (in numerical

priority order) specified in this column.(3) Per $1,000 principal

amount of Notes validly tendered prior to or at the Early Tender

Date and accepted for purchase.(4) The Total Consideration for each

series of Notes validly tendered prior to or at the Early Tender

Date and accepted for purchase is calculated using the applicable

Fixed Spread and is inclusive of the applicable Early Tender

Payment. The Total Consideration for each series of Notes does not

include accrued and unpaid interest, which will be payable in

addition to the applicable Total Consideration.

The tender offers are being made upon the terms and subject to

the conditions previously described in the offer to purchase dated

August 26, 2022, as amended and supplemented by Cenovus’s news

release on September 12, 2022 (as so amended, the “Offer to

Purchase”). Cenovus refers investors to the Offer to Purchase for

the complete terms and conditions of the tender offers.

Withdrawal rights for the Notes expired at 5:00 p.m., New York

City time, on the Early Tender Date. The tender offers for the

Notes will expire at midnight, New York City time, at the end of

September 23, 2022, or any other date and time to which Cenovus

extends the applicable tender offer, unless earlier terminated. As

previously announced, Cenovus expects to elect to exercise its

right to make payment for Notes that were validly tendered prior to

or at the Early Tender Date and that are accepted for purchase on

September 13, 2022 (the “Early Settlement Date”). Cenovus intends

to fund the purchase of validly tendered and accepted Notes on the

Early Settlement Date with cash on hand and certain short-term

borrowings.

Because the aggregate principal amount of Pool 1 Notes validly

tendered and not validly withdrawn prior to or at the Early Tender

Date has an aggregate purchase price, excluding accrued and unpaid

interest, that exceeds the Pool 1 Maximum Amount, Cenovus does not

expect to accept for purchase all Pool 1 Notes that have been

validly tendered and not validly withdrawn prior to or at the Early

Tender Date. Rather, subject to the Pool 1 Maximum Amount and the

Acceptance Priority Levels set forth in the table above, in each

case as further described in the Offer to Purchase, Cenovus expects

to accept for purchase all of the 4.250% Notes due 2027, 4.400%

Notes due 2029, 4.450% Notes due 2042, 5.200% Notes due 2043 and

5.375% Notes due 2025 validly tendered and not validly withdrawn

prior to or at the Early Tender Date. Cenovus does not expect to

accept for purchase any 5.400% Notes due 2047. As described further

in the Offer to Purchase, Notes tendered and not accepted for

purchase will be promptly credited to the tendering holder’s

account. Additionally, because the aggregate principal amount of

Pool 1 Notes validly tendered and not validly withdrawn prior to or

at the Early Tender Date has an aggregate purchase price, excluding

accrued and unpaid interest, that exceeds the Pool 1 Maximum

Amount, Cenovus does not expect to accept for purchase any Pool 1

Notes tendered after the Early Tender Date on a subsequent

settlement date.

Because the aggregate principal amount of Pool 2 Notes validly

tendered and not validly withdrawn prior to or at the Early Tender

Date has an aggregate purchase price, excluding accrued and unpaid

interest, that exceeds the Pool 2 Maximum Amount, Cenovus does not

expect to accept for purchase all Pool 2 Notes that have been

validly tendered and not validly withdrawn prior to or at the Early

Tender Date. Rather, subject to the Pool 2 Maximum Amount, the

Acceptance Priority Levels and the applicable proration factors set

forth in the table above, in each case as further described in the

Offer to Purchase, Cenovus expects to accept for purchase the

6.750% Notes due 2039 validly tendered and not validly withdrawn

prior to or at the Early Tender Date on a prorated basis using a

proration factor of approximately 55.56%. Cenovus does not expect

to accept for purchase any 6.800% Notes due 2037 or 5.250% Notes

due 2037. As described further in the Offer to Purchase, Notes

tendered and not accepted for purchase will be promptly credited to

the tendering holder’s account. Additionally, because the aggregate

principal amount of Pool 2 Notes validly tendered and not validly

withdrawn prior to or at the Early Tender Date has an aggregate

purchase price, excluding accrued and unpaid interest, that exceeds

the Pool 2 Maximum Amount, Cenovus does not expect to accept for

purchase any Pool 2 Notes tendered after the Early Tender Date on a

subsequent settlement date.

The applicable Total Consideration listed in the table above

will be paid per $1,000 principal amount of each series of Notes

validly tendered and accepted for purchase pursuant to the

applicable tender offer on the Early Settlement Date. Only holders

of Notes who validly tendered and did not validly withdraw their

Notes prior to or at the Early Tender Date are eligible to receive

the applicable Total Consideration for Notes accepted for purchase.

Holders will also receive accrued and unpaid interest on Notes

validly tendered and accepted for purchase from the applicable last

interest payment date up to, but not including, the Early

Settlement Date.

All Notes accepted for purchase will be retired and cancelled

and will no longer remain outstanding obligations of Cenovus.

Cenovus’s obligation to accept for payment and to pay for Notes

validly tendered and not validly withdrawn in the tender offers is

subject to the satisfaction of certain conditions described in the

Offer to Purchase. Cenovus reserves the right, subject to

applicable law, to (i) waive any and all conditions to any of the

tender offers, (ii) extend or terminate any of the tender offers,

(iii) further increase or decrease either of the Maximum Amounts,

or (iv) otherwise further amend any of the tender offers. Cenovus

may take any action described in clauses (i) through (iv) above

with respect to one or more tender offers without having to do so

for all tender offers.

Information relating to the tender offers BofA

Securities, J.P. Morgan Securities LLC and Mizuho Securities USA

LLC are the lead dealer managers and BMO Capital Markets Corp. and

CIBC World Markets Corp. are the co-dealer managers for the tender

offers. Investors with questions regarding the terms and conditions

of the tender offers may contact BofA Securities at (888) 292-0070

(toll-free) or (980) 387-3907 (collect) or by email at

debt_advisory@bofa.com, J.P. Morgan Securities LLC at (866)

834-4666 (toll-free) or (212) 834-3554 (collect) and Mizuho

Securities USA LLC at (866) 271-7403 (toll-free) or (212) 205-7736

(collect). D.F. King & Co., Inc. is the tender and information

agent for the tender offers. Investors with questions regarding the

procedures for tendering Notes may contact the tender and

information agent by email at cve@dfking.com, or by phone at (212)

269-5550 (for banks and brokers only) or (888) 644-5854 (for all

others, toll-free). Beneficial owners may also contact their

broker, dealer, commercial bank, trust company or other nominee for

assistance.

The full details of the tender offers, including complete

instructions on how to tender Notes, are included in the Offer to

Purchase. Holders are strongly encouraged to read carefully the

Offer to Purchase, including materials incorporated by reference

therein, because they contain important information. The Offer to

Purchase may be downloaded from D.F. King & Co., Inc.’s website

at www.dfking.com/cve or obtained from D.F. King & Co., Inc.,

free of charge, by calling (212) 269-5550 (for banks and brokers

only) or (888) 644-5854 (for all others, toll-free).

This news release does not constitute an offer to purchase, or a

solicitation of an offer to sell, or the solicitation of tenders

with respect to, the Notes. No offer, solicitation, purchase or

sale will be made in any jurisdiction in which such an offer,

solicitation or sale would be unlawful. The tender offers are being

made solely pursuant to the Offer to Purchase made available to

holders of the Notes. None of Cenovus or its affiliates, their

respective boards of directors, the dealer managers, the tender and

information agent or the trustee with respect to any series of

Notes is making any recommendation as to whether or not holders

should tender or refrain from tendering all or any portion of their

Notes in response to the tender offers. Holders are urged to

evaluate carefully all information in the Offer to Purchase,

consult their own investment and tax advisors and make their own

decisions whether to tender Notes in the tender offers, and, if so,

the principal amount of notes to tender.

Advisory

Forward-looking Information This news

release contains certain forward-looking statements and

forward-looking information (collectively referred to as

“forward-looking information”) within the meaning of applicable

securities legislation, including the United States Private

Securities Litigation Reform Act of 1995, about Cenovus’s current

expectations, estimates and projections about the future, based on

certain assumptions made in light of the company’s experience and

perception of historical trends. Although Cenovus believes that the

expectations represented by such forward-looking information are

reasonable, there can be no assurance that such expectations will

prove to be correct. Readers are cautioned not to place undue

reliance on forward-looking information as actual results may

differ materially from those expressed or implied. Cenovus

undertakes no obligation to update or revise any forward-looking

information except as required by law.

Forward-looking information in this document is identified by

words such as “may”, “will”, “expect” or similar expressions and

includes suggestions of future outcomes, including statements

about: the purchase of the Notes and the timing thereof; the

deadlines, determination dates and settlement dates regarding the

tender offers; increasing or decreasing the Maximum Amounts; the

payment of accrued and unpaid interest; the use of a proration

factor in respect of the 6.750% Notes due 2039; and the series of

Notes to be accepted for purchase pursuant to the tender

offers.

Developing forward-looking information involves reliance on a

number of assumptions and consideration of certain risks and

uncertainties, some of which are specific to Cenovus and others

that apply to the industry generally. Material factors or

assumptions on which the forward-looking information in this news

release is based include: risks related to the acceptance of any

tendered Notes, the expiration and settlement of the tender offers,

the satisfaction of conditions to the tender offers, whether the

tender offers will be consummated in accordance with the terms set

forth in the Offer to Purchase or at all, and the timing of any of

the foregoing.

Readers are cautioned that other events or circumstances,

although not listed above, could cause Cenovus’s actual results to

differ materially from those estimated or projected and expressed

in, or implied by, the forward-looking statements. For a full

discussion of material risk factors, refer to “Risk Management and

Risk Factors” in Cenovus’s Management’s Discussion and

Analysis (MD&A) for the year ended December 31, 2021

and in Cenovus’s MD&A for the three and six months

ended June 30, 2022 and to the risk factors described in other

documents Cenovus files from time to time with securities

regulatory authorities in Canada, available on SEDAR

at sedar.com, and with the U.S. Securities and Exchange

Commission on EDGAR at sec.gov, and on its website

at cenovus.com.

Cenovus Energy Inc. Cenovus Energy Inc. is

an integrated energy company with oil and natural gas production

operations in Canada and the Asia Pacific region, and upgrading,

refining and marketing operations in Canada and the United States.

Cenovus is focused on managing its assets in a safe, innovative and

cost-efficient manner, integrating environmental, social and

governance considerations into its business plans. Cenovus common

shares and common share purchase warrants are listed on the Toronto

Stock Exchange and the New York Stock Exchange, and Cenovus’s

preferred shares are listed on the Toronto Stock Exchange. For more

information, visit cenovus.com.

Find Cenovus on Facebook, Twitter, LinkedIn, YouTube and

Instagram.

Cenovus contacts

|

Investors |

Media |

|

Investor Relations general line |

Media Relations general line |

|

403-766-7711 |

403-766-7751 |

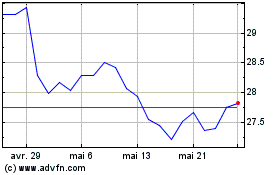

Cenovus Energy (TSX:CVE)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Cenovus Energy (TSX:CVE)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025